Mega Trend : India Equity, MF, AIF growth

BE FINANCIALLY INDEPENDENT

Please treat this as just a indicator as these are subject to change or could have been changed

Consult you financial advisor before making any investment decision

In recent years, there is strong inclination see in investors for investing in US stocks. Of course there is a reasoning behind it. Let’s try to figure out WHY and HOW part of it

To understand this let’s understand the returns by DOW and BSE in last 10 years

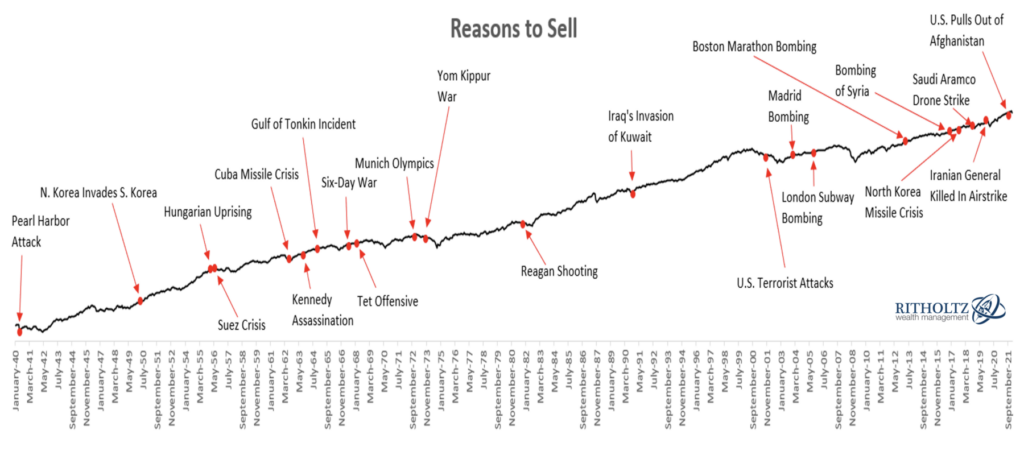

US market consistently outperformed Indian market in last 10 years. Although there is no guarantee that it will happen in next 10 yrs again

So outperformance of US markets along with Indian currency depreciation widens this performance gap further and this makes a strong case for investments in foreign stocks

Buying foreign stocks allows investors to

As a thumb rule for starters, a 5% to 10% exposure to foreign stocks for conservative investors, and up to 10-25% for aggressive investors seems ok

Individual investors can invest up to $250,000 every year overseas under the RBI’s Liberalised Remittance Scheme. After opening an overseas brokerage account, investors will be needed to fund it by remitting money from his/her bank account

Now let us understand the 2nd part of it

Open a low-cost international broking account and invest in low-cost international exchange-tradedfunds

Let’s also understand the precaution or risks to be taken care of

When you invest in the US stock market, , please be aware of taxation part

Dividends will be taxed in the US at a flat rate of 25%. Due to Double Taxation Avoidance Agreement (DTAA), taxpayers can offset income tax already paid in the US (Foreign Tax Credit)

Disclaimer : The article is written to provide information and make investors aware of potential avenues of investment. Please don’t treat this as an investment advice. There could be change in tax laws from time to time and one should track it before investing. Past performance of any index returns can not and should not be taken as reference for future performance. Percentage allocation for each investor can vary and its best to consult to one ‘s own financial advisor before making investment decisions. We don’t have any mutual agreement with the sources or apps shared for investment and we dont gain/loss from your action in this regard

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Stocks bought by prominent MF in Oct2020

Multicap Funds — most diversified equity mutual funds that can put money in stocks across market capitalization.

Sebi new direction for multicap funds– Allocate minimum 25% each in large, mid and small cap by Feb 2021

Purpose : Recently these funds have been found to invested heavily towards large caps and Regulator’s move aimed at reducing risk of concentration in large-cap stocks and making market broad based. This way these funds can be truly labelled as Multi-cap

One quick estimate from a Quantum fund manager shows that 40% of entire MF industry equity investment is concentrated in top 6 large cap stocks thereby posing a huge concentration risk.

Why multicap loaded towards these large caps — to beat the benchmar index which has heavily loaded in these large caps

What all these changes can lead to

Multi cap fund managers to diversify and find opportunities in small and mid cap segment

Selling in Large cap stocks and some of mid cap stocks

Reshuffling of multicap funds portfolios multiple times for diversification and hence estimate is 25K cr will move into mid cap and small cap

Liquidity issues while investing in small caps –some of these small caps will become mid caps just by so much money coming into them and leading into ASM framework or mid caps becoming small caps because of selling pressure

Recategorisation of multicap funds into Large cap MF or Large and Mid cap mutual funds

Merging of few MF schemes into another in same fund house

Will small cap and mid cap stocks rally because of this? Should we buy more small cap and mid cap stocks?

Initial euphoria may drive this rally but retail people should understand the possibilities before putting their hard earned money

So any wrong move without due diligence can lead a retail investor into proud owner of junk stocks.

Best way is to own the business what you understand and have conviction. Other things will fall in place for you

Should we sell Multicap funds or buy them?

Stay invested in multi cap funds although one should not be having more than one or two of such category of funds.

Any such funds which will be recategorised as large cap funds will not change your returns much

Any such funds who will reshuffle their portfolio can go through short term pain but returns can be better in long run

Will this regulation stay? and is it good?

I see it as a good regulation because it helps in removing the concentration risk in few stocks from MF industry and as years progresses, this industry is bound to grow by leaps and bounds. This kind of framework helps in longer run although its a big pain in shorter run. It also helps few fund managers to showcase their skills for which we are spending 2-3% of expense ratio. Otherwise we are better off with Index ETF MF with lowest expense ratio if fund managers skills are absent and don’t make any difference to my returns

Happy investing!!

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Article says that one will have miniscule impact on long term basis and major impact on liquid or overnight funds

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

As we have seen multiple times, people enter into stock markets with a lure of quick money and start buying stocks based on tips, analysts recommendations, social media news or friends recommendations. All this stock buying happens as a blind follower. Unfortunately most of the times these blind follower theory works for buying only. People forget to sell stocks or intentionally keep holding them because of losses in these stocks and they don’t want to miss out if stock rebounds. So they keep on waiting for stock to come to their buying level or worse they keep averaging such stocks.

What people really miss or can not analyze is whether the stock bought is good enough to hold or not? or Is it good fundamentally? or the original buying thesis has undergone a change or not? Whether this stock ever turns back or not and why? Whether they should average or not?

Our team at Alpha Affairs has recognize this need for common people who need a opinion on their holding so that they can take a decision themselves with better understanding. Alpha Affairs has filled this need by giving a chance to common man to get the third eye look on his/her portfolio.

Portfolio opinion is a premium service (nominal fees) and our motto behind this service is to help our friends remove dud stocks from portfolios to improve overall portfolio returns. We call it as a Third Eye Look on your portfolio. This Opinion should be construed as knowledge sharing only and not be construed as financial advice ( we are not SEBI registered) and any losses or profits arising out of same are responsibility of the stock owner. We are only trying to help each other in best possible way we can. It is better to consult your financial adviser before initiating buying, sell or hold calls on your portfolio

Please find the details at the link provided below

https://alpha-affairs.com/portfolio/portfolio-opinion-third-eye-look/

Your portfolio review maximum two times.

One at start of discussion and

another review on or before 90 days as per request

You can use Services for Stocks or Mutual funds review or both together.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.