Google vs OpenAI

BE FINANCIALLY INDEPENDENT

Unified by Purpose : Accelerated by AI

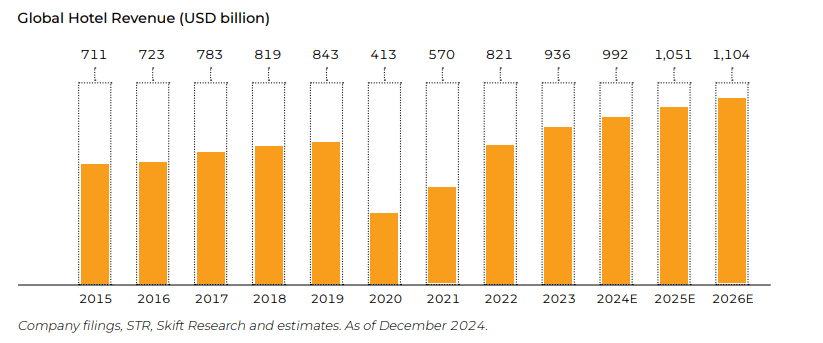

Steady growth

RATEGAIN Platform

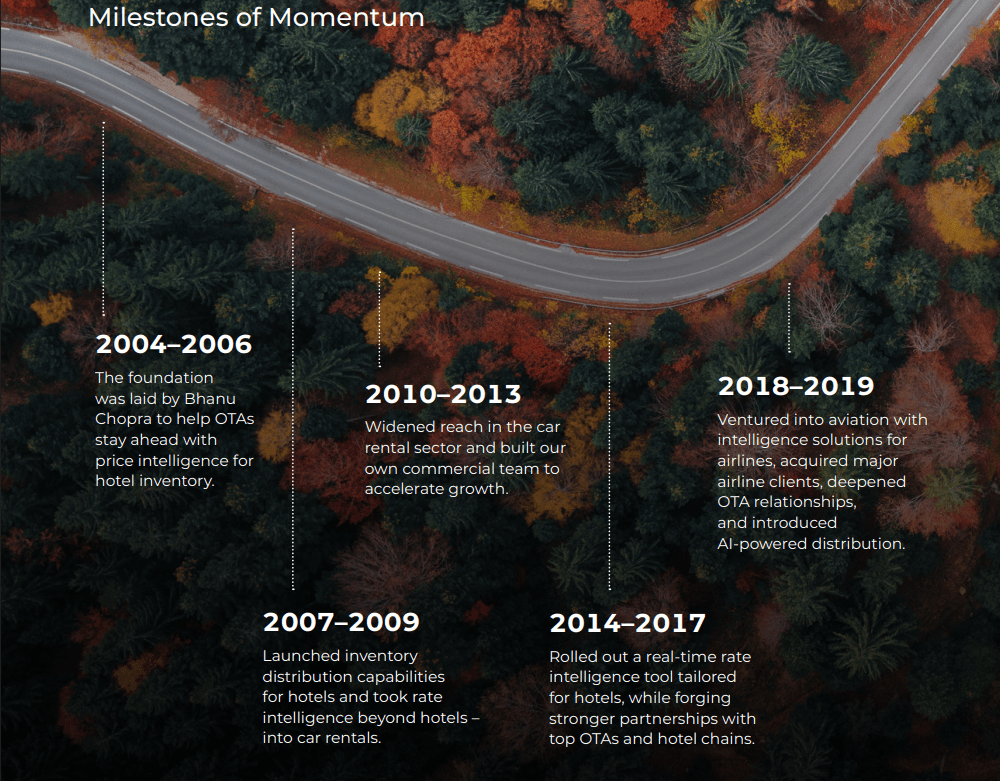

Milestone of momentum

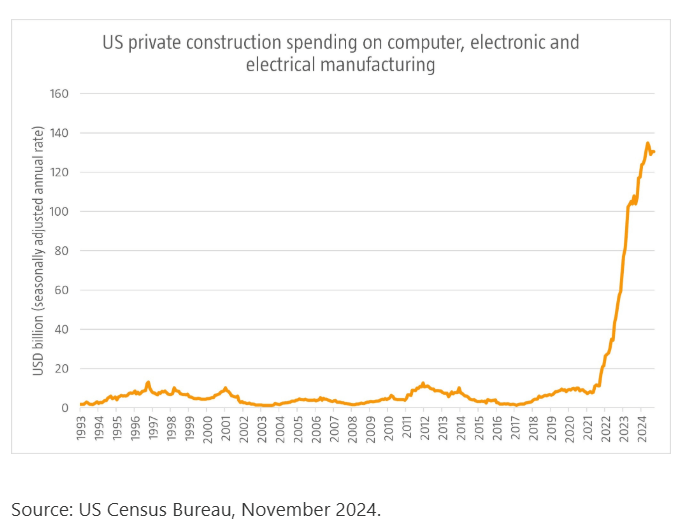

World is changing : AI first approach

5 Megatrends transforming the global travel technology

Navigating NEXT

RateGain plans to drive growth by:

About company –See the cutting edge cloud GPU’s

Services

TIR GEN AI PLatform

AI LABS as a service

FY25 Highlights

Monthly Run rate

Strategic Leap with L&T

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Impact Of Data Localisation Laws

The Indian government’s push for data localisation, under policies like the Digital Personal Data Protection Act, has accelerated the establishment of data centres. Global players such as AWS, Microsoft, and Google are investing heavily to comply with these regulations, while Indian companies like Jio and Yotta Infrastructure are scaling up their capacities.

Green Data Centres On The Rise

Sustainability is a key focus for Indian data centres in 2025. Operators are investing in renewable energy sources like solar and wind to power facilities, with states such as Rajasthan and Gujarat leading in renewable energy adoption. Innovative cooling technologies, including liquid cooling and the use of natural resources for temperature management, are becoming standard practices to enhance energy efficiency.

Edge Computing And Regional Growth

India’s shift towards edge computing is transforming data centre architecture. With the rollout of 5G and the proliferation of IoT devices, smaller edge data centres are being established closer to users in Tier 2 and Tier 3 cities.

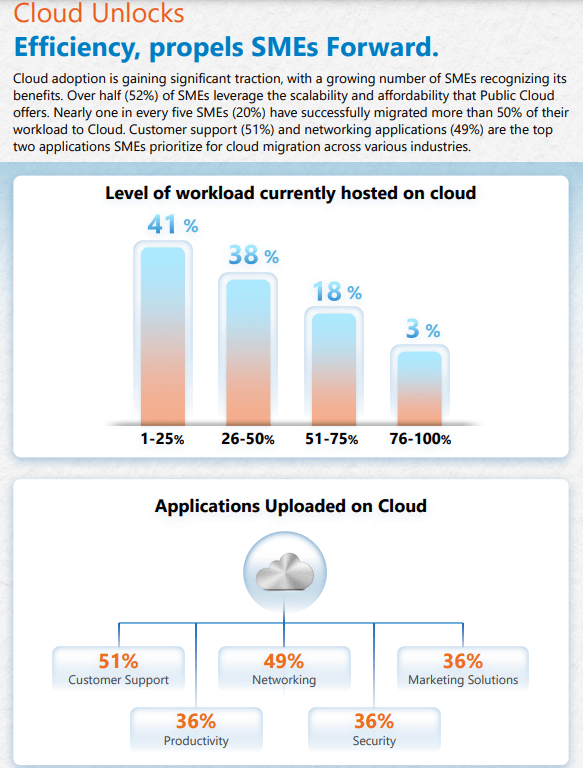

Expansion Of Colocation And Hyperscale Facilities

By 2025, colocation and hyperscale data centres will dominate the Indian market. Colocation facilities, which allow multiple organizations to share infrastructure, are becoming the preferred choice for startups and small businesses due to cost efficiency. On the other hand, hyperscale data centres, built to support massive data volumes for global giants like Amazon and Google, are rapidly expanding to cater to India’s growing digital needs.

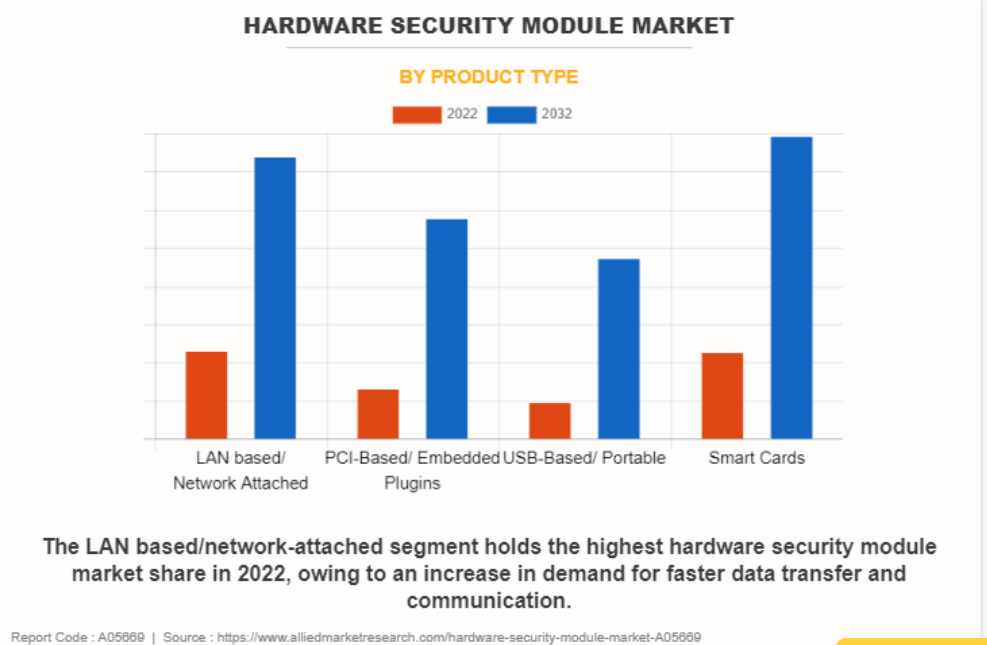

Advances In Security And Automation

With increasing cyber threats, Indian data centres are integrating advanced security measures such as Zero Trust Architecture, AI-powered threat detection, and biometric access controls. Automation is playing a vital role in optimizing operations. AI systems are managing energy consumption, predicting maintenance needs, and ensuring seamless uptime, reducing operational costs while improving efficiency.

Government Support And Policy Initiatives

The Indian government’s initiatives, such as the National Policy on Software Products and state-level incentives, are creating a favourable ecosystem for data centre growth. Many states are offering subsidies on land, power tariffs, and taxes to attract data centre investments.

Opportunities In Tier 2 And Tier 3 Cities

As data consumption grows beyond urban centres, data centre operators are expanding into Tier 2 and Tier 3 cities. These locations offer lower operational costs, ample land availability, and growing demand for digital services, making them attractive for future investments.

Full article here

https://www.businessworld.in/article/data-centers-in-2025-whats-driving-the-boom-in-india-540530

Copied key contents from confcall and AGM

Disclosure : I am holding it from very low levels, Not added/not sold recently

Keeping in mind the seasonality pattern inherent to our business wherein Q1 is the weakest quarter and the major chunk of revenues are captured in the subsequent part of the financial year. We want to highlight that we have also improved our gross margin significantly, which were primarily driven by continuous improvement in the product mix where the domestic defense business contributed to 65% of the topline, followed by exports whose contribution is around 21% and the space with 11.5% with rest of the business coming in from meterology and other sectors

Employee expenses have slightly gone up because of the increase in the number of skilled and professional employees. This is mainly due to our employee addition at our Bangalore facility. At the end of the quarter, the employees count is close to about 1537, up from 1468 at the end of the financial year.

We have created that Bangalore facility for our systems integration and testing, especially in the radar and electronic warfare domain and we have built up NFTR facility also and also assembly hangers to handle and address the radar systems. And also we have created space division in Bangalore facility. We have incorporated 100% subsidiary unit, Astra Space Technologies Limited and that group is basically going to address all future satellite requirements and they are also working in the same facility.

Objective is to get qualified for satelitte integration and launching business. Own satellite launch is the goal in next 2-3 years with synthetic aperture, radar payload ( ISRO collaboration)

Guidance :

And lastly, for the current financial year, we maintain our target which was given previously for an order book in the range of about Rs. 1,200-Rs. 1,300 crores and the topline in the range of Rs. 1,000-Rs. 1,100 crore with the PBT margin to the tune of about 16%-18% on standalone basis.

Import Substitution + Winning Contracts

We made a breakthrough in replacing imported critical wideband receiver for EW project which DPSU has been using for product of foreign make and the DPSU has the production order. Also, we have bagged precision approach radar and repeat order of Doppler weather radars in this quarter. Our anti drone radar is ready for the

deployment in the field and we have been responding RFP’s from various agencies.

we define ourselves to be in the IP business. We are in the business of creating IP, enhancing our IP and that can be done both through our own internal efforts as well as collaborations. But eventually we are in the business of monetizing intellectual property. We have embarked on an exercise now aimed at selling out the IP which has been created within the Company and shared to a large extent which we can now either monetize on a standalone basis or combine it with the other IPs which may be available within the Company or externally available to create value. We found that we had multiple products and technologies which had been created and then not acted upon any further post order completion and had just been filed away as the teams got busy in fulfilling other orders. So, taken out of cold storage and updated with the current tech standards, we can productize these technologies on their own, or combine them with other technologies and that is a low hanging route for us. The incremental efforts at making this tech viable and commercial in minimal and offer us easy way to monetize our efforts

Glad to share that two definitive binding term sheets have been signed this past quarter alone, one in the area of chip design services and another in the radar space while discussions have been initiated with multiple companies, both listed space as well as in the smaller unlisted space for enhanced collaboration with the platform, which Astra provides to further enhance our joint intellectual property and create products which are well suited for the future. We are also in a hurry to monetize things at the fastest possible pace and collaborations

Capacity expansion and ability to handle more orders

we enhanced our facility. Recently, we have added auto bonding facility by virtue of which in fact our subsystems that is the tier module of those radars we can produce manifold in the sense about 20 times than what we made it with semi-automatic facility. So, that way we have enhanced our infrastructure, we scaled up our capacity. We are geared up to manufacture as many as numbers as we want.

Order Book

We have crossed the milestone of Rs. 2,000 crores mark this time where the standalone order book as of June 2024 stood at Rs. 2,099 crores and our order wins continues to be healthy. On a consolidated basis, our order book stood at Rs. 2,365 crores as of June 2024. Overall, our order book comprises of 88% of the domestic orders, which are largely BTS, which enjoys good margins and 12% of export, which is a mix of BTP and BTS business. Our consolidated order book consists of Rs. 120 crores worth of service orders, which are typically margin accretive. Our focus remains on getting more orders, which consists of high proportion of complex system projects

Q. top 5 programs that would be critical for our order book accretion and revenue growth in the next 2 years?

Management: There are many projects we have been addressing radar and electronic warfare domain especially if you take in the radar, we have been addressing airborne radar and also the ground radars, shipborne radars in all three segments.

Like airborne radars, we have been working for AWC Mk1, Mk1A and also we are waiting for the RFPs for Mk2. . Similarly there is Su-30 opportunities also will come.

Similarly like in the ground segment, there are many radars like we are talking about Tushar like Akash-NG, Akash Prime, WLR repeat orders, these are all which customers DPSS are likely to get. So, we will be getting subsystems from those particular segments.

And shipborne Navy, as I said we are likely to get some repeat orders from Navy.

And in electronic warfare, we have been working for pod jammer for LCA Mk1 as well as we have been working on the ongoing production programs of BEL like Nayan Shakti, Himshakti and all these programs, we are there. And also we are there in the EW programs of like DR118, R118. So, all these programs, we have some orders on hand, and we are likely to get more orders, repeat orders from these customers

Uttam Radar –75% of Radar cost is Antenna –We are supplying exclusively Active Antenna Array units for same. we are expecting around close to Rs. 1,100-1,200 crores worth of business from the Uttam radar in the next 3-4 year’s timeframe

Avantel AGM 2024

Copied key contents which I liked from AGM transcript.

Disclosure : I am holding it from very low levels, Not added/not sold recently

we have consolidated our existing business in satellite communication for defence applications, we are also diversifying into two different areas and the results we expect to see in two years from now in a big way.

So, and we are very confident that both these initiatives will put the company in a different orbit.

From 2026 -27 onwards, we expect to see the results. And from 2027 onwards, the three years from now, there will be a quantum jump. we expect the company to establish itself as the top five companies in the country in the space of defence

First diversification that we are doing is the software defined radios. It’s a big, huge market globally. But if you come to very specific to India alone itself, it’s around $11 billion market globally. But coming to India in the Indian Defence market alone, it’s, it’s around, it’s around $300 million leaving the civilian commercial market only Indian defence market per annum. That is $300 million is per annum

we would be number two, I mean, if I’m not wrong, in that space of SDR’s with SCI compliance and that covers various spectrum like HF, VHF, UHF, L band, Satcom, SDR. There are various frequency bands and various versions of them for like portable versions, handheld versions with vehicle borne aircrafts, helicopters, shipborne submarines

C4ISR is the basic backbone of any, you know, any defence service, which includes command, control, communication, computing, intelligence, surveillance and reconnaissance

We are planning to complete a range of products by this year, financially and itself, but we expect to see a good revenue and all from 26, 27 onwards. By 2027, we should have, we consolidated as a serious player in that segment in India. And these products will also have possibility to expand in the global market.

second diversification is in the space sector where there the government of India has started opening up the sector very seriously and they want to see that private sector enters BLO, build, launch and operate kind of services. So in all the both upstream as downstream and midstream services in satellite space will be open to the private sector either through partnership with public sector or, government. Public private partnership or private sector alone government of India is looking at something like $50 billion in the next eight to nine years

we are well positioned to expand our presence in the space sector by getting into two areas.

One is ground station as a service like it includes satellite operation Centre, mission control Centre and also receiving the data and images from the satellites. Their station is supposed to receive the signals from satellites and then distribute that to the customers.

And the second part is the assembly, integration and testing of the satellites themselves. There up to satellite weight of say 1000 kgs max. We should be able to do it in house. So we are establishing a facility in ECT electronic city in Hyderabad. It is near airport. It’s about four acres of land. The construction is going on and we should be able to complete that facility in all respects by this year end. So there two things

Orders

we have around 287 crores worth of orders on hand right now. there are a lot of other things in pipeline railways now, we are well established. We are expecting another 60 crores order, approximately, and maybe in a month or two and followed up by another tender coming up. They are coming up for I think maybe 12,000 terminals. So that will be a public tender. NSIL, we are doing, I mean, we have an order for around 27,600 or so

Five-kilowatt HF system we have already delivered and that has only been delivered to Indian Navy, government

of India through bath electronics, installed and commissioned. So, there’s a good requirement in that space. And right now, A, we have the product in hand and we are ready for that. So, whenever the RFP comes, we are. That will be a big opportunity. Maybe few hundred crores.

we want to work on satellite payloads also which is again state of the art kind of development work. Subsystems for satellites. These are highly manpower intensive kind of work. So, the manpower expenses in R and D will grow a lot significantly in the next three to four years because we are investing heavily in R and D in those software, different radios and satellite subsystems right now.

We have five projects sanctioned by Minister of defence government of India and five is the maximum they can give to any company. So, and we got five out of this. Two contracts are signed. One is in the final stage of contract signing. Maybe this month, June they will sign another one, maybe in June end or July. So enough. There are two major projects we have signed wherein once we complete the development, we’ll be the only vendor for those requirements. And those projects are having high potential because we’ll be the single vendor and those projects are having huge requirement from Indian army

Government of India is giving a grant for those projects, investing in that. And they are investing in their time and effort to do the trials, conduct the field trials for these projects. So earlier we have to understand the requirements, develop the product without anything, no cost, no commitment basis, go after them to conduct trials and accept that. Now it has come from them. They are given the specs, they have given the requirements, they are giving the grant and they are saying once it is completed, they will buy from us. So, it is like a phenomenal change in the outlook from the government of India. And in terms of making India and self-reliant, I think they mean business

Receivables

Receivables we have, because we did 38 crores in the last quarter. I mean there is some, it appears to be more, but we have already received close to 39 crores from those 68 crores. And in that again around eleven crores is towards installation commissioning which will come over a period of time as we complete the installation of the equipment and all crores, another remaining eleven crores we should be receiving in June or July. So, there is absolutely no, as you could see, there are no bad debts at all for the company and they are, if they are there also, they are minuscule, 0.001% something like that. Because all receivables are from government of India or government of India undertakings.

IMax opportunity

we may do some two and a half crores or so next year. Then following year maybe, we may even go up to ten crores, then 15 crores. But we are confident that we will reach 100 crores by 2030. So that’s not a very ambitious target because of the market here is around $11 billion and we are importing about $7 billion every year in medical equipment. That sector, which is about $7 billion, is the import itself around 60,000 crores or more they are importing. There is a huge potential there that is also expected to go to $50 billion by 2030. we are very well positioned in that because our expertise in electronics and engineering and mechanical, everything is very helpful in making world class equipment. We are not compromising on quality or anything. We are trying to build artificial intelligence into that. We want to make this equipment IOT enabled and benchmarked against the best in the world. So, there is no doubt that we will do well in image. It’s only a matter of time. So, But the break-even may happen. Maybe if not this year, next year definitely it will break even and get into cash profit. We’ll make profits in 25, 26 for sure. And after that the growth will be exponential. So, the I max would be a very, very significant

we are positioned in a place called AP MedTech zone where the world class facilities are created for complete testing and certification. It’s world class, it is recognized by WHO also. So, our facility is coming up in that 300 acre or something kind of a thing, where there is incubation centre, the test labs, certification labs, and many companies also have already started operations about four or five years back, and they’re doing extremely well. So, in that we have chosen space where two, three areas we have identified.

One is the respiratory area, like. Like ventilators and C Pap, BiPap and things like that. Then we are selected. Endoscopy is one of the areas And of course, to start with a low, low-end side, we have taken surgical staplers where it is certified. And then we, as I briefed you earlier, we got a contract for supply, 25,000 numbers per month from another OEM company. So, we’re on the right track. And then the final, we also want to, as I rightly, as I told you earlier, we want to develop something called hospital at home kind of equipment, which will be very useful for in times like Covid or for elders or for communities. So where in a budget of, say, ten lakhs, you can have everything that a hospital can provide. In an ICU, which is a small, it’s an equipment which will be carried on a cart or something like that, which will monitor all vitals. It will supply oxygen, it will have ventilator, it will have infusion pump to infuse injections and all. It will monitor all the vitals. They will be communicated to the doctor. Essential medicines will be made available there. Simple. Some small blood tests also can be done. So basically, it is like everything that you can ask for in an ICU, kind of things will be made available. Any nurse can handle that. And as the vitals are monitored remotely and doctor can be. Will receive alerts and then he can give guidance and then nurse can attend to that

are we able to develop any new products now which will help us be ahead of the competition for the next three, four years and enjoy similar margins?

Dr Abburi Vidyasagar- Actually we are continuing that initiative in developing intellectual property. The fundamental focus of the company is on innovation. Always it’s an innovation driven company, though we give very lot of importance to customer service and operational excellence, which are also required to make our company profitable. But the core is innovation only even today.

we have already started working on software, different radios with SCA compliance for Indian as well as global market in defence communication. That is going to be. I mean, there will not be many companies in that anyway. Okay, I don’t say zero competition. There will be competition, but there will be limited competition. Similarly, the ground terminals I am talking about in KU band, cultivating Gaga band, which is again, very few companies will be there. I mean, the satellite terminals I am talking about, which are portable, mobile, you know, airborne, those versions which can be mounted in aircraft or a helicopter, those satellite terminals, again, very few companies will be there

Avantel AGM 2025

we have taken

up five projects, 5 projects from the Ministry of Defence under the scheme of iDEX Indian

Defence Challenges. So, the projects are mostly related to satellite communication. In fact,

all the five projects are related to satellite communication. And the first one is sat phone

based on geostationary satellite. The second one was again Convoy Management based on

satellite. Both are for Indian Army. The third one is the receiver for receiving video through

satellite, again for Indian Army. Port and 5th projects are for the requirements of Indian

Navy, which is mostly based on Satcom on the move, the communication on the move for

both land-based platforms as well as for the airborne applications. So, all five out of the

five project, the 5th project contract was signed recently, but the fourth projects were

signed quite some time back about six months back and the development work is going on

very well

we have come for rights issue which is that

near Vijayawada about an hour from the airport of Vijayawada, it’s on the highway. So that

we would like to use for you know, making antennas which like HF antennas which are

very huge and in terms of occupy a lot of space, 5 kilowatt HF antennas, one kilowatt HF

antennas and then other types of antennas use it in military applications as well as sat com

ground station antennas for say 7.3 meters, 9.3 meters, even 11 meters satellite (Not

Clear) antennas can be manufactured there.

we are meeting all the

requirements in terms of production as well as design, development of various products for

MSS, particularly MSS mobile satellite services and UHF, SATCOM and UHF LOS

radios, HFSDRs and HF one kilowatt systems and the real time training information

systems, fishing transponders for boats from the Department of Fisheries through NSL.

The

growth again using CAGR growth. So for example, in 2021, the sales was 77 crores and

now 24-25 it is 248 crores either kind of almost it’s more than it’s about 3 times 300%. If

you look at the profit, it was 15 crores in 2021 and now it is 24-25 which has come to about

close to 60 crores, 59.56 crores see this is about almost four times Ok, the 400% something

like. So this kind of increase you, I would like to caution you will not be there for next

couple of years in 25-26 and 26-27, which it will be more stable and from 27-28 again, you

can expect a steep growth. If a couple of opportunities from say 4 to 5 opportunities, 5

opportunities are there, which are likely to take us to the next level of growth to say sound

50 crores turnover supposed to be aimed to reach by 2030 to reach that kind of from say

sound 50 again, 300% again over a period of four years. So that is possible from if we can

convert two out of five to six opportunities that we are working on, which will get us good

numbers in terms of both sales as well as the profit

l. Coming to IMAX, so as I told you in the last meeting, this medical

equipment requires certification, Ok. The certification process will quite elaborate and go

through and has to go through many levels of testing particularly things like those

noninvasive ventilators and then you know CPAP patient monitoring systems. Those things

have to go through a lot of processes that for certification. But the total money, if you to

put them in the right perspective the startups with one single product also I have to remain

investing at least 5 to $10 million. And all the money that we have invested here is close

to $4 million, not even 4 million rather than 4 million. And if we have around 5 products

in place and the certification process will be completed for all these products by September

for sure. I mean some of them we got already and some of them by June this month end,

some of them July end one more and August one more and September. So in the next three

months we are getting all the certifications. Plus we have to build a facility with a clean

room and other things. The kind of world class facility built and out of 30 crores close to 22

crores has gone for fixed assets. There’s nothing that and you can assume that eight crores

have gone for product development. So basically we laid the strong foundation for IMAX

to go forward and if any of the shareholders are very, very, I mean worried about this, then

the promotes can take over if required. So, but thing is the medical industry, the projections

are from $12 billion in 23-24, they are expected to reach $50 billion by 2030. That is the

kind of growth they are expecting in IMAX

. I’ll come to the first point

that and he also was asked about unsecured loans and all that CDB. There are two reasons

for which the shares have been sold. One is to subscribe to the rights issue number 1.

number 2 is Laxmi Foundation. I have donated quite some time back the 45,00,000 shares

and obviously that donated means I want to sell the shares and invest in the trust for

building the hospital, which we already have a hospital in leisure premises and we want to

go for our own building for the hospital, much bigger hospital, maybe around 200 bed

hospital, multi-specialty hospital. So we have to, I mean, I’m going to not stop here. I’m

going to maybe donate more, another 45,00,000 shares or maybe another 45,00,000 shares,

maybe another 90,00,000 shares for every next 3-4 years. So that’s and I think that’s my

privilege to donate. And then once we donate, they have to be sold to be able to invest in

the foundation activities. So I think that’s obvious and I hope shareholders understand that

point. Regarding these loans unsecured loans because the company because suddenly the

lot of projects were implemented and obviously the receivables have to come from

government PSUs and where there were delays, there were delays in receivables. So instead

of rushing to the bank. So whatever money I wanted to got to invest in rights, I have

invested as unsecured loans here because it is the easiest route for me to fund immediately.

e SDR market is around 3000 crores every year for the last,

so many last 7-8 years is buying from different services is about SDR business for military

segment alone is that much so and obviously it’s not something that you can do overnight,

then everybody could have done it, you know, So for Avantel also, it takes time to do as

per software communication architecture, SCA 4.1 specifications and kind of stringent

requirements that army and the navy are asking for, including Air Force that shows that the

kind of intellectual property that is involved in development of SDRs and Avantel’s

capability number one is we are already supplying HFSDRs 1 kilowatt HFSDRs is being

supplied to Indian Navy and the shipyards. So our competency and capability is already

proven. We have delivered. We are already demonstrated and trials have completed for

UHF SDR and UHF sat com SDR to Indian Navy in trials on ships. So there also it’s not

on the board drawing board. It’s proven. And 3rd, as you can see, we are selected by Deal

Dehradun as against competition from Bell L&T and other major players. So we are short,

we became L1 and we are technically qualified. So and those radios are meant for Indian

Air Force, Ok, so airborne SDRS for which we have been we got the received the contract

also they gave us two years, but I am sure we will develop much before that. Ok. That’s a

four channel radio now. Right now they are being imported. This is an import. Two

companies were there and we are L1 and some company L2 both of us shared the order,

other one is Coral yeah. So that that’s about the SDR capability and development and the

big numbers. Defence Services in the next maybe one year. So we are participated in the RFI and if

definitely qualification criteria we have to see how much turnover and all that individually

or through conversion we will bid for that. That’s big number. So in that the product that is

required for that is in am advanced stage and definitely we will meet the requirements. We

have given the complaints for all the requirements and it’s that development is going on

now, right now at ECT facility in Hyderabad, Ok, when that is 12,000, you can, I don’t

know it will be 3000 crores or by 10,000 crores. It depends upon the kind of estimate they

have for this product. But definitely I’m sure it will be around maybe 3000 crores or even

more, Ok. So that’s the kind of segment we are positioning ourselves and there are entry

barriers. There is not something that everybody can by investing money they can develop

the product unless the import and obviously imported the equipment are at least 100% more

expensive than what is developed by Bharat Electronics. Not even a lender in Bharat

Electronics is giving it a competitive price when compared to imports. Dr. Ajit may correct

me if I’m wrong. So this is about the SDR part about win profile radar. Yes, we have the

technology. We already delivered sharp and two more tenders are coming. One tender is

expected this year. One tender is already come. We have already participated in the bid and

it may be opened anytime, maybe in the next couple of months. And the next one, the RFP

for us may come in the next 2-3 months and we are very confident that we will be there,

one for Indian Air Force, One for ISTRAC

Somebody’s talking about 100 crores less or something kind

of order. This 100 plus crores of orders will come this year itself and other things like

ground stations and all that. One good news is we have a good collaboration with Safran

France, the one of the best companies in France, in aerospace, not only in France, in the

Europe itself and maybe in the world. So they are, we are collaborating with them for all

the ground station 360° coverage, full motion antennas for satellite data reception,

we have already tied up with one company in Med Tech

industry for Health Kiosk and we will be doing the contract manufacturing for them. And

also we can also sell directly also. It is a very good product. It’s called help pod. It’s like an

ATM for healthcare. There are many, many parameters automatically measured. Maybe

it’ll take 15 minutes maximum, Max that is otherwise all together, actual measurement time

is 5 minutes. So that health part like an ATM Kiosk and we have some requirements. It can

be proliferated both. In fact, there’s a potential in military also for that along with our home

care product which can be moved into ambulances, army vehicles, trucks and health centers

everywhere. It can be fixed along with the H pod. H pod and our health home care unit

together. It will be like a mini hospital during diagnostics and service. So both are very

good products and the home care product when it comes, it integrates multiple technology.

It will have x-ray, ultrasound scan, patient monitor, ventilator. It will have everything that

you can ask for to like in whatever is there for the best possible treatment in hospital. So that’s

our product and HPOD is the product from Satyendra Goyal who is from Chicago, USA.

They have developed it and they want us to partner. We have signed an MOU also and that

is another great opportunity. And in Imax when, when we when we start producing, after

the certificate get, start get going, the growth rates will not be 10-15%, but they could be

40-50% year on year or even more 100% or something like that. So once it starts with some

4-5 crores this year, afterwards it could be 30 crores, then it could be 60 to 75 and then

hundred. That’s the kind of potential that is there in that area in highlights

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time 21st jul24

Live classes on Sunday Morning/afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months approx.

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Be ready to WELCOME 2025 with Knowledge

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

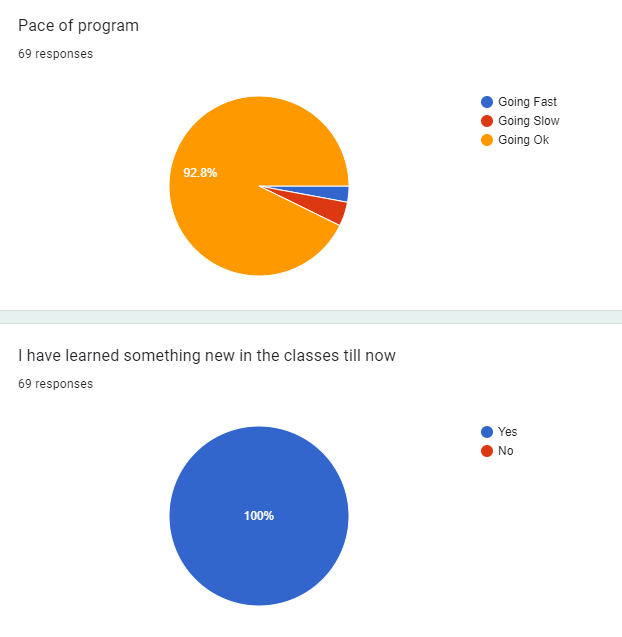

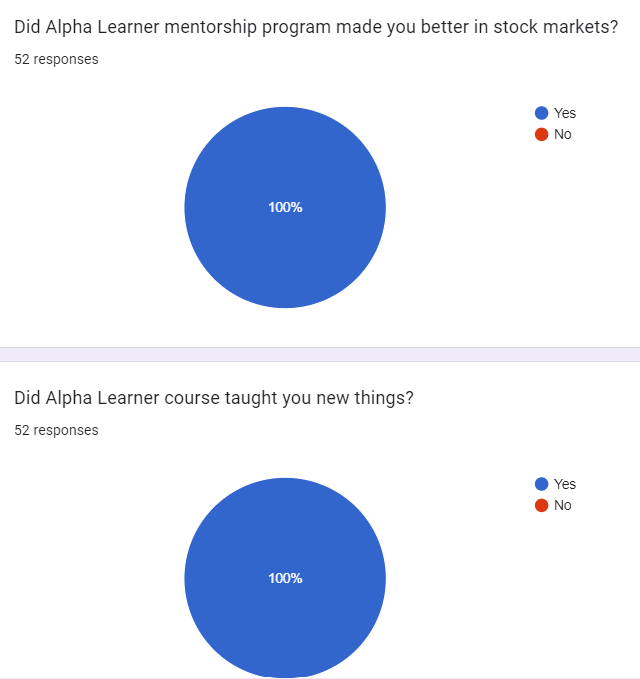

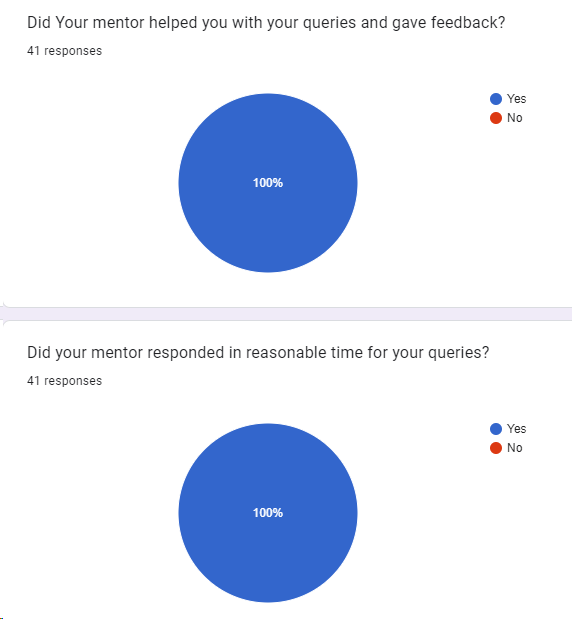

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Key Investment thesis –> Smart city contracts and infrastructure solutions

Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9, Pick10, Pick11, Pick12, Pick13, Pick14, Pick15, Pick16, Pick17, Pick18, Pick19, Pick20, Pick21, Pick22, Pick23, Pick24

ADSL global IT Consulting and Services provider and Systems integrator offering infrastructure solutions and services to clients across 70 countries. It designs, develops, and deploys digital solutions and delivers end-to-end IT infrastructure services including, End user IT Support, IT asset life cycle, enterprise applications and integrated solutions

CMMi Level 3, SOC2 certified, ISO 9001, 27001 & 20000 – Highest standard for IT Service Management Tools

Customers, Global Presence and Revenue Mix

Increasing clients. Deals from big clients

Stable Ebitda, Pat margins. Debt to Equity under control. ROCE is on uptrend in medium term

Working capital days and cash conversion cycle have been improving

ADSL when i first published the report

ADSL NOW

Securing new projects of Smart city

Securing of prestigious contracts, exemplified by projects like the Ayodhya Smart City and Taloja Smart City.

In February 2024, ADSL received a Letter of Intent for the Taloja Smart Industrial City Solution contract in Navi Mumbai. This groundbreaking initiative will unfold over an 18- month implementation phase, followed by a 60-month Operations and Maintenance period. The project’s scope involves establishing an Integrated Command & Control Centre (ICCC) at both the Corporation’s Head office and the Industrial Township. The ICCC software will seamlessly integrate with a Cloud-based Data Center/Disaster Recovery system. Furthermore, the project encompasses the deployment of a cutting edge CCTV-based Surveillance System to bolster security and monitoring capabilities.

In January 2024, was selected as a Master System Integrator (MSI) for the Integration of CCTV Surveillance with Existing ITMS Control Room for the Ayodhya Smart City Project. This project entails the establishment of a multi-location CCTV surveillance system. The capital expenditure (CAPEX) and implementation phase is anticipated to last three months, followed by a five-year operational and maintenance (O&M) phase.

Completed 12 smart city projects with 2 new wins.

Expecting an opportunity size of Rs. 50,000 crore in the smart city projects in the next 5 years.

Seeing traction in the smart city space with upcoming tenders.

Future Outlook,Targeting Acquisitions and exploring fields like

Eyeing opportunities in Cybersecurity and Cloud arena for potential acquisitions.

Focused on improving margins in O&M contracts and government projects.

Expecting better traction in IT business with growing interest in European and APAC markets.

Revenue Plan

Plans to reach INR1,000 crores in revenue over the next 2-3 years with a focus on improving margins

Order book outstanding at Rs. 1,600 crore, with execution period of around three years (Nov23)

Digital Desk (formerly ADiTaaS):

Leadership Augmentation

8th October 24

Allied Digital awarded Pune Safe City (FY 2024) Project for Total Contract Value of Rs. 430+ Crore

Key project highlights include:

Comprehensive surveillance: Track 1 of the project shall cover O&M of the existing cameras for a period of 6 years and Track 2 shall cover Implementation of new infrastructure over 12 months followed by 5 years of O&M.

Advanced technology: The project will feature advanced Artificial Intelligence-enabled video analytics, an Automatic Number Plate Recognition (ANPR) system, Vehicle Over speed Detection System (VDS) a Facial Recognition System (FRS), Drones, and Mobile surveillance vans to ensure robust security and monitoring.

Upgraded infrastructure: The Command-and-Control Center at the Commissioner of Police office and supporting Data Center will be upgraded with implementation of additional capacity and installation of advanced software leading to improved efficiency and 24×7 real time monitoring. Additional viewing facilities will be established at various police stations and key government offices

Concentration of revenue from top clients

Working capital intensive nature of operations

Highly competitive nature of IT industry

on 17-Oct 24

on 29-Jun-24

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

CMP 569, Market cap ~3150cr

ROCE ~32%, ROE ~24%, D/E ~0.07 PE ~29 (based on screener)

🟢EMS Limited is a multi-disciplinary EPC company, headquartered in Delhi that specializes in providing turnkey services in water and wastewater collection, treatment and disposal. EMS provides complete, single-source services from engineering and design to construction and installation of water, wastewater and domestic waste treatment facilities

🟢The company provides Sewage solutions, Water Supply Systems, Water and Waste Treatment Plants, Electrical Transmission and Distribution, Road and Allied works, operation and maintenance of Wastewater Scheme Projects (WWSPs) and Water Supply Scheme Projects (WSSPs) for government authorities/bodies.

🟢Healthy Order book of ~2100cr provides strong visibility of revenues over next few years. Company has repeat orders from various Government departments.

🟢EMS promoters have more than a decade of experience in executing water supply and sewage treatment projects

🟢Since incorporation, it has completed 67 projects in Bihar, Uttarakhand, Madhya Pradesh, Rajasthan, and Haryana. It has executed many projects awarded by government bodies such as Uttar Pradesh Jal Nigam (UPJN), Construction and Design Services (C&DS), Military Engineering Services (MES), and Indian Railway Construction Limited (IRCON). It has completed 4 O&M projects in last 4 years.

🟢Key clientele includes government bodies like Municipal corporation of Rajasthan (under AMRUT Scheme), Uttarakhand Urban Sector Development Agency and Bihar Urban Infrastructure Development Corporation (under National Mission for Clean Ganga ) and CPWD, Maharashtra

🟢EMS Limited has its own civil construction team and employs 57+ engineers, supported by third-party consultants and industry experts.

🟢Projects are mostly funded by World bank

🟢Development of Tier 2 Tier 3 towns, capital expenditure by Government gives good visibility for few years

🟢Promoter has sufficient skin in game with approx. 70% holdings, Sales are increasing and NPM is good

Risks

🔴Company works in a field of high capital intensive business and receivables will remain high

🔴Project execution risks within a budget are the ones which constantly hurts companies in these kind of businesses

🔴The company has not executed any HAM projects in the past but is executing one HAM project for the UP Jal Nigam. It has entered a joint venture with Ercole Marelli Impianti Tecnologici S.R.L. Italy.

🔴Revenue concentration from few clients/states poses a risk

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

CMP 417, Market cap ~1450cr

ROCE ~15%, ROE ~10%, D/E ~0.19 PE ~41 (based on screener)

🟢Kabra Extrusion Technik Limited : It is India’s largest manufacturer of plastic extrusion machinery for more than 4 decades and recently ventured into manufacturing of Lithium-ion Battery Packs. The company is a part of the well-known Kolsite Group.

🟢In Extrusion Machinery Business it is India’s premier manufacturer & exporter of extrusion plants with presence in 100+ countries with +15,000 installations. also commands close to 40% market share in FY23

🟢Industry application in different sectors like -Packaging Industry, Infrastructure & Construction, Telecom and Plasticulture

🟢It has different products : Blown Film Lines, Pipe Extrusion Lines, Sheet Extrusion Lines, Compounding Lines and Auto Feeding Systems

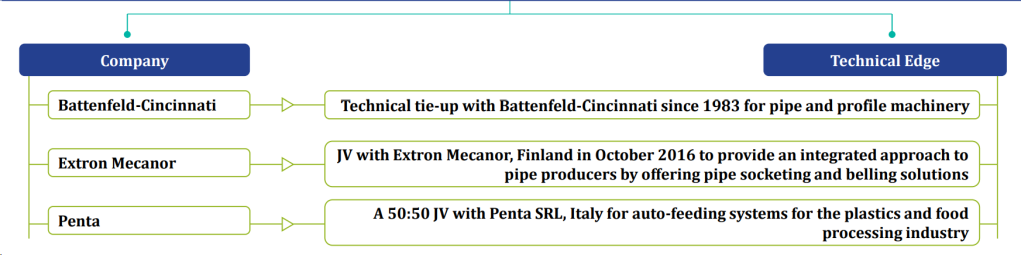

🟢In new segment of Battrixx –Its an emerging leader and commands approx, 15% market share where

🟢Battrixx business is a battery related solutions for electric mobility and energy storage, Battery & related components constitutes ~35-45% of cost in an Electric Vehicle

🟢Products in Battrixx segment are Battery Packs across multiple chemistries, Battery Management Systems (BMS) and IoT Solutions

It is One of the few players with

🟢Company is continuously investing in RnD and want to enter E-trucks, E-buses and ESS(energy storage systems)

🟢Company is first EV battery-pack manufacturer to be accredited with ARAI certification under AIS 156 Amendment III Phase 2 for its batteries, conceptualized and designed in-house strategically with Hero Electric’s R&D team

🟢Company had earlier won 3L battery packs and chargers order from Hero Electric Mobility for FY24

Key focus areas of our R&D

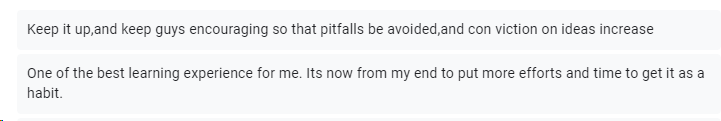

Company has technical tie up with Battenfeld-Cincinnati, Extron Mecanor and Penta for different domains

🟢Company has right tailwinds in longer run

🟢Company business is profitable though facing short term headwinds

🟢Promoter has sufficient skin in game with 60% holdings, FII holdings increasing in FY24

🟢Company credit rating has been upgraded last year CRISIL A+/Stable (Upgraded from ‘CRISIL A/Positive’)

Risks

🔴Company was able to successfully established new business but EV Battery sector run into headwinds with new rules. Company was first to be accredited with certification for new rules but still headwinds not went away fully. Company might take more time based on customers business

🔴Crude oil has indirect dependency as customers order go down for new machinery with increasing crude oil price. Hopefully now Crude is stable and Pipe volumes may come up seeing the real estate boom

🔴Low OPM, NPM margins as of now –may improve with both domains of business picking up

🔴Technically weak structure for stock price

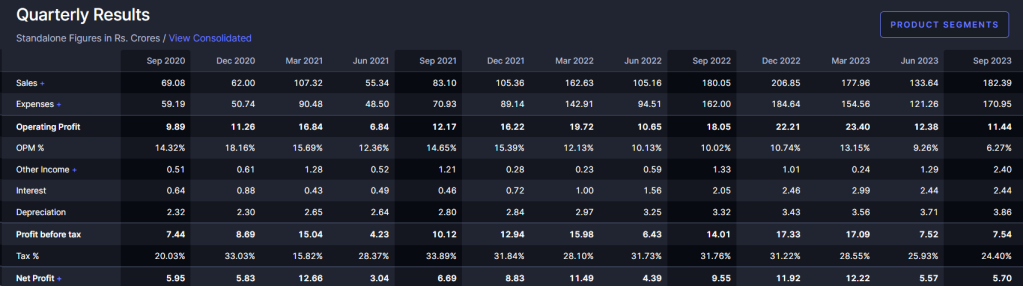

Company OPM have gone down recently and may take time to stabilize and come up. We need to carefully watch this space. Expected OPM is around 12% in longer run so enough space for company to showcase good results in coming years

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

India has been going through a transformative change through Aatmnirbharta

Lot of sectors have big tailwinds including

Considering all above, ALPHA AFFAIRS see

FORGING as MEGA TREND

And from that Mega trend, we focused earlier on RK forge, covered here and here

Today we are focusing on one emerging player in same industry but has bigger vision in new sunrise industries as well. We have also covered with small details on Baluforge earlier

CMP 285, Market cap ~2900cr

ROCE ~27%, ROE ~22%, D/E ~0.16 PE ~44 (based on screener)

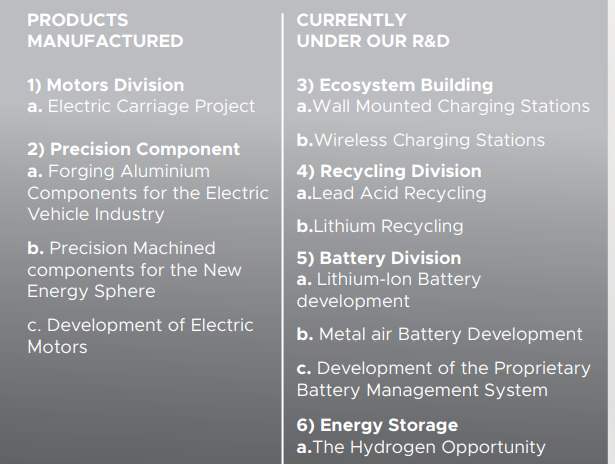

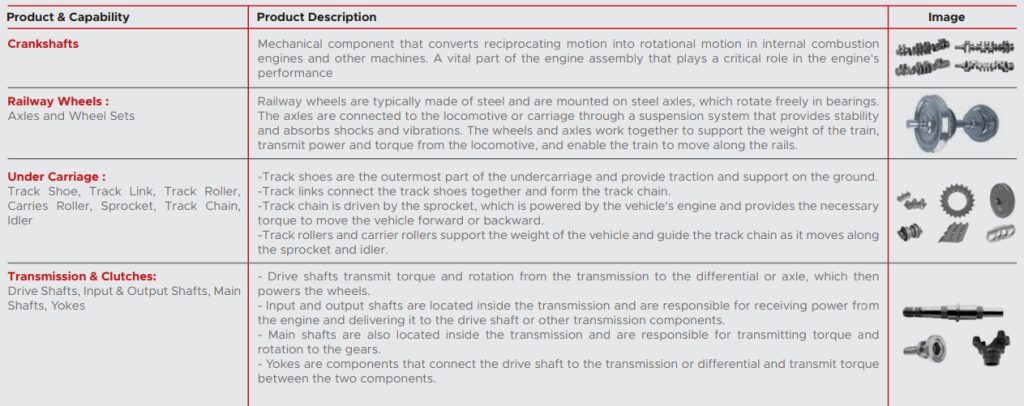

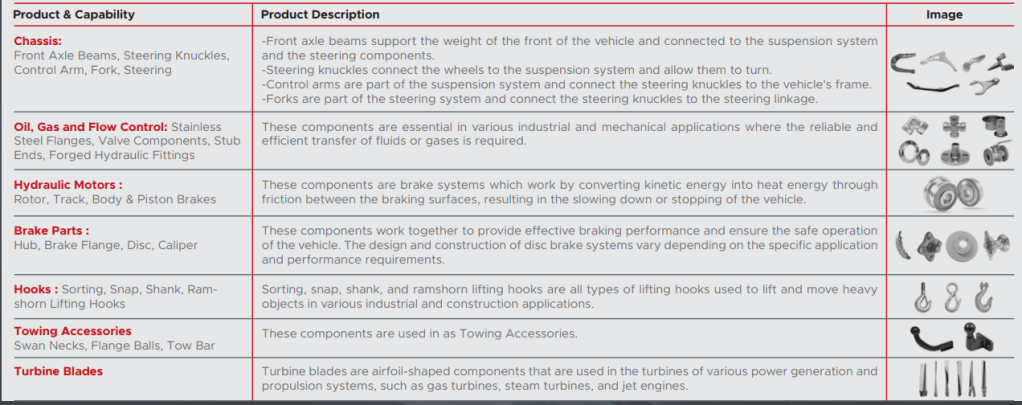

🟢It is engaged in the manufacturing of finished and semi-finished crankshafts and forged components and has a strong clientele comprising of 25+ OEM’s. Company has Fully Integrated Forging & Machining Unit with a large product portfolio offering to customers ranging from 1 Kg to 500 Kgs. The Forging Unit comprises Both Closed Die Forging Hammers & Presses

🟢Balu Forge has a distribution network in over 80+ countries and operates in domestic and export markets

🟢Balu Forge is already an approved vendor to a majority of the 41 Ordnance Factories part of the Ordnance Factory Board in India.

🟢Acquired Mercedes Benz Truck, Mannheim, Precision Machining Plant in 2021.

🟢Company has 3 subsidiaries. 2 in UAE and One in India.

Kelmarsh Technologies FZ LLC in 2021 (100%). Headquartered in the UAE with operations spread across 3 countries in Africa. Focused on manufacturing and innovation of agricultural equipment predominately tractors and tractor ancillary components

Safa Otomotiv FZ LLC (100%). Focusing on the machining and assembly of products in order to increase localization in the MENA region as well as meeting the product requirements for Agriculture and Oil & Gas industry

Balu Advanced Technologies & Systems Private Limited

Naya Energy Works Pvt Ltd (100%). Naya Energy is engaged in manufacturing of products for New Energy Sector

Company claims to work on Hydrogen Fuelling Stations & pilot project is presently underway to establish the first Hydrogen Fuelling Stations for fuel cell vehicles

Also company is in the process of patenting our domestically developed Refining Technology, NayaRefine. Currently One Module deployed can roughly produce 3-3.5 Tons of pure lead every day.

Company is working on a range of Charging Stations Conforming to Bharat EV AC Charger (BEVC-AC001) & Bharat EV DC Charger (BEVC-DC001) norms

Company also claims to work on ESS (energy storage solutions in form of hydrogen)

🟢Entered into leave and lease agreement with Hilton Metal Forging Ltd enabling Balu to backward integrate from precision machining player to Forging and Machining player

🟢Existing capacity to produce 18,000 tonnes Forged Components per annum which will be expanded to ~32,000 tonnes in the coming quarters. Annual capacity to manufacture 3,60,000 crankshafts. Wheel Production capacity of 6,000 wheels per year with a diverse application suitable for railway wagons, passenger coaches & locomotives in various gauges. Company want to Expand the wheel production capacity to 48,000 wheels per year

🟢On the capex front, Company plan for enhancing machining capacity by ~14,000 tonnes at newly acquired 13 acre land in Belgaum, Karnataka is progressing well. The operations from this facility are expected to commence from Q4 FY24, that will enable us to produce heavier and more complex crankshafts having better realizations and margins. After expansion, company will be operating on 22cr (previously 9 acres)

🟢The new facility will not only act as a Manufacturing Centre but will also be setup as a Technology & Innovation Campus with a strong focus on Integrated Defence Research & Production, Cylindrical Cell Production for Electric Vehicles, Components Suitable for New Energy Vehicle Drivetrains & Powertrains, Spent Battery Recycling to name a few but not limited to the same. There will be a dedicated R&D center spread over 4000 m² with a strong focus on the following key areas:

Key focus areas of our R&D

Exploring the use of new materials, such as lightweight alloys or advanced composites, to enhance the product offering.

Investigating cutting-edge manufacturing methods, such as additive manufacturing (3D printing) or advanced Machining, to achieve higher precision and tighter tolerances.

Analyzing and optimizing product designs using computer simulations and finite element analysis to maximize performance and minimize stress concentrations.

Building a robust platform for the product expansion into the Railway & Defence Industry by way rapid prototyping & increase the speed of New product development

Successful Prototyping of some key components for the New Energy Mobility sphere to ensure the long-term vision of building strong capabilities in Fuel Agnostic solutions.

Investigating new heat treatment methods to enhance the strength and fatigue resistance of our products.

🟢Diverse array of products including Crankshafts, Railway Wheel, Under carriage, Transmission and clutches, Hydraulic motors etc

🟢Company is witnessing a lot of green-shoots in the defense and railway industry. This presents a significant growth opportunity for BFIL, as we continue to expand our footprints in these sectors

🟢Company is spending 2-4% in R&D and have 45 employees in that division, Overall employee strength is more than 700. Company is also Backed by certifications like IATF 16949 accredited by Tuv Nord Cert GMBH

🟢Revenue is expected to conservatively grow by ~25.0% in FY24 over FY23, led by growth opportunities in the various industries like defence, railways, and others

🟢EBITDA margins are expected to be in the corridor of 22.0%-23.0% in the upcoming quarter on the back of increasing scale of operations and efficiencies

🟢Promoter has skin in game with roughly 54% allocation. FII Have entered. Some DII money is also getting poured in this one. Management has good 3 decades of experience in the industry and now 3rd generation also into same business leveraging the domain strength acquired over years

🟢Fund raising and Preferential allotment Promoter infused 26cr at 115 Rs/share in 2023 and then 92cr (almost double of fixed assets 48cr) at 183 Rs/Share. Ashish Kacholia & Sage one also participated in Pref. at Rs.115. On 48crs of Fixed assets , Company has raised~300crs for expansion. Recently new fund also entered at 183 Rs/Share. All the selling hangover by a fund over last 2 years has been absorbed and stock is back to new highs

🟢Order wins in last 12 months. Significant order win from a tractor manufacturer based out of the Middle East of supplying 10,000 sets of sub-assemblies & there is scope to increase the same to over 50,000 annually

Risks

🔴 Volatility in the price of major raw material- steel and aluminum is a major risk, the operating margin remain susceptible to these volatilities

🔴Large working capital days cycle. The company provides a credit period of 150-180 days to its customers due to business requirements and maintains an inventory of 60-80 days due to diversified product portfolio

🔴Most of the talks under Naya energy division or Balu Advanced systems is just been talk. We need to see when and what product comes out of these new divisions. Many other companies progressing fast on Recycling, Defense and EV/Hydrogen space. We have not seen much on this part regarding their advances in these domains which significantly upgrade their Revenue or profit from these divisions. These may become sunk cost if management is not focused

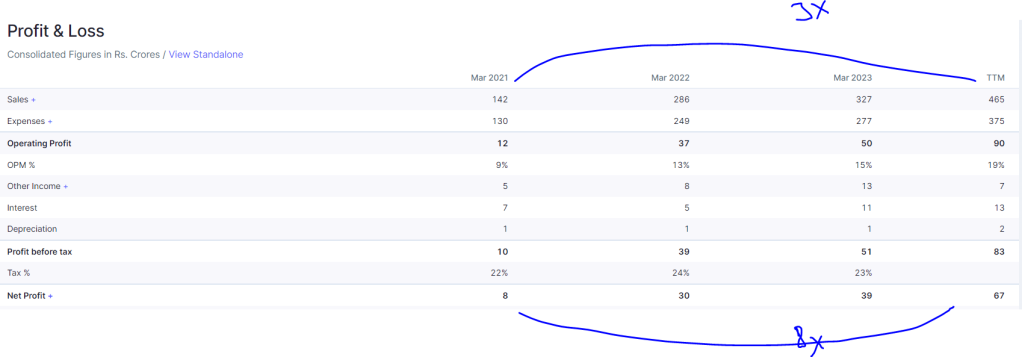

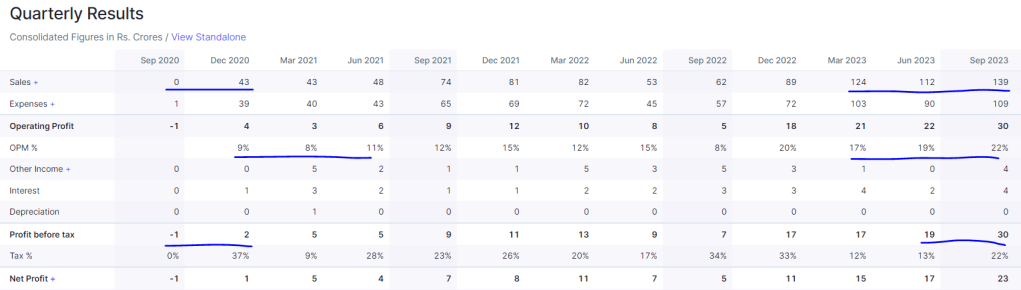

Sales have grown 3x and Profits 8x in last 3 years approximately, OPM margins have improved, over 3 years company financials have improved

Technical chart

Good Daily and Weekly Breakout with volumes in 1st Week of Jan24

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

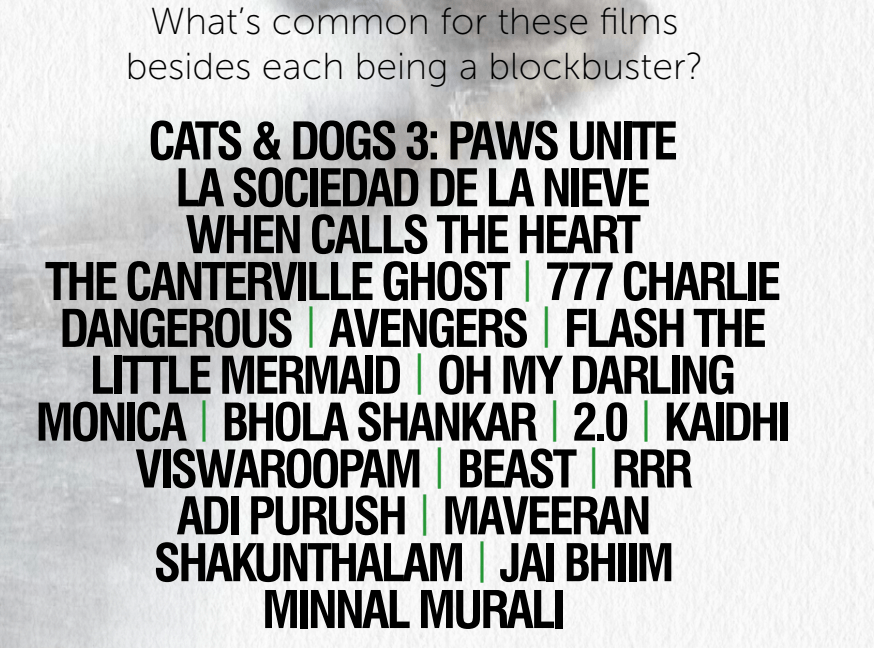

The visual effects of these films were done by an Indian company that has made these movies a thorough visual delight and provided millions worldwide with pulsating entertainment and ever-lasting memories.

Yes, We are talking about our next research IDEA

WHAT IS VFX?

Visual effects (VFX) refer to special effects that deeply reflect the story’s visual representation

VFX has evolved to deliver sights that cannot be filmed. This procedure involves the incorporation of live-action footage as well as the imagery created to create realistic scenes. It is expensive and requires considerable investment, which involves creating a large creative workforce, big state-of-the art studios and electronic instruments. Additionally, it needs an uninterrupted power supply and good cooling capabilities

Fun Fact

10% EVERY MOVIE IN ANY GENRE ACCOUNTS FOR 10% OF VFX USAGE

90% of all movies have some form of VFX involved

Before we move further , lets see what they do through a reel

Incorporated in 2016, Phantom Digital Effect limited is a creative VFX studio that excels in creating jaw-dropping visual effects for leading movie/ documentary makers worldwide and in India. Company contribute to the production, pre and post production of feature films, web series and commercials. Besides working directly on a particular project, they take up subcontracts for large VFX studios.

PhantomFX specializes in various VFX services

Some stats

Geographical presence –Company has three state-of-the-art studios in Chennai, Mumbai and Hyderabad, India

And has marketing teams at Los Angeles, Vancouver and Montreal

Clients –500+

Employees/ Artists -500+

Office space 39000 Sq ft

Repeat clientele ~46%

Clients associated for more than 5 yrs –25%

International business vs Domestic business 40:60

Strength

Promoters have significant industry experience and have been instrumental in the Company’s consistent growth

Esteemed clientele with strong relationships

Good work done in past to showcase and bring new clients

Phantom FX has recently acquired a new studio cum office space in Mumbai, Hyderabad and Chennai with the capacity to accommodate ~150, ~60 & ~50 employees, respectively.

Phantom FX plans to open office cum studio space in London and Dubai shortly

Latest update in 21Sep23

Planning to hire 2,000 more employees in the next two years.

Targeting significant contribution from the OTT sector and expects at least 50% of revenue from international operations.

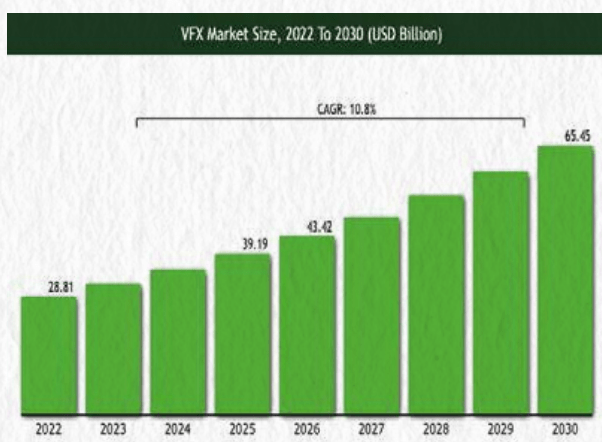

The global VFX market is expected to grow from US$28.81 BILLION (2022) to US$65.45 BILLION (2030) AT 10.8% (CAGR)

According to an Indian I&B Ministry estimate, between 2023 AND 2024 the domestic VFX space is expected to GROW AT 30% (CAGR)

Increasing use of digital video streaming platforms and high-quality content has positioned VFX as an integral part of the OTT evolution

Expansion of OTT services: The proliferation of smart devices like smartphones, HDTVs, laptops, tablets and subscription-based video streaming services in both advanced and emerging economies are driving the growth in the VFX industry

Owing to the rapidly growing demand for OTT content driven by low data charges in mobile broadband, the Asia-Pacific region is expected to witness the fastest market growth till 2030. India and China are likely to surpass the continent over the medium term

Demand for highly realistic and super-quality content: Worldwide demand for high quality realistic content is driving the demand for the market. VFX alters, creates, replaces and enhances live-action media to include effects that are otherwise impossible to capture

To promote the animation, visual effects, gaming and comic sector in India, the I&B Ministry of India formed a task force likely to create nearly 2 million jobs in India. AVGC XR (Animation, Visual Effects, Gaming, Comics, and Extended Reality) Promotion Task Force recently submitted their plan with several recommendations to the Government.

Plans to foray into animation services space and tap allied field of gaming which requires extensive VFX by leveraging its capabilities and experience.

VFX Tailwinds emerging

VFX grew 30% to reach INR50 billion in 2022

Top global VFX players expanded into India to leverage the cost arbitrage that India continues to offer

► For a global VFX player having operations in India, Indian VFX artists cost only one-eighth of the cost incurred on hiring artists in the UK or North America16

► In the last two years alone, the Indian visual effects industry has created 60,000 jobs, with studios like MPC in Bengaluru going for an extensive hiring spree

► In 2022, five global VFX players, including ILM, have either started operations or announced their entry into the Indian market

New subsidiaries, Offices, Capex plans, Orders, QIP

The company has recently been awarded a prestigious contracts worth Rs. 62.5 Mn which includes a significant deal valued at Rs. 40 Mn, in the field of international movie production.

Company has received work order from Netflix (Netflix Worldwide Entertainment, Netflix US and Netflix India Originals). VFX for Project includes Netflix-branded audio-visual content, whether produced directly by Netflix or licensed from a Licensor for exhibition on Netflix OTT. Time period of the order is 4 years with extension option for another 2 years. Estimated order is INR 120 Cr over 4 years.

Total order book from May23 onwards is 200cr approximately (100cr is estimated execution order for FY24)

Added 50cr more in Jan24 in order book from KJR studios after recent success of movie Ayalaan

Jun ‘23: BoD has approved the incorporation of a wholly owned subsidiary of the Company in London, UK. This will leverage the growth opportunities in the international market and avail the maximum benefit of the resources available. The business of subsidiary is in line with the main object of business of the Company.

Dec ‘22: Company has been endorsed as an Amazon-approved VFX studio. The same is notified to all Amazon productions. Due to this development, it will be able to provide various VFX services for Amazon’s production.

It has also been qualified for the Walt Disney Vendor Evaluation Program. It is authorized to receive content from Walt Disney Studios and/ or Television groups. There will be an increase in the total number of OTT Projects with the active participation by Amazon and Walt Disney for the same.

DNEG, one of the world’s leading visual effects and animation studios for feature film and television, has approved the Company as an Outsourcing Vendor to handle various assignments pertaining to their feature film, television, and multiplatform content. This association with DNEG will further boost Company’s order book and further enhance the quantum of projects.

Dec ‘22: Company announced its opening of a third office with the ability to accommodate 50 employees in Chennai.

Nov’22: Company is on the verge of completion of establishment of a new studio cum office in Bandra, Mumbai. Once operational, it will be able to accommodate 250 employees and will be equipped with infrastructural facilities for VFX studio to expand the services of the Company.

Openings recently in the company

QIP of 80cr done with renowned fund houses at 412Rs/share. What caught my eye is expansion in Gaming and Animation space

Success of Movie Ayalaan

15Feb 24 update on process of acquiring a company

Certifications and Awards

Phantom FX is TPN Certified, among the few in India with this coveted watermark.

This certification means that we are a ‘data-secure ecosystem’ that meets the rigorous standards of the MPAA.

Financials

Management Guidance

Revenue is expected to grow by ~75-80% in FY24 led by inflow of demand for our services and effective execution of order book.

EBITDA margins is expected to stay within a corridor of 33-35%

Jun23 results shows management walking the talk

Skin in game along with FII and DII increasing stake

Management guides 100cr revenue approximately leading to bottom line of approx. 22-27Cr

Estimated EPS 20-23, PE range 20-50 leading to price range of 400-1050

That means we are very close to low valuations

on 27th Oct23

Interesting Pattern on 5dec23

Support demand zone seems to be respected in recent downturn

RISKS

Increasing assets and employees, if not ably supported by orders, can turn out to be a problem

Increase in trade receivables as business grows is an issue which needs to be monitored very closely

Just 1-2 bad reviews, bad work can lead to downfall of company faster than we can imagine. In simple words, clients will come because of work quality

Valuations –Company though looks undervalued considering the growth potential, but if growth stalls or new orders don’t come at an anticipated pace, then these valuations may turn out to be a trap

Heavy Dependence on Exports–Company and industry in general is dependent on International assignments. Recent strike by artists in Hollywood crippled the revenue in second quarter of H1FY24

Risk of talent poaching— The attrition rate in the VFX segment in 2022 was 25% to 30%. High poaching of mid-level talent was also observed in the segment. Almost all industry leaders were concerned about the inability to find technically skilled employees to meet the opportunities provided by the high global and domestic demand for content –Companies are working in it by implementing training programs to acquire, retain and up-skill talent

Competition: The high-margin business and its growing opportunities is attracting a number of players into this field which is increasing the competitive intensity.

Technology: VFX studios require cutting-edge technology and software to produce high quality visual effects, which can be expensive to acquire and maintain. Additionally, keeping up with the latest technological advancements can be a challenging task.

AI tools are posing a threat where with use of AI tools, movie can be created without much effort and labor. We see this as an accomplice for the company where such tools help to add value along with human creativity, Read few such article on AI impact and usage in VFX

Timeline issues: The VFX industry faces is the increasing demand for visual effects combined with tight project timelines. As clients demand high-quality visual effects in less time, VFX studios often have to work overtime to deliver the final product on time. This can lead to employee burnout and a decline in the quality of work produced, ultimately impacting the reputation of the studio