Small fish in Big Ocean

BE FINANCIALLY INDEPENDENT

Most of the investors I talk are bullish and confident after making money in last one year. They are quite confident that every fall now is a buying opportunity

Also read : Invest in Stock market IF

We can broadly classify investors today in four kinds

So as you are reading this article, did you notice where do you belong?

Congratulations, if you are able to see yourself amongst one of the four kinds mentioned above

Question still remains same for everyone : What to do now? Should we buy, sell or keep holding? What’s next : Is it bull market or is crash near?

Let’s read further to understand more about it and see what strategies people can adopt

Thsi strategy is for people who

Advantage with these strategy is you may not lose capital if market goes down and may get a chance to re-enter at lower levels. Problem with this strategy is it is impossible for anyone to predict whether market has topped out or not. Will Market go further up and can give you a bigger chance to cash out? Will market come down and give you a chance to enter at lower levels. Nobody knows. Get away from people if they claim to know.

It is always better to cash out if our goals are near or we have debt to pay because when correction happens, it will not give you a chance to exit at your desired levels

You may need to decide a market point where you should re-enter

I will strongly advised against this. Problem with this strategy is most of us will be invested in 50 + stocks by taking tips from random sources and keeping most of the stocks which are in loss. So if market correction happens, we will not be having enough money to average down all stocks.

In case, you have idle money and have a itch to invest at these levels, in such cases adopt a simple strategy

Correct portfolio allocation and conviction in the chosen stocks is a must for investing at these levels

This strategy is for people

Under this strategy, adopt the simple course of action

This strategy is for people

What i am doing in this market? My answer is Case 4.

So that effectively means

I am not putting new money into the market

I am selling my existing less convincing or loss making positions

I am waiting for small correction in market to add more

I am not re-organizing my portfolio for next cycle of market

I am keeping Cash levels close to 20% to handle market correction and adding more.

I am happy to ride with my invested convincing positions

I would not recommend to sell out and sit if you have not borrowed money and are not facing immediate liquidity issues. But for sure remove dud stocks and put that money into other quality stocks as always

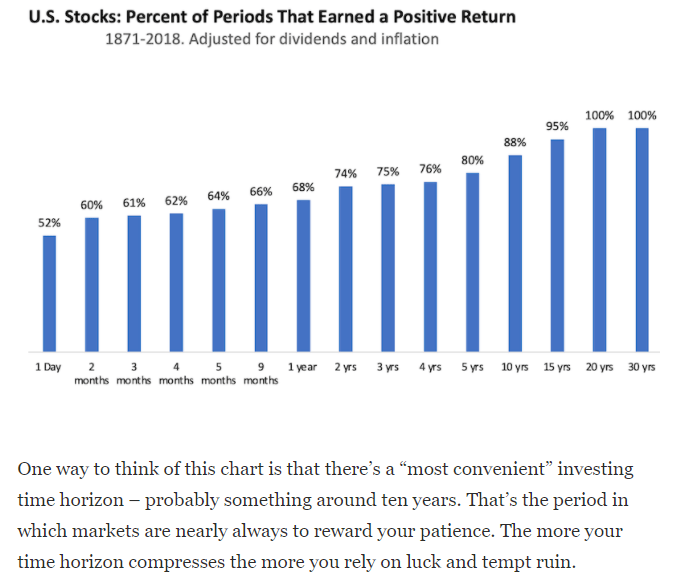

Overall, what I learnt from markets in my journey is very simple and easy to follow :

You can’t be 100% invested in market

You can’t be 100% sold out from market.

Will correction happen–We don’t know but fact is every rise is being sold into. The situation on ground is bad for COVID-19. Correction if happens, can take Nifty to 13100, 12400 levels where we can average on our positions. Bounce back should be sharper until and unless Covid 19 gets out of control and needed stringent undesired lockdowns, In such scenario 10k on nifty cant be ruled out

Are things all bad –No, not all is bad , There is good ray of hope for Q4FY21 results and Q1 FY22 results. There is hope for different vaccines being rolled out. Nifty new high cant be ruled out as of now

Whatever strategy finally you adopt. don’t be a blind follower

Read more on Blind follower here

Wishing you all the best and lots of luck

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Please treat this as just a indicator as these are subject to change or could have been changed

Consult you financial advisor before making any investment decision

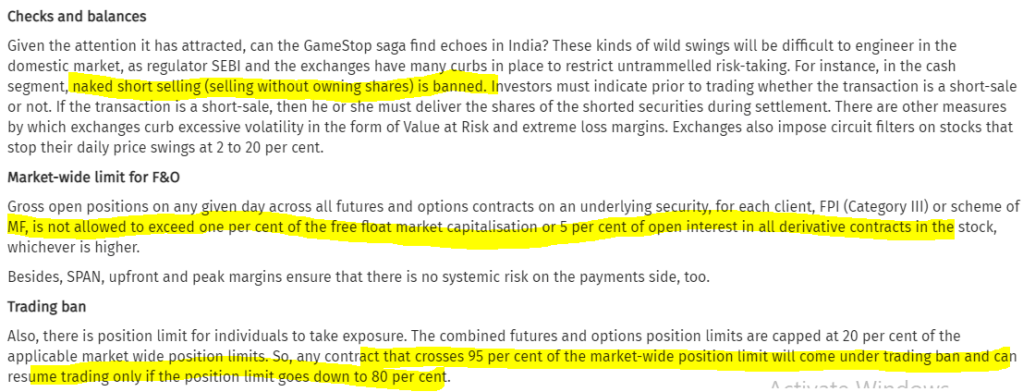

A Decision which can have far reaching consequences for NSE, BSE, CDSL, NSDL

Out of these BSE and CDSL are listed on stock exchanges

More Details and discussion paper attached here ( from SEBI)

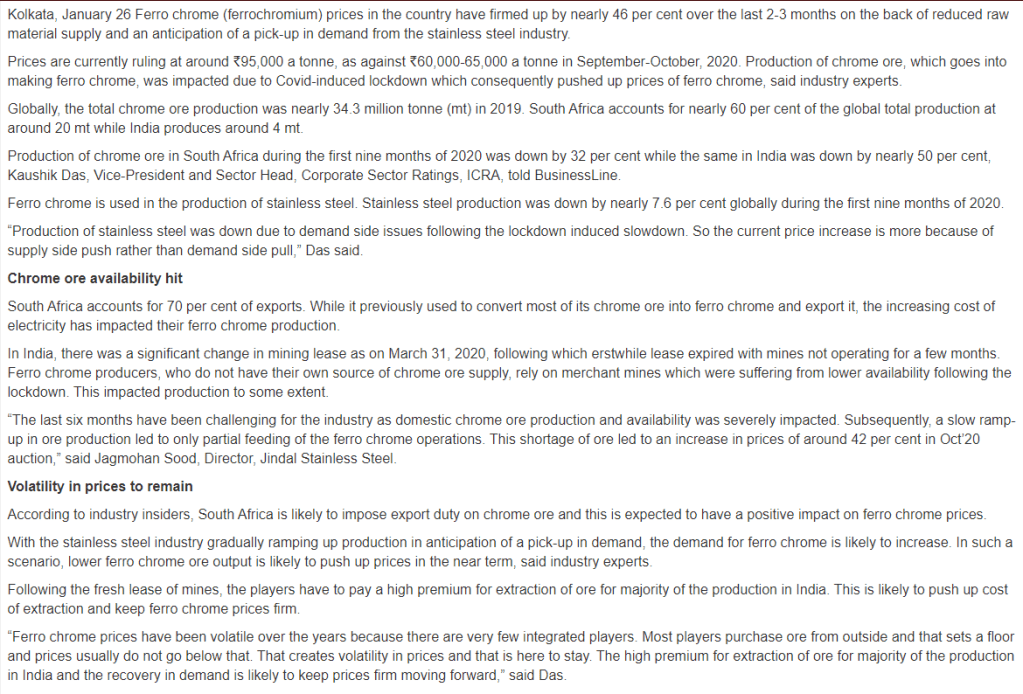

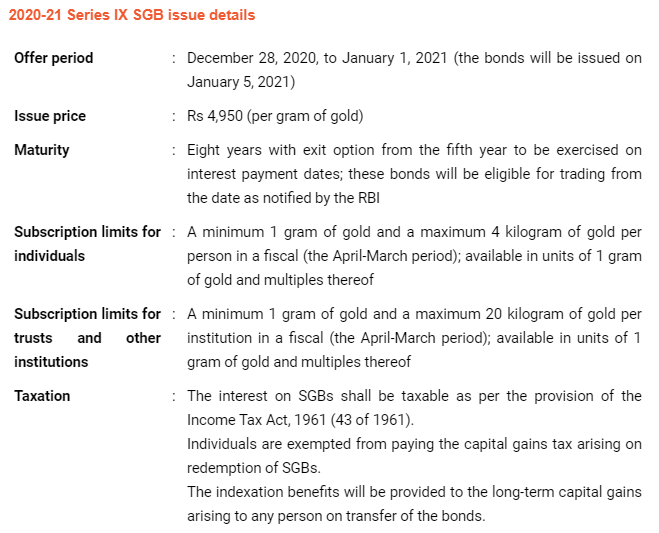

SGBs are government securities denominated in grams of gold.

These are substitutes for holding physical gold.

SGBs are issued by the central bank on behalf of the Government of India.

Investors have to pay the issue price in cash and the bonds are redeemed in cash on maturity.

There are many reasons for buying gold.

The yellow metal acts as a hedge against inflation.

It is a relatively stable investment compared to equities.

It is a good diversification strategy.

It can be purchased easily

Read more for these IPO before listing on their business, strength, risks Bector Food , Happiest minds, Route mobile, Rossari biotech, Burger king

Read more here on Route Mobile

Read more here on Burger King

Read more here on boAT

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Among Top 5 car makers, Kia Motors and Tata motors gain market share and other have lost. After quite some time, Maruti’s Market share dropped below 50% mark

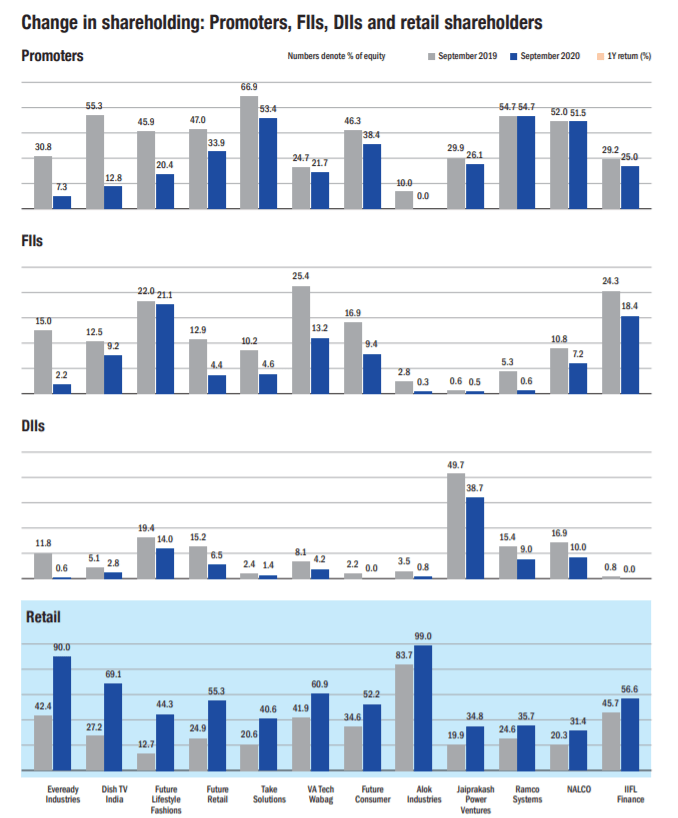

Retail investors often take their investment decisions based on the share price instead of the fundamentals. They tend to buy what looks ‘cheap’ and get influenced by the news around a company. They often see a large fall in share price as an opportunity. However, such investments often end up becoming value traps. A huge price decline may not always be due to a temporary issue but also due to a permanent dent in the company’s prospects. Also, a sudden surge in the stock price attracts retail investors. They then invest in such a company, without paying much attention to its fundamentals. Curiously, the lower the ticket size of the share, the more interested retail investors become. All these are wrong reasons to buy a stock. A stock should be bought because the fundamentals of the underlying company are robust. Tracking the activity of promoters, FIIs and DIIs can be a useful input in determining this.

-source Valueresearchonline

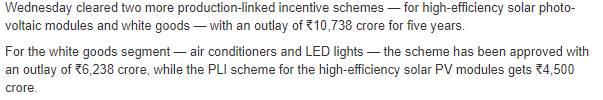

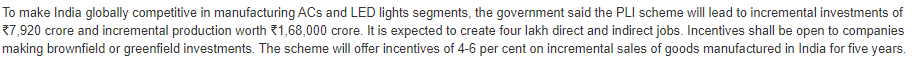

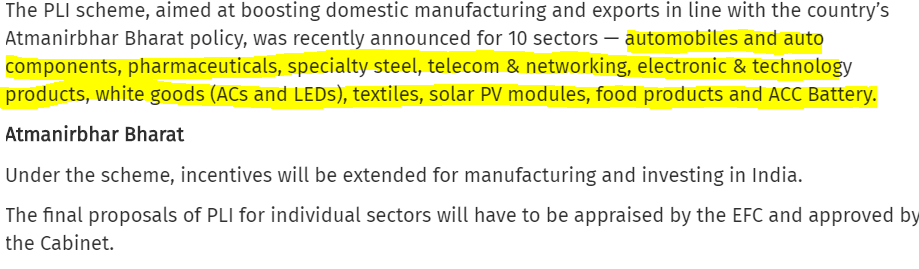

Implementation of production-linked incentive (PLI) schemes worth up to ₹1.45 lakh crore for 10 key sectors announced recently by the government is likely soon.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

If you have not read my earlier post , please go through What to do in stock market in early 2020. It’s important as you will be able to relate to this post in much better way after that!

Most of the investors I talk nowadays are not willing to invest in this supposedly overheated Indian stock market and its not about only December 2020, i can see the fear of crash looming in their talk from Sep2020. Most of them have cashed out from market in September 2020 due to Indian Chinese troop clashes and fear of US election results. What happened thereafter is more painful for such investors, Markets ran away further leaving them behind.

Also read : Invest in Stock market IF

We can broadly classify investors in Dec2020 in three kinds

So as you are reading this article, did you notice where do you belong?

Congratulations, if you are able to see yourself amongst one of the three kinds mentioned above

Question still remains same for everyone : What to do now? Should we buy, sell or keep holding? What’s next : Is it bull market or is crash near?

Let’s read further to understand more about it and see what strategies people can adopt

Thsi strategy is for people who

Advantage with these strategy is you may not lose capital if market goes down and may get a chance to re-enter at lower levels. Problem with this strategy is it is impossible for anyone to predict whether market has topped out or not. Will Market go further up and can give you a bigger chance to cash out? Will market come down and give you a chance to enter at lower levels. Nobody knows. Get away from people if they claim to know.

It is always better to leave last 10% on the table and cash out if our goals are near or we have debt to pay because when correction happens, it will not give you a chance to exit at your desired levels

You may need to decide a market point where you should re-enter

I will strongly advised against this. Problem with this strategy is most of us will be invested in 50 + stocks by taking tips from random sources and keeping most of the stocks which are in loss. So if market correction happens, we will not be having enough money to average down all stocks.

In case, you have idle money and have a itch to invest at these levels, in such cases adopt a simple strategy

Correct portfolio allocation and conviction in the chosen stocks is a must for investing at these levels

This strategy is for people

Under this strategy, adopt the simple course of action

What i am doing in this market? My answer is Case 3.

So that effectively means

I am not putting new money into the market

I am selling my existing less convincing or loss making positions

I am adding more of existing convincing positions

I am adding new stocks position partially and waiting for small correction in market to add more

I am re-organizing my portfolio for next cycle of market

I am keeping Cash levels close to 20% to handle market correction and adding more.

I am happy to ride with my 80% invested convincing positions

I would not recommend to sell out and sit if you have not borrowed money and are not facing immediate liquidity issues. But for sure remove dud stocks and put that money into other quality stocks as always

Overall, what I learnt from markets in my journey is very simple and easy to follow :

You can’t be 100% invested in market

You can’t be 100% sold out from market.

Whenever I tried to cash out in fear, I lost major gains in next cycle. Whenever I invested fully 100% in greed, I lost good amount of capital and recovery becomes difficult.

Holding and adding to convincing positions seems simple but definitely a task which is not easy

So is this a bullish market — i dont know and neither i want to know as i am working on stock specific action

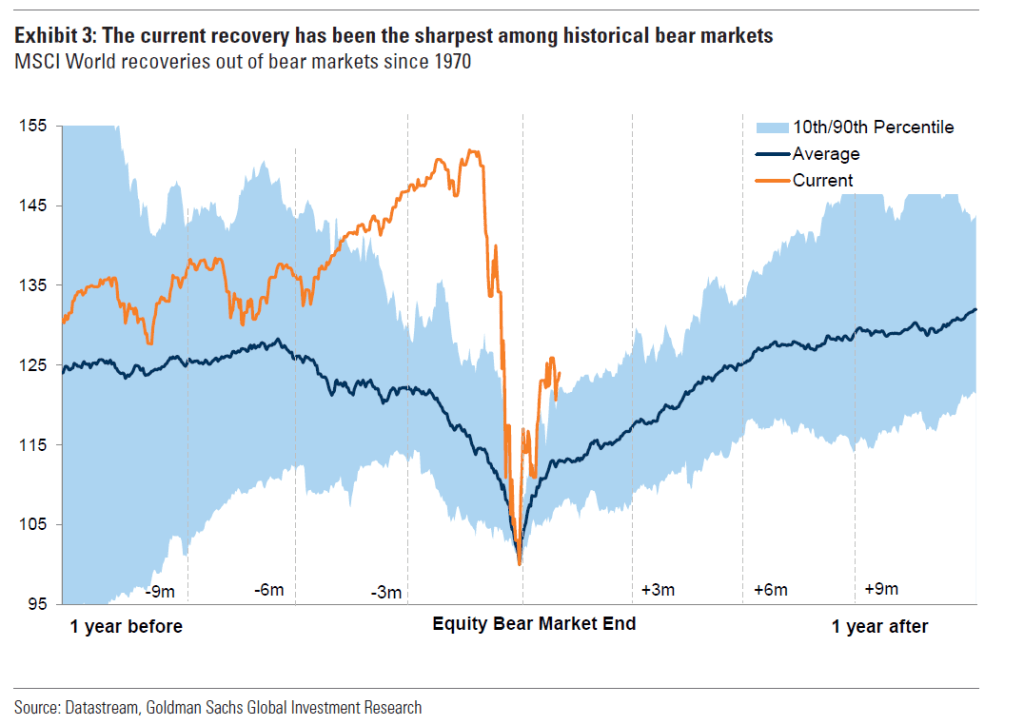

Will correction happen–The more we go away from March 2020 lockdowns, greater will be the chances of economic recovery and lesser are the chances of crash. Healthy Market correction (upto 15-20%) can still happen and can give a nice entry point. Not sure of whether it will happen next week, next month or next year or not at all!!

Whatever strategy finally you adopt. don’t be a blind follower

Read more on Blind follower here

Wishing you all the best and lots of luck

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

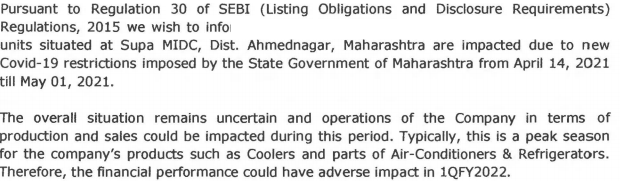

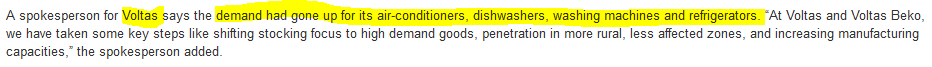

Covid -19 has an impact on consumer durables to such an extent that demand outsrips supply and many SKU have waiting periods.

Interestingly Dishwashers demand is so high that it outstrips last few years combined sales already. Listed Companies like Whirlpool, Siemens,, Voltas, IFB can be beneficiary and Voltas and IFB stocks have run up in recent past already

This is a trend which will not stop and will have a contagious effect in Indian Society where word of mouth helps a lot in buying decision.

So premium items like dishwashers may become a common sight in coming days in many Indian households. Look for this trend to unfold in medium term

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

FMEG segment already growing –from earlier posts some indicators showing this already

Despite Fall in revenue in other segments in 1st half FY21

Q2 FY21 results fo SBI cards are out and does not look great on few fronts although long term story seems intact as of now

Few snaps from SBI recent investor presentation where we can see the lagging part from company as compared to previous year FY20

SBI Cards : Declining portfolio growth, SBI Cards : Increasing NPA , SBI Cards : Declining PAT

Looks better to wait for right entry price : NOT a RECOMMENDATION

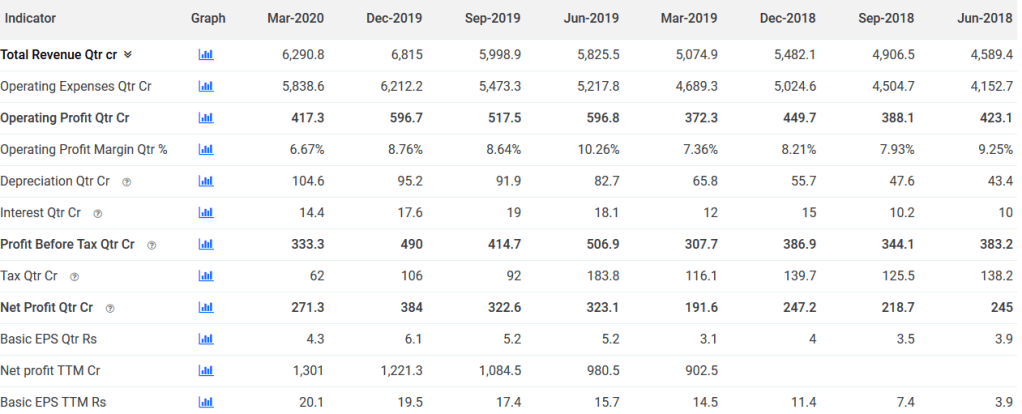

After a meltdown in Q4 in markets, there was an anticipation of meltdown which never happened. Is current market correction on the way to meltdown? Which stocks to buy/ which to leave? Questions galore!! Lets revisit some of the stocks which have decent set of results in Q1 of FY21

Also go through decent set of results in Q4 FY20

Don’t treat this post as a basis of investment. There are lot more factors to decide where a company will go in coming quarters. Discuss with your financial advisors before taking any position in stocks

Disclaimer : I may be fully biased while treating a company result as decent or bad

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Recently 4 shocks shook the garment industry –highlighted few points from an article in Hindu business line — Read the full article to have better understanding

1. Shortage of import of raw materials from China which hit countries which are dependent on import

2. Cancelled order or delay in payment from brands

3. Lockdown by administartion

4 Dull demand and slow recovery due to macroeconomic trends

This all will contract the industry by 20-30% despite an opportunity to make masks and other related stuff

Also read : https://alpha-affairs.com/2020/08/19/yes-bank-path-to-recovery/

Also read : https://alpha-affairs.com/2020/08/19/one-more-blow-to-hospitality-industry/

Three common ratios ( D/E), (Debt Service Coverage ratio) and (Interest service coverage ratio) represented in annual report and discussed at various places in quarterly results of many companies.

These numbers, if not given, can also be calculated if few details are looked into the report carefully

So instead of worrying about market fall or rise, decide on whether the companies invested are sound and safe and can increase your wealth in right proportions

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

This is in series of posts where you can find the SWOT of a listed company along with factors to watch out for in coming quarters.

SWOT means

S – Strength of a company

W- Weakness of a company

O- Opportunities available for a company

T – Threats for a company

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Also Read – SWOT- Parag Milk Foods

Also Read – SWOT- SBI CARDS

Also Read – New to Stock Market : Part 1 : As Investor or Trader?

Also Read – Invest in stock markets only if

Investing is buying right stocks with right allocation at right price at opportune time with exit strategy in place Experience counts!!

Lets invest!!

Join our Equity booster plan at very nominal fees get in touch https://wa.me/919740311223?text=interestedinequityboosterplan

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Please note that I had hold positions in DMART stock in past and exited and may hold in future as well. I may be fully biased in the below opinion. Please don’t take it as investment advice. Its just sharing of what i observed and reader is advised to do due diligence before acting on opinion

Dmart is a stock which i am tracking from IPO days. Could not get IPO allocation but I entered into it at very late stage and also exited without making much gains. The Reasons are aplenty but as we see it is also a stock which has defied gravity in valuations. Here i am trying to find the correlation with the results announced for Q4 and full FY19-20 with what i have observed a month back and shared to people on twitter. .

This what i observed and shared a month back on 22nd April 2020

Almost 50% stores closed for a month, open stores only selling essential items like grocery which have low margin, other things like clothes, utensils (high margin business) is closed because of less staff operating. Open stores have less footfall, there is limit as well on items that can be taken out while on the other side they need to keep store open for longer time –our area 24 hrs open, instead of normal 10am-9pm ..so more operating costs. Plus operating expenses are rising because of social distancing, sanitation of trolleys, infrared thermometers, sanitizes to people when they enter the store , Electricity expenses, Getting worker to work at night shift may increase salary allowance. More people in line has forced DMart to put up tents outdoors. So less revenues, more expenses, profit will take a plunge in coming time. And now enters JIO deal. A bigger challenge for dmart to retain customers. May force them towards home delivery with shrinking margins My view at that time was to exit DMART and re-enter later.

What happened to DMART price. From the point i exited, it went from 2150 to 2380 in last one month

Sounds familiar!!

You sell a stock, it goes high

You buy a stock, it goes low

Amazing isn’t it!!!

But here the pain is less, atleast till now, as i was waiting for Q4 results to take a fresh call .

So how was DMART results on 23rd May 2020?

First glance at results shows solid performance with approx 24% increase in YOY revenues, 29 % yoy growth in EBITDA and 60% rise in EPS YOY. Looks like i missed the bus by selling my position and already stock by approx 10%.

Still i decided to delve deeper into results and compared Q-O-Q numbers (Q4vs Q3 of FY19-20). I saw a decline in Revenue as well as EBITDA and only 8 days were the stores closed in Q4. Why did the Q4 numbers so weak? I thought actual impact should be visible in Q1 FY21 but here Q4 revenue decline is not making much sense? It is beyond my imagination that only 8 days has caused such havoc in Q4 numbers. I was not able to solve the puzzle for quite some time. Could not get any clue and I was re-reading the results & commentary again and again.

I pulled out numbers for past 8 quarters and there you go!! It confirms that Q4 is a historically weak quarter. But here the decline from Q3 to Q4 was 30% approx while in the past years the decline from Q3 to Q4 profits were limited to 20%. Somehow what i observed a month back starts making some sense . 8 days of lockdown did have an impact and its clearly visible in Q4 numbers.

I reached to Management commentary and in section Covid-19 update, Management very clearly reflected on the lock-down observations and its impact on business. I am highlighting the paras below for your readings.

Reading the paragraphs gave me a sense of relief that missing such bus last month might not be not painful in long run. It also highlight the fact that while the results may look better at first glance but they are more than mere numbers and why one should go deeper to understand the results.

Entry of JIO MART along with COVID-19 lockdown may be a lethal combination for DMART. We need to see how the company performs in coming days and will NEWTON’s gravity will finally pull the stock down or not at all.

I don’t yet know whether i may get a chance to board the bus again or not as stocks prices can remain irrational longer than one’s patience!! I am also skeptical as of now whether bus should be boarded at all. I may be totally wrong as i see there are people who are predicting or rather speculating that all is well with company and stock price is on way to 3200!!! Its better to wait and watch from sidelines although I would be really surprised if the DMART stock reaches 3000 levels before retreating back to 2000 or 1900 levels. But Stock markets can really make you go crazy at times.

Please share your opinion on what you think about DMART stock price

We will revisit this post possibly after Q1 results again and learn more from markets.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Interesting to see how many from solid and good results will move to Average and bad results category after Q1 FY21 results. Those who survive in good or solid category even after Q1’FY21 should be worth researching more to invest

Don’t treat this post as a basis of investment. There are lot more factors to decide where a company will go in coming quarters. Discuss with your mentors or financial advisors before taking any position in stocks

Banking and finance sector is the worst performer in recent months and there are high chances that it will continue to do so. There could be multiple reasons for same including defaults in payments and slow credit growth

Below is the list of Public and private sector banks with NIM, Net NPA %and Gross NPA% as of 17th April 2020. It may help you to make an investment decision more prudently. Don’t forget to consult your financial adviser before doing so.

Given a choice based on this data, the below banks seems better than other banks on certain criteria.

![]() Be aware that these NPA numbers has a high probability of increase in next two quarters.

Be aware that these NPA numbers has a high probability of increase in next two quarters.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Read full article at we have all stopped our SIP

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

This is in series of posts where you can find the SWOT of a listed company along with factors to watch out for in coming quarters.

SWOT means

S – Strength of a company

W- Weakness of a company

O- Opportunities available for a company

T – Threats for a company

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Also Read – SWOT- Parag Milk Foods

Also Read – New to Stock Market : Part 1 : As Investor or Trader?

Also Read – Invest in stock markets only if

Also Read – SWOT- Dhanuka

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

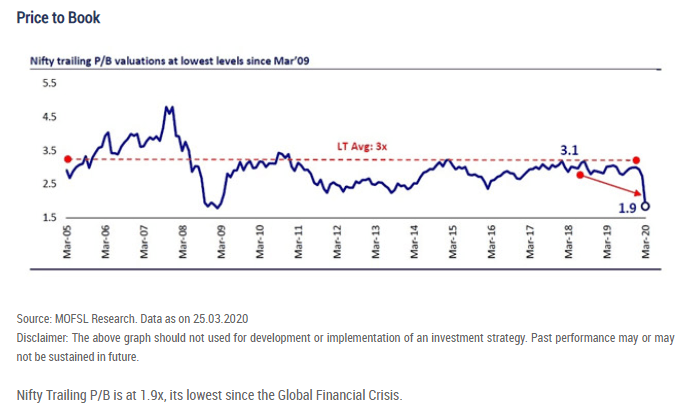

Market Capitalisation (M-CAP) to GDP Ratio : The stock market capitalization-to-GDP ratio is a ratio used to determine whether the overall market is undervalued or overvalued compared to a historical average. As pointed by Warren Buffett, M-CAP to GDP is “probably the best single measure of where valuations stand at any given moment”. The result of this ratio calculation is the percentage of GDP that represents stock market value. The Ratio for Sensex is currently stands at 54%, way below its historical mean of 69%. This ratio is at its lowest level since 2010 – an outcome of the flash crash seen in the last 22 odd trading sessions.

If we look at Nifty, on financial year basis this ratio stands at 49%, again lowest since the global financial crisis.

If February 2020 was forgettable for investors then March 2020 would be a month which most of the investors want to skip in their investing life. But what is the guarantee that April and May 2020 will be better if not the worst? So a rational investor can not wait for bottom as he dont know about the bottom. But what to buy and what to leave in such markets?

Let’s try to find out

Just when i was thinking what stocks to buy in these stressing conditions for economy and people, i mostly get stuck on FMCG companies. But the amount of negative news for the whole market is so high that making a decision is becoming difficult day by day. So i thought to keep watch on all news around COVID-19 lockdown and see if there are any positive inputs for any sector or industry.

It is evident from various sources that people are getting bored at home even when they are WFH. Although some of them are fitness conscious and are actively engaged in indoor exercises but their normal physical movement has almost gone done to ZERO. To pass the time, they have started indulging in binge watching/exercising to somehow beat boredom or depression. So i feel that these are the two sectors which could benefit the most in this lockdown as grocery stores are open and some of them do keep yoga mats or basic exercise equipment.

I searched a bit more on internet and came across something which positively testify this theory. https://www.stackline.com/news/top-100-gaining-top-100-declining-e-commerce-categories-march-2020

The site mention the TOP 100 Grwoing and declining e-commerce categories in US although most of these things also apply to Indian context as well.

Some of the major takeaways are (source : stackline)

· There is a surge in home fitness products including weight training equipment, fitness accessories and yoga equipment as gyms and workout studios are forced to close. Due to the increase in at home workouts, the gym bag category and many outdoor sport categories such as baseball & softball and track & field are in decline.

· Many companies have implemented a work-from-home policy, driving demand for computer monitors, keyboards & mice, and office chairs up as employees look to create a temporary home office.

· Most travel has been halted, causing declines in the luggage & suitcases, briefcase, and camera categories. Additionally,many spring break vacations were canceled, triggering a decline across sandal and swimwear categories.

· Formal apparel categories including Bridal and Men’s Suits are in decline as many couples are forced to cancel or delay their weddings.

My observations (not recommendations) :

Please note that the information shared is for educational purposes. My views can be biased and i may hold some of the stocks mentioned. Please consult your financial adviser before taking any financial decision and most importantly do your own due dligence

What do you think out of this COVID lockdown? Please comment or mail me your views

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Weekend HookUp: 29 March, 2020

Life: The 1 Percent Rule (James Clear)

Investment: Unknown man became Billionaire from one Idea (Ridgewood)

Psychology : Investment Quotes (DollarsandData)

Health: Sugar : The Bitter Truth (Youtube)

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

As we have seen multiple times, people enter into stock markets with a lure of quick money and start buying stocks based on tips, analysts recommendations, social media news or friends recommendations. All this stock buying happens as a blind follower. Unfortunately most of the times these blind follower theory works for buying only. People forget to sell stocks or intentionally keep holding them because of losses in these stocks and they don’t want to miss out if stock rebounds. So they keep on waiting for stock to come to their buying level or worse they keep averaging such stocks.

What people really miss or can not analyze is whether the stock bought is good enough to hold or not? or Is it good fundamentally? or the original buying thesis has undergone a change or not? Whether this stock ever turns back or not and why? Whether they should average or not?

Our team at Alpha Affairs has recognize this need for common people who need a opinion on their holding so that they can take a decision themselves with better understanding. Alpha Affairs has filled this need by giving a chance to common man to get the third eye look on his/her portfolio.

Portfolio opinion is a premium service (nominal fees) and our motto behind this service is to help our friends remove dud stocks from portfolios to improve overall portfolio returns. We call it as a Third Eye Look on your portfolio. This Opinion should be construed as knowledge sharing only and not be construed as financial advice ( we are not SEBI registered) and any losses or profits arising out of same are responsibility of the stock owner. We are only trying to help each other in best possible way we can. It is better to consult your financial adviser before initiating buying, sell or hold calls on your portfolio

Please find the details at the link provided below

https://alpha-affairs.com/portfolio/portfolio-opinion-third-eye-look/

Your portfolio review maximum two times.

One at start of discussion and

another review on or before 90 days as per request

You can use Services for Stocks or Mutual funds review or both together.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Most of the investors are waiting for market to overcome the budget day shock given by markets and hoping that February should end fast and March should begin as earnestly as possible. Little did they know the second week of March 2020 will bring more blood on the streets literally (Dalal street became Laal street ), pun intended.

Most of these investors are new into the market and did not know how to react to such situations in market. Some of them only read about 1992, 2000, 2008 market crashes and personally not experienced them. This market crash is a kind of a graduation ceremony for new investors, while at the same time its a post graduation for 2000, 2008 graduates. If you survive 1992, 2000, 2008 and ongoing 2020 then you deserve a lifetime achievement award as well.

So as you are reading this article, did you notice any pattern in stock market crashes?

Congratulations, if you are able to see that

Stock Market crash is inevitable every 8-10 years.

Ofcourse capital protection in these times are the first priority. How to do that, lets read further on what strategies people can adopt

Thsi strategy is for people who

Advantage with these strategy is you may not lose further capital if market goes down and may get a chance to re-enter at lower levels or bit higher levels when dust settles. Problem with this strategy is it is impossible for anyone to predict whether market has bottomed out or not. Will Market go down further in next 2 days or 2 weeks or 2 months. Nobody knows. Get away from people if they claim to know.

We may see occasional sharp upturn but may not be able to sustain it because economy will be impacted definitely due to most of world going into lockdown mode for few months.

You may need to decide a market point where you should re-enter

Since such market crashes, most of the stocks fall even if they have good balance sheets, business , zero debt, so advantage with this strategy is you will get good quality stocks at throwaway prices and from these levels, they can return 15-20% CAGR in 5 years. Problem with this strategy is most of us go overboard and can’t classify what to leave.

In such cases adopt a simple strategy

Correct portfolio allocation including cash in hand at all times is the key to survive these crashes.

This strategy is for people

Under this strategy, neither you buy nor you sell but wait for the dust to settle down to take the next course of action.

What i am doing in this market? My answer is Case 2.

I would not recommend to sell out and sit if you have not borrowed money and are not facing immediate liquidity issues. But for sure remove dud stocks and put that money into other quality stocks

Whatever strategy finally you adopt. don’t be a blind follower

Read more on Blind follower here

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Read on SBI cards Business Strengths, Oppurtunities, Weakness, Threats in the post SBI CARDS IPO. We will discuss in this post on what could be an investor strategy once its listed on 16th Mar20.

Since Market scenario has turned bad as compared to IPO subscribe days, its better to be prudent in investing. Just pulling back line from old article on subscription strategy, the longer term strategy will remain as such

One can subscribe to SBI cards IPO if one can hold the shares for 3 to 5 years and looking for long term gains

Note taken from earlier post on subscribe or not : SBI CARDS IPO.

This could very well turn out to be a blessing in disguise as you have money available to put in stock market. Whereas others are finding it challenging to arrange money to buy stocks available at cheap valuations after a drastic fall, you are spoilt of choices.

Action 1–> Keep some money ready for SBI cards and allocate rest amount to buy other quality stocks in market

Action 2–> If Listing happens at premium of +15-25% IPO price, you need not to do anything. Wait for correction in stock price before initiating your position

Action 3–> If Listing happens at +/- 5% of IPO price, you need not to do anything. Wait for correction in stock price before initiating your position

Action 4–> If Listing happens at -20% of IPO price or share price moves down 20% from IPO price ( approx 600 Rs), you can initiate buying and can put 33% of your money kept aside for SBI Cards. In more likelihood, you will get chance to put more at down levels.

Action 1–> Sell all allotted shares of SBI cards if listed at 20-25% premium to IPO price and wait for re-entry

Action 2–> If Listing happens at +/- 5% of IPO price, you need not to do anything and wait for further correction before averaging down your price

Action 3–> If Listing happens at -20% of IPO price or share price moves down 20% from IPO price ( approx 600 Rs), you can initiate buying and can put 25% of your money kept aside for SBI Cards. In more likelihood, you will get chance to put more at down levels.

Action 4–> Buy 50% or more of money kept aside if share price moves down 40% from IPO price ( approx 450 Rs).

Action 1–> Sell all allotted shares of SBI cards if listed at 15-20% premium to IPO price and wait for re-entry.

Action 2–> If Listing happens at +/- 5% of IPO price, you need not to do anything and wait for further correction before averaging down your price.

Action 3–> If Listing happens at -25% of IPO price or share price moves down 25% from IPO price ( approx 530 Rs), you can initiate your further buying and can put 20% of your money kept aside for SBI Cards. In more likelihood, you will get chance to put more at down levels.

Action 4–> Buy 50% or more of money kept aside if share price moves down 50% from IPO price ( approx 375 Rs).

Slowing economy may led to lot of defaults. NPA % is sure thing to watch out for

Rich Valuations at IPO time may take longer time to deliver mutlibagger returns and if any quarter results are not as good as expected, these rich valuations may play havoc

Emergence of new player to snatch market share. Keep watch out for AXIS Bank and ICICI Bank market share vs SBI Cards market share

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer : I am not a Sebi Registered adviser and currently invested in Yes Bank with average holding @45 Rs. This article is based on Yes Bank taken over by RBI and placed under moratorium on 5th Mar 2020. The content of the articles are not relevant if there are any future developments which are not in sync with this article. This article is not meant for traders. Please consult your financial adviser before making any decision on buy, sell or hold. You are advised to have your conviction and owning the decision thereafter.

As per the recent developments, Yes bank is placed under moratorium by RBI and SBI , LIC are potential investors with dilution of shares. So in such a case what an existing shareholder can do.

Your all investments may not be successful and may fail. One should be ready to accept such failures, learn lessons and move on to next opportunity.

Stocks may fail or fall due to technical reasons (overpriced) , due to bear market (every stock falling) , due to bad policies (power stocks, aviation are good examples), or change in fundamental story.

Be clear that Yes bank has fallen due to change in its fundamentals and its story has changed. Whatever thesis we have for Yes Bank at the time of investing is changed forever and this is the time to have a relook on yes bank investment.

So what we can do as retail investor when you are up against

Here is the practical advise in three scenarios

Hold if your average is too high (beyond 60 Rs and further) (CMP Yes Bank is ~16 Rs) and don’t book losses. Let the losses remain on paper.

You can not do anything with pennies anyway.

Wait for investment thesis by SBI, other players to play out

Let the stock get stable and take a call again but do remember not to throw good money after bad money.

This section is specifically for investors holding positions below 60 Rs.

First step you should do is look existing amount as fresh investment in new bank or a new company & ask yourself few questions

◆Will new Yesbank be multibeggar in near future?

◆Can I afford to lose all what i invested till now or further money in Yesbank debacle?

◆Will brand value of Yes Bank remain intact among customers and depositors after moratorium.

◆Will new customers open their account in Yes Bank ?

and like wise you can frame more questions

◆Are there better opportunity in this falling market?

◆Will old customers withdraw all money on first given opportunity from Yes Bank?

and like wise you can frame more questions

If the answer is YES (for Qs in Section 1) along with NO ( for Qs in Section 2), Then read Option 3 down further

If the answer is Yes for some of the above questions in section 2 along with No answers to some questions in section 1, Then there are three options

Option 1. Think it is one of the bad ideas and sell if liquidity is a challenge. Book your losses and Move on to next opportunity.

Option 2. Hold if liquidity is not a problem. You may recover some of the price and decide accordingly. Don’t throw good money after bad money

Option 3. You have enough liquidity and can afford to lose all money invested in yes bank plus you have enough time horizon to play like 3-5 years, Go and buy shares of new Yes Bank and average your holding if shares available at below 10 Rs. Even if you choose option 3, allocate not more than what you afford to lose completely. I would not advise you to go beyond 5% to 10% capital in yes bank of your total capital allocated in market. Definitely a Riskiest option but rewards (if any) will be equally high.

Choose your option wisely based on current liquidity, your risk appetite and investment horizon and do as much due diligence as possible on your holding.

I hope this article might have brought some clarity to your current thoughts. Any feedback’s are welcome.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Few things on SBI CARDS IPO to help you decide whether to go ahead with subscribing for IPO or not.

Healthy Balance sheet

Strong parentage backup (subsidiary of SBI)

Second largest credit card issuer in India with 18%

Low credit card penetration in India ( @ 3% only) . Developed markets have this ratio @300%

Largest co-brand credit card issuer, having partnerships with several major players.

Will become the only listed company in India in this space.

Fast usage of UPI interfaces may led to increased competition

Fast usage of mobile wallets may led to decline of credit card users or slow penetration into new user base

Unsecured credit may lead to high NPA

High Valuations

One can subscribe to SBI cards IPO if one can hold the shares for 3 to 5 years and looking for long term gains

Slowing economy may led to lot of defaults. NPA % is sure thing to watch out for

Rich Valuations at IPO time may take longer time to deliver mutlibagger returns and if any quarter results are not as good as expected, these rich valuations may play havoc

Emergence of new player to snatch market share. Keep watch out for AXIS Bank and ICICI Bank market share vs SBI Cards market share

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

A dilemma every investor face : To remain invested in market or be fearful and cash out.

NO doubt, abundance of cash will allow you lot more investment flexibility than other people in market, more so in such volatile times or bloodbath in share market. But for that, you have to pass so many good looking (but not good) opportunities when markets are going up to preserve your cash.

On the other hand, if you are fully cash out in times of fear, you will miss the amazing wealth creation journey as shown below

So these two tweets shows exactly the dilemma one faces. As John Keynes quoted long time back –“Markets can remain irrational longer than you can remain solvent“

So the key here is to have correct portfolio allocation.

You should know which opportunities to let pass by. That can only happen when you don’t work on tips but study the business (ok, i mean share) in which you are going to invest.

If you can’t understand Balance sheet or cash flows, no problem.

As long as its not a penny stock chosen by you, you can just start with a basic google search about management integrity or business viability as a macro picture and things will start to appear. Take help to understand bigger picture of business. Understand the parameters for different kind of business. Is it cash guzzler or work on leverage? Is it a high margin business or high volume business?

So if your basic search, sanity checks on company itself shows you own a dud investment, be fearful and cash out. Deploy that cash to buy quality stocks further. Not only it will avoid to push more cash from your pocket but also trim your future losses.

So the cash you generally deploy for below par investments can be saved by doing some basic sanity checks on a company and that cash can be really useful in bloodbath in share market. You will get good companies at prices which will be seen as missed opportunity by people who don’t have cash.

Before i leave you to ponder on further details about the companies, do remember

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Bengaluru-based Barbeque Nation Hospitality (BHNL) has filed IPO papers with SEBI for the second time. Backed by private equity investor CX Partners and ace investor Rakesh Jhunjhunwala’s investment firm Alchemy Capital, the IPO would comprise a fresh issue of shares as well as offer for sale.

Barbeque Nation is one of India’s fastest growing and widely recognised restaurant brands in the rapidly growing CDR market

Rakesh Jhunjhunwala’s investment firm Alchemy Capital holds 2.05 per cent stake in the company. Private equity investor CX Partners owns 33.79 per cent. The promoters of Barbeque Nation Hospitality are Sayaji Hotels, Sayaji Housekeeping Services, Kayum Dhanani, Raoof Dhanani and Suchitra Dhanani. They together hold 60.24 per cent stake in the firm.

A very limited quantity of pre-IPO shares of Barbeque Nation is on offer.

Some of the details can be found here at https://economictimes.indiatimes.com/markets/ipos/fpos/barbeque-nation-hospitality-ipo-all-you-need-to-know/articleshow/74223280.cms

For those interested,please email me with details through Contact Form

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Weekend HookUp: 9 February, 2020

Stocks: Blue Chips with almost zero returns in a decade (NT)

Travel: Agra Beyond Taj (Livehistoryindia)

Auto: 10 worst Indian Cars of a decade (TeamBHP)

Health: Ideal level for Ketosis (Livingwellwithketo)

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

As lot of people keep asking me regarding the specific financial advice when entering a stock market, this quick-read article gives you some pointers before you jump into stock markets

Read in detail : Emergency funds

Also Read : You should invest in Stock Market if

Also Read : You should not invest in Stock Market if

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Emergency fund is money which comes to your rescue when something unexpected pops up in our daily routine. One needs an emergency fund as life is very unpredictable. Something that can go wrong will eventually go wrong at wrong time.

Just think of emergency fund as a lifeline thrown at you when you are drowning and this article is about creating that lifeline yourself

One may need to travel unexpectedly (we all know how much bomb a ticket costs at last minute) or there could be medical emergency (Generally Life insurance or medical insurance will work for this but by the time insurance claim comes to you, you need to survive yourself and family and pay hospital bills) You need funds for that.

Or worse if you are working in an industry where jobs are not secure and layoffs are frequent, such a fund becomes mandatory.

You wouldn’t be forced to reach out to family or your so called friends for help and further You also wouldn’t have to accept the first job offer that lands on your plate in such a scenario

Basic Thumb rule is to have minimum of 3 months and maximum of 12 months of expenses as your emergency funds. e.g, if your monthly income is Rs. 50000 and you spend Rs 45000 month on an average and save 5000 Rs per month then you should have minimum 45000*3 =135000 as your emergency fund.

| Asset | %age of emergency fund | Storage mode | How to access | Accessibility days |

|---|---|---|---|---|

| Cash | 15 % | Safe vault at home | Direct | 365*24*7 |

| Liquid Bank Balance | 50% | FD/RD/Saving account | Cheque/NEFT/ IMPS/UPI | 365*24*7 to T+(1 to 2) working days |

| Debt Mutual Funds | 30% | Ultra short duration funds, liquid funds | Demat account/ Cheque/ NEFT | T+(1 to 2) working days |

| Gold | not more than 5-10% | Safe vault at home | Sell to Jeweler | Jeweler working hours |

| Other avenues which can be used | How much % to use in case of emergency | How to use | Advantage | Disadvantage |

| Credit card | 25% | Make a habit to not cross 75% of allocated limit. Reserve 25% of credit card limit as emergency fund usage | It will give you 20-40 days to arrange funds from other resources. | Debt trap |

| Real estate | Neither recommended nor preferred | Additional plot/flat can be used to serve this purpose | Huge amount will be available | Highly illiquid. May be sold at high discount to market in emergency and may take months |

| Stocks/ equity Mutual funds | Neither recommended nor preferred | Sell in market | Emergency funds may grow faster | May be sold at high discount to market in emergency. T+3 working days to access funds |

Also Read :

You should not invest in Stock Market

You should invest in Stock Market

You can safely assume the emergency fund as gateway to wealth creation. Until you pass this gateway, dont dare to think of entering stock market.

The point i want to bring to your attention is — if you have build up emergency fund and saved enough money further (approximate 2 year expenses) in bank account then such a huge money can give you access to new opportunities in stock market.

Let’s say the economy crashes and potential layoff’s are round the corner and eventually stock market crashes and asset prices are below their intrinsic values. In such a scenario, instead of selling your stocks at penny prices, you would have enough disposable money to take advantage of stock market and build up new positions without fear.

Do keep in mind that Stock market is a risky place and there could be times where the market is down for quite a long time and you do not want to sell your securities at highly discounted rate, this kind of emergency fund may help you to pass through such bad times without worrying about any unforeseen risks in your daily life.

Last but not the least You need to have more than few of the personal qualities to succeed e.g.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Positives, negatives and how to beat budget — https://mfresponse.adityabirlacapital.org/Hosted_pdfs/FEB_2020/Budget/INV/budget2020_MF.pdf

Budget 2020 & you — https://www.primeinvestor.in/2020/02/01/budget-2020-and-you/

Important takeaway points —https://finshots.in/archive/points-of-the-budget/

Shocker on non tax paying NRI’s – https://www.cnbctv18.com/personal-finance/income-tax-shocker-budget-2020-proposes-tax-on-non-taxpaying-indians-residing-overseas-5180771.htm

Budget 2020 : An eyewash : https://www.capitalmind.in/2020/02/budget-2020-lower-tax-slabs-just-an-eye-wash-but-check-for-yourself/

Also Read : Move to New Tax Regime or Stick to Old Tax Regime

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

You can afford to lose money without that loss having any affect on your and your family daily life in the foreseeable future.

You do not need money in immediate future (means within 2-3 years) e.g.

You decided to diversify your income streams.

You decided to get out of losing your savings from inflation

You are not fortunate to have a windfall family inheritance to live off.

You know stock market is a risky place and can differentiate between investing, trading and speculating. Read more in

You are aware that in long run, Equity investing is the best investment theme as compared to GOLD, FD, CD, BONDS, REAL ESTATE

Last but not the least You have more than few of the personal qualities needed to succeed e.g.

Also Read : You should not invest in Stock Market if

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

You need money in immediate future (means within 2-3 years) e.g.

You decided to live on fixed income e.g.

You do not have control over your emotional behavior e.g.

Also Read : You should invest in Stock Market if

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

This is in series of posts where you can find the SWOT of a listed company along with factors to watch out for in coming quarters.

SWOT means

S – Strength of a company

W- Weakness of a company

O- Opportunities available for a company

T – Threats for a company

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Also Read – SWOT- Parag Milk Foods

Also Read – New to Stock Market : Part 1 : As Investor or Trader?

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.