PFAS Trend

BE FINANCIALLY INDEPENDENT

Market took away updated SL and we did not lose anything on the positions. Following process saved us

No positions as of now. From January to March we have gradually reduced from 8 to 6 to 4 to 3 positions and did not add new ones. It really helped in this fall from Positional portfolio perspective

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There could be lot of things which might have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

AVG Logistics Ltd, incorporated in 2010, provides road transportation services, warehousing facilities and Railway transportation to various domestic and multinational companies. AVG Logistics provides customized and technology-driven solutions across transportation, warehousing, distribution, and supply chain management. Furthermore, the Company also offers Third-Party Logistics Services (3PL), effectively complementing its wide range of logistics solutions. Company mission is to offer an integrated Multimodal network of Logistics

solutions across varied industries

Products, Segments and Strengths

Transportation: Express Delivery, Refrigerated Transportation, Freight Forwarding, etc

Warehousing: Manpower Handling, Packaging, Multi-User Warehouse facility, etc

Value-Added Services like custom clearance, E2E solution, Multimodal transportation, Reverse logistics, etc.

The Co. also undertakes transportation services to Nepal, Bangladesh and Bhutan

AVGL had the agreement of 1 – 3 years with all its major customers and the agreement includes the escalation clause based on the 5% change in the diesel cost

Fleet Size

The Co as of 31st December 2023 has a fleet size of more than 3000+ vehicles, including hired & owned dry/reefer vehicles. Owned vehicle fleet is approx 500+

Network

The Co has a pan India presence with 50+branches and 7 zonal offices.

Company caters to 6 rail routes and can deliver 1 to 40 tons of logistics

9 trans-shipment hubs for LTL services, 1 owned fleet maintenance hub

~7,.05L sq. ft. of warehousing footprint pan India ( 81,000+ sq. ft. Owned and 6.24L leased Warehousing Space). Further expansion happening

Company has certain moats/advantages wrt new entrants in terms of

It offers a range of rail logistics services to its customers, including Full rack and piece meal transportation, container movement, and terminal management across all CONCOR ICDs. This is very important in bigger scheme of things in coming years

Cold chain logistics is the segment to watch out for in coming decade

Company has a clear focus on Tech Initiatives regarding its operations. Company keeps on finding Disruptive & Innovative Customised Solutions. Zero Residual Food Grade Tanker is one of the solutions. Curtain Multi-door Truck is another solution

Clients

Reputed clientele in diverse sectors like FMCG, Chemicals, Power, Electrical, automotive like Nestle, Mother Dairy, ITC Ltd, Coca-Cola etc

Well recognized by clients and external agencies in terms of awards and recognition

Similarly ROCE and ROE are decent.

Debt to Equity is high and needs to be closely monitored

Cash conversion cycle is stable and Working capital days are also stable

Tie up with railways :Signed 6 tenders worth ₹510 cr with Indian Railways for 6 leased parcel trains.

They also got 150 crore contract from Indian Railways for operations of Leased Parcel Express Train. This special train, connecting Bangalore to Ludhiana (Punjab), will complete one round trip every week over the next 6 years, totaling 313 trips. The Express Service will cover the distance in ~72 hours ensuring expeditious, seamless connectivity between the important locations. Ludhiana is an invaluable addition to our railway network, opening doors to a gigantic textile market -largest hosiery manufacturing, cotton textiles, cycle manufacturing amongst others

QSR clients :Started servicing QSR clients

Expanding the cold chain and parcel division. Company is acquiring 50+ fleet of cold chain vehicles to enhance its cold chain capabilities

Also is Upcoming 50,000 sq. ft. Owned Warehousing Space In Agartala

JV : Joint Ventured with Sunil Transport for liquid logistics.

EV Fleet : They are planning to introduce electric vehicles in their fleet in the future.

Company also recently had a collaboration with Blue Energy Motors (BEM), India’s only LNG truck manufacturers. This represents a significant leap towards a more sustainable and eco-friendly future in the transportation industry. This landmark collaboration is formalized through a strategic Transportation as a Service (TAAS) Agreement, wherein AVG Logistics and BEM join forces to integrate LNG-powered vehicles. The collaboration underscores a shared commitment to advancing sustainable transportation practices and fostering a greener future.

Backward integration for last mile : Incorporated a Wholly owned subsidiary named ‘Galaxy Packers and Movers’

They have onboarded Gazal Kalra, co-founder of Rivigo, as a strategic advisor to guide them on sustainability and technology. She also Subscribed to Warrants at 371 Rs

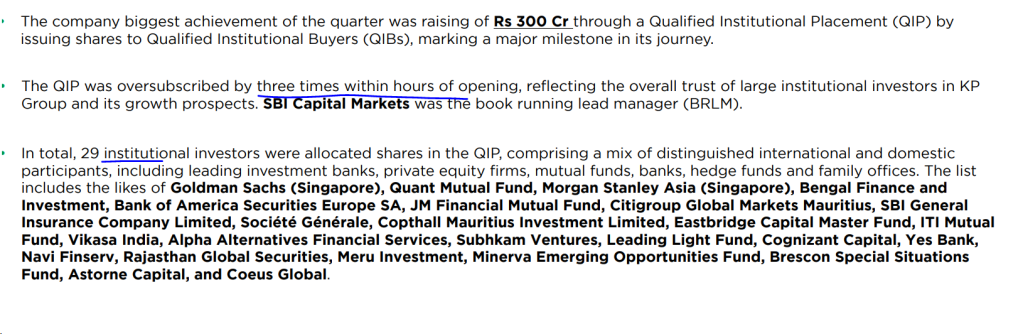

Company has also raised funds at 371 Rs/Share through

Govt Initiatives to Improve Infrastructure aid Logistics growth : India aims to reduce logistics cost from 13% – 14% of GDP to 8% – 10% of GDP. It is estimated that a 10% reduction in indirect logistics cost will result in 5% to 8% rise in exports. GOI to undertake multiple logistics specific initiatives, such as GatiShakti, National Logistics Policy and others. These programs aim to streamline India’s logistics sector by making it more green, agile, transparent and integrated.

Valuations

Expected sales projections for FY25 is ~700cr and with PAT margin of ~7-8.5%, we get PAT of 50-60 cr. So stock price may move towards 700-900 by 31Mar25. There could be volatility in stock which can be used for accumulation

High Debt to Equity Ratio. This needs to be monitored very closely

New warehouse opening and its utilization

Renewal of contracts with customers on favourable terms needs to be watched out

High capital working requirements remain a risk.

High competitive industry

Technicals on 11Feb24

Stock has been consolidating between 400-460

Technical chart on 16 Mar24

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip, market offers, else Ignore the stock

Stock might be volatile in short term and give a chance to buy for long term investment purpose

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There could be lot of things which might have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There could be lot of things which might have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9, Pick10

Kilburn Engineering Limited is primarily engaged in designing, manufacturing and commissioning customized equipment / systems for critical applications in several industrial sectors viz. Chemical including Soda Ash, Carbon Black, Steel, Nuclear Power, Petrochemical and Food Processing etc.

Company has cutting-edge manufacturing facility for fabrication, machining, and assembly of equipment located in Thane, Maharashtra (India). Manufacturing plant spans an area of 30,960 square meters and is equipped with state-of-the-art technology and machinery.

Products, Segments and Strengths

Company operates in two segments viz. Process Equipment and Tea Drying Equipment

Food Processing Equipment -During FY23 Company had bagged a total of 103 orders in the domestic market and 5 from overseas Market

for tea dryers

40+ Years of rich experience with 3,000+ Installations globally done

200+ Workforce and 15+ Sectors catered by products and solutions

Kind of Equipment’s & system’s orders got by company

In the wake of increasing concerns about environmental degradation, our Paddle dryers have emerged as a sustainable solution for drying sludge. These advanced dryers play a vital role in states where strict pollution norms have been enforced, making it imperative for industries to adopt ecofriendly practices. By efficiently removing moisture from sludge, these dryers significantly reduce the volume of waste generated, thereby minimizing the environmental footprint of industrial processes

Sewage treatment — The market size for water and wastewater management in India was 216.03 billion in 2022. By 2027, it is anticipated to grow to518.15 billion, with a projected CAGR of 15.95% during the period 2023-2027.

On similar note, many other industries catered by Kilburn are expected to grow at 5-14% CAGR till 2030 and further

Eextensive and sophisticated R&D facility that are equipped with a full range of pilot plant dryers,

including

Company has good manufacturing capabilities and order book of 236cr in hand at 31st Dec23.

Order received in Q3FY24 94cr. Executed 73cr

Continuous order inflow in Q4FY24 as well

Order Enquiries –> Approx 100cr

Clients

Reputed clientele lik ACC, JSW , Reliance, Arvind, PCBL, Fnolex, Granules, Coromandel, SRF, LnT and many other renowned names

Professional Management team

Similarly ROCE and ROE are at reasonably good levels

Debt to Equity is under control

Sales, OPM, Net profit has been on rising trend continuously

Cash conversion cycle needs to be monitored.

Working capital days are good and have been improving

Promoter has skin in game. One of the old promoters has been selling and other has been buying. Now its settled and Public domain have few strong holdings as well.

Promoter buying from open market

Promoter has been buying from open market continuously. Good buying happened between 270-310 zone

Last buy around 320

Acquisition of ME energy

This acquisition will help the company to grow faster

Company has put an estimated target of 500cr revenue by FY25 as ME energy has a 118cr pending order book

Capex

Expecting small capex of 15-20 cr till Dec25

Valuations

Expected Cumulative sales projections for FY25 is ~500cr (considering orders and Acquisition) and with PAT margin of ~12% after merger, we get PAT of 60 cr. So stock price may move towards 500 by 31Mar25. There could be volatility in stock which can be used for accumulation

Chequered history of non-payment of loans and subsequent new promoters on board.

Due to the non-payment of its loan obligations to RBL Bank Limited (RBL) starting in March 2020, KEL underwent debt restructuring in FY21. The resolution plan (RP) sanctioned by RBL in accordance with the Reserve Bank of India’s criteria was accepted by the company board on March 4, 2021, and it was put into effect on March 31, 2021. As per the RP, the outstanding principal loan of Rs 95 crores and interest of Rs 9 crores due to RBL up to 31 March 2021 was to be restructured. As part of the debt restructuring, Rs 65 crores of sustainable debt was converted into long- term loans with a 12.5 year payback period at an annual interest rate of 9%, Rs 13.5 crores in equity shares were allocated to RBL, and Rs 25.5 crores in 0.01% cumulative redeemable preference shares (CRPS) were also allocated to RBL.

Chemical companies are facing challenge to make sales. Their capex plan may be delayed further leading to slow flow of order to companies like Kilburn

Economy impact because of possible US recession might delay things by a year or more

High capital working requirements remain a risk.

Delay in Acquisition of ME energy. This is major risk in short term

Technicals on 10Feb24

Stock has been consolidating between 260-290 for almost few months and given a breakout recently and then got good results as well

Technicals on 31-Mar-24

Survived well in last one month market correction

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip, market offers, else Ignore the stock

Stock might be volatile in short term and give a chance to buy around 270-340 range for long term investment purpose

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There could be lot of things which might have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

CMP 569, Market cap ~3150cr

ROCE ~32%, ROE ~24%, D/E ~0.07 PE ~29 (based on screener)

🟢EMS Limited is a multi-disciplinary EPC company, headquartered in Delhi that specializes in providing turnkey services in water and wastewater collection, treatment and disposal. EMS provides complete, single-source services from engineering and design to construction and installation of water, wastewater and domestic waste treatment facilities

🟢The company provides Sewage solutions, Water Supply Systems, Water and Waste Treatment Plants, Electrical Transmission and Distribution, Road and Allied works, operation and maintenance of Wastewater Scheme Projects (WWSPs) and Water Supply Scheme Projects (WSSPs) for government authorities/bodies.

🟢Healthy Order book of ~2100cr provides strong visibility of revenues over next few years. Company has repeat orders from various Government departments.

🟢EMS promoters have more than a decade of experience in executing water supply and sewage treatment projects

🟢Since incorporation, it has completed 67 projects in Bihar, Uttarakhand, Madhya Pradesh, Rajasthan, and Haryana. It has executed many projects awarded by government bodies such as Uttar Pradesh Jal Nigam (UPJN), Construction and Design Services (C&DS), Military Engineering Services (MES), and Indian Railway Construction Limited (IRCON). It has completed 4 O&M projects in last 4 years.

🟢Key clientele includes government bodies like Municipal corporation of Rajasthan (under AMRUT Scheme), Uttarakhand Urban Sector Development Agency and Bihar Urban Infrastructure Development Corporation (under National Mission for Clean Ganga ) and CPWD, Maharashtra

🟢EMS Limited has its own civil construction team and employs 57+ engineers, supported by third-party consultants and industry experts.

🟢Projects are mostly funded by World bank

🟢Development of Tier 2 Tier 3 towns, capital expenditure by Government gives good visibility for few years

🟢Promoter has sufficient skin in game with approx. 70% holdings, Sales are increasing and NPM is good

Risks

🔴Company works in a field of high capital intensive business and receivables will remain high

🔴Project execution risks within a budget are the ones which constantly hurts companies in these kind of businesses

🔴The company has not executed any HAM projects in the past but is executing one HAM project for the UP Jal Nigam. It has entered a joint venture with Ercole Marelli Impianti Tecnologici S.R.L. Italy.

🔴Revenue concentration from few clients/states poses a risk

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.