Category: Stock Markets

Which one!!

Protected: Positional Stocks – 25-June-23

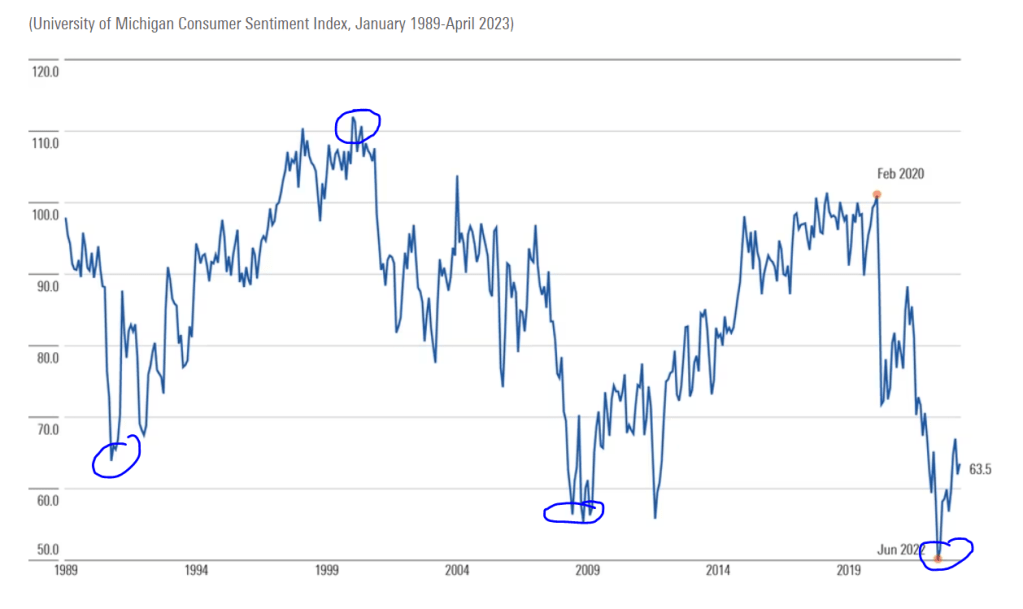

Consumer Sentiment

Protected: Positional Stocks – 18-June-23

Protected: Positional Stocks – 11-June-23

Protected: Positional Stocks – 3-June-23

Protected: Positional Stocks – 28-May-23

Protected: Positional Stocks – 21-May-23

Protected: Positional Stocks – 14-May-23

Protected: Positional Stocks – 8-May-23

Protected: Where are we on NIFTY : ONLY for ALPHA LEARNERS

Protected: Positional Stocks – 1-May-23

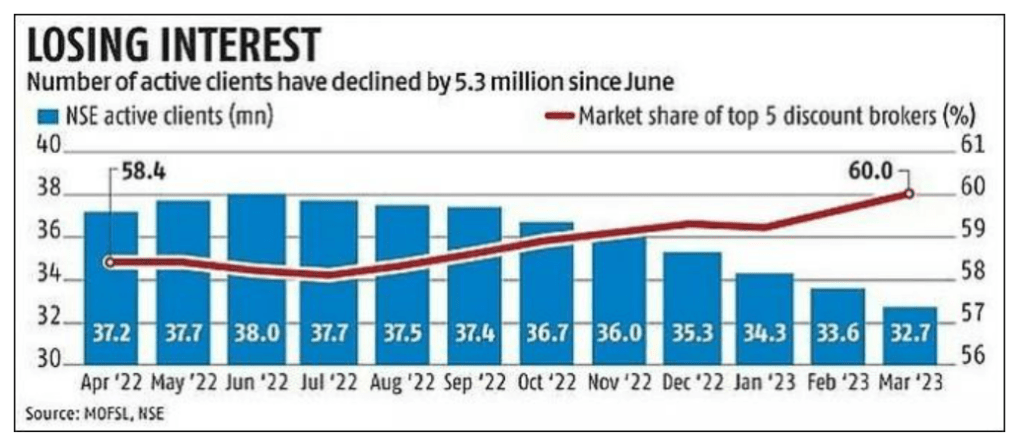

Active clients reduction : One more indicator of bottom formation

Weakest breadth on record : One more indicator of bottom formation

Protected: Where are we on NIFTY : ONLY for ALPHA LEARNERS

Protected: Positional Stocks – 16-Apr-23

Protected: Positional Stocks – 7-Apr-23

MF to FD : One more indicator of bottom formation

Protected: Positional Stocks – 1-Apr-23

Protected: Positional Stocks – 25-Mar-23

Protected: Positional Stocks – 12-Mar-23

Protected: Positional Stocks – 5-Mar-23

Protected: Positional Stocks – 26-Feb-23

Protected: Post is only for Alpha Learners : Art and Science of Investing

Protected: Positional Stocks – 19-Feb-23

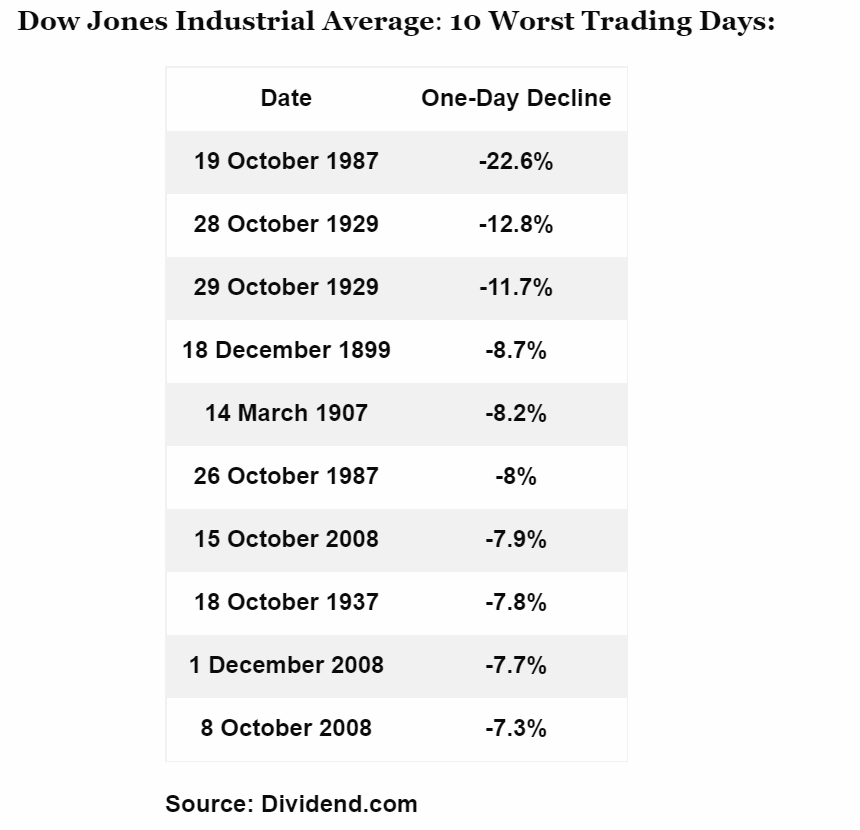

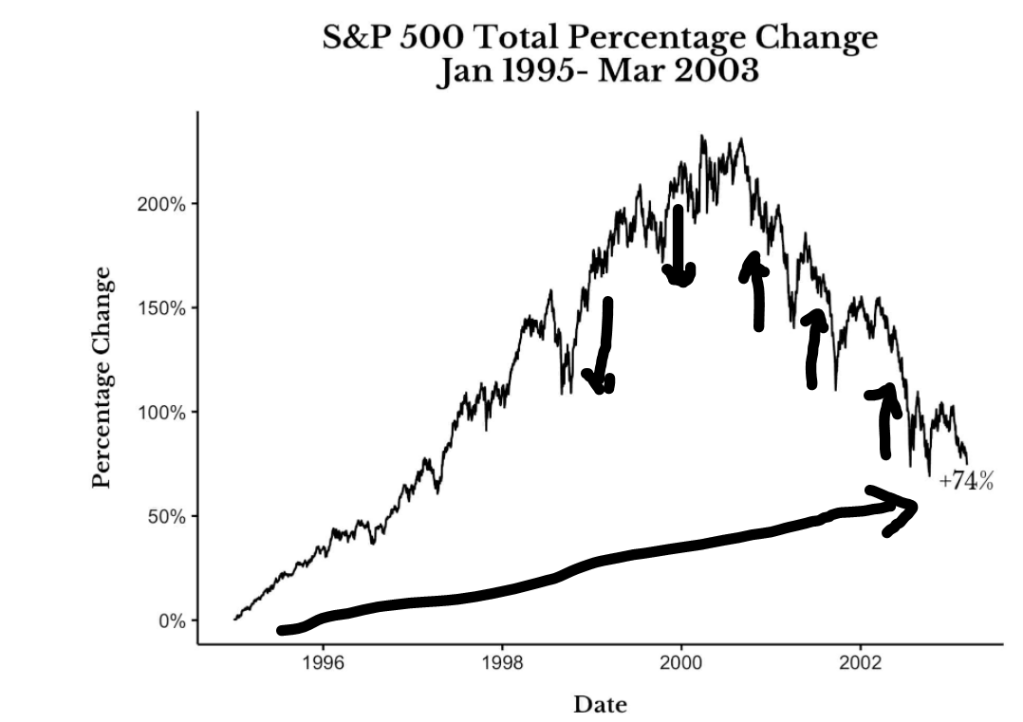

Roller coaster from pasts

Protected: Positional Stocks – 29-Jan-23

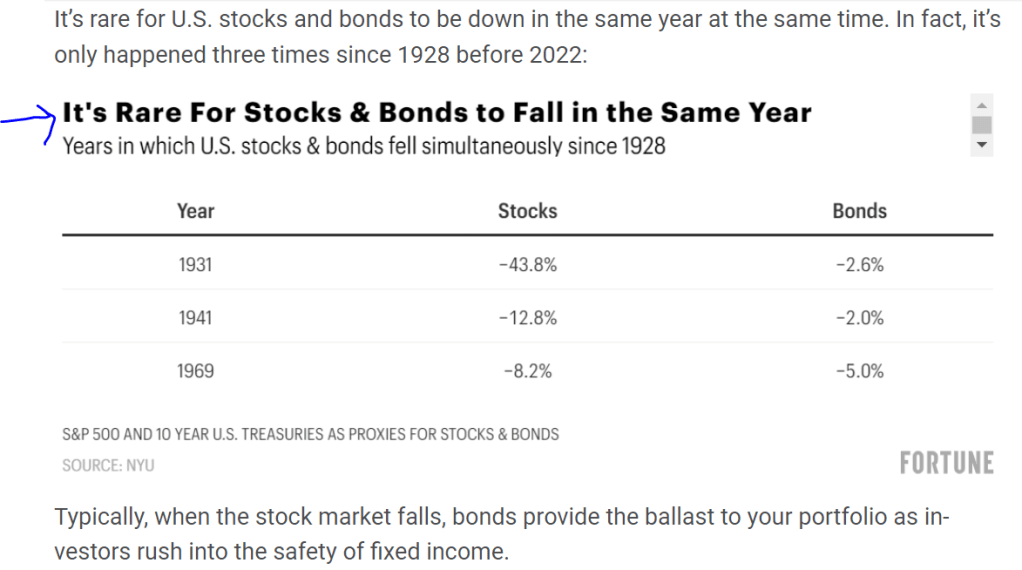

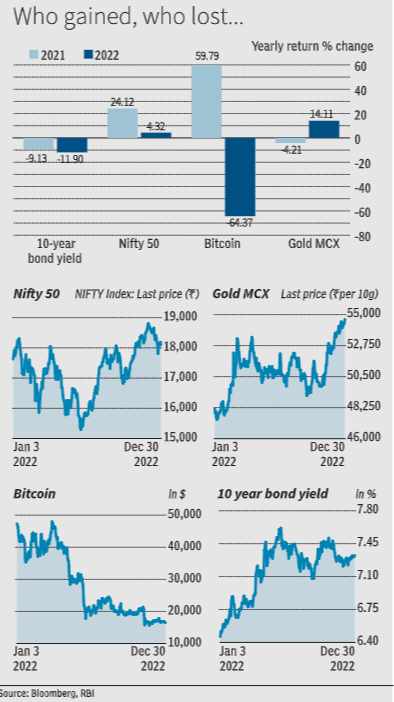

Rarest of rare event : How bad was 2022

Protected: Positional Stocks – 21-Jan-23

Thread on Dependable Clean energy Giant in making!!

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

MTAR Technologies – Emerging Midcap

Story – When the going gets tough, the tough get going, wrote American football coach John Thomas in 1953. This axiom today applies to the Hyderabad-based MTAR Technologies too, in more than one way. Old-timers at MTAR recall India’s former President and ‘Missile Man’ Abdul Kalam telling his team during his DRDO days: “If nothing is getting done, go to that Reddy company at Hyderabad.”

In fact, the Reddy duo – Ravindra and Satyanarayana – set up MTAR, to meet a challenge thrown at them by the government, way back in 1970, to make a critical cooling channel for a nuclear reactor.

As global suppliers began tightening their screws on India’s nuclear power ambitions, the government asked HMT to work on the cooling channel. The late Ravindra’s son P. Srinivas Reddy, MD, MTAR, recalls that HMT expressed its inability to do this and the Reddy duo, who were working there, quit and told DAE they would take up the channel challenge.

There are many Proud moments on its journey including

Mangalyan PSLV engine supplied by MTAR to ISRO

GSLV Mark III engine for the Chandrayaan II mission

Base shroud assembly for Agni missiles

Source —BusinessIndia

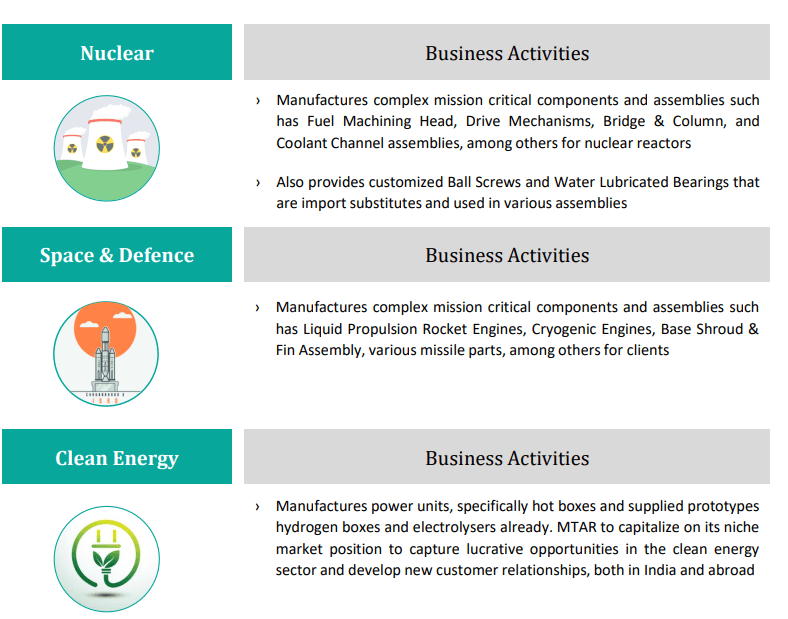

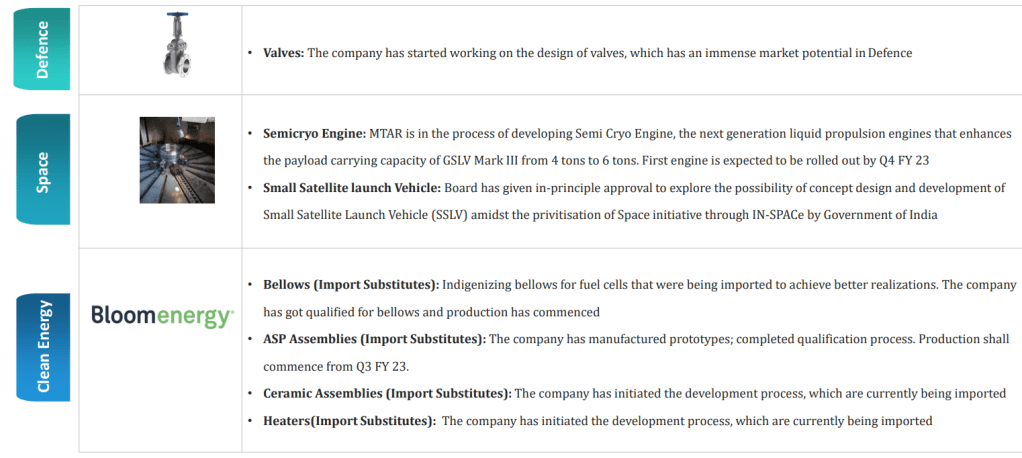

Business Domains

Order Book

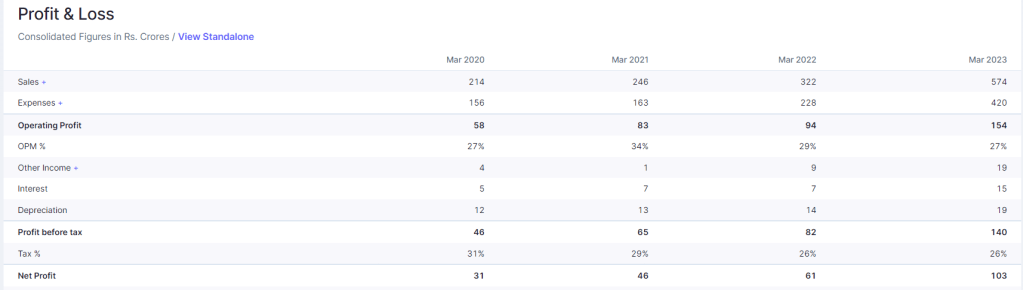

Order Book moving to Clean energy over last 2years. Order book at Sep 2022 closure is 1288 cr while Current TTM sales is ~394 cr (till Sep22)

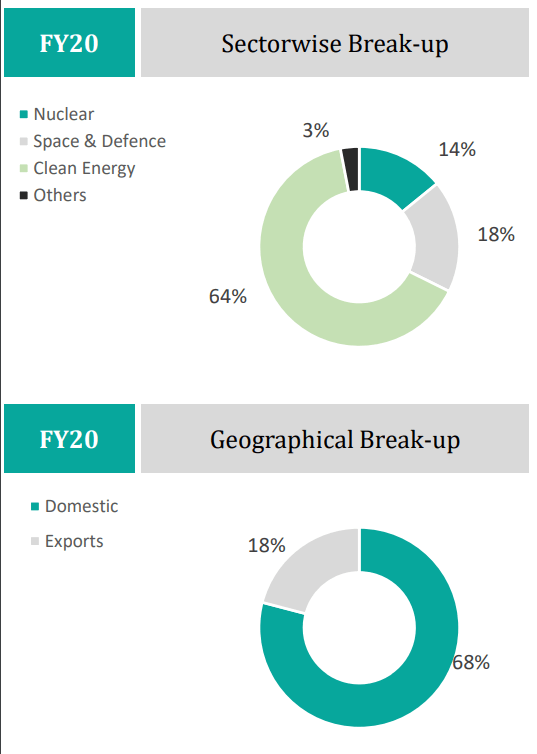

Sector wise and Geographical Break up of Orders

Company is export oriented–trend is almost same in last 3 years

Clean energy orders constitutes almost more than 50% order book every year

Space and Defense Constitutes between 18-26%

Nuclear constitutes 14-22% order book

Other segments growing fast and now at 5.7%

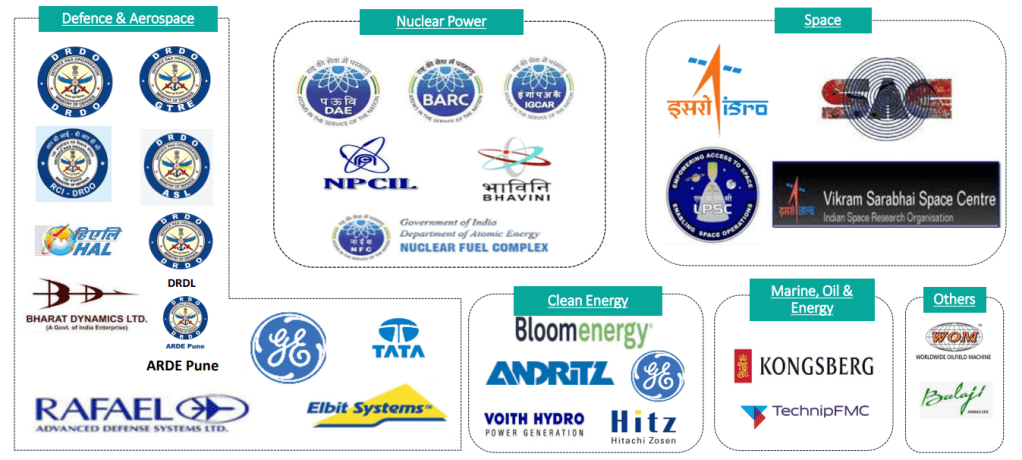

Customers

Strengths

High Entry Barriers and Increased customer dependency on Mtar

Strong Order Book Position and Strong repeat business due to MTAR’s engineering capability

Advanced and End to End Manufacturing Capabilities

Strong Diversified portfolio of critical and differentiated engineered products in emerging domains of Nuclear, Space,Defense, Clean energy , fuel cell etc

Manufactures import substitute products like Roller screws, ball screws. MTAR will be the first manufacturer of roller screws in India and the product will be used for a wide variety of applications in the nuclear, space and defence sectors

Manufactures precision machined components

Strong association with Exiting Customers & new Customers in Pipeline

Stringent Quality checks –Company uses high precision quality inspection equipment such as 3D co-ordinate measuring machines (CMM), laser measuring, optical alignment instruments, non-contact measuring and other such non-destructive testing equipment, to ensure ideal quality. “MTAR enjoys an unblemished record of quality for its product range”

Capability of making —

- Low volume R&D to high volume production products

- Regular to complex products

- Low weight to high weight products

- Export oriented to import substituition products

Experienced Board of Directors & Well Qualified Management Team

Certifications and Awards

Developed global supplier base over the years &procures materials from US, Brazil, among others, Low supplier dependency which also enables negotiation of favorable terms. Global network provides the option to take advantage of better pricing as available in a particular market

Triggers

Strong growing order book –Currently ~1300cr order book giving revenue visibility of 2+ years

Strong Net profit margins with company growing at 30% CAGR. FY23 and FY24 expected to grow similarly or better

The company has got the in principle approval from the board to establish electronics manufacturing in-house and started working on it

Indigenization of Roller Screws done, Executed the FAI orders

The company has also initiated the development of Electromechanical actuators, which find application in Space and Defense sectors

Specialized fabrication facility to be functional soon, The new capabilities are expected to bring in lot more customers. Sheet metal manufacturing facility at Adibatla, Hyderabad has become operational in Fiscal 2023 to undertake sheet metal jobs for ISRO, Bloom Energy and certain other customers. This business expected to generate 100 cr revenue in FY24. Commenced shipments to South Korea and USA; supplied Rs. 11.8 Crs worth of sheet metal orders for Clean Energy sector in Q2 FY 23

Upgrade existing facilities by implementing new technology and releasing release bottlenecks in production capacity

Expanding Product Portfolio and CAPEX ongoing along with IMPORT SUBSTITUITION

Increasing employee strength in last two years as order book increasing continuously

In discussion with below customers to reduce dependency on existing clients

MTAR is developing the following products in collaboration with Bloom to expand its product portfolio in clean energy sector:

Hydrogen boxes- Use Hydrogen to generate power

Electrolyzers – generate green hydrogen from water that shall be used in power units to generate power with zero carbon emissions

(Bloom is one of the largest and the fastest growing player globally in the stationary hydrogen fuel cell segment and has 70% of its revenues

coming from products segment and balance from services)

Opportunities in each business domain due to Indigenization policies in defense, Aatmnirbhar Bharat policies in different sectors, demand of fuel cells and growing maintenance market

Exponential growth expected for Indian players in Space sector given ISRO’s plan to commercialise the Indian space sector

and offer its products and services to other countries

Opportunities in defence offset partnership with certain global OEMs

14 New reactors planned and tenders to be released, one recator have equipments worth ~2200 cr Rs where MTAR is focussing on. Long term relationship with NPCIL can help MTAR to grab that opportunity

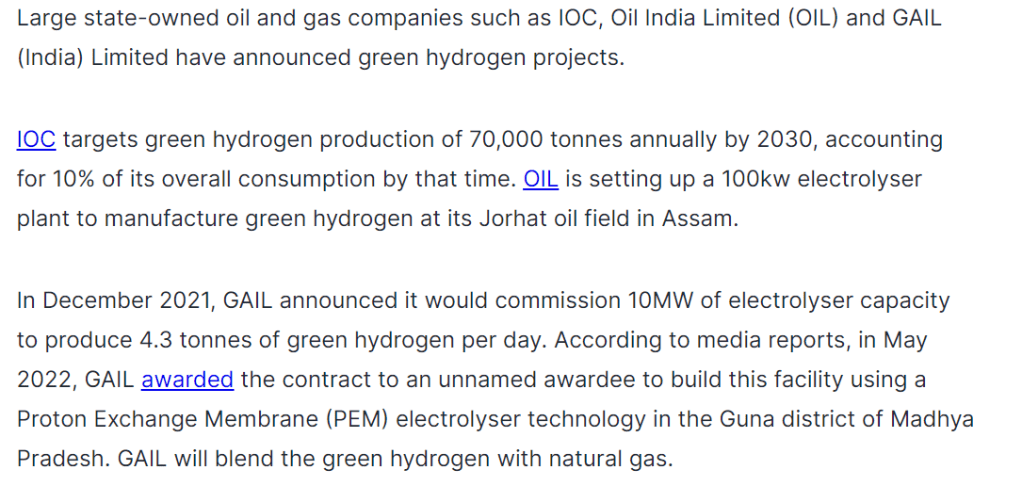

Green Hydrogen push by Government brightens prospects further. A capital outlay of Rs75,000 crore (US$9.4 billion) over the next three years to develop manufacturing capacities for clean energy technologies, which include electrolysers to produce green hydrogen. NTPC is already walking the talk on green hydrogen. The company is developing India’s first hydrogen-to-electricity project using US-headquartered Bloom Energy’s solid-oxide electrolysers and fuel cell technology. NTPC’s floating solar plant will power the electrolysers to produce green hydrogen. Bloom Energy’s hydrogen fuel cell technology will convert the hydrogen into carbon-neutral electricity without combustion to power NTPC’s Guest House in Simhadri, Visakhapatnam.

Risks

No long term contracts with suppliers, though risk is mitigated with enough suppliers on board

Client concentration risk –Bloom energy almost constitutes 50% of orders–Company is trying to get more clients onboard to mitigate this risk

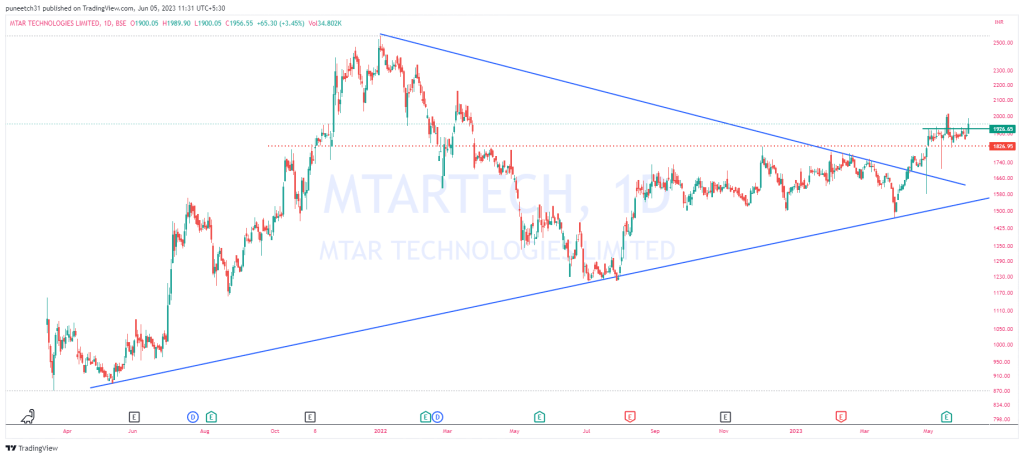

Valuations seems a bigger risk than above mentioned ones. If orders/Profit don’t materialize on expected lines, stock can easily correct to 900-1200 zone or It can happen that stock may not fall much , but may remain stagnant between 1200-2000 range for long leading to opportunity loss

Any policy changes can delay the expected outcome

Technicals

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

CY2023 – Alpha Picks for Investors

Will keep updating this Hashtag, follow closely to cancel out noise and focus long

DREAMFOLKS

PG ELECTROPLAST

HG INFRA

MTAR Technologies

ALLCARGO LOGISTICS

BHARTI AIRTEL

LIKHITHA INFRA

STERLING TOOLS

GRAVITA INDIA

EXIDE INDUSTRIES

KABRA EXTRUSIONS

DATA PATTERNS

LARSEN TOUBRO

Protected: Positional Stocks – 9-Jan-23

Protected: Positional Stocks – 1-Jan-23

Who gained Who lost

Protected: Positional Stocks – 24-Dec-22

Protected: Positional Stocks – 10-Dec-22

Protected: Positional Stocks – 4-Dec-22

Its Home run

An insight into Infra company

Stock Name –Likhitha Infra

Small Effort for all followers –Just compiled the thoughts together. Feel free to reach me for queries

Disclosure- I am invested from lower levels. Please assume that I may add, sell at any point of time without communicating. Hence Do your own due diligence before Buying selling

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 27-Nov-22

Protected: Positional Stocks – 15-Nov-22

Are we going to make J curve

Haunted October

Protected: Positional Stocks – 02-oct-22

Frenziness…

Protected: Positional Stocks – 25-Sep-22

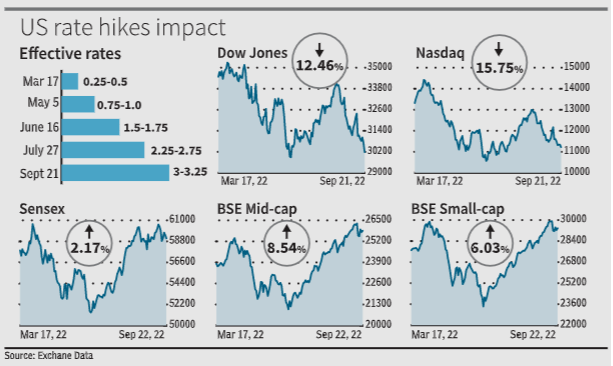

Resilient Indian Markets

Protected: Positional Stocks – 18-Sep-22

Protected: Positional Stocks – 11-Sep-22

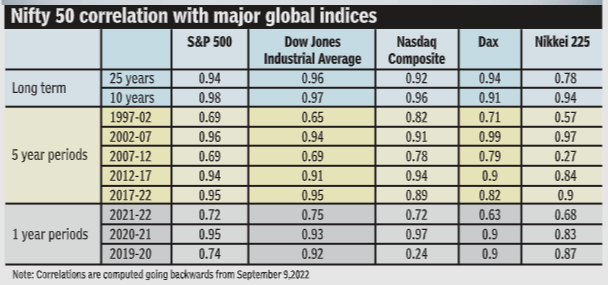

Correlation is strong!!

Protected: Positional Stocks – 29-aug-22

Festive season boost on cards?

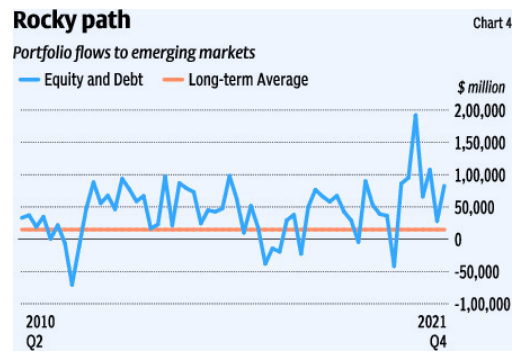

Emerging Markets!!

Protected: Positional Stocks – 20-aug-22

Positional Stocks – 7-aug-22

Stocks moved very well in last two weeks, keep booking profits

Remember : For exit in stop loss levels Day closing price is important and 1% downside from SL levels is still a hold for next day

Reminder for Quantity in Positional to be chosen carefully and based on formula i have shared below. That will allow us to take sufficient bets to succeed

Protected: Positional Stocks – 31-Jul-22

Portfolio flow to Emerging markets

Protected: Positional Stocks – 25-Jul-22

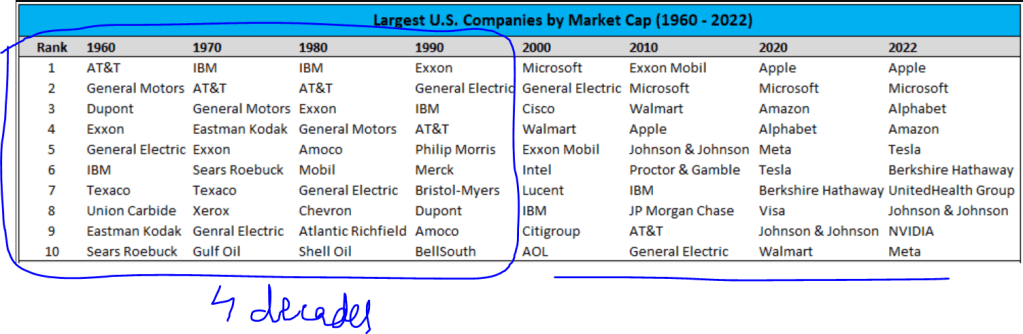

40 Years : New Companies take top post

Protected: Positional Stocks – 17-Jul-22

Protected: Positional Stocks – 10-Jul-22

Chart of the year 2022 till now speaks for itself

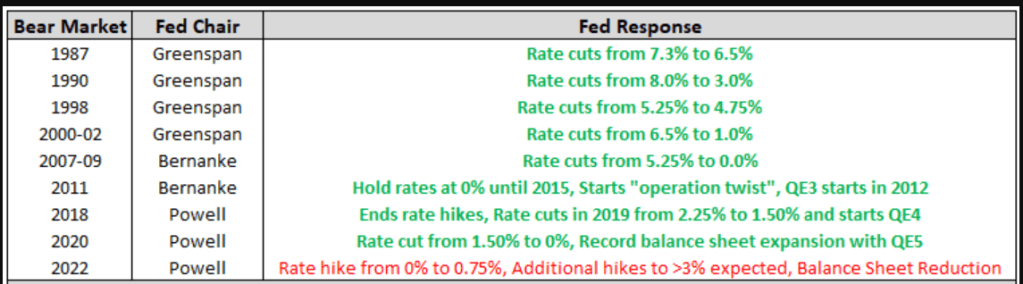

Fed and Bear

Protected: Positional Stocks – 1-may-22

FII Ownership below COVID Lows!!

Protected: Positional Stocks – 3-apr-22

NSE IFSC US stocks

Protected: Positional Stocks – 23-Jan-2022

Protected: Positional Stocks – 16-Jan-2022

Do you have time to make mistakes!! Learn from others learnings

Protected: Positional Stocks – 10-Jan-2022

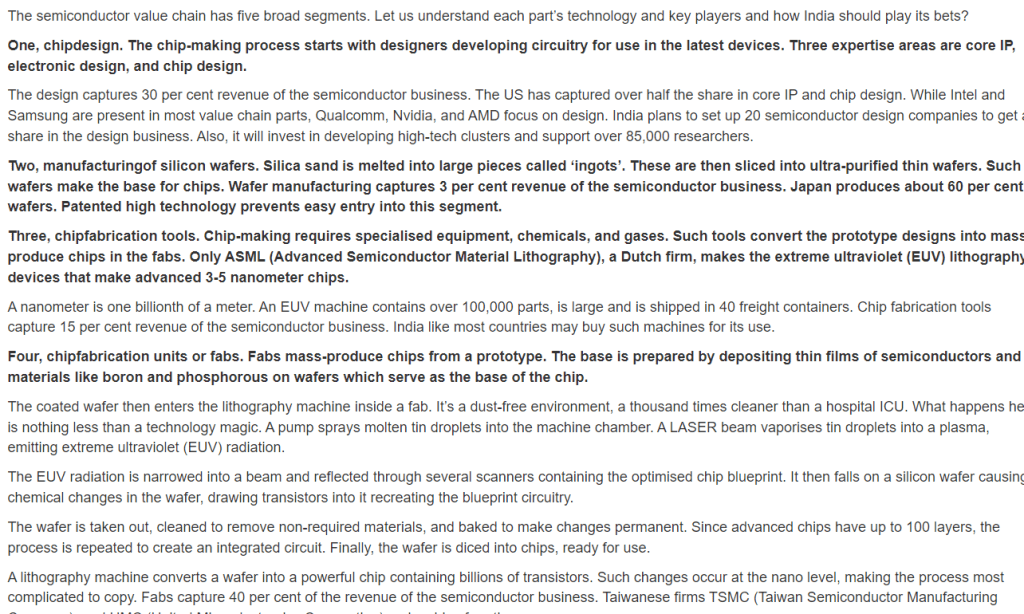

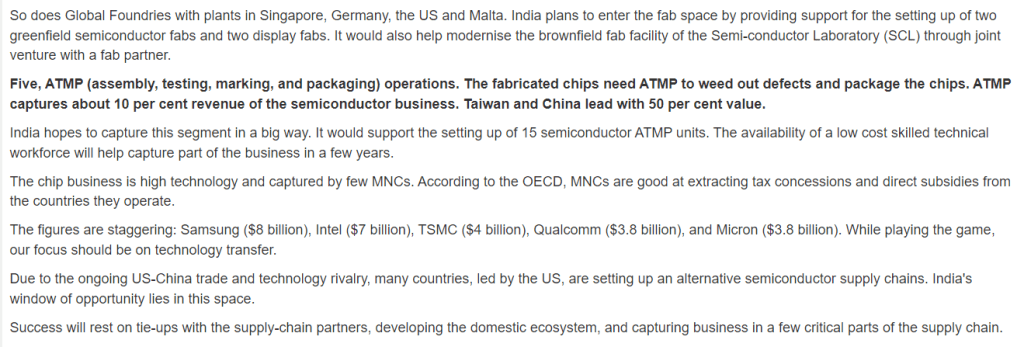

Aatmnirbhar version : PLI Semiconductors

Protected: Positional Stocks – 11-Dec-21

Protected: Positional Stocks – 21-nov

Protected: Positional Stocks – 14-nov

Short term vs Long term

Protected: Positional Stocks – 7-nov

Protected: Positional Stocks – 31 Oct 21

IPO recent trends across world and DTC Winc’s IPO

Protected: Positional Stocks – 17 Oct 21

What to do in Current Stock Market in Oct2021: Sell out, buy more or hold or Reorganize ?

Also read : Invest in Stock market IF

We can broadly classify investors today in three kinds only

- Who have made lot of money in last 1 year or so and kept on riding and still want to ride further

- Who are sitting on sidelines and thinking to jump or have jumped in last few months

- Those who wanted to exit now looking at various indicators

Most of the investors I talk are fearful of immediate correction in market, though they have not exited the market yet to cash positions. Some of them are confident after making money in last one year. Even the so called new breed of investors are also 1 year old in markets and calling themselves experienced now who have seen volatilities, and buying every dip. Time will tell who will be the Last Standing Man

So as you are reading this article, did you notice where do you belong? If you feel you are outside the purview of these three kinds, you have two choices. 1. Align to one of the view 2. Send me with your classification!

Congratulations, if you are able to see yourself amongst one of the three kinds mentioned above

Question still remains same for everyone : What to do now? Should we buy, sell or keep holding? What’s next : Is it bull market or is crash near?

Let’s read further to understand more about it and see what strategies people can adopt

Case 1. Sell out 100% and wait to re-enter at lower levels

This strategy is for people who

- Are facing Liquidity challenges

- Can’t sleep properly due to fear of crash in markets

- Borrowed money to invest

- Goals are near ( within 1-2 years)

OR

You are able to foresee with your experience drastic correction coming. It may be due to Evergrande default or US debt or may be some other reason

Advantage with these strategy is you may not lose capital if market goes down and may get a chance to re-enter at lower levels. Problem with this strategy is it is impossible for anyone to predict whether market has topped out or not. Will Market go further up and can give you a bigger chance to cash out? Will market come down and give you a chance to enter at lower levels. Nobody knows. Get away from people if they claim to know.

It is always better to cash out if our goals are near or we have debt to pay because when correction happens, it will not give you a chance to exit at your desired levels

This strategy although seems good but it can be painful as markets may remain irrational longer than you remaining rational and you might keep on getting the itch to enter again.

So be careful of this approach and you have to be sure when you should re-enter.

Case 2 Go opposite and buy more

I will strongly advised against this

Problem with this strategy is most of us will be invested in 40-50 stocks on tips from random sources and keeping most of the stocks which are in loss. So if market correction happens, we will not be having enough money to average down all stocks.

In case, you have idle money and have a itch to invest at these levels, in such cases adopt a simple strategy

- Keep buying same quality stocks based on quarterly results or in sip mode

- Plan your investment in a staggered manner instead of putting money in single go

- Invest the money which you don’t need for next 5 years

Correct portfolio allocation and conviction in the chosen stocks is a must for investing at these levels.

Case 3- Hold and reorganise your portfolio

This strategy is for people

- Who have long term views on equity

- Who have money available to invest right now

- Who do not need to sell out as no immediate money requirement

- Who understand their stocks and sitting on good cushion of profit in last one year and can handle 30% downside

- Who will not panic when market falls down and quality watchlist is ready to buy in such an event

Under this strategy, adopt the simple course of action

- Reduce number of stocks to a level which you can track easily. (20 stocks in a portfolio is considered reasonable for an average investor to track)

- Reduce the stocks positions partially or completely which you have bought on tips and not working or in loss. Getting out with a small loss is good at these levels to rearrange your portfolio

- Moving some part to cash from positional stocks. May be keeping cash close to 30-40%

- Buy stocks from upcoming niche sectors

- Buy more of convincing stocks with long term horizon of 3-5 yrs.

- Increase the positions in stocks which are showing a promising future and management is walking the talk

Case 4- Sell Partially

This strategy is for people

- Who are ready to leave last 10-20% gains on table

- Who are ready to have patience for their cash deployment

- They do not feel zealous when other people make money and they themselves stay in cash

- Under this the simple course of action is

- Sell partially up to 10-25% and sit on cash, may or may not get a chance to deploy cash soon and wait can get longer

- Rest 75% to 90% should remain invested, so if markets runs up, they are still in the market

What I am doing in this market? My answer is Case 3 ( changed from Case 4 earlier this year)

- I have booked out of most positional stocks apart from few holding with my closed group of people. Last few months, i have moved to already 35-40% cash but at same time reshuffled that cash to strengthen my existing positions or build new positions aligning to next few months

- I am holding stocks which have good story building up and adding more on each quarterly result. I do expect strong quarterly results of my investment holdings

- Any new stock which looks promising to me, I am adding as positional and converting to investment as my conviction increases

- I am not averaging down any stock as of now

So that effectively means

I am putting money into the market from so many booked positions in last few months and adding new positions

I am selling my existing less convincing or loss making positions

I am not waiting for correction in market as i have sufficient liquidity available

I am re-organizing my portfolio for next cycle of market

I am happy to ride with my invested convincing positions

Overall, what I learnt from markets in my journey is very simple and easy to follow :

You can’t be 100% invested in market

You can’t be 100% sold out from market.

Will correction happen–Few events like US Debt, Tapering of interest rates, China India talks failure, China Power crisis, India Power crisis can dampen the spirit much faster than anticipated. So yes, quite a few things are bad, China power crisis is biggest of them. Any correction will be fast and furious. Be ready to see 30-40% erosion of capital seen on Screen today.

Are things all bad — On other hand there is good results anticipated for Q2FY22 both QoQ and YoY in many companies. Bigger population has been been vaccinated either partially or fully so effectively third wave is ruled out for few more weeks. Currently many things looking positive. Be it exports, be it festive demand in many sectors. Nifty has made new highs and can go further up. In short term upside seems limited though if everything falls in place, 21K on Nifty cant be ruled out within 7-9 Months (Jun-Jul2022)

Whatever strategy finally you adopt. don’t be a blind follower

Read more on Blind follower here

Wishing you all the best and lots of luck

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 08 Oct 21

Nifty Influencers

Protected: Positional Stocks – 03 Oct 21

Protected: Positional Stocks – 25sep21

Sensex :Which direction

Protected: Positional Stocks – 18sep21

Protected: Positional Stocks – 04sep21

Protected: Positional Stocks – 28Aug21

Bubble and Burst and Gains

Protected: Positional Stocks – 22Aug21

Protected: Positional Stocks – 14Aug21

Protected: Positional Stocks – 08Aug21

Protected: Positional Stocks – 01Aug21

Protected: Positional Stocks – 25Jul21

Protected: Positional Stocks – 10Jul21

Protected: Positional Stocks – 3Jul21

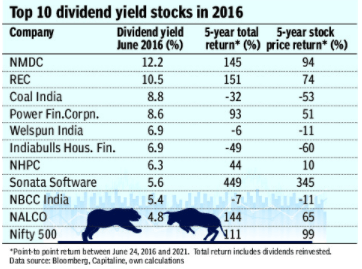

Reality Check on dividends

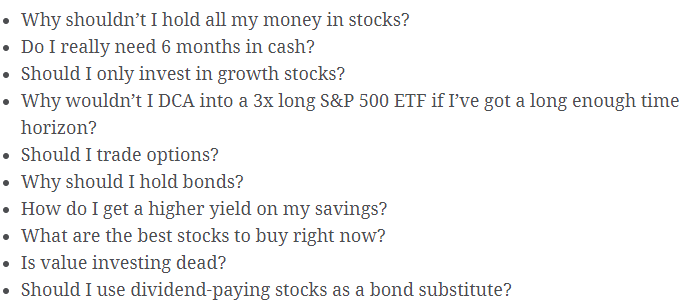

Bull Market Questions

Quant investing : Upcoming way of investing