Capex Champs

BE FINANCIALLY INDEPENDENT

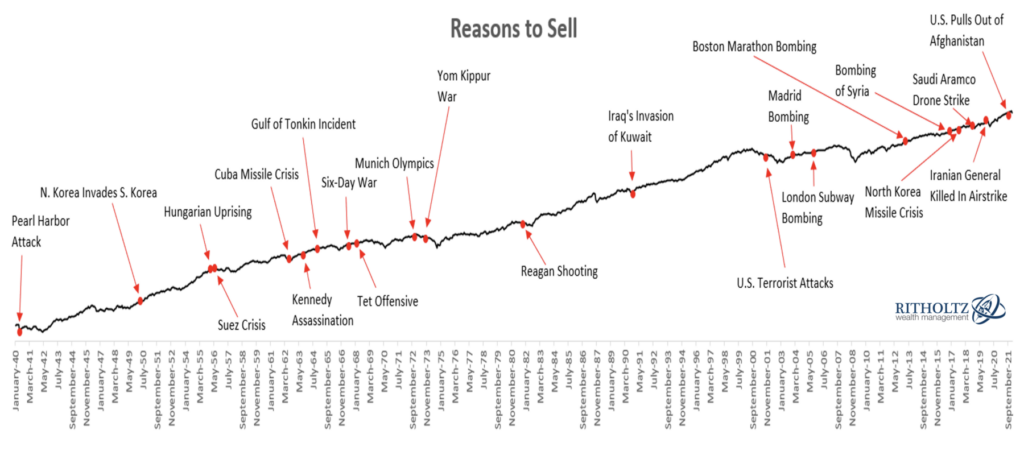

Stocks moved very well in last two weeks, keep booking profits

Remember : For exit in stop loss levels Day closing price is important and 1% downside from SL levels is still a hold for next day

Reminder for Quantity in Positional to be chosen carefully and based on formula i have shared below. That will allow us to take sufficient bets to succeed

Likhitha Infra (approx 33 yr old company) is an Oil Gas Pipeline Infrastructure provider in India. Operations include Cross Country pipelines and associated facilities, City Gas Distribution including CNG stations, and Operation & Maintenance of CNG/PNG services.

Strong presence in more than 16 states and 2 Union Territories in India.

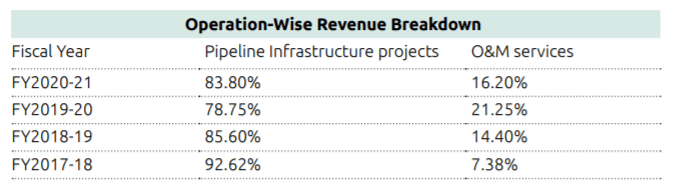

Two major domains, if we divide the operations , are Pipeline Infrastructure Projects and O&M services (Operation and Maintenance)

Revenue breakdown for the domains are highlighted below (for last 4 Financial years)

Long standing relationships with domestic marquee customers.

Efficient business model

Strong project execution capabilities

Diversified geographical presence in India

Strong Technical Qualification to bid for new projects

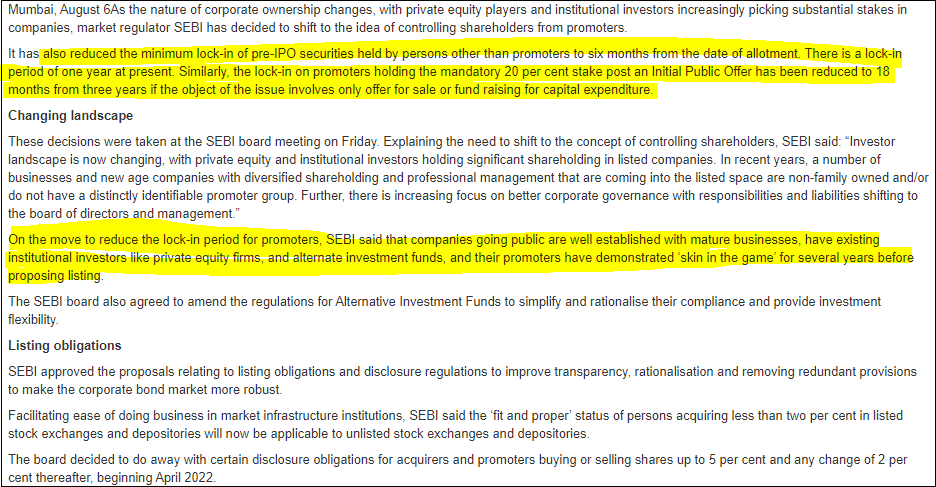

Strong promoter holding showing skin in game

Good ROCE, stable and improving PAT margins and EBITDA

Highly experienced Management Team

CGD is increasing in India and company is at right place for its business to grow with Strong client base and on top of that company has Strong Technical Qualification to bid for new projects which is visible in orders won recently

Company has received orders worth Rs. 250 Crores (approx.) excluding GST from various City Gas Distribution Companies during the

quarter from October 2021 to December 2021.

Till Aug. 2021 company has an outstanding order book of 1020 cr giving good revenue visibility. In Oct-Dec 2021 , company received 250cr of additional orders

As per the recent Government policies, PNGRB has increased the number of Geographical Areas (GAs) to 228 comprising of 402 districts spread over 27 States and Union Territories, covering 70% of Indian population and 53% of its area. These recent Government initiatives have provided lucrative opportunities for Oil & Gas infrastructure service providers

Recent policy moves, including a wide-scale rollout of CNG and the expansion of gas infrastructure including LNG terminals, long-distance transmission pipelines and city gas distribution networks, will help drive 30bnm³ of gas demand growth over the next decade through fuel switching away from coal and oil. A recent switch to CNG from coal in India’s brick industry is encouraging greater gas use.

Exit Triggers

Order chain drying up in coming quarters

Unforeseeable change in Government policies

Declining margins and increasing debtors or working capital cycle days

Risks

Any change in CGD policy

Much faster penetration of EV in coming 2-3 years

Rising raw material and commodity costs

The Company is deriving significant portion of orders from major Oil & Gas distribution companies inducing a client concentration risk

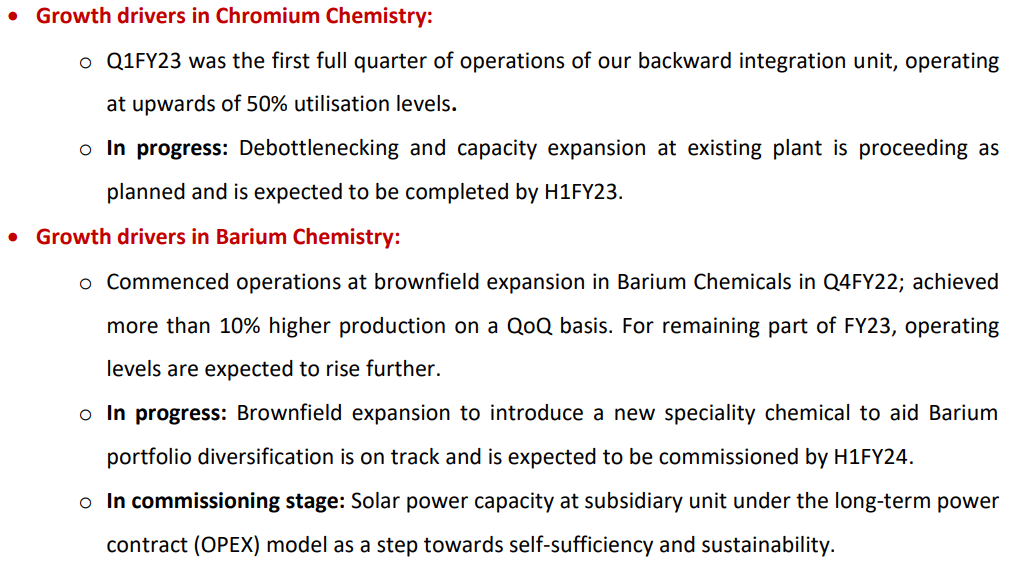

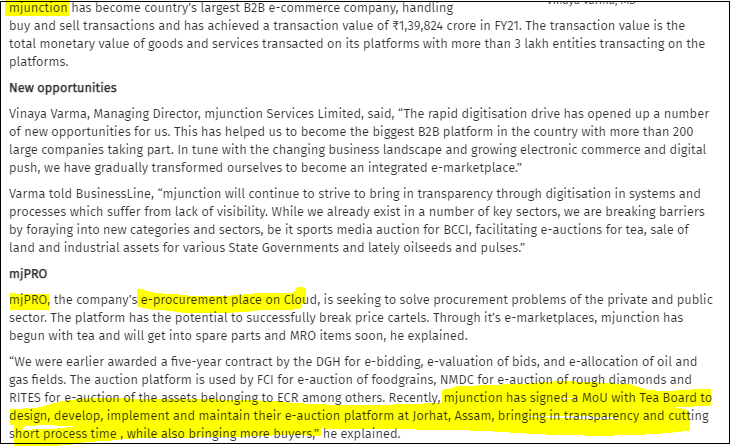

Vishnu Chemicals Limited is a market leader in manufacturing and sales of Chromium chemicals and Barium compounds across the world

Serving 12+ industries across 50+ countries (83 countries as per publicly available information)

~85% revenues (FY21) , Leading manufacturer in India as well as South Asia,

FY21 Domestic: Export Sales Mix: 51:49 , 3 manufacturing units

Over the last few fears, the company has diversified its Chromium revenue profile with presence in both domestic and export markets. Earlier the portfolio was concentrated in chromium, domestic oriented and now diversified and balanced geographically in domestic and export markets

Applications –> Pharmaceuticals, Leather tanning, Pigments and Dyes, Plastic masterbatches, Ceramic glazes, tiles, Electroplating, Automotives, Refractories, Wood Preservative, Paper pulping and others.

~15% revenues (FY21), Leading manufacturer in India, FY21 Domestic: Export Sales Mix: 45:55 ,1 manufacturing unit.

Applications –> Ceramics, tiles, glazes, bricks, refractories and water purification chemical in caustic soda industry, speciality glass, Luminescent Compounds, etc.

Long standing relationships with domestic and overseas marquee customers.

Well diversified board with specialists in field

Certifications — ISO 9001:2015 , ISO 14001:2008, REACH Quality Certification

Income, EBITDA, PAT, PAT Margin improving

D/E is high but decreasing as desired

Ability to pass the rise in input prices and freight costs.

Operating leverage: Most of the overheads or manpower addition are largely done considering FY21 as a base.

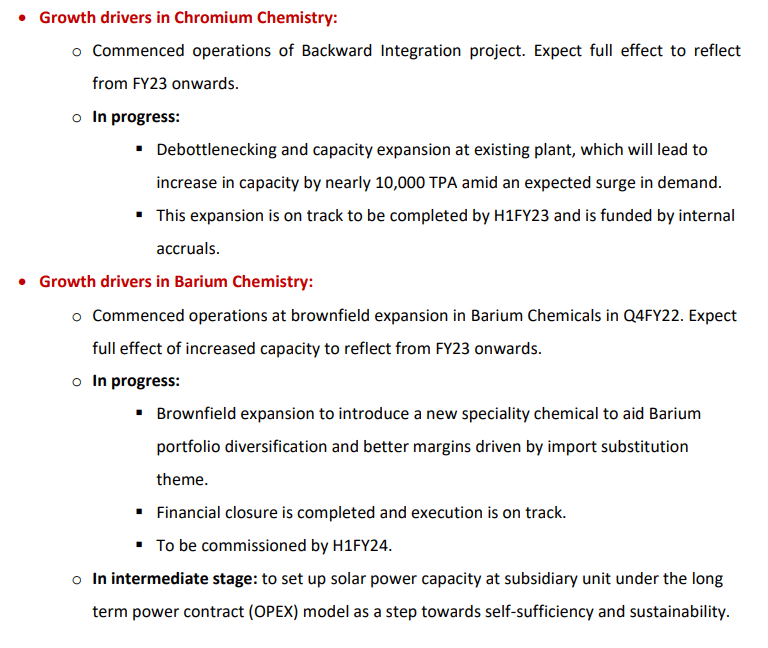

Higher utilizations from existing capacity: Major debottlenecking completed in Vizag unit in FY21 will lead to better throughput & efficiency

Majority of the capital expenditure towards sodium carbonate in Chromium chemicals is completed, Majority of company’s sodium carbonate’s current requirement will be met through the process. Significant cost reduction expected from upon being operational by Q4FY22E.

Focus is to increase market share with higher volumes in Barium chemicals

Leading manufacturer in India for Barium Chemical : Other players have less than 1/10th of Vishnu’s current capacity.

Incremental capacity of 20,000 TPA of Barium Carbonate expected to be operational by Q4FY22E

China plus 1 strategy has made them a preferred vendor instead of being a second option for their customers.

Exit Triggers

Crash in finished products prices or inability to pass on raw material in coming quarters

Any change in China +1 strategy for customers

Less than expected utilization of incremental capacity

Risks

Debt profile is still out of comfort zone

ROCE and PAT Margin still not as much as desired

Any Exports oriented issues including currency risk, freights costs

Significant promoter pledge of 40%

Any delay in operations of underway capacity expansion

Jubilant Ingrevia Ltd (JVL) houses the Specialty Chemicals, Nutrition & Health Solutions, and Life Science Chemicals businesses, which have been demerged from Jubilant Pharmova Ltd (erstwhile Jubilant Life Sciences Ltd)

It has a Strong presence in diverse sectors and its vertically integrated and due to this , it is Globally Lowest cost producers for most products.

Multi Location Manufacturing & Operation Excellence is achieved by company over the years

Leadership team has an average 30 years of industry experience

Company has expertise in 35 technological platforms at large commercial scale and

Company also has an expertise to handle multistep chemistry (up to 13 steps) at large scale.

Three major segments of Speciality chemicals, Nutrition and Health solutions and Life sciences chemicals

As shared from Company presentation 25% of Life sciences chemicals are consumed in house by specialty chemicals segment while for Nutrition and health solutions segment (vitamin B3, 100% in house sourcing done from Speciality chemicals)

Financial Highlights– RoE, RoCE stood at 15%+, EBITDA grew by 53% YoY while revenue from all segments growing well

Growth triggers

Company is planning to invest 900 cr (550 cr,100cr, 250 cr in different segments by FY24) and expecting 2x revenue in ~5 years

Multiple products in different segments are in pipeline to be launched in coming years

There is a strong demand for Acetic Anhydride and there is no new facility addition announcement globally in the recent past. Company’s customers are exploring to shift from high cost to low-cost countries. They are adding another Acetic Anhydride facility to increase capacity by ~35% by investing ₹250cr over next 3 years.

Co is planning to increase focus to leverage its long standing relationship with innovator pharma & agro-chemicals companies to expand its CDMO operation.

Company is also moving up the value chain in most of their product segments

In the process of launching its diketene (highly complex due to high temperature cracking and storage hazards) and its value added derivatives.

Risks

Raw Materials Prices: Key raw material for life sciences biz is acetic acid. Hence, dependent on the prices of Acetic Acid(Very volatile).

Large capex in next few years: he funding of this 900cr capex will largely from internal accruals. But if for some reason this capex is not completed on time or need more debt then it may affect profits in coming years

Exit Strategy

Acetic acid Raw material prices hurting company growth or

Any ban on application of its pyridine and similar substances by other countries can hurt the company growth

In such cases , its better to exit and have a relook on invested amount

Current Market price of 760 Rs, Company looks optically expensive for investment but looking at big picture if it sustains 10.5 eps for next 3 quarters giving 42 eps for FY22 , stock price looks to have decent upside available

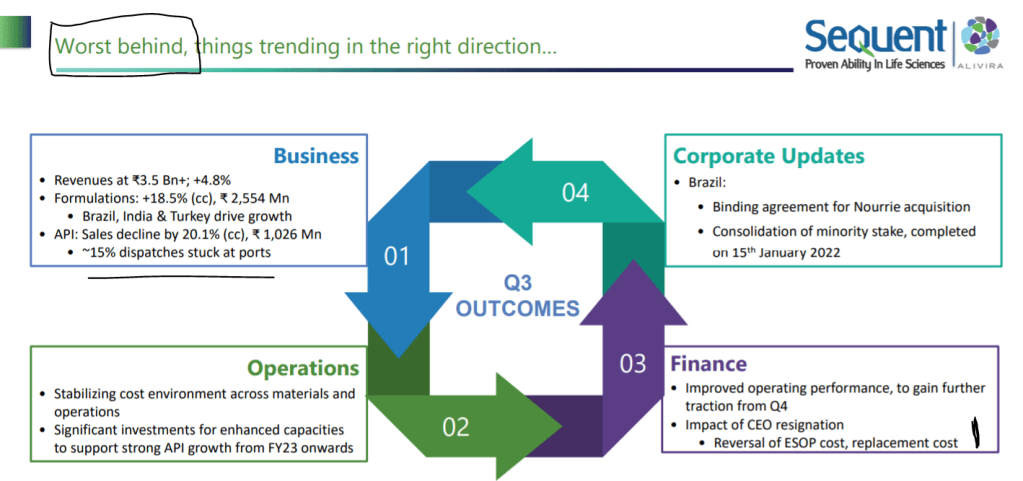

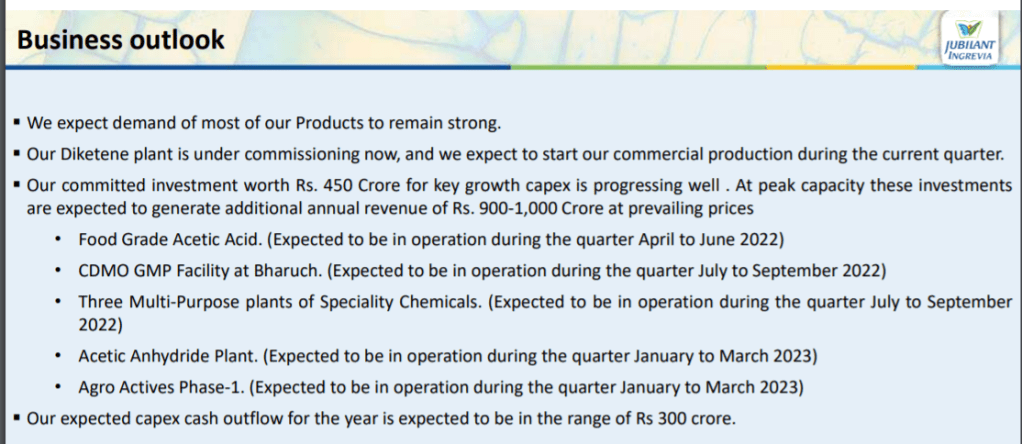

Update on Q2FY22 by Company on business outlook

Update on Q3FY22 by Company on business outlook

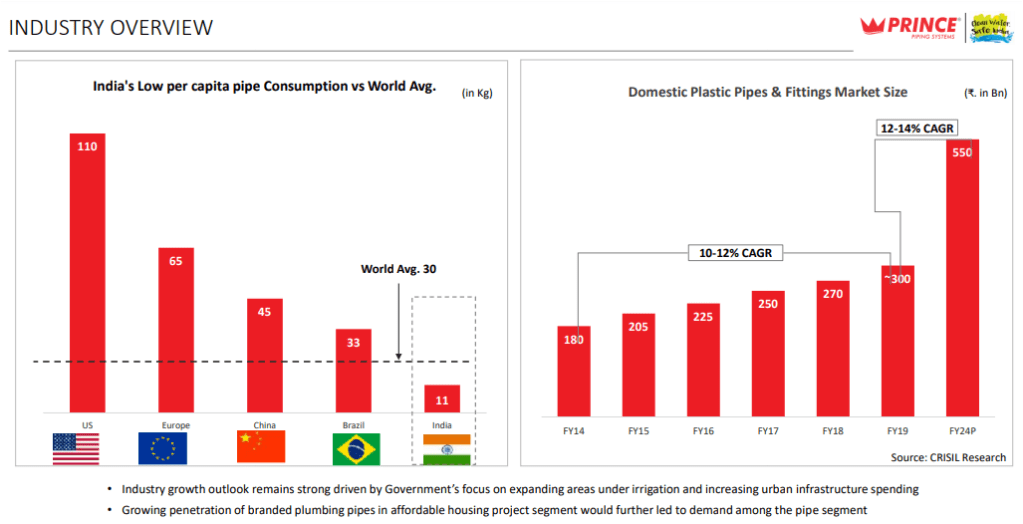

Prince Pipes and Fitting makes polymer pipes and fittings in India that are used in plumbing, irrigation and soil, waste and rainwater (SWR) management

It has 7,200 stock keeping units (SKUs) and 1,500+ channel partners.

Company has strong cash flow from operations and business share in Q4FY21 has been 69% from construction

Company current strategy is to expand in south india and increase distribution network while keeping the margins(EBITDA,OPM), ROCE in similar range

Company has been able to make use of 3 drivers of margin expansion in FY21 : inventory gains, product mix change, superior pricing power: past 8 Quarters company has been aggressive in passing on price .

Growth triggers

Total installed capacity of approximately 259,000 tonnes per annum (TPA). This will increase by a further 51,000TPA once its Telangana plant is fully commissioned- that means almost 20% increase in capacity

Various Government initiatives like AMRUT scheme, which is aimed at providing basic services, such as WSS, and ensuring that every household has access to assured tap water supply and a sewerage connection. Jal Jeevan mission (Urban) focuses on providing water supply to 4,378 urban local bodies with 260 million household tap connections. Nal se Jal scheme is planned to offer piped water to every rural household by 2024 –all these schemes is helping industry to grow by 35%(estimated) in next 2-3 years

There is a visible structural shift from unorganized to organised players and Prince pipes has shown both volume and sales growth wile other major players have shown de-growth in FY21

PPF is gradually increasing its emphasis on high-margin business of CPVC and double-wall corrugated pipes (DWC).

Recent tie up with Lubrizol will help the company in getting its supplies secure and as well as will attract more distributors towards company

Expansion into South India with Telangana Plant and focus on east india in coming years may keep the growth rate intact

Data-driven pull against conventional push is the new sales strategy of the company for the retail segment. Business-to-business (B2B) remains an area of improvement where PPF sees ocean of opportunities. It has moved into technology driven plumber data to move into B2B business as well as for normal business

Risks

Raw Materials Prices: Raw materials (resin) are derived from crude oil and any increase in crude oil price can hurt margins in short term.

COVID Lock-downs: Second wave of COVID, many states have had to announce lock-downs, although this time plants were not completely shut but still first quarter at least, could be dampner.

Corporate Governance Issues: There have been allegations of inadequate disclosure in the IPO prospectus of PPF PPF did not disclose all litigations, claims and criminal proceedings against the promoters (although re-filed DHRP corrected anamolies but still some differences are claimed)

No moats and No barriers to entry in this business

Fake / duplicate products can hurt company business

Exit Strategy

COVID-19 third wave creating more havoc than 2nd wave can impact the company balance sheet in big way for construction and this should be on radar

Break up with Lubrizol will definitely hurt the company and we need to relook if such thing happens in future

Any negative change in Govt policy for water schemes can hurt the growth prospects and may warrant an exit

This is in series of posts where you can find the SWOT of a listed company along with factors to watch out for in coming quarters.

SWOT means

S – Strength of a company

W- Weakness of a company

O- Opportunities available for a company

T – Threats for a company

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Also Read – SWOT- Parag Milk Foods

Also Read – SWOT- SBI CARDS

Also Read – New to Stock Market : Part 1 : As Investor or Trader?

Also Read – Invest in stock markets only if

Investing is buying right stocks with right allocation at right price at opportune time with exit strategy in place Experience counts!!

Lets invest!!

Join our Equity booster plan at very nominal fees get in touch https://wa.me/919740311223?text=interestedinequityboosterplan

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

This is in series of posts where you can find the SWOT of a listed company along with factors to watch out for in coming quarters.

SWOT means

S – Strength of a company

W- Weakness of a company

O- Opportunities available for a company

T – Threats for a company

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Also Read – SWOT- Parag Milk Foods

Also Read – New to Stock Market : Part 1 : As Investor or Trader?

Also Read – Invest in stock markets only if

Also Read – SWOT- Dhanuka

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

As we have seen multiple times, people enter into stock markets with a lure of quick money and start buying stocks based on tips, analysts recommendations, social media news or friends recommendations. All this stock buying happens as a blind follower. Unfortunately most of the times these blind follower theory works for buying only. People forget to sell stocks or intentionally keep holding them because of losses in these stocks and they don’t want to miss out if stock rebounds. So they keep on waiting for stock to come to their buying level or worse they keep averaging such stocks.

What people really miss or can not analyze is whether the stock bought is good enough to hold or not? or Is it good fundamentally? or the original buying thesis has undergone a change or not? Whether this stock ever turns back or not and why? Whether they should average or not?

Our team at Alpha Affairs has recognize this need for common people who need a opinion on their holding so that they can take a decision themselves with better understanding. Alpha Affairs has filled this need by giving a chance to common man to get the third eye look on his/her portfolio.

Portfolio opinion is a premium service (nominal fees) and our motto behind this service is to help our friends remove dud stocks from portfolios to improve overall portfolio returns. We call it as a Third Eye Look on your portfolio. This Opinion should be construed as knowledge sharing only and not be construed as financial advice ( we are not SEBI registered) and any losses or profits arising out of same are responsibility of the stock owner. We are only trying to help each other in best possible way we can. It is better to consult your financial adviser before initiating buying, sell or hold calls on your portfolio

Please find the details at the link provided below

https://alpha-affairs.com/portfolio/portfolio-opinion-third-eye-look/

Your portfolio review maximum two times.

One at start of discussion and

another review on or before 90 days as per request

You can use Services for Stocks or Mutual funds review or both together.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.