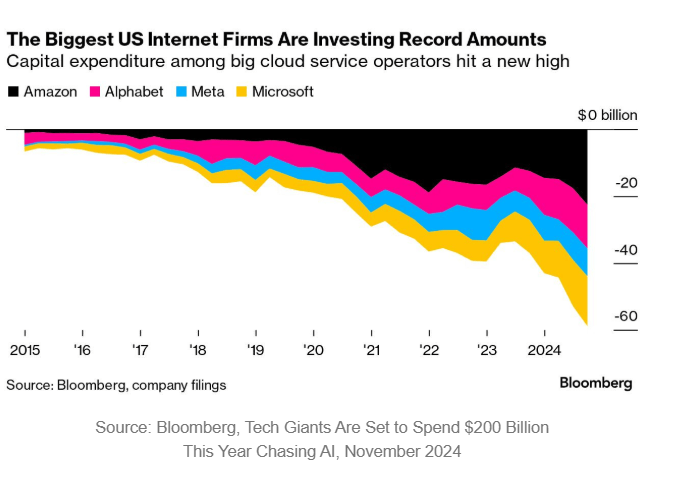

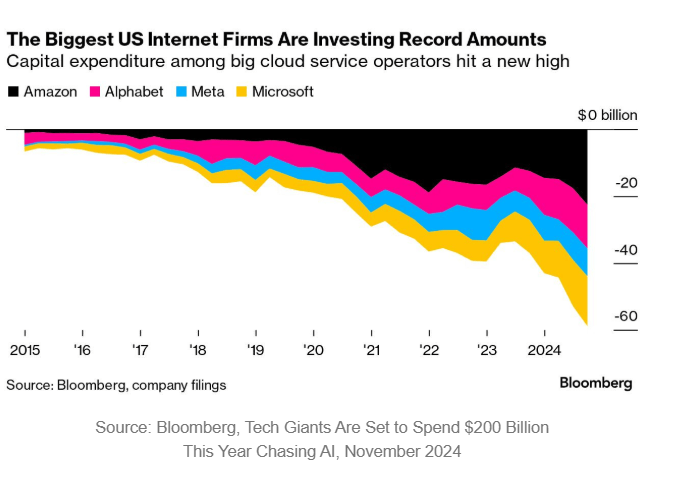

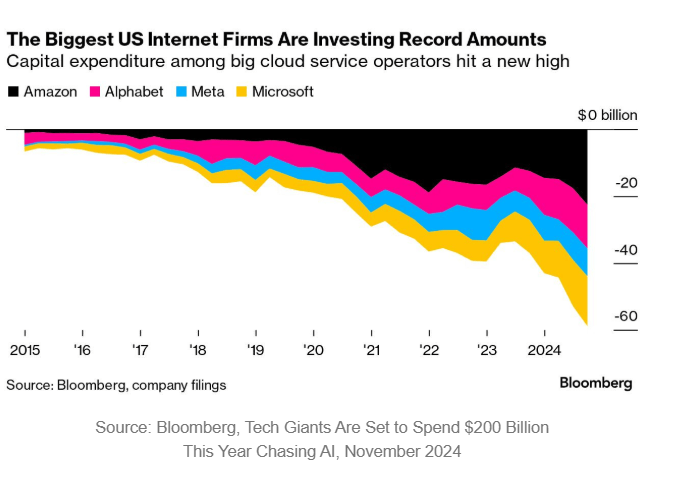

Record Capex by Internet firms

BE FINANCIALLY INDEPENDENT

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

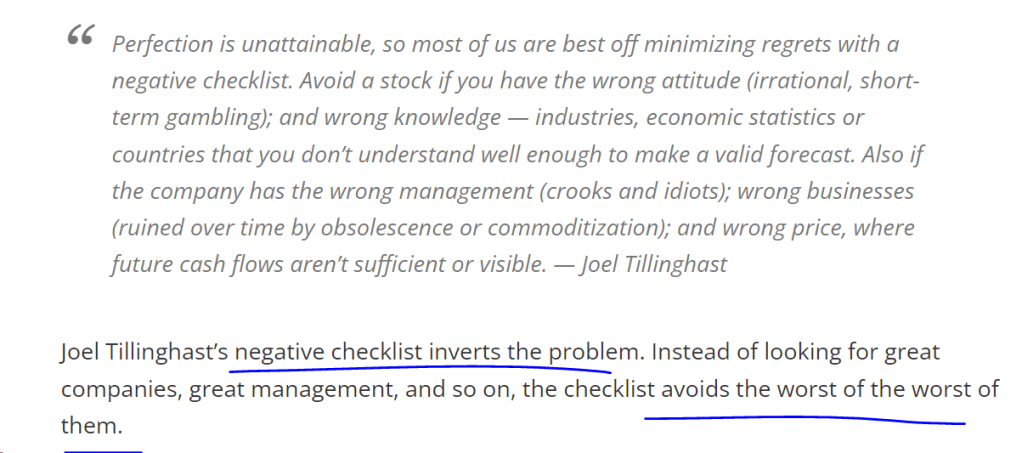

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time 21st jul24

Live classes on Sunday Morning/afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months approx.

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Be ready to WELCOME 2025 with Knowledge

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

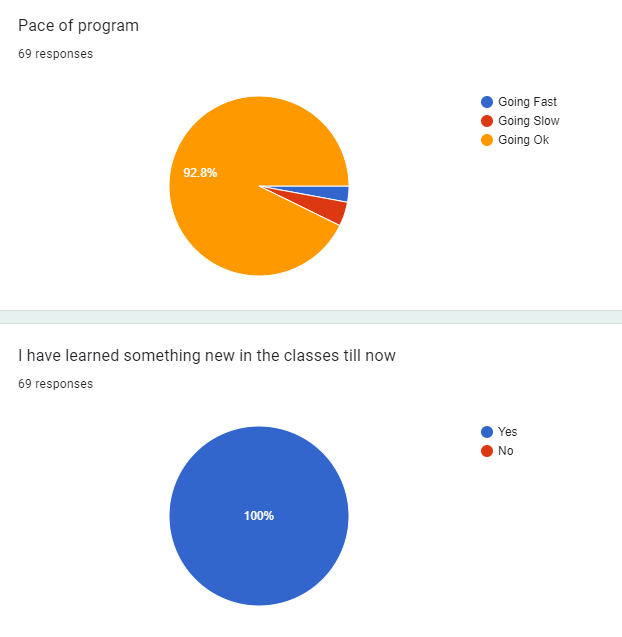

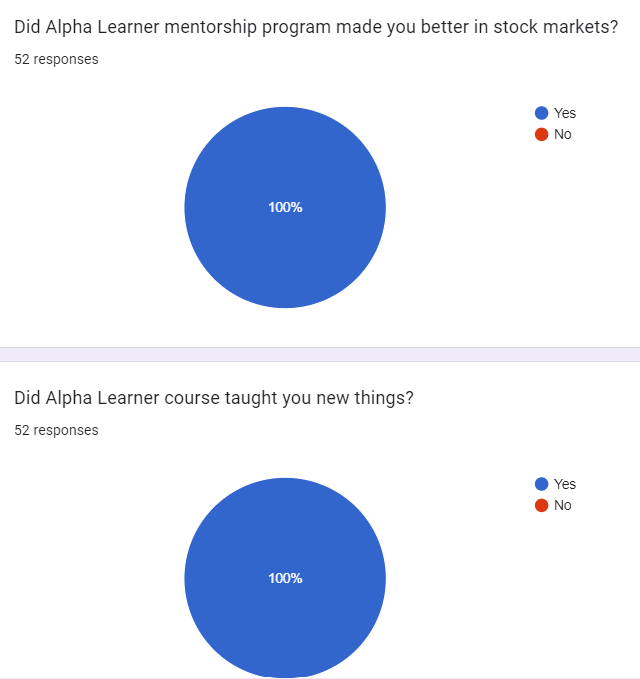

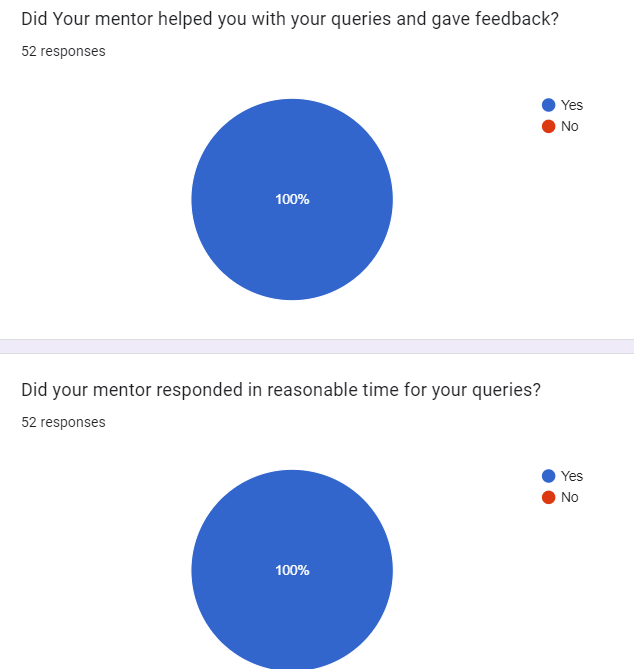

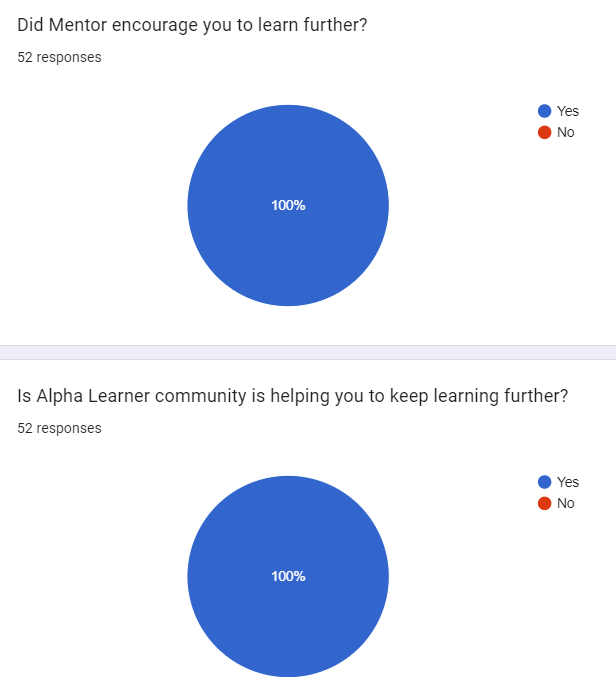

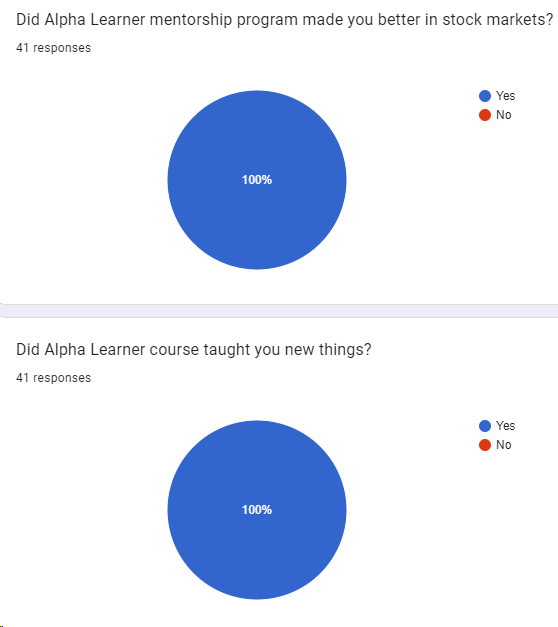

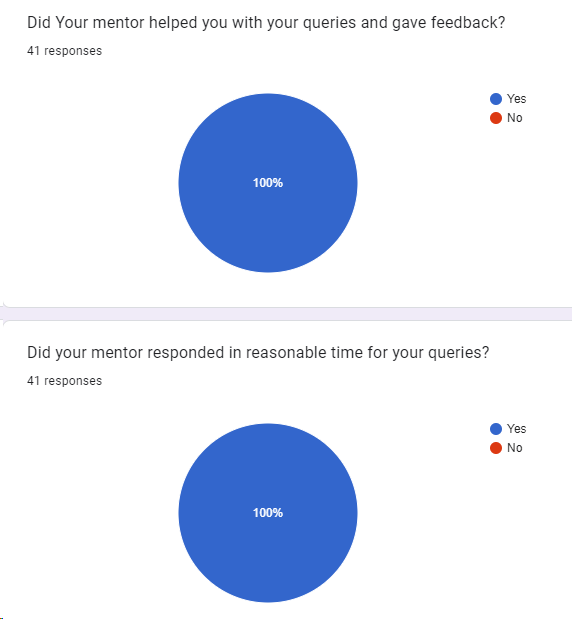

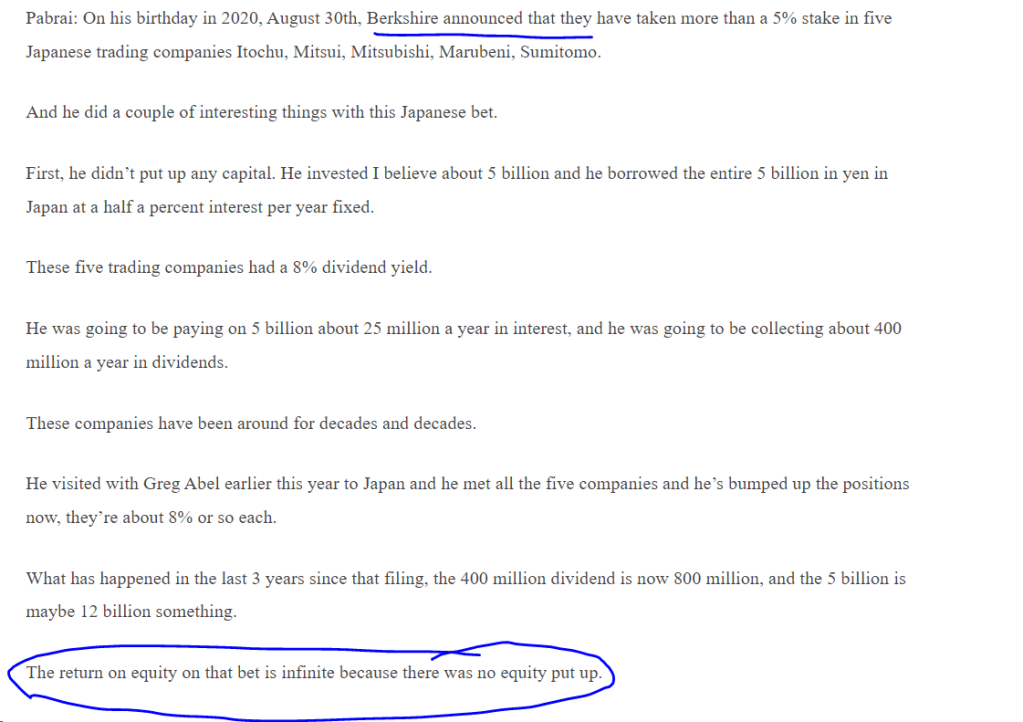

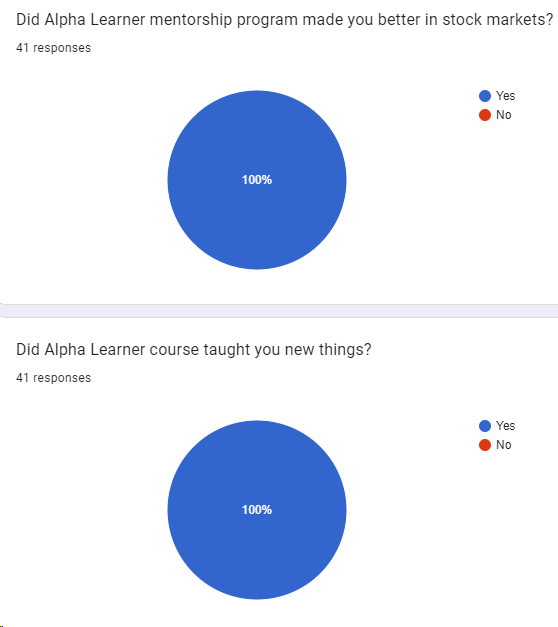

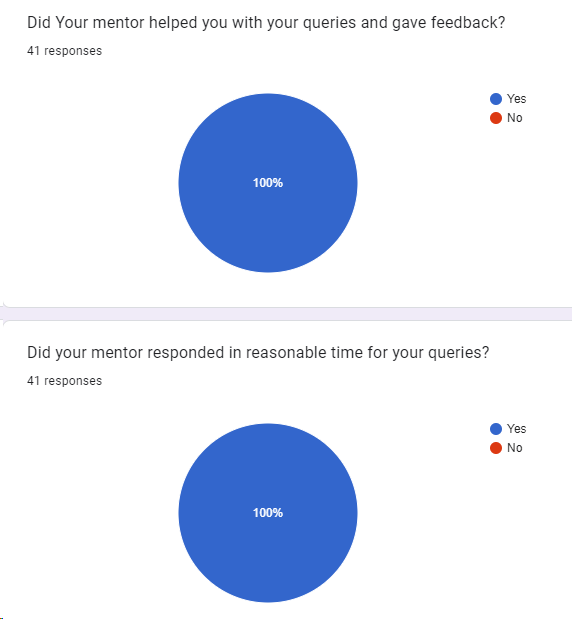

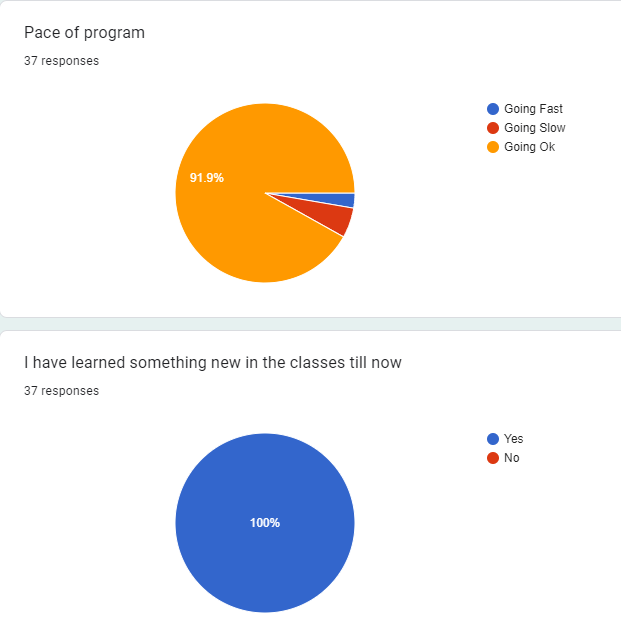

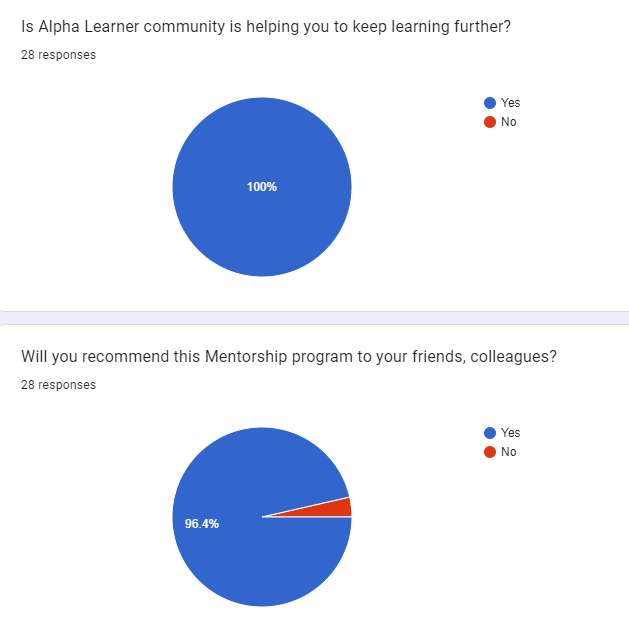

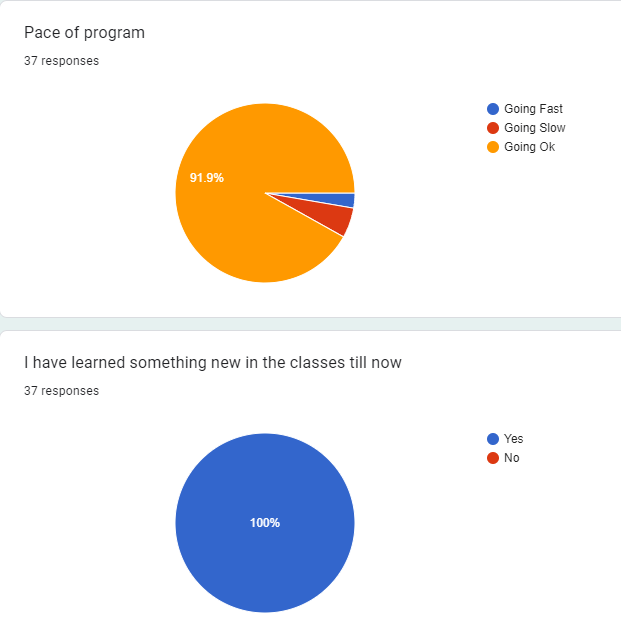

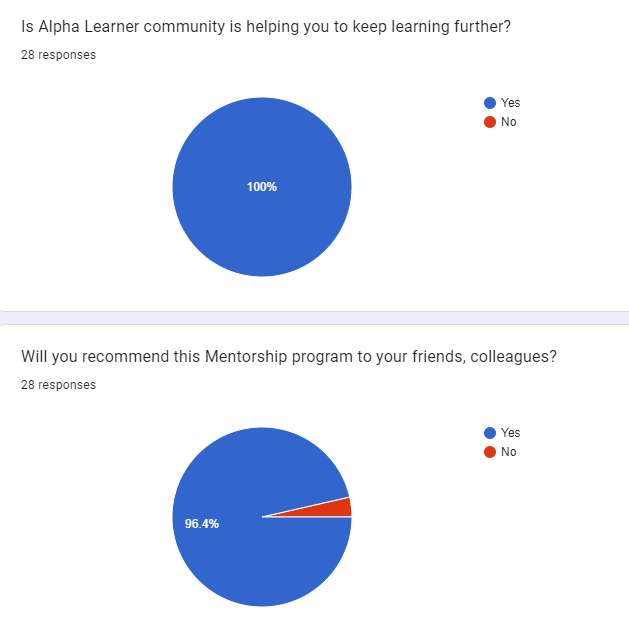

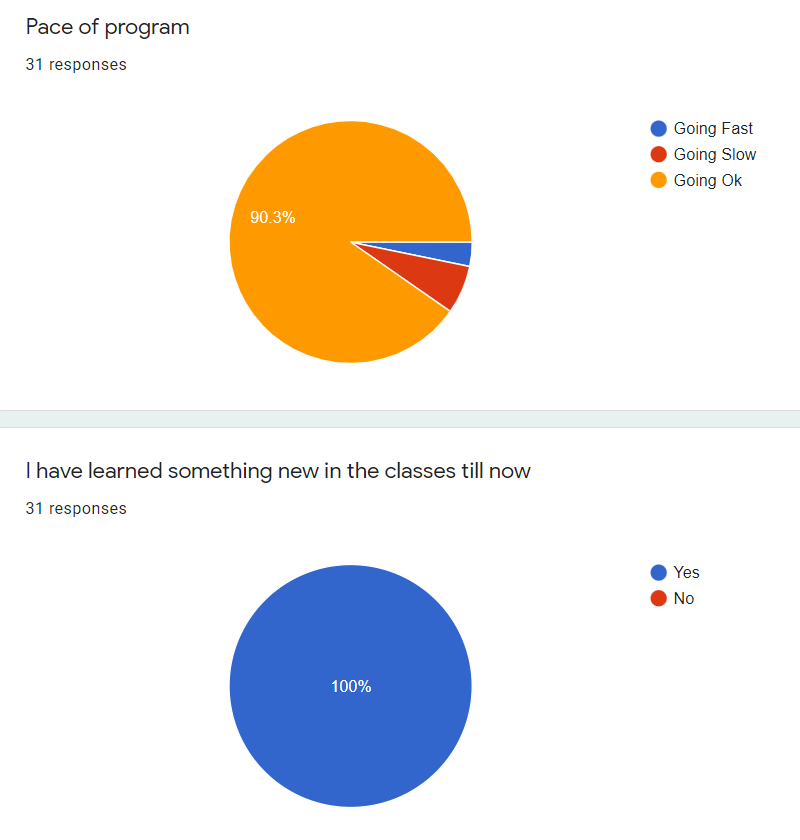

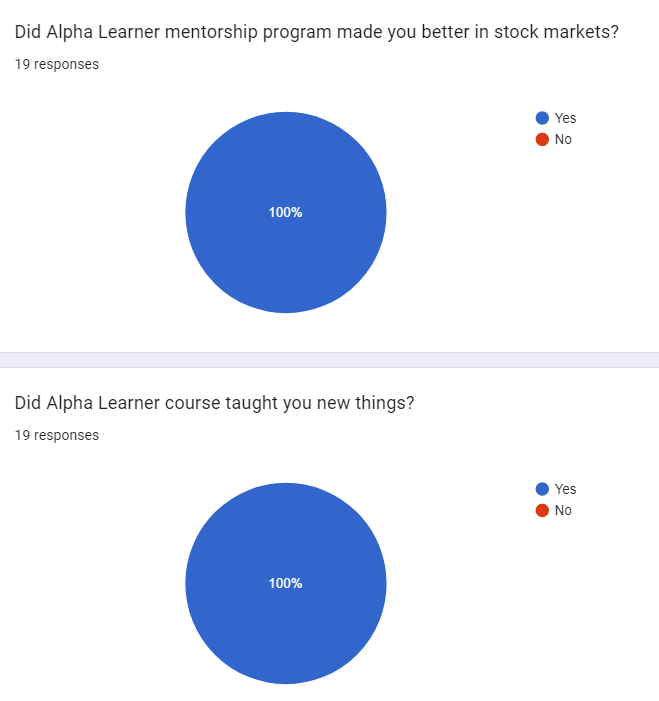

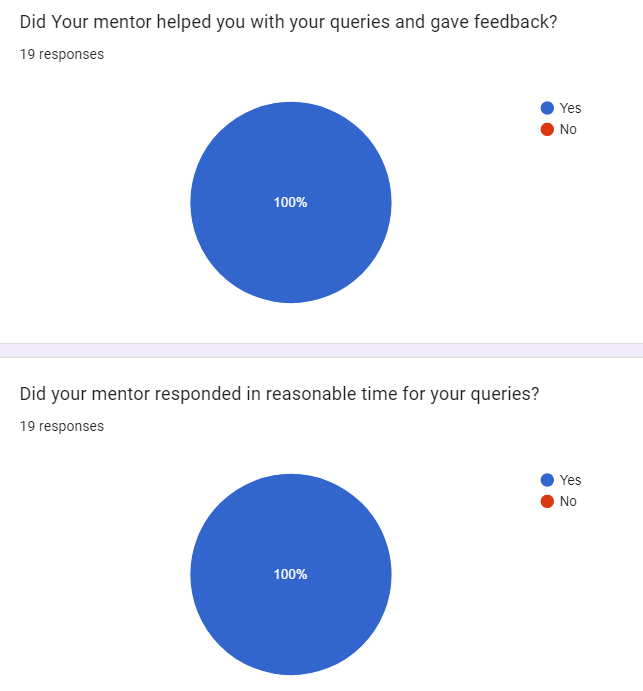

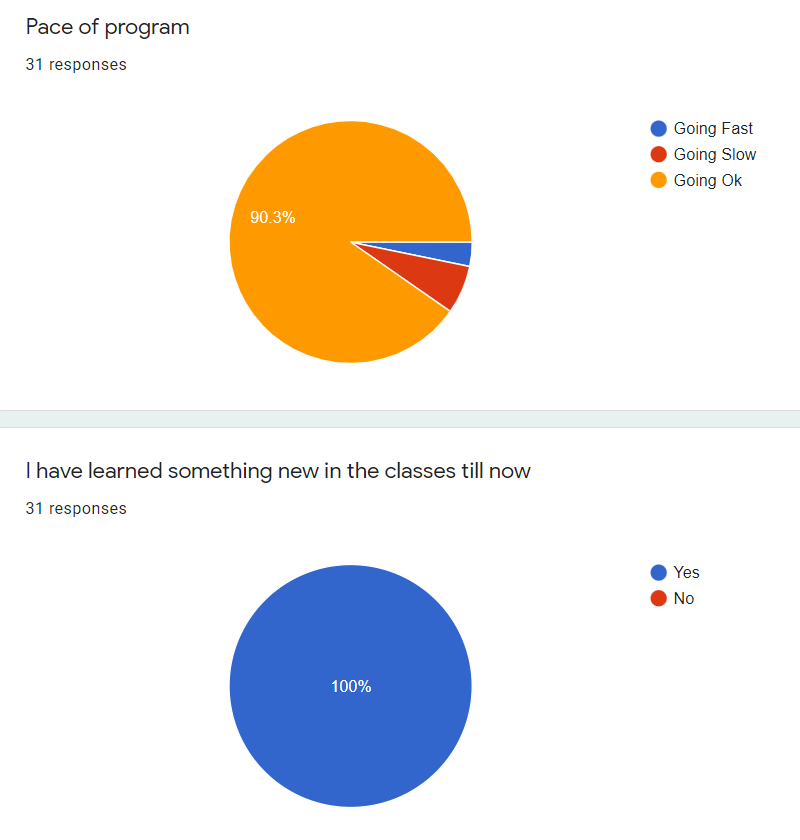

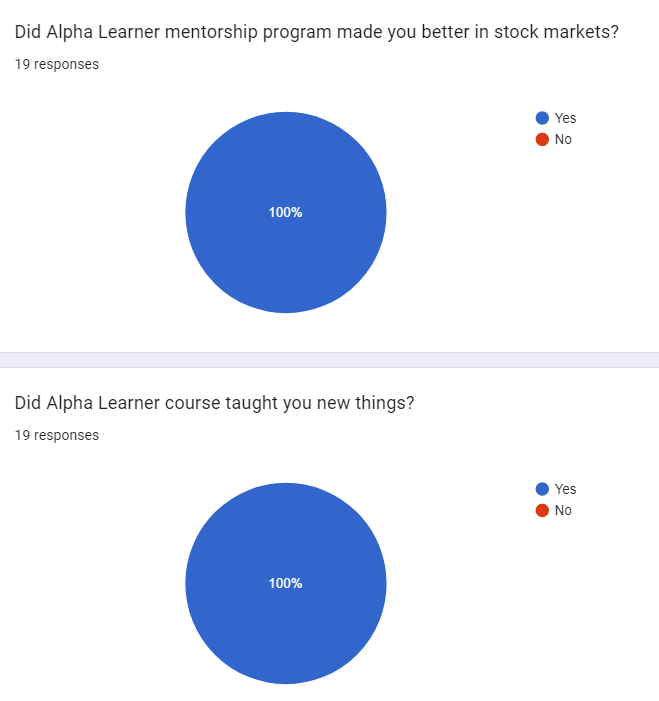

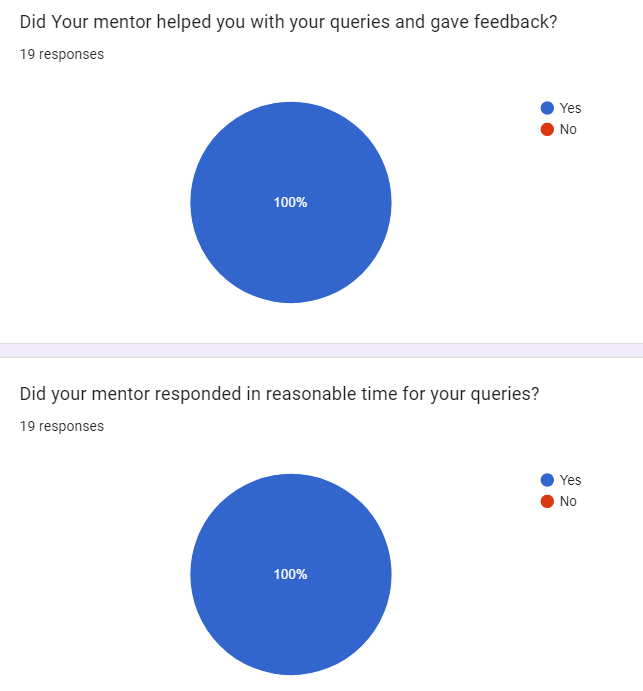

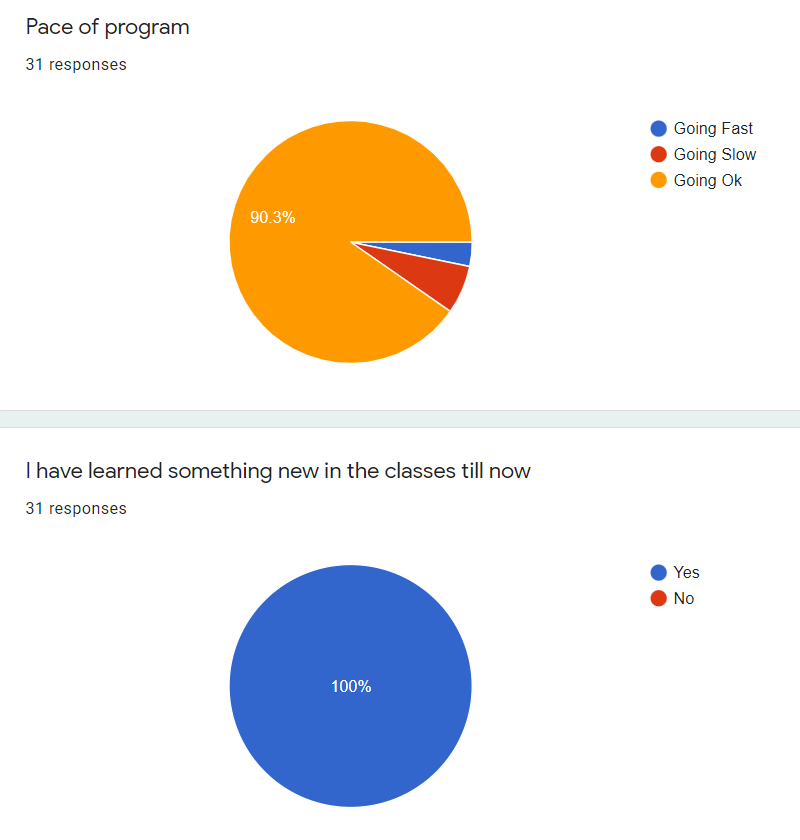

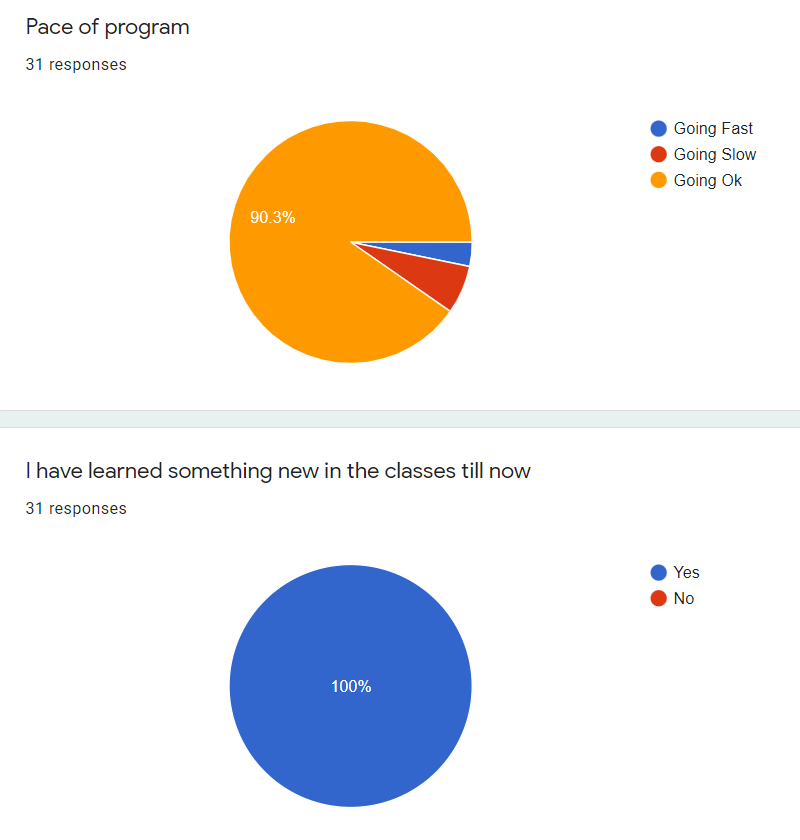

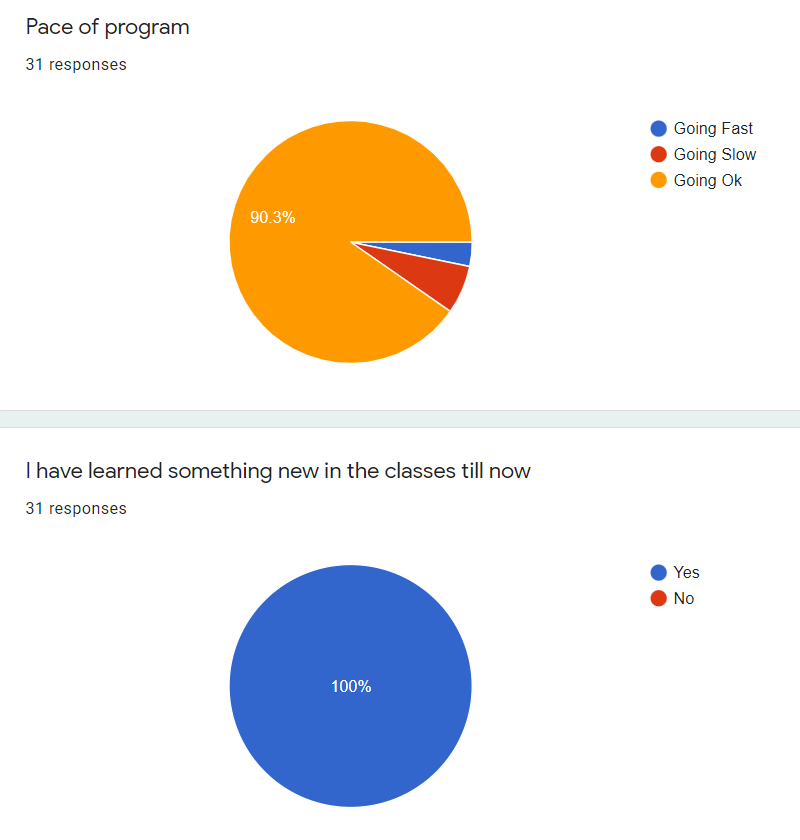

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 2 years of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS MONTH of 2023 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 30th June23

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS MONTH of 2023 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

AVAIL EARLY BIRD OFFER (save 3000 bucks) till 30th June 2023

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

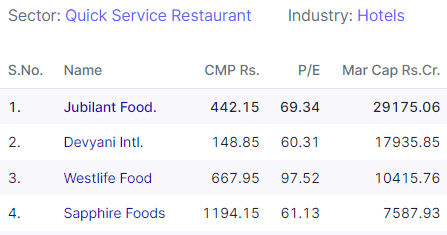

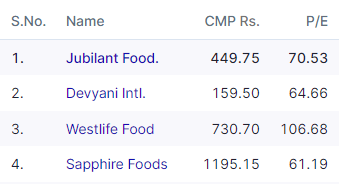

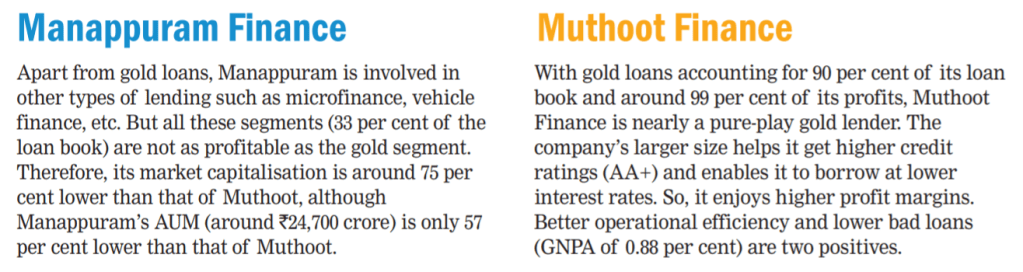

Looks better to stay away from QSR companies like Sapphire, Devyani, Zomato, Jubilant food

Dated 25-feb-23

Dated 25Apr-23 –Decision paid off well –even in the recent rally , these stocks did not run

Time is coming to accumulate slowly after one correction

Will keep updating this Hashtag, follow closely to cancel out noise and focus long

Most clicks on alpha-affairs.com in 2022

And

Book Summary : The Little Book That Builds Wealth by PAT DORSEY

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 31stDec 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Bonus sessions on (apart from Program content)

Financial planning &

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

4-5 months of teaching and mentoring

Can be extended based on queries, case studies

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS Last MONTH of 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 31st Dec 2022

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 15th Aug 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL, Heiken Ashi candles, different time frames

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Bonus sessions on (apart from Program content)

Financial planning &

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

4-5 months of teaching and mentoring

Can be extended based on queries, case studies6-7 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap –this will be an approximate six month effort by all participants

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS INDEPENDENCE MONTH of 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 15th Aug 2022

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 25th April 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions (apart from Program content)

Mutual Funds

Financial planning

IPO and

Big money moves

3-4 months of teaching and mentoring

Can be extended based on queries, case studies1-2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap –this will be an approximate six month effort by all participants

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS NEW YEAR 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 15th April 2022

FEEDBACK By Ongoing ALPHA LEARNERS

ACT NOW for your Independence

FEEDBACK By Ongoing ALPHA LEARNERS

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

Accumulation Distribution session

3-4 months of teaching and mentoring

Can be extended based on queries, case studies1-2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS NEW YEAR 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 1st Jan 2022

ACT NOW for your Independence

FEEDBACK By Ongoing ALPHA LEARNERS

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

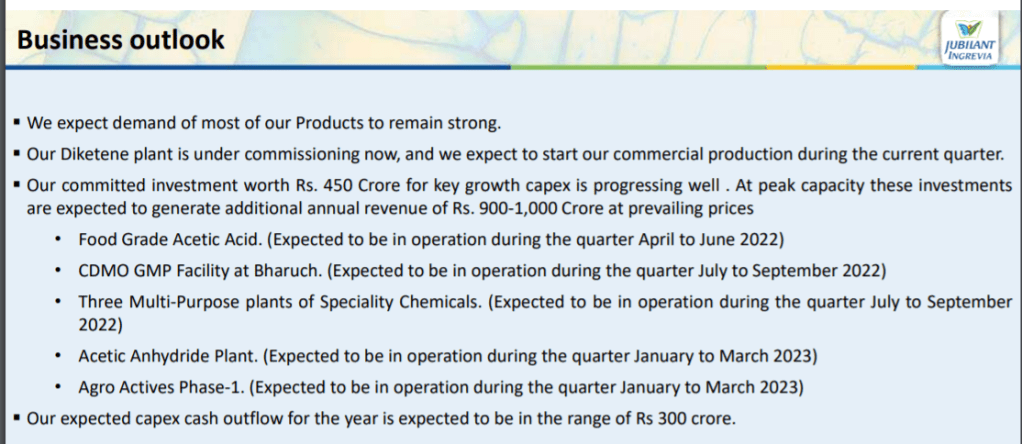

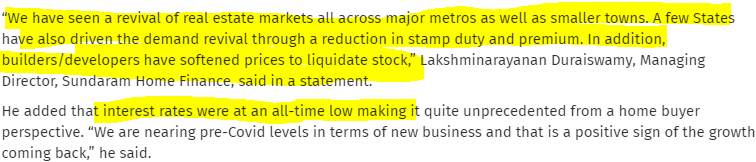

Jubilant Ingrevia Ltd (JVL) houses the Specialty Chemicals, Nutrition & Health Solutions, and Life Science Chemicals businesses, which have been demerged from Jubilant Pharmova Ltd (erstwhile Jubilant Life Sciences Ltd)

It has a Strong presence in diverse sectors and its vertically integrated and due to this , it is Globally Lowest cost producers for most products.

Multi Location Manufacturing & Operation Excellence is achieved by company over the years

Leadership team has an average 30 years of industry experience

Company has expertise in 35 technological platforms at large commercial scale and

Company also has an expertise to handle multistep chemistry (up to 13 steps) at large scale.

Three major segments of Speciality chemicals, Nutrition and Health solutions and Life sciences chemicals

As shared from Company presentation 25% of Life sciences chemicals are consumed in house by specialty chemicals segment while for Nutrition and health solutions segment (vitamin B3, 100% in house sourcing done from Speciality chemicals)

Financial Highlights– RoE, RoCE stood at 15%+, EBITDA grew by 53% YoY while revenue from all segments growing well

Growth triggers

Company is planning to invest 900 cr (550 cr,100cr, 250 cr in different segments by FY24) and expecting 2x revenue in ~5 years

Multiple products in different segments are in pipeline to be launched in coming years

There is a strong demand for Acetic Anhydride and there is no new facility addition announcement globally in the recent past. Company’s customers are exploring to shift from high cost to low-cost countries. They are adding another Acetic Anhydride facility to increase capacity by ~35% by investing ₹250cr over next 3 years.

Co is planning to increase focus to leverage its long standing relationship with innovator pharma & agro-chemicals companies to expand its CDMO operation.

Company is also moving up the value chain in most of their product segments

In the process of launching its diketene (highly complex due to high temperature cracking and storage hazards) and its value added derivatives.

Risks

Raw Materials Prices: Key raw material for life sciences biz is acetic acid. Hence, dependent on the prices of Acetic Acid(Very volatile).

Large capex in next few years: he funding of this 900cr capex will largely from internal accruals. But if for some reason this capex is not completed on time or need more debt then it may affect profits in coming years

Exit Strategy

Acetic acid Raw material prices hurting company growth or

Any ban on application of its pyridine and similar substances by other countries can hurt the company growth

In such cases , its better to exit and have a relook on invested amount

Current Market price of 760 Rs, Company looks optically expensive for investment but looking at big picture if it sustains 10.5 eps for next 3 quarters giving 42 eps for FY22 , stock price looks to have decent upside available

Update on Q2FY22 by Company on business outlook

Update on Q3FY22 by Company on business outlook

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run

Fundamental Quantitative concepts to substantiate what we have seen qualitatively

Necessary Technical aspect to make our entry and exit better in stocks

Resources to analyze faster to analyze more companies faster

Big money moves aspect to understand where money is moving

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary and derivatives market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

a SURPISE session

3 months of teaching and mentoring

Can be extended based on queries, case studies2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

12 Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the program

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS INDEPENDENCE MONTH be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 30th Sep 2021

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run

Fundamental Quantitative concepts to substantiate what we have seen qualitatively

Necessary Technical aspect to make our entry and exit better in stocks

Resources to analyze faster to analyze more companies faster

Big money moves aspect to understand where money is moving

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary and derivatives market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

a SURPISE session

3 months of teaching and mentoring

Can be extended based on queries, case studies2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

12 Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the program

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS INDEPENDENCE MONTH be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 31st Aug 2021

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

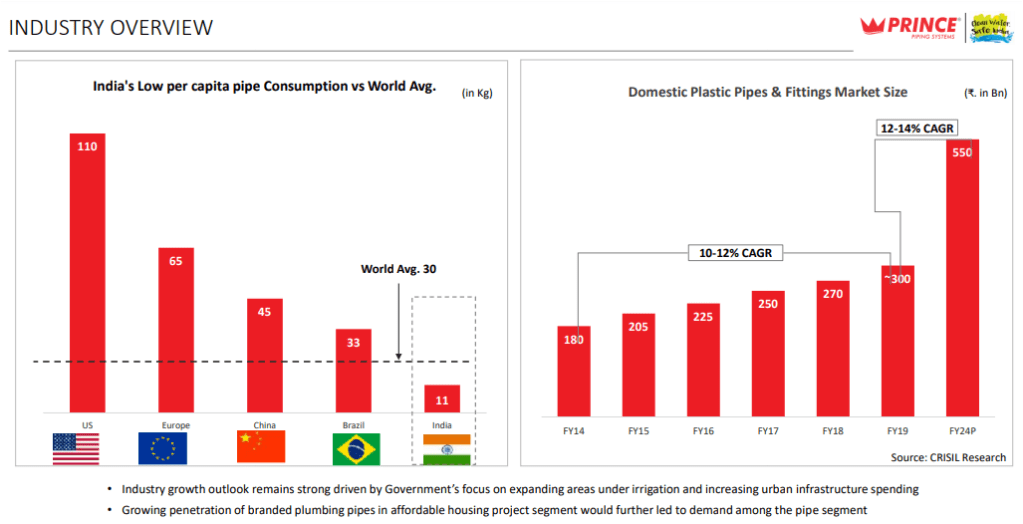

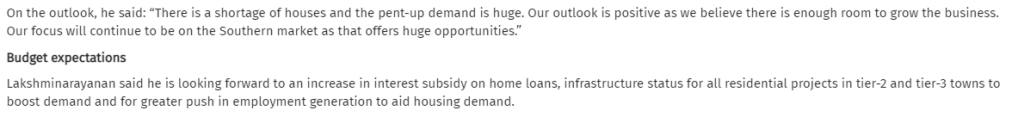

Prince Pipes and Fitting makes polymer pipes and fittings in India that are used in plumbing, irrigation and soil, waste and rainwater (SWR) management

It has 7,200 stock keeping units (SKUs) and 1,500+ channel partners.

Company has strong cash flow from operations and business share in Q4FY21 has been 69% from construction

Company current strategy is to expand in south india and increase distribution network while keeping the margins(EBITDA,OPM), ROCE in similar range

Company has been able to make use of 3 drivers of margin expansion in FY21 : inventory gains, product mix change, superior pricing power: past 8 Quarters company has been aggressive in passing on price .

Growth triggers

Total installed capacity of approximately 259,000 tonnes per annum (TPA). This will increase by a further 51,000TPA once its Telangana plant is fully commissioned- that means almost 20% increase in capacity

Various Government initiatives like AMRUT scheme, which is aimed at providing basic services, such as WSS, and ensuring that every household has access to assured tap water supply and a sewerage connection. Jal Jeevan mission (Urban) focuses on providing water supply to 4,378 urban local bodies with 260 million household tap connections. Nal se Jal scheme is planned to offer piped water to every rural household by 2024 –all these schemes is helping industry to grow by 35%(estimated) in next 2-3 years

There is a visible structural shift from unorganized to organised players and Prince pipes has shown both volume and sales growth wile other major players have shown de-growth in FY21

PPF is gradually increasing its emphasis on high-margin business of CPVC and double-wall corrugated pipes (DWC).

Recent tie up with Lubrizol will help the company in getting its supplies secure and as well as will attract more distributors towards company

Expansion into South India with Telangana Plant and focus on east india in coming years may keep the growth rate intact

Data-driven pull against conventional push is the new sales strategy of the company for the retail segment. Business-to-business (B2B) remains an area of improvement where PPF sees ocean of opportunities. It has moved into technology driven plumber data to move into B2B business as well as for normal business

Risks

Raw Materials Prices: Raw materials (resin) are derived from crude oil and any increase in crude oil price can hurt margins in short term.

COVID Lock-downs: Second wave of COVID, many states have had to announce lock-downs, although this time plants were not completely shut but still first quarter at least, could be dampner.

Corporate Governance Issues: There have been allegations of inadequate disclosure in the IPO prospectus of PPF PPF did not disclose all litigations, claims and criminal proceedings against the promoters (although re-filed DHRP corrected anamolies but still some differences are claimed)

No moats and No barriers to entry in this business

Fake / duplicate products can hurt company business

Exit Strategy

COVID-19 third wave creating more havoc than 2nd wave can impact the company balance sheet in big way for construction and this should be on radar

Break up with Lubrizol will definitely hurt the company and we need to relook if such thing happens in future

Any negative change in Govt policy for water schemes can hurt the growth prospects and may warrant an exit

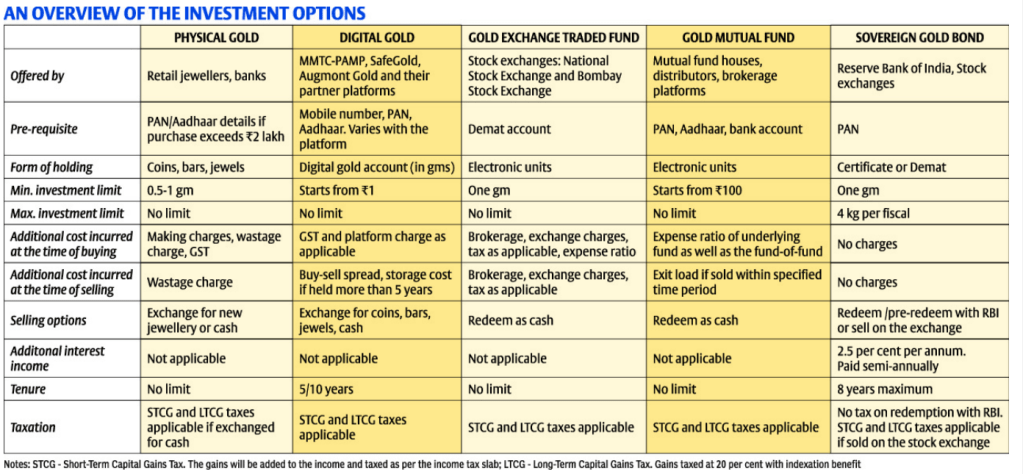

Yield : No assurance

Capital : Risk of capital losses

Fees : Multiple layer of fees with no regulatory cap as of now

Taxation : Complex : Interest Income, Dividend Income, Capital gains might fall into different tax slabs

Returns : Not guaranteed, can be lumpy

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Please treat this as just a indicator as these are subject to change or could have been changed

Consult you financial advisor before making any investment decision

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Weekend HookUp: 22nd January, 2021

Gold from waste; Bitcoin Myths; Coffee; Founders to Funders

Gold from Waste: Antony waste Handling (Fortuneindia)

Bitcoin: Myths (ArkInvest)

Learning: Curious case of Coffee (LiveHistory)

Founders to Funders: Startups (Forbes)

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

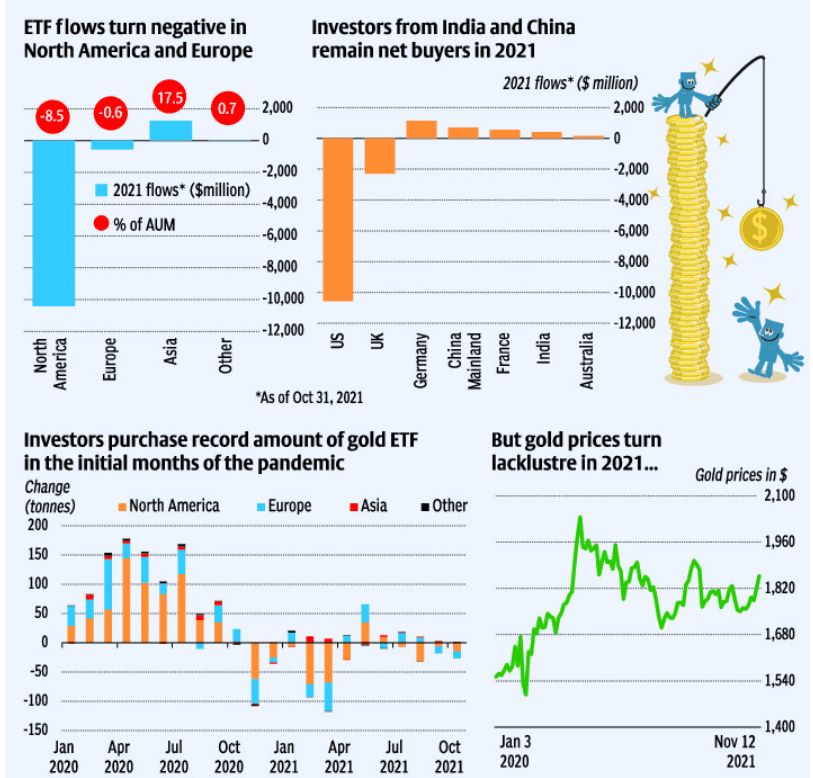

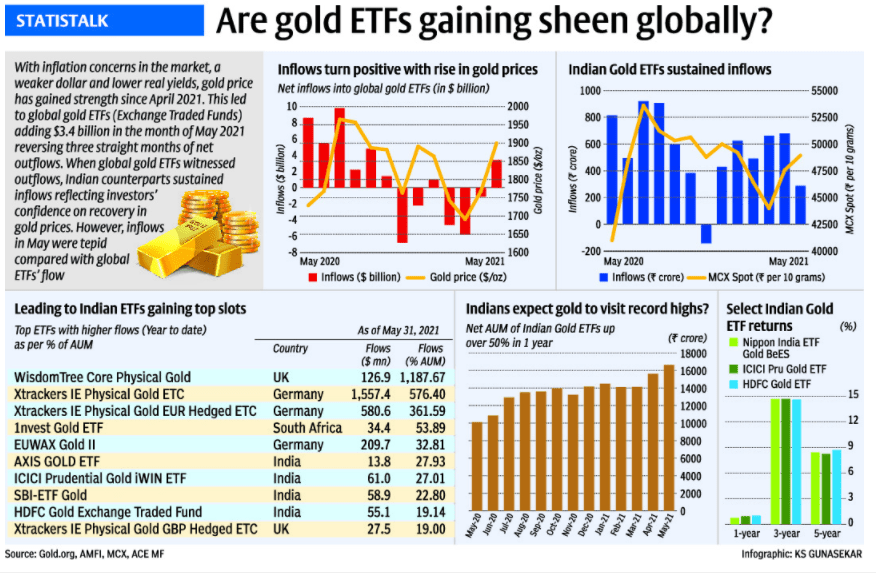

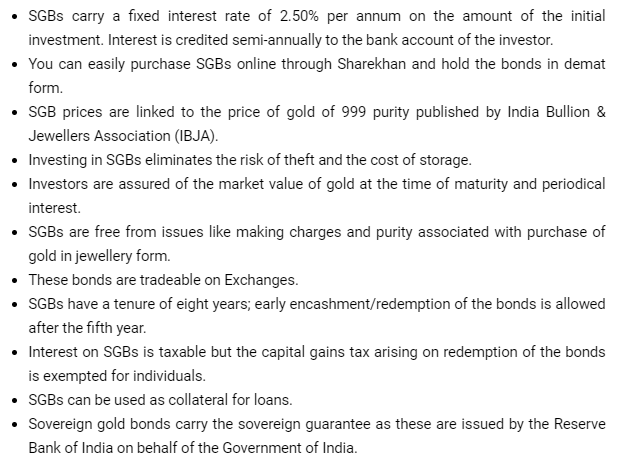

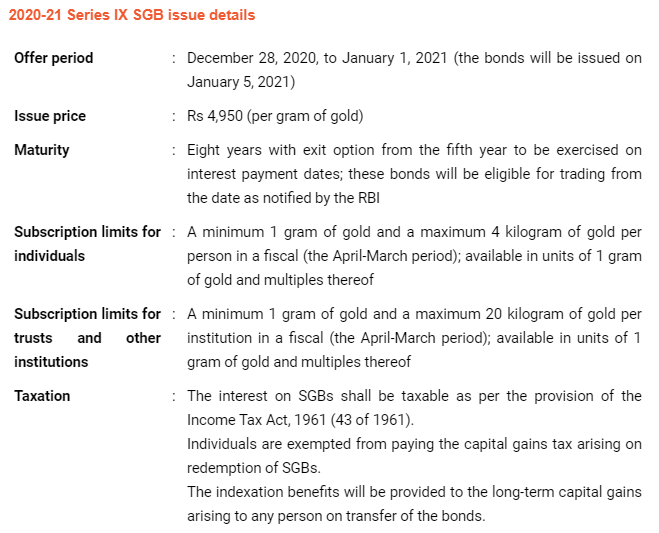

SGBs are government securities denominated in grams of gold.

These are substitutes for holding physical gold.

SGBs are issued by the central bank on behalf of the Government of India.

Investors have to pay the issue price in cash and the bonds are redeemed in cash on maturity.

There are many reasons for buying gold.

The yellow metal acts as a hedge against inflation.

It is a relatively stable investment compared to equities.

It is a good diversification strategy.

It can be purchased easily

Read more for these IPO before listing on their business, strength, risks Bector Food , Happiest minds, Route mobile, Rossari biotech, Burger king

Among Top 5 car makers, Kia Motors and Tata motors gain market share and other have lost. After quite some time, Maruti’s Market share dropped below 50% mark

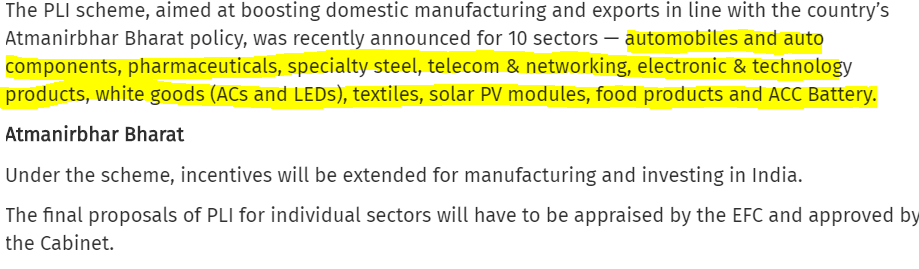

Implementation of production-linked incentive (PLI) schemes worth up to ₹1.45 lakh crore for 10 key sectors announced recently by the government is likely soon.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

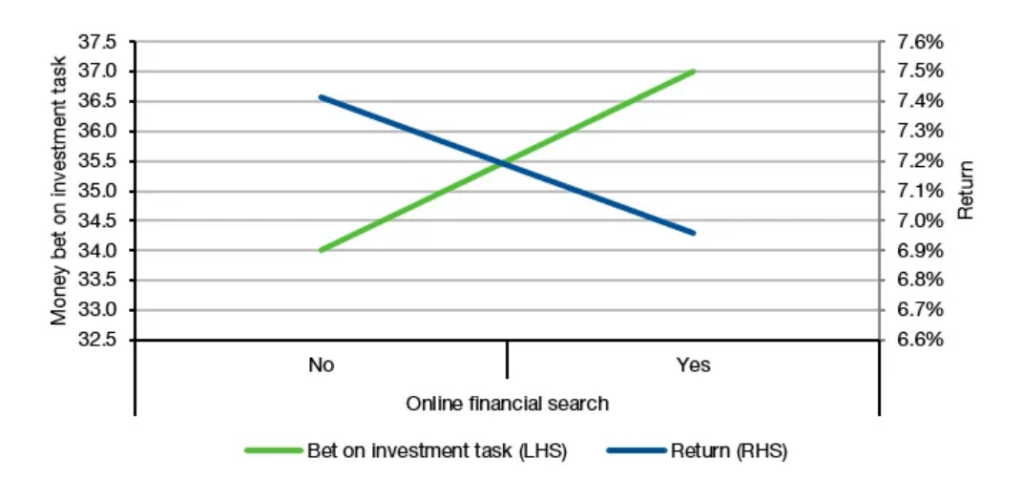

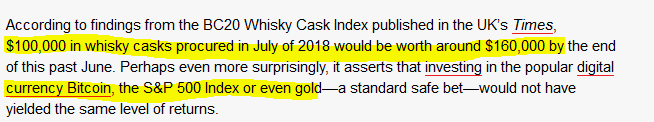

In recent years, there is strong inclination see in investors for investing in US stocks. Of course there is a reasoning behind it. Let’s try to figure out WHY and HOW part of it

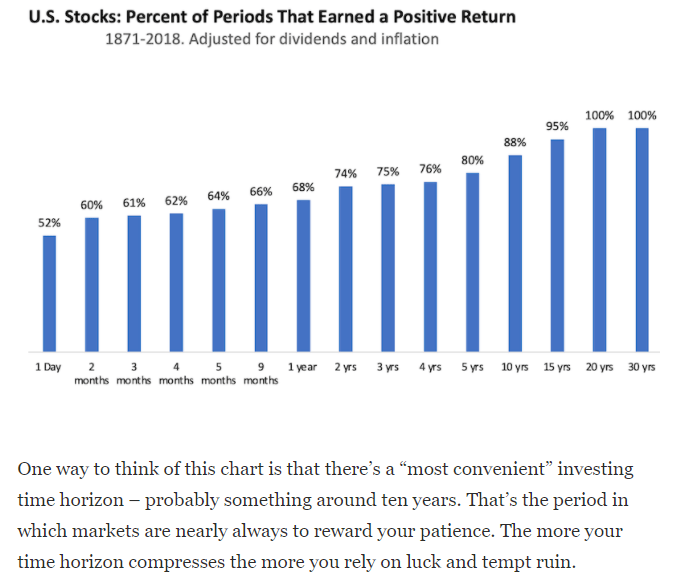

To understand this let’s understand the returns by DOW and BSE in last 10 years

US market consistently outperformed Indian market in last 10 years. Although there is no guarantee that it will happen in next 10 yrs again

So outperformance of US markets along with Indian currency depreciation widens this performance gap further and this makes a strong case for investments in foreign stocks

Buying foreign stocks allows investors to

As a thumb rule for starters, a 5% to 10% exposure to foreign stocks for conservative investors, and up to 10-25% for aggressive investors seems ok

Individual investors can invest up to $250,000 every year overseas under the RBI’s Liberalised Remittance Scheme. After opening an overseas brokerage account, investors will be needed to fund it by remitting money from his/her bank account

Now let us understand the 2nd part of it

Open a low-cost international broking account and invest in low-cost international exchange-tradedfunds

Let’s also understand the precaution or risks to be taken care of

When you invest in the US stock market, , please be aware of taxation part

Dividends will be taxed in the US at a flat rate of 25%. Due to Double Taxation Avoidance Agreement (DTAA), taxpayers can offset income tax already paid in the US (Foreign Tax Credit)

Disclaimer : The article is written to provide information and make investors aware of potential avenues of investment. Please don’t treat this as an investment advice. There could be change in tax laws from time to time and one should track it before investing. Past performance of any index returns can not and should not be taken as reference for future performance. Percentage allocation for each investor can vary and its best to consult to one ‘s own financial advisor before making investment decisions. We don’t have any mutual agreement with the sources or apps shared for investment and we dont gain/loss from your action in this regard

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Weekend HookUp: 29th November, 2020

Cycling; Optimism; Electric Vehicles; Investing and Learning

Cycling: Benefits (Cycling weekly)

Optimism: Good things taken too far (CollaborativeFund)

Learning: Bargain Hunter’s Dilemma (Ritholtz)

Electric Vehicles: Big bet but is it enough (Fortuneindia)

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Weekend HookUp: 22nd November, 2020

<p class="has-text-align-justify" value="<amp-fit-text layout="fixed-height" min-font-size="6" max-font-size="72" height="80">Cycling; Flying; Investing and LearningCycling; Flying; Investing and LearningCycling: Cycling shorts (Velocrush)

Investing: How to invest abroad (Morningstar)

Flying: How spicejet is re-learning to fly (Forbes)

Learning: How to take smart notes (Janav)

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

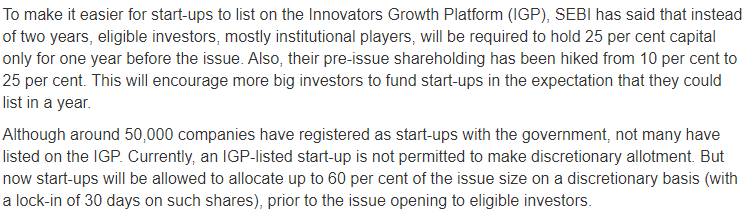

A move which seems bad for both retailer and broker in its first look!!! But devil lies in details. Its a move which will help everyone

SEBI aim is to check rampant usage of margin money paid by one client for another. The whole exercise looks to protect retail investors and in my view its a very good move for long term. This move i believe will limit the number of people leaving markets forever with losses as it may reduce the risk a retail investor can take with his money.

Brokers need to get this point that in long term their operations become efficient and their survival improves because investors will increase.

Retail investor has to understand that limiting margin will help them to take calculated risks and improve their chances of profit

BOGUS people will be filtered out. That’s the expected bonus

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Three common ratios ( D/E), (Debt Service Coverage ratio) and (Interest service coverage ratio) represented in annual report and discussed at various places in quarterly results of many companies.

These numbers, if not given, can also be calculated if few details are looked into the report carefully