Ghosla banega

BE FINANCIALLY INDEPENDENT

Guest Blogger : Seth

The Importance of Tracking Expenses for a Profitable Rental Property Business

Alpha Affairs is your source of financial, fitness, and health tips and resources. Subscribe now to live your best life!

Tracking expenses can mean the difference between success and failure for a business. For a company that manages multiple properties, keeping track of finances, managing your profit and loss, and monitoring expenditure can be a full-time job — a job that can be made easier with the use of effective accounting tools.

Why should I track expenses?

A record of expenses needs to be kept by every business, including one that’s focused on investment property. Tracking costs allows you to keep track of spending, which is especially important in larger organizations where multiple employees incur costs. Keeping an eye on your outgoings helps you make better analyses to minimize mistakes made through human error. Collecting data around your earnings and outgoings allows you to oversee your P&L and use the data to identify areas of weakness and potential growth. In addition, the government requires you, by law, to keep paper copies of some expenses for tax purposes.

What records do I need to track?

Fortune Builders estimates there are 14 types of expenses that a property rental business needs to track: property taxes, maintenance, utilities, property management, homeowners insurance, appraisal fees, home inspection, broker fees and tenant screening, marketing, property improvements, accounting fees, vacancy costs, business permits, and closing costs. Even for one property, this is a large number of expenses to monitor — multiply that by 10 or 100, and you can see the importance of sophisticated expense tracking systems.

How can I track my expenses?

A property rental business should focus on organizing expenses by specific categories, ideally by each property and by type of expenditure (i.e., repairs, insurances, etc.). Accounts should be regularly updated with earnings and outgoings for the entire business. Expense tracking can be done traditionally, through paper filing, via spreadsheets such as Excel, or through robust accounting software systems.

Paper tracking

It can be tempting to shun paper filing in place of modern accounting systems. However, paper filing does have some benefits. The IRS requires receipts for business expenses that are more than $75.00. Moreover, it is recommended that small businesses retain receipts for all purchases to track business expenses effectively.

Paper tracking uses a traditional hand filing system to file documents into category folders. Paper filing is tedious, takes up physical space, and doesn’t give you an effective overview of your accounts department without transferring at least some of the data onto a spreadsheet or accounting system

Spreadsheets

For small businesses, the use of a spreadsheet may be enough to keep track of business expenses, and it has the advantage of eliminating some wasteful paper usages. However, spreadsheets for large businesses, or companies with many users, can become unwieldy and are open to human error. For this reason, spreadsheets are suggested for SMEs only.

Online accounting systems

For businesses, both large and small, that want a robust accounting system, QuickBooks Online Advanced is highly endorsed. Quickbooks process invoices, bills, checks, and expenses faster by allowing the user to input all data directly into the system, and it is connected to your bank and Paypal accounts. This complete integration into the financial aspects of your business allows you to see where your money is going by giving you a simple overview and analysis of your data. Quickbooks can be used to oversee a large number of employees, making this an excellent option for large companies. This sophisticated accounting system means your business is fully prepared when tax time rolls around.

Whichever method you choose to track your expenses, with managing rental property, it is imperative that you ensure that detailed accounts are kept and reviewed regularly. Successful businesses keep an eye on cash flow and use the data that they obtain to tweak practices to ensure growth and profit for the future.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Aptus Value Housing IPO– Incorporated in 2009, Aptus Value Housing is a retail focused housing finance company primarily serving low and middle income self- employed customers in the rural and semi-urban markets of India.

Business — It offers customers home loans for the purchase and self-construction of residential property, home improvement and extension loans, loans against property and business loans. It only offers loans to retail customers and does not provide any loans to builders or for commercial real estate. Its target customers are first time home buyers where the collateral is a self-occupied residential property. It provides loans with a ticket size only below ₹25 lacs

Region of operation –Company caters to 4 states namely Tamilnadu, Andhra pradesh, Telangana, Karnataka

Offer purpose — The IPO is fresh issue of 500 cr and offer for sale by promoter. The issuance of shares is for branch expansion and general corporate purposes. It proposes to utilize the Net Proceeds from the Fresh Issue towards fully augmenting the tier I capital requirements of the company.

Risks —

Limited region of operation can pose regional risks

Loans to low and middle income groups may lead to spike in NPA with COVID-19 3rd wave risk

Strength

Good Financial ratios despite catering to low and middle income groups

One of the largest housing finance companies in South India

Highest return on assets (RoA) of 5.7% among 25% the Peer Set during FY21 and low Loan to value size helps the company further

Backed by sound promoters

Future

With affordable housing on rise in India and emergence of nuclear families present a long runway for company in short to medium term to grow the business and grab the opportunities. Expansion into new markets is also another opportunity

Valuations

Valuations are bit on higher side considering peers but look reasonable due to better finacial metrics

Should we apply?

People can subscribe for listing gains and hold longer with each quarterly review

Exit on listing if getting more than 30-40% gains

Add more if it dips below issue price keeping long term horizon mindset

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

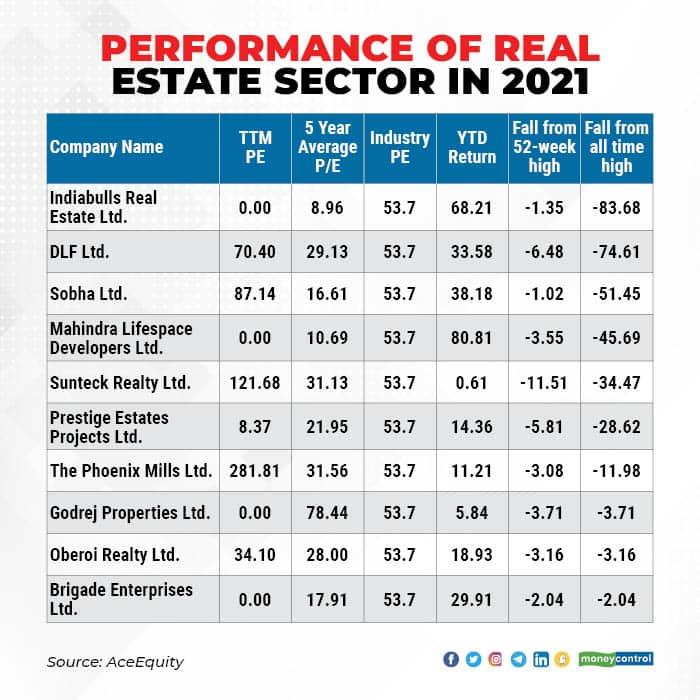

Looking at Knight Frank report and few article here and here , it seems best to wait for a quarter or half year to get the best deal out of real estate.

Real estate sales for residential units at low and office units vacancy at high