Lean AI Leaders

BE FINANCIALLY INDEPENDENT

Delhi pricked the Bengaluru bubble

For a long time, most people agreed that if you wanted to start a tech company, the “default” place to do it was Bengaluru. It had everything that young startups wanted—a vibrant city, access to tech talent, VCs, and even great weather. For over a decade, some of the most notable startups emerged from Bengaluru. Everyone believed this was an advantage, i.e., the ecosystem made these companies stronger, resilient, and more innovative.

But of late… we aren’t so sure about that. Even though most people in Bengaluru believe that they are doing exciting, innovative work, it’s the startups from another city…

Read more at

https://the-ken.com/story/delhi-pricked-the-bengaluru-bubble/

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

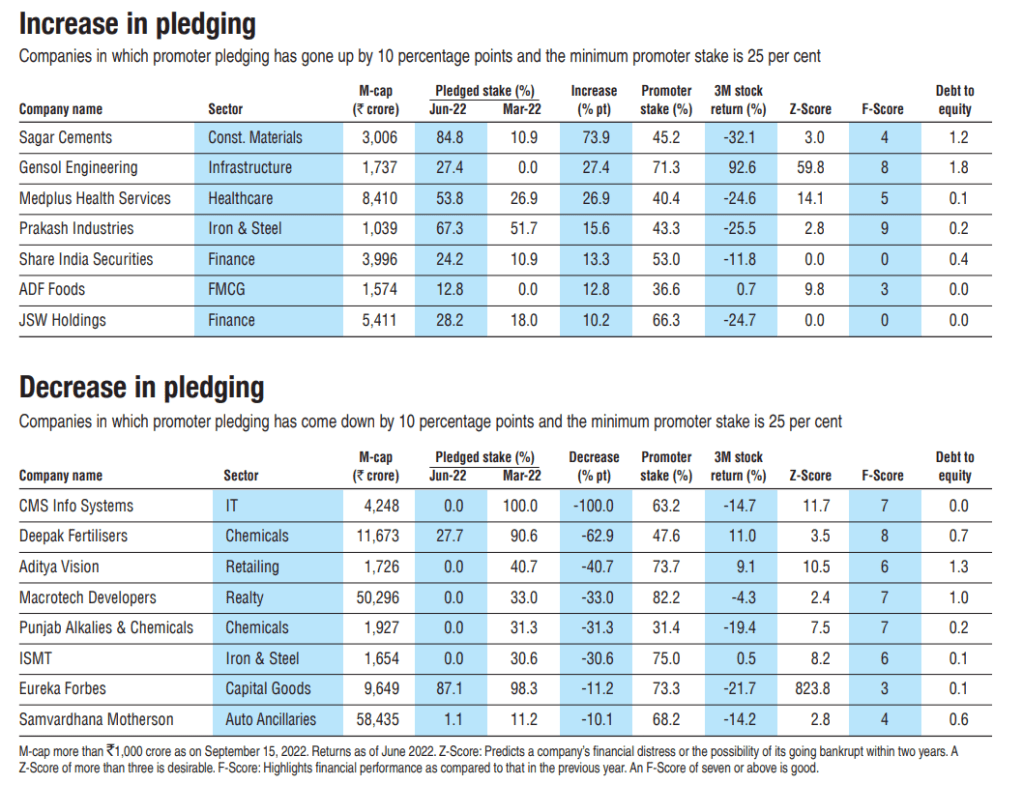

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time 21st jul24

Live classes on Sunday Morning/afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months approx.

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Be ready to WELCOME 2025 with Knowledge

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

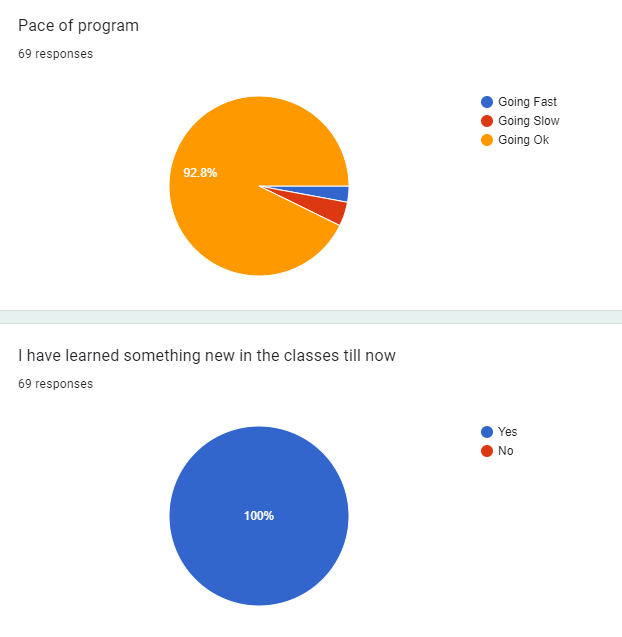

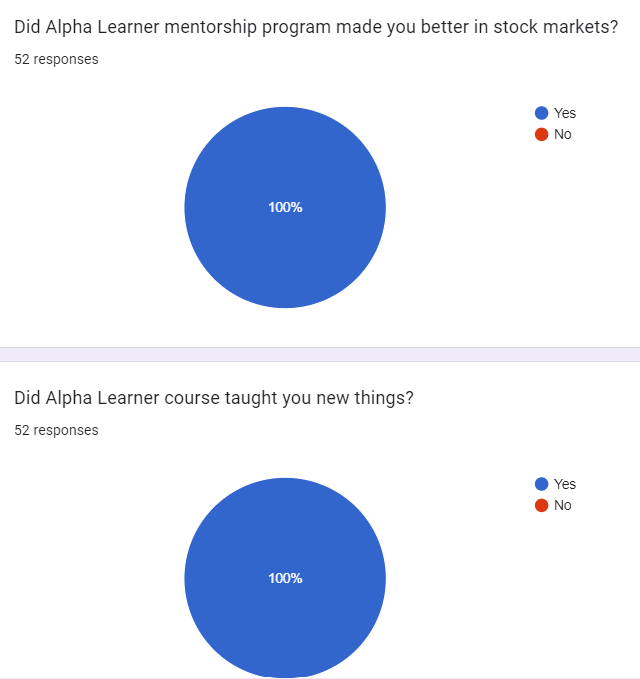

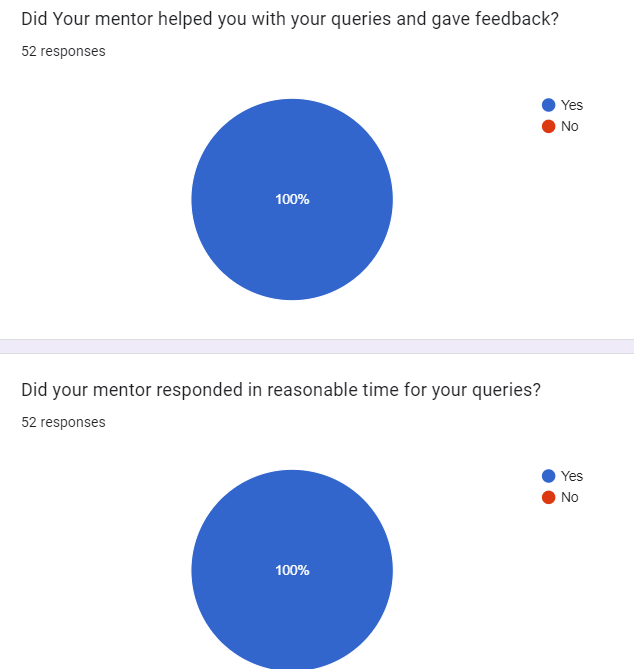

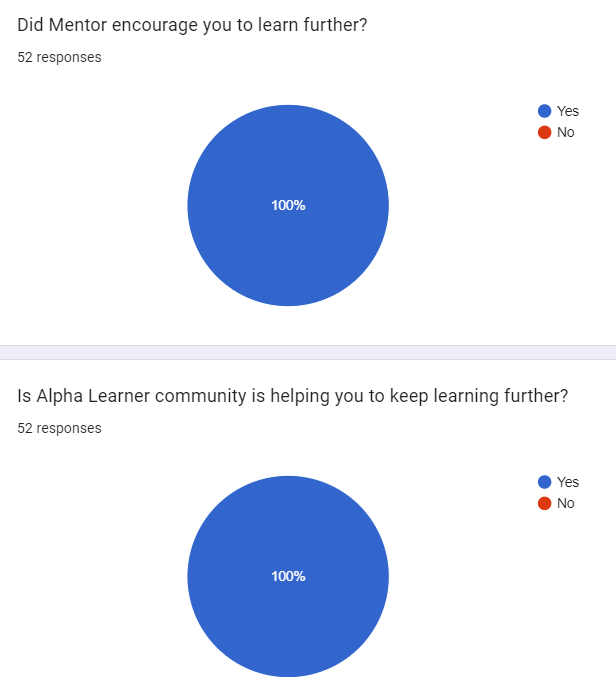

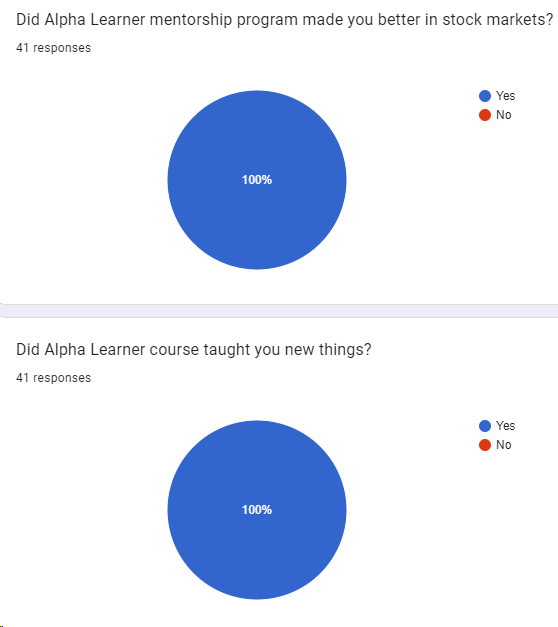

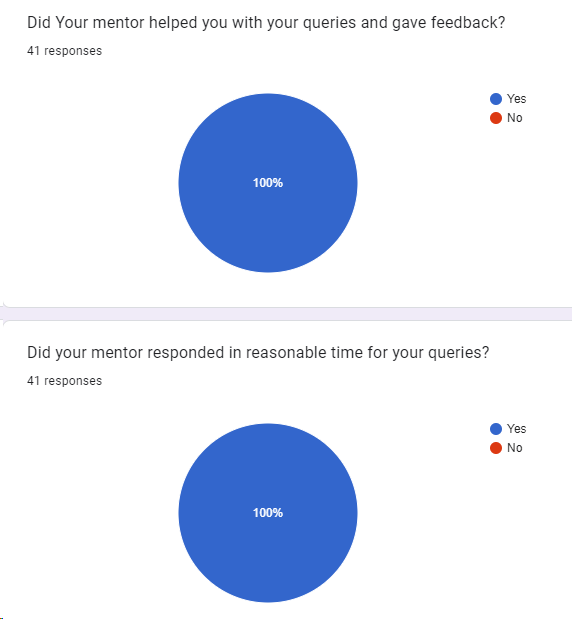

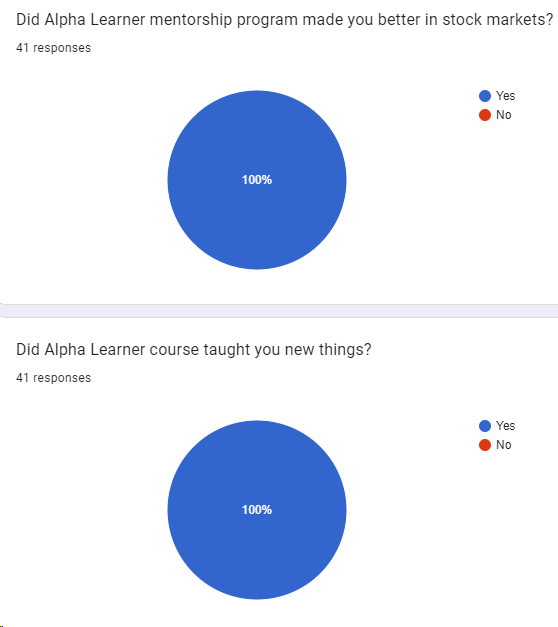

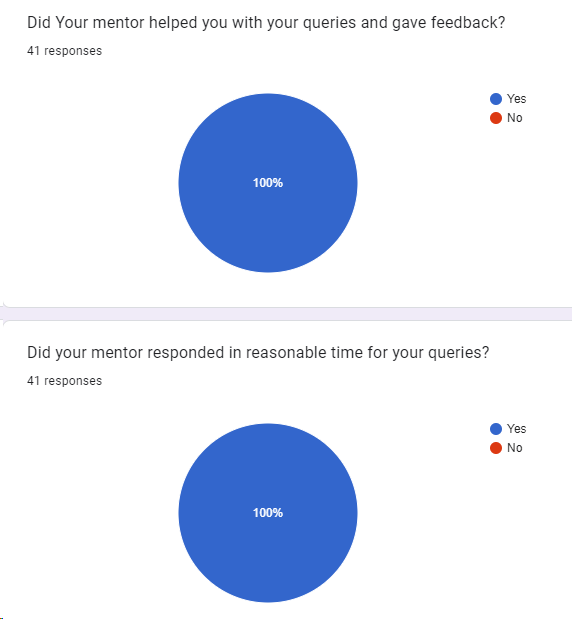

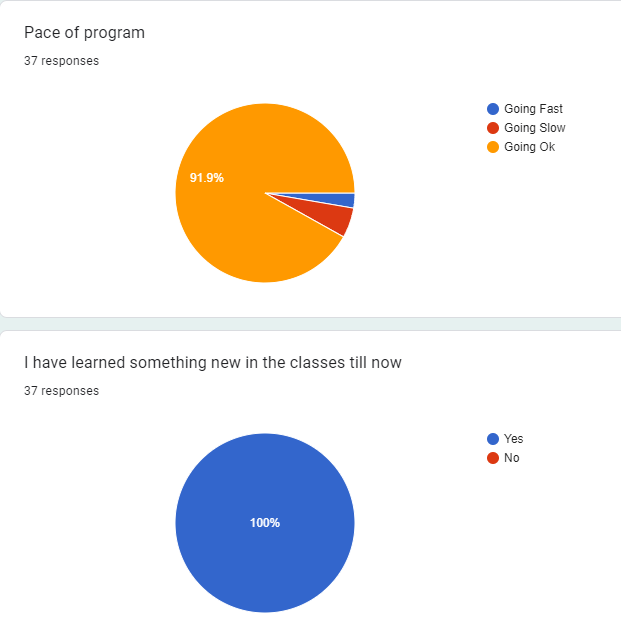

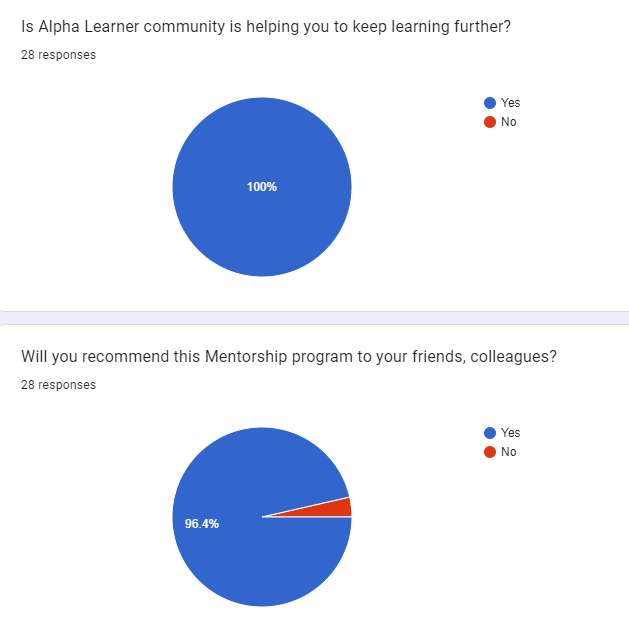

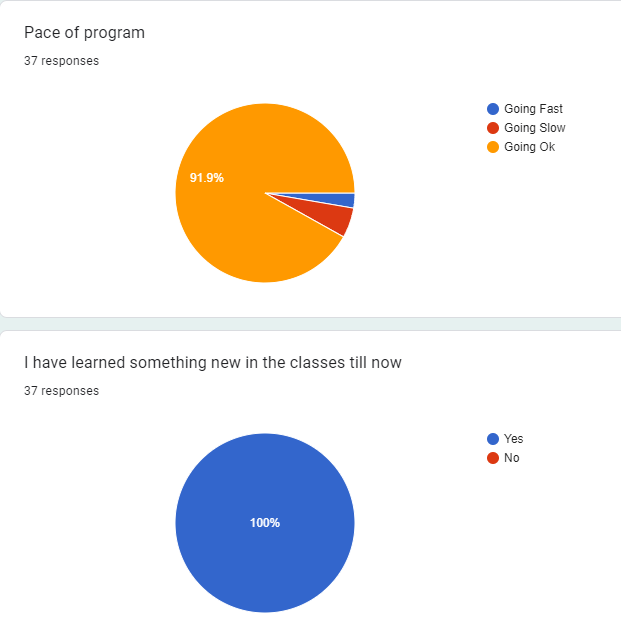

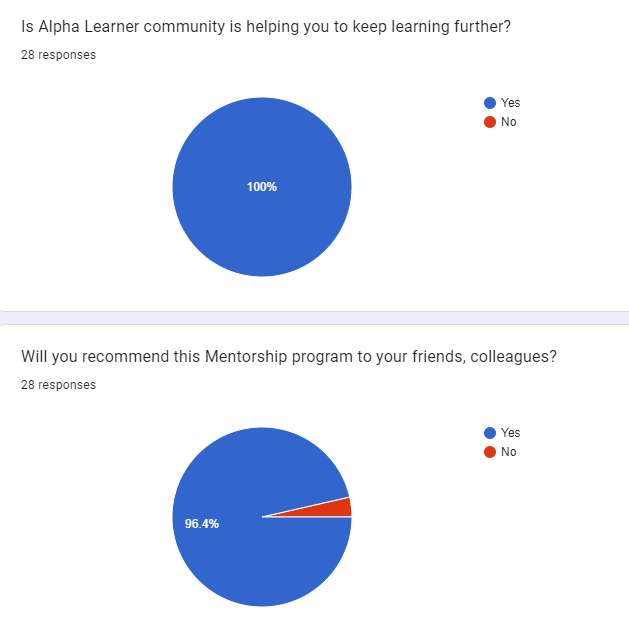

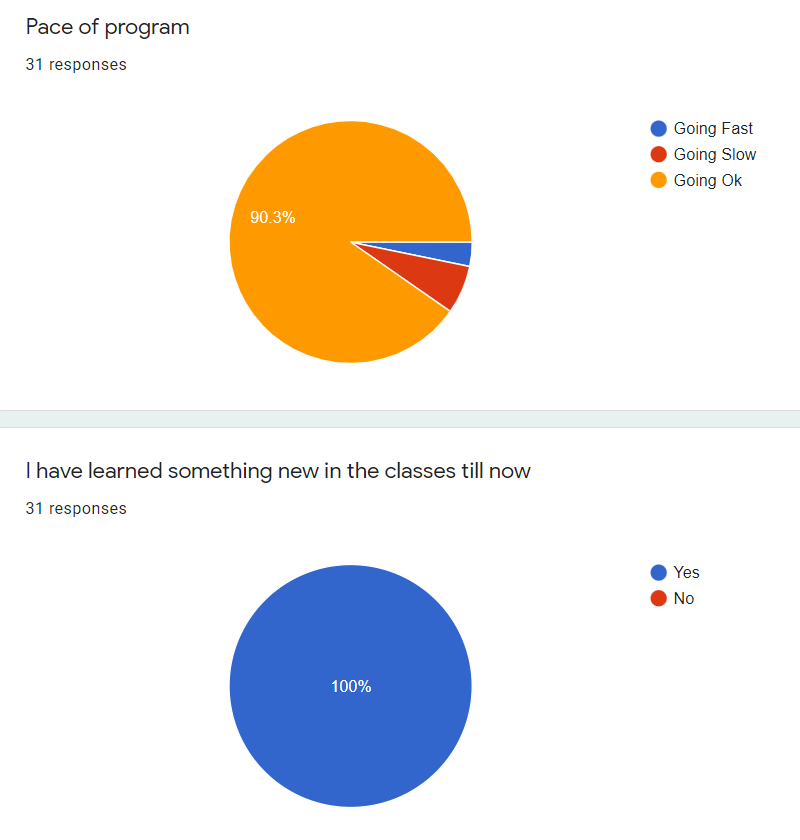

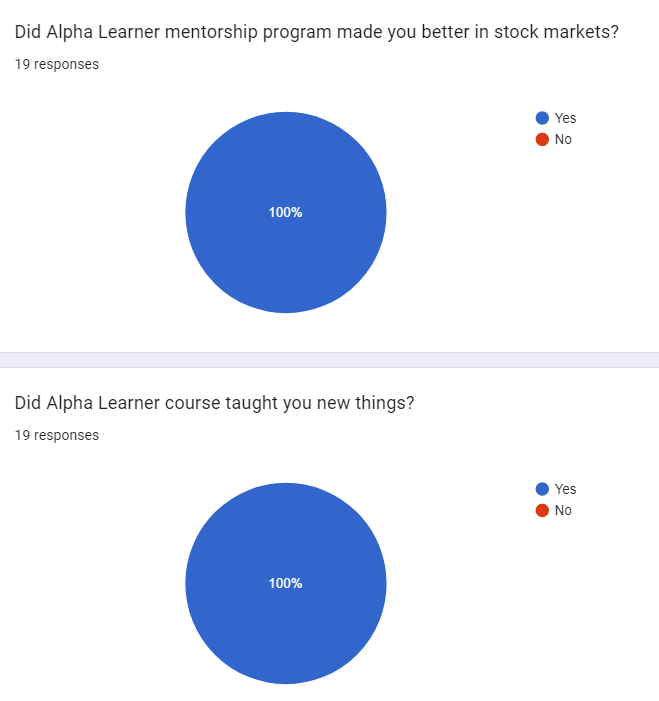

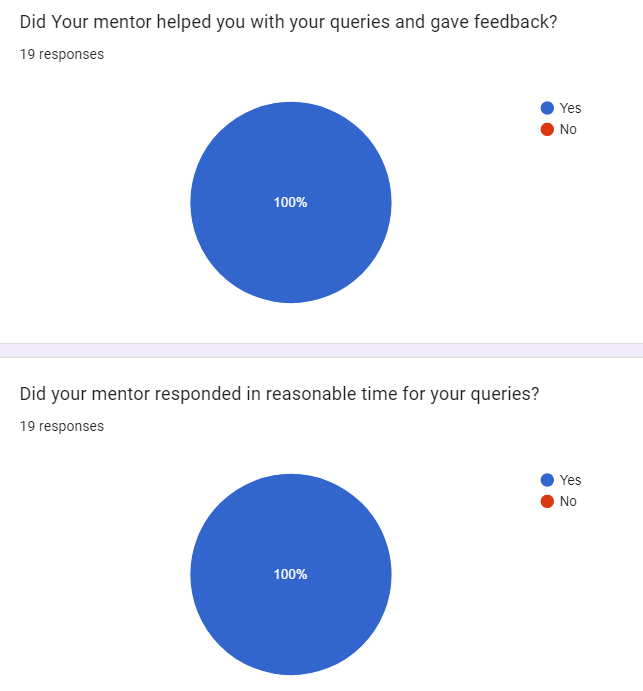

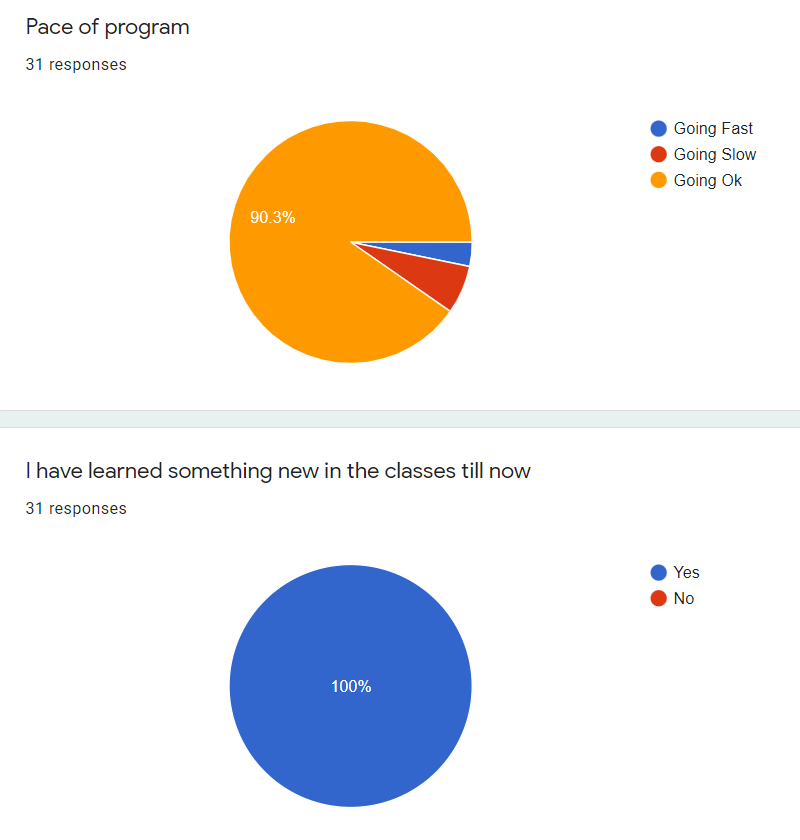

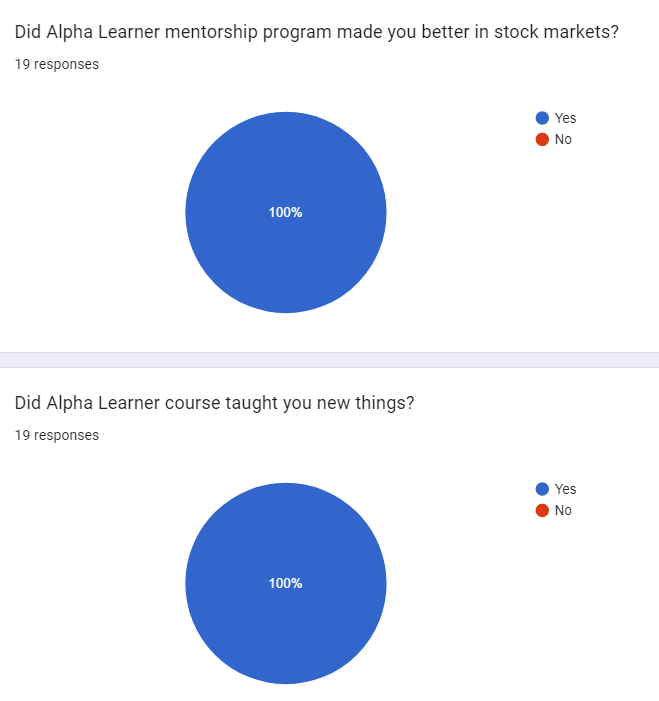

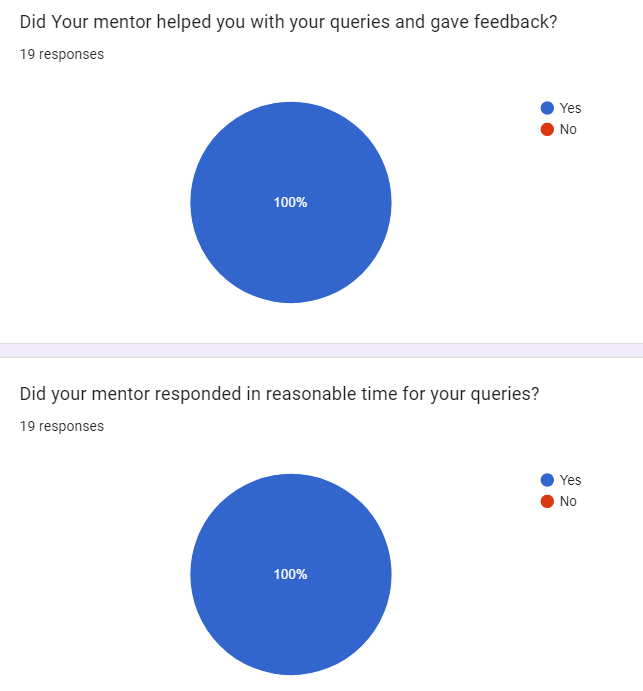

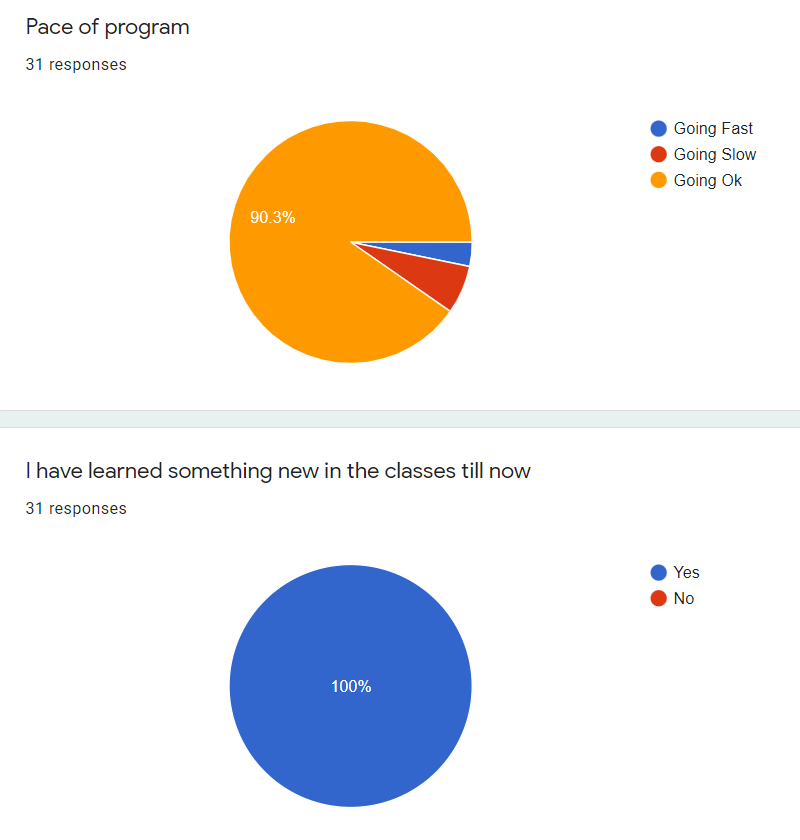

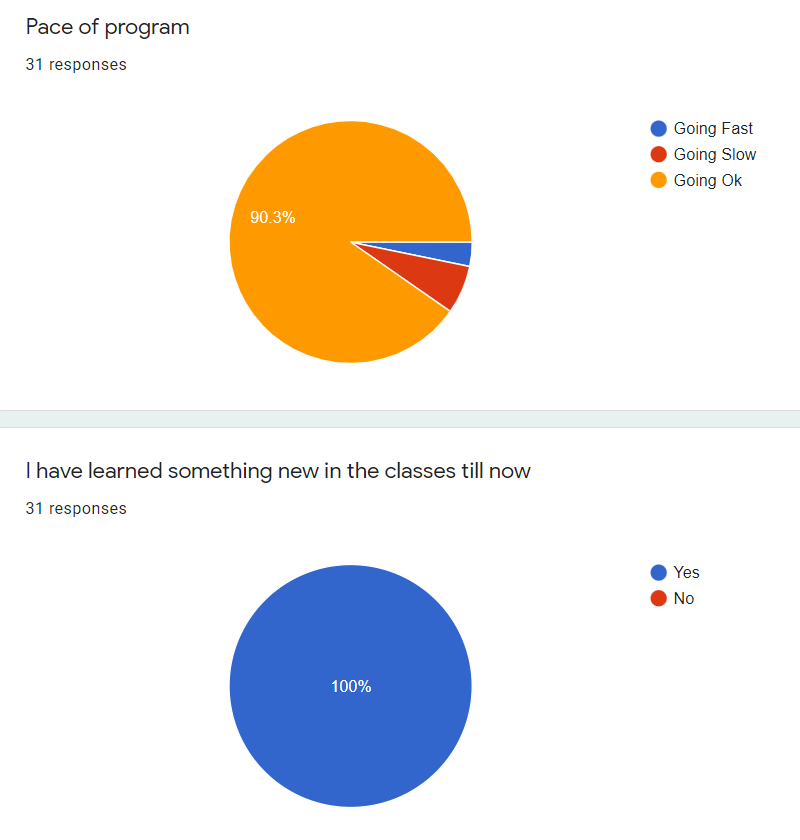

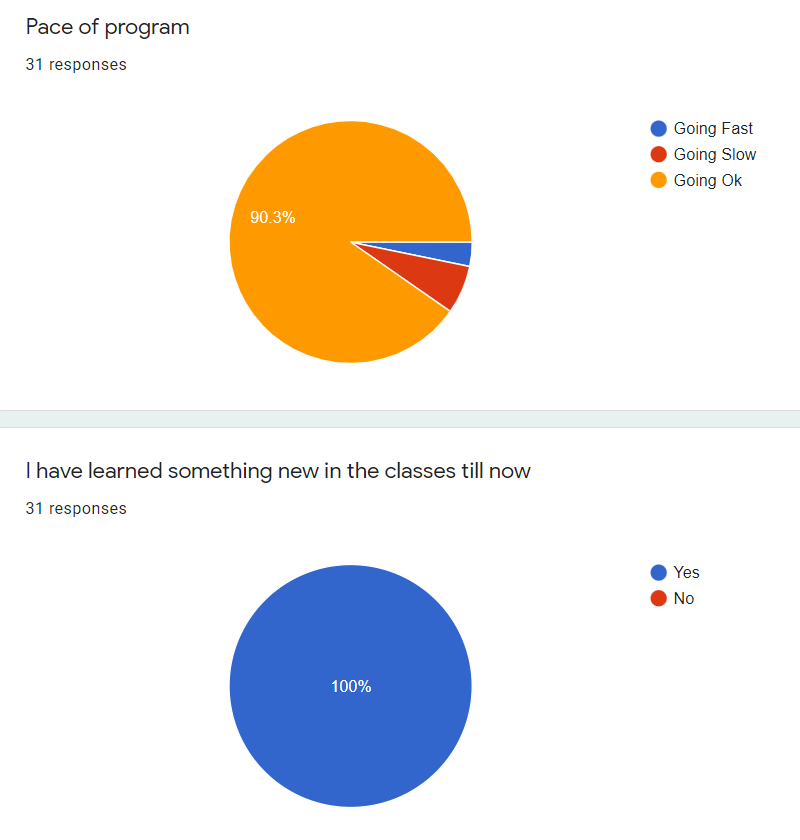

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 2 years of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS MONTH of 2023 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 30th June23

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS MONTH of 2023 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

AVAIL EARLY BIRD OFFER (save 3000 bucks) till 30th June 2023

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

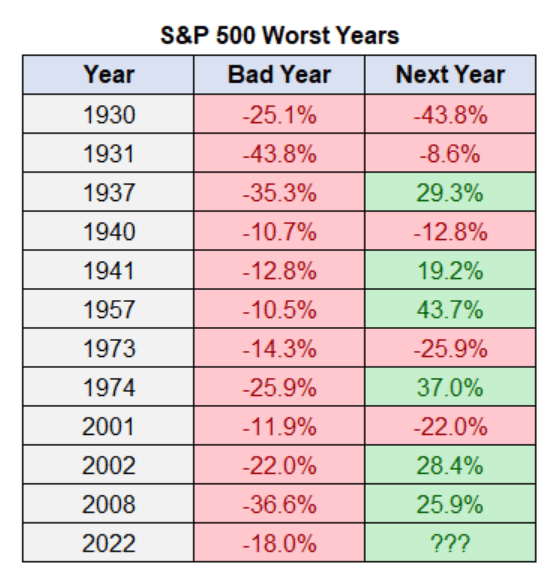

The thing about big losses in the stock market is sometimes they are followed by big losses…but sometimes they’re followed by big gains.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 31stDec 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Bonus sessions on (apart from Program content)

Financial planning &

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

4-5 months of teaching and mentoring

Can be extended based on queries, case studies

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS Last MONTH of 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 31st Dec 2022

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 15th Aug 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL, Heiken Ashi candles, different time frames

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Bonus sessions on (apart from Program content)

Financial planning &

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

4-5 months of teaching and mentoring

Can be extended based on queries, case studies6-7 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap –this will be an approximate six month effort by all participants

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS INDEPENDENCE MONTH of 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 15th Aug 2022

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 25th April 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions (apart from Program content)

Mutual Funds

Financial planning

IPO and

Big money moves

3-4 months of teaching and mentoring

Can be extended based on queries, case studies1-2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap –this will be an approximate six month effort by all participants

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS NEW YEAR 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 15th April 2022

FEEDBACK By Ongoing ALPHA LEARNERS

ACT NOW for your Independence

FEEDBACK By Ongoing ALPHA LEARNERS

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

Accumulation Distribution session

3-4 months of teaching and mentoring

Can be extended based on queries, case studies1-2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS NEW YEAR 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 1st Jan 2022

ACT NOW for your Independence

FEEDBACK By Ongoing ALPHA LEARNERS

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Also read : Invest in Stock market IF

We can broadly classify investors today in three kinds only

Most of the investors I talk are fearful of immediate correction in market, though they have not exited the market yet to cash positions. Some of them are confident after making money in last one year. Even the so called new breed of investors are also 1 year old in markets and calling themselves experienced now who have seen volatilities, and buying every dip. Time will tell who will be the Last Standing Man

So as you are reading this article, did you notice where do you belong? If you feel you are outside the purview of these three kinds, you have two choices. 1. Align to one of the view 2. Send me with your classification!

Congratulations, if you are able to see yourself amongst one of the three kinds mentioned above

Question still remains same for everyone : What to do now? Should we buy, sell or keep holding? What’s next : Is it bull market or is crash near?

Let’s read further to understand more about it and see what strategies people can adopt

This strategy is for people who

OR

You are able to foresee with your experience drastic correction coming. It may be due to Evergrande default or US debt or may be some other reason

Advantage with these strategy is you may not lose capital if market goes down and may get a chance to re-enter at lower levels. Problem with this strategy is it is impossible for anyone to predict whether market has topped out or not. Will Market go further up and can give you a bigger chance to cash out? Will market come down and give you a chance to enter at lower levels. Nobody knows. Get away from people if they claim to know.

It is always better to cash out if our goals are near or we have debt to pay because when correction happens, it will not give you a chance to exit at your desired levels

This strategy although seems good but it can be painful as markets may remain irrational longer than you remaining rational and you might keep on getting the itch to enter again.

So be careful of this approach and you have to be sure when you should re-enter.

I will strongly advised against this

Problem with this strategy is most of us will be invested in 40-50 stocks on tips from random sources and keeping most of the stocks which are in loss. So if market correction happens, we will not be having enough money to average down all stocks.

In case, you have idle money and have a itch to invest at these levels, in such cases adopt a simple strategy

Correct portfolio allocation and conviction in the chosen stocks is a must for investing at these levels.

This strategy is for people

Under this strategy, adopt the simple course of action

This strategy is for people

What I am doing in this market? My answer is Case 3 ( changed from Case 4 earlier this year)

So that effectively means

I am putting money into the market from so many booked positions in last few months and adding new positions

I am selling my existing less convincing or loss making positions

I am not waiting for correction in market as i have sufficient liquidity available

I am re-organizing my portfolio for next cycle of market

I am happy to ride with my invested convincing positions

Overall, what I learnt from markets in my journey is very simple and easy to follow :

You can’t be 100% invested in market

You can’t be 100% sold out from market.

Will correction happen–Few events like US Debt, Tapering of interest rates, China India talks failure, China Power crisis, India Power crisis can dampen the spirit much faster than anticipated. So yes, quite a few things are bad, China power crisis is biggest of them. Any correction will be fast and furious. Be ready to see 30-40% erosion of capital seen on Screen today.

Are things all bad — On other hand there is good results anticipated for Q2FY22 both QoQ and YoY in many companies. Bigger population has been been vaccinated either partially or fully so effectively third wave is ruled out for few more weeks. Currently many things looking positive. Be it exports, be it festive demand in many sectors. Nifty has made new highs and can go further up. In short term upside seems limited though if everything falls in place, 21K on Nifty cant be ruled out within 7-9 Months (Jun-Jul2022)

Whatever strategy finally you adopt. don’t be a blind follower

Read more on Blind follower here

Wishing you all the best and lots of luck

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run

Fundamental Quantitative concepts to substantiate what we have seen qualitatively

Necessary Technical aspect to make our entry and exit better in stocks

Resources to analyze faster to analyze more companies faster

Big money moves aspect to understand where money is moving

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary and derivatives market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

a SURPISE session

3 months of teaching and mentoring

Can be extended based on queries, case studies2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

12 Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the program

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS INDEPENDENCE MONTH be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 30th Sep 2021

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run

Fundamental Quantitative concepts to substantiate what we have seen qualitatively

Necessary Technical aspect to make our entry and exit better in stocks

Resources to analyze faster to analyze more companies faster

Big money moves aspect to understand where money is moving

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary and derivatives market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

a SURPISE session

3 months of teaching and mentoring

Can be extended based on queries, case studies2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

12 Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the program

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS INDEPENDENCE MONTH be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 31st Aug 2021

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Zomato IPO is little different because company is showing losses and when they will break-even is not sure. So read further and analyse all points with a pinch of salt. Many investors dream of being a venture capitalist one day and to all those guys, Zomato is giving you a chance.

Put your HAT of venture capitalist and drop the hat of investor to view this IPO. If it works good — ENJOY!!, If it does not–Don’t lose sleep.

Zomato IPO– Incorporated in the year 2008 as a restaurant-discovery website – Zomato, is now one of India’s largest food delivery company.

Business — Zomato has four business segments – two core B2C offerings including food delivery and dining-out. There is B2B ingredients procurement platform ‘Hyperpure’ and the customer loyalty program, ‘Zomato Pro’ as well

Region of operation — Company has operations in 23 foreign countries – UAE, Australia, New Zealand, Philippines, Indonesia, Malaysia, USA, Lebanon, Turkey, Czech, Slovakia, and Poland. However, the company generates 90% of its revenue from India.

Offer purpose — 9,000 crore will be a fresh issue, while the remaining an offer for sale from the oldest investor – Info Edge (India) Ltd. Company will be possibly using this money for organic and inorganic growth

Risks —

Company unit economics of profitability is not sustainable as of now

Highly competitive industry and many players have shut down in past few years. Any new player with deep pockets can come and start competing. Amazon has already started with aggressive pricing

High dependence on order size and repeat orders for making money

Strength

Adjusted for cash and cash equivalents, Zomato has an asset-light balance sheet and it will help company to sustain for few more years with almost 16000cr cash and cash equivalents

Covid-19 has given push to delivery based eating model and it will possibly help the company to cut operational costs with lower discounts and higher delivery charges

Only two major players in fray and other players are only focused on one part of business while Zomato is well leading ahead in other domains as of now

Able management

International presence

Future

Company has been growing and survived last few years onslaught when many players have shut shop(including uber, ola, foodpandaetc). The way Indian population is moving to nuclear families, demand for food delivery will increase and so will be competition.

Hence ability to charge high prices may remain limited.

Diversification into other areas like stake in grofers, kitchens, increase in memberships may help the company to survive against competition a bit longer.

How fast they can expand in tier 2 and tier 3 towns and how much they are able to extract from people is the key in next few years for breaking even.

Its the only player in 4 different segments as compared to peers is an advantage for them as of now

Valuations

Valuations are extremely stretched out. Nothing much to talk sensible here

Should we apply?

People falling into high risk taking category can bid in IPO and and add more after listing to play out this theme over few years.

People who can take risk of capital erosion can subscribe with one lot and book out on listing gains if any.

Please note that company is not profitable and entire capital put in company shares can go down the drain if things do not turn in anticipated way

Whatever you want to do with this IPO , don’t become a long term investor if you applied for listing gains or vice versa. Be sure of why you are applying and stick to that

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Most of the investors I talk are bullish and confident after making money in last one year. They are quite confident that every fall now is a buying opportunity

Also read : Invest in Stock market IF

We can broadly classify investors today in four kinds

So as you are reading this article, did you notice where do you belong?

Congratulations, if you are able to see yourself amongst one of the four kinds mentioned above

Question still remains same for everyone : What to do now? Should we buy, sell or keep holding? What’s next : Is it bull market or is crash near?

Let’s read further to understand more about it and see what strategies people can adopt

Thsi strategy is for people who

Advantage with these strategy is you may not lose capital if market goes down and may get a chance to re-enter at lower levels. Problem with this strategy is it is impossible for anyone to predict whether market has topped out or not. Will Market go further up and can give you a bigger chance to cash out? Will market come down and give you a chance to enter at lower levels. Nobody knows. Get away from people if they claim to know.

It is always better to cash out if our goals are near or we have debt to pay because when correction happens, it will not give you a chance to exit at your desired levels

You may need to decide a market point where you should re-enter

I will strongly advised against this. Problem with this strategy is most of us will be invested in 50 + stocks by taking tips from random sources and keeping most of the stocks which are in loss. So if market correction happens, we will not be having enough money to average down all stocks.

In case, you have idle money and have a itch to invest at these levels, in such cases adopt a simple strategy

Correct portfolio allocation and conviction in the chosen stocks is a must for investing at these levels

This strategy is for people

Under this strategy, adopt the simple course of action

This strategy is for people

What i am doing in this market? My answer is Case 4.

So that effectively means

I am not putting new money into the market

I am selling my existing less convincing or loss making positions

I am waiting for small correction in market to add more

I am not re-organizing my portfolio for next cycle of market

I am keeping Cash levels close to 20% to handle market correction and adding more.

I am happy to ride with my invested convincing positions

I would not recommend to sell out and sit if you have not borrowed money and are not facing immediate liquidity issues. But for sure remove dud stocks and put that money into other quality stocks as always

Overall, what I learnt from markets in my journey is very simple and easy to follow :

You can’t be 100% invested in market

You can’t be 100% sold out from market.

Will correction happen–We don’t know but fact is every rise is being sold into. The situation on ground is bad for COVID-19. Correction if happens, can take Nifty to 13100, 12400 levels where we can average on our positions. Bounce back should be sharper until and unless Covid 19 gets out of control and needed stringent undesired lockdowns, In such scenario 10k on nifty cant be ruled out

Are things all bad –No, not all is bad , There is good ray of hope for Q4FY21 results and Q1 FY22 results. There is hope for different vaccines being rolled out. Nifty new high cant be ruled out as of now

Whatever strategy finally you adopt. don’t be a blind follower

Read more on Blind follower here

Wishing you all the best and lots of luck

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Home First Finance IPO– 10 yr old company promoted by private equity funds.

Business — In the affordable housing segment in 11 states with 70 branches. 80% business from 4 states including 40% from Gujarat only

Offer purpose — Offer for sale (1153cr) including fresh issue of 265 cr. for expansion and general purposes

Key domains – Affordable housing finance for construction , loans for purchasing commercial property and loans against property to both salaried and small business owners/self-employed customers

Risks —

Consistently need to remain in limelight in highly competitive industry, Key financial metrics are not great as of now

With focus on middle class and recent Covid impact , NPA will always be struggle for few quarters

Strength

Focus on growing affordable housing category for middle income and low income category which is not serviced by many big banks

Company use technology to its advantage and do fast processing of loans

Average ticket size is 10 lacs approximately which makes it target highly growing category of loans

Future

Various government initiatives such as housing for all, amongst others are likely to offer exciting growth opportunities in the coming years.

Last three years CAGR is 60% plus although on smaller base shows future seems bright if it remains on track

Valuations

In almost all aspects except PE, Better listed options available

Should we apply?

People can avoid or subscribe only for listing gains

Recommended to sell if getting gains on listing day

One can wait to enter at low prices for investment purposes or choose peers for investment purpose during corrections

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

UTI AMC IPO crisp Summary — Listed with loss as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Angel Broking IPO crisp summary –Listed with loss as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Stove Kraft IPO– Almost 20 yr old company involved in manufacturing, marketing and exporting kitchen appliances

Business — Company is into manufacturing LPG gas stoves, induction cooktops, non-stick cookware, pressure cookers, chimneys etc

Offer purpose — Offer for sale (412cr) including fresh issue of 95 cr. for repayment of debt and general purposes

Key domains -Company have three different segments. Pigeon for Mass market, Gilma for Mid level and Balck and Decker at top level premium category

Risks —

Company has yet to show sustainable profits.

It is operating in field of established players like Prestige, Hawkins so with such intense competition, profits margins will always face heat.

Company has ongoing litigation and not efficient to recover money from retailers.

Company has been into unrelated segments like LED which can derail the focus on key categories

Customers may not remain loyal as switching to other brands is easy, so basically no moat

Strength

Company has two under-utilised plants which can be ramped up without any major capex

Company have different brands catering to different segments and have good reputation of its products

Company has multiple distribution channels including e-commerce

Future

Market is expected to grow at 11% CAGR in near future

Company existing capacity is not fully utilised and with growth of overall market, company has room to grow

There is a systematic shift happening towards usage of kitchen appliances

Valuations

Recently turned profitable company with low ROE and margins seeking almost equal valuations as leaders in their categories

Bullish market and IPO frenzy makes the valuations stretched leaving little room for improvement

Should we apply?

People can subscribe for long term only if they want to bet on growth potential

If applying, recommended to sell on getting gains on listing day

One can avoid for investment purposes presently as there are better listed option available in market

Also Read

Home First Finance IPO Crisp Summary

Burger King IPO crisp Summary — Listing with huge gains as shared

UTI AMC IPO crisp Summary — Listed with loss as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Angel Broking IPO crisp summary –Listed with loss as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

IRFC IPO– Incorporated in 1986 by the Ministry of Railways (MoR), the Government of India, Indian Railway Finance Corporation (IRFC) is a wholly-owned public-sector undertaking

Business — Its engaged in the activity of mobilising funds on behalf of the Indian Railways to finance its procurement of locomotives, passenger coaches, and wagons as well as to fund other railway infrastructure assets. Apart from providing finance to the MoR, IRFC has provided loans to Rail Vikas Nigam Limited (RVNL), which is wholly owned by the MoR.

Offer purpose — Offer for sale (4600cr) including fresh issue of 3100 cr. for expansion and general purposes,1500 cr will flow to Goverment

Key Service domains – NBFC -Infrastructure finance to MoR

Risks —

Low RoE, lending to government entities at the fixed spread,

and risk of equity dilution from OFS in subsequent years

Strength

Zero NPAs, Lowest Borrowing cost (AAA rated), high operationally managed entity

Strategic role in financing growth of Indian Railways with regular demand for loans which is favorable for its asset growth.

Competitive cost of borrowings: Because IRFC belongs to GoI, and lends to GoI owned entities, the cost of borrowing is very low for IRFC.

Consistent financial performance and cost-plus model: IRFC charges a fixed interest rate for sourcing loans for MoR. It gets fixed spread in the range of 0.3% to 0.4% above its cost of borrowings.

Future

IRFC is strategically important to the MoR as it raises around 25-35% of the total funding requirement (plan outlay) of the Ministry.

It is growing at good rate but ROE can’t be expanded much.

Could be a consistent dividend player

Valuations

Profit making company with stable below par ROE

AUM growth (3yr CAGR>20%) coming at 1x H1FY21 P/BV, Valuations are underpriced to reasonable range of P/B ~1

Should we apply?

People can subscribe looking at mid term to long term prospects

Avoid if one is averse to PSU or looking at big gains

Stellar gains at IPO may not be visible due to large IPO size

One can wait to enter at low prices for investment purposes for dividend play as well

Also Read

Indigo Paints IPO crisp Summary — Apply or not

Burger King IPO crisp Summary — Listing with huge gains as shared

UTI AMC IPO crisp Summary — Listed with loss as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Angel Broking IPO crisp summary –Listed with loss as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Indigo Paints IPO– Among top 5 in Decorative Paint Industry in India with growing over 40% CAGR in terms of sales since inception.

Business — In the Decorative paints industry with high share of differentiated products with high barriers of entry,

~28% business comes from differentiated products

Offer purpose — Offer for sale (1169cr) including fresh issue of 300 cr. for expansion and general purposes

Key Service domains – Repainting constitutes >70% demand and Tier 2, Tier 3, Tier 4 regions are major targets for company

Risks —

Consistently need to spend on Ads to remain in limelight. Currently they spend 12-13% of revenue on ad spends as compared to 3-5% for other big players

As they are expanding to big cities, competition from other 4 large players will pose serious challenge as retail outlets space is limited

Strength

Paint Industry has relatively high entry barriers and need a technologically advanced Manufacturing and distribution network

Company provides low discount on gross sales due to differentiated products

Have low operating expenses as compared to peers and high margins which sustain higher ad spends

Manufacturing locations are close to raw materials keeping costs low

Future

Various government initiatives such as housing for all, smart-cities, industrial corridors and Atmanirbhar Bharat amongst others are likely to offer exciting growth opportunities in the coming years.

As per capita income increases in India, re-painting cycles will be shortened possibly to 5-6 years. Also that will help people to upgrade to premium paints

GST, COVID-19 has shifted the paint market towards organised one and that will help this company in coming years

Valuations

Profit making company with improving ROE, ROCE but seeking very high valuations in IPO (~140X PE)

Asian Paints At 9X Capacity, 500 bps higher margin at 32X Higher Sales than Indigo currently trades at 70X FY22e

Should we apply?

People can subscribe looking at IPO frenzy and possible listing gains only

Recommended to sell if getting 10-30% gains on listing day

One can wait to enter at low prices for investment purposes and review holdings with each quarter earnings

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

UTI AMC IPO crisp Summary — Listed with loss as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Angel Broking IPO crisp summary –Listed with loss as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Read more here on Route Mobile

Read more here on Burger King

Read more here on boAT

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

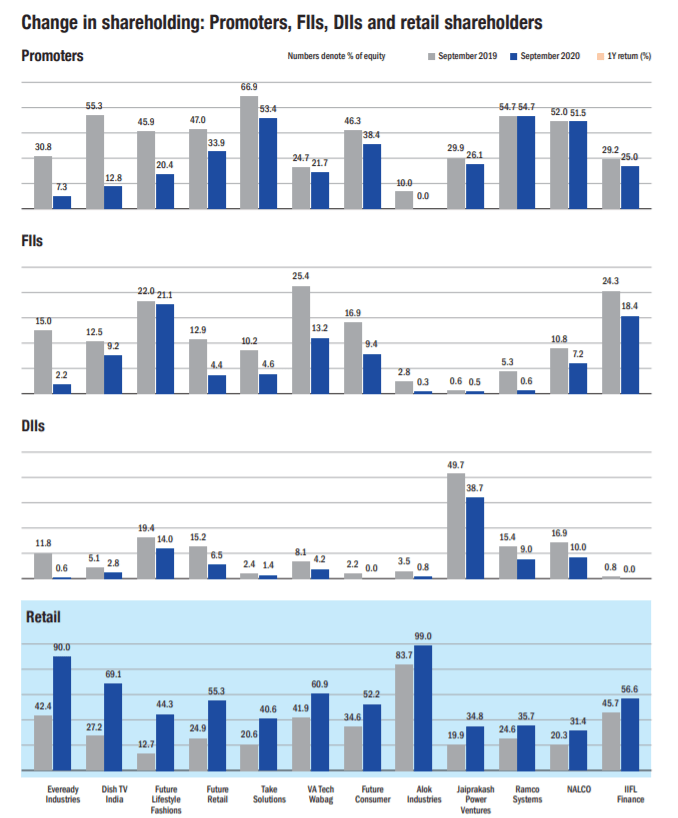

Retail investors often take their investment decisions based on the share price instead of the fundamentals. They tend to buy what looks ‘cheap’ and get influenced by the news around a company. They often see a large fall in share price as an opportunity. However, such investments often end up becoming value traps. A huge price decline may not always be due to a temporary issue but also due to a permanent dent in the company’s prospects. Also, a sudden surge in the stock price attracts retail investors. They then invest in such a company, without paying much attention to its fundamentals. Curiously, the lower the ticket size of the share, the more interested retail investors become. All these are wrong reasons to buy a stock. A stock should be bought because the fundamentals of the underlying company are robust. Tracking the activity of promoters, FIIs and DIIs can be a useful input in determining this.

-source Valueresearchonline

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Bector Food Specialities IPO– Mrs. Bector’s Food is one of the leading companies in the premium and mid-premium biscuits segment and the premium bakery segment. Company is largest supplier of buns for QSR restaurants in India.

Business — Sells Biscuits, Bakery products, Frozen Products. And a contract Manufacturer for Oreo and Bournvita biscuits

Offer purpose — Offer for sale (540cr) including fresh issue of 40 cr. for expansion and general purposes

Key Service domains – Biscuits domestic 43% of total sales, 24% exports of total sales.

Key export regions are Africa and North America. Total 64 countries where export is done

Risks —

There are cases of non-compliance against certain legislations in the past by group company and some disciplinary actions as well

Highly competitive industry with company having only 1% market share. Margins can reman depressed for quite long time putting strain on cash flows

Low shelf life of certain products

Company do not have any long term supply agreements with any of their QSR customers is a strange thing and deals on day to day basis requirement for bns, bakery and frozen products

One of the lowest risk but having high business impact is focus on nutritional value of products which can hamper sales in future

Strength

A leader in biscuits and bakery segments in North India with well-diversified product portfolio.

Major food certifications i.e. BRC, USFDA, and FSSC.

Modern production process, Strong sales and distribution network.

Strategically located in proximity to target markets which minimizes freight and logistics related expense and time

Future

QSR is thriving industry and consumption food business will gain. QSR CAGR expected to grow >20% for next 4-5 yrs

Proxy play to QSR story, so should do well in coming years

Valuations

Profit making company but PAT going down from last three years

Focusing on growth in premium biscuits and bakery segment to improve margin having high competition

As compared to peers, valuations looks ok but needs consistent review

Should we apply?

People can subscribe looking at growth prospects

Listing day may see good gains. Recommended to sell if getting 10-30% gains on listing day

One can also hold long and review holdings with each quarter earnings

Also Read

Burger King IPO crisp Summary — Possible Listing with gain on cards

UTI AMC IPO crisp Summary — Listing with loss as shared

CAMS IPO crisp summary — Listing with 20% gains as shared

Angel Broking IPO crisp summary –Listing with loss as shared

Happiest Minds IPO crisp summary –Listing with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

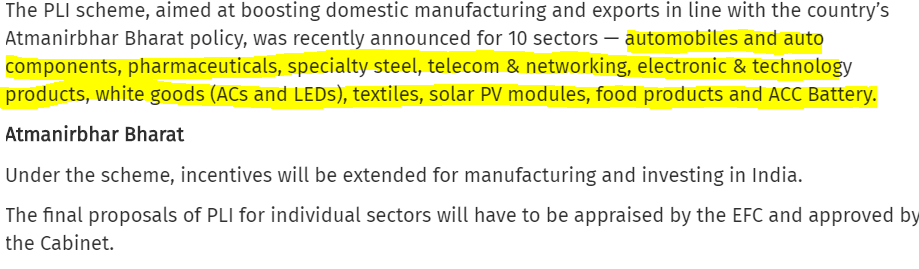

Implementation of production-linked incentive (PLI) schemes worth up to ₹1.45 lakh crore for 10 key sectors announced recently by the government is likely soon.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

If you have not read my earlier post , please go through What to do in stock market in early 2020. It’s important as you will be able to relate to this post in much better way after that!