Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There could be lot of things which might have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Jupiter Wagons

Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9, Pick10, Pick11, Pick12, Pick13

Business

Jupiter Wagons Limited (JWL) is a provider of comprehensive mobility solutions, with diverse offerings across Freight Wagons, Locomotives, Passenger Coaches (LHB), Braking Systems, Metro Coach, Commercial Vehicles, ISO Marine Containers, and products such as Couplers, Draft Gears, Bogies, and CMS Crossings. JWL has manufacturing facilities located in Kolkata, Jamshedpur, Indore, and Jabalpur with full backward integration to its foundry operations.

With a rich legacy over four decades, the Company has leveraged its deep technological capabilities and robust financial position to emerge as a one-stop shop for mobility solutions and reinforce its position as one of the fastest growing within the industry.

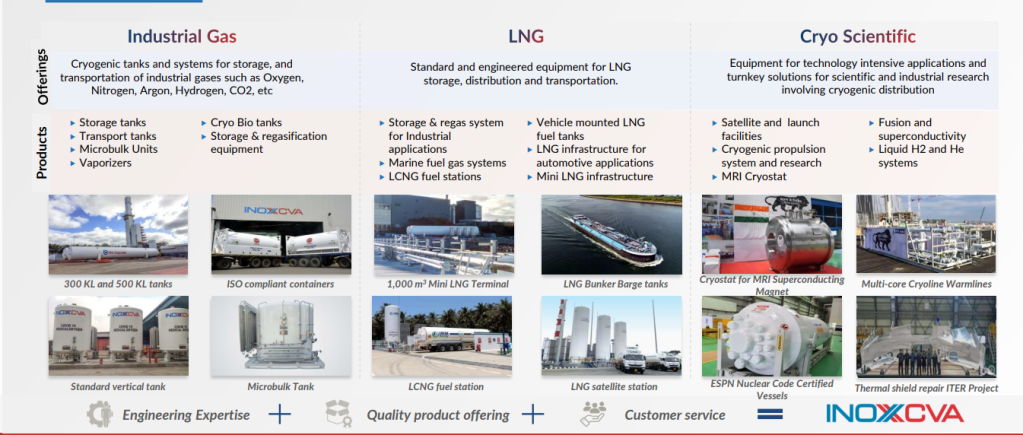

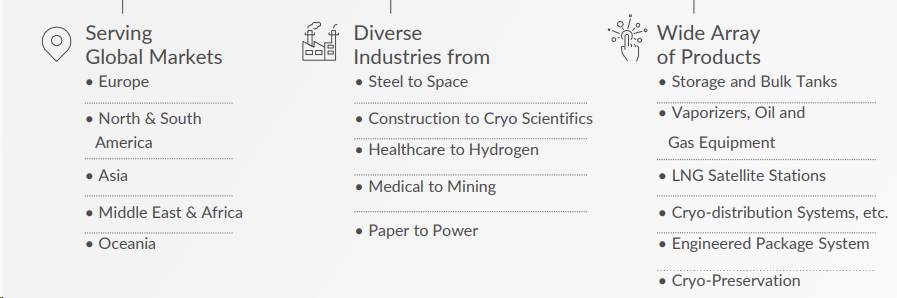

Products, Segments

Railway Wagons

Commercial Vehicles incluising Electric Light Commercial Vehicle business (eLCV)

CMS Crossing

Brake Systems & Brake Disc

Containers including Flex Containers, Marine containers , BESS containers

Strengths and Certifications

- The Group has established partnerships with leading global companies such as Tatravagonka (Slovakia), DAKO-CZ (Czech Republic), Kovis Proizvodna (Slovenia), Telleres Alegria S.A (Spain).

- Marquee clients associated with company

- JWL is one of India’s largest wagon manufacturers, with a capacity of 9,600 wagons per annum

- Improving scale of operations

- Healthy order book providing revenue visibility

- Experienced Management and leadership team

Clients

Catering to industries such as Railways (Freight + Passenger), Metro Rail, Automobile, Transportation, Logistics, Construction Equipment, Municipalities, Healthcare, Energy, Mining and Infrastructure, the Company boasts a marquee client base including the Indian Railways, American Railroads, Indian Ministry of Defense, Tata Motors, GE, Volvo Eicher Motors

Joint Ventures

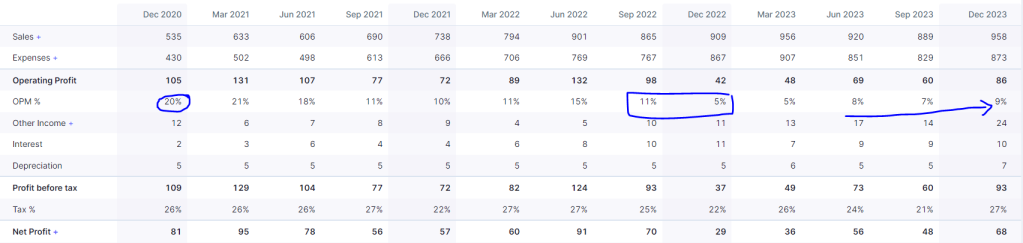

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

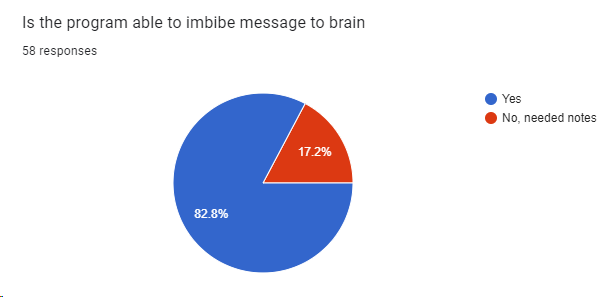

Consistent increase in sales over last 12 qtrs barring a quarter or so

Profits have multiplies by 8x in last 2 years

Consistent Tax records

ROCE and ROE is reasonably above 20%

Promoter has skin in game, FII is increasing stake, DII stake is stable

Recent Developments and Key Triggers

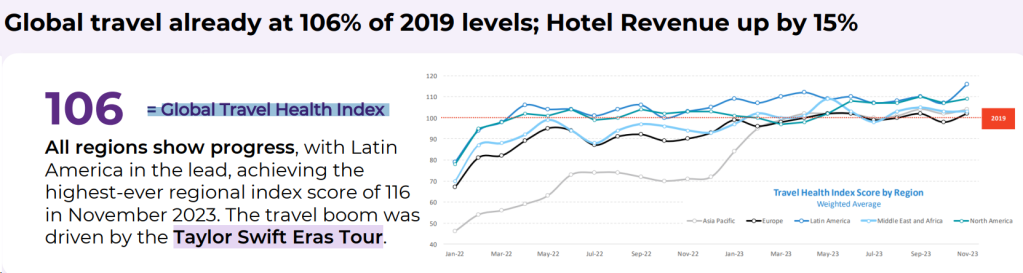

Dedicated Freight corridor, Projected Wagon demand, Improving logistics share through Railways are big triggers for continuous growth of this segment

- JWL has made a strategic entry into the global markets by signing a long-term Memorandum of Understanding (MOU) with RITES Limited, a prominent PSU associated with the Indian Railways, to explore opportunities in the international market for railway rolling stock projects. JWL’s focus is on the design, manufacturing, and supply of Railway wagons.

- The Company is focusing efforts on achieving Import Substitution, particularly in the areas of High-tech and Highend Containers. To further elevate global competitiveness, manufacturing facilities have been fully automated, enabling consistent production and maintaining world-class quality standards. The manufacturing facility is certified by both ‘LRQA’ and ‘BVQI’.

- A new foundry is scheduled to be established in Jabalpur over the next 18 months with a capacity of 2,000 tonnes, catering to both captive use and exports. This initiative is expected to yield cost savings in freight expenses.

- In the Marine Container Business, the outlook for specialized containers is improving as the Company has: Secured a contract for 40-foot ‘Open Top, Coil Containers’ with a pilot order worth ₹ 1,000 lakh.

- Received a Letter of Intent (LOI) from an Indian Subsidiary of a Prestigious Global Group for the supply of 1,000 units of special Flex Inverter containers for the fiscal year 2024-25.

- JV Company JWL DAKO CZ India Ltd. has received an order aggregating ~₹ 11,200 lakh for axle-mounted disc brake systems from Indian Railways.

- The BESS container, a key element in Solar and Data Centre Containers, offering energy storage capabilities has a huge market opportunity in round-the-clock Renewable Energy Projects as well as Commercial Industrial Energy storage in both domestic and international markets. With Jupiter’s expertise in making containers for this application, we now are looking forward to adding more value for the same by creating complete integrated solutions for varied markets.

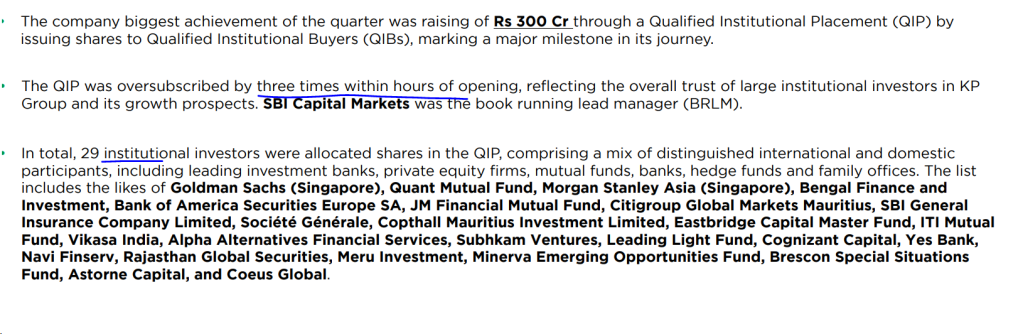

- Successful Qualified Institutional Placement (QIP) in May and December 2023 amounting to ~ ₹ 528cr which includes prominent investors, including DIIs like Tata MF, HSBC MF, Bandhan Equity Fund, and FII’s like Societe Generale, and Copthall Mauritius Investment Limited.

- JWL is one of India’s largest wagon manufacturers, with a capacity of 9,600 wagons per annum with plans to enhance capacity to 12,000 wagons per annum by Q1 fiscal 2025.

- JWL has also ventured in brake disc, brake systems for rolling stock and weldable CMS Crossing manufacturing during fiscals 2023-24 equipping JWL to capitalize on robust spendings for developing high speed train infrastructure, and to fortify its market position in this segment, in Q1 fiscal 2024 JWL has acquired Stone India Limited, having extensive infrastructure and licensing for brake manufacturing.

Valuations

Looking at their growth currently and opportunity size in coming years, Stock is trading at fair value. Once the capacity comes online and if company executes the order well , it might look undervalued intermittently

Risks

Exposure to risks relating to fluctuation in raw material prices and intense competition: The key inputs include steel and related products. While the IR projects generally have a long execution period and are covered by a price-variation clause to a large extent, private sector orders are generally fixed in nature.

Cash flows poses a big risk due to intensive working capital operations

Valuations are subjective but definitely its not hugely undervalued in short term

Most orders are from Railways and have this dependency in business, though company is trying to diversify

Technicals on 11-May-24

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip, market offers, else Ignore the stock

Stock might be volatile in short term and give a chance to buy around 425-525 range for long term investment purpose

Also Read : Savita Oil

ALSO READ : SS7 (Diwali to Diwali)

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There could be lot of things which might have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.