Tag: Stocks

Protected: Positional Stocks 17-Feb-24

Flee Paytm !!

29 Institutions!!

Transportation Solutions

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

AVG logistics

Also Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9

Business

AVG Logistics Ltd, incorporated in 2010, provides road transportation services, warehousing facilities and Railway transportation to various domestic and multinational companies. AVG Logistics provides customized and technology-driven solutions across transportation, warehousing, distribution, and supply chain management. Furthermore, the Company also offers Third-Party Logistics Services (3PL), effectively complementing its wide range of logistics solutions. Company mission is to offer an integrated Multimodal network of Logistics

solutions across varied industries

Products, Segments and Strengths

Transportation: Express Delivery, Refrigerated Transportation, Freight Forwarding, etc

Warehousing: Manpower Handling, Packaging, Multi-User Warehouse facility, etc

Value-Added Services like custom clearance, E2E solution, Multimodal transportation, Reverse logistics, etc.

The Co. also undertakes transportation services to Nepal, Bangladesh and Bhutan

AVGL had the agreement of 1 – 3 years with all its major customers and the agreement includes the escalation clause based on the 5% change in the diesel cost

Fleet Size

The Co as of 31st December 2023 has a fleet size of more than 3000+ vehicles, including hired & owned dry/reefer vehicles. Owned vehicle fleet is approx 500+

Network

The Co has a pan India presence with 50+branches and 7 zonal offices.

Company caters to 6 rail routes and can deliver 1 to 40 tons of logistics

9 trans-shipment hubs for LTL services, 1 owned fleet maintenance hub

~7,.05L sq. ft. of warehousing footprint pan India ( 81,000+ sq. ft. Owned and 6.24L leased Warehousing Space). Further expansion happening

Company has certain moats/advantages wrt new entrants in terms of

- 3 decades of promoter experience

- End to end solution provider

- Multimodal transport

- Distribution network is strong pan India

- Client relationships with dedicated warehouses for Nestle, HUL and Mother dairy

- Reverse logistics

- Tech-enabled fleet with GPRS systems

- and Asset light model of fleet

- Company also offers Rail logistics

- Also offers Cold chain logistics

- Versatile Solutions For Efficient Storage & Operations (caters to liquid, container, Agri, FMCG, chemicals)

It offers a range of rail logistics services to its customers, including Full rack and piece meal transportation, container movement, and terminal management across all CONCOR ICDs. This is very important in bigger scheme of things in coming years

Cold chain logistics is the segment to watch out for in coming decade

Company has a clear focus on Tech Initiatives regarding its operations. Company keeps on finding Disruptive & Innovative Customised Solutions. Zero Residual Food Grade Tanker is one of the solutions. Curtain Multi-door Truck is another solution

Clients

Reputed clientele in diverse sectors like FMCG, Chemicals, Power, Electrical, automotive like Nestle, Mother Dairy, ITC Ltd, Coca-Cola etc

Well recognized by clients and external agencies in terms of awards and recognition

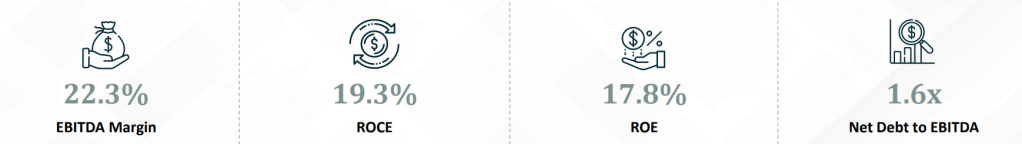

Fundamental Ratios, Cash, Loans, EBITDA, PAT margin, SHP

Similarly ROCE and ROE are decent.

Debt to Equity is high and needs to be closely monitored

Cash conversion cycle is stable and Working capital days are also stable

Shareholding pattern

Promoter has skin in game. FII adding, DII selling. Public domain have few strong holdings as well but overall public holdings have increased

ALSO READ : SS7 (Diwali to Diwali)

Recent Developments in last 1.5 years

Tie up with railways :Signed 6 tenders worth ₹510 cr with Indian Railways for 6 leased parcel trains.

They also got 150 crore contract from Indian Railways for operations of Leased Parcel Express Train. This special train, connecting Bangalore to Ludhiana (Punjab), will complete one round trip every week over the next 6 years, totaling 313 trips. The Express Service will cover the distance in ~72 hours ensuring expeditious, seamless connectivity between the important locations. Ludhiana is an invaluable addition to our railway network, opening doors to a gigantic textile market -largest hosiery manufacturing, cotton textiles, cycle manufacturing amongst others

QSR clients :Started servicing QSR clients

Expanding the cold chain and parcel division. Company is acquiring 50+ fleet of cold chain vehicles to enhance its cold chain capabilities

Also is Upcoming 50,000 sq. ft. Owned Warehousing Space In Agartala

JV : Joint Ventured with Sunil Transport for liquid logistics.

EV Fleet : They are planning to introduce electric vehicles in their fleet in the future.

Company also recently had a collaboration with Blue Energy Motors (BEM), India’s only LNG truck manufacturers. This represents a significant leap towards a more sustainable and eco-friendly future in the transportation industry. This landmark collaboration is formalized through a strategic Transportation as a Service (TAAS) Agreement, wherein AVG Logistics and BEM join forces to integrate LNG-powered vehicles. The collaboration underscores a shared commitment to advancing sustainable transportation practices and fostering a greener future.

Backward integration for last mile : Incorporated a Wholly owned subsidiary named ‘Galaxy Packers and Movers’

They have onboarded Gazal Kalra, co-founder of Rivigo, as a strategic advisor to guide them on sustainability and technology. She also Subscribed to Warrants at 371 Rs

Company has also raised funds at 371 Rs/Share through

- ISSUE OF CONVERTIBLE WARRANTS ON PREFERENTIAL BASIS TO PERSONS BELONGING TO PROMOTER CATEGORY

- ISSUE OF CONVERTIBLE WARRANTS ON PREFERENTIAL BASIS TO PERSONS BELONGING TO NON-PROMOTER CATEGORY

- ISSUE OF EQUITY SHARES ON PREFERENTIAL BASIS TO NON-PROMOTERS

Govt Initiatives to Improve Infrastructure aid Logistics growth : India aims to reduce logistics cost from 13% – 14% of GDP to 8% – 10% of GDP. It is estimated that a 10% reduction in indirect logistics cost will result in 5% to 8% rise in exports. GOI to undertake multiple logistics specific initiatives, such as GatiShakti, National Logistics Policy and others. These programs aim to streamline India’s logistics sector by making it more green, agile, transparent and integrated.

Valuations

Expected sales projections for FY25 is ~700cr and with PAT margin of ~7-8.5%, we get PAT of 50-60 cr. So stock price may move towards 700-900 by 31Mar25. There could be volatility in stock which can be used for accumulation

Risks

High Debt to Equity Ratio. This needs to be monitored very closely

New warehouse opening and its utilization

Renewal of contracts with customers on favourable terms needs to be watched out

High capital working requirements remain a risk.

High competitive industry

Technicals on 11Feb24

Stock has been consolidating between 400-460

Technical chart on 16 Mar24

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip, market offers, else Ignore the stock

Stock might be volatile in short term and give a chance to buy for long term investment purpose

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Capex is the key

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Kilburn Engineering

Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9, Pick10

Business

Kilburn Engineering Limited is primarily engaged in designing, manufacturing and commissioning customized equipment / systems for critical applications in several industrial sectors viz. Chemical including Soda Ash, Carbon Black, Steel, Nuclear Power, Petrochemical and Food Processing etc.

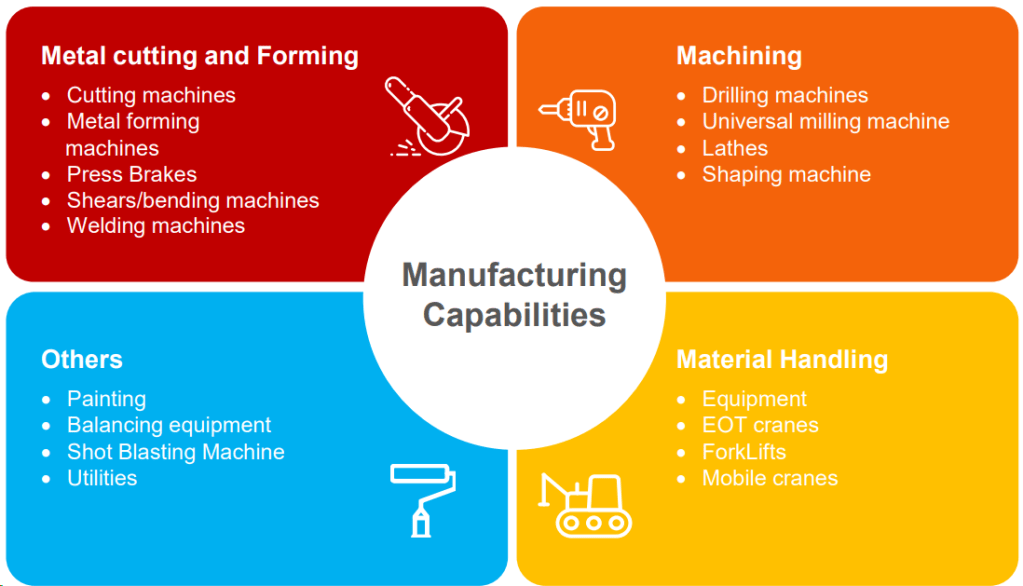

Company has cutting-edge manufacturing facility for fabrication, machining, and assembly of equipment located in Thane, Maharashtra (India). Manufacturing plant spans an area of 30,960 square meters and is equipped with state-of-the-art technology and machinery.

Products, Segments and Strengths

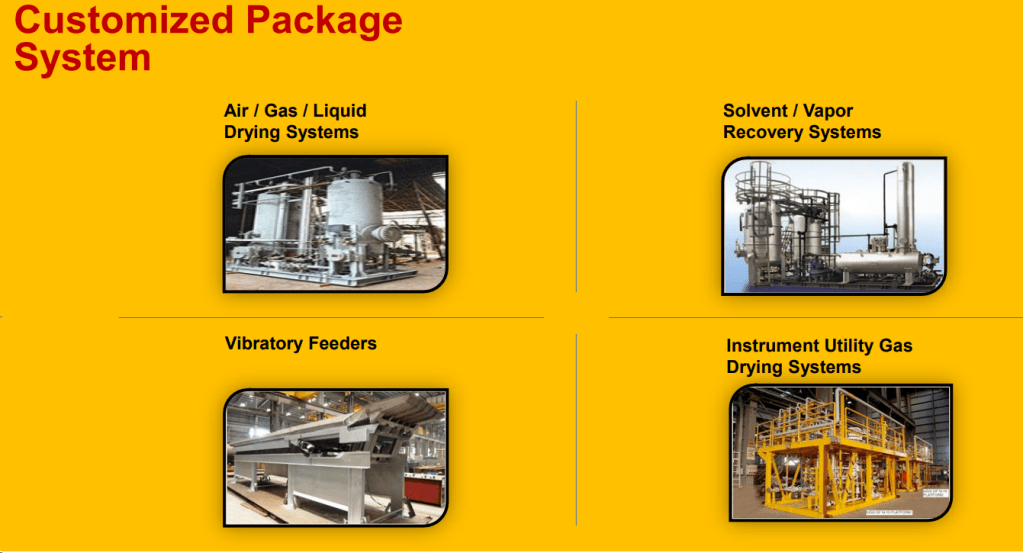

Company operates in two segments viz. Process Equipment and Tea Drying Equipment

Food Processing Equipment -During FY23 Company had bagged a total of 103 orders in the domestic market and 5 from overseas Market

for tea dryers

40+ Years of rich experience with 3,000+ Installations globally done

200+ Workforce and 15+ Sectors catered by products and solutions

Kind of Equipment’s & system’s orders got by company

- Silos for storage of PTA.

- Metal extraction plant for extraction of exotic material from refinery spent catalyst.

- Dryer, cooler, Granulator and Coater for fertilisers.

- Calciner package for API (Active Pharmaceutical Ingredients) industry.

- Hydrogen Fluoride Reactor package (Rotary Kiln)

- Rotary Dryers

- VFBD for wet clay

- Tea Dryers and others

In the wake of increasing concerns about environmental degradation, our Paddle dryers have emerged as a sustainable solution for drying sludge. These advanced dryers play a vital role in states where strict pollution norms have been enforced, making it imperative for industries to adopt ecofriendly practices. By efficiently removing moisture from sludge, these dryers significantly reduce the volume of waste generated, thereby minimizing the environmental footprint of industrial processes

Sewage treatment — The market size for water and wastewater management in India was 216.03 billion in 2022. By 2027, it is anticipated to grow to518.15 billion, with a projected CAGR of 15.95% during the period 2023-2027.

On similar note, many other industries catered by Kilburn are expected to grow at 5-14% CAGR till 2030 and further

Eextensive and sophisticated R&D facility that are equipped with a full range of pilot plant dryers,

including

- Paddle Dryers

- Vacuum Paddle Dryers

- Band Dryers

- Fluid Bed Dryers,

- Vibrating Fluid Bed Dryers

Company has good manufacturing capabilities and order book of 236cr in hand at 31st Dec23.

Order received in Q3FY24 94cr. Executed 73cr

Continuous order inflow in Q4FY24 as well

Order Enquiries –> Approx 100cr

Clients

Reputed clientele lik ACC, JSW , Reliance, Arvind, PCBL, Fnolex, Granules, Coromandel, SRF, LnT and many other renowned names

Professional Management team

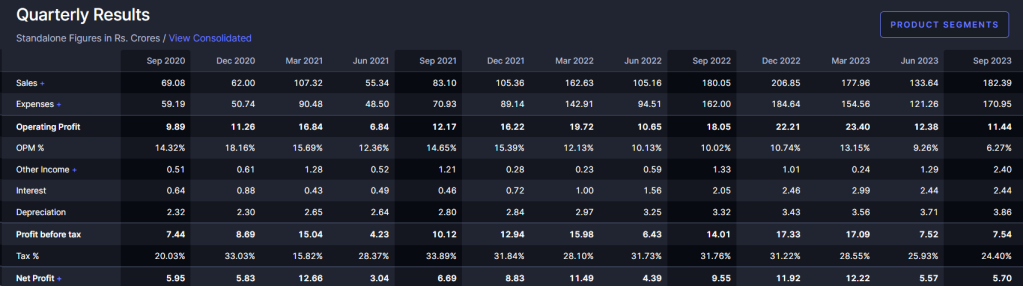

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

Similarly ROCE and ROE are at reasonably good levels

Debt to Equity is under control

Sales, OPM, Net profit has been on rising trend continuously

Cash conversion cycle needs to be monitored.

Working capital days are good and have been improving

Shareholding pattern

Promoter has skin in game. One of the old promoters has been selling and other has been buying. Now its settled and Public domain have few strong holdings as well.

ALSO READ : SS7 (Diwali to Diwali)

Recent Developments

Promoter buying from open market

Promoter has been buying from open market continuously. Good buying happened between 270-310 zone

Last buy around 320

Acquisition of ME energy

This acquisition will help the company to grow faster

Company has put an estimated target of 500cr revenue by FY25 as ME energy has a 118cr pending order book

Capex

Expecting small capex of 15-20 cr till Dec25

Valuations

Expected Cumulative sales projections for FY25 is ~500cr (considering orders and Acquisition) and with PAT margin of ~12% after merger, we get PAT of 60 cr. So stock price may move towards 500 by 31Mar25. There could be volatility in stock which can be used for accumulation

Risks

Chequered history of non-payment of loans and subsequent new promoters on board.

Due to the non-payment of its loan obligations to RBL Bank Limited (RBL) starting in March 2020, KEL underwent debt restructuring in FY21. The resolution plan (RP) sanctioned by RBL in accordance with the Reserve Bank of India’s criteria was accepted by the company board on March 4, 2021, and it was put into effect on March 31, 2021. As per the RP, the outstanding principal loan of Rs 95 crores and interest of Rs 9 crores due to RBL up to 31 March 2021 was to be restructured. As part of the debt restructuring, Rs 65 crores of sustainable debt was converted into long- term loans with a 12.5 year payback period at an annual interest rate of 9%, Rs 13.5 crores in equity shares were allocated to RBL, and Rs 25.5 crores in 0.01% cumulative redeemable preference shares (CRPS) were also allocated to RBL.

Chemical companies are facing challenge to make sales. Their capex plan may be delayed further leading to slow flow of order to companies like Kilburn

Economy impact because of possible US recession might delay things by a year or more

High capital working requirements remain a risk.

Delay in Acquisition of ME energy. This is major risk in short term

Technicals on 10Feb24

Stock has been consolidating between 260-290 for almost few months and given a breakout recently and then got good results as well

Technicals on 31-Mar-24

Survived well in last one month market correction

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip, market offers, else Ignore the stock

Stock might be volatile in short term and give a chance to buy around 270-340 range for long term investment purpose

Also Read : ICEMAKE Refrigeration : Time to Chill

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Time for Logistics

Protected: Positional Stocks 10-Feb-24

SS-7

EMS limited

CMP 569, Market cap ~3150cr

ROCE ~32%, ROE ~24%, D/E ~0.07 PE ~29 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6

🟢EMS Limited is a multi-disciplinary EPC company, headquartered in Delhi that specializes in providing turnkey services in water and wastewater collection, treatment and disposal. EMS provides complete, single-source services from engineering and design to construction and installation of water, wastewater and domestic waste treatment facilities

🟢The company provides Sewage solutions, Water Supply Systems, Water and Waste Treatment Plants, Electrical Transmission and Distribution, Road and Allied works, operation and maintenance of Wastewater Scheme Projects (WWSPs) and Water Supply Scheme Projects (WSSPs) for government authorities/bodies.

🟢Healthy Order book of ~2100cr provides strong visibility of revenues over next few years. Company has repeat orders from various Government departments.

🟢EMS promoters have more than a decade of experience in executing water supply and sewage treatment projects

🟢Since incorporation, it has completed 67 projects in Bihar, Uttarakhand, Madhya Pradesh, Rajasthan, and Haryana. It has executed many projects awarded by government bodies such as Uttar Pradesh Jal Nigam (UPJN), Construction and Design Services (C&DS), Military Engineering Services (MES), and Indian Railway Construction Limited (IRCON). It has completed 4 O&M projects in last 4 years.

🟢Key clientele includes government bodies like Municipal corporation of Rajasthan (under AMRUT Scheme), Uttarakhand Urban Sector Development Agency and Bihar Urban Infrastructure Development Corporation (under National Mission for Clean Ganga ) and CPWD, Maharashtra

🟢EMS Limited has its own civil construction team and employs 57+ engineers, supported by third-party consultants and industry experts.

🟢Projects are mostly funded by World bank

🟢Development of Tier 2 Tier 3 towns, capital expenditure by Government gives good visibility for few years

🟢Promoter has sufficient skin in game with approx. 70% holdings, Sales are increasing and NPM is good

Risks

🔴Company works in a field of high capital intensive business and receivables will remain high

🔴Project execution risks within a budget are the ones which constantly hurts companies in these kind of businesses

🔴The company has not executed any HAM projects in the past but is executing one HAM project for the UP Jal Nigam. It has entered a joint venture with Ercole Marelli Impianti Tecnologici S.R.L. Italy.

🔴Revenue concentration from few clients/states poses a risk

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks 4-Feb-24

Travel health index

Protected: ALD 26-27Jan Presentations

Stay away from FnO

Protected: Positional Stocks 27-Jan-24

SS-6

Kabra Extrusion Tecknik

CMP 417, Market cap ~1450cr

ROCE ~15%, ROE ~10%, D/E ~0.19 PE ~41 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5

🟢Kabra Extrusion Technik Limited : It is India’s largest manufacturer of plastic extrusion machinery for more than 4 decades and recently ventured into manufacturing of Lithium-ion Battery Packs. The company is a part of the well-known Kolsite Group.

🟢In Extrusion Machinery Business it is India’s premier manufacturer & exporter of extrusion plants with presence in 100+ countries with +15,000 installations. also commands close to 40% market share in FY23

🟢Industry application in different sectors like -Packaging Industry, Infrastructure & Construction, Telecom and Plasticulture

🟢It has different products : Blown Film Lines, Pipe Extrusion Lines, Sheet Extrusion Lines, Compounding Lines and Auto Feeding Systems

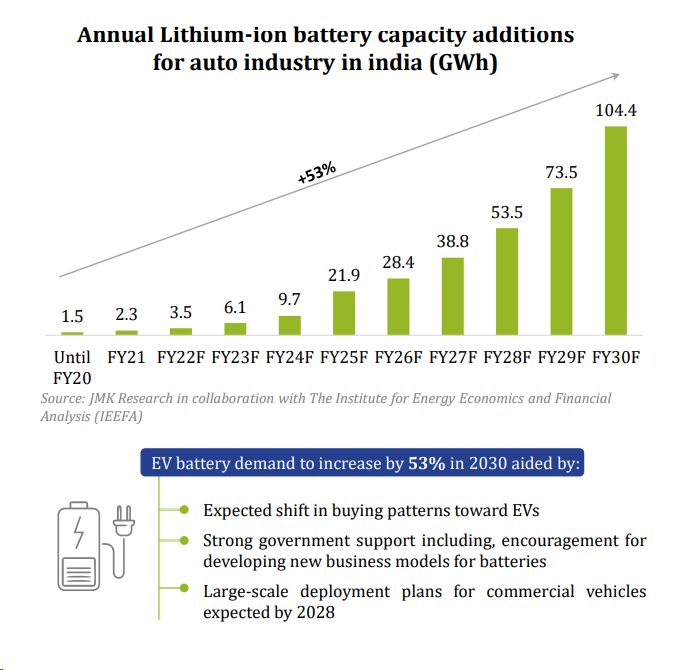

🟢In new segment of Battrixx –Its an emerging leader and commands approx, 15% market share where

🟢Battrixx business is a battery related solutions for electric mobility and energy storage, Battery & related components constitutes ~35-45% of cost in an Electric Vehicle

🟢Products in Battrixx segment are Battery Packs across multiple chemistries, Battery Management Systems (BMS) and IoT Solutions

It is One of the few players with

- The ability to handle multiple chemistries & types of cells

- Chemistries – LFP, NMC, NCA, etc.

- Types of Cells – Prismatic & Cylindrical

- Expertise across Electrical & Electronics

- Smart BMS

- IoT & Telematics

- Data Analytics Solutions

🟢Company is continuously investing in RnD and want to enter E-trucks, E-buses and ESS(energy storage systems)

🟢Company is first EV battery-pack manufacturer to be accredited with ARAI certification under AIS 156 Amendment III Phase 2 for its batteries, conceptualized and designed in-house strategically with Hero Electric’s R&D team

🟢Company had earlier won 3L battery packs and chargers order from Hero Electric Mobility for FY24

Key focus areas of our R&D

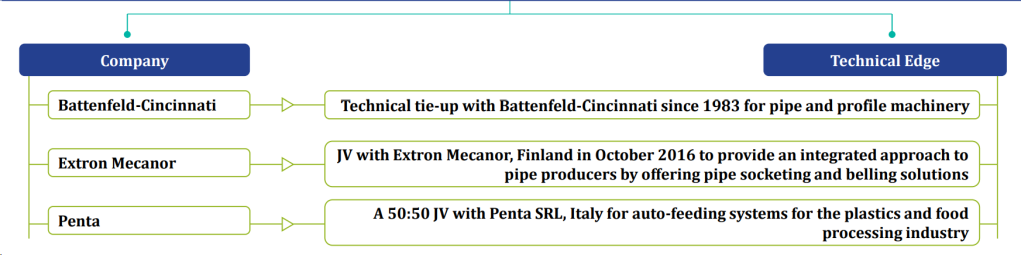

Company has technical tie up with Battenfeld-Cincinnati, Extron Mecanor and Penta for different domains

🟢Company has right tailwinds in longer run

🟢Company business is profitable though facing short term headwinds

🟢Promoter has sufficient skin in game with 60% holdings, FII holdings increasing in FY24

🟢Company credit rating has been upgraded last year CRISIL A+/Stable (Upgraded from ‘CRISIL A/Positive’)

Risks

🔴Company was able to successfully established new business but EV Battery sector run into headwinds with new rules. Company was first to be accredited with certification for new rules but still headwinds not went away fully. Company might take more time based on customers business

🔴Crude oil has indirect dependency as customers order go down for new machinery with increasing crude oil price. Hopefully now Crude is stable and Pipe volumes may come up seeing the real estate boom

🔴Low OPM, NPM margins as of now –may improve with both domains of business picking up

🔴Technically weak structure for stock price

Financials

Company OPM have gone down recently and may take time to stabilize and come up. We need to carefully watch this space. Expected OPM is around 12% in longer run so enough space for company to showcase good results in coming years

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks 20-Jan-24

Protected: Premium Stocks : 13-Jan-24

Protected: Positional Stocks 13-Jan-24

Chemical and Pharma Player : AMI organics

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Ami Organics

SS9

CMP 1116, Market cap ~4100cr

ROCE ~20%, ROE ~15%, D/E ~0.16 PE ~57 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8

Business

AMI Organics (AMI) is a research and development driven manufacturer of specialty chemicals with varied end usage and is focused on the development and manufacturing of advanced pharmaceutical intermediates for regulated and generic active pharmaceutical ingredients (“APIs”) and New Chemical Entities (“NCE”) and key starting material for agrochemical and fine chemicals. AOL has three manufacturing facilities (excluding the recent acquisition of Baba Fine Chemicals [BFC] during H1FY24). Company manufactures intermediates from the ‘N minus 8’ to the ‘N minus 1’ level (where N is the final active pharmaceutical ingredient [API])

Products, Segments and Strengths

Company operates in two segments

Advance Pharma intermediates — 185+ Products, Intermediates across 17 therapeutic areas, Chronic Therapy focus: ~90%, Majorly backward integrated to Basic Chemical level, 50-90% global market share key molecules

Fermion had been among the biggest clients for Ami Organics in this domain. Ami Organics had been supplying intermediates for APIs like Darolutamide (prostate cancer), Entacapone (Parkinson) and Trazodone (Antidepressant). Company would be supplying an advanced intermediate for the Darolutamide API, starting from Q4FY24. At present, the company is the exclusive supplier for the same.

Speciality chemicals –This is where we are interested in coming future

Niche KSM for Agrochem and Finechem companies, Parabens & paraben formulations, Salicylic Acid and other specialty chemicals that

find end-use in cosmetics, dyes, polymers and agrochemical industries, animal foods, and personal care industries

New segment – Electrolyte used in manufacturing cells for energy storage devices. This also has huge potential in solar industry, automobiles industry

Clients

Advance intermediates : Speciality chemicals sales ratio –Approximate is 82:18 which is expected to go towards 75:25 in coming time. FY23 Ratio was 84:16

Export Sales: Domestic Sales ratio is approx. 58:42 in FY23, Q2FY24 ratio was 54:46 due to China oversupply and price erosion factors

➢ Well established and long-term relations with domestic and MNCs across large and fastgrowing markets globally

➢ Diversified customer base, 58% of revenue from Top 10 customers in FY23, 13 customers associated since last 10 years, 50 customers associated since last 5 years

➢ Long term supply contract with key customers

➢ Prolonged adherence to stringent client requirements leads to new business from existing customer base as well as from new client. ➢High entry barriers due to long gestation period to be enlisted as a supplier, Involvement of complex chemistries, Regulatory requirements. First to Market in most of the products

Strong focus on R&D

120 R&D members with 16 PhD, 14 process patents, Average approx expense on R&D is 1.7% of Revenue over last 4 years. In absolute terms its almost 7-8Cr per year

The Patent Office, Government of India, has granted Pracess Patents to Company for its inventions titled:

- A PROCESS FOR THE PREPARATION OF 2- (PIPERIDIN-4-YL)-1H-BENZO[D]IMIDAZOLE

- APROCESS FOR THE DIRECT SYNTHESIS OF FEDRATINIB INTERMEDIATE

for the term of 20 years in accordance with the provisions of the Patents Act, 1970. The above mentioned patented processes have been indigenously developed at the R&D Centre of Ami Organics Limited. With this the total number of Patents granted to Company for its innovative processes and technology stands at 9.(march2024)

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

Sales and Profits have been growing decently(>25-30%) over past few years while for current FY24, it has slowed down, FY25 and FY26 seems to be the major booster for company going forward

Similarly ROCE and ROE has come down in last 2 years but still at reasonable levels

Debt to equity is at comfortable levels and can afford more debt for future expansions

Cash conversion cycle is on uptrend (not a good sign) and Working capital days are also increasing . Need to be monitored closely

Shareholding pattern

Increasing promoter holding, FII, DII are increasing stake, Public domain have few strong holdings as well

ALSO READ : Company at Y2K moment

Recent Developments

Advance Pharmaceutical Intermediates

➢ Fermion contract: – Signed a new contract for additional advanced intermediate taking total product under CDMO contract to 3 products. On track to start the production from Q4FY24 onwards from Ankleshwar Unit

15-sep-23 Ami Organics Limited has signed another definitive multi-year, multi-tonne agreement with Fermion. As part of the agreement, Ami Organics will supply an additional advanced pharmaceutical intermediate to Fermion. Based on the supply projection shared by Fermion, the total minimum contract value is expected to be multi-million Dollar, spread across multi-year horizon. The product is expected to start contributing meaningfully to the revenue from FY25. Ami Organics had signed its first agreement with Fermion in November 2022 for supply of an advanced pharmaceutical intermediate. This agreement is in addition to previous agreement and further increases the total value of the CDMO contract with Fermion.

14-Dec-23 Ami Organics and Fermion ink another agreement for two additional Advanced Pharmaceutical Intermediate with Fermion. The products are slated to be manufactured at the Ankleshwar Facility and is expected to start contributing meaningfully to the revenue from FY25

Specialty Chemicals

- Received orders for a UV Observer product used in Paint Industry. Expect commercial production to start from Q3 FY24

- Electrolyte additives update- Advanced stages of negotiation of contract with couple of customers.

- Process upgradation for existing products – methyl salicylate and parabens

- it is working on two additives, not been manufactured so far by any other company in India. In this space, the company has received approval from nine customers and expects a large commercial order

Ami Organics Limited has signed a non-binding MOU with a global manufacturer of Electrolytes for manufacturing of electrolytes for battery cells and allied materials in Gujarat, India. In furtherance to this, the company will also sign an MOU with Government of Gujarat for

investment amounting up to Rs 300 crores for set up of dedicated manufacturing facility for electrolytes business in the state of Gujarat, in the upcoming Vibrant Gujarat Summit 2024.

Capex ongoing

Pharma intermediates capacity to expand to 4x

Related to the Fermion contract is the capacity expansion plan in Ankleshwar at a capital outlay of Rs 190 crore. Here, one block is dedicated for Fermion. This would carry on supplies related to the recent contract. Machinery installation in progress in block-1 at Ankleshwar unit, Started the recruitment process for the new facility. On track to commence the production activity in Q4 FY24 .The Ankleshwar facility is envisaged to have 436 KL — nearly 3x bigger than the existing facility

Acquisitions

Baba Fine Chemicals Acquisition – Completed acquisition of majority partnership stake in Baba Fine Chemicals during Q2FY24. The acquisition of Baba Fine Chemicals (55 percent stake) is interesting as it deals with high entry-barrier products (photo-resistant chemicals), having applications in the semiconductor industry.

To reduce operational cost , the board has approved investment in a 16 MW solar power plant which along with already work in progress 5 MW solar power plant that will nullify our electricity expense once fully operational.

Company decided to fully impair the existing investment of Company, in the joint venture Ami Oncotheranostics LLC, as it is presumed that revenue generation from Ami Oncotheranostics will take significant time considering the inherent nature of its research activity in terms of

longer gestation period and uncertain success rate

Transformation of acquired entities like Gujarat Organics

Recently they acquired two manufacturing facilities Gujarat Organics (which was making loss makings as they did green field expansion in 2018) as Guj Org was making losses, it was bought by AMI Organics and turned EBITA margin moved from meagre 2% to 10% as of now (expected to touch 18% by next 2 year – also highlighted in their conf call as they are moving from batch processing to continuous flow chemistry). This acquisition enhances its specialty and fine chemical portfolio to enter Agrochemical, Cosmetics & Polymer Industry.

Due to this acquisition, one of client of Guj Organics referred them to make this electrolyte addictive. And hence, they have ventured into electrolyte addictive (belonging to carboxylic group) which is made by AMI in the whole Asia (except for few Chinese companies)

Details about Baba Fine chemicals

Valuations

Expected Cumulative sales projections for FY25 and FY26 is 2800-3500cr (considering existing business will also grow at 18-20%) and with PAT margin of 14% , we get PAT of 390-525 cr cumulatively. So stock price may move towards 2000-4200 Range by 31Mar26. There could be short term downside in stock which can be used for accumulation in case we are convinced about projections and sales

Risks

Susceptibility to raw material cost could affect Company profitability.

Inherent regulatory risk (USFDA compliance)

Competitive nature of industry driving pricing pressures. Oversupply from China does impact company growth in targeted markets

Combination of low margin and high margin products causes volatile OPM –This risk is expected to reduce with integration and business of other acquisitions done in recent years

High Capex ongoing and timely completion and start of production along with capacity utilization is a risk which needs to be monitored

High capital working requirements remain a risk. This is due to its wide portfolio, AOL needs to maintain sufficient inventory of the raw material as well as finished products.

Fermion contract getting cancelled midway

No major breakthrough in BFC business or electrolyte business

Technicals on 13Jan24

Stock has been consolidating between 900-1300 mostly in last 2+ years

Technicals on 3-Mar-24

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip market offers else Ignore the stock

Stock might be volatile in short term and give a chance to buy around 1000-1200 range for long term investment purpose

Also Read : ICEMAKE Refrigeration : Time to Chill

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

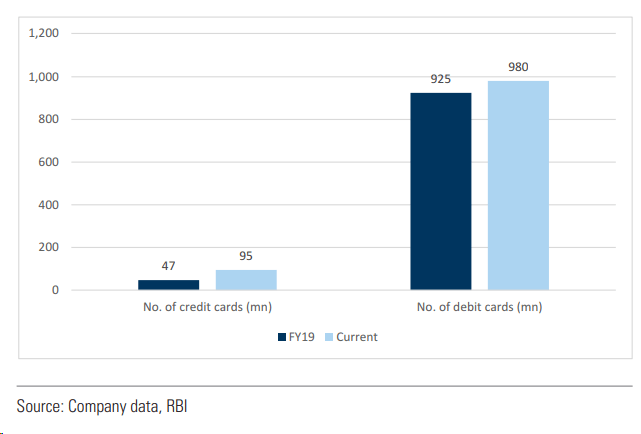

Credit cards rising faster : Long term Trend

Semicondutors : An era is changing for Indian markets

Fortnightly Thesis

SS-5

India has been going through a transformative change through Aatmnirbharta

Lot of sectors have big tailwinds including

- Railways (New Trains, New Tracks, New Wagons, Metro rail expansion to new cities etc.)

- Defense (Reducing imports, Replacing old ammunition, New Fighter planes, Ships )

- Automobiles (Building India as exports hub, increasing population with rising income profile)

- Space ( Chandrayaan, Aditya L1 launches, Starlink agreements with ISRO, small satellites launches increase etc)

- Marine and Shipping Industry (Building submarines, Ships, Ports infra, Sagarmala projects etc)

- Industrial Expansion in many industries with capex being announced every week here and there

- Oil and Gas industries And Heavy Earth moving Equipment’s

- Power transmission and distribution

Considering all above, ALPHA AFFAIRS see

FORGING as MEGA TREND

And from that Mega trend, we focused earlier on RK forge, covered here and here

Today we are focusing on one emerging player in same industry but has bigger vision in new sunrise industries as well. We have also covered with small details on Baluforge earlier

Balu Forge

CMP 285, Market cap ~2900cr

ROCE ~27%, ROE ~22%, D/E ~0.16 PE ~44 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4

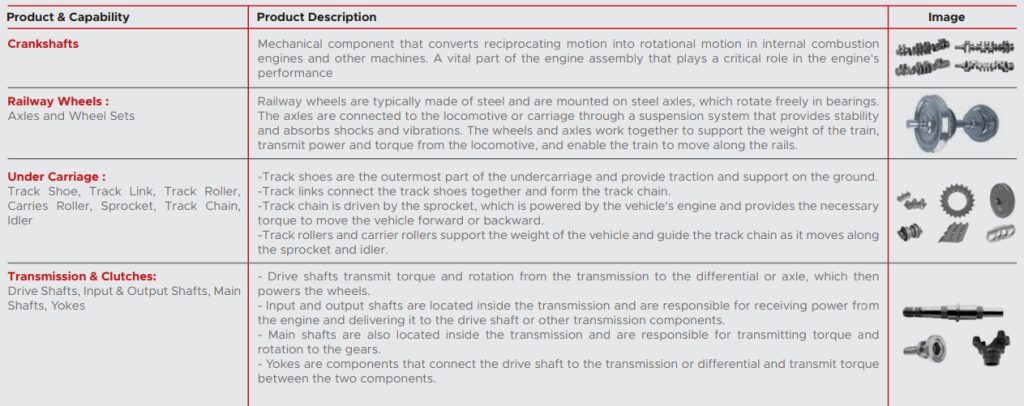

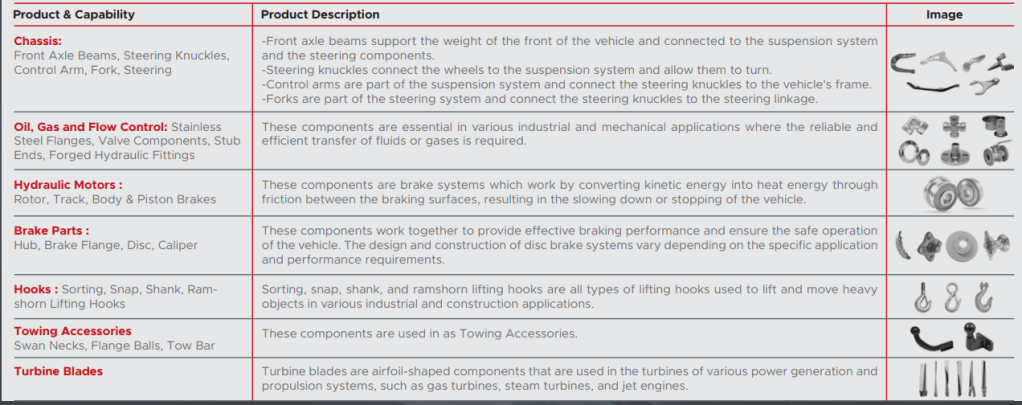

🟢It is engaged in the manufacturing of finished and semi-finished crankshafts and forged components and has a strong clientele comprising of 25+ OEM’s. Company has Fully Integrated Forging & Machining Unit with a large product portfolio offering to customers ranging from 1 Kg to 500 Kgs. The Forging Unit comprises Both Closed Die Forging Hammers & Presses

🟢Balu Forge has a distribution network in over 80+ countries and operates in domestic and export markets

🟢Balu Forge is already an approved vendor to a majority of the 41 Ordnance Factories part of the Ordnance Factory Board in India.

🟢Acquired Mercedes Benz Truck, Mannheim, Precision Machining Plant in 2021.

🟢Company has 3 subsidiaries. 2 in UAE and One in India.

Kelmarsh Technologies FZ LLC in 2021 (100%). Headquartered in the UAE with operations spread across 3 countries in Africa. Focused on manufacturing and innovation of agricultural equipment predominately tractors and tractor ancillary components

Safa Otomotiv FZ LLC (100%). Focusing on the machining and assembly of products in order to increase localization in the MENA region as well as meeting the product requirements for Agriculture and Oil & Gas industry

Balu Advanced Technologies & Systems Private Limited

Naya Energy Works Pvt Ltd (100%). Naya Energy is engaged in manufacturing of products for New Energy Sector

Company claims to work on Hydrogen Fuelling Stations & pilot project is presently underway to establish the first Hydrogen Fuelling Stations for fuel cell vehicles

Also company is in the process of patenting our domestically developed Refining Technology, NayaRefine. Currently One Module deployed can roughly produce 3-3.5 Tons of pure lead every day.

Company is working on a range of Charging Stations Conforming to Bharat EV AC Charger (BEVC-AC001) & Bharat EV DC Charger (BEVC-DC001) norms

Company also claims to work on ESS (energy storage solutions in form of hydrogen)

🟢Entered into leave and lease agreement with Hilton Metal Forging Ltd enabling Balu to backward integrate from precision machining player to Forging and Machining player

🟢Existing capacity to produce 18,000 tonnes Forged Components per annum which will be expanded to ~32,000 tonnes in the coming quarters. Annual capacity to manufacture 3,60,000 crankshafts. Wheel Production capacity of 6,000 wheels per year with a diverse application suitable for railway wagons, passenger coaches & locomotives in various gauges. Company want to Expand the wheel production capacity to 48,000 wheels per year

🟢On the capex front, Company plan for enhancing machining capacity by ~14,000 tonnes at newly acquired 13 acre land in Belgaum, Karnataka is progressing well. The operations from this facility are expected to commence from Q4 FY24, that will enable us to produce heavier and more complex crankshafts having better realizations and margins. After expansion, company will be operating on 22cr (previously 9 acres)

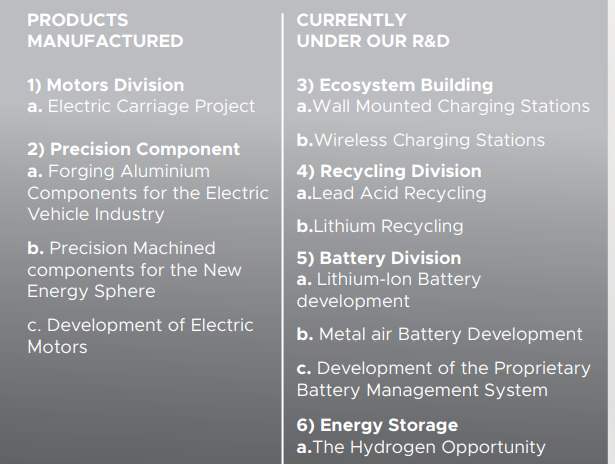

🟢The new facility will not only act as a Manufacturing Centre but will also be setup as a Technology & Innovation Campus with a strong focus on Integrated Defence Research & Production, Cylindrical Cell Production for Electric Vehicles, Components Suitable for New Energy Vehicle Drivetrains & Powertrains, Spent Battery Recycling to name a few but not limited to the same. There will be a dedicated R&D center spread over 4000 m² with a strong focus on the following key areas:

- Advanced Materials & Composites (Development of New Materials)

- Fuel Cell Development

- Cylindrical Cell & Module Development (LFP & NMC)

- Metal Air Battery Development (Zinc Air)

- New Energy Powertrain & Drivetrain solutions (New Vehicle Components)

- Advanced & Additive Manufacturing

- Energy Storage Solutions

- Alternate Bio fuels

- Spent Battery Recycling

- Advance Defence systems & solutions

Key focus areas of our R&D

Exploring the use of new materials, such as lightweight alloys or advanced composites, to enhance the product offering.

Investigating cutting-edge manufacturing methods, such as additive manufacturing (3D printing) or advanced Machining, to achieve higher precision and tighter tolerances.

Analyzing and optimizing product designs using computer simulations and finite element analysis to maximize performance and minimize stress concentrations.

Building a robust platform for the product expansion into the Railway & Defence Industry by way rapid prototyping & increase the speed of New product development

Successful Prototyping of some key components for the New Energy Mobility sphere to ensure the long-term vision of building strong capabilities in Fuel Agnostic solutions.

Investigating new heat treatment methods to enhance the strength and fatigue resistance of our products.

🟢Diverse array of products including Crankshafts, Railway Wheel, Under carriage, Transmission and clutches, Hydraulic motors etc

🟢Company is witnessing a lot of green-shoots in the defense and railway industry. This presents a significant growth opportunity for BFIL, as we continue to expand our footprints in these sectors

🟢Company is spending 2-4% in R&D and have 45 employees in that division, Overall employee strength is more than 700. Company is also Backed by certifications like IATF 16949 accredited by Tuv Nord Cert GMBH

🟢Revenue is expected to conservatively grow by ~25.0% in FY24 over FY23, led by growth opportunities in the various industries like defence, railways, and others

🟢EBITDA margins are expected to be in the corridor of 22.0%-23.0% in the upcoming quarter on the back of increasing scale of operations and efficiencies

🟢Promoter has skin in game with roughly 54% allocation. FII Have entered. Some DII money is also getting poured in this one. Management has good 3 decades of experience in the industry and now 3rd generation also into same business leveraging the domain strength acquired over years

🟢Fund raising and Preferential allotment Promoter infused 26cr at 115 Rs/share in 2023 and then 92cr (almost double of fixed assets 48cr) at 183 Rs/Share. Ashish Kacholia & Sage one also participated in Pref. at Rs.115. On 48crs of Fixed assets , Company has raised~300crs for expansion. Recently new fund also entered at 183 Rs/Share. All the selling hangover by a fund over last 2 years has been absorbed and stock is back to new highs

🟢Order wins in last 12 months. Significant order win from a tractor manufacturer based out of the Middle East of supplying 10,000 sets of sub-assemblies & there is scope to increase the same to over 50,000 annually

Risks

🔴 Volatility in the price of major raw material- steel and aluminum is a major risk, the operating margin remain susceptible to these volatilities

🔴Large working capital days cycle. The company provides a credit period of 150-180 days to its customers due to business requirements and maintains an inventory of 60-80 days due to diversified product portfolio

🔴Most of the talks under Naya energy division or Balu Advanced systems is just been talk. We need to see when and what product comes out of these new divisions. Many other companies progressing fast on Recycling, Defense and EV/Hydrogen space. We have not seen much on this part regarding their advances in these domains which significantly upgrade their Revenue or profit from these divisions. These may become sunk cost if management is not focused

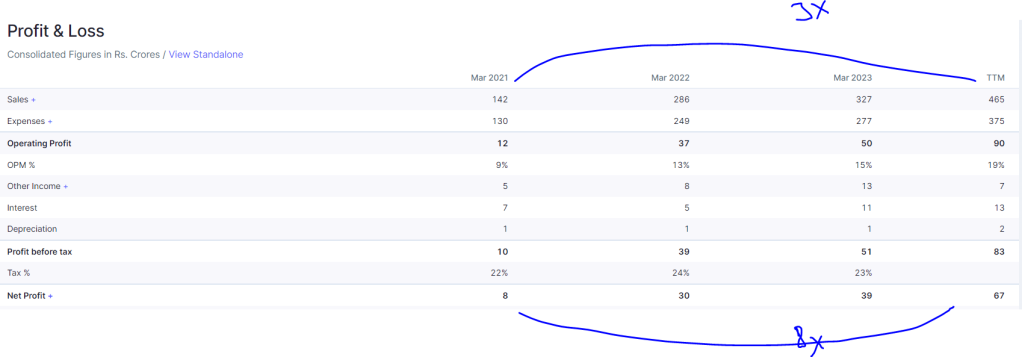

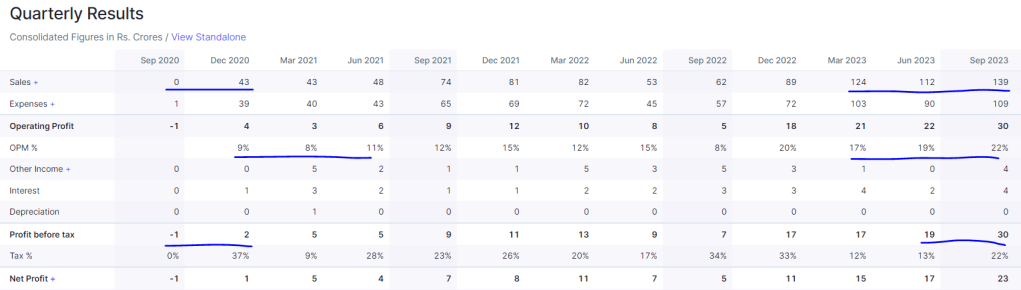

Financials

Sales have grown 3x and Profits 8x in last 3 years approximately, OPM margins have improved, over 3 years company financials have improved

Technical chart

Good Daily and Weekly Breakout with volumes in 1st Week of Jan24

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks 6-Jan-24

CBG : New trend

Protected: Positional Stocks 31-Dec-23

Diwali to Diwali -4

MSTC

CMP 568, Market cap ~4000cr

ROCE ~37%, ROE ~33%, ROE 3Yr 30 %, D/E ~0.16 PE ~17.4 (based on screener)

Company is paying Dividends but not consistent, Changing Business Profile

Also Read Pick1, Pick2, Pick3

🟢Company conducts electronic auctions (“e-auctions”) primarily on behalf of the government of India and related parties like government-owned companies. MSTC is a Mini Ratna Category-I PSU of GoI, based in Kolkata.

🟢MSTC has 50:50 joint venture with the Mahindra group called Mahindra MSTC Recycling Private Limited (MMRPL). This company is an authorised RVSF (“Registered Vehicle Scrapping Facility”) for vehicles reaching end of their life. These old vehicles are purchased for de-polluting, dismantling and converting the metallic parts in an environmental friendly manner. In December 2022, the Government of India issued a directive regarding its Scrappage Policy, a government-funded initiative which seeks to phase out old passenger and commercial vehicles, thereby reducing urban air pollution, increasing passenger and road safety, and stimulating vehicle sales. This means that all government owned vehicles will be auctioned off on MSTC’s e-commerce platform when they reach end of life. This opportunity is close to 15Lakh vehicles

🟢MSTC is casting more focus on the untapped e-commerce business from the private sector and in this stride MSTC has signed big ticket agreement with Reliance Industries, Indus Tower, Tata Power, L&T, Jindal Group, Vedanta

🟢Company has negative cash conversion cycle and that helps company to grow without any need of capital

🟢Diversity in auctions management is a kind of moat. Company have done auction of properties, Gold, Metal scrap, Steel, coal mines, Aircarft, UDAN scheme etc etc etc

🟢Promoter has skin in game with roughly 64% allocation. FII started entering. Some DII money is also getting poured in this one

🟢Sale of natural resources such as iron ore mines, coal, minerals, sand blocks, and resources extracted by government-owned companies like iron ore and natural gas. This principle also extends to the ongoing sale of scrap, surplus stores, old plant and machinery, e-waste, and obsolete items belonging to different branches of both the state and central government across India.

🟢Recently Govt has announced that multiple block of minerals mines will be auctioned. Bidding of these auctions will be around 50K crore. MSTC will be getting % of these auctions (mostly less than 1%). Most of these auctions if done through MSTC, then most of the revenue will also flow to bottom line

Risks

🔴Company business is dependent on many government entities auction like coal, metal etc. So business can be lumpy to certain extent

🔴Launch of any new portal or shifting of auction business to individual companies of Govt or reduction of margins can potentially derail thesis

🔴Significant increase risk of investing in PSU as Govt can interfere on many things

🔴Any breakdown of portal or any bug in portal can lead to revenue loss and further loss of business

🔴Company has litigations earlier and need to be closely tracked on this front as well

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks 24-Dec-23

Protected: Positional Stocks 16-Dec-23

Aatmnirbhar version : 5G RAN

NERF : 3D modelling

Diwali to Diwali -3

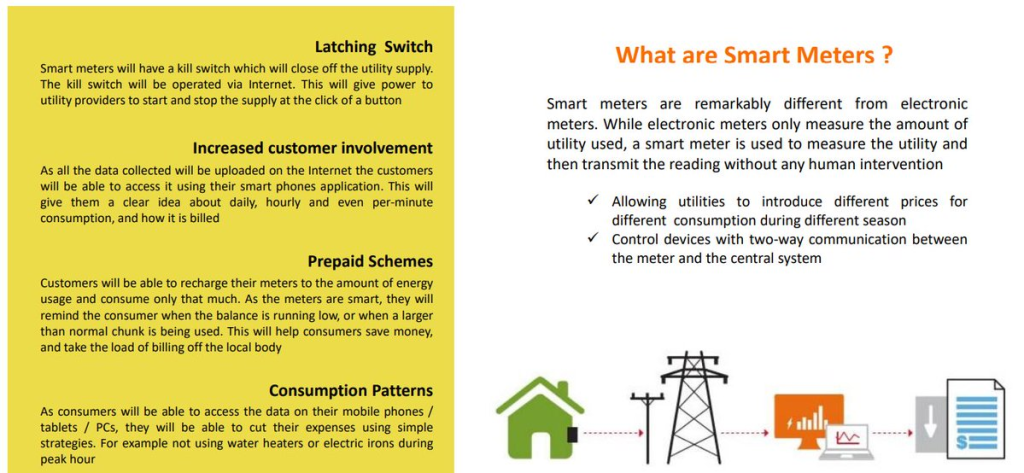

▪ At present, India loses around 30% of its power generated due to transmission, distribution, billing generation and collection inefficiencies

▪ Theft is the one of the main causes of the high losses. Theft occurs in several ways, viz: by tapping power lines and tempering / by-passing meter etc

▪ Meters play a vital role in reduction of AT&C Losses – Replacement of defective meters by tamper proof electronic meters / smart meters – AMI / Smart metering to the consumer for reduction of commercial losses and billing and collection ease

▪ Smart meter has the following capabilities: – Smart Meters and AMI Meters have communication capability – It can register real time or near real time consumption of electricity or export both. – Read the meter both locally or remotely – Remote connection or disconnection of electricity – Remote communication facilities through GSM / GPRS / RF etc

Here comes the company which tackles the problem head on and manufacture smart meters

Genus Power

CMP 223

Stock PE 71, ROCE, ROE <10%, Debt to equity < 0.3 (based on screener)

Also Read Pick1, Pick2

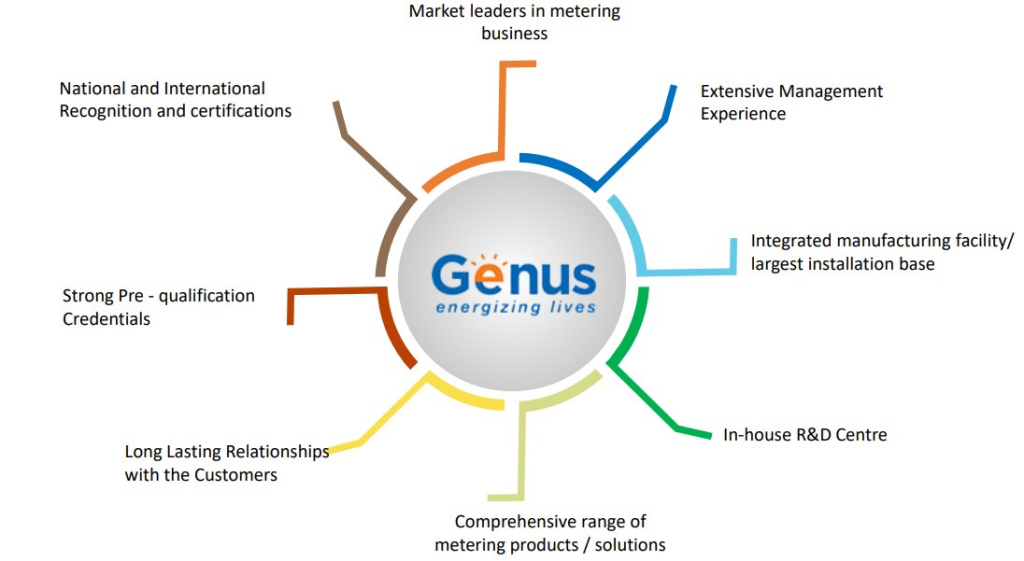

➡️It is engaged in manufacturing and providing Metering and Metering Solutions and undertaking ‘Engineering, Construction, and Contracts’ on a turnkey basis

➡️In 1996 it pioneered unique tamper-proof single & three-phase electronic energy meters in India.

➡️1st company in India to obtain various certifications like DLMS certification for Energy Meters, BIS certification for Smart Meters, etc.

➡️Current Order book is massive 19K crore –many order they have won recently

➡️Many State Electricity Boards (SEBs) have initiated the process of inviting bids for the deployment of smart meters under RDSS scheme

➡️In May 2023, the company has signed a commitment letter with United States International Development Finance Corporation (“DFC”) to obtain a Loan up to USD 49.5 million to scale up the deployment of electric smart meters.

➡️Company expects a substantial recovery in revenue from Q3FY24 onwards on back of our robust orderbook and consistent order inflow, further bolstered by the normalisation of the supply chain

➡️GIC Affiliate and Genus Power Infrastructures Limited to set up a Platform to fund Smart Metering projects

o Company signed definitive agreements with Gem View Investment Pte Ltd, an affiliate of GIC, Singapore (“GIC”) for setting up of a Platform for undertaking Advanced Metering Infrastructure Service Provider (“AMISP”) concessions

o Genus Power would be the exclusive supplier to the Platform for smart meters and associated services

➡️Largest player in India’s electricity meter industry ~27% market share in Meter Industry

~70% market share in Smart Meters

➡️Annual Production capacity of 10 mn+ meters

➡️Empanelled with 40+ different utilities across the country

➡️Only Indian company to receive BIS certification for Smart Gas Meters

➡️CMMI level 3 Company Accredited with – ISI, KEMA, SGS, STS, ZIGBEE, UL, DLMS etc., which is amongst the highest in Indian Metering Solutions Industry

➡️Big and reputed clientele

➡️In-House NABL Accredited Electronic Energy Meter Testing Laboratories

GOVERNMENT INVESTMENT

The government is planning to invest up to $21 billion till 2025 in smart grid technologies

The smart cities initiative is targeting 100+ cities in India, out of which 20 have been declared

More than 14 smart grid pilots have been launched in cities across India, to push smart solutions in Power Generation & Distribution Industry

Risks

➡️Fairly valued to bit overvalued until Earnings kick in

➡️Increase in employee cost and other expenses, as expanding workforce and enhancing systems in preparation for the execution of the substantial orderbook

➡️Significant increase in financing costs as a result of the company’s obligation to provide new bank guarantees to secure the massive order inflow

➡️Delay in execution of existing orders received by a quarter or two

➡️New order tenders getting delayed

➡️Change in policies

➡️Increase in RM costs

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Insourcing : Short term trend

Protected: Positional Stocks 9-Dec-23

Most Profitable

Cathode Vision

Protected: Positional Stocks 2-Dec-23

Bread and Bakery : Long term trend

CBG Blending for CNG PNG

Writing Instruments : Medium term trend

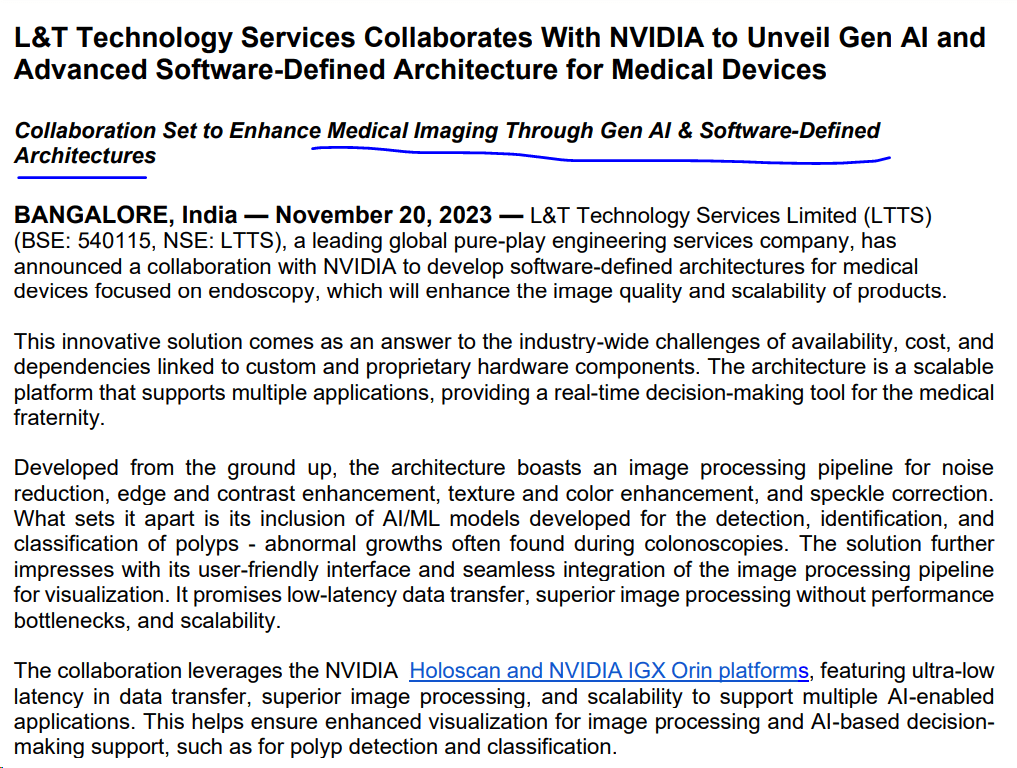

Medical Imaging AI : New trend

DIWALI To DIWALI PICKS – 2

FCL –Fineotex Chemicals

CMP 358, Market cap ~4000cr

ROCE ~36%, ROE ~28%, ROE 3Yr 25.5 %, D/E ~0

Consistent Dividend Payout, Consistent increase in revenues, Profits over a decade

Also Read : PICK1

Business, Revenues and SHP

➡️FINEOTEX group is one of the leading manufacturers of chemicals for textiles, construction, water treatment, fertilizer, leather, and paint industry. Fineotex manufactures and provides products for Pretreatment processes, Dyeing processes, Printing processes, and Finishing processes for textile processing to customers across the globe

➡️Company focus is on two categories –Textile chemicals and Clean & Hygiene chemicals

➡️Revenue 77% domestic, 23% International

➡️Bluesign, ZDHC, Star Export House Accreditations + several ISO certifications

➡️Fineotex Chemical Limited has earned the prestigious ECO PASSPORT by OEKO-TEX® certification, the highest rating in the globally renowned audit that measures standards of sustainability

➡️Received Dun and Bradstreet ESG Badge, it showcases the impact of ESG listing and ranking on organizations, and recognize their contribution towards sustainability

➡️Presence in more than 70 countries with 100 + dealers with 470+ product categories

➡️Consistent promoter holding, Good DII participation, Big Shark Ashish Kacholia holding 2.83% stake ( built his stake in last one year)

➡️Company has strong experienced leadership team and has reputed clientele

Strengths and Triggers

🟢Capex, expansion Done in last few years–Total capacity 104000MT, Ambernath plant is fungible and has the capabilities to manufacture products for both textile chemical and cleaning and hygiene segment.

🟢The facility is equipped with modern infrastructure and amenities, enabling sustainable chemical production with advanced automation, storage, and logistics handling

🟢Emerging/Expected Favorable tailwinds with UK FTA deal under discussion, Can open doors for Indian Textile segment and the company is proxy to textile sector

🟢Working capital days, Inventory days have come down significantly

🟢Malaysia plant has Easy access to high quality raw materials in the region. Malaysian plant provides raw materials to the Indian facilities. Cost benefits due to Free Trade Agreements (FTAs) with important regional markets like Vietnam, China and India

🟢Recent collaborations to expand product profile and geographical reach —

Eurodye-CTC, Belgium, to commercialize specialty chemicals for the Indian market

HealthGuard, Australia to become the exclusive global marketing and sales channel partner with joint operations from Malaysia

Setting up a state of art Research & Development center in collaboration with Sasmira Institute, one of India’s premier textile institutes

🟢Developed technical expertise to enter attractive new markets –like -Cleaning and Hygiene Chemicals Drilling Speciality Chemicals Other Speciality Chemicals

🟢Non-textile segments will drive volume and value growth going forward

🟢Team of 34 professionals for providing technical solutions to customers

🟢Technical barriers to entry and high levels of development and product customisation

🟢ICRA rating upgraded -Long Term Rating: A+ -Short Term Rating: A1+

🟢Successful acquisition and realisation of synergies with Biotex

RISKS

🔴Further Delay or non progress in UK FTA deal

🔴Textile exports remaining down or Reemergence with force by Bangladesh Textile companies

🔴Threat of imports of chemicals/dumping by China

Disclaimer — Not a buy/sell recommendation.

Purely for studying the stock idea with risks and strengths

Your Profit, Your Loss based on your conviction

Disclaimer

Protected: Premium Stocks : 26-Nov-23

Protected: Positional Stocks -26-Nov-23

Biofuel gensets

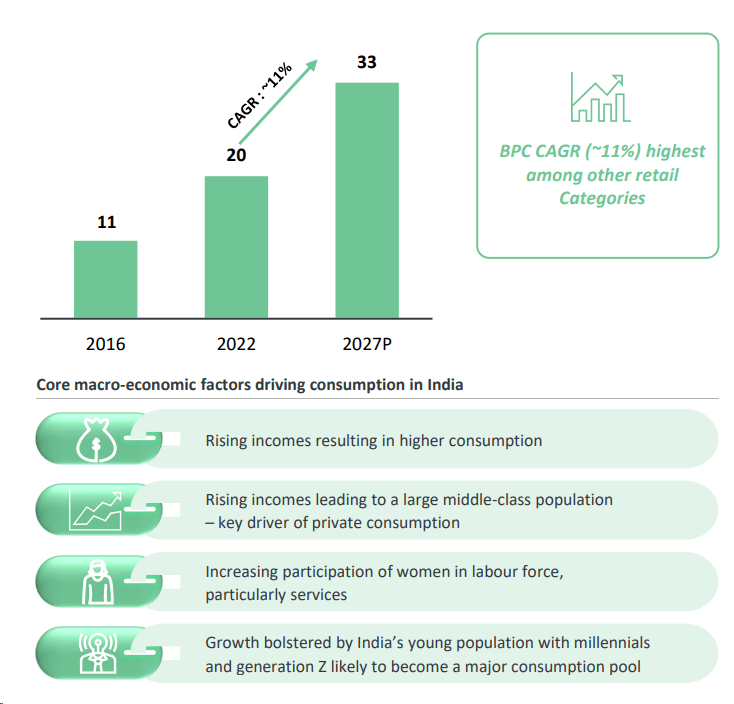

BPC market : Medium term trend

Winner or runner up

Protected: Positional Stocks -19-Nov-23

DIWALI PICKS – 1

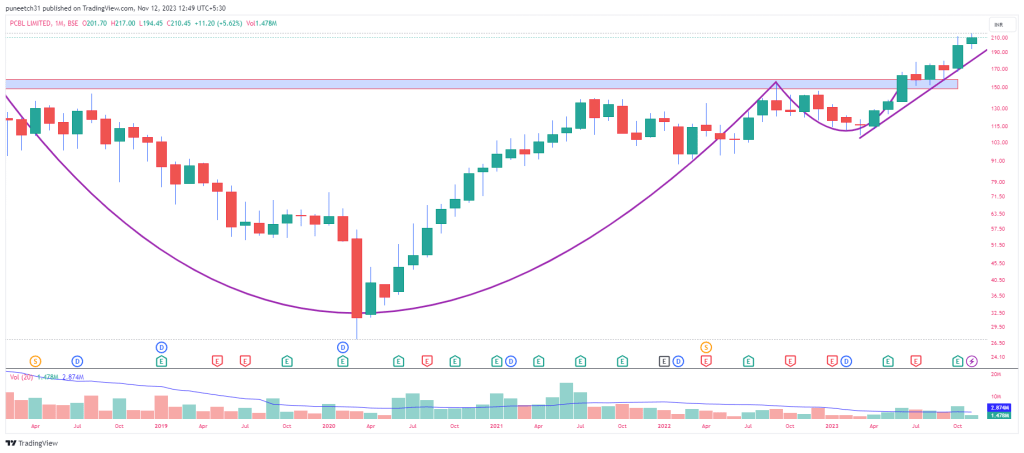

PCBL –Philips carbon black

CMP 210, Market cap ~7900cr

Mcap/Sales < 1.5, ROCE ~17%, PE ~18.5

Business, Revenues and SHP

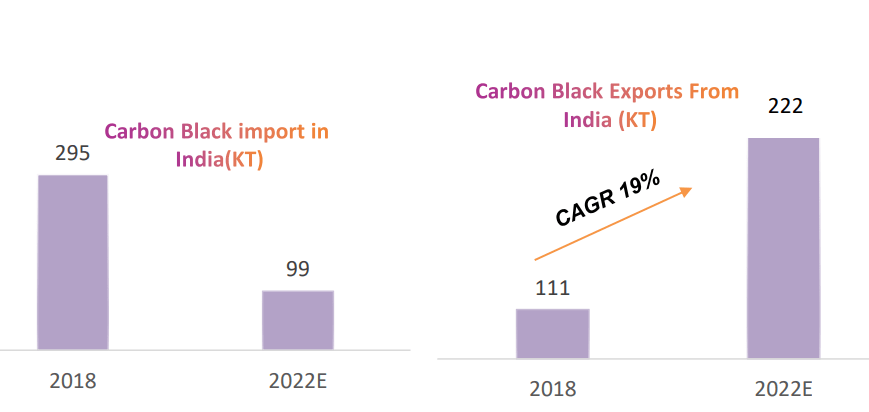

➡️India’s largest & world’s 7th largest Carbon Black Company with strong presence in specialty chemical

➡️Existing 4 plants combined Annual capacity of 623 KTPA & green power generation plant of 98 MW

➡️Focus on RnD in Speciality chemicals -50+ scientists & technical professionals in R&D and process technology

➡️70% revenue from domestic, 30% international

➡️65% revenue from Tyre segment –Major Tyre companies are doing capex–INR 35000 crs of investment by tyre industry in last 3 years in capacity creation & debottlenecking

➡️Presence in more than 50 countries with 100 grades of Carbon black, 65+ grades of speciality chemicals, 1100+ employees

➡️Consistent promoter holding, Good FII and DII participation

➡️Company has strong experienced leadership team + Company belongs to Renowned RPG group

Strengths and Triggers

🟢Capex, expansion ongoing -Green field project at Tamil Nadu with Annual capacity of 147 KTPA & green power generation plant of 24 MW, Specialty capacity in Mundra of 20 KTPA. Brownfield Expansion at Mundra plant, Gujarat. Total Specialty Chemical capacity after all expansions – 112 KT.

🟢Favorable tailwinds as vehicle scrappage policy, Growing demand for EV tyres, SUV tyres, Acceleration in freight movement

🟢Tyre exports witnessed healthy growth of 9% in FY23 driven by growth in passenger car , agri & construction sectors and increased acceptance for Indian tyres globally. Domestic Tyre demand is estimated to grow by 8-9 % in FY24 with growth recovery in OEM and replacement segments

🟢Tyre imports are reducing

🟢Easy access to raw materials and international customers with proximity to ports

🟢Lower logistics cost on account of well spread manufacturing facilities and proximity to customers

🟢Lower risk of business interruption with multiple manufacturing location spread across India

🟢Increasing Contribution from High Margin Specialty & Performance Chemicals Portfolio

🟢Company is also focusing on digitalization in its operations like INDUSTRY 4.0: Smart factory Solutions —

a) Smart Automation in new manufacturing unit in Chennai, Tamil Nadu to generate key analytics and dashboards, eliminate human error and improve safety.

b) Adoption and deployment of best-in-class Data Security softwares and Advanced threat protection for all end users.

c) Creating Digital Infrastructure by set up of disaster recovery data centre for critical data protection, Automated tool-based backup is scheduled and monitored for all critical Cloud Servers.

RISKS

🔴Key Raw material CBFS is imported and dependent on crude oil price

🔴Major portion of PCBL’s revenue is from sale of CB to tyre manufacturers which is cyclical business

🔴Threat of imports of carbon black or Dumping by China

Disclaimer — Not a buy/sell recommendation.

Purely for studying the stock idea with risks and strengths

Your Profit, Your Loss based on your conviction

Update in 28-Nov-23, 29-nov-23

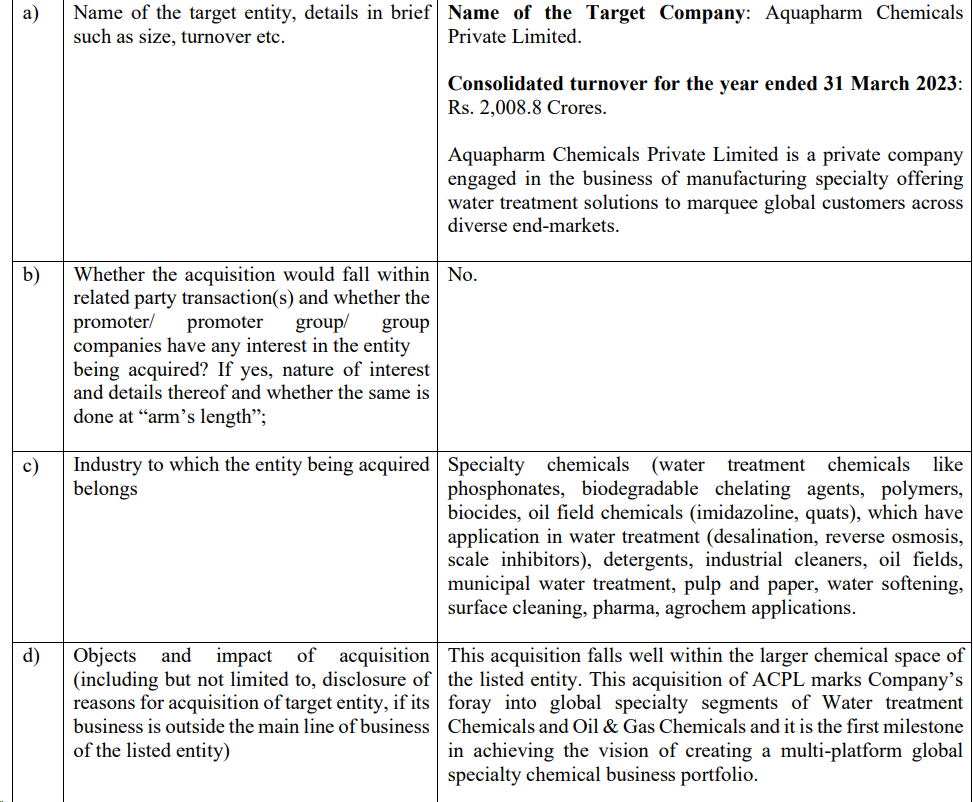

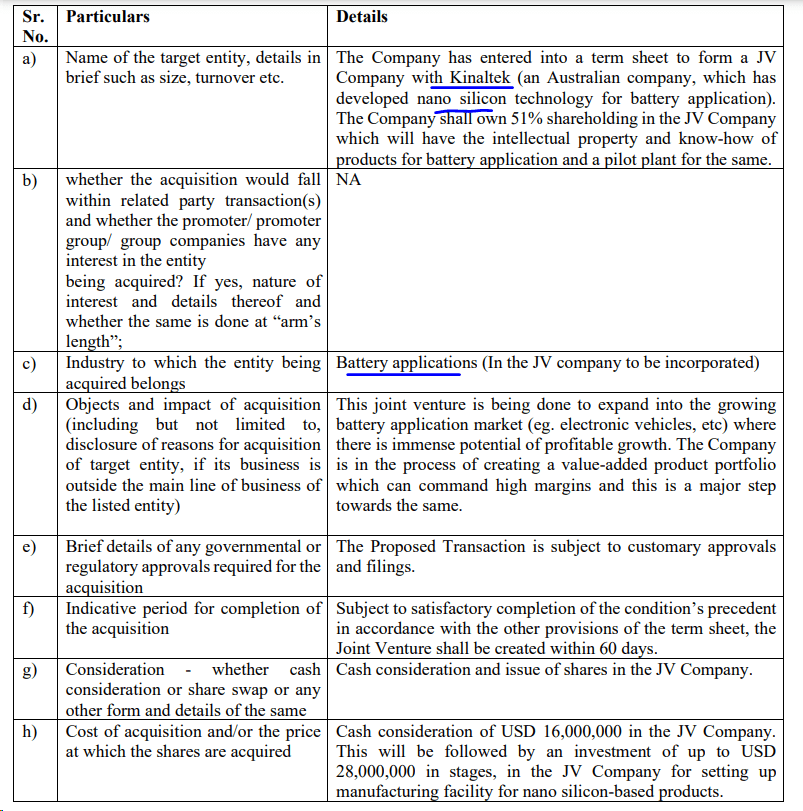

Acquisition of ACPL at 3800cr, EBITDA of ACPL is 417Cr in FY23

JV with Kinaltek for battery applications

EPIC value chain

Protected: Positional Stocks -22-Oct-23

Protected: Premium Stocks : 20-Oct-23

Protected: Positional Stocks – 14-Oct-23

India’s Space race

ALPHA SUNRISE Portfolio precisely captures this theme along with Recycling, Defense, EMS

If you want to be part of my journey of portfolio creation in emerging sunrise sectors then just drop a mail to alphaaffairsf2f@gmail.com and at a nominal yearly amount get to know ALPHA SUNRISE Entry and exits

Protected: Positional Stocks – 7-Oct-23

Protected: Positional Stocks – 2-Oct-23

Hopes on Ayodhya

Hydrogen Fuel cell Powered Buses

Protected: Positional Stocks – 17-Sep-23

Kaala sha kaala (Black is black)

Astra Microwave

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Astra Microwave

Business

Astra Microwave Products Limited (Astra) was incorporated in 1991 by a team of distinguished scientists with experience in RF/Microwave/Digital Electronics and management of projects with high technology content. Astra Microwave Products Limited, engaged in the business of design, development and manufacture of RF and Microwave Components, sub-systems and systems used in defense, space, meteorology and telecommunication

With over 30 years of experience in microwave radio frequency (RF) applications, AMPL has moved up the value chain from sub-systems to high value-added systems

Astra has 3 Automatic assembly lines for PCBA assembly, 5 class 10K cleanrooms, functional test infrastructure that extends from 30MHz up to 40GHz, in-house Environment test facilities including EMI/EMC facility and a first for any Indian Private Industry – Near Field Antenna test and measurement range.

Total workforce (as on March 31st, 2023) – 1,290

Subsidiaries

In fiscal 2014, AMPL floated the 100% owned BEPL as a captive supplier of raw material for overseas orders. In fiscal 2015, AMPL floated the 100% owned ASPL in Singapore, as a supplier of MMIC products for semi-conductors. In fiscal 2019, AMPL set up a joint venture, Astra Rafael Comsys Pvt Ltd, with Rafael Advanced Defence Systems for production of communication systems and sub-systems for defence.

Product Portfolio

The company’s product portfolio spans across Defense, Space, Meteorology, Homeland Security and Systems Vertical

Has a diverse range of microwave products like filters, transmitters, receivers, antennas etc.

Manufacturing facilities

5 facilities in Hyderabad, Continuous investment in World Class Infrastructure for Assembly, Functional and Environment testing. Astra’s facilities are approved by several foreign companies for production

R&D Capabilities

Track record of new product development; now graduated to a SYSTEM integrator in Radar. Dedicated R&D facility at Bengaluru to manufacture radars

Strong in-house capability in the microwave radio frequency (RF) applications domain.

Executes orders through BTS (Build To Specifications) and BTP (Build To Print) route

Customers and Regions of Revenue

- Clientele includes Indian Government Laboratories, Indian Defense

- Public Sector Undertakings, Indian Space Research Organization

and many foreign OEM’s

Revenue mix

Geographical spread of total revenue stands as follows: India – 60% and Exports – 40%

Applications

Defense

- Radars

- Electronic Warfare

- Missile Electronics

- Telemetry

- Counter-Drones

Space

- Flight Model Application

- Ground based

Application - INSAT MSS Terminals

Hydro/Meteorology

- Water Level Measurement (Bubbler/

Radar Sensor) - Automatic Weather Stations (AWS)

- Agromet Met Stations (AMS)

- Automatic Rain Gauge (ARG) X

Band Doppler Weather Radar

Other areas of work

- Antennas

- MMIC

- Contract Manufacturing

- Homeland Security

Awards and Certifications

The company has various certificates such as AS9100D & BS EN ISO 9001:2015, ISO27001:2013, ISO9001:2015, ISO14001:2015, ISO45001:2018, ISO/IEC17025:2017.

Awards

LAToT Ceremony for Coastal Surveillance Radar

Excellence in Innovation, Design Technology, R&D 2021

Counter-Drone System LAToT Handing over Ceremony

Award for Excellence in Aerospace lndigenisation-2021

ELCINA EFY Award for Business Excellence

Fundamental Ratios, Cash, Loans, EBITDA,PAT etc

Debt to equity is under control < 1

ROCE> 17

Pledge 0%

Short and long term liquidity under control

Recent Q1FY24 have been weaker than expected

Opportunity Size

Various tailwinds in the defence sector are creating a wide range of opportunities for Indian firms. Company expected to hit 6000-8000cr cumulative revenue in next 5 years if TAM is correctly addressed

Triggers

Defence spend in India has received a mega boost

Opportunities to develop and supply products which are published as negative import list by GOI

Government of India’s Atma Nirbhar Bharat initiatives

Favorable policy initiatives like Buy (IDDM – Indigenously Designed, Developed and Manufactured),MAKE-II, MAKE-Ill

Expansions and Acquisitions for future growth

QIP has been done at 270 rs for Reducing working capital and corporate purposes

Operating margins can improve further

Focusing on domestic defense order can lead to 20% OPM in coming years.

We aim to achieve 70% Domestic 30% Export Revenue distribution over next 2-3 years. Domestic business on an average carries 40 to 45% of gross margin as against 8 to 10% gross margin in exports.

Order inflows

Orders are worth an aggregate amount Rs. 158 crores for supply of Software Defined Radio (SDR) by Astra Rafael Comsys Private Limited (Joint Venture) Company has received an order from India Meteorological Department (IMD) for Supply of C-Band Dual Polarized SSPA based Doppler Weather Radars for a total value of Rs.32.97 crores. Order is to be executed within a period of 18 months.

Orderbook as of March 2023 is Rs. 1,544 crores. This order book consists of only 24% of export orders rest 76% are domestic orders. The BTP segment is a major contributor of our export orders, which are executable in the next 24 months. The sales mix is anticipated to be skewed towards domestic, high margin business.

Orders are worth an aggregate amount order(s)/contract(s) awarded in brief; of Rs.16.8 crores for supply of Satellite sub-systems and weather data processing system from ISRO

Company has bagged orders worth Rs.158 crores for supply of Satellite sub-systems, Airborne Radar and sub-systems of Radar and EW projects, from DRDO, ISRO and DPSU’s

Targeting JV and exploring fields like

Through JV or strategic alliances, offer improved technology and products.

Target the offset requirement in large defence procurement programmes of Gol.

In discussion with our JV partners to develop EO (electro-optics) product line. Bidding for the whole system – the complete radar system – for both DRDO and for future MoD requirements

Risks

Lumpy nature of domestic defence/space programs –Orders come in bulk and so are the payments.

Large working capital requirement: Gross current assets (GCAs) improved to 346 days as on March 31, 2022, from 398 days a year before, led by reduction in debtor days. GCAs are expected at around 400 days over the near to medium term with increased execution of domestic orders. The group primarily caters to domestic defence research and space establishments that usually have a long production cycle and longer working capital cycle compared with overseas orders. Though export revenue may be realised faster, it will be offset by stretch in receivables from domestic orders as domestic order execution is expected to increase in the future and thus working capital intensity would be a key monitorable. Furthermore, the group must maintain sizeable inventory to cater to all segments, as products are customised, and thus, requirements vary across segments.

Susceptibility to risks inherent in a tender-based business, and long gestation period for projects: The business depends on success in bidding for tenders invited by defence public sector undertakings and research establishments. Establishments such as the DRDO invite tenders from qualified vendors for their R&D requirement and commence bulk production on successful completion of product development. Long-term revenue visibility is primarily driven by the success of R&D projects at DRDO and the subsequent mass production of products.

Margins Volatility is high. Export vs domestic order execution changes margin profile and needs to be seen closely in coming quarters

Technicals on 25th Aug23

Disclosure –Invested. Do your own diligence before buying/selling

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 10-Sep-23

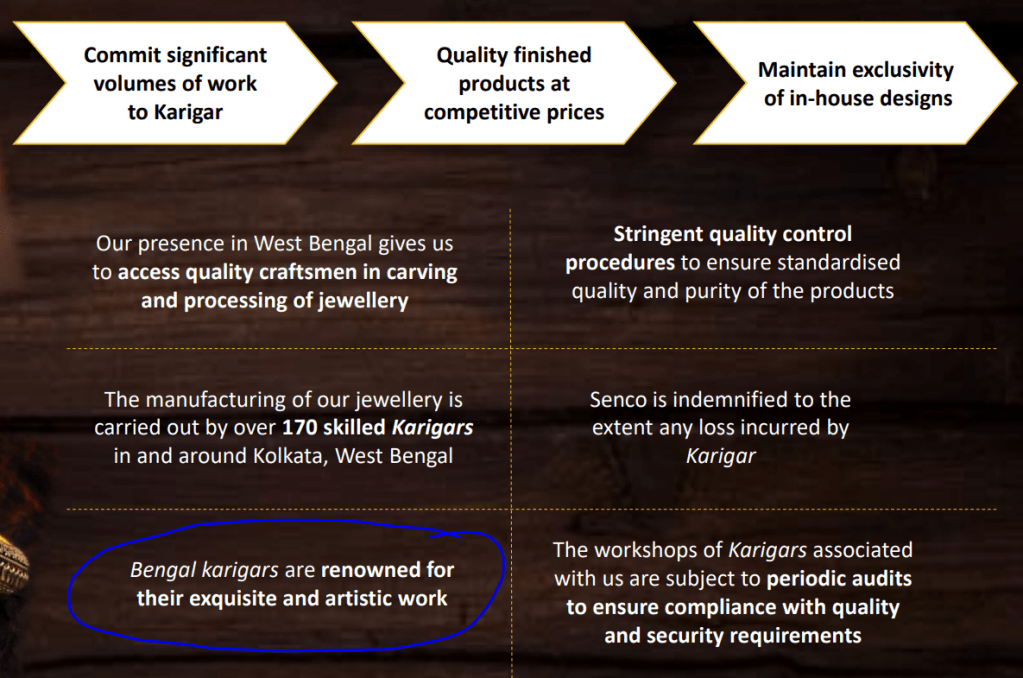

Renowned Bengal Karigars

Protected: Positional Stocks – 3-Sep-23

Only Indian Retailer

Protected: Premium Stocks : 28-Aug-23

Protected: Positional Stocks – 27-Aug-23

Protected: Positional Stocks – 20-Aug-23

Protected: Positional Stocks – 13-Aug-23

Global Travel Health Index : Short term trend

Protected: Positional Stocks – 6-Aug-23

Greener way of SDA

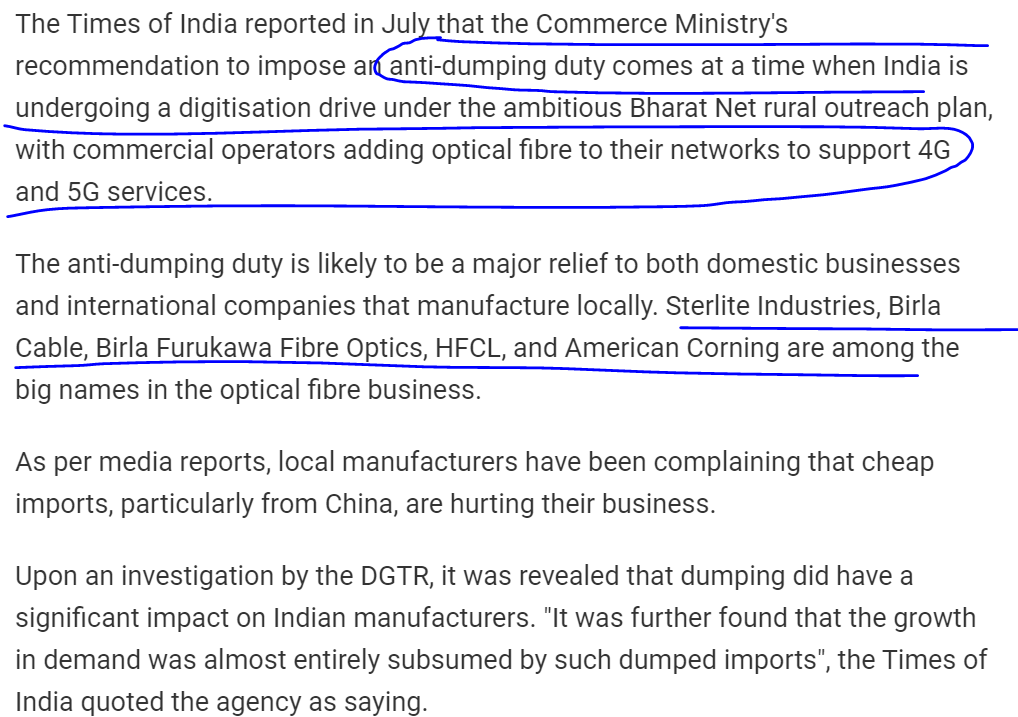

ADD on Optical Fibre Imports

2023 : 2032 : NTPC

Fertilisers : Drone friendship

Protected: Time for sunrise

Protected: Proxy to Sunrise Industries

Protected: Positional Stocks – 30-July-23

Winds of change

CBG ecosystem

Electricity Growth drivers

Protected: Positional Stocks – 23-July-23

Time to Forge bonds : Ramkrishna Forgings

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Ramkrishna Forgings

Business

Ramkrishna Forgings Ltd is primarily engaged in manufacturing and sale of forged components of automobiles, railway wagons & coaches and engineering parts. Company mission and vision is to be the most preferred supplier of forged, rolled, machined, fabricated and cast products for all end use industries like Railways, Automotive, Earth Moving, Mining, Farm Equipment, Oil & Gas and General Engineering globally by supplying products meeting highest quality standards at highly competitive costs

Manufacturing facilities

RKFL’s facilities in eastern India are located in close proximity to automobile manufacturing hubs and key suppliers of of raw material

- Less chance of supply interruptions

- Lower logistics cost

- Reduced working capital requirements

Customers and Regions of Revenue and Product verticals

Products

Company focus is on de-risking business from few customers or few segments or few geographical areas

They have succeeded quite well in last 4 years

When a company has to grow to large company, many such things will give stability to company to perform well

Experienced promoters and established track record of the company

Promoters have 40 years of experience in forging industry

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

PAT , ROE, ROCE, PAT margin showing improved profile

8x sales growth and 35x profit growth in 10 years

Stock price is also 20x in 10 years and its quite possible to become 2-3x in next 3 years with CAGR of 24-30% approximately

Debt to equity has come down considerably and now close to 1 while Debt to EBITDA also is planned to reduce to 1 by FY25

Cash conversion cycle has improved to 100 days and Working capital days has also improved

Topline and bottom-line has improved significantly in last 3 years and trajectory is expected to continue in similar fashion

Shareholding pattern

Good promoter holding, skin in game, FII are increasing stake, Public domain have few strong holdings as well

FY23 Fundamentals ratios

ALSO READ : Company at Y2K moment

ALSO READ : Dream come true

Strengths

Manufacturer and supplier of a variety of auto and non-auto components

Global presence with footprints in North America and Europe

2nd largest forging player in India with over 40 years of experience Promoter possessing multi-decade forgings industry experience

Continued focus on diversification with foray into EV components

Longstanding relationship with marquee customers

Outstanding Credit ratings –perfect recipe for large cap progerssion in coming years

Triggers

Opportunity size in exports and domestically

There is a huge requirement in India and in various overseas countries. Compant exports are grwoung well

Capacity Enhancement and future growth from internal accruals

Commissioned 7,000T Press Line in 2021 and also commissioned a Warm Forging Line and a Fabrication Facility in 2021

The company has commissioned 23,800T of capacity as on 18th July 2023 and the remaining 32,500T will be commissioned by September and overall Increasing to 2,10,900T (current installed capacity 187000T)

In addition, the company has planned to setup cold forging capacity of 25,000T. The Company has sufficient capacity for the next phase of healthy & robust growth. Capacity ramp-up along with operating leverage will result in faster improvement in profitability

Cold Forging Press line to be commissioned by Q1FY25

Entire 100% capacity has been booked by an OEM, the contract of the same is valid for 7 years

Management guidance in Q1FY24 Call

Subsidiaries and Strategic Acquisitions

Company has done a JV with Titagarh rail company for manufacturing and supplying of forged wheels for Indian railways

Ramkrishna Forgings announces strategic acquisition of Multitech Auto Private Limited and its wholly owned subsidiary Mal Metalliks Private Limited along with Mal Auto Products Private Limited. This can lead to 20% of current revenue addition

Also company has done some acquisitions in ACIL , JMT auto and Tsuyo. This push will help company to foray into tractor, PV segments, Heat treatment, gears, BLDC EV segments

Industry growth rate

Various forecast showing industry will grow between 6-10% for next few years. Important to understand here is the industries the company caters to

All these segments have Government focus and will grow heavily in next 5-7 years. So I believe company is present in right segment and right regions (fastest and biggest regions)

Recent Order wins

Just listing few wins in last one year

Risks

Susceptibility to raw material cost could affect Company profitability.

US landing into recession may also trigger less future orders in short term. Stock may consolidate before moving up

Stiff competition from peers like Bharat forge but this risk is bit mitigated with many order wins recently and consistently

Higher revenue concentration from Auto segment and CV domain in that is a risk–though company is taking utmost steps to remove this risk as highlighted above

High capital working requirements remain a risk

JV falling off with Titagarh rails for reasons is a small risk

Railways not going ahead with orders and new tenders in coming time is another risk which we need to consistently monitor

Technicals on 22 July 23

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip market offers else Ignore the stock

Stock might be up in short term and then give a chance to buy around 400-450 range for long term investment purpose

I am holding it from lower levels and I reserve the right to add more or exit as per company performance without a followup /update here

Also Read : ICEMAKE Refrigeration : Time to Chill

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form