With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

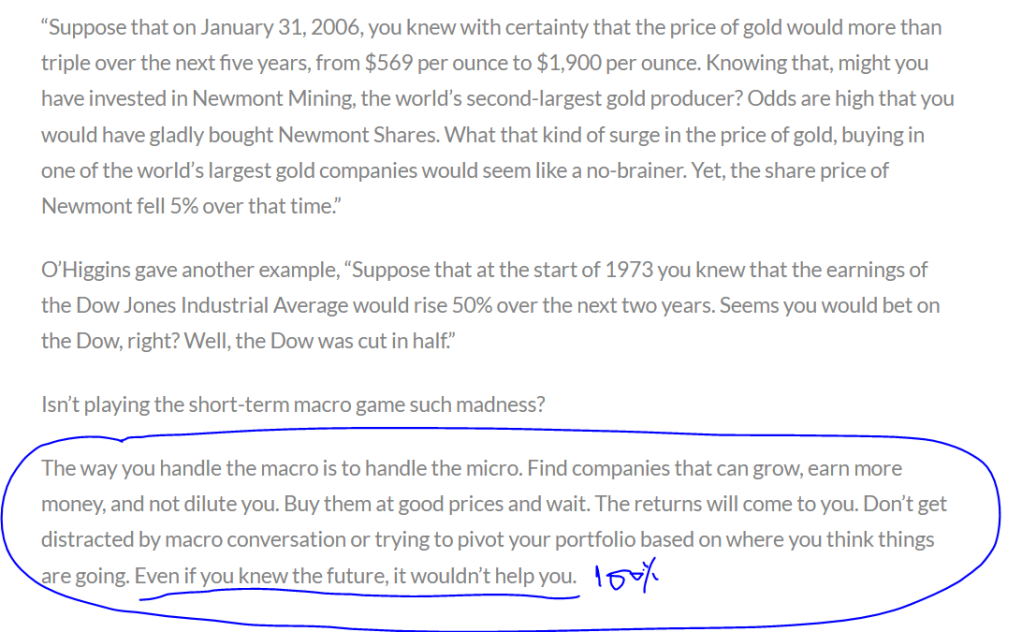

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Free lifetime learning through a Whatsapp Community (apart from Program content) & Bonus Sessions

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

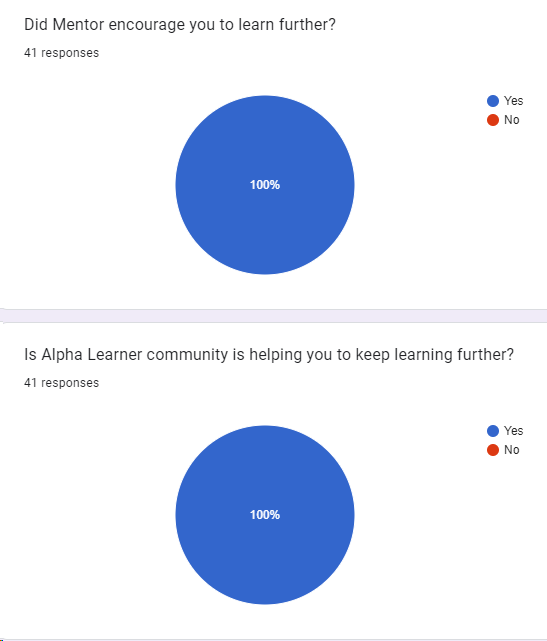

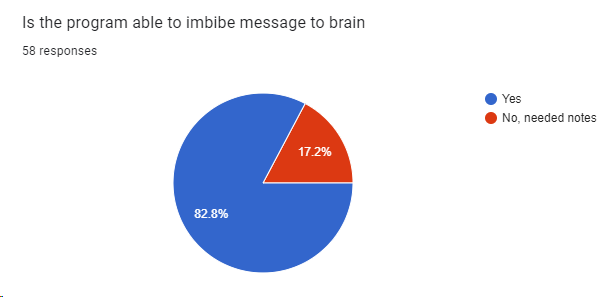

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.