Innovator CDMO market

BE FINANCIALLY INDEPENDENT

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

CMP 1116, Market cap ~4100cr

ROCE ~20%, ROE ~15%, D/E ~0.16 PE ~57 (based on screener)

AMI Organics (AMI) is a research and development driven manufacturer of specialty chemicals with varied end usage and is focused on the development and manufacturing of advanced pharmaceutical intermediates for regulated and generic active pharmaceutical ingredients (“APIs”) and New Chemical Entities (“NCE”) and key starting material for agrochemical and fine chemicals. AOL has three manufacturing facilities (excluding the recent acquisition of Baba Fine Chemicals [BFC] during H1FY24). Company manufactures intermediates from the ‘N minus 8’ to the ‘N minus 1’ level (where N is the final active pharmaceutical ingredient [API])

Products, Segments and Strengths

Company operates in two segments

Advance Pharma intermediates — 185+ Products, Intermediates across 17 therapeutic areas, Chronic Therapy focus: ~90%, Majorly backward integrated to Basic Chemical level, 50-90% global market share key molecules

Fermion had been among the biggest clients for Ami Organics in this domain. Ami Organics had been supplying intermediates for APIs like Darolutamide (prostate cancer), Entacapone (Parkinson) and Trazodone (Antidepressant). Company would be supplying an advanced intermediate for the Darolutamide API, starting from Q4FY24. At present, the company is the exclusive supplier for the same.

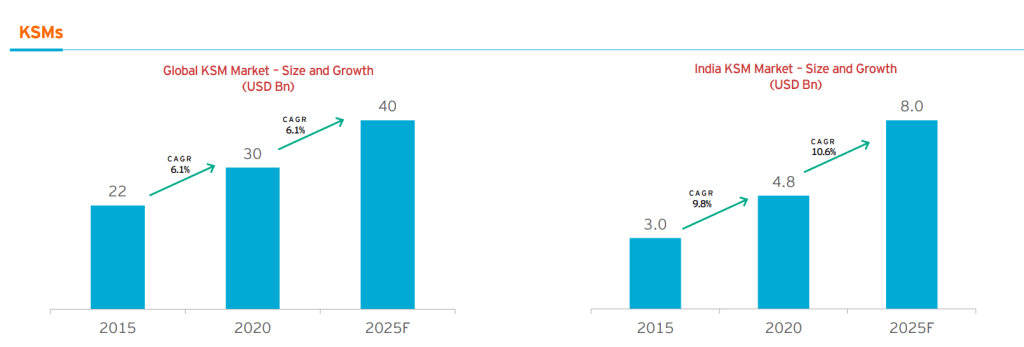

Speciality chemicals –This is where we are interested in coming future

Niche KSM for Agrochem and Finechem companies, Parabens & paraben formulations, Salicylic Acid and other specialty chemicals that

find end-use in cosmetics, dyes, polymers and agrochemical industries, animal foods, and personal care industries

New segment – Electrolyte used in manufacturing cells for energy storage devices. This also has huge potential in solar industry, automobiles industry

Clients

Advance intermediates : Speciality chemicals sales ratio –Approximate is 82:18 which is expected to go towards 75:25 in coming time. FY23 Ratio was 84:16

Export Sales: Domestic Sales ratio is approx. 58:42 in FY23, Q2FY24 ratio was 54:46 due to China oversupply and price erosion factors

➢ Well established and long-term relations with domestic and MNCs across large and fastgrowing markets globally

➢ Diversified customer base, 58% of revenue from Top 10 customers in FY23, 13 customers associated since last 10 years, 50 customers associated since last 5 years

➢ Long term supply contract with key customers

➢ Prolonged adherence to stringent client requirements leads to new business from existing customer base as well as from new client. ➢High entry barriers due to long gestation period to be enlisted as a supplier, Involvement of complex chemistries, Regulatory requirements. First to Market in most of the products

Strong focus on R&D

120 R&D members with 16 PhD, 14 process patents, Average approx expense on R&D is 1.7% of Revenue over last 4 years. In absolute terms its almost 7-8Cr per year

The Patent Office, Government of India, has granted Pracess Patents to Company for its inventions titled:

Sales and Profits have been growing decently(>25-30%) over past few years while for current FY24, it has slowed down, FY25 and FY26 seems to be the major booster for company going forward

Similarly ROCE and ROE has come down in last 2 years but still at reasonable levels

Debt to equity is at comfortable levels and can afford more debt for future expansions

Cash conversion cycle is on uptrend (not a good sign) and Working capital days are also increasing . Need to be monitored closely

Advance Pharmaceutical Intermediates

➢ Fermion contract: – Signed a new contract for additional advanced intermediate taking total product under CDMO contract to 3 products. On track to start the production from Q4FY24 onwards from Ankleshwar Unit

15-sep-23 Ami Organics Limited has signed another definitive multi-year, multi-tonne agreement with Fermion. As part of the agreement, Ami Organics will supply an additional advanced pharmaceutical intermediate to Fermion. Based on the supply projection shared by Fermion, the total minimum contract value is expected to be multi-million Dollar, spread across multi-year horizon. The product is expected to start contributing meaningfully to the revenue from FY25. Ami Organics had signed its first agreement with Fermion in November 2022 for supply of an advanced pharmaceutical intermediate. This agreement is in addition to previous agreement and further increases the total value of the CDMO contract with Fermion.

14-Dec-23 Ami Organics and Fermion ink another agreement for two additional Advanced Pharmaceutical Intermediate with Fermion. The products are slated to be manufactured at the Ankleshwar Facility and is expected to start contributing meaningfully to the revenue from FY25

Specialty Chemicals

Ami Organics Limited has signed a non-binding MOU with a global manufacturer of Electrolytes for manufacturing of electrolytes for battery cells and allied materials in Gujarat, India. In furtherance to this, the company will also sign an MOU with Government of Gujarat for

investment amounting up to Rs 300 crores for set up of dedicated manufacturing facility for electrolytes business in the state of Gujarat, in the upcoming Vibrant Gujarat Summit 2024.

Capex ongoing

Pharma intermediates capacity to expand to 4x

Related to the Fermion contract is the capacity expansion plan in Ankleshwar at a capital outlay of Rs 190 crore. Here, one block is dedicated for Fermion. This would carry on supplies related to the recent contract. Machinery installation in progress in block-1 at Ankleshwar unit, Started the recruitment process for the new facility. On track to commence the production activity in Q4 FY24 .The Ankleshwar facility is envisaged to have 436 KL — nearly 3x bigger than the existing facility

Acquisitions

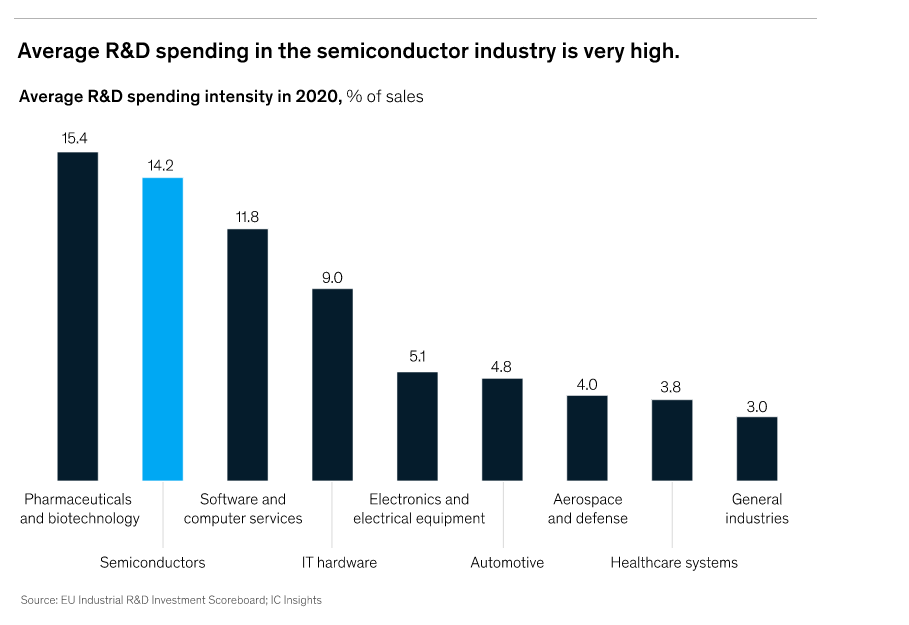

Baba Fine Chemicals Acquisition – Completed acquisition of majority partnership stake in Baba Fine Chemicals during Q2FY24. The acquisition of Baba Fine Chemicals (55 percent stake) is interesting as it deals with high entry-barrier products (photo-resistant chemicals), having applications in the semiconductor industry.

To reduce operational cost , the board has approved investment in a 16 MW solar power plant which along with already work in progress 5 MW solar power plant that will nullify our electricity expense once fully operational.

Company decided to fully impair the existing investment of Company, in the joint venture Ami Oncotheranostics LLC, as it is presumed that revenue generation from Ami Oncotheranostics will take significant time considering the inherent nature of its research activity in terms of

longer gestation period and uncertain success rate

Transformation of acquired entities like Gujarat Organics

Recently they acquired two manufacturing facilities Gujarat Organics (which was making loss makings as they did green field expansion in 2018) as Guj Org was making losses, it was bought by AMI Organics and turned EBITA margin moved from meagre 2% to 10% as of now (expected to touch 18% by next 2 year – also highlighted in their conf call as they are moving from batch processing to continuous flow chemistry). This acquisition enhances its specialty and fine chemical portfolio to enter Agrochemical, Cosmetics & Polymer Industry.

Due to this acquisition, one of client of Guj Organics referred them to make this electrolyte addictive. And hence, they have ventured into electrolyte addictive (belonging to carboxylic group) which is made by AMI in the whole Asia (except for few Chinese companies)

Details about Baba Fine chemicals

Valuations

Expected Cumulative sales projections for FY25 and FY26 is 2800-3500cr (considering existing business will also grow at 18-20%) and with PAT margin of 14% , we get PAT of 390-525 cr cumulatively. So stock price may move towards 2000-4200 Range by 31Mar26. There could be short term downside in stock which can be used for accumulation in case we are convinced about projections and sales

Susceptibility to raw material cost could affect Company profitability.

Inherent regulatory risk (USFDA compliance)

Competitive nature of industry driving pricing pressures. Oversupply from China does impact company growth in targeted markets

Combination of low margin and high margin products causes volatile OPM –This risk is expected to reduce with integration and business of other acquisitions done in recent years

High Capex ongoing and timely completion and start of production along with capacity utilization is a risk which needs to be monitored

High capital working requirements remain a risk. This is due to its wide portfolio, AOL needs to maintain sufficient inventory of the raw material as well as finished products.

Fermion contract getting cancelled midway

No major breakthrough in BFC business or electrolyte business

Technicals on 13Jan24

Stock has been consolidating between 900-1300 mostly in last 2+ years

Technicals on 3-Mar-24

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip market offers else Ignore the stock

Stock might be volatile in short term and give a chance to buy around 1000-1200 range for long term investment purpose

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer – Below Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

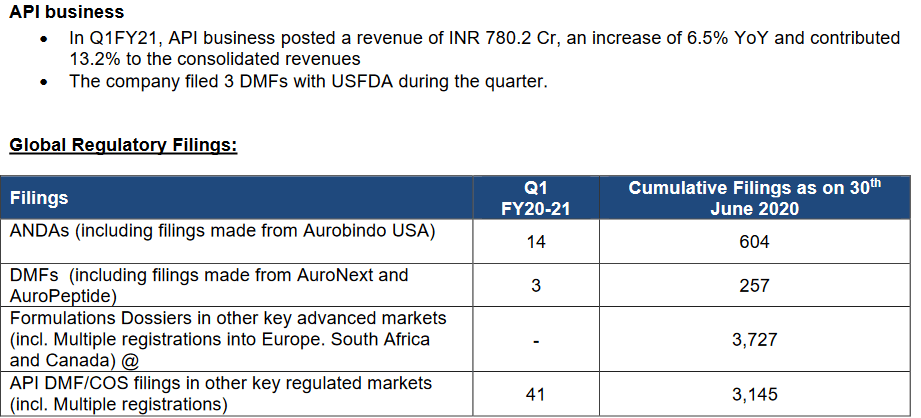

Supriya Lifescience Limited got incorporated in the year 2008 and became one of the key Indian manufacturers and the supplier of APIs.

Business —

Supriya sells 38 API focused on the diverse therapeutic segments, along with being the largest exporter of Chlorphenamine Maleate, Salbutamol Sulphate, Ketamine Hydrochloride and Esketamine from India.

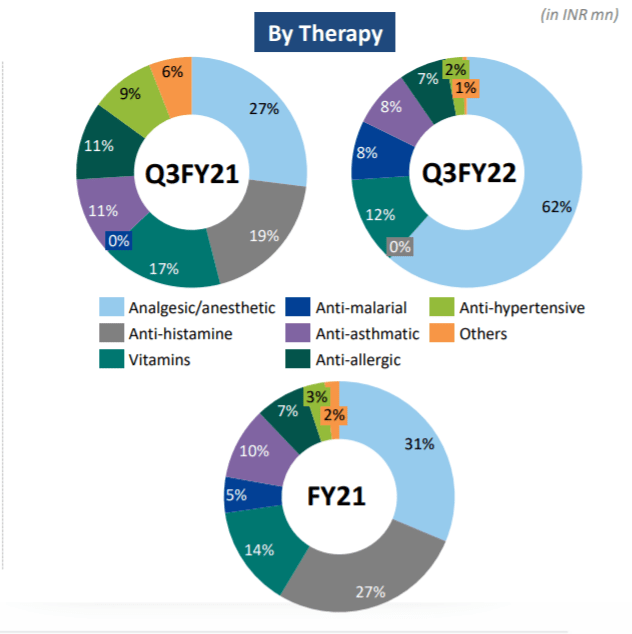

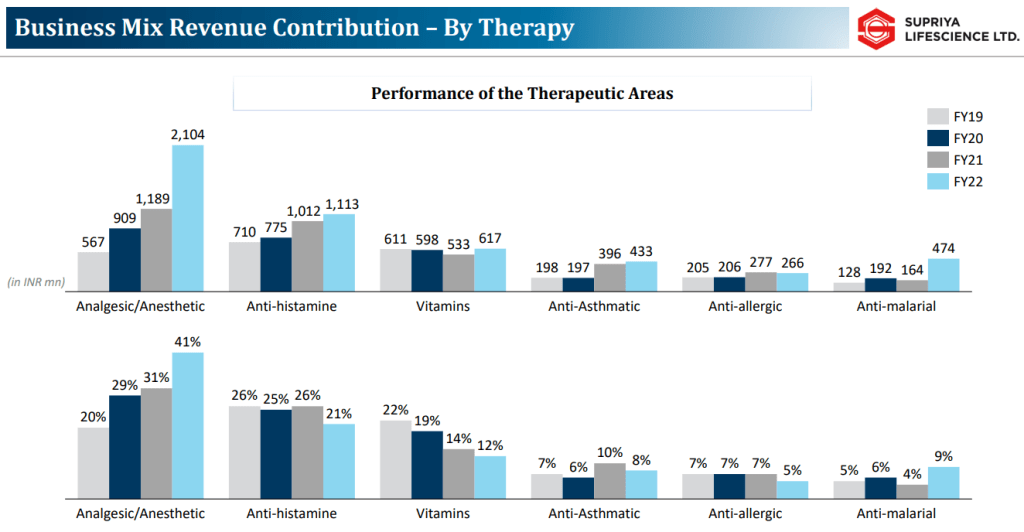

Supriya Lifescience is a pioneer in segments like antihistamine, analgesic, anesthetic, vitamin and anti-asthmetic and anti-allergic.

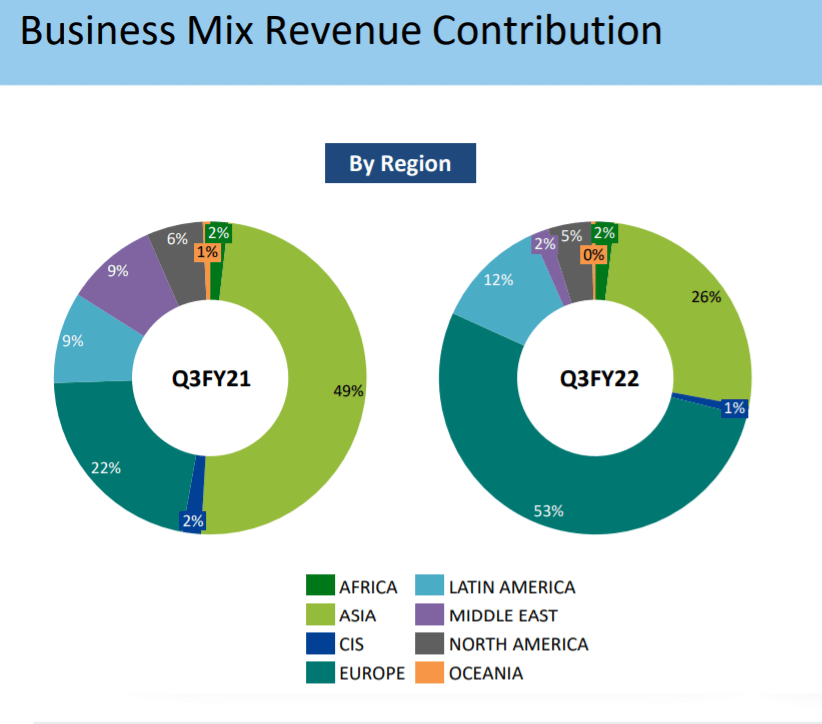

Region of operation—

Company is focused on regulated markets and company is more export oriented with 77% revenues coming from exports

END USER INDUSTRIES — Kind of evergreen and growing industries in coming decade

Moats —

Backward integrated business model with well established presence in the API manufacturing, with focus on high value products with limited competition. Backward integration of top 12 products generating 67% of revenues thus de-risking many issues on supplies, pricing

Niche product basket of 38 APIs across diverse therapeutic segments

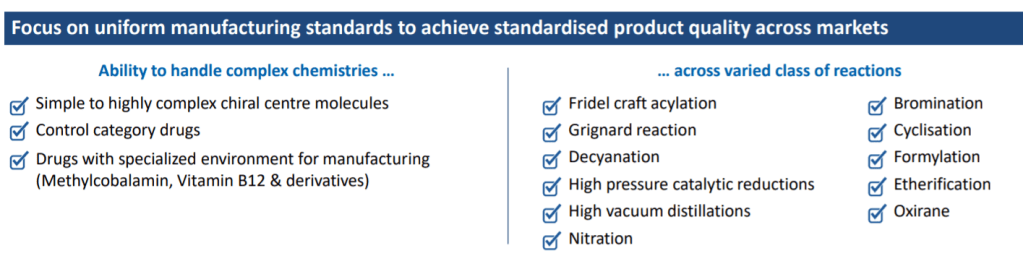

Advanced manufacturing and research and development capabilities with ability to handle complex chemistries across varied chain of reactions

Strengths

Pioneer in segments like antihistamine, analgesic, anesthetic, vitamin and anti-asthmetic and anti-allergic and clear leader in top three products having more than 50% share

Diversified export profile –Exports to 86 countries

Global clientele with long standing relationships on the back of consistent product quality & reliability of supply

Diversified therapeutic categories

USFDA, EUDQ, EUGMP, NMPA, CEP grants and approvals in place

Experienced senior management team and qualified operational personnel with new generation started in company already

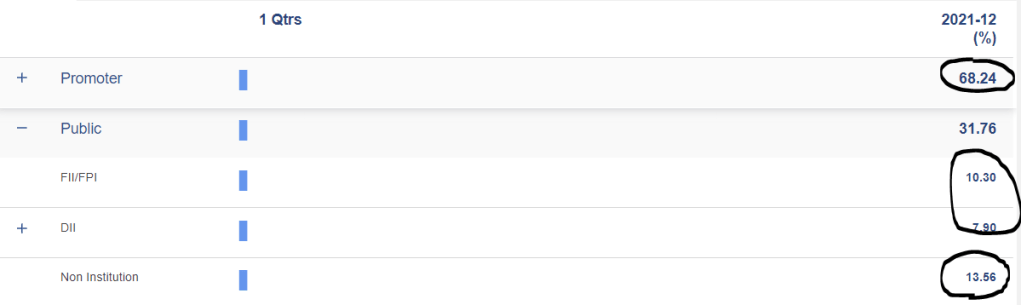

Shareholding

Promoter has sufficient skin in game with holding ~68% and other prominent players in DII/FII holding 18% more leaving only 13-14% to general public

Some triggers and updates from recent Q3Fy22 Concall

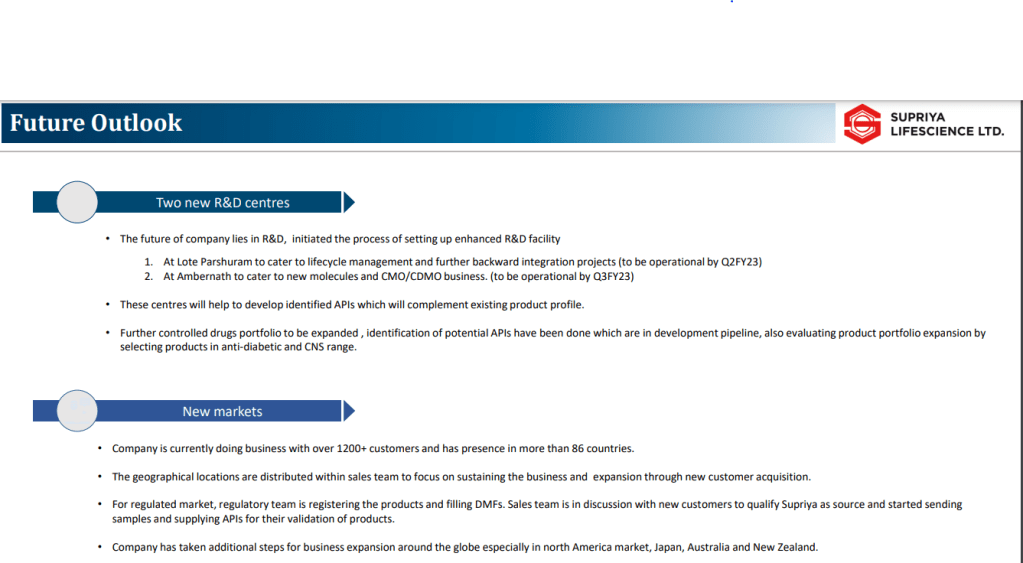

Getting portfolio derisked and adding more categories which are complementing existing therapies

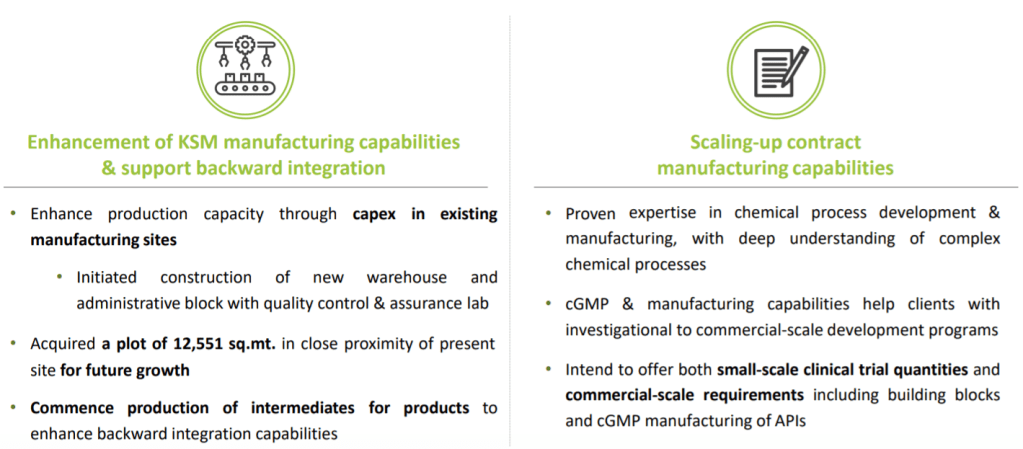

Expansion of manufacturing capability and capacity, scaling of existing molecules and addition of new products

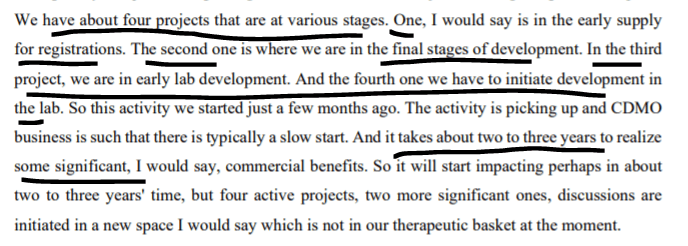

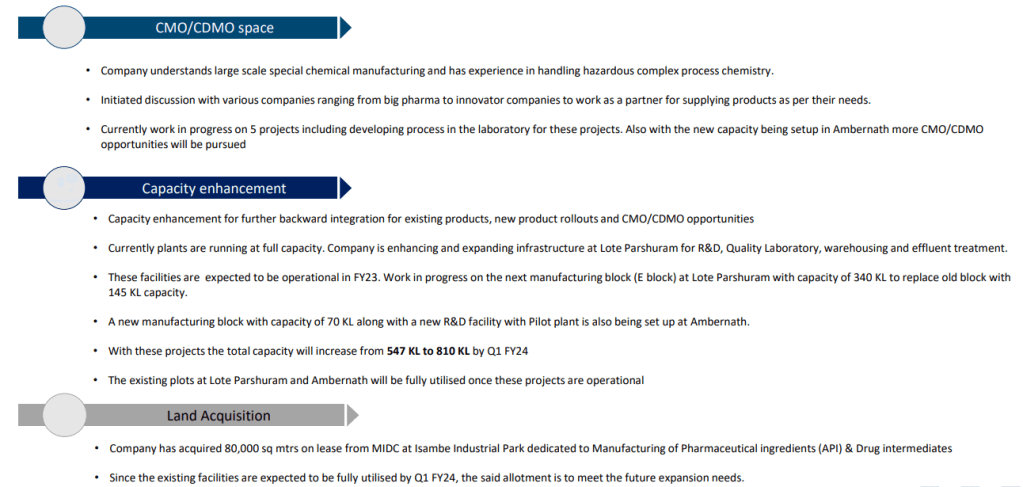

Entering CDMO space

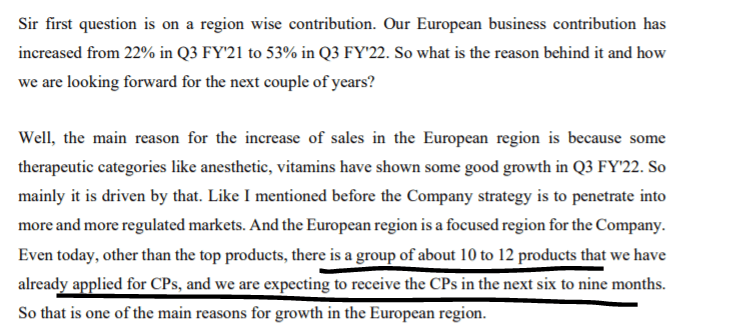

Growth in European region

Q4FY22 inputs from company

Company earnings are quarter dependent with some quarters showing better growth than other quarters, it will take company few years to balance this up and down quarters with new products filling up

Export oriented risks ( freight risks, currency risks, geographical risks)

Risks associated with pharma companies on USFDA etc. kind of approvals

Any delay in CMO, CDMO projects ramp up which is expected by Q2FY24 (Aug-Sep 2023)

Any delay in ramping up Amber Nath facility (expected Dec2022)

Any sell off by FII/DII can lead to quick price erosion

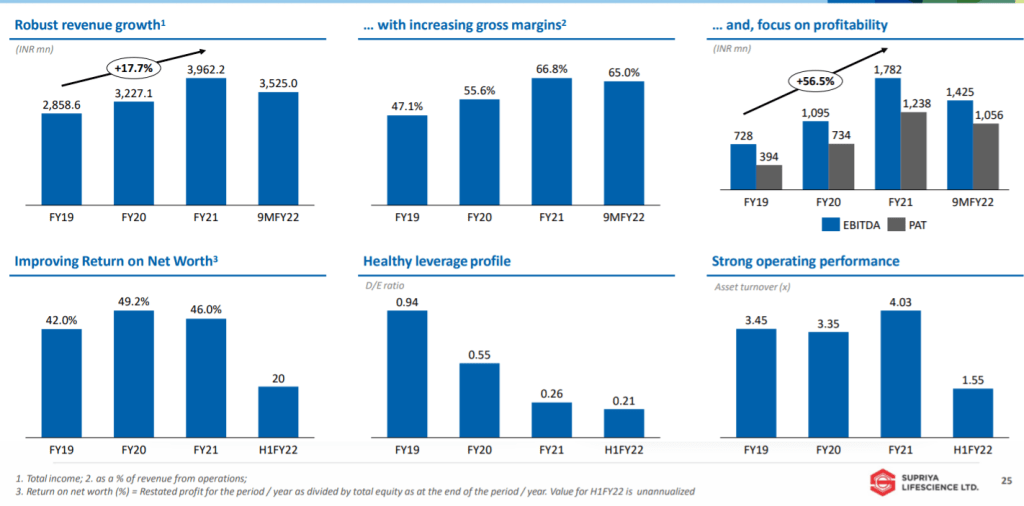

Company is showing Good revenue growth with increasing Gross margins and reducing Debt to equity profile

Current valuation look to factor in immediate growth for 1-2 quarters but if we keep our horizon long and vision as shared by company, then valuations seems reasonable (estimated PE of 16-19 Q1FY23E with CMP 386). Increasing capacity utilization and profitability can lead to rerating of company

Your strategy can be different than mine. Your selection of company might be different than mine. So lets not be a BLIND FOLLOWER

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer – Below Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

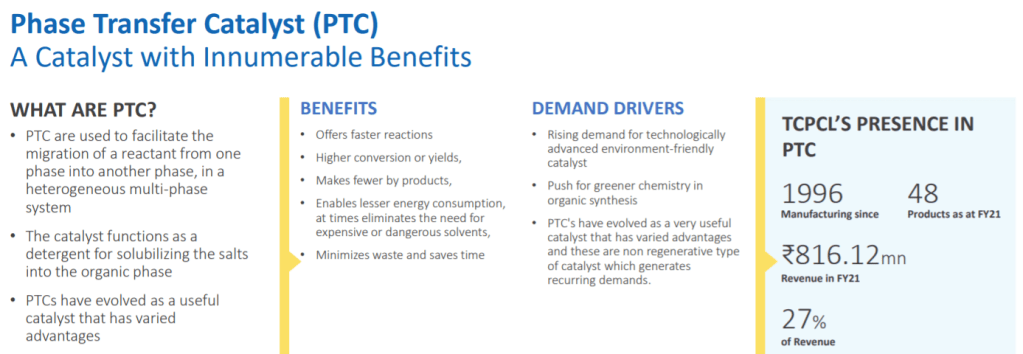

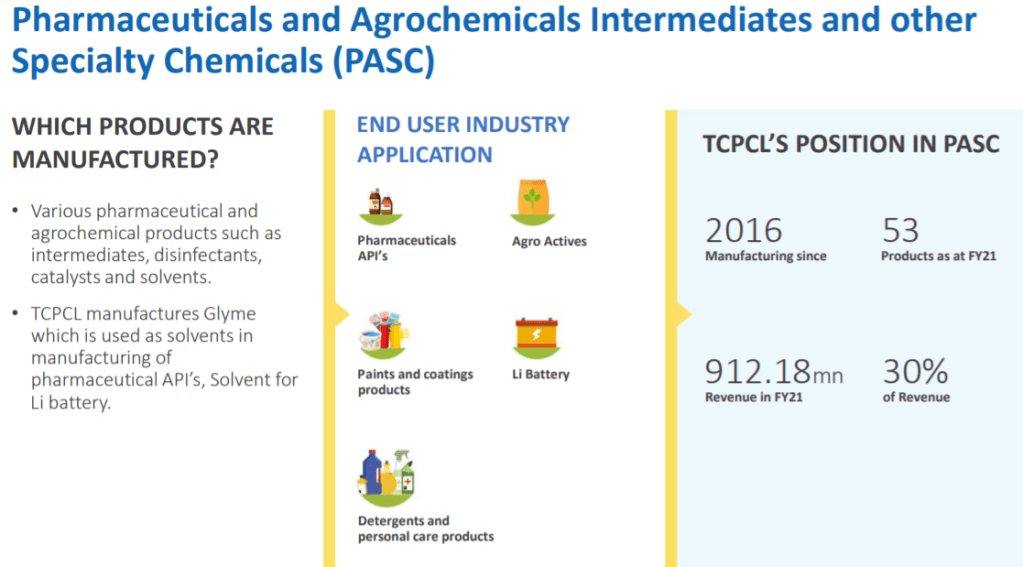

Incorporated in 1996, Tatva Chintan Pharma Chem Limited is a specialty chemicals manufacturing company. It is engaged in the manufacture of structure directing agents (SDAs), phase transfer catalysts (PTCs), electrolyte salts for super capacitor batteries and pharmaceutical & agrochemical intermediates & other specialty chemicals (PASC).

Business —

One of the leading producers with entire range of PTCs in India and one of the key producers across the globe

2nd largest manufacturer of SDAs for Zeolites globally and the largest commercial supplier in India

TCPCL is the largest producer of Glymes in India and third largest in the world.

Largest producer of electrolyte salts for super capacitor batteries in India

END USER INDUSTRIES — Growing industries in coming decade

Moats —

TCPCL is one of the few companies globally that uses Electrolysis process in organic synthesis. Advanced chemistries in process and for commercial development, manufacture and approvals, it takes 1-6 years for new players to enter this field.

In many of the segments, it is amongst top five players

Strengths

Considering the wide range of applications of our products, TCPCL can cater to customers across wide spectrum of Chemical Industries

which ensures a sustainable business model.

Diversified product portfolio has helped accelerate growth and in innovating and thus retain both new and existing customers

Diversified esteemed clientele

Necessary certifications in place : ISO 9001:2015 ISO 14001:2015 BS OHSAS 18001:2007

Advantages of Electrolyses

Region of operation

The company exports most of its products to over 25 countries, including the US, China, Germany, Japan, South Africa and the UK.

It reduced % revenue dependency on top 10 customers from 60% to 47%

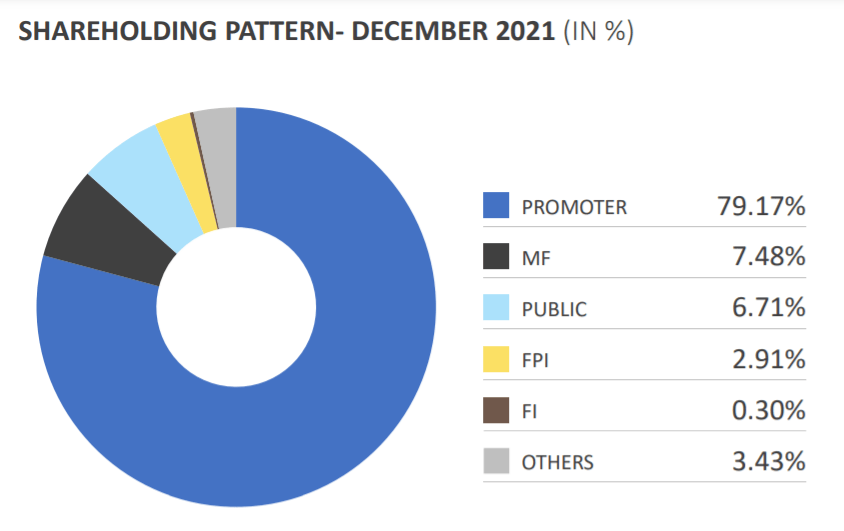

Shareholding

Promoter has sufficient skin in game with holding ~79% and other prominent players holding 10% more

Some triggers and updates from recent Q3Fy22 Concall

Getting approvals from two large customers

Getting into EV domain with supercapacitor batteries and new horizon opening up faster than anticipated

New versatile product development in Continuous flow chemistry us also capable in other applications including EV

Comfortable Leading market share in almost all operating domains

Mindset of accepting which projects

Delayed expansion –currently scheduled for Nov 22

Delay in semiconductors supplies impacting SDA in FY23 as well (current anticipation is till FY22)

Slow ramp up of electrolyte salts than projected

Approvals for new PASC delayed

Increase in raw material and frieght costs is already impacting margins, further increase will hurt next two quarters badly in terms of margins if it happens ( Q4FY22, Q1FY23)

They have to be seen in terms of huge growth runway available but current valuations don’t give that comfort to take large positions with risks on execution and inflation

Looks better to give time to company and see how it performs and keep accumulating in background in small tranches. That may work.

Your strategy can be different than mine. Your selection of company might be different than mine. So lets not be a BLIND FOLLOWER

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer : This is not a BUY/SELL/HOLD recommendation. Only for educational purposes. Please consult your financial adviser for investment purposes

Implementation of production-linked incentive (PLI) schemes worth up to ₹1.45 lakh crore for 10 key sectors announced recently by the government is likely soon.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.