Mall-a-maal

BE FINANCIALLY INDEPENDENT

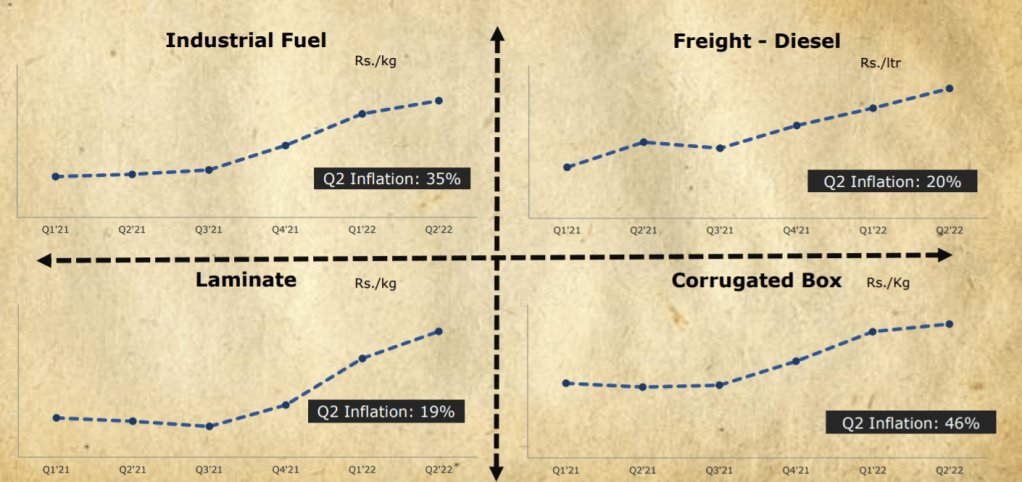

With inflation still high and central bank rates set to rise further, demand is expected to remain weak for the rest of the year.

Shipping group Maersk predicts that demand for containers — a proxy for trade — will fall by 2.5 per cent this year.

The S&P monthly survey of purchasing managers indicated that new export orders contracted across the world throughout the second half of last year and in January. Last month, the IMF forecast that global trade growth would decline to 2.4 per cent this year, from 5.4 per cent in 2022.

Q2 FY21 results fo SBI cards are out and does not look great on few fronts although long term story seems intact as of now

Few snaps from SBI recent investor presentation where we can see the lagging part from company as compared to previous year FY20

SBI Cards : Declining portfolio growth, SBI Cards : Increasing NPA , SBI Cards : Declining PAT

Looks better to wait for right entry price : NOT a RECOMMENDATION

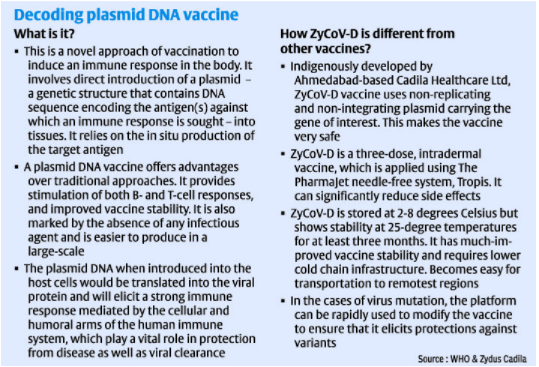

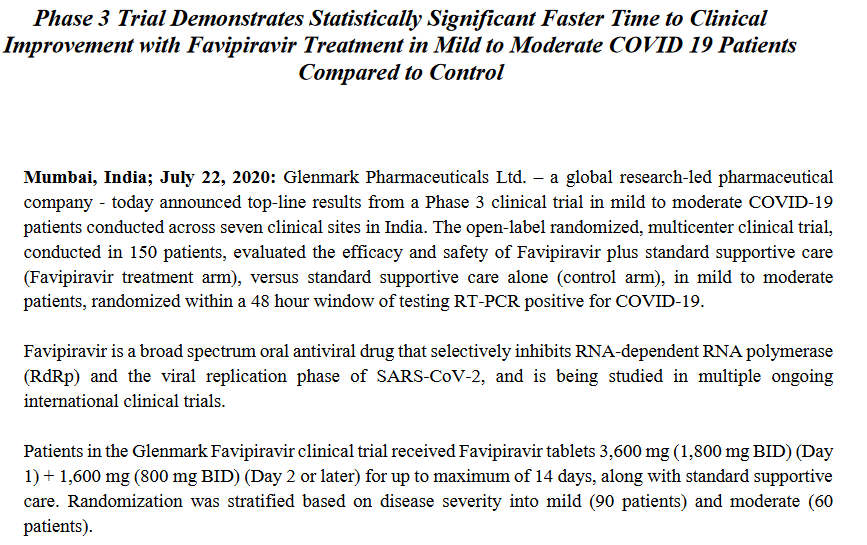

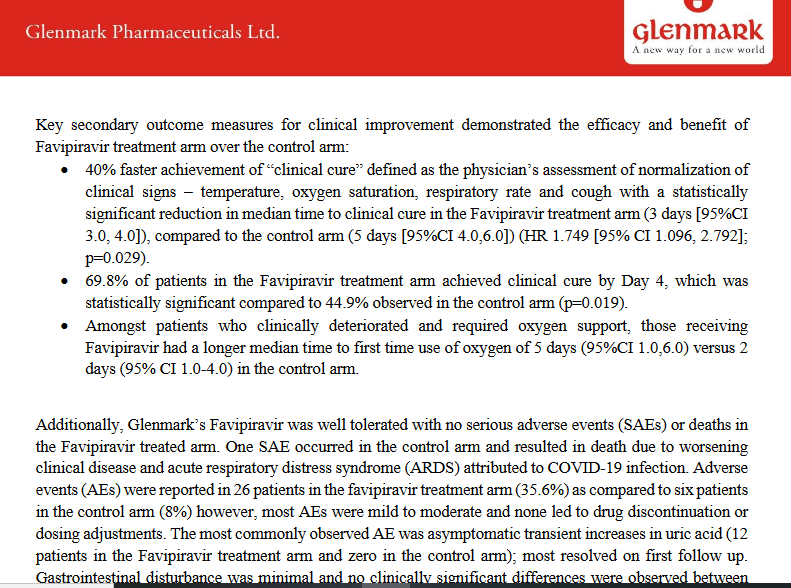

Claim is “no serious adverse effects seen” which is positive

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Weekend HookUp: 29 May, 2020

Read on how to get ideas for startups; research on fabric eradicating corona-virus; Short inspirational stories; How to travel sustainably

Startup: How to generate ideas for startup (SAMA)

Technology Research: Fabric eradicates corona-virus (Forbes)

Inspirational: Short stories (Gorilla)

Travel : How to travel sustainably (Lonelyplanet)

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Please note that I had hold positions in DMART stock in past and exited and may hold in future as well. I may be fully biased in the below opinion. Please don’t take it as investment advice. Its just sharing of what i observed and reader is advised to do due diligence before acting on opinion

Dmart is a stock which i am tracking from IPO days. Could not get IPO allocation but I entered into it at very late stage and also exited without making much gains. The Reasons are aplenty but as we see it is also a stock which has defied gravity in valuations. Here i am trying to find the correlation with the results announced for Q4 and full FY19-20 with what i have observed a month back and shared to people on twitter. .

This what i observed and shared a month back on 22nd April 2020

Almost 50% stores closed for a month, open stores only selling essential items like grocery which have low margin, other things like clothes, utensils (high margin business) is closed because of less staff operating. Open stores have less footfall, there is limit as well on items that can be taken out while on the other side they need to keep store open for longer time –our area 24 hrs open, instead of normal 10am-9pm ..so more operating costs. Plus operating expenses are rising because of social distancing, sanitation of trolleys, infrared thermometers, sanitizes to people when they enter the store , Electricity expenses, Getting worker to work at night shift may increase salary allowance. More people in line has forced DMart to put up tents outdoors. So less revenues, more expenses, profit will take a plunge in coming time. And now enters JIO deal. A bigger challenge for dmart to retain customers. May force them towards home delivery with shrinking margins My view at that time was to exit DMART and re-enter later.

What happened to DMART price. From the point i exited, it went from 2150 to 2380 in last one month

Sounds familiar!!

You sell a stock, it goes high

You buy a stock, it goes low

Amazing isn’t it!!!

But here the pain is less, atleast till now, as i was waiting for Q4 results to take a fresh call .

So how was DMART results on 23rd May 2020?

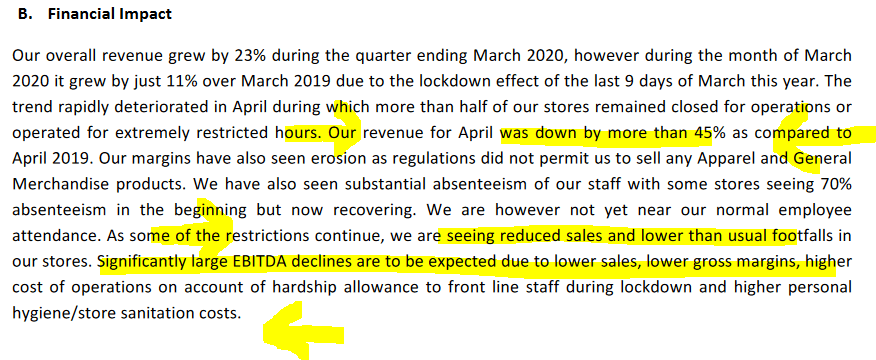

First glance at results shows solid performance with approx 24% increase in YOY revenues, 29 % yoy growth in EBITDA and 60% rise in EPS YOY. Looks like i missed the bus by selling my position and already stock by approx 10%.

Still i decided to delve deeper into results and compared Q-O-Q numbers (Q4vs Q3 of FY19-20). I saw a decline in Revenue as well as EBITDA and only 8 days were the stores closed in Q4. Why did the Q4 numbers so weak? I thought actual impact should be visible in Q1 FY21 but here Q4 revenue decline is not making much sense? It is beyond my imagination that only 8 days has caused such havoc in Q4 numbers. I was not able to solve the puzzle for quite some time. Could not get any clue and I was re-reading the results & commentary again and again.

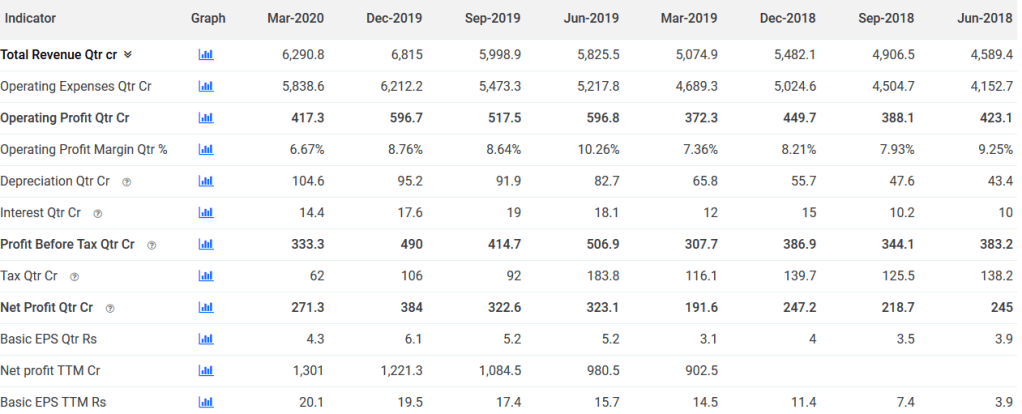

I pulled out numbers for past 8 quarters and there you go!! It confirms that Q4 is a historically weak quarter. But here the decline from Q3 to Q4 was 30% approx while in the past years the decline from Q3 to Q4 profits were limited to 20%. Somehow what i observed a month back starts making some sense . 8 days of lockdown did have an impact and its clearly visible in Q4 numbers.

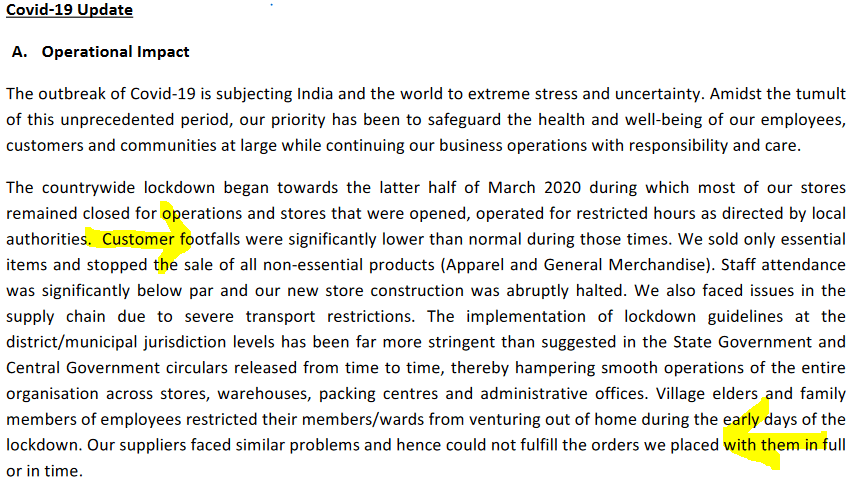

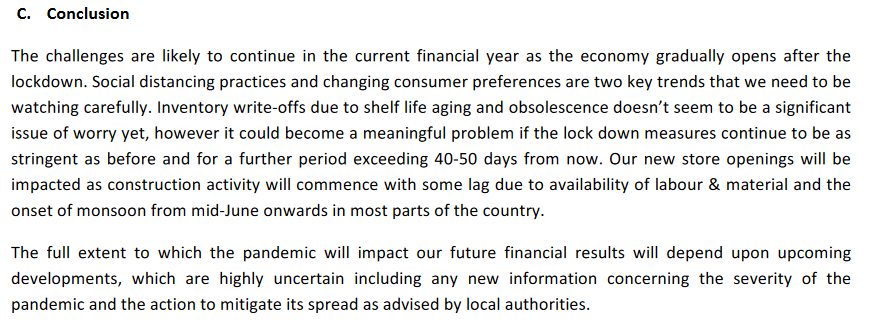

I reached to Management commentary and in section Covid-19 update, Management very clearly reflected on the lock-down observations and its impact on business. I am highlighting the paras below for your readings.

Reading the paragraphs gave me a sense of relief that missing such bus last month might not be not painful in long run. It also highlight the fact that while the results may look better at first glance but they are more than mere numbers and why one should go deeper to understand the results.

Entry of JIO MART along with COVID-19 lockdown may be a lethal combination for DMART. We need to see how the company performs in coming days and will NEWTON’s gravity will finally pull the stock down or not at all.

I don’t yet know whether i may get a chance to board the bus again or not as stocks prices can remain irrational longer than one’s patience!! I am also skeptical as of now whether bus should be boarded at all. I may be totally wrong as i see there are people who are predicting or rather speculating that all is well with company and stock price is on way to 3200!!! Its better to wait and watch from sidelines although I would be really surprised if the DMART stock reaches 3000 levels before retreating back to 2000 or 1900 levels. But Stock markets can really make you go crazy at times.

Please share your opinion on what you think about DMART stock price

We will revisit this post possibly after Q1 results again and learn more from markets.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

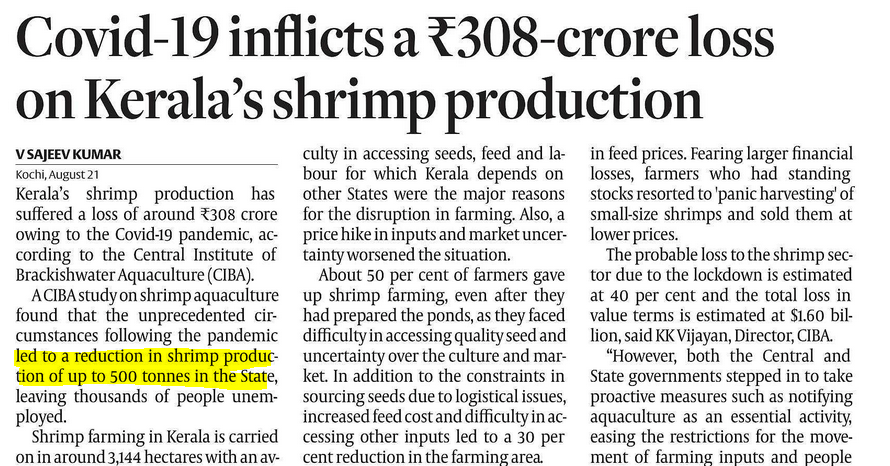

Also Read : COVID-19 Impact on Indian Economy

If February 2020 was forgettable for investors then March 2020 would be a month which most of the investors want to skip in their investing life. But what is the guarantee that April and May 2020 will be better if not the worst? So a rational investor can not wait for bottom as he dont know about the bottom. But what to buy and what to leave in such markets?

Let’s try to find out

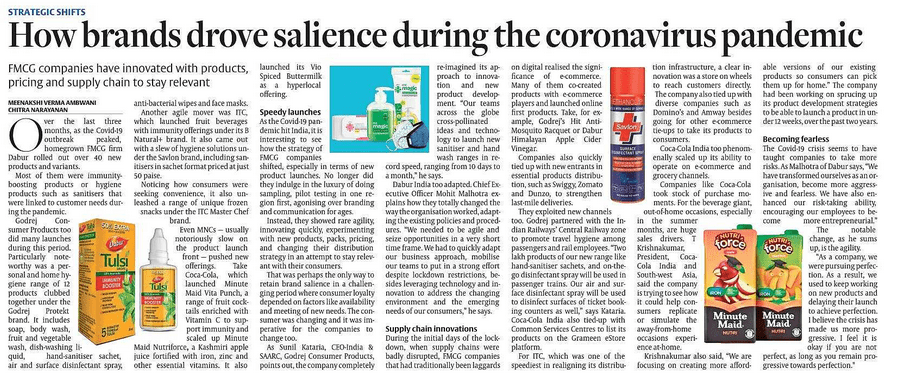

Just when i was thinking what stocks to buy in these stressing conditions for economy and people, i mostly get stuck on FMCG companies. But the amount of negative news for the whole market is so high that making a decision is becoming difficult day by day. So i thought to keep watch on all news around COVID-19 lockdown and see if there are any positive inputs for any sector or industry.

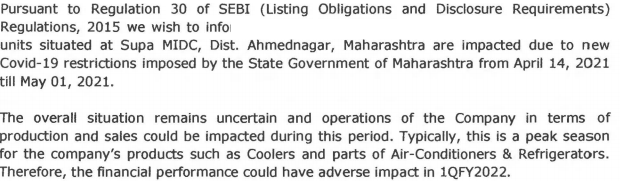

It is evident from various sources that people are getting bored at home even when they are WFH. Although some of them are fitness conscious and are actively engaged in indoor exercises but their normal physical movement has almost gone done to ZERO. To pass the time, they have started indulging in binge watching/exercising to somehow beat boredom or depression. So i feel that these are the two sectors which could benefit the most in this lockdown as grocery stores are open and some of them do keep yoga mats or basic exercise equipment.

I searched a bit more on internet and came across something which positively testify this theory. https://www.stackline.com/news/top-100-gaining-top-100-declining-e-commerce-categories-march-2020

The site mention the TOP 100 Grwoing and declining e-commerce categories in US although most of these things also apply to Indian context as well.

Some of the major takeaways are (source : stackline)

· There is a surge in home fitness products including weight training equipment, fitness accessories and yoga equipment as gyms and workout studios are forced to close. Due to the increase in at home workouts, the gym bag category and many outdoor sport categories such as baseball & softball and track & field are in decline.

· Many companies have implemented a work-from-home policy, driving demand for computer monitors, keyboards & mice, and office chairs up as employees look to create a temporary home office.

· Most travel has been halted, causing declines in the luggage & suitcases, briefcase, and camera categories. Additionally,many spring break vacations were canceled, triggering a decline across sandal and swimwear categories.

· Formal apparel categories including Bridal and Men’s Suits are in decline as many couples are forced to cancel or delay their weddings.

My observations (not recommendations) :

Please note that the information shared is for educational purposes. My views can be biased and i may hold some of the stocks mentioned. Please consult your financial adviser before taking any financial decision and most importantly do your own due dligence

What do you think out of this COVID lockdown? Please comment or mail me your views

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.