Greener way of SDA

BE FINANCIALLY INDEPENDENT

Disclaimer – Below Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

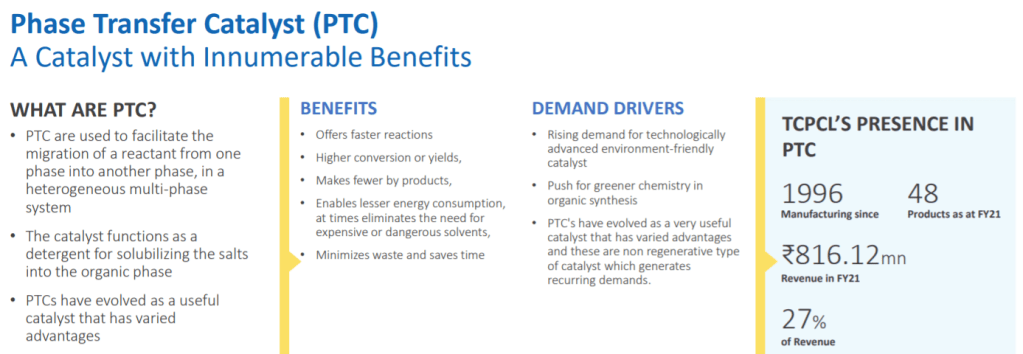

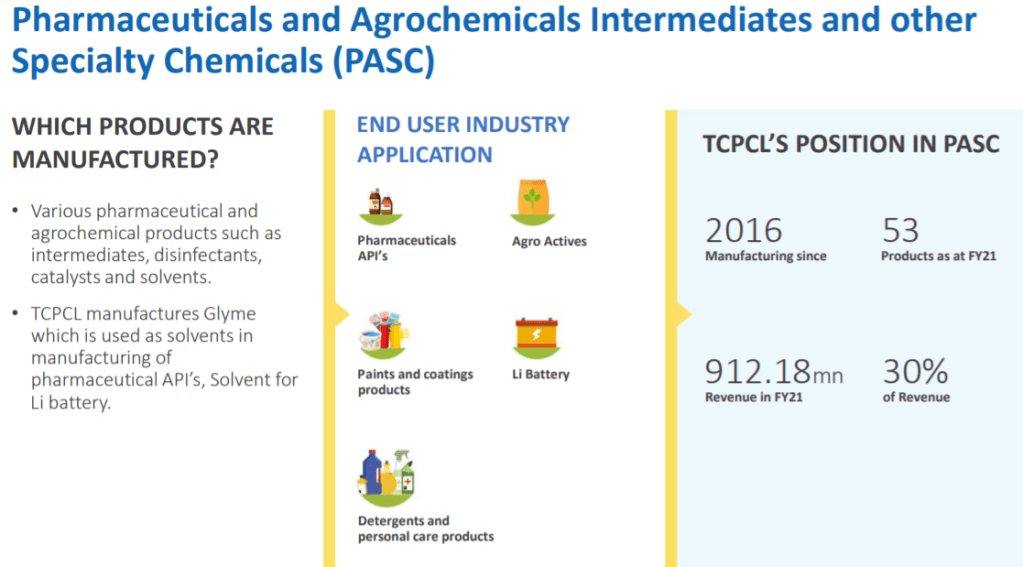

Incorporated in 1996, Tatva Chintan Pharma Chem Limited is a specialty chemicals manufacturing company. It is engaged in the manufacture of structure directing agents (SDAs), phase transfer catalysts (PTCs), electrolyte salts for super capacitor batteries and pharmaceutical & agrochemical intermediates & other specialty chemicals (PASC).

Business —

One of the leading producers with entire range of PTCs in India and one of the key producers across the globe

2nd largest manufacturer of SDAs for Zeolites globally and the largest commercial supplier in India

TCPCL is the largest producer of Glymes in India and third largest in the world.

Largest producer of electrolyte salts for super capacitor batteries in India

END USER INDUSTRIES — Growing industries in coming decade

Moats —

TCPCL is one of the few companies globally that uses Electrolysis process in organic synthesis. Advanced chemistries in process and for commercial development, manufacture and approvals, it takes 1-6 years for new players to enter this field.

In many of the segments, it is amongst top five players

Strengths

Considering the wide range of applications of our products, TCPCL can cater to customers across wide spectrum of Chemical Industries

which ensures a sustainable business model.

Diversified product portfolio has helped accelerate growth and in innovating and thus retain both new and existing customers

Diversified esteemed clientele

Necessary certifications in place : ISO 9001:2015 ISO 14001:2015 BS OHSAS 18001:2007

Advantages of Electrolyses

Region of operation

The company exports most of its products to over 25 countries, including the US, China, Germany, Japan, South Africa and the UK.

It reduced % revenue dependency on top 10 customers from 60% to 47%

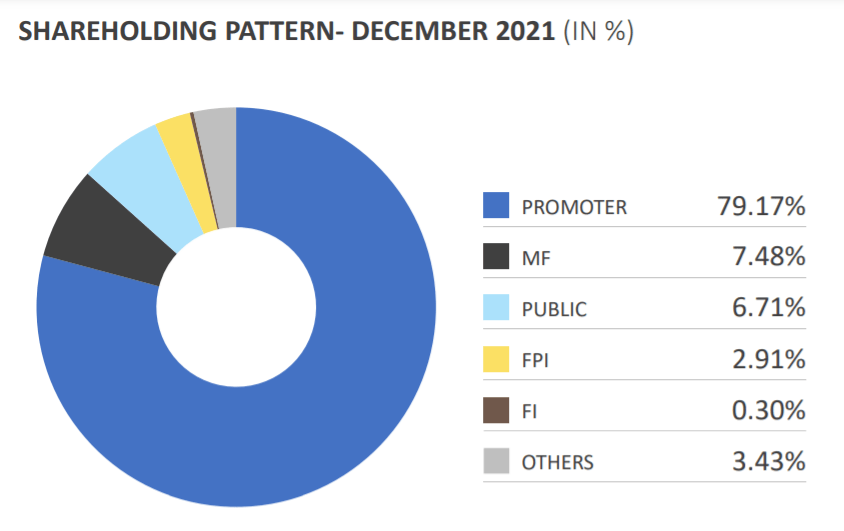

Shareholding

Promoter has sufficient skin in game with holding ~79% and other prominent players holding 10% more

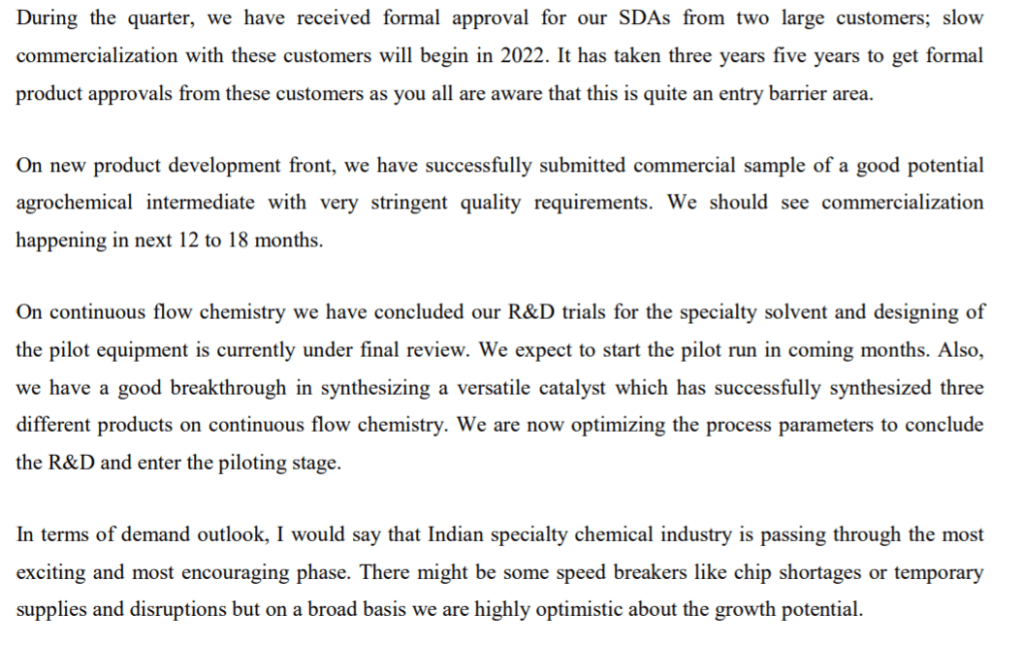

Some triggers and updates from recent Q3Fy22 Concall

Getting approvals from two large customers

Getting into EV domain with supercapacitor batteries and new horizon opening up faster than anticipated

New versatile product development in Continuous flow chemistry us also capable in other applications including EV

Comfortable Leading market share in almost all operating domains

Mindset of accepting which projects

Delayed expansion –currently scheduled for Nov 22

Delay in semiconductors supplies impacting SDA in FY23 as well (current anticipation is till FY22)

Slow ramp up of electrolyte salts than projected

Approvals for new PASC delayed

Increase in raw material and frieght costs is already impacting margins, further increase will hurt next two quarters badly in terms of margins if it happens ( Q4FY22, Q1FY23)

They have to be seen in terms of huge growth runway available but current valuations don’t give that comfort to take large positions with risks on execution and inflation

Looks better to give time to company and see how it performs and keep accumulating in background in small tranches. That may work.

Your strategy can be different than mine. Your selection of company might be different than mine. So lets not be a BLIND FOLLOWER

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Tatva Chintan IPO– Incorporated in 1996, Tatva Chintan Pharma Chem Limited is a specialty chemicals manufacturing company. It is engaged in the manufacture of structure directing agents (SDAs), phase transfer catalysts (PTCs), electrolyte salts for super capacitor batteries and pharmaceutical & agrochemical intermediates & other specialty chemicals (PASC).

Business — It is the largest and the only commercial manufacturer of SDAs for zeolites in India. It also enjoys the second largest position globally. It serves customers across various industries including automotive, petroleum, pharmaceutical, agro chemicals, paints and coatings, dyes and pigments, personal care and flavor & fragrances

Region of operation — The company exports most of its products to over 25 countries, including the US, China, Germany, Japan, South Africa and the UK

Revenue/Product Mix – India 28%, China 18%, US 15%, Others 39%

SDA 40%, PASC 31%, PTC 28%, Electrolyte Salts 1%

Offer purpose — The IPO is fresh issuance of shares worth ₹225 crore and an offer for sale to the tune of ₹275 crore by existing promoters and shareholders.Proceeds from the fresh issue would be used towards funding capital expenditure requirements for expansion of the company’s Dahej manufacturing facility; up-gradation of research and development facility in Vadodara; and general corporate purposes.

Risks —

Revenue of 60% from Top 10 Customers leads to concentration risk

Highly competitive industry and well established peers like Aarti Industries Limited, PI Industries Limited, Fine

Organic Industries Limited, Delta Finochem, Dishman group

High Expenses on raw materials (~50% of total expenses)

Strength

It is the largest and the only commercial manufacturer of SDAs for zeolites in India. It also enjoys the second largest position globally

Marquee list of customers Bayer, Merck, Navin Flourine, Divis,SRF, Atul, Laurus.

Strong long-term relationship with key customers with 53% customers with it over 5 years

Consistent track record of financial performance.

International presence with export to several countries i.e. China, USA, Japan etc.

Future

Company has been growing well in revenue and profitability. Unique products and diversified portfolio may help the company to retain growth path. Competition is high and will increase in coming years. Expansion and investment into R&D will help company for next phase of growth

Valuations

Valuations are as per bull market and comparatively lesser than peers

Should we apply?

People can subscribe for long term and keep on adding on dips & review holdings with each quarter earnings

Expecting strong listing gains.

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.