Category: Disruption

SS-5

India has been going through a transformative change through Aatmnirbharta

Lot of sectors have big tailwinds including

- Railways (New Trains, New Tracks, New Wagons, Metro rail expansion to new cities etc.)

- Defense (Reducing imports, Replacing old ammunition, New Fighter planes, Ships )

- Automobiles (Building India as exports hub, increasing population with rising income profile)

- Space ( Chandrayaan, Aditya L1 launches, Starlink agreements with ISRO, small satellites launches increase etc)

- Marine and Shipping Industry (Building submarines, Ships, Ports infra, Sagarmala projects etc)

- Industrial Expansion in many industries with capex being announced every week here and there

- Oil and Gas industries And Heavy Earth moving Equipment’s

- Power transmission and distribution

Considering all above, ALPHA AFFAIRS see

FORGING as MEGA TREND

And from that Mega trend, we focused earlier on RK forge, covered here and here

Today we are focusing on one emerging player in same industry but has bigger vision in new sunrise industries as well. We have also covered with small details on Baluforge earlier

Balu Forge

CMP 285, Market cap ~2900cr

ROCE ~27%, ROE ~22%, D/E ~0.16 PE ~44 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4

🟢It is engaged in the manufacturing of finished and semi-finished crankshafts and forged components and has a strong clientele comprising of 25+ OEM’s. Company has Fully Integrated Forging & Machining Unit with a large product portfolio offering to customers ranging from 1 Kg to 500 Kgs. The Forging Unit comprises Both Closed Die Forging Hammers & Presses

🟢Balu Forge has a distribution network in over 80+ countries and operates in domestic and export markets

🟢Balu Forge is already an approved vendor to a majority of the 41 Ordnance Factories part of the Ordnance Factory Board in India.

🟢Acquired Mercedes Benz Truck, Mannheim, Precision Machining Plant in 2021.

🟢Company has 3 subsidiaries. 2 in UAE and One in India.

Kelmarsh Technologies FZ LLC in 2021 (100%). Headquartered in the UAE with operations spread across 3 countries in Africa. Focused on manufacturing and innovation of agricultural equipment predominately tractors and tractor ancillary components

Safa Otomotiv FZ LLC (100%). Focusing on the machining and assembly of products in order to increase localization in the MENA region as well as meeting the product requirements for Agriculture and Oil & Gas industry

Balu Advanced Technologies & Systems Private Limited

Naya Energy Works Pvt Ltd (100%). Naya Energy is engaged in manufacturing of products for New Energy Sector

Company claims to work on Hydrogen Fuelling Stations & pilot project is presently underway to establish the first Hydrogen Fuelling Stations for fuel cell vehicles

Also company is in the process of patenting our domestically developed Refining Technology, NayaRefine. Currently One Module deployed can roughly produce 3-3.5 Tons of pure lead every day.

Company is working on a range of Charging Stations Conforming to Bharat EV AC Charger (BEVC-AC001) & Bharat EV DC Charger (BEVC-DC001) norms

Company also claims to work on ESS (energy storage solutions in form of hydrogen)

🟢Entered into leave and lease agreement with Hilton Metal Forging Ltd enabling Balu to backward integrate from precision machining player to Forging and Machining player

🟢Existing capacity to produce 18,000 tonnes Forged Components per annum which will be expanded to ~32,000 tonnes in the coming quarters. Annual capacity to manufacture 3,60,000 crankshafts. Wheel Production capacity of 6,000 wheels per year with a diverse application suitable for railway wagons, passenger coaches & locomotives in various gauges. Company want to Expand the wheel production capacity to 48,000 wheels per year

🟢On the capex front, Company plan for enhancing machining capacity by ~14,000 tonnes at newly acquired 13 acre land in Belgaum, Karnataka is progressing well. The operations from this facility are expected to commence from Q4 FY24, that will enable us to produce heavier and more complex crankshafts having better realizations and margins. After expansion, company will be operating on 22cr (previously 9 acres)

🟢The new facility will not only act as a Manufacturing Centre but will also be setup as a Technology & Innovation Campus with a strong focus on Integrated Defence Research & Production, Cylindrical Cell Production for Electric Vehicles, Components Suitable for New Energy Vehicle Drivetrains & Powertrains, Spent Battery Recycling to name a few but not limited to the same. There will be a dedicated R&D center spread over 4000 m² with a strong focus on the following key areas:

- Advanced Materials & Composites (Development of New Materials)

- Fuel Cell Development

- Cylindrical Cell & Module Development (LFP & NMC)

- Metal Air Battery Development (Zinc Air)

- New Energy Powertrain & Drivetrain solutions (New Vehicle Components)

- Advanced & Additive Manufacturing

- Energy Storage Solutions

- Alternate Bio fuels

- Spent Battery Recycling

- Advance Defence systems & solutions

Key focus areas of our R&D

Exploring the use of new materials, such as lightweight alloys or advanced composites, to enhance the product offering.

Investigating cutting-edge manufacturing methods, such as additive manufacturing (3D printing) or advanced Machining, to achieve higher precision and tighter tolerances.

Analyzing and optimizing product designs using computer simulations and finite element analysis to maximize performance and minimize stress concentrations.

Building a robust platform for the product expansion into the Railway & Defence Industry by way rapid prototyping & increase the speed of New product development

Successful Prototyping of some key components for the New Energy Mobility sphere to ensure the long-term vision of building strong capabilities in Fuel Agnostic solutions.

Investigating new heat treatment methods to enhance the strength and fatigue resistance of our products.

🟢Diverse array of products including Crankshafts, Railway Wheel, Under carriage, Transmission and clutches, Hydraulic motors etc

🟢Company is witnessing a lot of green-shoots in the defense and railway industry. This presents a significant growth opportunity for BFIL, as we continue to expand our footprints in these sectors

🟢Company is spending 2-4% in R&D and have 45 employees in that division, Overall employee strength is more than 700. Company is also Backed by certifications like IATF 16949 accredited by Tuv Nord Cert GMBH

🟢Revenue is expected to conservatively grow by ~25.0% in FY24 over FY23, led by growth opportunities in the various industries like defence, railways, and others

🟢EBITDA margins are expected to be in the corridor of 22.0%-23.0% in the upcoming quarter on the back of increasing scale of operations and efficiencies

🟢Promoter has skin in game with roughly 54% allocation. FII Have entered. Some DII money is also getting poured in this one. Management has good 3 decades of experience in the industry and now 3rd generation also into same business leveraging the domain strength acquired over years

🟢Fund raising and Preferential allotment Promoter infused 26cr at 115 Rs/share in 2023 and then 92cr (almost double of fixed assets 48cr) at 183 Rs/Share. Ashish Kacholia & Sage one also participated in Pref. at Rs.115. On 48crs of Fixed assets , Company has raised~300crs for expansion. Recently new fund also entered at 183 Rs/Share. All the selling hangover by a fund over last 2 years has been absorbed and stock is back to new highs

🟢Order wins in last 12 months. Significant order win from a tractor manufacturer based out of the Middle East of supplying 10,000 sets of sub-assemblies & there is scope to increase the same to over 50,000 annually

Risks

🔴 Volatility in the price of major raw material- steel and aluminum is a major risk, the operating margin remain susceptible to these volatilities

🔴Large working capital days cycle. The company provides a credit period of 150-180 days to its customers due to business requirements and maintains an inventory of 60-80 days due to diversified product portfolio

🔴Most of the talks under Naya energy division or Balu Advanced systems is just been talk. We need to see when and what product comes out of these new divisions. Many other companies progressing fast on Recycling, Defense and EV/Hydrogen space. We have not seen much on this part regarding their advances in these domains which significantly upgrade their Revenue or profit from these divisions. These may become sunk cost if management is not focused

Financials

Sales have grown 3x and Profits 8x in last 3 years approximately, OPM margins have improved, over 3 years company financials have improved

Technical chart

Good Daily and Weekly Breakout with volumes in 1st Week of Jan24

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Diwali to Diwali -4

MSTC

CMP 568, Market cap ~4000cr

ROCE ~37%, ROE ~33%, ROE 3Yr 30 %, D/E ~0.16 PE ~17.4 (based on screener)

Company is paying Dividends but not consistent, Changing Business Profile

Also Read Pick1, Pick2, Pick3

🟢Company conducts electronic auctions (“e-auctions”) primarily on behalf of the government of India and related parties like government-owned companies. MSTC is a Mini Ratna Category-I PSU of GoI, based in Kolkata.

🟢MSTC has 50:50 joint venture with the Mahindra group called Mahindra MSTC Recycling Private Limited (MMRPL). This company is an authorised RVSF (“Registered Vehicle Scrapping Facility”) for vehicles reaching end of their life. These old vehicles are purchased for de-polluting, dismantling and converting the metallic parts in an environmental friendly manner. In December 2022, the Government of India issued a directive regarding its Scrappage Policy, a government-funded initiative which seeks to phase out old passenger and commercial vehicles, thereby reducing urban air pollution, increasing passenger and road safety, and stimulating vehicle sales. This means that all government owned vehicles will be auctioned off on MSTC’s e-commerce platform when they reach end of life. This opportunity is close to 15Lakh vehicles

🟢MSTC is casting more focus on the untapped e-commerce business from the private sector and in this stride MSTC has signed big ticket agreement with Reliance Industries, Indus Tower, Tata Power, L&T, Jindal Group, Vedanta

🟢Company has negative cash conversion cycle and that helps company to grow without any need of capital

🟢Diversity in auctions management is a kind of moat. Company have done auction of properties, Gold, Metal scrap, Steel, coal mines, Aircarft, UDAN scheme etc etc etc

🟢Promoter has skin in game with roughly 64% allocation. FII started entering. Some DII money is also getting poured in this one

🟢Sale of natural resources such as iron ore mines, coal, minerals, sand blocks, and resources extracted by government-owned companies like iron ore and natural gas. This principle also extends to the ongoing sale of scrap, surplus stores, old plant and machinery, e-waste, and obsolete items belonging to different branches of both the state and central government across India.

🟢Recently Govt has announced that multiple block of minerals mines will be auctioned. Bidding of these auctions will be around 50K crore. MSTC will be getting % of these auctions (mostly less than 1%). Most of these auctions if done through MSTC, then most of the revenue will also flow to bottom line

Risks

🔴Company business is dependent on many government entities auction like coal, metal etc. So business can be lumpy to certain extent

🔴Launch of any new portal or shifting of auction business to individual companies of Govt or reduction of margins can potentially derail thesis

🔴Significant increase risk of investing in PSU as Govt can interfere on many things

🔴Any breakdown of portal or any bug in portal can lead to revenue loss and further loss of business

🔴Company has litigations earlier and need to be closely tracked on this front as well

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Diwali to Diwali -3

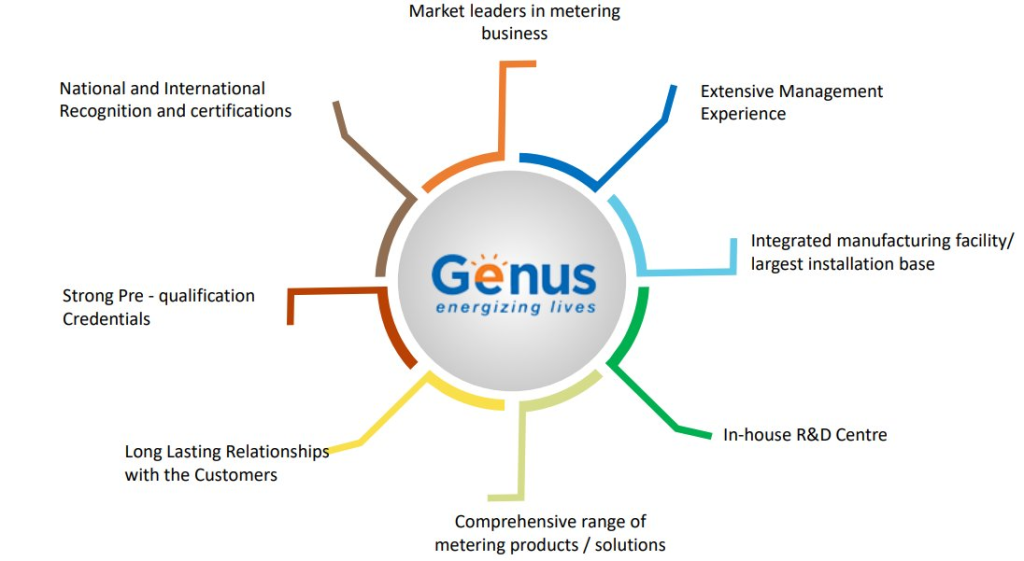

▪ At present, India loses around 30% of its power generated due to transmission, distribution, billing generation and collection inefficiencies

▪ Theft is the one of the main causes of the high losses. Theft occurs in several ways, viz: by tapping power lines and tempering / by-passing meter etc

▪ Meters play a vital role in reduction of AT&C Losses – Replacement of defective meters by tamper proof electronic meters / smart meters – AMI / Smart metering to the consumer for reduction of commercial losses and billing and collection ease

▪ Smart meter has the following capabilities: – Smart Meters and AMI Meters have communication capability – It can register real time or near real time consumption of electricity or export both. – Read the meter both locally or remotely – Remote connection or disconnection of electricity – Remote communication facilities through GSM / GPRS / RF etc

Here comes the company which tackles the problem head on and manufacture smart meters

Genus Power

CMP 223

Stock PE 71, ROCE, ROE <10%, Debt to equity < 0.3 (based on screener)

Also Read Pick1, Pick2

➡️It is engaged in manufacturing and providing Metering and Metering Solutions and undertaking ‘Engineering, Construction, and Contracts’ on a turnkey basis

➡️In 1996 it pioneered unique tamper-proof single & three-phase electronic energy meters in India.

➡️1st company in India to obtain various certifications like DLMS certification for Energy Meters, BIS certification for Smart Meters, etc.

➡️Current Order book is massive 19K crore –many order they have won recently

➡️Many State Electricity Boards (SEBs) have initiated the process of inviting bids for the deployment of smart meters under RDSS scheme

➡️In May 2023, the company has signed a commitment letter with United States International Development Finance Corporation (“DFC”) to obtain a Loan up to USD 49.5 million to scale up the deployment of electric smart meters.

➡️Company expects a substantial recovery in revenue from Q3FY24 onwards on back of our robust orderbook and consistent order inflow, further bolstered by the normalisation of the supply chain

➡️GIC Affiliate and Genus Power Infrastructures Limited to set up a Platform to fund Smart Metering projects

o Company signed definitive agreements with Gem View Investment Pte Ltd, an affiliate of GIC, Singapore (“GIC”) for setting up of a Platform for undertaking Advanced Metering Infrastructure Service Provider (“AMISP”) concessions

o Genus Power would be the exclusive supplier to the Platform for smart meters and associated services

➡️Largest player in India’s electricity meter industry ~27% market share in Meter Industry

~70% market share in Smart Meters

➡️Annual Production capacity of 10 mn+ meters

➡️Empanelled with 40+ different utilities across the country

➡️Only Indian company to receive BIS certification for Smart Gas Meters

➡️CMMI level 3 Company Accredited with – ISI, KEMA, SGS, STS, ZIGBEE, UL, DLMS etc., which is amongst the highest in Indian Metering Solutions Industry

➡️Big and reputed clientele

➡️In-House NABL Accredited Electronic Energy Meter Testing Laboratories

GOVERNMENT INVESTMENT

The government is planning to invest up to $21 billion till 2025 in smart grid technologies

The smart cities initiative is targeting 100+ cities in India, out of which 20 have been declared

More than 14 smart grid pilots have been launched in cities across India, to push smart solutions in Power Generation & Distribution Industry

Risks

➡️Fairly valued to bit overvalued until Earnings kick in

➡️Increase in employee cost and other expenses, as expanding workforce and enhancing systems in preparation for the execution of the substantial orderbook

➡️Significant increase in financing costs as a result of the company’s obligation to provide new bank guarantees to secure the massive order inflow

➡️Delay in execution of existing orders received by a quarter or two

➡️New order tenders getting delayed

➡️Change in policies

➡️Increase in RM costs

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Freight Corridor

Net Net Gain !!

TSMC : Going global

Hourly rent : Disruption

Disruptive Materials

Carbon capture in steel industry

BNPL vs Credit card

Lithium ion cell plant : Ex(cited)ide way

Smart meters

MDF : Future of furniture

Cloud Trends

Eggshells as bioceramics!

Ukraine Russia Share in global trade

A Wood without wood : Indowud

Credit cards vs UPI

Less Fluid hungry : EV

Our Defense : Shortage of components and ..and .. and..

Aatmnirbhar version : Drone manufacturing

Electrifying Shipping : Fleetzero

SSB : Future of EV!!

Containerized logistics challenge

Li-ion Batteries growth estimation in India

Semiconductors : Structural theme underway!

DRIFE : Blockchain-driven ride-hailing platform

E-Pack and E-Pump : 15 Minutes

BNPL and HOLIDAYS

Sun Setting on ATM’s

Two Crypto Unicorns of India

Mobile vs Card Payments

Coin Based Laundromats : Long term Trend

SaaS Innovation : Fixed to Variable

Private Labels : New trend for Food delivery

Silicon Carbide : Next Leap

V for VEGAN

Tin Manufacturers vs BIS certification

AUDIUS : Blockchain protocol on Music

Innovative Agile Platforms

BLOCKCHAIN @ NASDAQ SPEED

Farm-to-CUP on IOT : Cherise

Private trains : No Takers, still on paper

Hydrogen Fuel cell : Railways

BNPL model : Wallet Based

LEO Satellites

Saankhya Labs : 5G O-RAN

Hydroponic Farming

Face Mask and Covid Sensors

Innovative hand sanitisers

Mass Spectrometry vs RT PCR

WazirX and NFT

Saline Gargle RT-PCR

DIY COVID-19 Kit

Aatmnirbhar version : Battery Storage tech ACC

Aluminium Air Battery

Quant investing : Upcoming way of investing

Changing Dynamics : Broking industry

Bitcoin vs Ethereum Debate