Tag: Stocks

Protected: Sunrise 4

Protected: Sunrise 1

Protected: Positional Stocks – 28-May-23

Protected: Premium Stocks : 27-May-23

Pricol : Emerging Auto Ancillary

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Business

Pricol Limited is an auto component supplier headquartered in Coimbatore, Tamil Nadu that manufactures various products such as driver information systems, oil/water pumps, chain tensioners, cab tilts, fuel sensors, temperature/pressure sensors, speed limiting devices, and wiping systems. Company is the world’s second largest DIS manufacturer for 2 wheeler.

The promoters, and related family members/family-owned entities hold a 36.53% stake in Pricol.

Manufacturing facilities

9 Manufacturing Locations, 8 Manufacturing Plants in India , 1 Subsidiary Plant in Indonesia. 3 International Office in Tokyo, Singapore & Dubai

Two direct subsidiaries in Indonesia (produces and markets instrument clusters, oil pumps and fuel sensors), and Singapore (procurement arm).

R&D Capabilities

2 Technology Centers at Coimbatore, ~ 4.5% spend on total revenue for R&D, As of march 2022, co. has made 13 inventions for which 18 patents have been filed. Out of which 12 are granted and remaining are under review.

Employee strength 850+, Engineers 300+

Customers and Regions of Revenue

Two-wheelers accounted for 61% of revenues and domestic sales constituted over 90% of its revenues in FY2022. Exports as a % of total revenues have dropped from ~30% to ~10% from FY20 to FY22. primarily due to divestment of various loss-making foreign subsidiaries.

In FY21 , DIS and pumps & mechanical products accounted for 50% and 33% of consolidated revenues respectively. Target is to take it to 70:30 ratio

Awards and Certications

Leading Industry Certifications IATF 16949:2016, ISO 14001:2015, ISO 45001:2018

Pricol has been recognized with the “Business Innovation” Award by the Confederation of Indian Industries (CII) Tamil Nadu for the various innovations done on Driver Information and Connected vehicle solutions

Award received from Honda Motorcycle and Scooters India “Best Delivery Management”

Award From TATA Motors (TML) on 07-Sept-2022

Award received under the category “Technology Excellence Award 2022” for the Best Interactive Product in Automotive.Award From Quantic India on 14-OCT-2022

Award From Hero MotoCorp on 07-NOV-2022. Award received under the category “Best In Innovation & Technology” at the Hero – NEXT 22

TOP 50 INNOVATIVE COMPANIES

Confederation of Indian Industries (CII) awarded Pricol as one of the “TOP 50 INNOVATIVE COMPANIES” as a part of Industrial Innovation award 2022

Product verticals

Driver information and Connected Vehicle solutions

This vertical is having products which are becoming need of every vehicle, 2W, 4W, CV, PV, LCV. Next stage could be CV, 3W and EV penetration

Moreover with EV domain coming up, this vertical has more legs

Customers

All Major customers are their clients

Experienced promoters and established track record of the company

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

PAT transformation is sustained and growing, OPM got stable at 12%, we can expect OPM in range of 10-15% in coming years. Chances are it might get stable at 13-14% in next 2-3 years. EBITDA margins target of 15% from company side

ROE is improving over last decade and stands at 18%, ROCE at20%

Stable Cash conversion cycle and Working capital days are just under 25

Shareholding pattern

Low retail presence

IN house excellence

MANUFACTURING EXCELLENCE

PCB Assembly with SMT Lines

Robotic Lines with EOL Testing

State of the art Tool Room

Plastic Injection Molding

Pressure Die Casting

Machine Building

Sintering

Subject Matter Experts in Electronics

(Hardware & Software), Mechanical and

Electro-Mechanical domains

ASPICE level 2 practices

TESTING EXCELLENCE

EMI – EMC

Hil Lab

Environment

Endurance

Product Reliability

Triggers

Key partnerships of company with SIBROS, BMS, Technology provider, PSG institutions and Candera CGI studio can propel the company technically and come up with advanced products and solutions

Below snippet is from Q1FY23 Confcall Aug22 —talking about 12-36 months for different engines to fire

So 9 months has passed from that time.

New product launches in Q4FY23

In FY22, co. has launched certain new products, including some marking products especially for TVS on their iQube, the electric vehicle, a seven inch TFT the first of its kind, a hybrid TFT plus LCD instrument cluster, among others

Increase in exports to 20% of revenue

Exports as a % of total revenues have dropped from ~30% to ~10% from FY20 to FY22. Currently Plan of company is to take to 20% by 2025. Big deal with Caterpillar done and things will roll out in coming years

Capacity Enhancement and new machines

Production capacity enhancement in Tool room, Plastic Component Manufacturing Shop and SMT (Surface Mount Technology) for PCB assembly line by adding new machines.

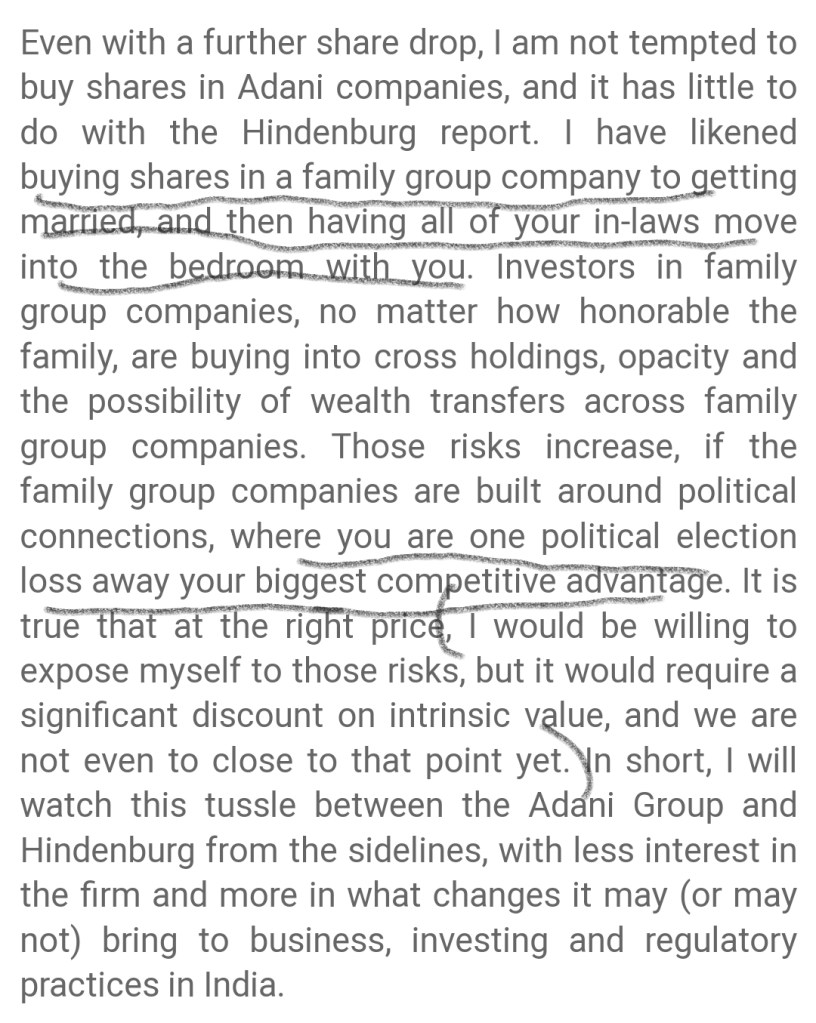

Acquisition of shares by Minda

Minda holds 15.7% and wants to increase till 24.5%, That can trigger an open offer and push share price might move up. As of now Pricol is opposing the deal

Diversified product profile comprising of driver information systems, pumps and mechanical products mitigates product-specific risks to a large extent

Established relationships with OEMs with healthy share of business – Pricol is a reputed player in the Indian auto component industry with presence for over five decades and supplies to original equipment manufacturers (OEMs) like Hero MotoCorp Limited, TVS Motor Company, Bajaj Auto Limited, Ashok Leyland Limited and Tata Motors Limited.

Company has the target to reach 4000cr revenue by FY26. The company has an order pipeline for the next 3 years

Past Disposal of loss-making businesses–No overhang there

In order to reduce debt, co. has disposed off certain loss-making businesses and divested subsidiaries, for example, co. disposed off its Wholly Owned Subsidiaries – PWS India and Pricol and Pricol Espana in 2019 and 2020 respectively.

It has written off ~400 crores in the process of selling its loss-making foreign businesses

Venturing into new markets

Co. has plans of Venturing into motors and actuators, such as new sensors and newer technologies in driver information systems, like areas in EV vehicles and they have identified certain areas.

In FY22, co. has won many new businesses across various segments including products like Connected Vehicle Solution and around 10 % of the revenue of FY 22 was contributed by new business

PLI scheme approval and CAPEX plans

Pricol is approved for PLI (Production Linked Incentives) Scheme The PLI scheme (outlay of $ 3.5 bn(or)Rs 25,938 crore) for the automobile sector proposes financial incentives of up to 18% to boost domestic manufacturing of Advanced Automotive Technology (AAT) products and attract investments in the automotive manufacturing value chain…PRICOL LIMITED is approved by the Ministry of Heavy Industries(MHI) for the Component champion Incentive scheme

From Aug22 confcall

Targeting Exports and EV segment India’s growth story will be muted in the next 3 years for 2W auto segments; the company’s target is export. Company has a LOI for next 30 months and on the basis of that company projected the target of 4000cr. The company is working on premium products so even at low volume growth the target will be achieved. 8. Company is EV ready and in touch with all EV players in India. Currently 8% revenue is from EV in the DIS segment. Working with 22 EV players in the country. Margins are same from EV as well; also share of EV will go up as EV adoption increases in India

Demerger possibilities to unlock value To unlock value for shareholders, if there is a need to align with some other company to get technology from MNC players, then Pricol may demerge into 2 different companies for DIS and other businesses

Risks

Muted growth in Indian 2W Market

Company has shared at multiple times that next 2-3 years they expect muted growth in Indian 2W market, though with supply of premium products and margin, company may grow better than industry

Exposure to volatility of raw materials and forex rate fluctuations due to high reliance on imports

Semiconductors and electronic components account of ~20% of Pricol’s raw material requirements. Supplies have eased out in last few months. But any recurrence can again lead to volatile times

Heavy Dependency on few customers

High segment concentration with 2W contributing to over 70% revenues– Pricol continues to derive 70% of its revenues from the 2W segment, and 57% of its revenues from its top three customers. Further, over 90% of the revenues are from the domestic market

Heavy dependency on top 5 customers and top 12 customers for business –>12 strategic customers contributing to about (+) 85% for sale and we continue to

grow with all of these 12 customers and our primary sales are driven by these 12 customers comprising of two wheelers primarily followed by commercial vehicles and then passenger cars.

Hostile takeover bid by Minda

This creates an Overhang and use Management Bandwidth in wrong direction. Can lead to company stock price going nowhere

Technicals on 21st May

ALSO READ : Company at Y2K moment

ALSO READ : Dream come true

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 21-May-23

Protected: Positional Stocks – 14-May-23

Protected: Positional Stocks – 8-May-23

Company at Y2K moment

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Business

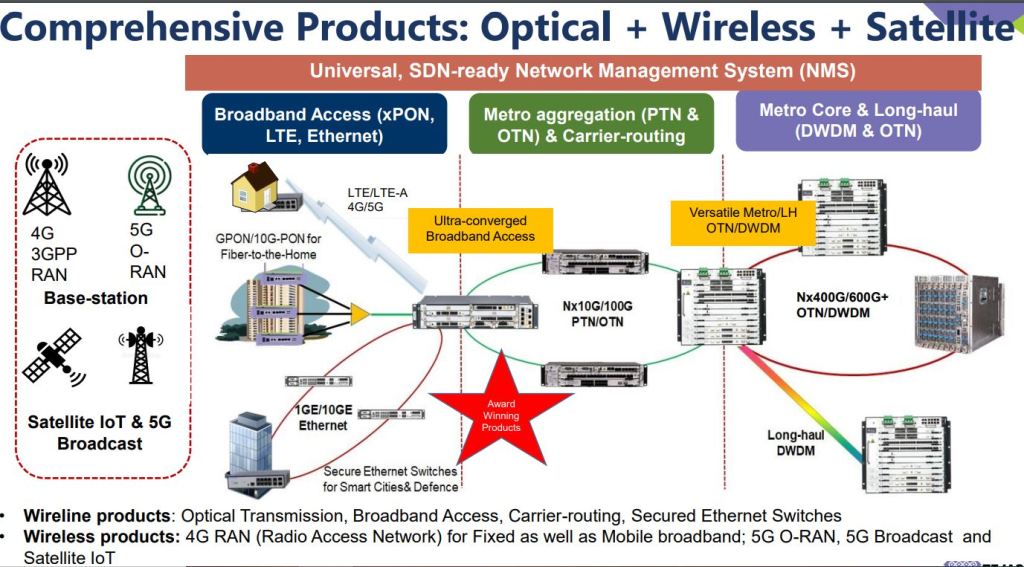

Incorporated in 2004, Syrma SGS Technology Limited is a Chennai-based engineering and design company engaged in electronics manufacturing services (EMS). The company provides integrated services and solutions to original equipment manufacturers (OEMs) from the initial product concept stage to volume production through concept co-creation and product realization

Syrma is a technology-focused engineering and design company engaged in turnkey electronics manufacturing services (“EMS”), specializing in precision manufacturing for diverse end-use industries. They are leaders in high-mix low volume product management and are present in most industrial verticals

Product Portfolio

– Printed circuit board assemblies (PCBA)

– Radio frequency identification (RFID) products

– Electromagnetic and electromechanical parts

– Motherboards

– Memory products – DRAM modules, solid state, and USB drives.

Manufacturing facilities

The company operates eleven manufacturing facilities in North India (Himachal Pradesh, Haryana, Uttar Pradesh) and South India (Tamil Nadu, Karnataka). The manufacturing facilities in Tamil Nadu are located in a special economic zone. The manufacturing facility in Haryana has been set up under the Electronic Hardware Technology Park scheme, which allows the company to avail of tax and other benefits.

R&D Capabilities

Co. has 3 dedicated R&D facilities, 2 of which are located in Chennai and Gurgaon, and one in Stuttgart, Germany. R&D efforts are focused on

(i) developing new products and improvement of the quality of existing products, and

(ii) driving the design and engineering capabilities and original design manufacturing capabilities of the company.

Customers and Regions of Revenue

TVS Motor Company Ltd., A. O. Smith India Water Products Pvt. Ltd., Robert Bosch Engineering and Business Solution Pvt Ltd., Eureka Forbes Ltd Limited, CyanConnode Ltd., Atomberg Technologies Pvt. Ltd., Hindustan Unilever Ltd., Total Power Europe B.V.

Company’s products are sold in 25+ countries, including USA, Germany, Austria, and the UK. In FY22, exports contributed 55% of the revenue.

Awards

Dec’22 Best EMS Supplier 2022 Award by Pricol

Nov’22 Innovation & Technology Excellence Award by Wabtec Corporation

Oct’22 Award for Techno Visionary – Industry for the Year 2022

Experienced promoters and established track record of the company

Syrma belongs to the Tandon group, which started its first manufacturing unit in 1976 for the manufacture of floppy drives for IBM. The unit was the first hard disk drive (HDD) manufacturing unit in South Asia then. Mr Sandeep Tandon, Chairman of Syrma, has over two decades of experience in the electronics industry. By 2000, the group diversified to high-volume electronics manufacturing services for leading IT majors of the world. The group’s range of products includes printed circuit boards (PCBs), magnetic disk drives, magnetic coils, RFID tags, etc. The promoters of the acquired entity – SGS – have more than three decades of experience in the electronics manufacturing industry, with operations across six manufacturing facilities. The company is led by four directors, who are also its founders. The promoters of the company are professionally qualified and have degrees in electronics engineering/management from reputed institutions. Mr J S Gurjal, who was the promoter of SGS, is now the Managing Director of Syrma.

Industry and prospects

The global EMS market traditionally comprised of companies that manufacture electronic products, predominantly assembling components on PCBs and box builds for OEMs. EMS differs by service providers, and any particular partner may provide any combination of the following: PCB assembly, cable assembly, electro-mechanical assembly, contract design, testing, prototyping, and aftermarket services. The market in India is highly competitive and there are more than 30 organized companies in the EMS industry, but the commercial semi-conductor fabrication operation is almost non-existent. The competition concentration is moderate as the top three companies account for about 30% of the market. The companies follow either of the two unique business models – high volume/low mix or low volume/high mix.

In terms of government initiatives for the sector, the Indian Government is attempting to enhance manufacturing capabilities across multiple electronics sectors and to establish the missing links in order to make the Indian electronics sector globally competitive. India is positioned not only as a low-cost alternative but also as a destination for high-quality design work. Many multinational corporations have established or expanded captive centres in India. Post the COVID-19 pandemic, many global electronics manufacturers are contemplating on the China+1 strategy and looking for alternate manufacturing locations for exports business, which is advantageous to Indian manufacturers. Syrma’s presence in the ODM segment offers the company a better position and margins. However, the company’s ability to scale up operations amid the improved demand for the sector and the capability of the company to manage the shortage of raw materials and the working capital cycle remains key to the prospects

Revenue mix

Quarterly basis

Nine month basis

Current mix of the Auto, Consumers, Healthcare , Industrials, IT and Railways

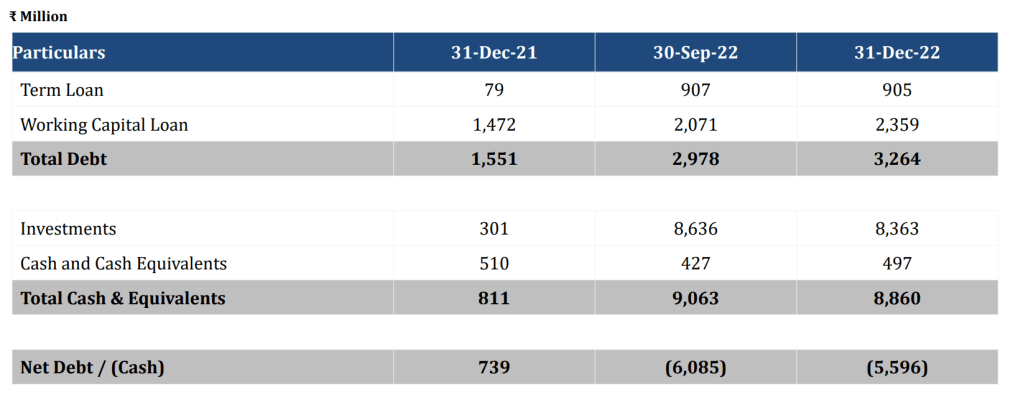

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

Company has sufficient Cash to grow

Stable PAT and EBITDA margins , ROCE is approx 13%

Opportunity Size

The Indian ESDM market is expected to grow at about 40% annually. The company expects to grow in line with industry growth rates.

Triggers

The company IPO has given sufficient cash for capex. Capex will involve around Rs.38 crore for setting up a R&D facility in Chennai, Rs.108 crore for setting up and expanding the manufacturing facility at the Chennai Plant, around Rs.52 crore for setting up new manufacturing facilities in Hyderabad, around Rs.228 crore for setting up and expanding of manufacturing facilities in Manesar, around Rs.62 crore for setting up new facilities in Bawal, and around Rs.83 crore for setting up new facilities in Hosur.

Q3Fy23 bringing up our new facility in Manesar and Chennai for the design and development

Incorporation of new subsidiary

Syrma SGS Electronics Private Limited is incorporated as a wholly owned subsidiary of the Company on March 03, 2023

To carry on the business of designers and manufacturers, buyers, sellers, assemblers, exporters, importers, distributors, agents, and dealers in memory chips, memory modules, PCB assemblies and other storage products, printers, readers magnetic or otherwise, CRT displays and terminals and all other electronic and communication equipment and parts, components, assemblies and subassemblies to be used in the computer and electronic industry

including voice coils, voice coil actuator assembly, antenna coils, smart cards and radio frequency identification devices.

Acquisitions of SGS and PerfectID

This is playing out already in right direction as businesses acquired are complementary

Syrma acquired a 20% stake in SGS in November 2020. Funds of Rs.92.04 crore from private equity funds and other shareholders have been infused in Syrma in FY21, partly as equity and partly as preference capital, which has been utilised for the purpose of inorganic growth by way of acquisition of SGS. The erstwhile promoters of SGS now hold 9.23% share each in Syrma, totaling to 37%.

SGS, incorporated in 1986, is an Indian EMS company that primarily assembles PCBs for its clients. In terms of customer and geographical profile, there is no overlap between Syrma and SGS, thereby diversifying the segment and client profile on a consolidated basis.

Syrma also acquired 75% stake in Perfect ID India Private Limited in October 2021. PerfectID manufactures RFID label tags and passive inlay tags, which is in addition to the existing capabilities for the manufacturing of RFID hard tags, thus expanding the RFID products portfolio.

PLI approvals

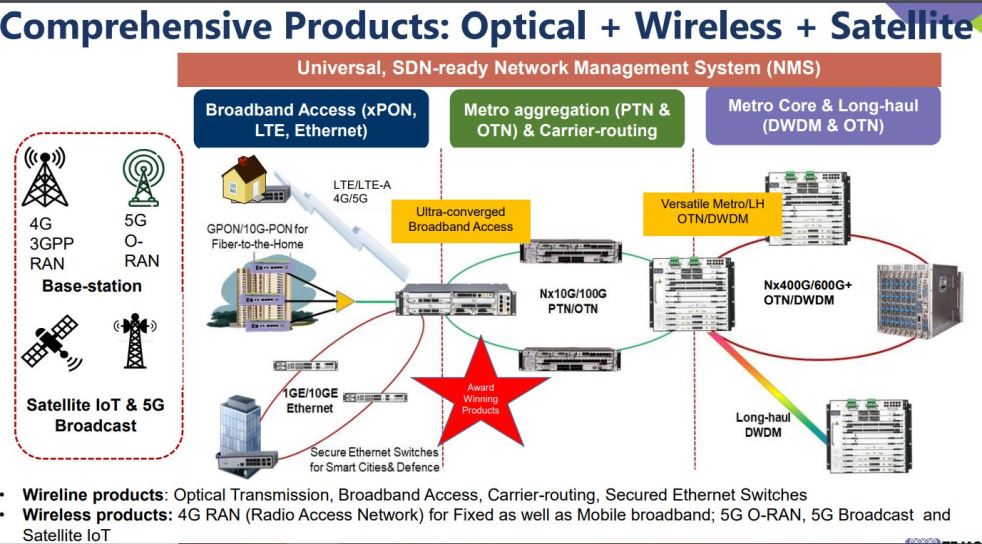

Company has received 2 PLI application Approvals in the telecom and in white goods air conditioning sector. As of date, the telecom PLI investments are on track, new facility at Manesar has been commissioned, it has gone into production in the second quarter of FY23 and expect huge traction in that business going forward in the coming quarters. The air conditioning PLI for products are under validation and it would be some quarters before we see any outcome. Products for the Indian market both inverter and non-inverter are under validation.

Company is focused on building out more ODM type development with current and new customers.

Very strong audits done by new marquee customers throughout facilities are done, so company is expecting new business to roll in over the next six to nine months with those customers

Order book size 1700 cr Sep22, 2100cr in Dec22–which is executable within 12 months is about Rs.1800 Crores and the spillover is about Rs.300 Crores

Capacity utiliation of old plants 75% approx, new plants commisioned approx 50%

Top 10 client concentration is 47% Dec22

In future margins increase can come from healthcare shipments which is export oriented business, or box build assemblies going more or asset turn increases with more production line and bulk order in consumer segment

Company is the single source for a lot of customers

Company is expecting rebound in Europe in two quarters

The growth is primarily led by continuous efforts on design lead manufacturing and has broadly been across sectors, but led by auto and consumer. The growth in a few sectors like healthcare and exports has been muted and slow because of the recessionary conditions and inflation in Europe, but we are very confident on the long term story and expect this to rebound in the coming quarter or two quarters.

Q3Fy23 call

Consumer growth business is primarily lead by our entry into the fiber to home devices and the telecom PLI scheme and the visibility which we have received makes us confident that this will lead to a sustainable growth in this segment in the coming quarters. It is not a one off growth, but a sustainable growth and we have also added more technology partners in this segment, which will further broaden the base and derisk the segment from the risk of a particular technology partner going down or a customer going down so we are broadening the base on this front.

In the automotive, the higher traction of growth will be in the EV segment

Next cycle of growth from EV charging infra and energy storage infra

Risks

High Valuation in short term

One needs to keep long term view, buy as SIP for risk mitigation of valuations

Exposure to volatility of raw materials and forex rate fluctuations due to high reliance on imports

Syrma’s raw materials consist of many components, including ICs, among others. Majority of the components, chips and PCB ICs, are imported and Syrma has the liberty to choose the buyer in most cases. Most of the contracts of Syrma with its suppliers are back-to-back contracts. Also, though the prices with most of Syrma’s customers are negotiated and agreed to initially, they are reviewed regularly. Recent times have seen a severe shortage of key components like ICs and this may also impact the operating margins and the working capital cycle of the company. Due to the high lead time for chips, which extends up to 52 weeks in some cases, the inventory-holding has increased. The company has to make advance payments in some cases to secure the raw materials, which has increased the working capital borrowings of the company. In the short term, this is expected to continue and the margins and working capital will remain affected by the shortage of semi-conductor chips.

Technological obsolescence risk

Electronics manufacturing companies are constantly exposed to obsolescence risk, which requires the company to keep up with the changes and advancements by constantly upgrading its products and technologies. But the company has seen and adapted to changes since inception and has been aware of the technological advancements, right from floppy disks manufacturing to RFID tags now. Syrma has recently forayed into manufacturing RFID tags, considering that the market for the same is expected to grow exponentially in future. The ability of the company to continuously enter new advanced product categories will be key to its future prospects.

Impact of the slowdown in the European and the U.S. market would only on this portfolio? Or it could be in any of the other segments of the exports of EMS?

In general, there’s a softening of the growth, I would say there is a reduction but there is a softening of the growth which we had projected, which we believe is for maybe 2 quarters or I don’t know, it’s just the geopolitical situation. But because of the diversified portfolio which we have, we have been compensated by other segments of the business, which is the domestic-led business. So, we would see the export business impacting on our overall plan for this year, in terms of our customer mix

Technicals on 14th May

Technicals when I entered

Disclosure –Invested from lower Levels . Do your own diligence before buying/selling

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 1-May-23

Deep Digital

Strategic Engagements : KPIT

Climbing up the river

4G to 5G

Protected: Positional Stocks – 16-Apr-23

Mega Trend : Biometrics

Protected: QnA session : Only for premium

Protected: Premium Stocks : 8-Apr-23

Protected: Alpha Electric Portfolio — 7-APR-2023

Protected: Positional Stocks – 7-Apr-23

Protected: Positional Stocks – 1-Apr-23

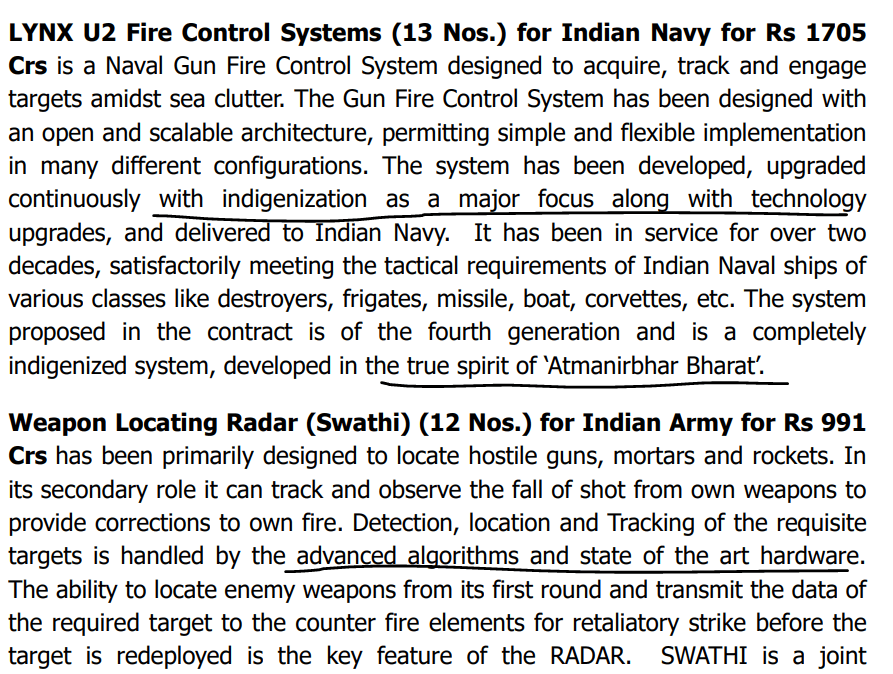

Indigenization progressing

Protected: Positional Stocks – 25-Mar-23

Protected: Positional Stocks – 12-Mar-23

BuLi CSM

As BAD as it gets

Protected: Positional Stocks – 5-Mar-23

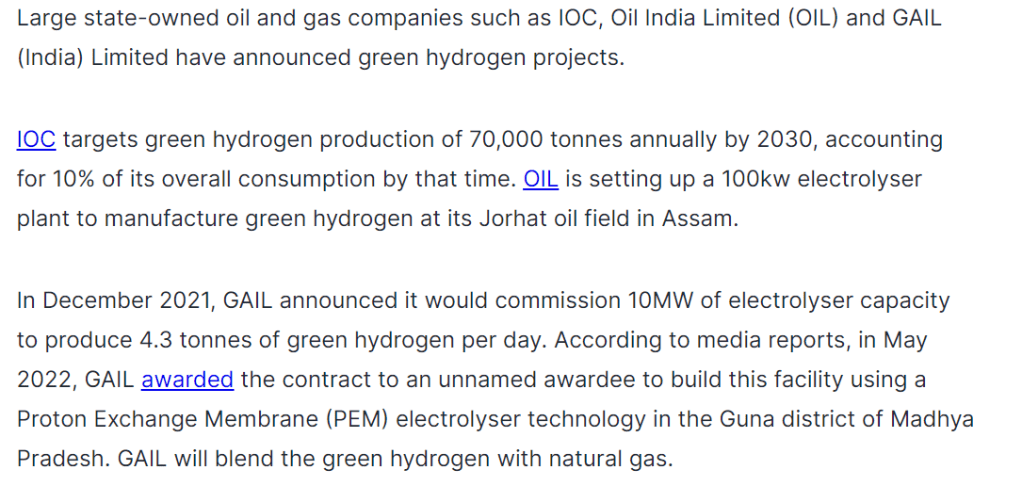

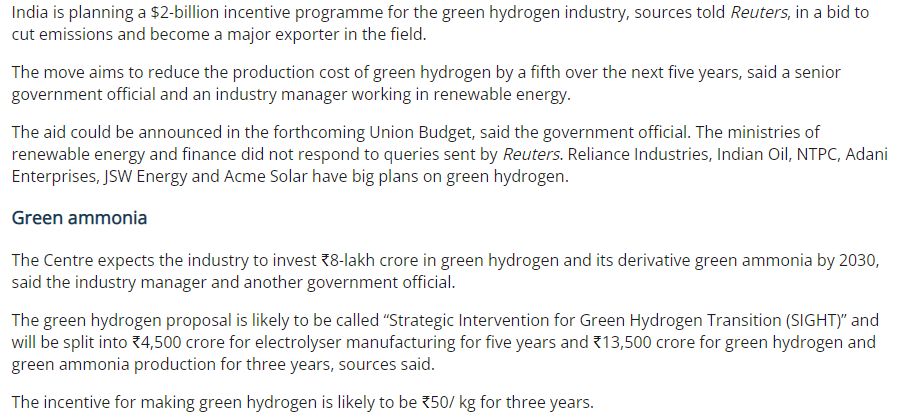

Its Hydrogen decades ahead

Its a DREAM come true

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Business

Dreamfolks in India’s Largest Airport Service Aggregator Platform. Company provides clients the option of providing their end consumers different mechanisms to access certain airport-related services like lounges and all the other services

DreamFolks platform is proprietary and has been developed in-house. The platform and the technology is cloud-based and it allows lounges and other operators to check the benefits of the consumers based on the cards, memberships, or vouchers, and also allows access to the different facilities based on the benefits or integration as per our clients, such as banks or networks, processes, and their systems

Company’s platform actually comprises of quite a few components. There is benefit configuration, there is benefit calculation, there’s an entire management engine, there are data exchange, APIs with different banks and networks, and integration options to embed into different mechanisms, including with company partners. Platform also facilitates the use of hybrid access modes depending on the client’s preference, so they can use whichever mechanism that is most beneficial for them. It also facilitates lounge access processes so that consumers benefit such things in real time across various access modes. And that drives accurate accounting and is designed to prevent abuse and denial of services to consumers

Major expenses are linked to employee compensation and in-house R&D expenses. And being an extremely asset-light company with a very lean organizational structure and size, Company don’t have any major capex needs or other outlays and Company seems confident of financing any future scale-up or expansion through internal accruals

Revenue mix

Current mix of the lounge versus other services 95% versus 5%, Similar margins

Seasonality

40% to 45% in the first half and rest in the second half of the year, due to the simple reason that the festivals and the holiday season kicks in only starting from August, September.

Coverage

100% coverage across all 60 Airport lounges operational in India

Market share of ~95% of all India issued card based access to domestic lounges in India (FY22)

68% share of the overall lounge access volume in India (FY22)*

Present currently in 10 railway lounges across the country and witnessed a steep growth rate with our modernization of railway stations happening at great next speed

Golf Games, Lessons and Railway lounges are new categories

This association will give customer access to golf games and lessons at 40+ golf clubs throughout India and 250+ golf clubs and resorts in the Asia Pacific region.

Price Realization on the blended basis is INR 940 approximately. Domestic is close to INR 840-INR 845. And internationally, that would be between INR 1,200 to 1,400.

Client 52 —Employees 60 –Nov 22 update, 64 employees Feb23

Touchpoints 1450 in Nov 22, 1486 in Feb23, might cross 1500 by Apr23

Touchpoints refer to a service fulfilment point at Airports across India and overseas owned by service providers with whom Dreamfolks has a contractual arrangement

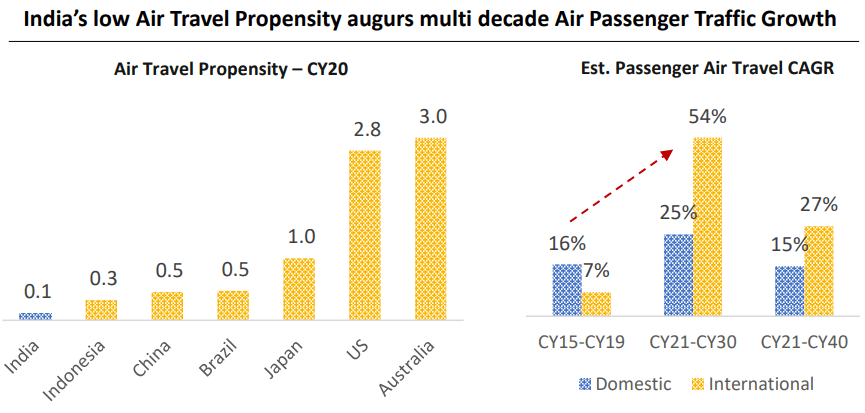

Opportunity Size

Triggers

- Rising preference of Air Travel amongst travelers over rail and road

- Jump in India’ Ease of Doing Business – Enhanced economic activity

- Rising class of leisure travelers – 72% extend business trip for leisure

- Declining Air travel cost compared to AC Rail travel

- GoI push through UDAN Scheme – Increase Air Travel in Tier 2 & Tier 3 cities

- Increasing Credit & Debit cards base bodes well for DreamFolks – Key beneficiary from Bank led Card Loyalty Programs targeting Airport Lounge Access

- Domestic air traffic grew by ~16.7% in Q3FY23 as compared to Q3FY22.

- Strong growth of ~63.0% in domestic air traffic in 9MFY23.

- Witnessing 98 Mn footfalls in Indian Airports during 9MFY23.

- Credit Card base in India grew by ~18% witnessing 81 Mn cards as on Dec’22

Next phase of growth is centered upon three levers;

Cross-selling and up-selling to existing clients,

Acquiring new clients in existing and new sectors and

Via geographic expansion from a purely domestic focus currently to an international focus in pre-determined geographies.

With the existing clients, we aim to increase wallet share and expand our association beyond airport lounge services to include F&B, spa, meet and assist.

As regards new clients, we aim to expand into new sectors to create customer engagement and provide loyalty management solutions. Another focus area is to focus on customer engagement and loyalty solutions for corporate clients and build specific solutions for loyalty companies, ecommerce companies, new age digital companies, hospitality sector companies, and neo banks amongst others

Replication of similar successful operating model by leveraging deep knowledge of industry, technology innovation, process expertise and business model across new high growth markets which include Central and Eastern Europe, Middle East, Africa and Southeast Asia.

Recent developments

ASPIRE Lounges Australia – Delighted to tie up with ASPIRE Lounges Australia. With this partnership, air travelers can now experience exclusive luxury lounge access in Sydney, Melbourne, Perth and Brisbane as part of 66 Aspire Branded Lounges globally.

Dhanlaxmi Bank – Tie-up for access to Indian Lounges for their customers

FCM Travel – Corporate tie-up to provide their customers with domestic lounge access, Meet & assist and Airport Transfer Services

Onboarded 5 New Clients Including Akasa Air, one of the newest LCCs in India

Lounge area and capacity expansion at T3 Indira Gandhi International Airport, Delhi from 2,500 sq ft to 10,000 sq ft.

Added Lounge at Bengaluru’s KempeGowda International Airport, T2

Strategic tie-up with the leading Golf Service provider for access to golf games and lessons at 40+ golf clubs throughout India and 250+ golf clubs & resorts in the Asia Pacific region.

Strengths

MOATS

Company is is getting into exclusive contracts with the lounges.

In terms of the technology company is deeply integrating with banking partners. So that is one of the strong points because the step of integrating with these clients itself is a very long process, And there are a lot of compliance as well.

Value added services:- airport meet, assist in transfer, golf, railway lounges not easy to start and pickup by competition

Amazing aspect is almost Nil CAC

Risks

RBI may reduce the MDR rates on credit card companies so going forward, what credit card companies also have indicated that if this were to happen, and they will reduce rewards and services they offer to protect their margins – that will negatively impact company business in short term

International lounge vs domestic lounge traffic can change margin profile on either side

Any situation like Covid can again lead to bad times for company

UPI payments can pose a small risk

Competition like Priority Pass etc –this risk is somewhat mitigated as competition have been in this market and they

have been the global player across for more than 30 years now. So, in their presence, Company have actually taken away the India share from them

IMAGES FROM INDIAN AIRPORTS over last 10 months showing lounges are high in demand, runway are back to back lined up with airplanes signifying air travel increasing and travellers interest in lounges also increasing–so Increase in travelers and increase in interest of traveler for lounges can be huge tailwind in coming decade 2023-2033

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 26-Feb-23

SAF market

Biofuel, Decarbonization, Aviation, Import saving, greenhouse gases, SAF

Protected: Alpha Electric Portfolio — 19-feb-2023

Protected: Positional Stocks – 19-Feb-23

Enablers for location intelligence

Mega trend : Geospatial Analytics

Eyes and Brain

Biggest moat!!

Protected: Premium Stocks : 4-Feb-23

We dont spend easily : Its costly

Roller coaster from pasts

Green Hydrogen Mission

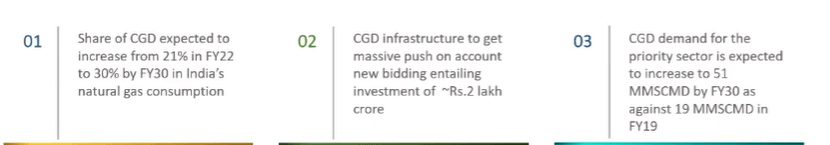

City gas distribution (CGD) Demand

To understand better on the stock, follow below links

Protected: Positional Stocks – 29-Jan-23

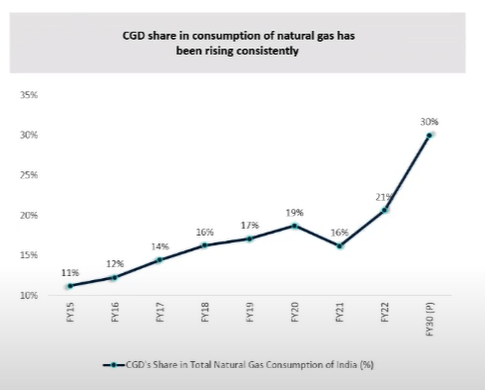

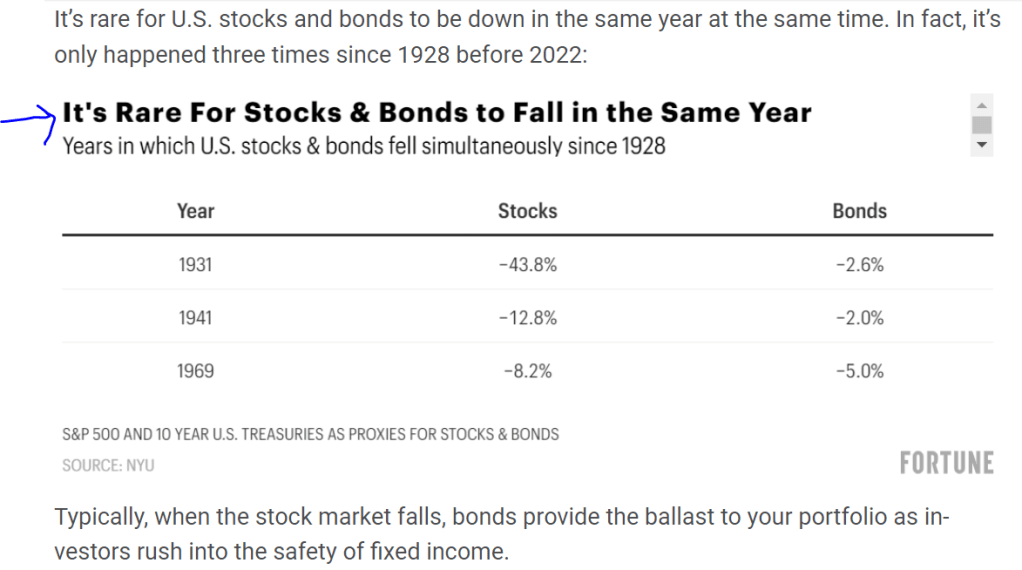

Rarest of rare event : How bad was 2022

Protected: Positional Stocks – 21-Jan-23

Thread on Dependable Clean energy Giant in making!!

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

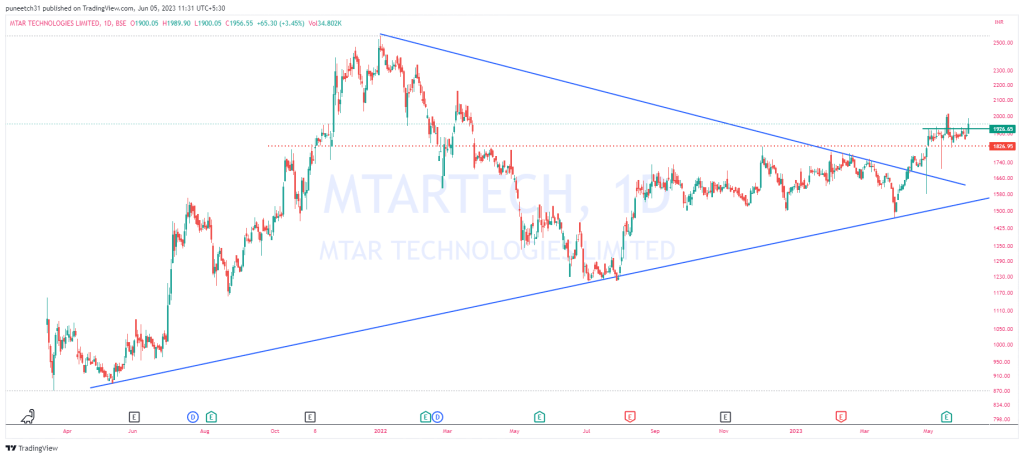

MTAR Technologies – Emerging Midcap

Story – When the going gets tough, the tough get going, wrote American football coach John Thomas in 1953. This axiom today applies to the Hyderabad-based MTAR Technologies too, in more than one way. Old-timers at MTAR recall India’s former President and ‘Missile Man’ Abdul Kalam telling his team during his DRDO days: “If nothing is getting done, go to that Reddy company at Hyderabad.”

In fact, the Reddy duo – Ravindra and Satyanarayana – set up MTAR, to meet a challenge thrown at them by the government, way back in 1970, to make a critical cooling channel for a nuclear reactor.

As global suppliers began tightening their screws on India’s nuclear power ambitions, the government asked HMT to work on the cooling channel. The late Ravindra’s son P. Srinivas Reddy, MD, MTAR, recalls that HMT expressed its inability to do this and the Reddy duo, who were working there, quit and told DAE they would take up the channel challenge.

There are many Proud moments on its journey including

Mangalyan PSLV engine supplied by MTAR to ISRO

GSLV Mark III engine for the Chandrayaan II mission

Base shroud assembly for Agni missiles

Source —BusinessIndia

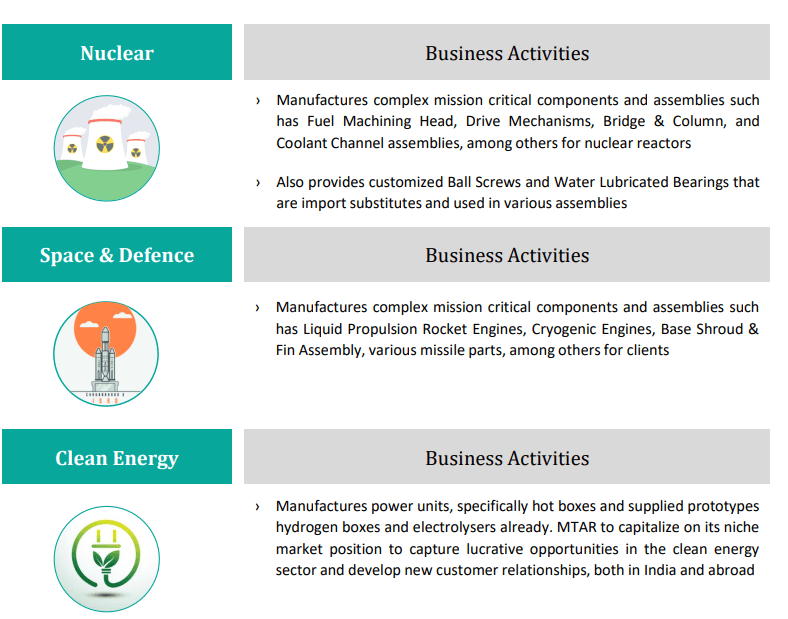

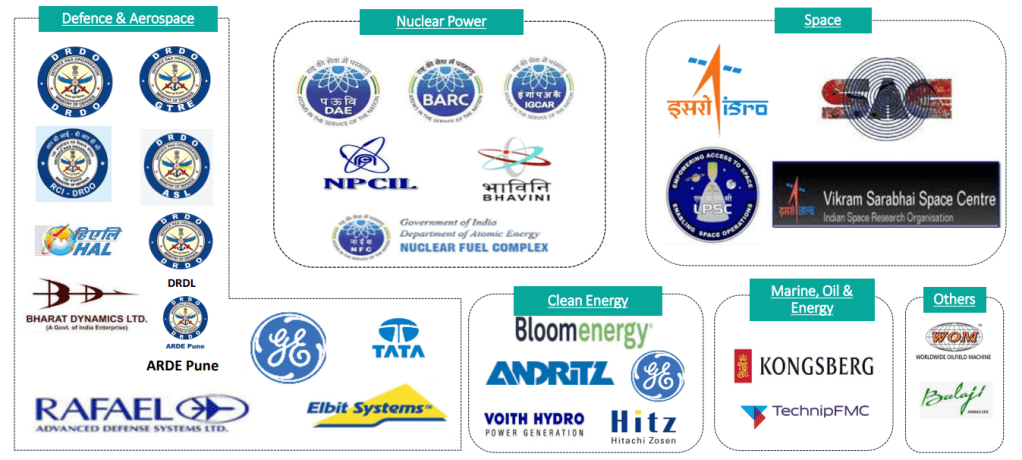

Business Domains

Order Book

Order Book moving to Clean energy over last 2years. Order book at Sep 2022 closure is 1288 cr while Current TTM sales is ~394 cr (till Sep22)

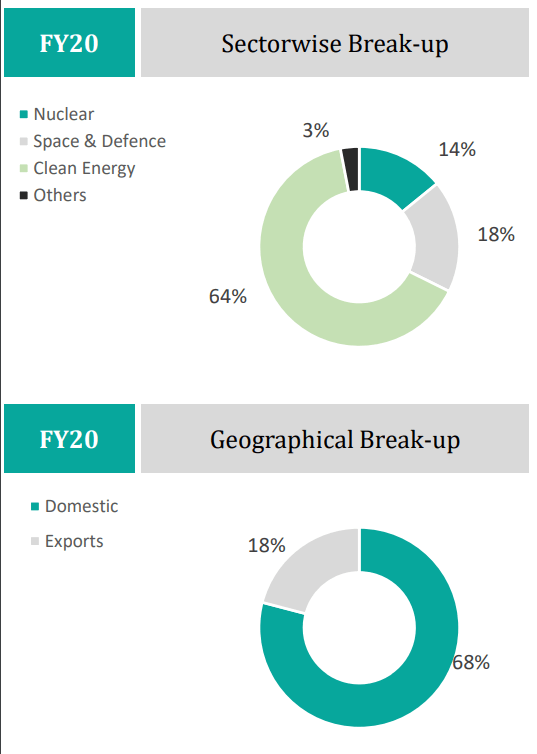

Sector wise and Geographical Break up of Orders

Company is export oriented–trend is almost same in last 3 years

Clean energy orders constitutes almost more than 50% order book every year

Space and Defense Constitutes between 18-26%

Nuclear constitutes 14-22% order book

Other segments growing fast and now at 5.7%

Customers

Strengths

High Entry Barriers and Increased customer dependency on Mtar

Strong Order Book Position and Strong repeat business due to MTAR’s engineering capability

Advanced and End to End Manufacturing Capabilities

Strong Diversified portfolio of critical and differentiated engineered products in emerging domains of Nuclear, Space,Defense, Clean energy , fuel cell etc

Manufactures import substitute products like Roller screws, ball screws. MTAR will be the first manufacturer of roller screws in India and the product will be used for a wide variety of applications in the nuclear, space and defence sectors

Manufactures precision machined components

Strong association with Exiting Customers & new Customers in Pipeline

Stringent Quality checks –Company uses high precision quality inspection equipment such as 3D co-ordinate measuring machines (CMM), laser measuring, optical alignment instruments, non-contact measuring and other such non-destructive testing equipment, to ensure ideal quality. “MTAR enjoys an unblemished record of quality for its product range”

Capability of making —

- Low volume R&D to high volume production products

- Regular to complex products

- Low weight to high weight products

- Export oriented to import substituition products

Experienced Board of Directors & Well Qualified Management Team

Certifications and Awards

Developed global supplier base over the years &procures materials from US, Brazil, among others, Low supplier dependency which also enables negotiation of favorable terms. Global network provides the option to take advantage of better pricing as available in a particular market

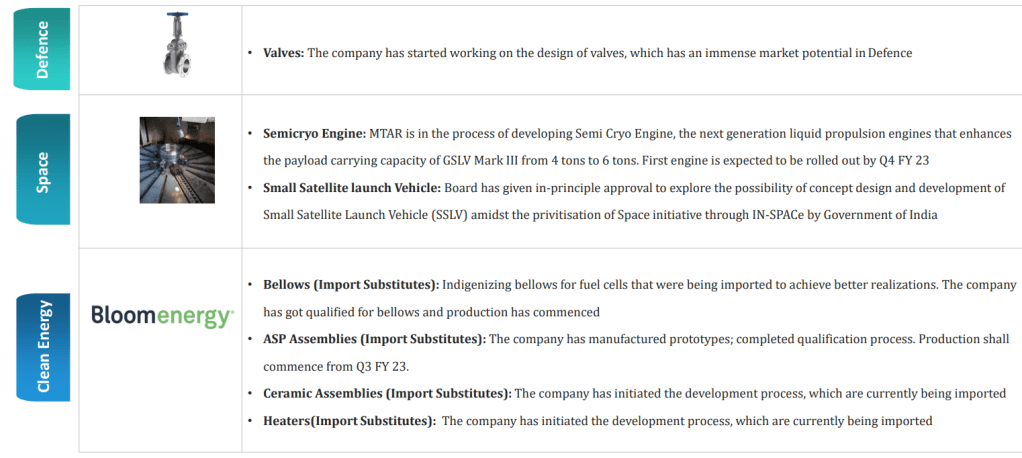

Triggers

Strong growing order book –Currently ~1300cr order book giving revenue visibility of 2+ years

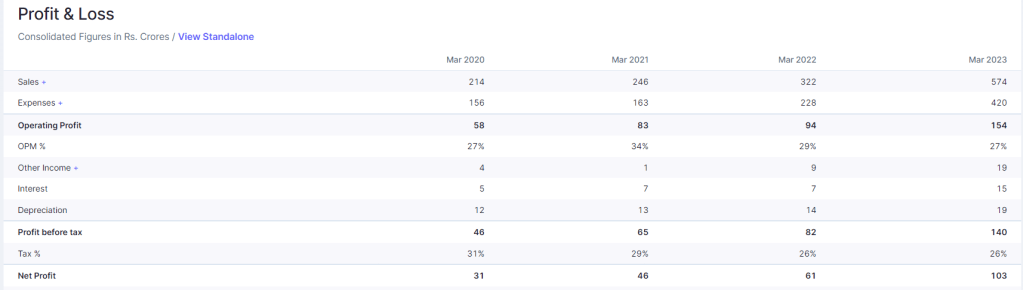

Strong Net profit margins with company growing at 30% CAGR. FY23 and FY24 expected to grow similarly or better

The company has got the in principle approval from the board to establish electronics manufacturing in-house and started working on it

Indigenization of Roller Screws done, Executed the FAI orders

The company has also initiated the development of Electromechanical actuators, which find application in Space and Defense sectors

Specialized fabrication facility to be functional soon, The new capabilities are expected to bring in lot more customers. Sheet metal manufacturing facility at Adibatla, Hyderabad has become operational in Fiscal 2023 to undertake sheet metal jobs for ISRO, Bloom Energy and certain other customers. This business expected to generate 100 cr revenue in FY24. Commenced shipments to South Korea and USA; supplied Rs. 11.8 Crs worth of sheet metal orders for Clean Energy sector in Q2 FY 23

Upgrade existing facilities by implementing new technology and releasing release bottlenecks in production capacity

Expanding Product Portfolio and CAPEX ongoing along with IMPORT SUBSTITUITION

Increasing employee strength in last two years as order book increasing continuously

In discussion with below customers to reduce dependency on existing clients

MTAR is developing the following products in collaboration with Bloom to expand its product portfolio in clean energy sector:

Hydrogen boxes- Use Hydrogen to generate power

Electrolyzers – generate green hydrogen from water that shall be used in power units to generate power with zero carbon emissions

(Bloom is one of the largest and the fastest growing player globally in the stationary hydrogen fuel cell segment and has 70% of its revenues

coming from products segment and balance from services)

Opportunities in each business domain due to Indigenization policies in defense, Aatmnirbhar Bharat policies in different sectors, demand of fuel cells and growing maintenance market

Exponential growth expected for Indian players in Space sector given ISRO’s plan to commercialise the Indian space sector

and offer its products and services to other countries

Opportunities in defence offset partnership with certain global OEMs

14 New reactors planned and tenders to be released, one recator have equipments worth ~2200 cr Rs where MTAR is focussing on. Long term relationship with NPCIL can help MTAR to grab that opportunity

Green Hydrogen push by Government brightens prospects further. A capital outlay of Rs75,000 crore (US$9.4 billion) over the next three years to develop manufacturing capacities for clean energy technologies, which include electrolysers to produce green hydrogen. NTPC is already walking the talk on green hydrogen. The company is developing India’s first hydrogen-to-electricity project using US-headquartered Bloom Energy’s solid-oxide electrolysers and fuel cell technology. NTPC’s floating solar plant will power the electrolysers to produce green hydrogen. Bloom Energy’s hydrogen fuel cell technology will convert the hydrogen into carbon-neutral electricity without combustion to power NTPC’s Guest House in Simhadri, Visakhapatnam.

Risks

No long term contracts with suppliers, though risk is mitigated with enough suppliers on board

Client concentration risk –Bloom energy almost constitutes 50% of orders–Company is trying to get more clients onboard to mitigate this risk

Valuations seems a bigger risk than above mentioned ones. If orders/Profit don’t materialize on expected lines, stock can easily correct to 900-1200 zone or It can happen that stock may not fall much , but may remain stagnant between 1200-2000 range for long leading to opportunity loss

Any policy changes can delay the expected outcome

Technicals

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Infra Speed breaker

CY2023 – Alpha Picks for Investors

Will keep updating this Hashtag, follow closely to cancel out noise and focus long

DREAMFOLKS

PG ELECTROPLAST

HG INFRA

MTAR Technologies

ALLCARGO LOGISTICS

BHARTI AIRTEL

LIKHITHA INFRA

STERLING TOOLS

GRAVITA INDIA

EXIDE INDUSTRIES

KABRA EXTRUSIONS

DATA PATTERNS

LARSEN TOUBRO

Protected: Positional Stocks – 9-Jan-23

Protected: Alpha Electric Portfolio — 8-Jan-2023

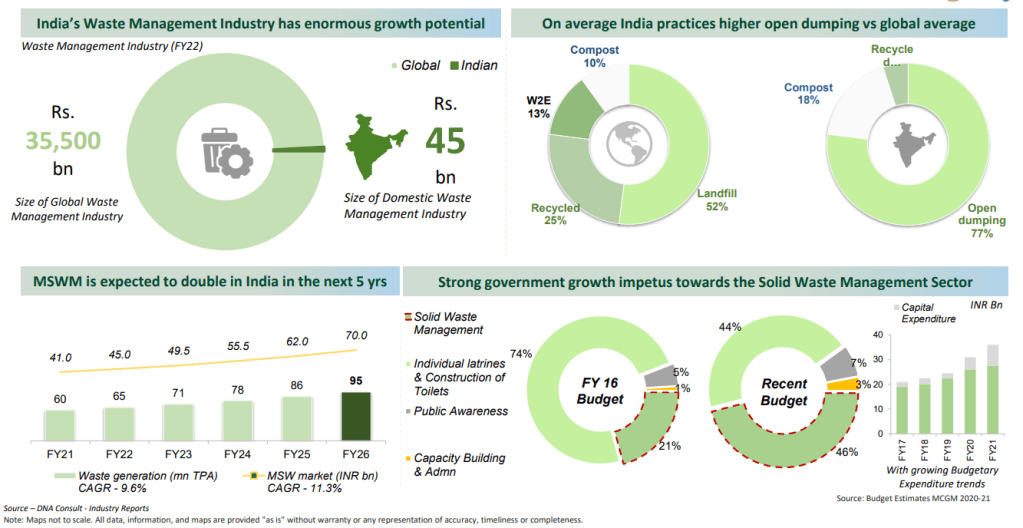

It’s Waste!

Protected: Positional Stocks – 1-Jan-23

Protected: Premium Stocks : 1-Jan-23

1% to 2%

Green Hydrogen : Long term trend

Key M&A : 2022

Protected: Positional Stocks – 24-Dec-22

Its M&A time!

IPO 2022

Mega trend : Lounge market

ALSO READ

Small satellites : Way forward

Protected: Positional Stocks – 10-Dec-22

Aatmnirbhar Version : Speciality Steel

PSU are moving to cloud solutions

Recycling game : Mega trend

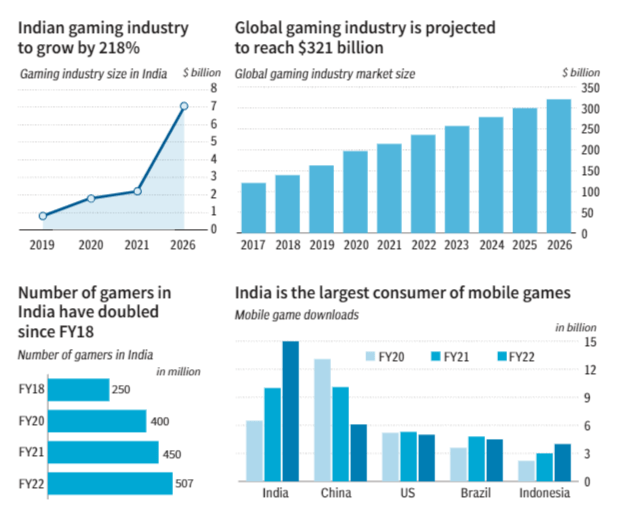

Are you game : Mega Trend

Protected: Positional Stocks – 4-Dec-22

Its Home run

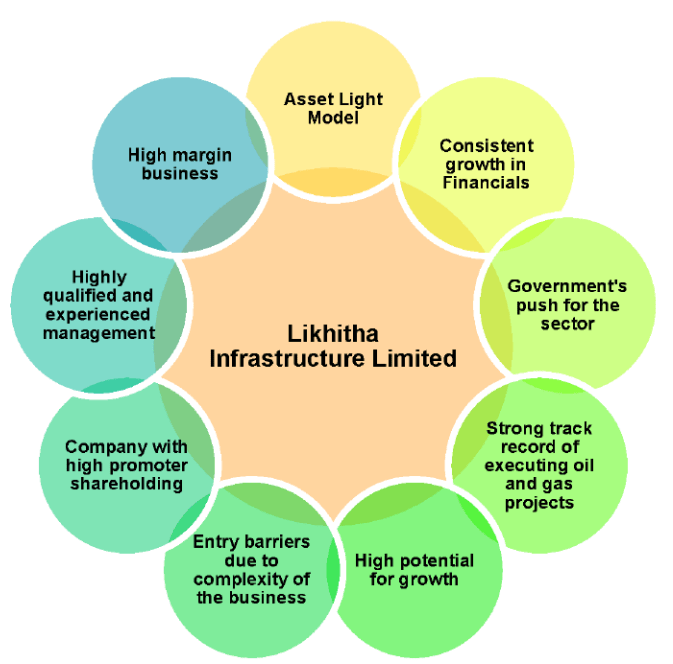

An insight into Infra company

Stock Name –Likhitha Infra

Small Effort for all followers –Just compiled the thoughts together. Feel free to reach me for queries

Disclosure- I am invested from lower levels. Please assume that I may add, sell at any point of time without communicating. Hence Do your own due diligence before Buying selling

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Likhitha Infra

Protected: Premium Stocks : 27-Nov-22

Protected: Positional Stocks – 27-Nov-22

Protected: Alpha Electric Portfolio — 27-Nov-2022

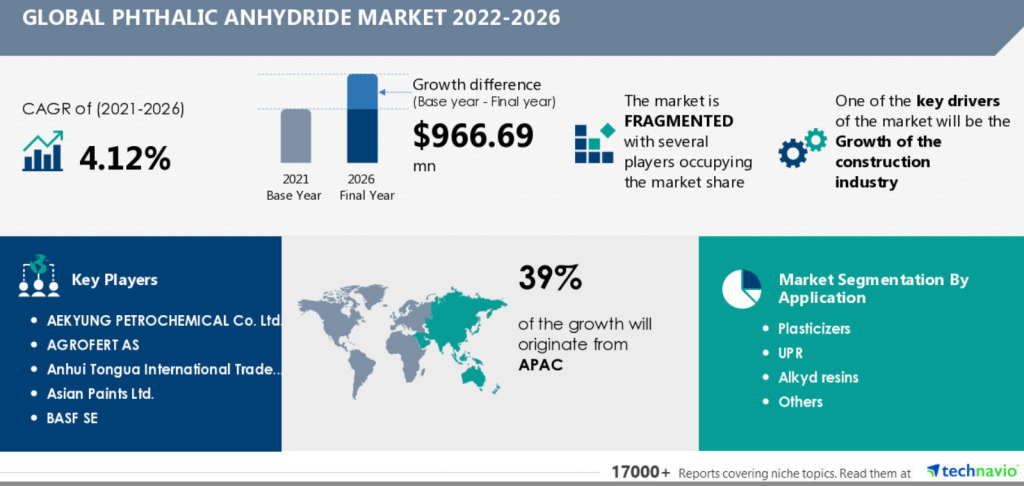

Phthalic Anhydride

Singapore calling

Carbon Markets and EV buses

We dont know, we hope for the best

Castrol on EV fluids

Protected: Positional Stocks – 15-Nov-22

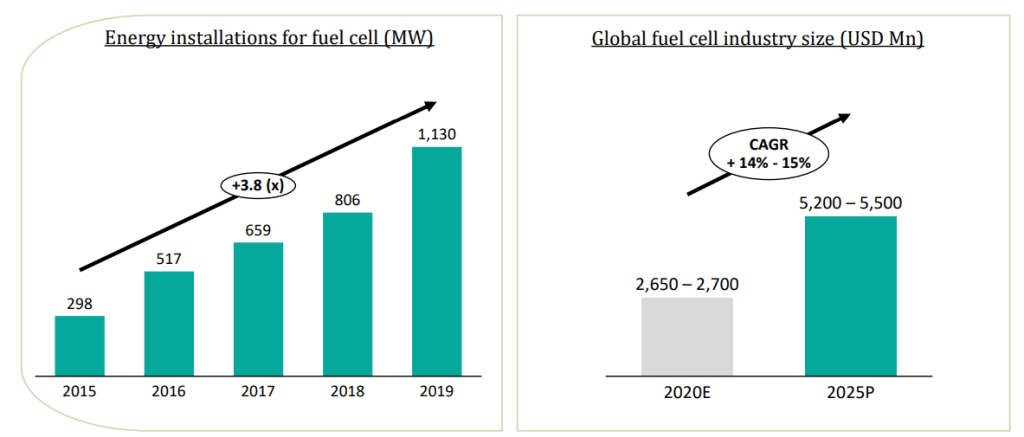

Fuel cells

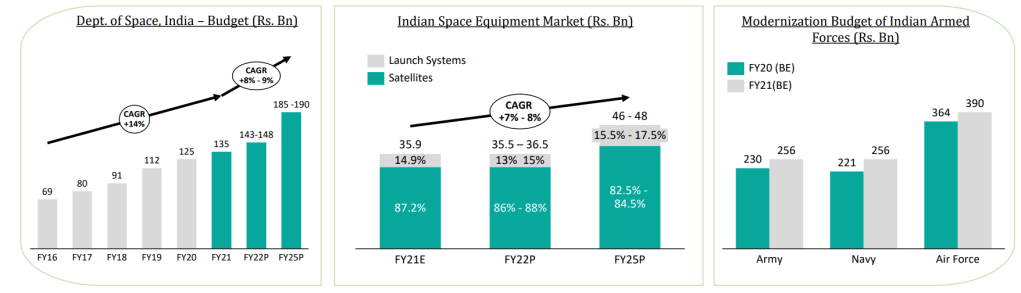

Space and Defense

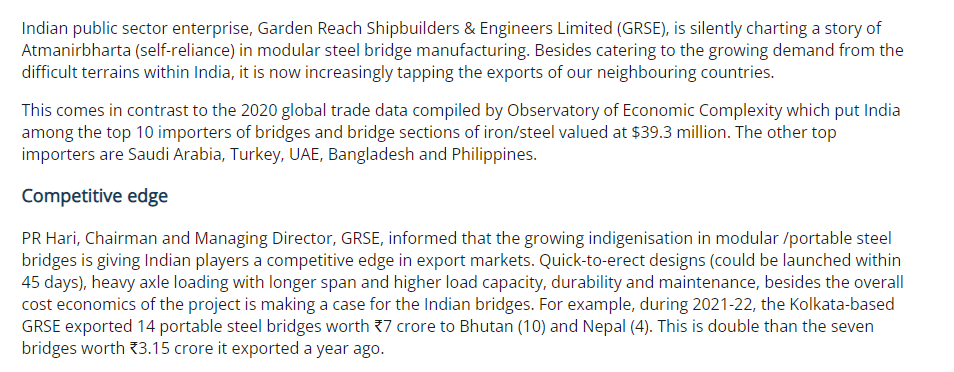

Modular Steel Bridges

Mega Trend : Green Energy Play

Ready to Drink : New trend

Air traffic

Long term trend : Travel Luggage

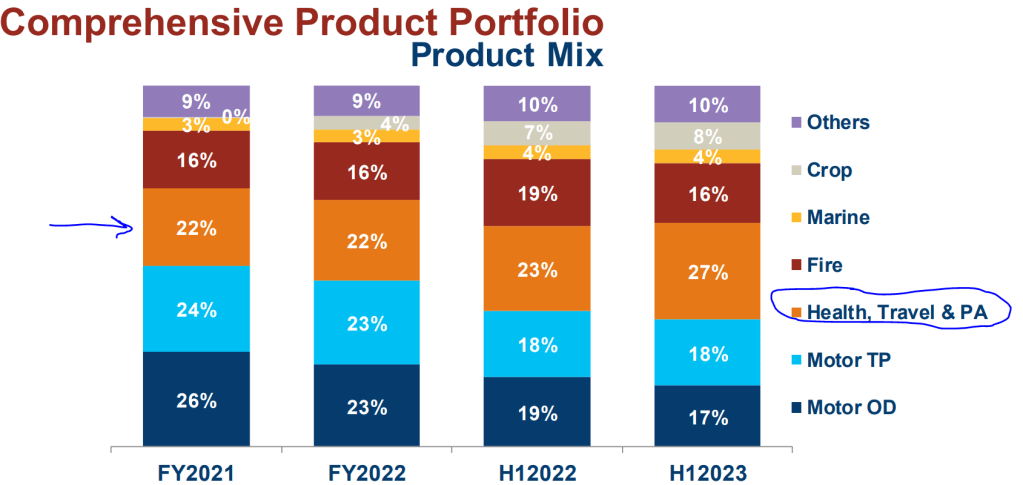

New trend : Travel, PA, Health

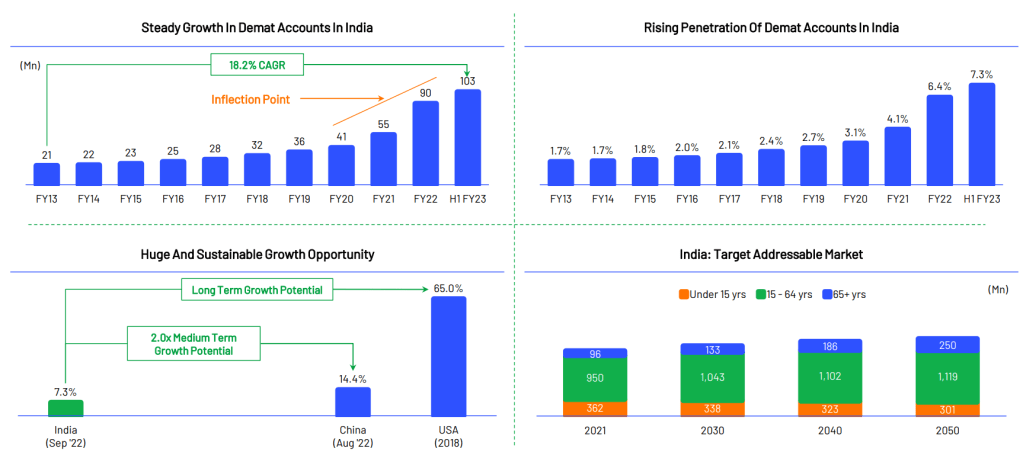

DEMAT Kranti

Protected: An insight into Versatile player related to RE Infra

An insight into Defense company : Data Patterns

Disclaimer – Below Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Data Patterns

Business —

Data Patterns is a leading player in India’s Defence and Aerospace industry. The Company is respected for its proprietary capabilities: design to manufacture, testing to validation and support for products throughout the life cycle. Data Patterns is the only Indian company in the Defence and Aerospace sectors to offer complete systems.

Data Patterns’ core competence covers the entire spectrum of electronics including Processors, Power, RF and Microwave, Embedded Software & Firmware. This unique capability allows Company to offer complete solutions, an area addressed only by international OEMs.

Data Patterns has succeeded in building products in high technology domains such as Radars, Electronic Warfare (EW), Communications, Satellite Systems, Video, Control Systems and Navigation, besides others. It is one of the few Indian companies offering indigenously developed products catering to the entire spectrum of Defence platforms – space, air, land, and sea. The Company established its quality management system in line with the demanding standards of AS9100 Rev. D by TUV-SUD, an internationally acclaimed certification

Product offerings and Clients

Can they do 3x in next 6yrs for revenue? Chances are bright with emerging tailwinds

Moats —

Biggest moat is long term relationship with Indian Defense companies built over years. A new company will take years to develop, manufacture, provide and test the integrated systems and then won new orders

Data Patterns is the only Indian company in the Defence and Aerospace sectors to offer complete systems.

Data Patterns’ core competence covers the entire spectrum of electronics including Processors, Power, RF and Microwave, Embedded Software & Firmware. This unique capability allows Company to offer complete solutions, an area addressed only by international OEMs

Strengths

- Data Patterns’ modern manufacturing facility consists of 2,00,000 square feet factory built on 5.75 acres of land in SIPCOT IT Park, Chennai. It has facilities for design, manufacturing, qualification and life cycle support of high reliability electronic systems used in Aerospace and Defence applications. The facility includes an EMS line, clean rooms, board, box and rack level integration capability and environmental testing to cater to the requirements of quality and complex production

- Vertically integrated defence and aerospace electronics solutions providers catering to the indigenously developed defence products industry

- Diversified order book with marquee customers along with state of the art manufacturing facilities

- Experienced management team and skilled workforce

- Highest Revenue growth, EBIDTA margin, ROCE and ROE (for FY20 &FY21) amongst key Indian defence and aerospace companies

- Strong Balance Sheet; Net Debt Free Company

Capabilities and Opportunity

Some triggers and updates ( Market size, order wins etc)

Opportunity Size

TAM (total addressable market) of USD 4.65 bn by 2030 growing at CAGR – 9% from 2020*

Make in India, Indigenous manufacturing defense Theme

Beneficiary of shifting procurement trends in Defence – Aatma Nirbhar Bharat , Make in India, new defence acquisition policies among

others

Increasing indigenization, Domestic defence procurement, Higher share of electronics in warfare

Defense modernization program

Expansion of facilities

Data Patterns is in the process of upgrading and expanding the current facility, with a proposed doubling of available floor area and manufacturing capacity, as well as addition of capability of handling large and heavy equipment, integration of large radars and mobile electronic warfare systems, satellite integration facility. The new infrastructure is slated to be ready by September 2022.

Data Patterns is also in the process of acquiring an additional 2.81 acres of adjacent land for further expansion

Promoter holding

Promoters have sufficient skin in game, along with FII and DII holdings and big players leading to only 21% approx for retail investors

Risks (tried to see major risks, please do due diligence to understand more on this part)

Fast rampup in orders is key along with execution. Will fast orders and execution can lead to profitability, we need to see in coming quarters and years

The business has long gestation period and inherited execution delays, consequently causes volatility in revenue recognition

Company face challenges to meet the requisite financial criteria of tender based business, for which it needs to rely on bigger entities

Cash conversion cycle and working capital cycle has been really a big risk. Need to be watchful on these two parameters consistently. Major trigger is inventory levels, which should come down with normalized operations and betterment of chip availability

Seasonality Improving but Q4 still Significant

Valuations —

Valuations for such company is difficult to judge as growth can happen exponentially and company one good year can turn the tables on valuations and vice -versa. As per experience start with specific risk reward and then performance observed over a period of time and as and when orders emerge.

Looking at past, such companies look overvalued, Looking at future opportunities, Company seem undervalued

We entered around 700 even when valuations look high and markets took it to 1540+ –so Premium companies might be rerated faster than one can imagine –hence our focus is to ride as long as growth happens in company but 1-2 quarters should not deter us to stop holding long enough and give chance to company to perform

Only thing here is if valuation blow up faster than business –we need to book some partial profits

Your strategy can be different than mine. Your selection of company might be different than mine. So let’s not be a BLIND FOLLOWER

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Stock : Paradeep Phosphates

P.S. We found that SIP MODE works better in such stocks which have certain risks associated with it.

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Most Browsed posts this week on ALPHA AFFAIRS

https://alpha-affairs.com/2022/10/06/haunted-october/

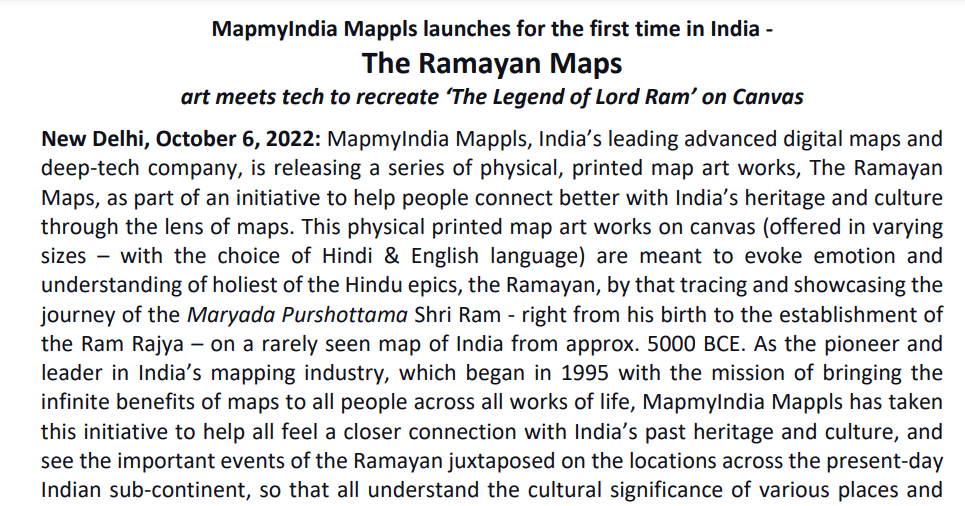

https://alpha-affairs.com/2022/10/07/ramayan-maps/

https://alpha-affairs.com/2022/10/07/biopolymers-and-bioplastics-new-trend/

https://alpha-affairs.com/2022/10/05/germany-industrial-giants-winter-plans/

https://alpha-affairs.com/2022/10/02/indigenous-4g-5g-and-worlds-first-ucb/

Ramayan Maps

Biopolymers and Bioplastics : New trend

Protected: Positional Stocks – 02-oct-22

Protected: Premium Stocks : 2-Oct-22

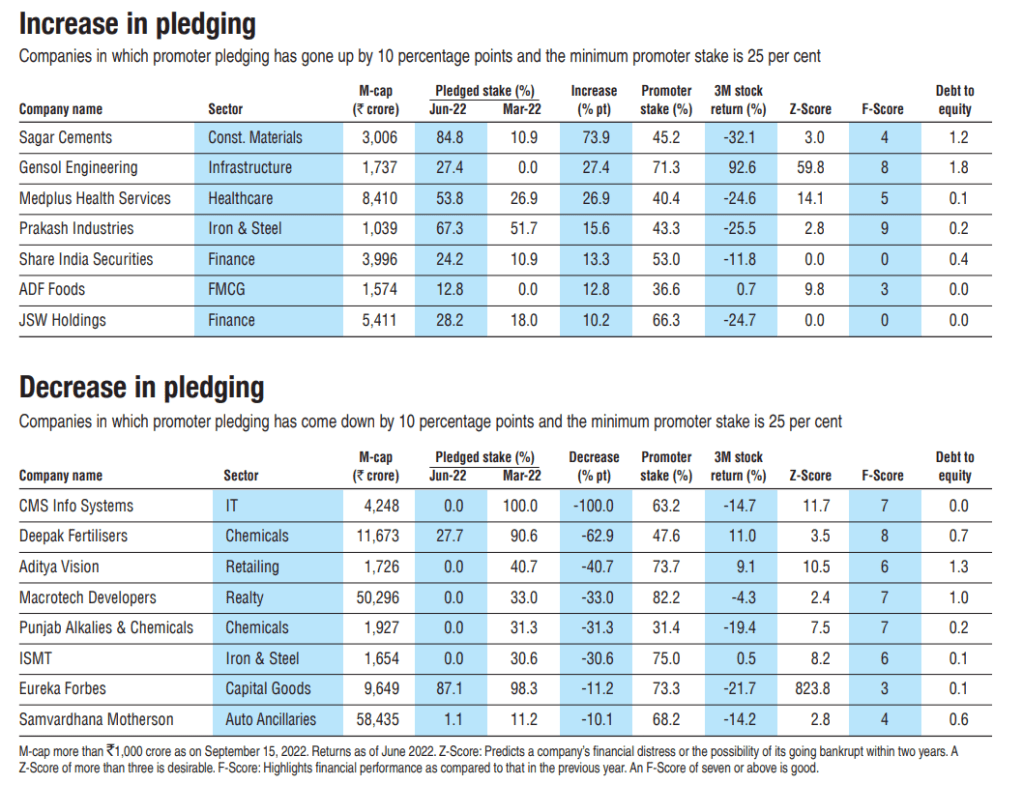

Rise and fall of stakes

Self reliance in ICEMF