Game is on!!

BE FINANCIALLY INDEPENDENT

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 25th April 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

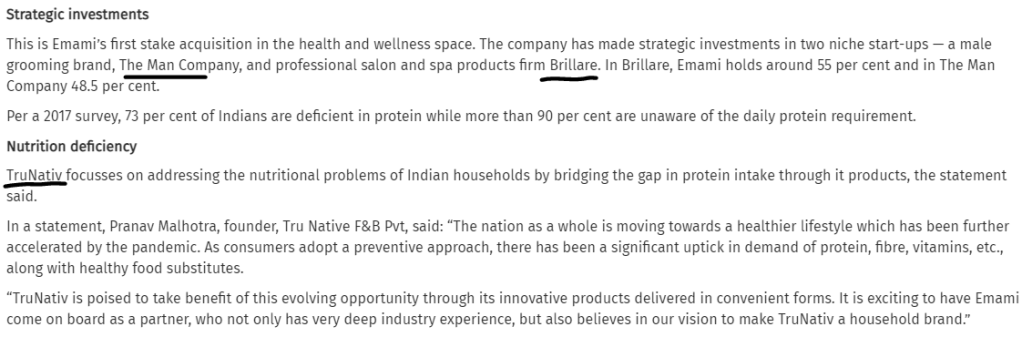

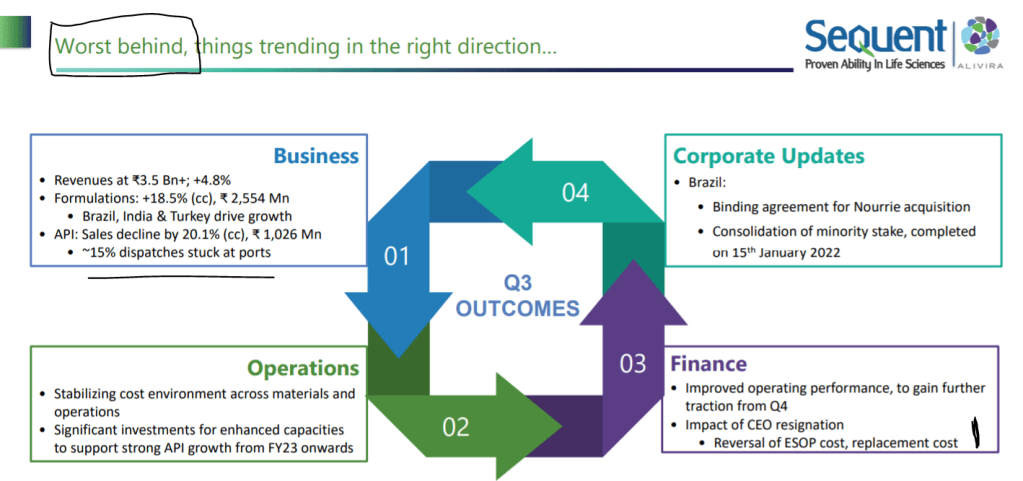

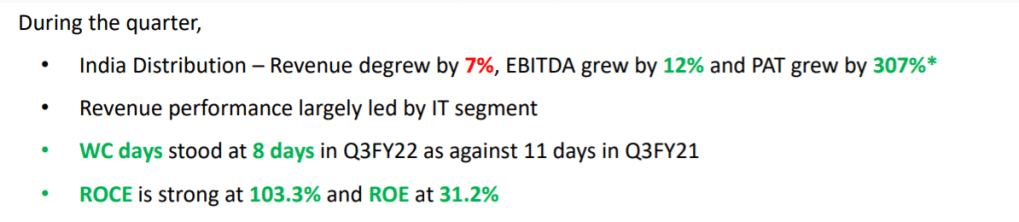

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

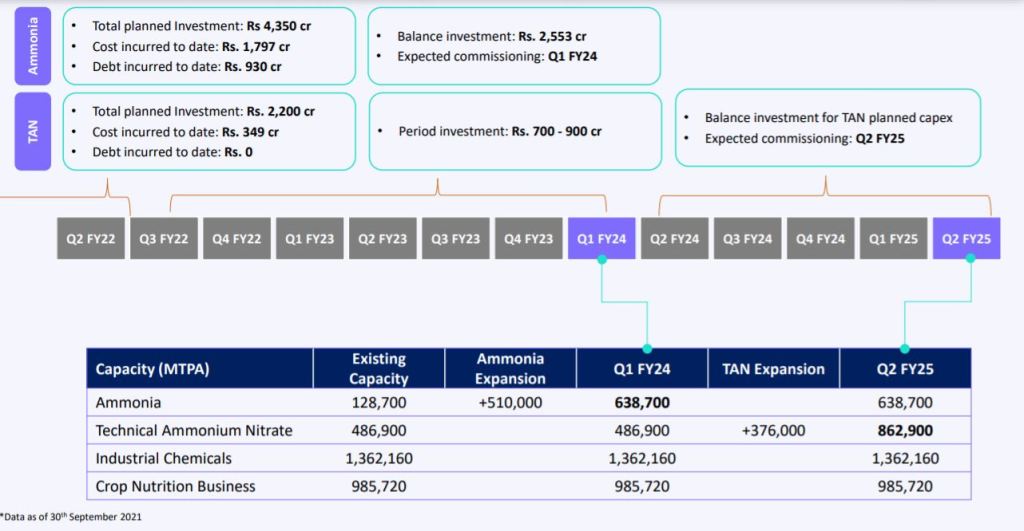

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions (apart from Program content)

Mutual Funds

Financial planning

IPO and

Big money moves

3-4 months of teaching and mentoring

Can be extended based on queries, case studies1-2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap –this will be an approximate six month effort by all participants

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS NEW YEAR 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 15th April 2022

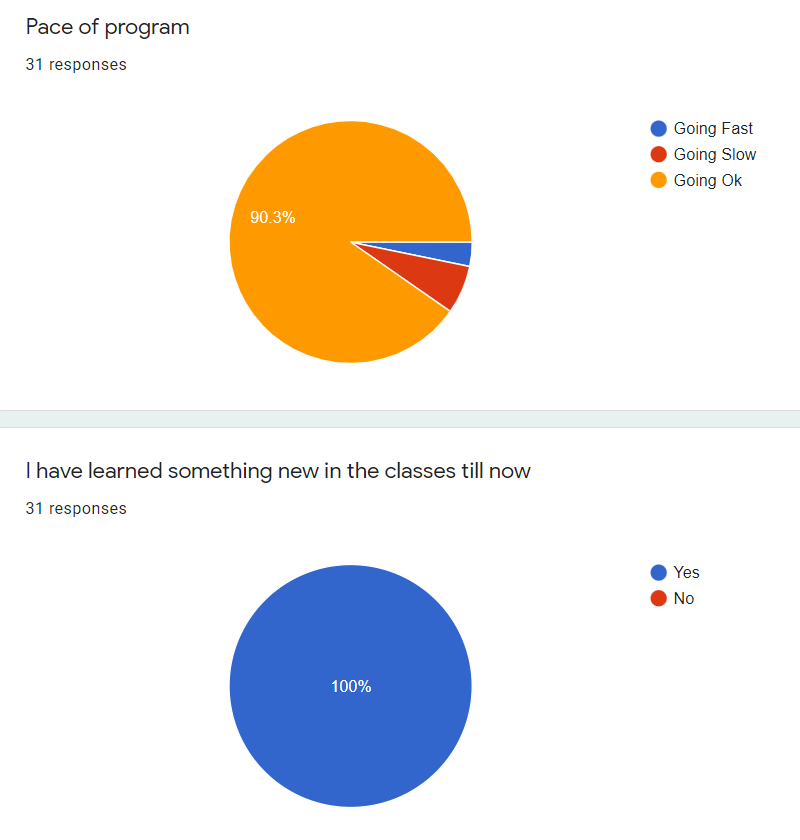

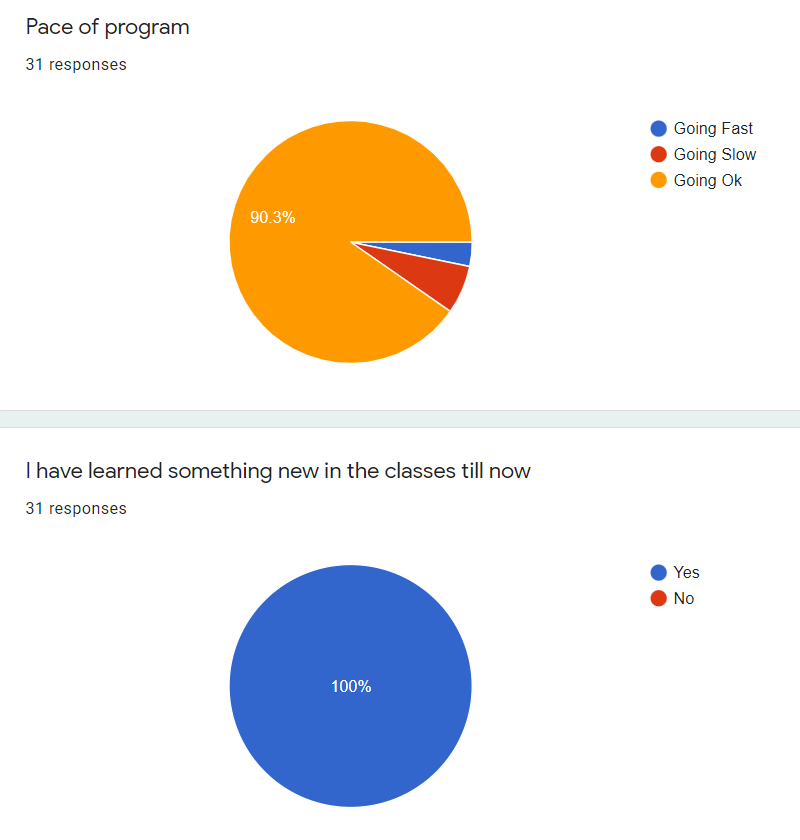

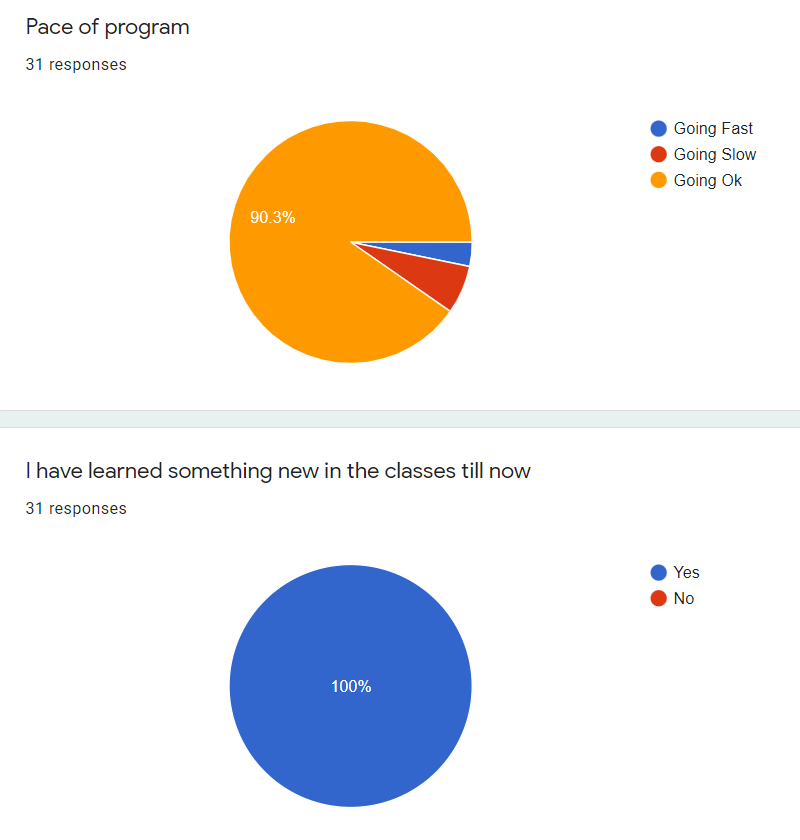

FEEDBACK By Ongoing ALPHA LEARNERS

ACT NOW for your Independence

FEEDBACK By Ongoing ALPHA LEARNERS

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer – Below Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Incorporated in 2004, Rategain Travel Technologies Ltd (RTTL) is a ‘software-as-a–service’ (SaaS) company offering distribution, marketing and revenue maximisation solutions for the hospitality and the travel industry. It is one of the leading distribution technology companies globally and the largest Software as a Service (SaaS) provider in the travel and hospitality industry in India.

Business —

It offers a suite of interconnected products that manage the revenue creation value chain for customers by leveraging big-data capabilities and integration with other technology platforms helping hospitality and travel providers acquire more guests, retain them via personalized guest experiences and seek to maximize their margins. The company serves a large and rapidly growing total addressable market.

RTTL’s mission is to be the leading revenue maximization platform for the hospitality and travel industry. It offers an integrated technology platform powered by artificial intelligence enabling customers to increase their revenue through customer acquisition, retention and wallet share expansion. COVID-19 has, however, accelerated the digitization of customer interactions with hospitality and travel companies. These changes are likely to lead to a shift by hospitality and travel companies from in-house solutions to third party software and services.

RateGain Travel delivers travel and hospitality technology solutions through the SaaS platform through 3 business units; 1. Data as a Service (DaaS), 2. Distribution, and 3. Marketing Technology (MarTech).

DaaS –It equips suppliers with data and information to increase acquisition and conversion. It offers data under two categories: Market Intelligence, which provides access to pricing and availability data at scale along with analytics to present trends, opportunities and market developments. Dynamic Pricing Recommendations, to serve certain segments with proprietary dynamic pricing technology to help maximize revenue.

For DaaS products, it operates on a subscription model where its customers in the hospitality sector subscribe to DaaS products such as Optima and Parity for a period. Its competitive intelligence products tracked points such as pricing, ratings, rankings, availability, room descriptions, cancellation policy, payment policy, discounting and package inclusions.

Distribution — It provides mission critical distribution including availability, rates, inventory and content connectivity between leading accommodation providers and their demand partners. Distribution also enables delivery of reservations back to hotel systems to ensure smooth operations and accurate reporting by hotels.

In its Distribution segment, it operates RezGain on a subscription basis where customers pay a subscription fee to access the product while DHISCO operates on a transaction model where it generates revenues from bookings done by OTAs and Global Distribution System operators

Martech — Its MarTech offering enhances brand experience to drive guest satisfaction, increase bookings and increases guest loyalty. It also manages social media for luxury travel suppliers allowing them to be responsive to social media engagements 24×7 as well as effectively manage their social media handles and run promotional campaigns

END USER INDUSTRIES — Growing industries in coming decade

Customers and Competitors–

Six Continents Hotels, Inc., an InterContinental Hotels Group Company, Kessler Collection, a luxury hotel chain, Lemon Tree Hotels Limited and Oyo Hotels and Homes Private Limited. It also counts 1,220 large and mid-size hotel chains, 110 travel partners including airlines, car rental companies and large cruise companies and over 132 distribution partners including OTAs such as GroupOn and distribution companies such as Sabre GLBL Inc., in over 110 countries as its customers

Moats —

Innovative Artificial intelligence-driven industry-relevant SaaS solution provider.

Leading distribution technology companies globally and the largest Software as a Service (SaaS) provider in the travel and hospitality industry in India.

Any other SaaS players will take time to break into this company niche market segment

Strengths

A large and rapidly growing addressable market opportunity for a vertical-specific platform kind of company

The travel technology segment is backed by industry tailwinds of digitization in the post COVID times.

Diversified clientele portfolio has helped accelerate growth and in innovating and thus retain both new and existing customers

Diversified esteemed clientele, RTTL served 1,462 customers including eight Global Fortune 500 companies till 30sep2021

Diverse and comprehensive portfolio of revenue maximization and business critical solutions

Strong financial performance with track record of successful acceleration post acquisitions

Innovative Artificial intelligence-driven industry-relevant SaaS solution provider.

Shareholding

Promoter has sufficient skin in game with holding ~67% and other prominent players holding 10% more. Bhanu Chopra is the chairman and managing director (CMD) of RTTL. He founded the company in 2004 and has been leading it since then. He was previously associated with Deloitte and he holds a BS in Business from Indiana University.

Some triggers and updates from recent press releases

Recognition in Industry with new customers

Recognition in Industry with best awards

Increase in Tourism Industry in coming years : Projections and online penetration

Getting along with Students for future

Update in H1FY24 results

Showing important traction in customers, employees increase + down in attrition and increasing contracts wins

Promoters skin in game + Other participants like FII , DII are also increasing in recent times, in Public domain, major chunk with Plutus wealth management

Cash flows, Sales, Profits all have improved in 2024

Big money from FII and DII have entered

Technicals on 27th Aug24

Badly affected by Covid-19 in terms of financials. May take time to recover fully and if more variants of Covid-19 appear, it can further delay the cause

Intensive competitive sector both at Domestic and International level. Continuous adaption is the key

Another risk could be the change in channel of distribution. Many client if develop their own software may lead to business kill for company

They have to be seen in terms of huge growth runway available with adaption to digital and highly competitive sector.

Once Covid resides, this could be the one company which gets off the block faster. So need to track on acquisitions, mergers, customers, new deals and financial improvement of company balance sheet

Your strategy can be different than mine. Your selection of company might be different than mine. So lets not be a BLIND FOLLOWER

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Likhitha Infra (approx 33 yr old company) is an Oil Gas Pipeline Infrastructure provider in India. Operations include Cross Country pipelines and associated facilities, City Gas Distribution including CNG stations, and Operation & Maintenance of CNG/PNG services.

Strong presence in more than 16 states and 2 Union Territories in India.

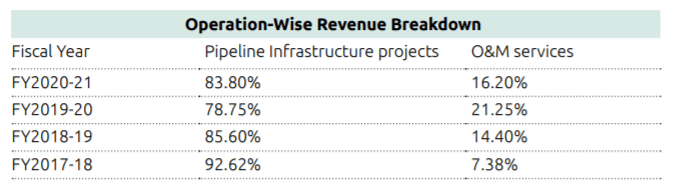

Two major domains, if we divide the operations , are Pipeline Infrastructure Projects and O&M services (Operation and Maintenance)

Revenue breakdown for the domains are highlighted below (for last 4 Financial years)

Long standing relationships with domestic marquee customers.

Efficient business model

Strong project execution capabilities

Diversified geographical presence in India

Strong Technical Qualification to bid for new projects

Strong promoter holding showing skin in game

Good ROCE, stable and improving PAT margins and EBITDA

Highly experienced Management Team

CGD is increasing in India and company is at right place for its business to grow with Strong client base and on top of that company has Strong Technical Qualification to bid for new projects which is visible in orders won recently

Company has received orders worth Rs. 250 Crores (approx.) excluding GST from various City Gas Distribution Companies during the

quarter from October 2021 to December 2021.

Till Aug. 2021 company has an outstanding order book of 1020 cr giving good revenue visibility. In Oct-Dec 2021 , company received 250cr of additional orders

As per the recent Government policies, PNGRB has increased the number of Geographical Areas (GAs) to 228 comprising of 402 districts spread over 27 States and Union Territories, covering 70% of Indian population and 53% of its area. These recent Government initiatives have provided lucrative opportunities for Oil & Gas infrastructure service providers

Recent policy moves, including a wide-scale rollout of CNG and the expansion of gas infrastructure including LNG terminals, long-distance transmission pipelines and city gas distribution networks, will help drive 30bnm³ of gas demand growth over the next decade through fuel switching away from coal and oil. A recent switch to CNG from coal in India’s brick industry is encouraging greater gas use.

Exit Triggers

Order chain drying up in coming quarters

Unforeseeable change in Government policies

Declining margins and increasing debtors or working capital cycle days

Risks

Any change in CGD policy

Much faster penetration of EV in coming 2-3 years

Rising raw material and commodity costs

The Company is deriving significant portion of orders from major Oil & Gas distribution companies inducing a client concentration risk

Vishnu Chemicals Limited is a market leader in manufacturing and sales of Chromium chemicals and Barium compounds across the world

Serving 12+ industries across 50+ countries (83 countries as per publicly available information)

~85% revenues (FY21) , Leading manufacturer in India as well as South Asia,

FY21 Domestic: Export Sales Mix: 51:49 , 3 manufacturing units

Over the last few fears, the company has diversified its Chromium revenue profile with presence in both domestic and export markets. Earlier the portfolio was concentrated in chromium, domestic oriented and now diversified and balanced geographically in domestic and export markets

Applications –> Pharmaceuticals, Leather tanning, Pigments and Dyes, Plastic masterbatches, Ceramic glazes, tiles, Electroplating, Automotives, Refractories, Wood Preservative, Paper pulping and others.

~15% revenues (FY21), Leading manufacturer in India, FY21 Domestic: Export Sales Mix: 45:55 ,1 manufacturing unit.

Applications –> Ceramics, tiles, glazes, bricks, refractories and water purification chemical in caustic soda industry, speciality glass, Luminescent Compounds, etc.

Long standing relationships with domestic and overseas marquee customers.

Well diversified board with specialists in field

Certifications — ISO 9001:2015 , ISO 14001:2008, REACH Quality Certification

Income, EBITDA, PAT, PAT Margin improving

D/E is high but decreasing as desired

Ability to pass the rise in input prices and freight costs.

Operating leverage: Most of the overheads or manpower addition are largely done considering FY21 as a base.

Higher utilizations from existing capacity: Major debottlenecking completed in Vizag unit in FY21 will lead to better throughput & efficiency

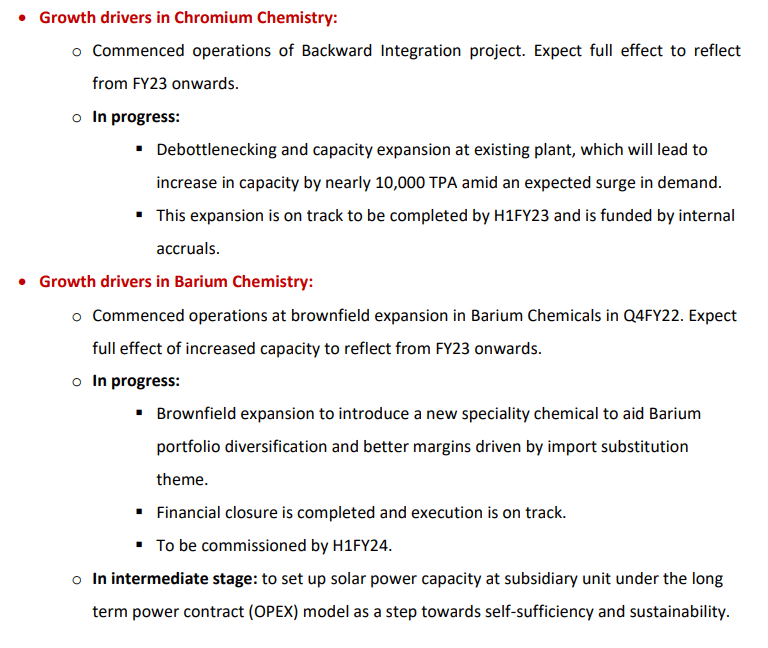

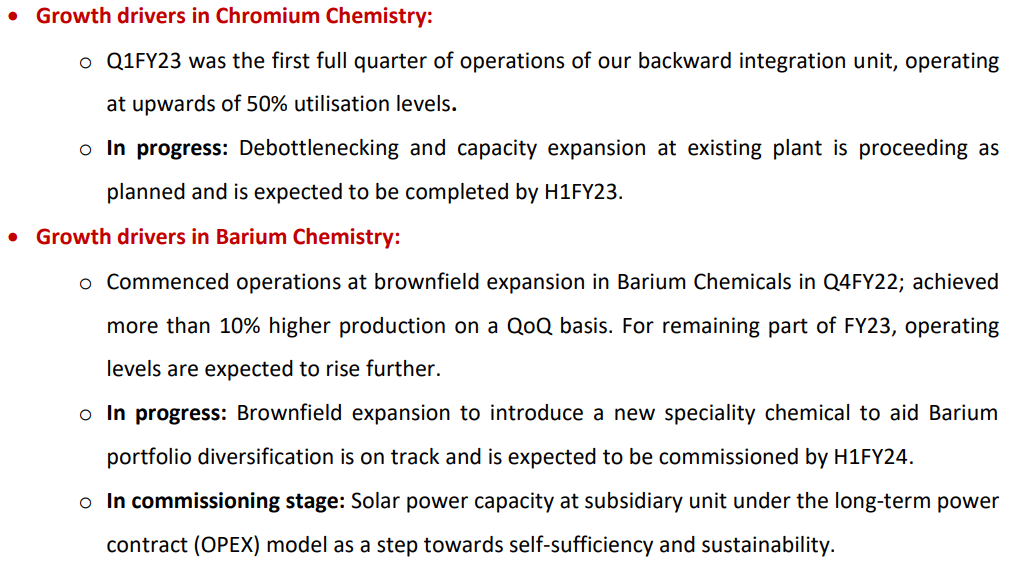

Majority of the capital expenditure towards sodium carbonate in Chromium chemicals is completed, Majority of company’s sodium carbonate’s current requirement will be met through the process. Significant cost reduction expected from upon being operational by Q4FY22E.

Focus is to increase market share with higher volumes in Barium chemicals

Leading manufacturer in India for Barium Chemical : Other players have less than 1/10th of Vishnu’s current capacity.

Incremental capacity of 20,000 TPA of Barium Carbonate expected to be operational by Q4FY22E

China plus 1 strategy has made them a preferred vendor instead of being a second option for their customers.

Exit Triggers

Crash in finished products prices or inability to pass on raw material in coming quarters

Any change in China +1 strategy for customers

Less than expected utilization of incremental capacity

Risks

Debt profile is still out of comfort zone

ROCE and PAT Margin still not as much as desired

Any Exports oriented issues including currency risk, freights costs

Significant promoter pledge of 40%

Any delay in operations of underway capacity expansion

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

Accumulation Distribution session

3-4 months of teaching and mentoring

Can be extended based on queries, case studies1-2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS NEW YEAR 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 1st Jan 2022

ACT NOW for your Independence

FEEDBACK By Ongoing ALPHA LEARNERS

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Tega Industries IPO — Established in 1976, Tega Industries is a leading manufacturer and distributor of specialized, critical, and recurring consumable products for the global mineral beneficiation, mining, and bulk solids handling industry.

Business and Key areas of Operation -Tega industries are the second largest producers of polymer-based mill liners. The company offers a wide product portfolio of specialized abrasion and wear-resistant rubber, polyurethane, steel, and ceramic-based lining components used by their customers across different stages of mining and mineral processing, screening, grinding, and material handling. The company’s product portfolio comprises more than 55 mineral processing and material handling products.

The company has 6 manufacturing sites, including 3 in India, and 3 sites in major mining hubs of Chile, South Africa, and Australia. Majority of the company’s revenue (86.42% in 2021) comes from operations outside India. The company has 18 global and 14 domestic sales offices located close to its key customers and mining sites.

Offer purpose — The issue consists of a offer for sale of 619 Cr.

Risks —

Entire money is offer for sale, Company will not have any access to money raised

Strength

One of the world’s largest producers of polymer-based mill liners

Products cater to after-market spends providing recurring revenues

In-house R&D and manufacturing capabilities and a strong focus on quality control

Global customer base, and strong global manufacturing and sales capabilities

Consistent market growth and operational efficiency

Experienced management team supported by a large, and diversified workforce

Future

Tega Industries are further expanding their operations in major markets including North America, South America, Australia, and South Africa.

Valuations

Valuations are on higher side as expected in bull market

Should we apply?

For medium to long term, prospects looks ok

Wait for listing to buy

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Star Health IPO — Incorporated in 2006, Star Health and Allied Insurance Company Ltd is one of the largest private health insurers in India with a market share of 15.8% in Fiscal 2021.

Business and Key areas of Operation – The company primarily focuses on the retail health and group health segments which accounted for 89.3% and 10.7% of the company’s total GWP in Fiscal 2021 respectively. The company mainly distributes policies through individual agents and also includes corporate agent banks and other corporate agents. As of Sep 31, 2021, its network distribution includes 779 health insurance branches across 25 states and 5 union territories in India. Star Health has also built one of the largest health insurance hospital networks in India with more than 11,778 hospitals.

Offer purpose — The issue consists of a fresh equity issue of 2000 Cr and offer for sale of 5250 Cr. Offer is to augment its capital base

Risks —

In Short term , Increasing Covid-19 is a major risk. In Long term, any such major disease can be a risk

Strength

Largest private health insurance company in India with leadership in the attractive retail health segment.

Largest network distribution in the health insurance industry.

Diversified product suite with a focus on innovation and specialized products.

Strong risk management with superior claims ratio and quality customer services.

Demonstrated track record of operating and financial performance.

Future

Company is working in an underpenetrated but highly competitive sector

Valuations

Valuations are pricey, better options in secondary market

Should we apply?

For medium to long term, prospects looks ok

Wait for listing to buy at discount to IPO price

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

DMR Hydro SME IPO Business — DMR is engaged in providing engineering consultancy and due diligence services to hydropower, dams, roads, and railway tunnels. The services offered by the company include the entire life cycle of projects covering design & engineering, due diligence & regulatory, bid management & construction engineering, and quality & inspection

Key areas of Operation -Company has been working into renewables, water resources, mining, and urban infrastructure domains. The company has a presence across 11 states in India. Internationally the company provides services to over 5 countries including Nepal, Nigeria, Dubai, Germany, and Senegal.

Offer purpose — The issue consists of a fresh equity issue of 798000 shares and offer for sale of 198000 shares. Offer is to Fund working capital requirements and General corporate purposes

Risks —

SME company so liquidity risk is a major risk

The company is operating in a highly competitive and fragmented segment. There are many big players as well

Strength

Presence in both domestic and international markets

A wide offering of engineering consultancy and due diligence services

Experienced management and dedicated employee base

Catering to diversified sectors

Accredited with various quality certificates

Future

Company is working on areas for consultancy which are kind of good for future. Sustainability of margins could be thing to look for

Valuations

Valuations are reasonable looking at future. In short term, Price looks at par

Should we apply?

For medium to long term, prospects looks ok

People having risk apetite and long term vision can apply if they can held this stock patiently as liquidity can be low after listing

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

GoColors IPO– Incorporated in 2010, Go Fashion (India) Limited is one of the largest women’s bottom-wear brands in India.

Business — The company is engaged in the development, design, sourcing, marketing, and retailing of a range of women’s bottom-wear products under the brand, ‘Go Colors’. The company offers one of the widest portfolios of bottom-wear products among women’s apparel retailers in terms of colors and styles.

Way of Operation – Company has 450 exclusive brand outlets (EBOs) that are spread across 23 states and union territories in India. The company’s distribution channels include large format stores (LFSs) including Reliance Retail Limited, Central, Unlimited, Globus Stores Private Limited, and Spencer’s Retail among others. The company’s LFSs have grown from 925 LFSs in 2019 to 1,332 LFSs in May 2021. The company also sells its products through its website, online marketplaces, and multi-brand outlets (MBOs).

Offer purpose — To part finance its plans for funding roll out of 120 new EBOs (Rs. 33.73 cr.), working capital (Rs. 61.40 cr.) and general corporate purpose, IPO has planned by company

Risks —

Highly competitive business

Third party contracts is a risk

Strength

One of the largest women’s bottom-wear brands in India

Wide, well-diversified, product portfolio and first-mover advantage

Multi-channel retail presence across India

Strong unit economics with an efficient operating model

Extensive procurement base and automated procurement & supply chain

In-house expertise in developing and designing products

Strong financial performance record

Future

Company is a pure long term story considering an expansion plan to increase outlets from 450+ to 2000+ in the coming five to six years plus its association with large format stores will bode well. Third party contracts may remain a risk

Valuations

Valuations are dicey as last two years Covid-19 plays havoc, though company was growing

Should we apply?

One can avoid and wait for company to perform and come back in positive territory

Risk takers can apply for listing gains(if any)

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

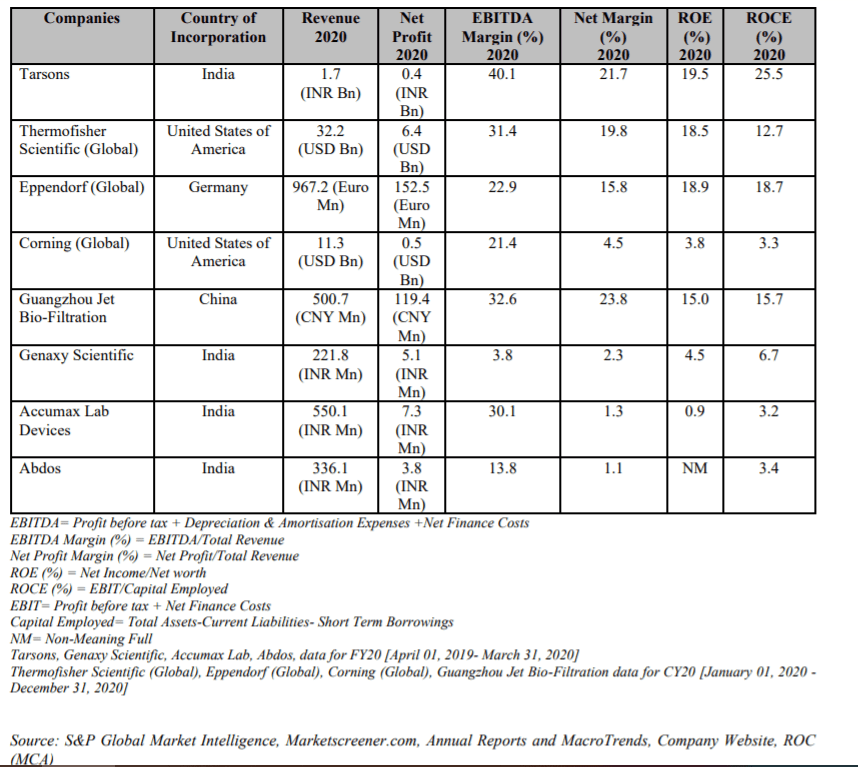

Tarsons Products IPO– Tarsons Products Limited is a leading Indian life sciences company with more than three decades of experience in the production and supply of labware products.

Business — The company manufactures a range of quality labware products that helps advance scientific discovery and improve healthcare systems. The company’s product portfolio is classified into three broad categories including consumables, reusables. These Products are used in various laboratories across research organizations, academic institutes, pharmaceutical companies, Contract Research Organizations (CRO), diagnostic companies, and hospitals.

Region of Operation -Company has 5 manufacturing facilities located in West Bengal spread across approximately 20,000 sq. mts of area. The company has a strong distribution network across India comprising of over 141 authorized distributors as of March 31, 2021 and supplies its products to more than 40 countries.

Also READ : NYKAA IPO : SUBSCRIBE OR NOT

Offer purpose — The IPO comprises a fresh issue of equity shares up to ₹150 crore and an offer for sale (OFS) of ₹850 crore by existing shareholders and promoters. Company is planning to use IPO for Repayment/prepayment of all or certain of company’s borrowings; Funding a part of the capital expenditure for new manufacturing facility at Panchla, West Bengal (proposed expansion) and General corporate purposes

Risks —

High Import dependency

Competition with MNC players

Environmental concern on Plastics

Regional concentration of plants

Strength

Leading supplier of life sciences products

Extensive product offering

Large addressable market of life sciences industry

Well-equipped and automated manufacturing facilities

Strong sales and distribution network

Experienced Promoter backed by a strong management team

Future

Company is vertically integrated and equipped with automated support systems that help the company in maintaining quality, increasing productivity, and reducing costs. Its key manufacturing facilities are ISO 9001:2015 and ISO 13485:2016/NS-EN ISO 13485:2016 certified. Company is poised for bright prospects ahead. It is expanding to meet the rising demand for its products.

Valuations

Valuations are reasonable looking at future. In short term, Price looks expensive

Should we apply?

For medium to long term, prospects looks bright with good set of customers and looking at no listed peers, may be advantage to subscribe

One must apply if they can held this stock patiently and not looking for immediate returns

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Sapphire foods IPO-Sapphire Foods India is YUM brand’s largest franchise operator in the Indian subcontinent in terms of revenue as of FY’20. It is also Sri Lanka’s largest international QSR chain in terms of revenue for FY’ 2021 and the number of restaurants operated as of March 31, 2021. .

Business — Company owned and operated 204 KFC restaurants in India and the Maldives, 231 Pizza Hut restaurants in India, Sri Lanka and the Maldives, and 2 Taco Bell restaurants in Sri Lanka.The company has an in-house supply chain function and works with vendor partners for food ingredients, packaging, warehousing, and logistics. The company operates warehouses across 5 Indian cities and has invested in building technology solutions in their restaurants. The company operates its restaurants at high traffic and high visibility locations in key metropolitan areas and cities across India and develop new restaurants in new cities as part of its expansion strategy.

Region of Operation -It serves clients in India and Srilanka with KFC, Pizza hut and Taco bell outlets

Offer purpose — The IPO comprises a complete offer for sale of 2000 cr. Proceeds will not go company

Risks —

Decreasing revenues from same stores

Operating losses continuing

High competition

Strength

One of India’s largest restaurant franchisee operators and Sri Lanka’s largest international QSR chain

YUM’s largest franchise operator in the Indian subcontinent in terms of revenue

Focus on delivering excellent customer experience

Quality control and operational excellence

Scalable business model

Experienced management team with robust corporate governance practices.

Future

Company has been working to reduce costs on multiple fronts like store size etc which is yet to show up in financials. Similarly Increasing delivery revenues and opening new stores, driving same store sales growth is a work in progress. Model is scalable and with demographic advantage, it should be able to sustain and turnaround over a long period

Valuations

Valuations are comparable to peers and lower wrt some peers in this bull marlet. Looking in isolation, valuations are not attractive though

Should we apply?

Long term investors need to wait and watch company progress before investing.

Risk takers can apply for IPO and exit on listing gains if any

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

One97 Communications IPO– Incorporated in 2000, One 97 Communications Ltd is India’s leading digital ecosystem for consumers as well as merchants. As of March 31, 2021, the company has a 333 million+ client base and 21 million+ registered merchants to whom it offers payment services, financial services, and commerce and cloud services

Business — The company offers an entire digital ecosystem for its customers and merchants –ranging from payment services (money transfers, in-store payments, recharge, and bill payments), and financial services (digital banking including FASTag, PayTM Wallet and deposit accounts, loan or BNPL referral, wealth management and insurance). Generating revenue in the form of transaction fee, consumer convenience fee, and recurring subscription fee (from merchants), payment services comprises 62 per cent of the company’s consolidated revenues in FY21 and 4 per cent comes from cross selling financial services

Also READ : Latent View IPO : SUBSCRIBE OR NOT

Offer purpose —

Risks —

Revenue scalability is the biggest risk as the RBI has restricted the transaction fees and commissions on various payment services to less than 1 percent. Already revenue drop is happening compared to last few years

Lot of uncertainty in digital share with lot of big players also joining the league ( like google, whatsapp etc)

Over diversified –Kind of deworsefication by company–not a clear path which will bring profit

Strength

India’s leading digital payment service platform.

Strong brand identity with a brand value of US$6.3 billion.

Large customer base with 333 million total customers, 114 million annual transacting users, and 21 million registered merchants.

Paytm Super-app to access a wide range of digital payment services over mobile phones.

Future

Company has been into multiple segments and can grow with digital payments and PayTM payments bank, MF business as well. But due to this scattered approach, no clear visibility which path company is taking. Road is long and uncertain.

Valuations

Valuations are extremely high, Founder skin in the game is really low

Should we apply?

AVOID

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Latent view IPO– Latent view is incorporated in 2006, Company provides services ranging from data analytics consulting to business analytics and insights, advanced predictive analytics, data engineering and digital solutions to companies in technology, BFSI, CPG and retail, industrials and other industries.

Business — Four Major domains -> (i) Consulting services (ii) Data engineering (iii) Business analytics (iv) Digital solutions

Region of Operation -It serves clients across the US, Europe, and Asia through its subsidiaries in the US, Netherlands, Germany, UK and Singapore.

Also READ : NYKAA IPO : SUBSCRIBE OR NOT

Offer purpose — The IPO comprises a fresh issue of equity shares up to ₹474 crore and an offer for sale (OFS) of ₹126 crore by existing shareholders and promoters. Company plans to use about ₹148 crore to fund inorganic growth initiatives, ₹130 crore for investment in subsidiaries and the remaining to fund working capital and general corporate purposes.

Risks —

Client Concentration

Regional Concentration

Technology disruption Risk

Strength

Future

Company has created a niche place in data analytics services globally and It caters to Fortune 500 companies with long term relationships and it is also able to maintain healthy margins on its contracts

Valuations

Valuations are high

Should we apply?

Looks almost priced in at IPO price but for medium to long term, prospects looks bright.

One can apply if can held this stock patiently and not looking for immediate returns

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

SJS enterprises IPO –SJS is one of the leading players in the Indian decorative aesthetics industry. The company is a ‘design-to-delivery’ aesthetics solutions provider with a diverse product offering for the automotive and consumer appliance industries.

Business — The company’s product offerings include – decals and body graphics, 2D appliques and dials, 3D appliques and dials, 3D lux badges, domes, overlays, aluminum badges, in-mold labels, or decoration parts, lens mask assembly, and chrome-plated printed, and painted injection moulded plastic parts. The company’s subsidiary, Exotech, caters to requirements in the two-wheelers, passenger vehicles, consumer durables/appliances, farm equipment, and sanitary ware industries for chrome-plated, printed, and painted injection moulded plastic parts.

Offer purpose —

An offer for sale of Rs. 800 cr from existing promoters and stakeholders

Risks —

Massive dilution in IPO as offer of sale does not bode well

Maximum revenue coming from few client posing concentration risk

Short term revenue and profit risk is there

Strength

Leading decorative aesthetics supplier with a wide portfolio of premium products

Strong manufacturing capabilities and established supply chain network

Innovative product designing capabilities

A strong relationship with global Tier-1 companies

Strong financials

Experienced and qualified management team

Future

SJS is a leading player in the Indian decorative aesthetics industry and scope of growth is there.

Valuations

The issue looks fully priced discounting all near term positives

Should we apply?

Avoid and wait for results for next 2-3 qtrs to see if company is able to perform as anticipated

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

PB Fintech IPO– PB Fintech is India’s leading online platform for insurance and lending products. The company provides convenient access to insurance, credit, and other financial products

Business — Policybazaar is an online platform for consumers and insurer partners to buy and sell insurance products. 51 insurer partners offered over 340 term, health, motor, home, and travel insurance products on the policy bazaar platform, as of March 2021. Policybazaar offers its users with i) pre-purchase research, ii) purchase, including application, inspection, medical check-up, and payment; and iii) post-purchase policy management, including claims facilitation, renewals, cancellations, and refunds. The company has partnered with 54 large banks, NBFCs, and fintech lenders offering a wide choice of products to consumers across personal credit categories, including personal loans, business loans, credit cards, home loans, and loans against property.

Also READ : NYKAA IPO : SUBSCRIBE OR NOT

Offer purpose —

Risks —

Till date the company has been posting negative earnings and can continue to do so in near term

Strength

Providing a wide choice and transparency to customers to research and select insurance and personal credit products.

Proprietary Technology helps in superior data intelligence and customer service.

Collaborative partnership with various companies for insurance and lending products.

Strong network effects for Policybazaar and Paisabazaar platforms.

High renewal rates.

Capital efficient model with low operating costs.

Experienced Founders and management.

Future

PBFL has two verticals of online business i.e. Policybazaar and Paisabazaar. With its novel technology-based initiatives, it has created a niche place. With network effects, company has a good scope to scale its business

Valuations

Valuations are really high and no listed peers to compare with as well

Should we apply?

Risk takers can put in IPO and exit with listing gains if any. Wait for significant dip to enter for long term as long term prospects are bright

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

FSN E-commerce Ventures (Nykaa) IPO –Incorporated in 2012, FSN E-commerce Ventures, the parent company of Nykaa, is a native consumer-technology company involved in selling beauty, wellness, personal-care and fashion products

Business — FSNEV has a diverse portfolio of beauty, personal care and fashion products, including owned brand products manufactured by it. As a result, the company has been established not only as a lifestyle retail platform but also as a consumer brand. It offers consumers an Omnichannel experience with an endeavour to cater to the consumers’ preferences and convenience.

Offer purpose —

Fresh equity issue worth Rs. 630.00 cr. and an offer for sale of Rs. 5351.92 cr,To meet its requirements of funds for investment in subsidiaries (Rs. 42.00 cr.), capital expenditure (Rs. 42.00 cr.), repayment/prepayment of certain borrowings (Rs. 156.00 cr.), brand visibility and awareness (Rs. 234.00 cr.) and general corporate purpose

Risks —

High competitive landscape and on top of that unorganised market also poses a challenge

Maximum revenue coming from few client posing concentration risk

Any negative publicity in today digital marketing can have significant impact on company revenues

Strength

Association with National and international brands

Omnichannel presence

India’s leading beauty and personal-care companies in the organised space and enjoys strong brand awareness

Strong supply-chain capabilities with around 20 warehouses throughout the country

Stringly technological driven business

Future

The company has a relatively asset-light business. With significant spending on marketing to attract new consumers and subsidiaries to open new retail stores, it will be able to scale up its business.

Valuations

Valuations are really astronomical and looks like promoters encashing the bull market leaving little on table

Should we apply?

One can avoid and wait for significant dip to enter. Long term story remains intact

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Fino Payments Bank IPO– incorporated in 2007 and it offers a diverse range of financial products and services that are primarily digital and have a payments focus. The company is a fully-owned subsidiary of Fino Paytech. It is backed by investors like Blackstone, ICICI Group, Bharat Petroleum and International Finance Corporation (IFC).

Business — The company has a pan-India distribution network and its’ major products and services includes:

• Current accounts and Savings accounts (CASA),

• Issuance of debit card and related transactions,

• Facilitating domestic remittances,

• Open banking functionality (through their Application Programming Interface),

• Withdrawing and depositing cash (via micro-ATM or Aadhaar Enabled Payment System (AePS) and

• Cash Management Services (CMS).

The company’s merchants facilitate them in cross-selling their other financial products and services such as third-party gold loans, insurance, bill payments and recharges. Fino Payments also manages a large BC (Business Correspondents) network on behalf of other banks.

Also READ : NYKAA IPO : SUBSCRIBE OR NOT

Offer purpose —

300 cr of fresh equity and 900 cr of offer for sale of existing shares. Augmenting Bank’s Tier – 1 capital base to meet its future capital requirements.

Risks —

High competitive landscape

Payments banks cannot undertake lending activities restricting their growth, They can accept only savings and current deposits. The aggregate limit per customer is Rs 2,00,000. They are required to have a minimum of 25 per cent of their physical access points in rural areas.

Geographical concentration also poses a risk

Strength

Unique DTP (Distribution, Technology, Partnership) network helps in better customer servicing

Focus on technology development and in-house technological expertise

Customer centric and innovative business model

Highly experienced management team

Vision of socially inclusiveness and empowerment

High market share in the Micro-ATM segment

Future

The bank’s unique DTP (distribution, technology and partnership) framework, technological expertise and merchant-led distribution model enable it to reach a vast number of customers in under-penetrated markets while keeping its costs low.

Valuations

Valuations are really high and looking at growth prospects , it will take time for valuations to become reasonable

Should we apply?

One can avoid and wait for significant dip to enter. Also keep in mind better choices available in market for investment

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Also read : Invest in Stock market IF

We can broadly classify investors today in three kinds only

Most of the investors I talk are fearful of immediate correction in market, though they have not exited the market yet to cash positions. Some of them are confident after making money in last one year. Even the so called new breed of investors are also 1 year old in markets and calling themselves experienced now who have seen volatilities, and buying every dip. Time will tell who will be the Last Standing Man

So as you are reading this article, did you notice where do you belong? If you feel you are outside the purview of these three kinds, you have two choices. 1. Align to one of the view 2. Send me with your classification!

Congratulations, if you are able to see yourself amongst one of the three kinds mentioned above

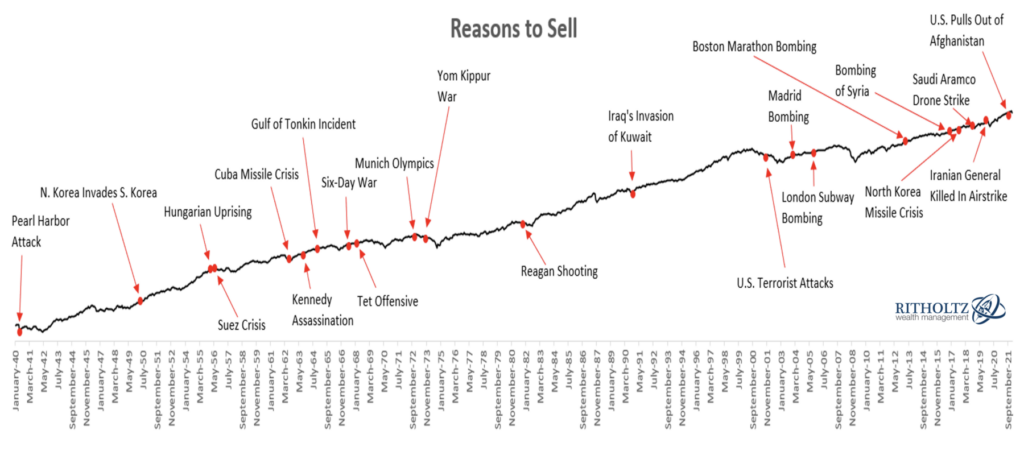

Question still remains same for everyone : What to do now? Should we buy, sell or keep holding? What’s next : Is it bull market or is crash near?

Let’s read further to understand more about it and see what strategies people can adopt

This strategy is for people who

OR

You are able to foresee with your experience drastic correction coming. It may be due to Evergrande default or US debt or may be some other reason

Advantage with these strategy is you may not lose capital if market goes down and may get a chance to re-enter at lower levels. Problem with this strategy is it is impossible for anyone to predict whether market has topped out or not. Will Market go further up and can give you a bigger chance to cash out? Will market come down and give you a chance to enter at lower levels. Nobody knows. Get away from people if they claim to know.

It is always better to cash out if our goals are near or we have debt to pay because when correction happens, it will not give you a chance to exit at your desired levels

This strategy although seems good but it can be painful as markets may remain irrational longer than you remaining rational and you might keep on getting the itch to enter again.

So be careful of this approach and you have to be sure when you should re-enter.

I will strongly advised against this

Problem with this strategy is most of us will be invested in 40-50 stocks on tips from random sources and keeping most of the stocks which are in loss. So if market correction happens, we will not be having enough money to average down all stocks.

In case, you have idle money and have a itch to invest at these levels, in such cases adopt a simple strategy

Correct portfolio allocation and conviction in the chosen stocks is a must for investing at these levels.

This strategy is for people

Under this strategy, adopt the simple course of action

This strategy is for people

What I am doing in this market? My answer is Case 3 ( changed from Case 4 earlier this year)

So that effectively means

I am putting money into the market from so many booked positions in last few months and adding new positions

I am selling my existing less convincing or loss making positions

I am not waiting for correction in market as i have sufficient liquidity available

I am re-organizing my portfolio for next cycle of market

I am happy to ride with my invested convincing positions

Overall, what I learnt from markets in my journey is very simple and easy to follow :

You can’t be 100% invested in market

You can’t be 100% sold out from market.

Will correction happen–Few events like US Debt, Tapering of interest rates, China India talks failure, China Power crisis, India Power crisis can dampen the spirit much faster than anticipated. So yes, quite a few things are bad, China power crisis is biggest of them. Any correction will be fast and furious. Be ready to see 30-40% erosion of capital seen on Screen today.

Are things all bad — On other hand there is good results anticipated for Q2FY22 both QoQ and YoY in many companies. Bigger population has been been vaccinated either partially or fully so effectively third wave is ruled out for few more weeks. Currently many things looking positive. Be it exports, be it festive demand in many sectors. Nifty has made new highs and can go further up. In short term upside seems limited though if everything falls in place, 21K on Nifty cant be ruled out within 7-9 Months (Jun-Jul2022)

Whatever strategy finally you adopt. don’t be a blind follower

Read more on Blind follower here

Wishing you all the best and lots of luck

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

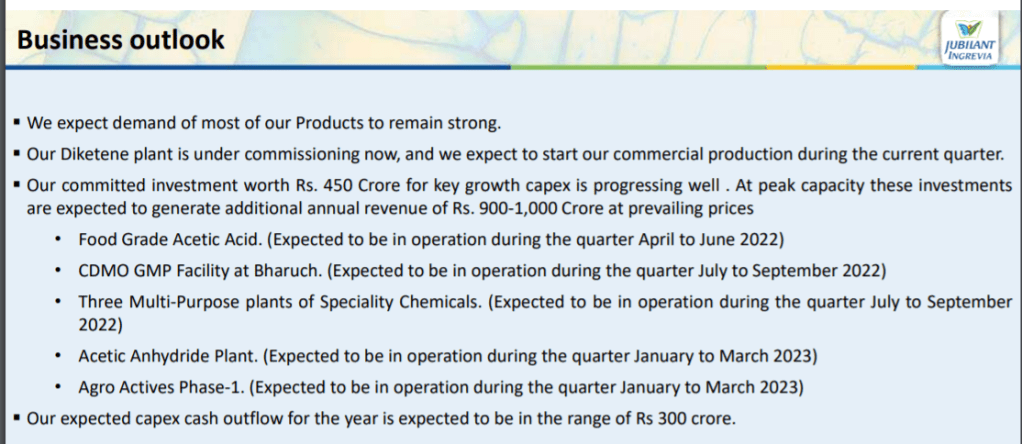

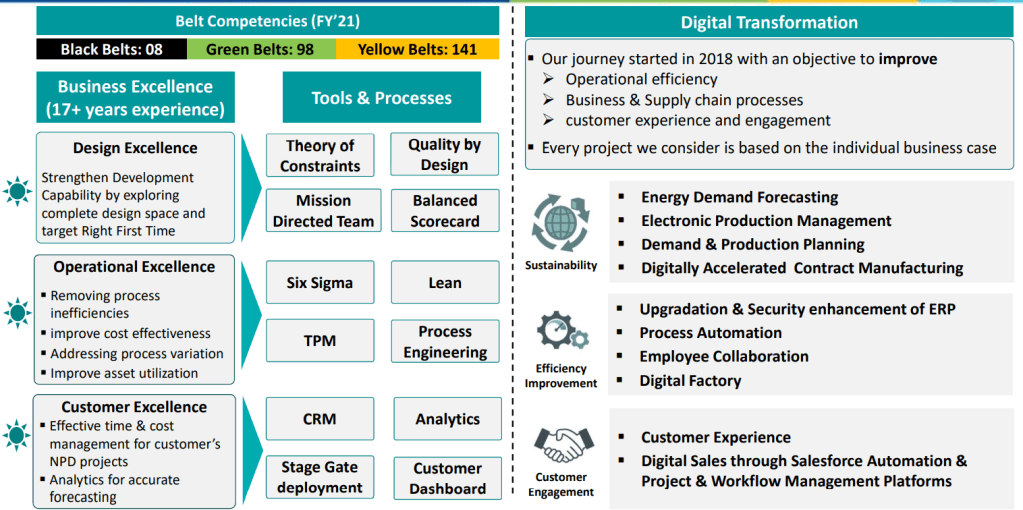

Jubilant Ingrevia Ltd (JVL) houses the Specialty Chemicals, Nutrition & Health Solutions, and Life Science Chemicals businesses, which have been demerged from Jubilant Pharmova Ltd (erstwhile Jubilant Life Sciences Ltd)

It has a Strong presence in diverse sectors and its vertically integrated and due to this , it is Globally Lowest cost producers for most products.

Multi Location Manufacturing & Operation Excellence is achieved by company over the years

Leadership team has an average 30 years of industry experience

Company has expertise in 35 technological platforms at large commercial scale and

Company also has an expertise to handle multistep chemistry (up to 13 steps) at large scale.

Three major segments of Speciality chemicals, Nutrition and Health solutions and Life sciences chemicals

As shared from Company presentation 25% of Life sciences chemicals are consumed in house by specialty chemicals segment while for Nutrition and health solutions segment (vitamin B3, 100% in house sourcing done from Speciality chemicals)

Financial Highlights– RoE, RoCE stood at 15%+, EBITDA grew by 53% YoY while revenue from all segments growing well

Growth triggers

Company is planning to invest 900 cr (550 cr,100cr, 250 cr in different segments by FY24) and expecting 2x revenue in ~5 years

Multiple products in different segments are in pipeline to be launched in coming years

There is a strong demand for Acetic Anhydride and there is no new facility addition announcement globally in the recent past. Company’s customers are exploring to shift from high cost to low-cost countries. They are adding another Acetic Anhydride facility to increase capacity by ~35% by investing ₹250cr over next 3 years.

Co is planning to increase focus to leverage its long standing relationship with innovator pharma & agro-chemicals companies to expand its CDMO operation.

Company is also moving up the value chain in most of their product segments

In the process of launching its diketene (highly complex due to high temperature cracking and storage hazards) and its value added derivatives.

Risks

Raw Materials Prices: Key raw material for life sciences biz is acetic acid. Hence, dependent on the prices of Acetic Acid(Very volatile).

Large capex in next few years: he funding of this 900cr capex will largely from internal accruals. But if for some reason this capex is not completed on time or need more debt then it may affect profits in coming years

Exit Strategy

Acetic acid Raw material prices hurting company growth or

Any ban on application of its pyridine and similar substances by other countries can hurt the company growth

In such cases , its better to exit and have a relook on invested amount

Current Market price of 760 Rs, Company looks optically expensive for investment but looking at big picture if it sustains 10.5 eps for next 3 quarters giving 42 eps for FY22 , stock price looks to have decent upside available

Update on Q2FY22 by Company on business outlook

Update on Q3FY22 by Company on business outlook

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run

Fundamental Quantitative concepts to substantiate what we have seen qualitatively

Necessary Technical aspect to make our entry and exit better in stocks

Resources to analyze faster to analyze more companies faster

Big money moves aspect to understand where money is moving

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary and derivatives market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

a SURPISE session

3 months of teaching and mentoring

Can be extended based on queries, case studies2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

12 Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the program

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS INDEPENDENCE MONTH be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 30th Sep 2021

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

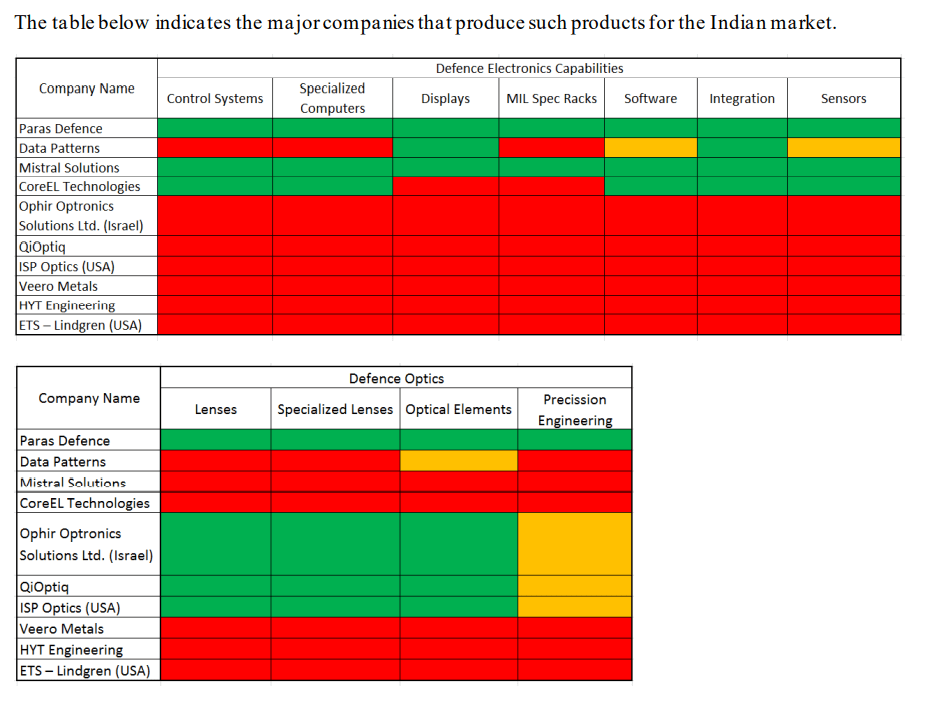

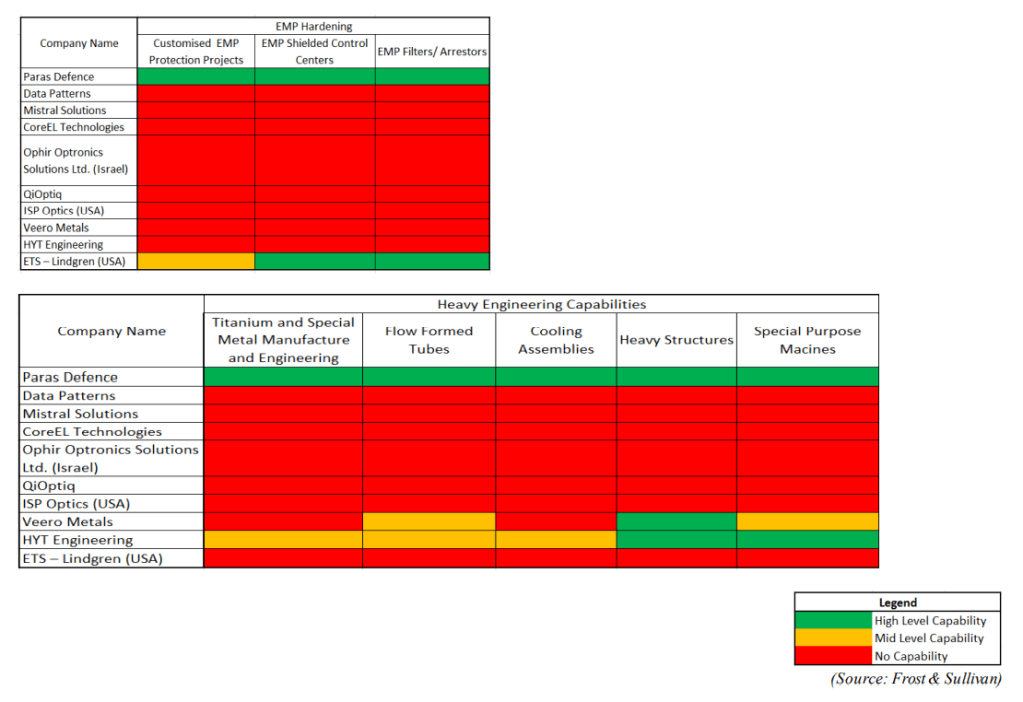

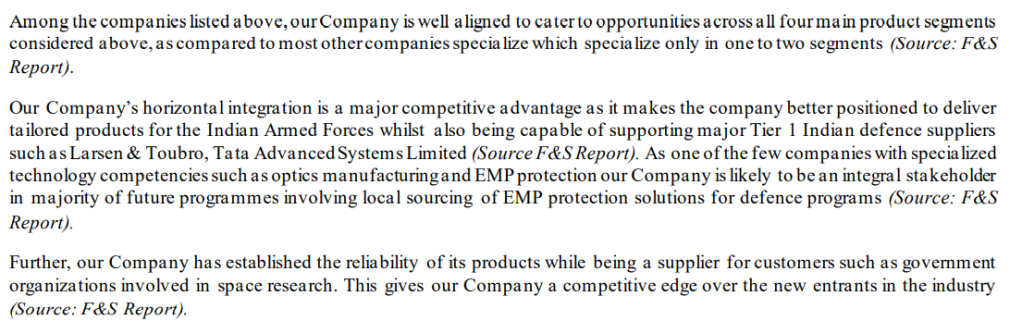

Paras Defence IPO– Incorporated in 2009, Paras Defence is an Indian private sector company engaged in designing, developing, manufacturing and testing of a wide range of defence and space engineering products and solutions.

Business — It is one of the leading ‘Indigenously Designed Developed and Manufactured’(IDDM) category private sector companies in India, which caters to four major segments of Indian defence sector i.e. defence and space optics, defence electronics, electro-magnetic pulse (“EMP”) protection solution and heavy engineering. It is also the sole Indian supplier of critical imaging components such as large size optics and diffractive gratings for space applications

Region of operation –Company caters to India 83% revenue and have 17% exports revenue

Offer purpose —

Purchase of machinery and equipment’s: It has placed orders for ₹6.7 crore for the purchase of new and upgraded machineries, it is yet to place orders for ₹27.9 crore, Funding incremental working capital requirements of the company and Repayment or prepayment of all or a portion of certain borrowings/ outstanding loan facilities availed by the company

Risks —

High concentration of revenues from Goverment contracts

Cost overruns is common in fixed contracts (may lead to losses)

Technology risks

Various ongoing court cases may lead to penalty

Strength

Wide range of products and solutions offerings for defence and space applications.

One of the few manufacturers of optics for space and defence application in India.

Companies offerings are aligned with the “Atmanirbhar Bharat” and “Make in India” initiatives by the government.

Strong R&D capabilities with a focus on innovation.

Strong customer relationship with government arms and government organizations.

Strong experienced management.

Future

They are currently developing several new products, such as hyper spectral space camera, ARINC-818 based avionic display and naval periscopes,

and multi and hyper spectral cameras for drones and space, Unmanned Aerial Vehicles, cubesats and anti-drone systems. Looking at horizantal integration, prospects look bright if unfolded as looking currently

Valuations

Valuations are pricey

Should we apply?

People with high risk apetite can subscribe for long term only

Add more if it dips below issue price keeping long term horizon mindset

Others can avoid

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Sansera Engineering IPO-Incorporated in 1981, Sansera manufactures complex and critical precision engineered components and caters across automotive and non-automotive sectors

Business — The company manufactures precision components such as connecting rods, rocker arms, crankshaft assembly and gear shift forks for the automotive industry

Region of operation –Company caters to India 65% revenue and have 35% exports revenue. 12% revenue comes from non automotive segment.

Offer purpose —

The IPO is entirely an offer for sale by the promoters and other strategic investors

Risks —

High concentration of revenues from few clients. Bajaj auto being highest , contributing close to 20% of automotive revenue

Export oriented risks

Faster shift to EV can cause some turbulence

Strength

Strong Operating profit Margin

Pass through arrangements with domestic customers for cost escalations help margins

Long term relationship with most customers

Reducing dependence on ICE vehicles

Experienced management team.

Future

The client profiles and relationship, move towards EV and contracts available presents good future prospects

Valuations

Valuations are matching with peers but look pricey

Should we apply?

People with high risk apetite can subscribe for long term only

Add more if it dips below issue price keeping long term horizon mindset

Others can avoid

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

NaapBooks Limited IPO– SME company, Naapbooks is engaged in developing and providing Information Technological solutions to corporates.

Business —

The company develops Fintech App, Cloud Consulting, Blockchain App, Mobile App, Web App, Embedded App products to its clients.

Companies’ services include designing, developing, operating, installing, analysing, designing, maintaining, converting, porting, debugging, coding, and programming software to be used on computers, microprocessor-based devices, or any other such hardware. The company also provides Software Consultancy services.

Offer purpose — The IPO is for Funding the working capital requirements of the company, Funding purchases of equipment and Meet general corporate purposes.

Risks —

SME company and minimum lot size > 1 lac

Very less information available on business and management

Strength

Strict adherence to quality compliance standards.

Big demand for IT and automation in India post covid.

Strong customer relationship and repetitive clients.

Future

The company is showing good growth and profitable.

Valuations

Very small company and hence valuations could not be easily made out

Should we apply?

People with big risk apetite can subscribe for long term only

Others avoid

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Ami Organics IPO-Incorporated in 2004, Ami Organics Limited is one of the leading research and development driven manufacturers of specialty chemicals.

Business — The company manufactures different types of Advanced Pharmaceutical Intermediates and Active Pharmaceutical ingredients (API) for New Chemical Entities, and material for agrochemicals and fine chemicals. The company has developed over 450 pharma intermediates across 17 key therapeutic areas i.e. anti-retroviral, anti-inflammatory, anti-psychotic, anti-cancer, anti-Parkinson, anti-depressant, and anti-coagulant.

Region of operation –Company caters to India and in 25 countries overseas i.e. Europe, USA, China, Israel, Japan, Latin America

Offer purpose — The IPO includes an OFS portion of ₹370 crore and a fresh issue of ₹200 crore. The fresh issue proceeds will be utilised to lower the

debt of ₹140 crore (from a recent acquisition) and shore up stretched working capital requirements of the company (₹90 crore).

Risks —

High concentration of revenues from few clients

Export oriented risks

Strength

Leading global market share for some of intermediaries

Strong R&D, sales and marketing capabilities

Consistent financial performance track record

Long term contracts for most of exports with price escalation clauses

Strong relationship with customers over long ter

Future

The strong growth anticipated for Ami Organics, drawing from its product and client profile and strong pipeline presents a good future prospects

Valuations

Valuations are matching considering peers but look reasonable

Should we apply?

People can subscribe for long term only

Add more if it dips below issue price keeping long term horizon mindset

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Vijay Diagnostic Center IPO-Established in 1981, Vijaya Diagnostic Centre is one of the fastest-growing diagnostic chains in Southern India

Business — The company offers a one-stop solution for pathology and radiology testing services. The company offers around 740 routine tests, 870 specialized pathology tests, 220 basic tests, and 320 advanced radiology tests. The company also offers a broad spectrum of customized health and wellness packages to its customers.

Region of operation — Company’s operational network consists of 80 diagnostic centers and 11 reference laboratories spread across 13 cities and towns in the states of Telangana, Andhra Pradesh, National Capital Region, and Kolkata. 96.2% of the revenue comes from Hyderabad, the rest of Telangana, and the Andhra Pradesh region.

Offer purpose —

The IPO is entirely an offer for sale to provide partial exit to existing investors, who will be divesting 30 per cent of the stake

while the promoter is divesting 5 per cent.

Risks —

Company is in a highly competitive space

High regional concentration risk

Company not getting any proceeds from IPO for growth

Strength —

Largest and fastest-growing diagnostic chain in Southern India.

Affordable diagnostics service provider with a focus on superior quality.

Strong technical capabilities, cutting-edge diagnostic testing technology and robust IT infrastructure.

High brand recalls driving high individual consumer business.

Future

Company is operating with non-franchise model so growth is based on company reach. Focus is more on quality which bring people back to same place. Although the industry is highly competitive, but regional it has strong presence.

Valuations

Valuations are slightly lower considering peers but look reasonable

If we see growth projections, then valuations are at par or premium only

Should we apply?

We can completely avoid

Wait for lower prices to emerge to invest

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.