Healthcare Spending : Long term !!

BE FINANCIALLY INDEPENDENT

The Centre is significantly scaling up its proposed Maritime Development Fund (MDF) to ₹70,000 crore, 2.8 times the allocation announced in the February Budget, to boost shipbuilding, ship repair, ancillary industries, expansion of shipping tonnage, and port-linked infrastructure, according to a report by The Economic Times.

The revised corpus has reportedly already secured clearance from the expenditure finance committee (EFC), chaired by the finance ministry’s expenditure secretary, with Cabinet approval expected shortly.

The MDF will operate on a blended finance model: 49 per cent concessional capital from the government, including contributions from state-owned major ports, and 51 per cent commercial capital from multilateral and bilateral lenders as well as sovereign funds.

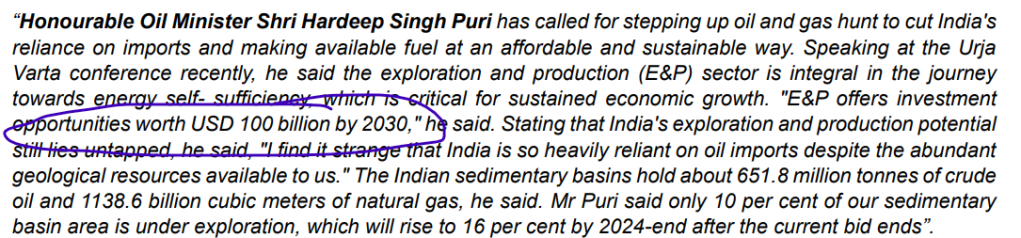

Government estimates peg India’s maritime sector investment requirement between $885 billion and $940 billion by 2047, The Economic Times report said. This includes:

Impact Of Data Localisation Laws

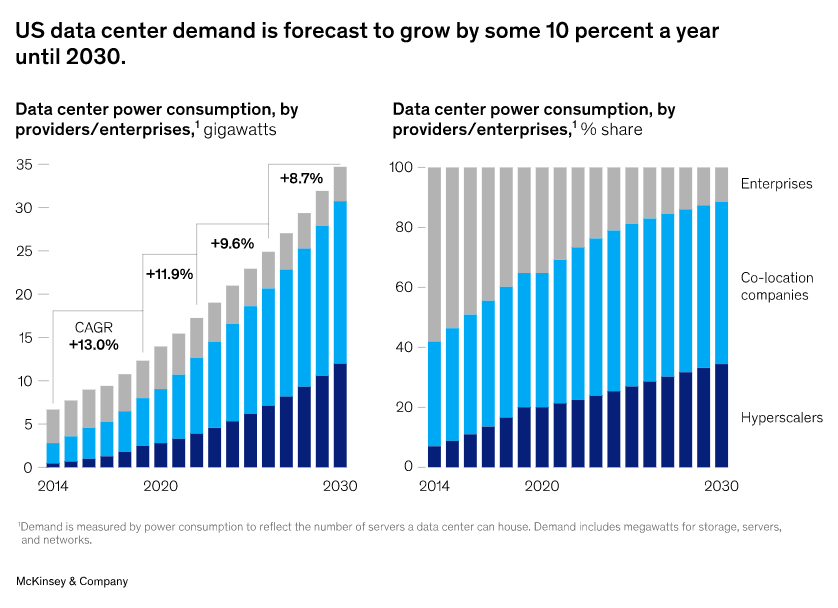

The Indian government’s push for data localisation, under policies like the Digital Personal Data Protection Act, has accelerated the establishment of data centres. Global players such as AWS, Microsoft, and Google are investing heavily to comply with these regulations, while Indian companies like Jio and Yotta Infrastructure are scaling up their capacities.

Green Data Centres On The Rise

Sustainability is a key focus for Indian data centres in 2025. Operators are investing in renewable energy sources like solar and wind to power facilities, with states such as Rajasthan and Gujarat leading in renewable energy adoption. Innovative cooling technologies, including liquid cooling and the use of natural resources for temperature management, are becoming standard practices to enhance energy efficiency.

Edge Computing And Regional Growth

India’s shift towards edge computing is transforming data centre architecture. With the rollout of 5G and the proliferation of IoT devices, smaller edge data centres are being established closer to users in Tier 2 and Tier 3 cities.

Expansion Of Colocation And Hyperscale Facilities

By 2025, colocation and hyperscale data centres will dominate the Indian market. Colocation facilities, which allow multiple organizations to share infrastructure, are becoming the preferred choice for startups and small businesses due to cost efficiency. On the other hand, hyperscale data centres, built to support massive data volumes for global giants like Amazon and Google, are rapidly expanding to cater to India’s growing digital needs.

Advances In Security And Automation

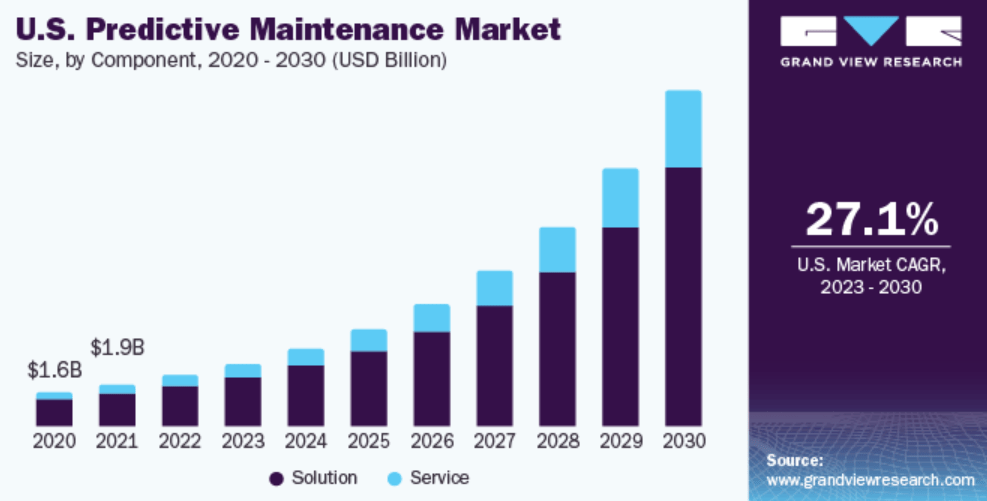

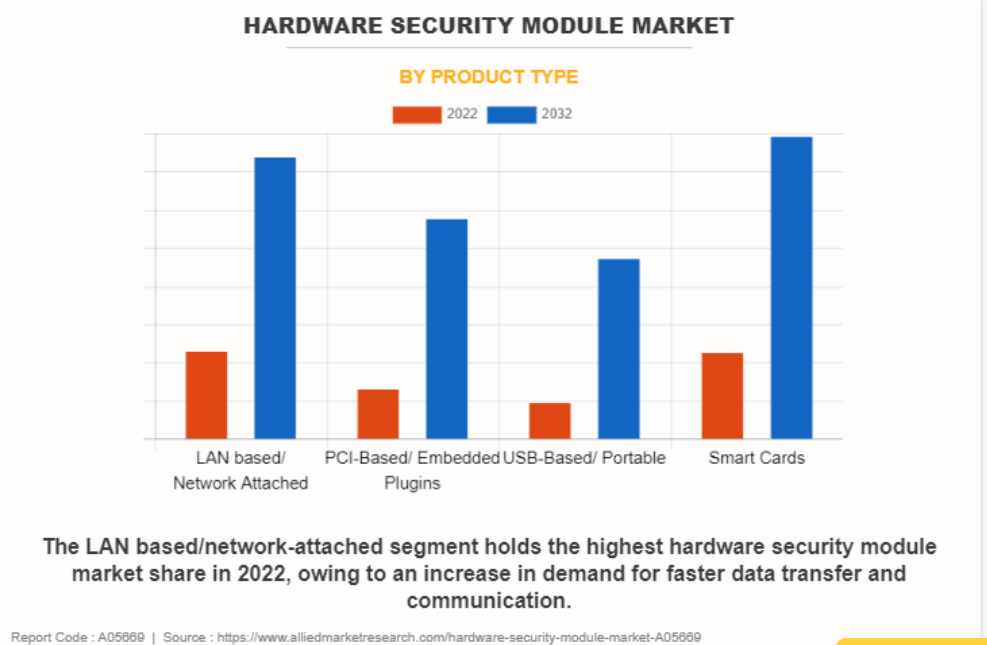

With increasing cyber threats, Indian data centres are integrating advanced security measures such as Zero Trust Architecture, AI-powered threat detection, and biometric access controls. Automation is playing a vital role in optimizing operations. AI systems are managing energy consumption, predicting maintenance needs, and ensuring seamless uptime, reducing operational costs while improving efficiency.

Government Support And Policy Initiatives

The Indian government’s initiatives, such as the National Policy on Software Products and state-level incentives, are creating a favourable ecosystem for data centre growth. Many states are offering subsidies on land, power tariffs, and taxes to attract data centre investments.

Opportunities In Tier 2 And Tier 3 Cities

As data consumption grows beyond urban centres, data centre operators are expanding into Tier 2 and Tier 3 cities. These locations offer lower operational costs, ample land availability, and growing demand for digital services, making them attractive for future investments.

Full article here

https://www.businessworld.in/article/data-centers-in-2025-whats-driving-the-boom-in-india-540530

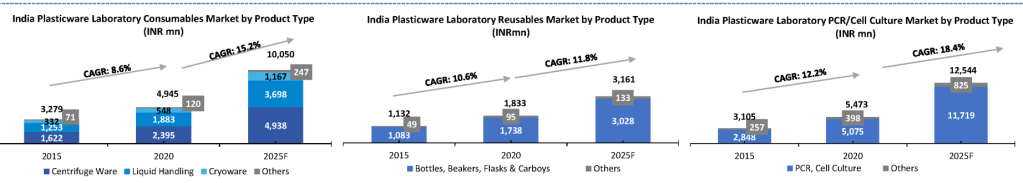

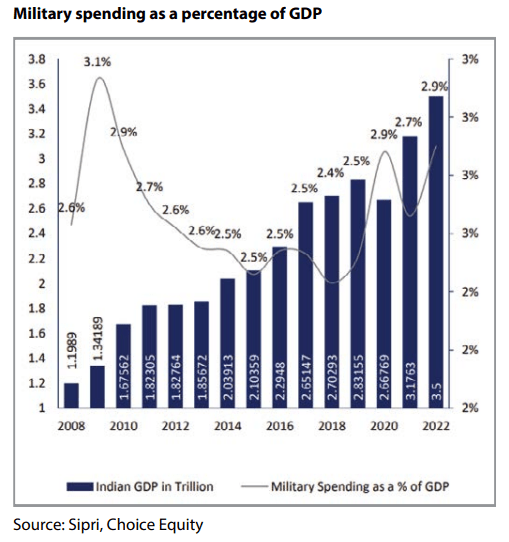

Spending is going to go up in coming years–As we see that from past trend

one can find stocks related to the theme

Lets Dive into our next research Idea

Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9, Pick10, Pick11, Pick12, Pick13, Pick14, Pick15, Pick16

I also talked about the same company in my YT channel in ALPHA LEARNER DAY 28Oct 23

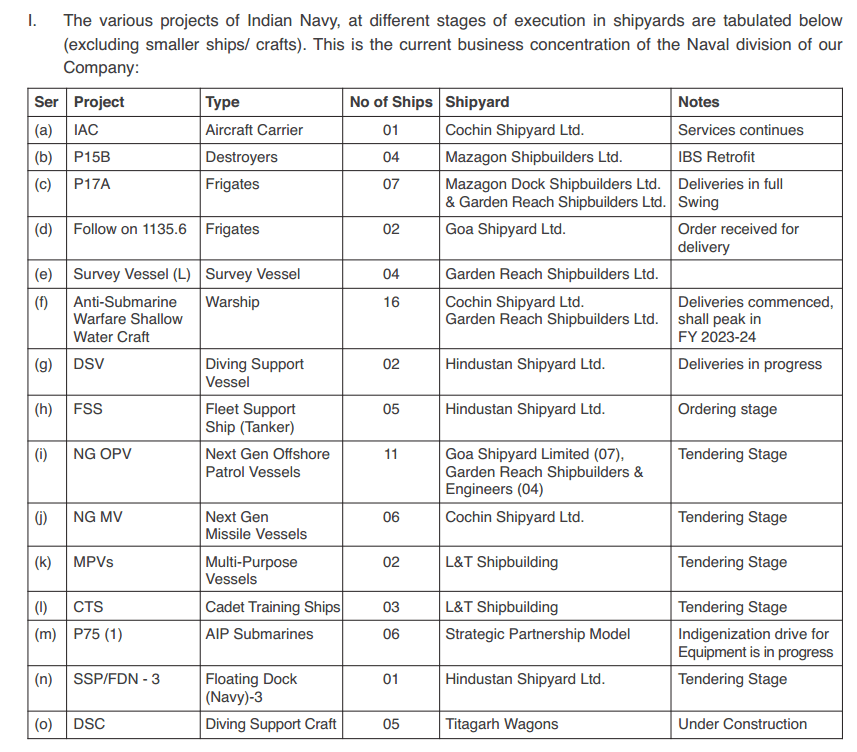

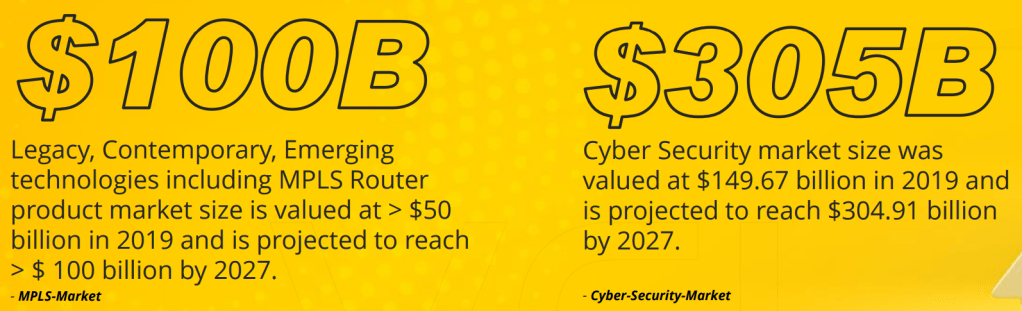

Marine Electricals is an integrated technical services provider in the fields of electrical automation and information and communication technology solutions.

Marine Electricals offers integrated and multidisciplinary total solutions that lead to better business processes and more efficiency for customers and the customers they, in their turn, serve.

Established in 1978, Marine Electricals serves the market for about 34 years in diversified areas like Ship Building / Navy / Industries / Commercial Establishments. We are one of the largest supplier of Electrical & Automation Equipment for Marine Applications in India and Middle East Markets

In electrical engineering Marine Electricals covers the entire range of electrical engineering solutions of every size, such as low and medium voltage, energy distribution, measuring and control technology, instrumentation, infrastructure technology, electrical propulsion, integrated security, building management, access technology, system technology, and power electronics.

Buildings: All types of buildings including data centres, distribution centres, offices, government buildings, high rise building, laboratories, airports, penal institutions, leisure centres, stadiums, stations, universities and colleges, shopping centres, hospitals and care institutions.

Industry: A focus on power plants, the automotive industry, pharmaceuticals, chemicals and petrochemicals, the energy and environment market, pharmaceuticals, machine building, oil & gas, and the aircraft industry.

Marine: Naval vessels (logistic support ships, frigates, corvettes, patrol vessels and submarines), special ships (dredgers, offshore support ships, diving support vessels, crane ships) offshore platforms, cargo vessels (container ships, bulk carriers and other cargo ships), passenger liners and inland waterways vessels.

Company provide innovative state-of-the-art system solutions and products designed to meet the most exacting requirements for ships of all types and sizes through the entire life cycle. These range from coastal and inland shipping vessels, ocean-going passenger vessels, bulk carriers, tankers, container vessels, luxury yachts, tankers to specialist offshore, environmental and research ships as well as naval vessels.

One of the few companies in the world capable of supplying from a single in-house source the following:

Employee –1000+

Manufacturing plants -6 across Goa, Mumbai, Chennai and UAE & Italy

Service centers – 14 Service Centers across Coastal locations in India ensures shorter Service Time for Clients

Subsidiary and Group companies

Evigo Charge Pvt. Ltd a subsidiary of Marine Electricals India Limited established in 2018, is an e- mobility venture, operating across the country and is visible through its brand Bijlify®. The company is one of the vertically integrated companies in the EV charging space, with its core activity being Design, manufacture and supply of various types of Electric Vehicle Chargers and powering up sustainable mobility through its mobile application under the Bijlify Brand. The company offers the complete eco-system including software, hardware and service for the same. The software set comprises of a next generation CPMS Terminal that is scalable and can be customized based on needs of our customers. The hardware boasts of AC and DC types of fast chargers that can accommodate the needs of most electric vehicles. All of these are designed in-house and completely tailored to offer maximum convenience to the end-user and manufactured in state-of-the-art facilities in Goa of Marine Electricals India Ltd.

Based in Italy, STI has its own production facility to design and engineer suitable renewable energy solutions as per the clients’ requirements.

As a leading EPC (Engineering, Procurement and Construction) company, STI provides outstanding design and engineering services, onsite project management, execution, installation, testing and commissioning as well as maintenance services across the world.

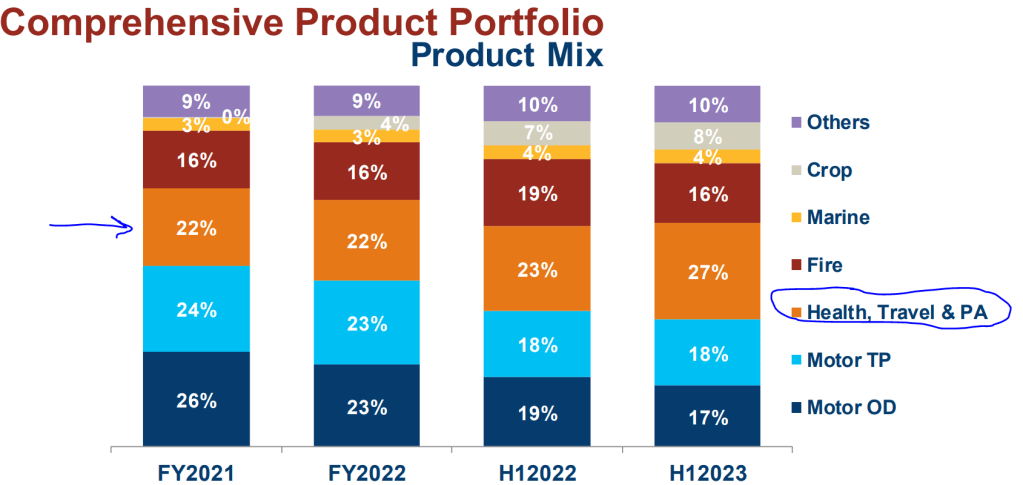

Different Segments (Industrial, Data centers, Marine, Solar, EV chargers)

Electric power generation, management and distribution is becoming increasingly important on modern day vessels. Marine Electricals can offer the entire power systems starting from the generators right up the lighting distribution panels and sockets thus offering a complete system responsibility, using the latest engineering tools Marine Electricals is able to ensure that individual components forming part of the complete system comply with the requirements( short circuit levels, discrimination, cascading, harmonic distortion, failure mode effect analysis, vibration etc.)

Marine Electricals provides solar power solutions to the industrial, institutional and commercial sectors. Right from design, engineering to project development and maintenance, we provide a comprehensive range of services to the clients looking for a reliable and environmental friendly source of electricity.

Strong Management team with extensive experience

Esteemed clientele with strong relationships

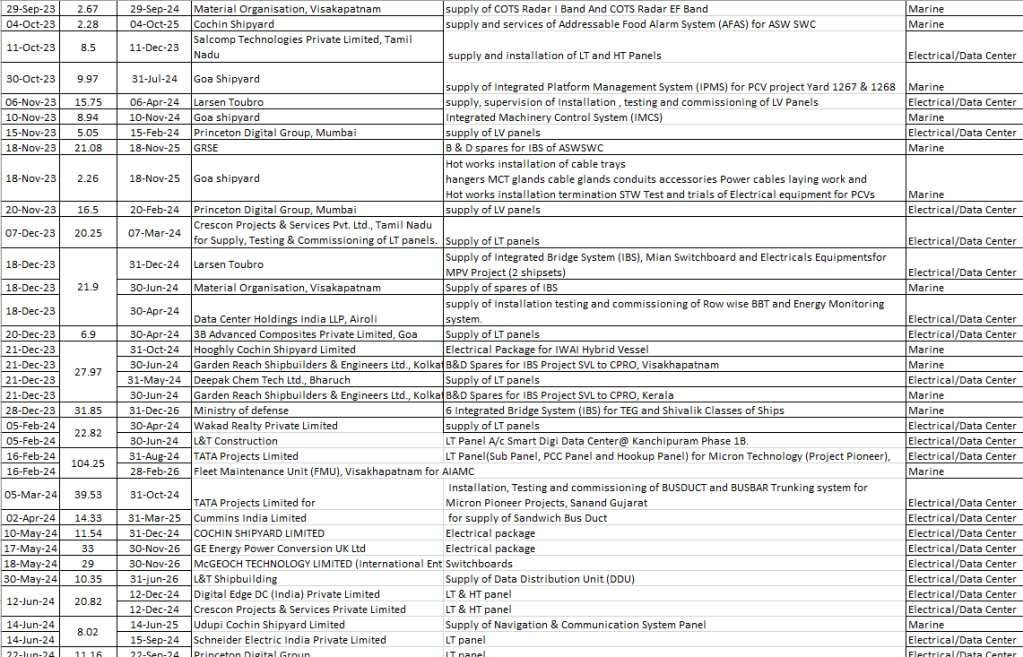

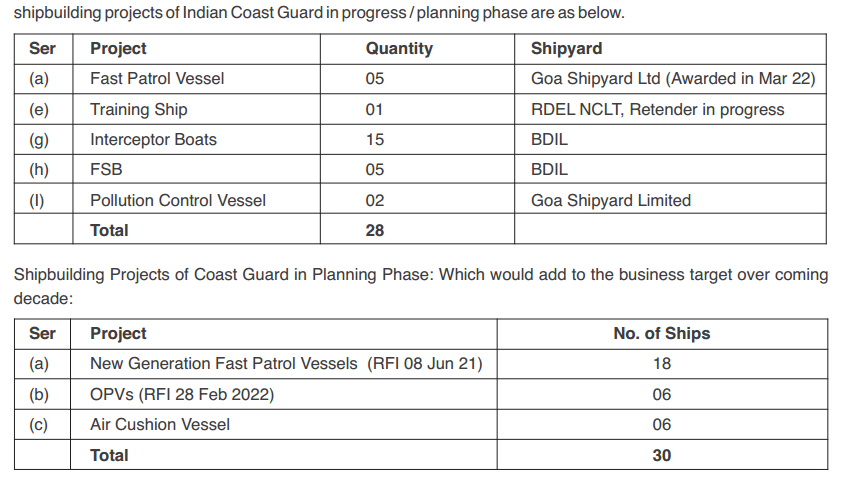

Current order book position standing at Rs. 482cr approximately at end of FY 2022- 2023. Considering below orders from Mar23 onwards minus the Q1Fy24–Order book looks to be around 482+102-101= ~482 Cr at 24Sep23. Few more orders came after that —so around 500cr order book is expected

To Expand Capabilities in

Defense Tailwinds + Shipping ecosystem emerging + Increasing order book of Shipyards

Exploring new opportunities in Metro, Railways, Ports, EV Charging

Expanding Solution Offerings in Marine

Geographical expansion in Industrial segment

Evigo charge, a subsidiary, is eyeing a rapid expansion in the next couple of years. It is aiming to contribute to the country’s fascinating growth story by taking this charging ecosystem to the last mile. Over the next two fiscals it is eyeing a double digit growth.

EVIGO offers featurerich EV charging software solution

Certifications and Awards

Quality Management System, compliant with the international ISO 9001:2015, ISO 14001:2015 & OHSAS 18001:2007 Quality Management Standard, is certified by Indian Registrar of Quality Systems.

Time when I started buying Marine electricals

Improving sales , Stable OPM, Improving Cash conversion and Working capital cycle, Improving ROCE

Valuations

Looking reasonable considering the tailwinds in Navy and Ship building sector and upcoming Metros, Data center and EV charger industries

Technical Chart

Technical chart on 29-jun-24

Technical chart on 23Sep23 and Oct23

RISKS

Ongoing NCLT case — MEIL has purchased the property by making payment of sale consideration of Rs. 11.60 crore and stamp duty & registration fees of Rs. 1.11 crore towards registration of Sale certificate (ciemme jewels ltd liquidation)

Electrical business has high competition though their strong relationship should sail them through.

EV chargers business- Need to track this business carefully on how the margins, orders turn up in near future.

Solar panels business could be deworsification.

There is a GST notice which came in oct23 –which is also explained by company –that they have paid the GST earlier and its a mistake from Tax dept for the state in which they accounted it.

Update on NCLT case –Notification 4th oct23

Case is dismissed, Company expecting 11.6cr refund and it will be used for company own purposes, no acquistions planned in near future

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

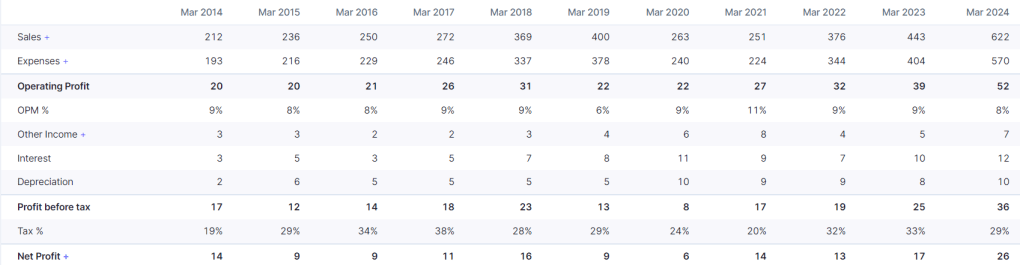

The visual effects of these films were done by an Indian company that has made these movies a thorough visual delight and provided millions worldwide with pulsating entertainment and ever-lasting memories.

Yes, We are talking about our next research IDEA

WHAT IS VFX?

Visual effects (VFX) refer to special effects that deeply reflect the story’s visual representation

VFX has evolved to deliver sights that cannot be filmed. This procedure involves the incorporation of live-action footage as well as the imagery created to create realistic scenes. It is expensive and requires considerable investment, which involves creating a large creative workforce, big state-of-the art studios and electronic instruments. Additionally, it needs an uninterrupted power supply and good cooling capabilities

Fun Fact

10% EVERY MOVIE IN ANY GENRE ACCOUNTS FOR 10% OF VFX USAGE

90% of all movies have some form of VFX involved

Before we move further , lets see what they do through a reel

Incorporated in 2016, Phantom Digital Effect limited is a creative VFX studio that excels in creating jaw-dropping visual effects for leading movie/ documentary makers worldwide and in India. Company contribute to the production, pre and post production of feature films, web series and commercials. Besides working directly on a particular project, they take up subcontracts for large VFX studios.

PhantomFX specializes in various VFX services

Some stats

Geographical presence –Company has three state-of-the-art studios in Chennai, Mumbai and Hyderabad, India

And has marketing teams at Los Angeles, Vancouver and Montreal

Clients –500+

Employees/ Artists -500+

Office space 39000 Sq ft

Repeat clientele ~46%

Clients associated for more than 5 yrs –25%

International business vs Domestic business 40:60

Strength

Promoters have significant industry experience and have been instrumental in the Company’s consistent growth

Esteemed clientele with strong relationships

Good work done in past to showcase and bring new clients

Phantom FX has recently acquired a new studio cum office space in Mumbai, Hyderabad and Chennai with the capacity to accommodate ~150, ~60 & ~50 employees, respectively.

Phantom FX plans to open office cum studio space in London and Dubai shortly

Latest update in 21Sep23

Planning to hire 2,000 more employees in the next two years.

Targeting significant contribution from the OTT sector and expects at least 50% of revenue from international operations.

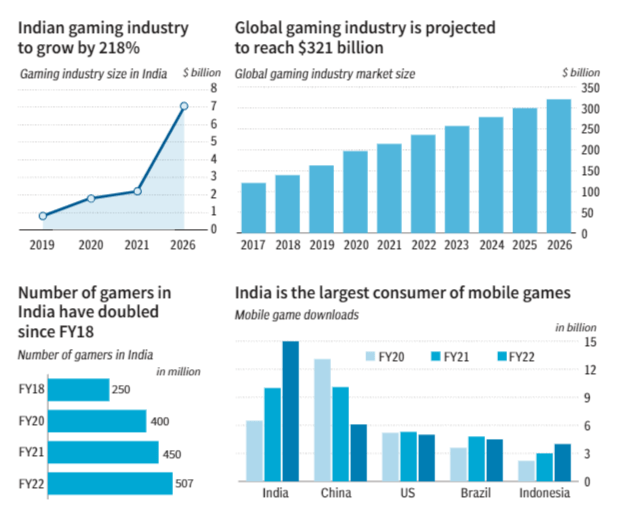

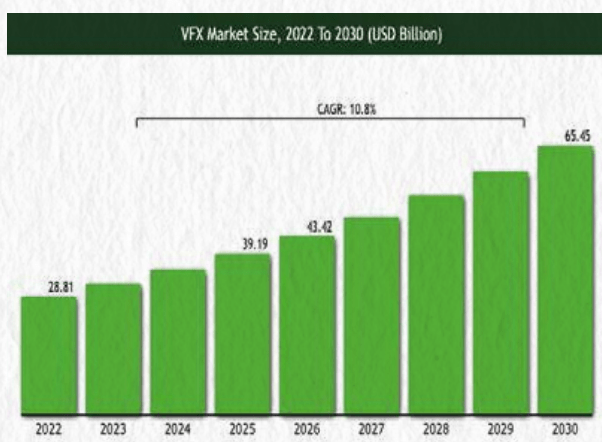

The global VFX market is expected to grow from US$28.81 BILLION (2022) to US$65.45 BILLION (2030) AT 10.8% (CAGR)

According to an Indian I&B Ministry estimate, between 2023 AND 2024 the domestic VFX space is expected to GROW AT 30% (CAGR)

Increasing use of digital video streaming platforms and high-quality content has positioned VFX as an integral part of the OTT evolution

Expansion of OTT services: The proliferation of smart devices like smartphones, HDTVs, laptops, tablets and subscription-based video streaming services in both advanced and emerging economies are driving the growth in the VFX industry

Owing to the rapidly growing demand for OTT content driven by low data charges in mobile broadband, the Asia-Pacific region is expected to witness the fastest market growth till 2030. India and China are likely to surpass the continent over the medium term

Demand for highly realistic and super-quality content: Worldwide demand for high quality realistic content is driving the demand for the market. VFX alters, creates, replaces and enhances live-action media to include effects that are otherwise impossible to capture

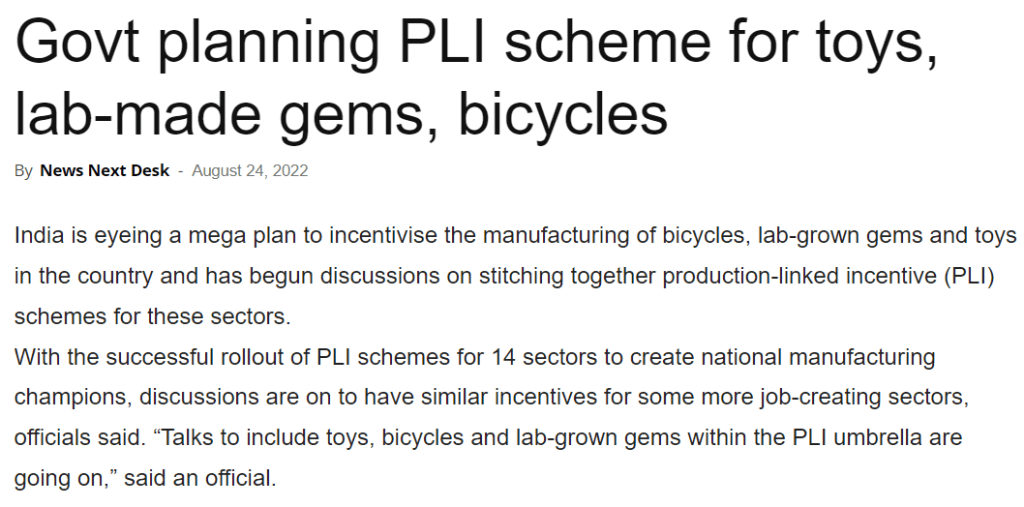

To promote the animation, visual effects, gaming and comic sector in India, the I&B Ministry of India formed a task force likely to create nearly 2 million jobs in India. AVGC XR (Animation, Visual Effects, Gaming, Comics, and Extended Reality) Promotion Task Force recently submitted their plan with several recommendations to the Government.

Plans to foray into animation services space and tap allied field of gaming which requires extensive VFX by leveraging its capabilities and experience.

VFX Tailwinds emerging

VFX grew 30% to reach INR50 billion in 2022

Top global VFX players expanded into India to leverage the cost arbitrage that India continues to offer

► For a global VFX player having operations in India, Indian VFX artists cost only one-eighth of the cost incurred on hiring artists in the UK or North America16

► In the last two years alone, the Indian visual effects industry has created 60,000 jobs, with studios like MPC in Bengaluru going for an extensive hiring spree

► In 2022, five global VFX players, including ILM, have either started operations or announced their entry into the Indian market

New subsidiaries, Offices, Capex plans, Orders, QIP

The company has recently been awarded a prestigious contracts worth Rs. 62.5 Mn which includes a significant deal valued at Rs. 40 Mn, in the field of international movie production.

Company has received work order from Netflix (Netflix Worldwide Entertainment, Netflix US and Netflix India Originals). VFX for Project includes Netflix-branded audio-visual content, whether produced directly by Netflix or licensed from a Licensor for exhibition on Netflix OTT. Time period of the order is 4 years with extension option for another 2 years. Estimated order is INR 120 Cr over 4 years.

Total order book from May23 onwards is 200cr approximately (100cr is estimated execution order for FY24)

Added 50cr more in Jan24 in order book from KJR studios after recent success of movie Ayalaan

Jun ‘23: BoD has approved the incorporation of a wholly owned subsidiary of the Company in London, UK. This will leverage the growth opportunities in the international market and avail the maximum benefit of the resources available. The business of subsidiary is in line with the main object of business of the Company.

Dec ‘22: Company has been endorsed as an Amazon-approved VFX studio. The same is notified to all Amazon productions. Due to this development, it will be able to provide various VFX services for Amazon’s production.

It has also been qualified for the Walt Disney Vendor Evaluation Program. It is authorized to receive content from Walt Disney Studios and/ or Television groups. There will be an increase in the total number of OTT Projects with the active participation by Amazon and Walt Disney for the same.

DNEG, one of the world’s leading visual effects and animation studios for feature film and television, has approved the Company as an Outsourcing Vendor to handle various assignments pertaining to their feature film, television, and multiplatform content. This association with DNEG will further boost Company’s order book and further enhance the quantum of projects.

Dec ‘22: Company announced its opening of a third office with the ability to accommodate 50 employees in Chennai.

Nov’22: Company is on the verge of completion of establishment of a new studio cum office in Bandra, Mumbai. Once operational, it will be able to accommodate 250 employees and will be equipped with infrastructural facilities for VFX studio to expand the services of the Company.

Openings recently in the company

QIP of 80cr done with renowned fund houses at 412Rs/share. What caught my eye is expansion in Gaming and Animation space

Success of Movie Ayalaan

15Feb 24 update on process of acquiring a company

Certifications and Awards

Phantom FX is TPN Certified, among the few in India with this coveted watermark.

This certification means that we are a ‘data-secure ecosystem’ that meets the rigorous standards of the MPAA.

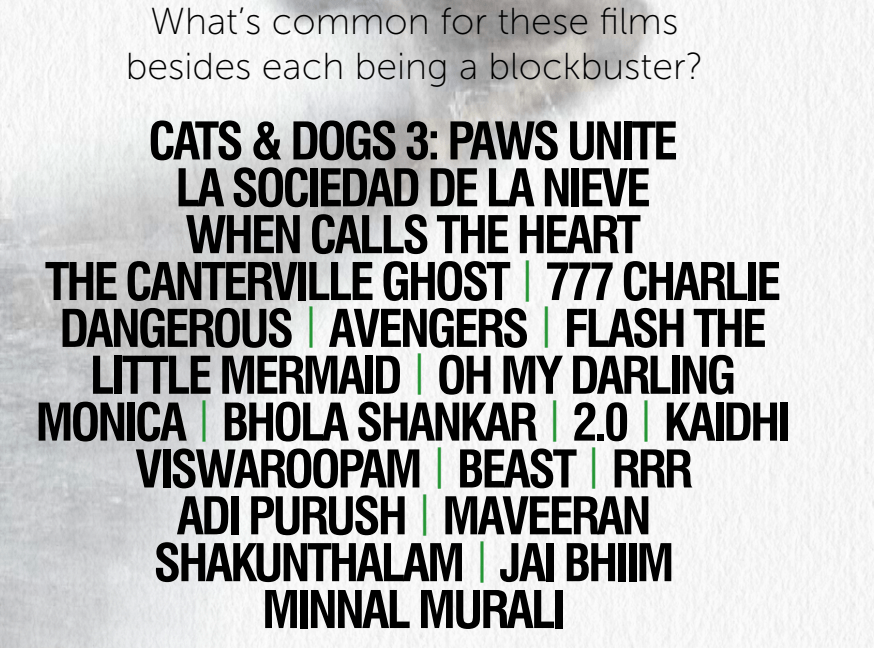

Financials

Management Guidance

Revenue is expected to grow by ~75-80% in FY24 led by inflow of demand for our services and effective execution of order book.

EBITDA margins is expected to stay within a corridor of 33-35%

Jun23 results shows management walking the talk

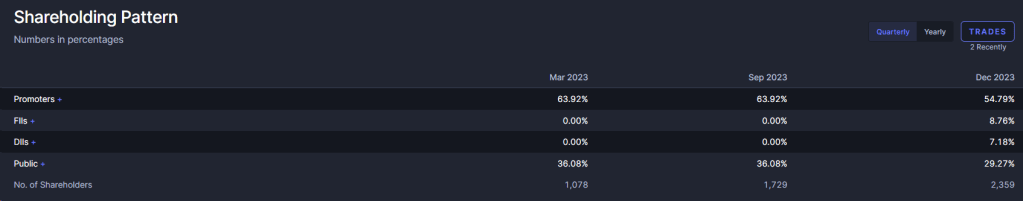

Skin in game along with FII and DII increasing stake

Management guides 100cr revenue approximately leading to bottom line of approx. 22-27Cr

Estimated EPS 20-23, PE range 20-50 leading to price range of 400-1050

That means we are very close to low valuations

on 27th Oct23

Interesting Pattern on 5dec23

Support demand zone seems to be respected in recent downturn

RISKS

Increasing assets and employees, if not ably supported by orders, can turn out to be a problem

Increase in trade receivables as business grows is an issue which needs to be monitored very closely

Just 1-2 bad reviews, bad work can lead to downfall of company faster than we can imagine. In simple words, clients will come because of work quality

Valuations –Company though looks undervalued considering the growth potential, but if growth stalls or new orders don’t come at an anticipated pace, then these valuations may turn out to be a trap

Heavy Dependence on Exports–Company and industry in general is dependent on International assignments. Recent strike by artists in Hollywood crippled the revenue in second quarter of H1FY24

Risk of talent poaching— The attrition rate in the VFX segment in 2022 was 25% to 30%. High poaching of mid-level talent was also observed in the segment. Almost all industry leaders were concerned about the inability to find technically skilled employees to meet the opportunities provided by the high global and domestic demand for content –Companies are working in it by implementing training programs to acquire, retain and up-skill talent

Competition: The high-margin business and its growing opportunities is attracting a number of players into this field which is increasing the competitive intensity.

Technology: VFX studios require cutting-edge technology and software to produce high quality visual effects, which can be expensive to acquire and maintain. Additionally, keeping up with the latest technological advancements can be a challenging task.

AI tools are posing a threat where with use of AI tools, movie can be created without much effort and labor. We see this as an accomplice for the company where such tools help to add value along with human creativity, Read few such article on AI impact and usage in VFX

Timeline issues: The VFX industry faces is the increasing demand for visual effects combined with tight project timelines. As clients demand high-quality visual effects in less time, VFX studios often have to work overtime to deliver the final product on time. This can lead to employee burnout and a decline in the quality of work produced, ultimately impacting the reputation of the studio

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

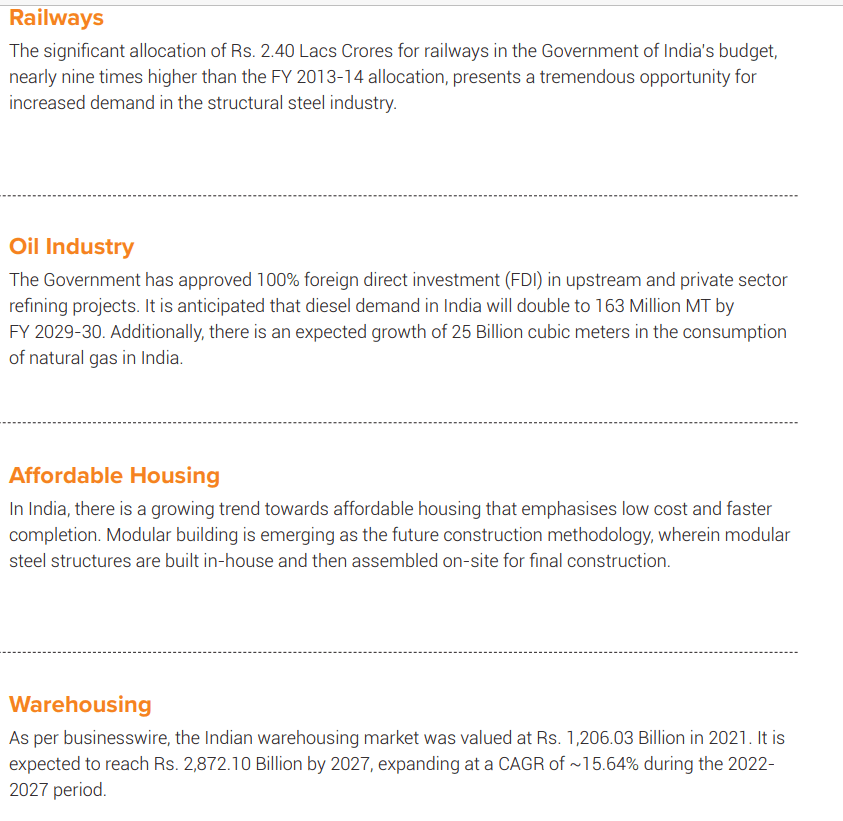

Ramkrishna Forgings Ltd is primarily engaged in manufacturing and sale of forged components of automobiles, railway wagons & coaches and engineering parts. Company mission and vision is to be the most preferred supplier of forged, rolled, machined, fabricated and cast products for all end use industries like Railways, Automotive, Earth Moving, Mining, Farm Equipment, Oil & Gas and General Engineering globally by supplying products meeting highest quality standards at highly competitive costs

Manufacturing facilities

RKFL’s facilities in eastern India are located in close proximity to automobile manufacturing hubs and key suppliers of of raw material

Customers and Regions of Revenue and Product verticals

Products

Company focus is on de-risking business from few customers or few segments or few geographical areas

They have succeeded quite well in last 4 years

When a company has to grow to large company, many such things will give stability to company to perform well

Promoters have 40 years of experience in forging industry

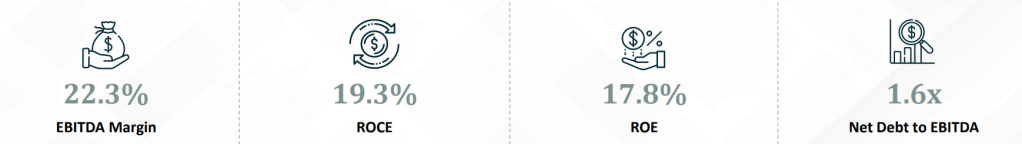

PAT , ROE, ROCE, PAT margin showing improved profile

8x sales growth and 35x profit growth in 10 years

Stock price is also 20x in 10 years and its quite possible to become 2-3x in next 3 years with CAGR of 24-30% approximately

Debt to equity has come down considerably and now close to 1 while Debt to EBITDA also is planned to reduce to 1 by FY25

Cash conversion cycle has improved to 100 days and Working capital days has also improved

Topline and bottom-line has improved significantly in last 3 years and trajectory is expected to continue in similar fashion

FY23 Fundamentals ratios

Manufacturer and supplier of a variety of auto and non-auto components

Global presence with footprints in North America and Europe

2nd largest forging player in India with over 40 years of experience Promoter possessing multi-decade forgings industry experience

Continued focus on diversification with foray into EV components

Longstanding relationship with marquee customers

Outstanding Credit ratings –perfect recipe for large cap progerssion in coming years

Opportunity size in exports and domestically

There is a huge requirement in India and in various overseas countries. Compant exports are grwoung well

Capacity Enhancement and future growth from internal accruals

Commissioned 7,000T Press Line in 2021 and also commissioned a Warm Forging Line and a Fabrication Facility in 2021

The company has commissioned 23,800T of capacity as on 18th July 2023 and the remaining 32,500T will be commissioned by September and overall Increasing to 2,10,900T (current installed capacity 187000T)

In addition, the company has planned to setup cold forging capacity of 25,000T. The Company has sufficient capacity for the next phase of healthy & robust growth. Capacity ramp-up along with operating leverage will result in faster improvement in profitability

Cold Forging Press line to be commissioned by Q1FY25

Entire 100% capacity has been booked by an OEM, the contract of the same is valid for 7 years

Management guidance in Q1FY24 Call

Subsidiaries and Strategic Acquisitions

Company has done a JV with Titagarh rail company for manufacturing and supplying of forged wheels for Indian railways

Ramkrishna Forgings announces strategic acquisition of Multitech Auto Private Limited and its wholly owned subsidiary Mal Metalliks Private Limited along with Mal Auto Products Private Limited. This can lead to 20% of current revenue addition

Also company has done some acquisitions in ACIL , JMT auto and Tsuyo. This push will help company to foray into tractor, PV segments, Heat treatment, gears, BLDC EV segments

Industry growth rate

Various forecast showing industry will grow between 6-10% for next few years. Important to understand here is the industries the company caters to

All these segments have Government focus and will grow heavily in next 5-7 years. So I believe company is present in right segment and right regions (fastest and biggest regions)

Recent Order wins

Just listing few wins in last one year

Susceptibility to raw material cost could affect Company profitability.

US landing into recession may also trigger less future orders in short term. Stock may consolidate before moving up

Stiff competition from peers like Bharat forge but this risk is bit mitigated with many order wins recently and consistently

Higher revenue concentration from Auto segment and CV domain in that is a risk–though company is taking utmost steps to remove this risk as highlighted above

High capital working requirements remain a risk

JV falling off with Titagarh rails for reasons is a small risk

Railways not going ahead with orders and new tenders in coming time is another risk which we need to consistently monitor

Technicals on 22 July 23

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip market offers else Ignore the stock

Stock might be up in short term and then give a chance to buy around 400-450 range for long term investment purpose

I am holding it from lower levels and I reserve the right to add more or exit as per company performance without a followup /update here

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Ice Make Refrigeration Limited is a leading producer of Cold Rooms, Freezer, Refrigeration System and Chilling Plant, etc. having a plant at Dantali, Ahmedabad. Company is leading supplier of innovative cooling solutions and manufacturer of over 50 plus refrigeration equipment in India. The company has started its business with a mere of Rs. 3 lakh & has crossed the market cap of Rs. 500 crores recently

Manufacturing facilities

Company has two manufacturing units in Gujarat and Tamil Nadu and also they have setup one more unit of manufacturing in West Bengal that is expected to be operational in the next one month

R&D Capabilities, Employee strength

Employee strength 625+, increased from 560+ in last 2 years

Company keeps on introducing new products in market. Ice Make’s innovative equipment product range also includes ice cream mix

preparation for small and medium scale, specially designed mix plant units. Its chiller product range includes Air Cooled Chiller, Water Cooled Chiller, liquid Chiller, Brine Chiller, and Screw Chillers.

Customers and Regions of Revenue and Product verticals

The Company operates under key business verticals including Cold Room, Commercial Refrigeration, Industrial Refrigeration, Transport Refrigeration & Ammonia Refrigeration and caters to wide range of Industries in India and also exports its products to overseas clients in 24 countries

The diversification in IMRL’s client profile also remained healthy with top clients contributing only around 25-40% of its total revenue over the last three years ended FY22. Around 70% of IMRL’s revenue is generated from direct sales whereas the balance is through its dealers and distributors spread across the country

Awards and Certifications

The company over the years have received several awards and accolades including Indian Leadership Award for Industrial Development, Best Medium Enterprise Canara Bank and SKOCH Award for manufacturing, India SME 100 Award and Gold Award for Excellence within its Core Industry category

PAT , ROE PAT margin showing improved profile

Debt to equity has come down considerably

Cash conversion cycle has improved to 64 days and Working capital days has also improved

Topline and bottom-line has improved significantly in last 2 years

.New product launches in last few years as industry is evolving

Opportunity size

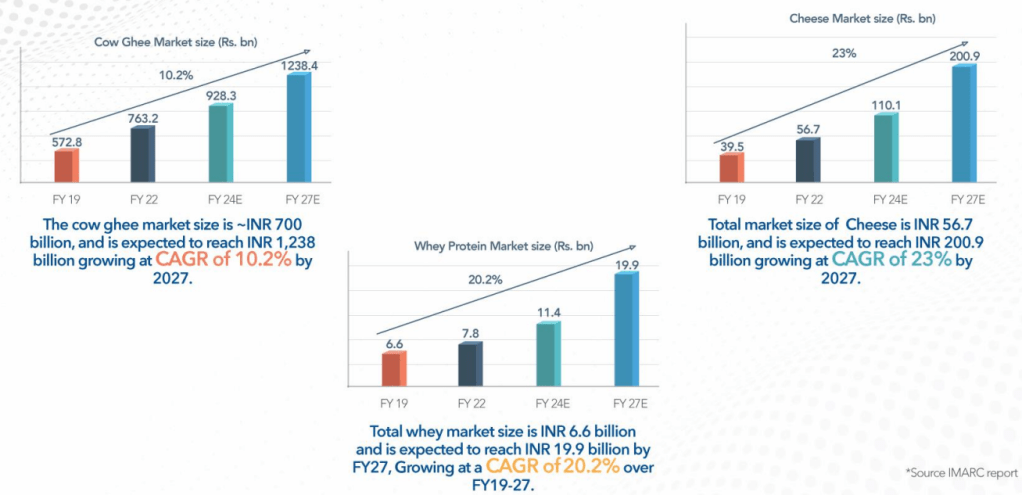

There is a huge requirement in India and in various overseas countries for innovative cooling and cold chain storage solutions and ICE Make is well positioned to take advantage of these opportunities. Continuous Penal business is expected to grow at a 14 % CAGR YOY & Cold Chain and storage business is expected to grow at a CAGR of 15% to 17% between years 2022 to 2027”

Need of cold chain infrastructure for Dairy, food and pharma

Capacity Enhancement

Company has acquired approximately 44,538 Sq. Mtr land situated at Mouje : Dhanwada, Taluka : Bavla, District : Ahmedabad, for “Continuous Panel” business. Project shall be fully functional by April 2024. Continuous penal business is a part of our refrigeration business which shall be used in big cold storage projects as well as in infrastructure projects

Company also setup one more unit of manufacturing in West Bengal that is expected to be operational in the next one month

Ice Make’s new project for Continuous PUF Panels has a revenue potential of over Rs. 200 crores in a single shift.

Subsidiaries and Acquisitions

Ice Make Refrigeration Limited has incorporated a Subsidiary of the Company in the name of ‘IceBest Private Limited’. As per the certificate of incorporation dated 28th December, 2022. runrate of 10cr expected, which will increase market share from east India

Industry growth rate

Various forecast showing industry will grow between 14-16% for next few years

Venturing into new markets

Expansion in east for manufacturing will help with voluminous products. Expansion in south, once the current lease gets over for subsidiary may happen. So company has that vision of expanding pan India

Recent Order win

lcemake has bagged Dairy Project for Design, Supply, Installation, and Commissioning of Civil, Mechanical & Electrical work for 1.0 LLPD (Exp. 1.5 LLPD) on Turnkey Basis at Haringhata, Dist. : Nadia, State : West Bengal, from West Bengal Livestock Development Corporation Limited (A Govt. of West Bengal Undertaking) for which the Company has received Award of Contract, amounting to Rs. 65.48 Crore including GST and all other charges / taxes. Entire Job including Handing over shall be completed within 540 days.

Scuttlebutt shared by one of fellows Yogesh whose family is in Icecream business–adding details with his permission

Susceptibility of IMRL’s profitability to volatile raw material prices. The main raw material used by IMRL in manufacturing comprise of polyurethane (PU) chemical and galvanized steel sheets along with components made from copper and aluminium. Prices of these products are volatile in nature (as PU is a crude oil derivative, while prices of metals are inherently volatile), it exposes IMRL’s profitability to adverse movement in these prices. Considering raw material cost constitutes ~75% of Cost of Sales, any variability in the same could affect IMRL’s profitability.

Further the nature of contracts are fixed, price can not be changed for existing contracts easily.

Stiff competition from organized big logistics players

Subdued performance of its wholly owned subsidiary viz. Bharat Refrigerations Private Limited (BRPL).

Technicals on 11 July 23

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.