Compiled my learnings from my Stock market journey

— alphaaffairsf2f (@alphaaffairsf2f) January 1, 2022

I see them relevant today also for both new and old investors

Start of YEAR 22 –lead me to compile a thread of 22 learnings

please add further guys@sahil_vi @NiveshakBharat @Sandeep_Majjigi @719Freedom @VidyaG88

Thread🧵

1/n

Tag: Learning

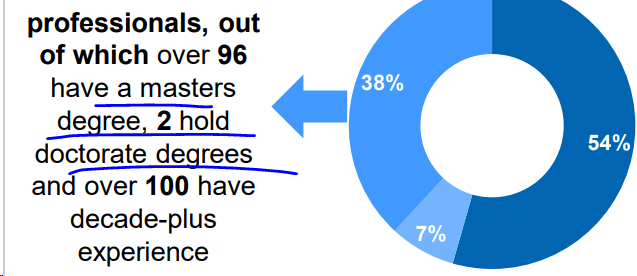

ALPHA LEARNERS – Mentorship Program Jul-24

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

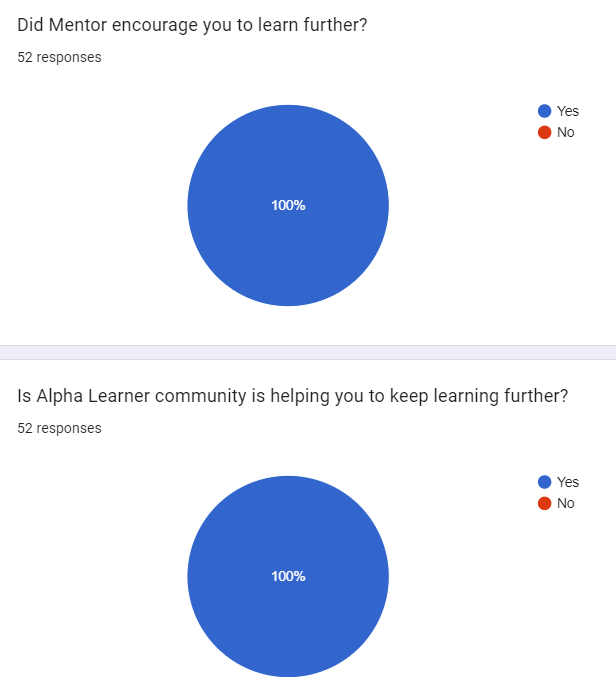

Free lifetime learning through a Whatsapp Community (apart from Program content) & Bonus Sessions

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time 21st jul24

Live classes on Sunday Morning/afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months approx.

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Be ready to WELCOME 2025 with Knowledge

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

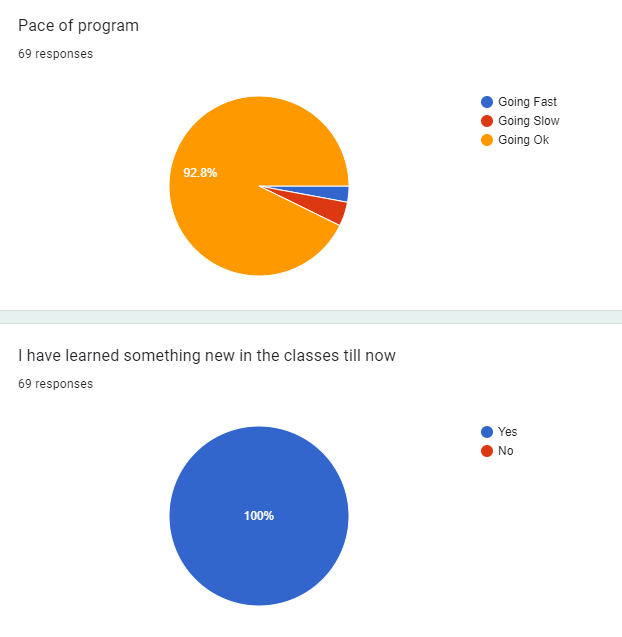

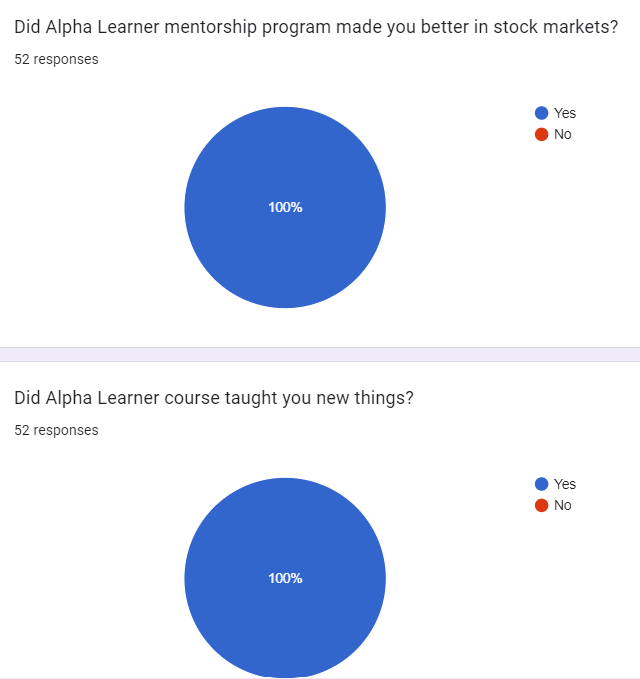

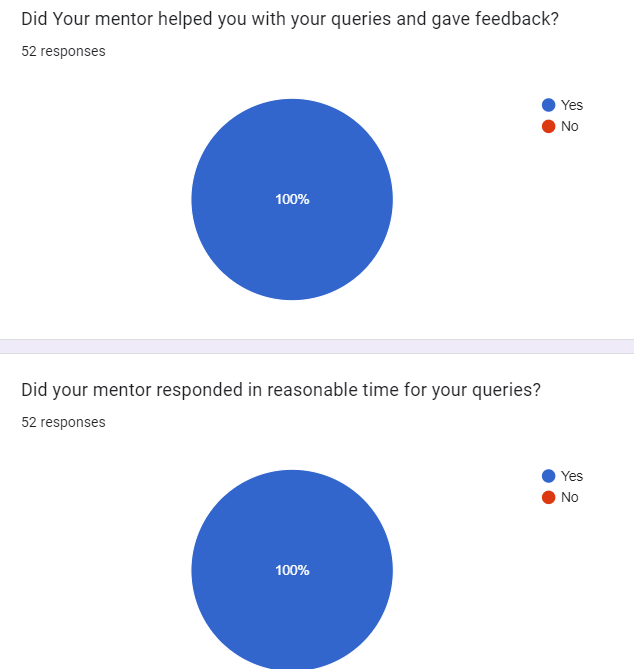

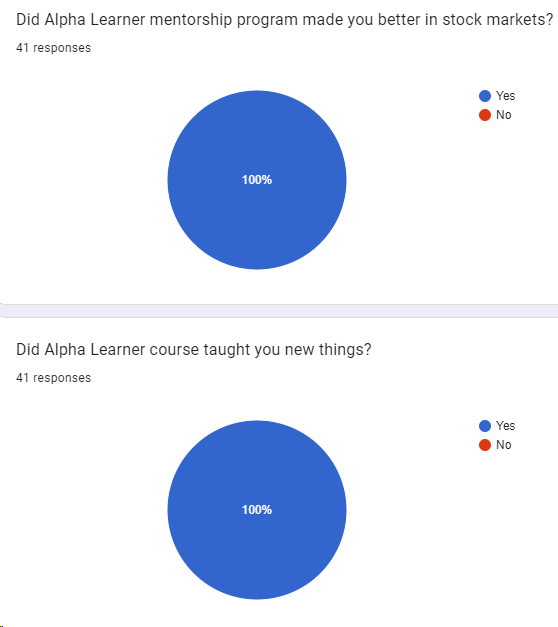

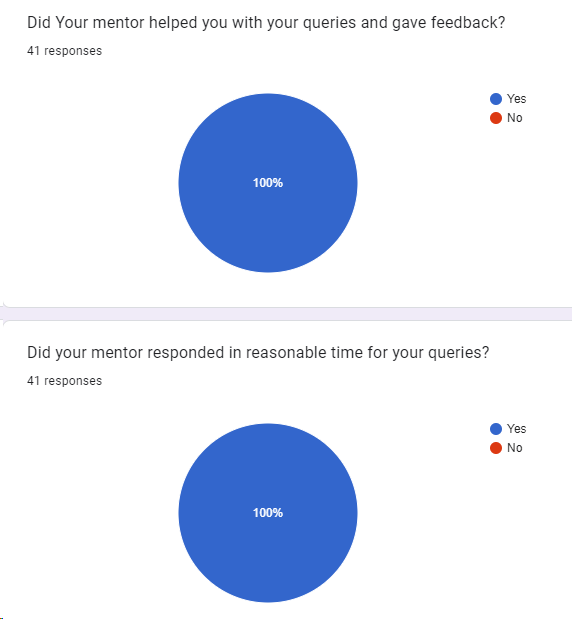

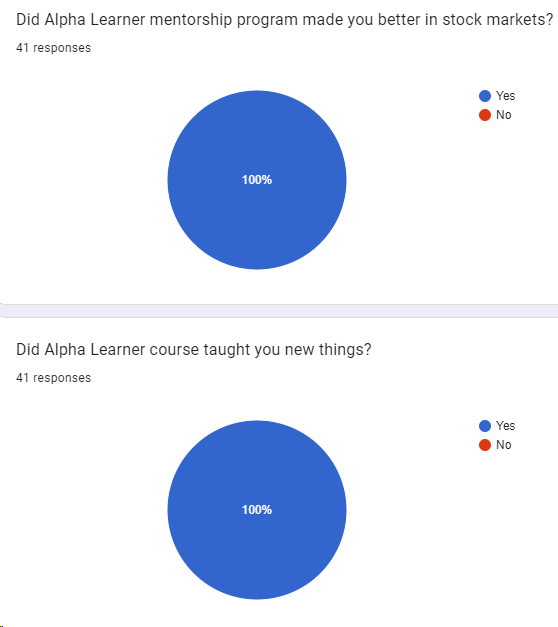

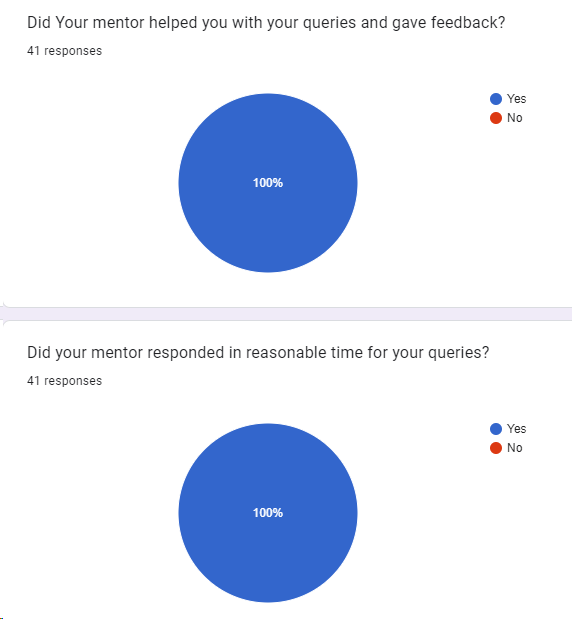

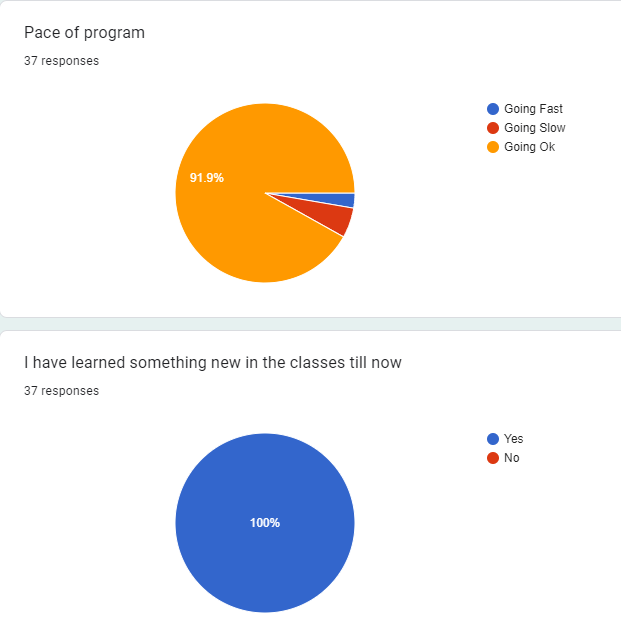

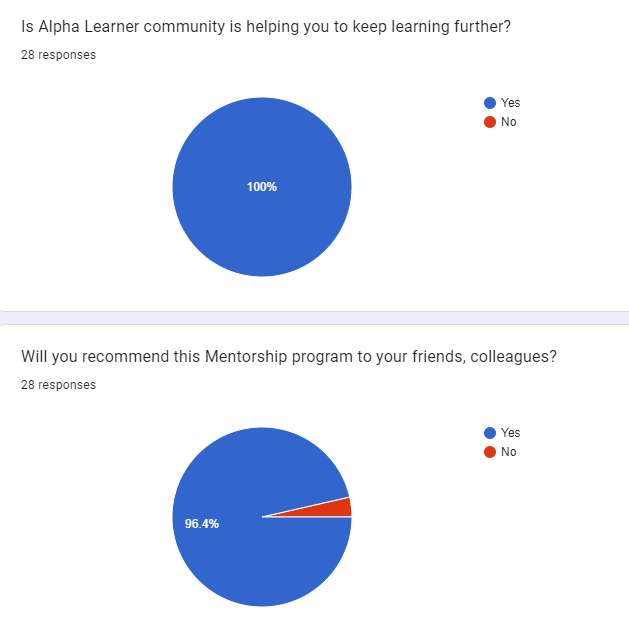

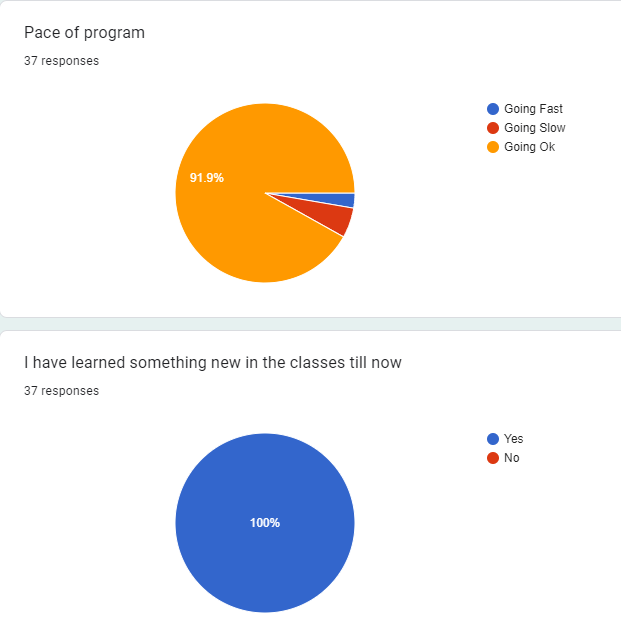

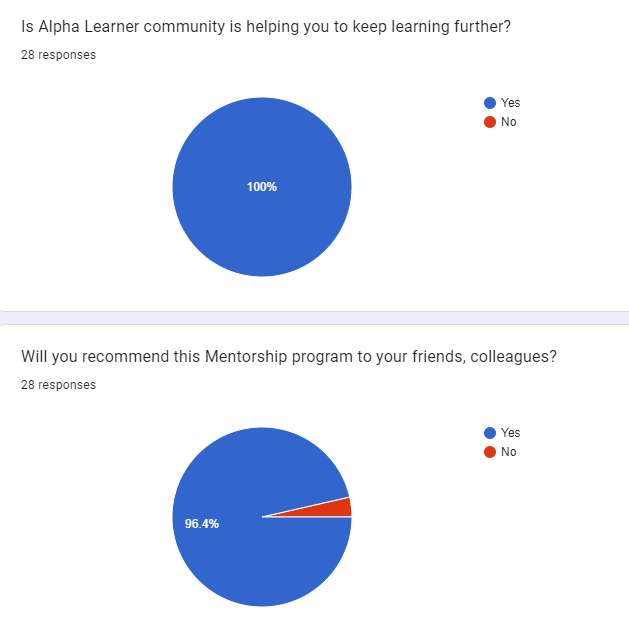

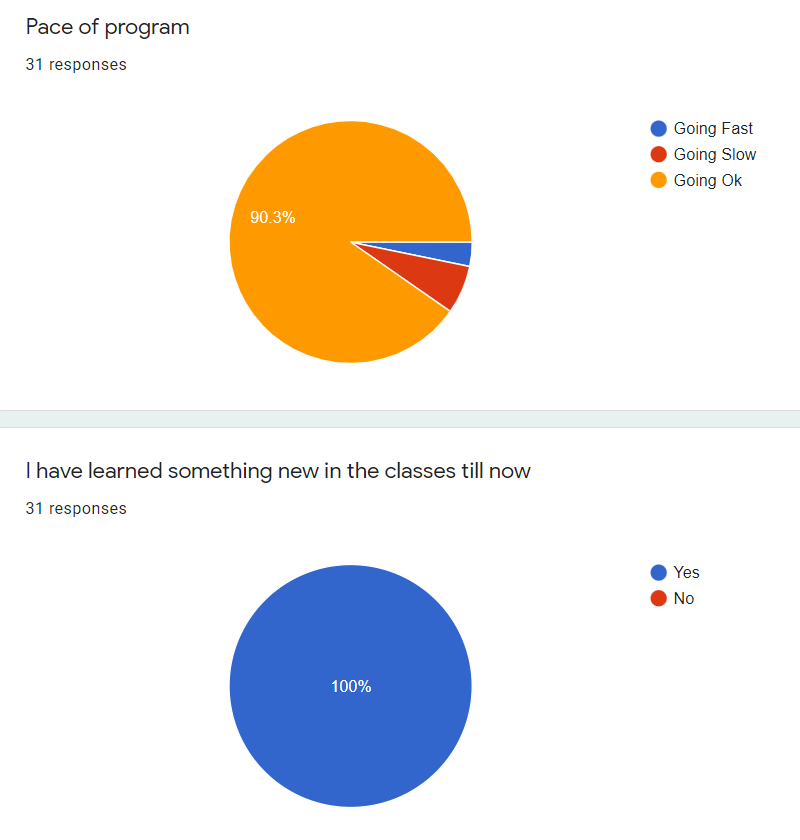

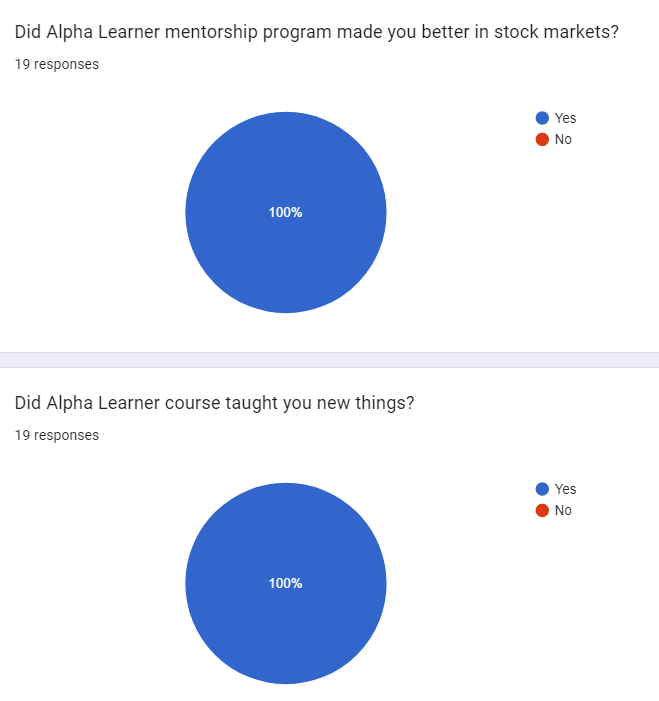

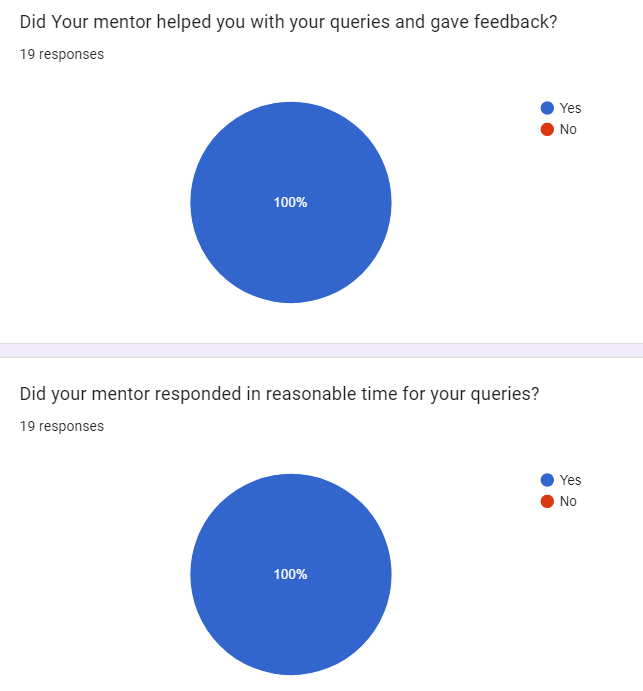

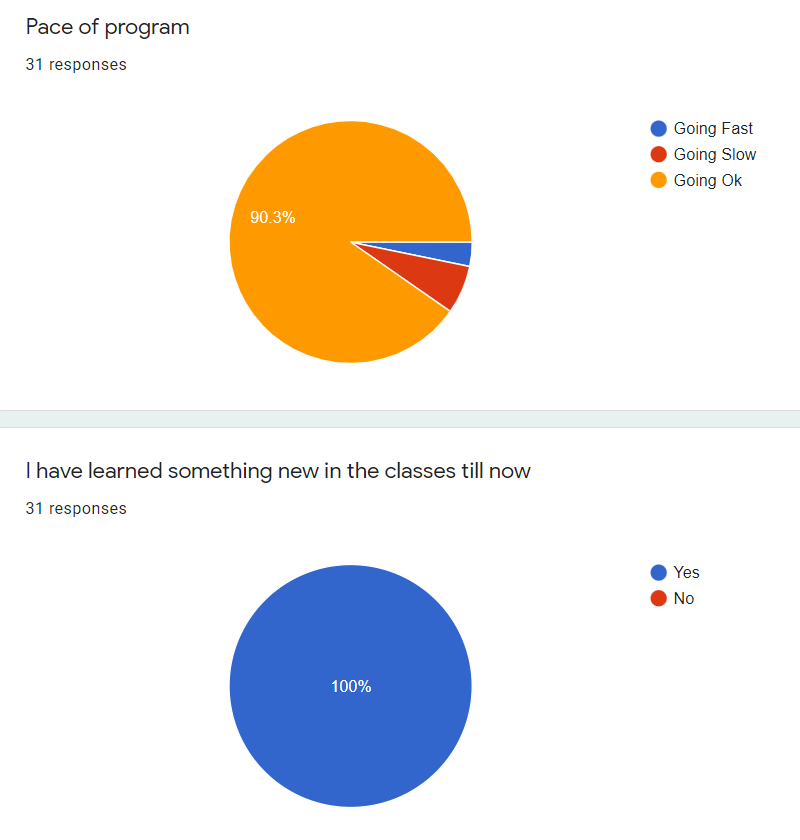

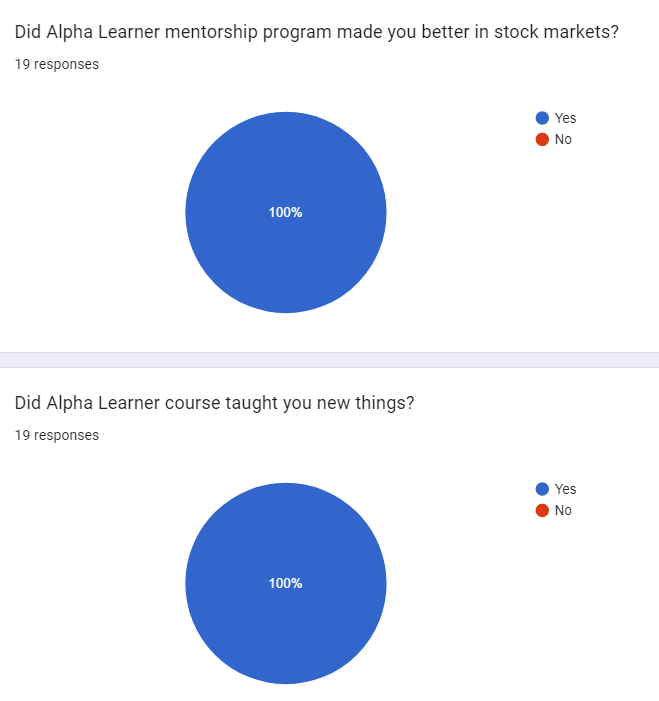

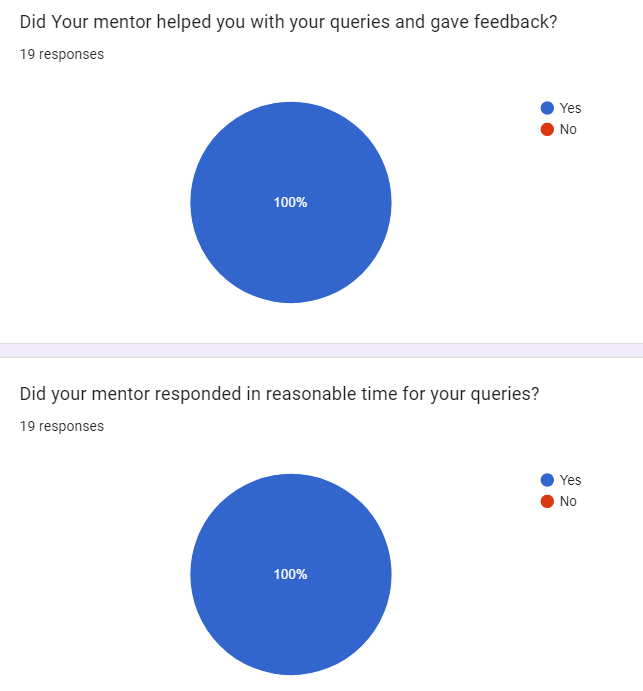

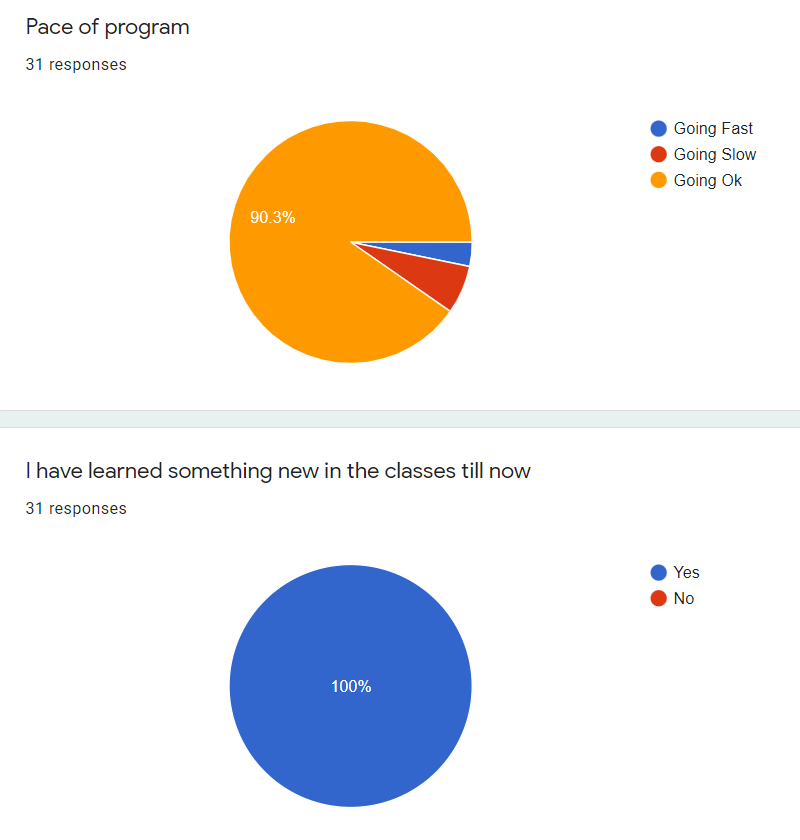

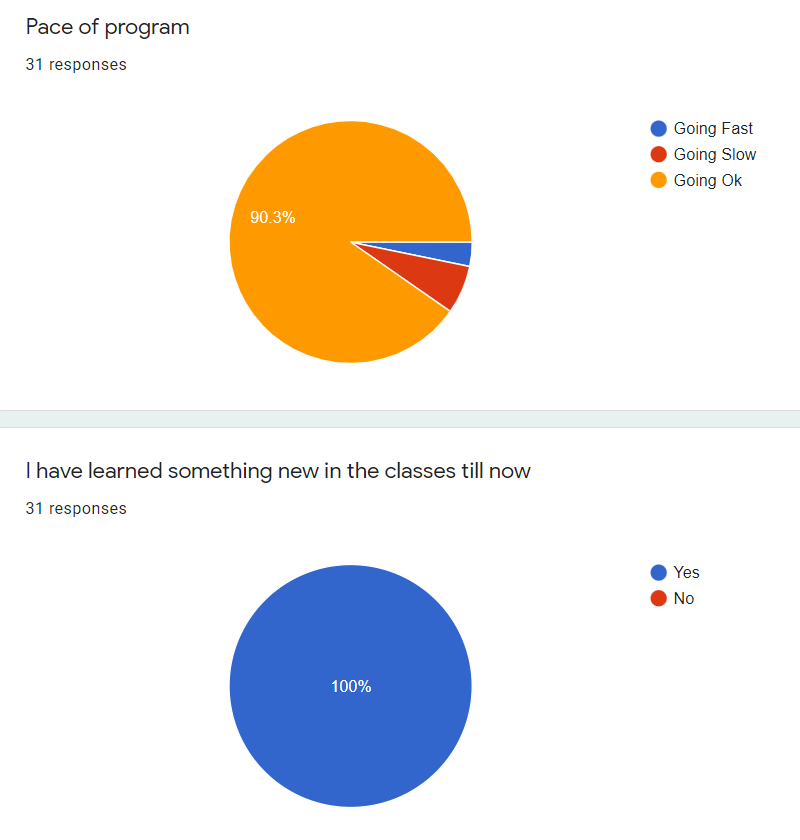

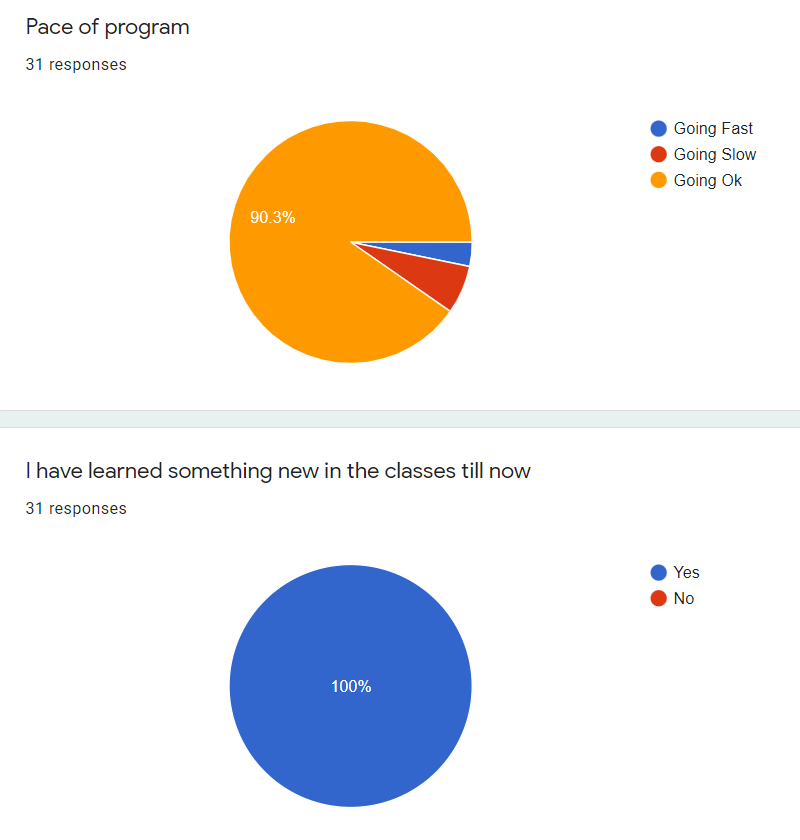

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

ALPHA LEARNERS – Mentorship program Apr-24

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Free lifetime learning through a Whatsapp Community (apart from Program content) & Bonus Sessions

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Road to Junk

SS-7

EMS limited

CMP 569, Market cap ~3150cr

ROCE ~32%, ROE ~24%, D/E ~0.07 PE ~29 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6

🟢EMS Limited is a multi-disciplinary EPC company, headquartered in Delhi that specializes in providing turnkey services in water and wastewater collection, treatment and disposal. EMS provides complete, single-source services from engineering and design to construction and installation of water, wastewater and domestic waste treatment facilities

🟢The company provides Sewage solutions, Water Supply Systems, Water and Waste Treatment Plants, Electrical Transmission and Distribution, Road and Allied works, operation and maintenance of Wastewater Scheme Projects (WWSPs) and Water Supply Scheme Projects (WSSPs) for government authorities/bodies.

🟢Healthy Order book of ~2100cr provides strong visibility of revenues over next few years. Company has repeat orders from various Government departments.

🟢EMS promoters have more than a decade of experience in executing water supply and sewage treatment projects

🟢Since incorporation, it has completed 67 projects in Bihar, Uttarakhand, Madhya Pradesh, Rajasthan, and Haryana. It has executed many projects awarded by government bodies such as Uttar Pradesh Jal Nigam (UPJN), Construction and Design Services (C&DS), Military Engineering Services (MES), and Indian Railway Construction Limited (IRCON). It has completed 4 O&M projects in last 4 years.

🟢Key clientele includes government bodies like Municipal corporation of Rajasthan (under AMRUT Scheme), Uttarakhand Urban Sector Development Agency and Bihar Urban Infrastructure Development Corporation (under National Mission for Clean Ganga ) and CPWD, Maharashtra

🟢EMS Limited has its own civil construction team and employs 57+ engineers, supported by third-party consultants and industry experts.

🟢Projects are mostly funded by World bank

🟢Development of Tier 2 Tier 3 towns, capital expenditure by Government gives good visibility for few years

🟢Promoter has sufficient skin in game with approx. 70% holdings, Sales are increasing and NPM is good

Risks

🔴Company works in a field of high capital intensive business and receivables will remain high

🔴Project execution risks within a budget are the ones which constantly hurts companies in these kind of businesses

🔴The company has not executed any HAM projects in the past but is executing one HAM project for the UP Jal Nigam. It has entered a joint venture with Ercole Marelli Impianti Tecnologici S.R.L. Italy.

🔴Revenue concentration from few clients/states poses a risk

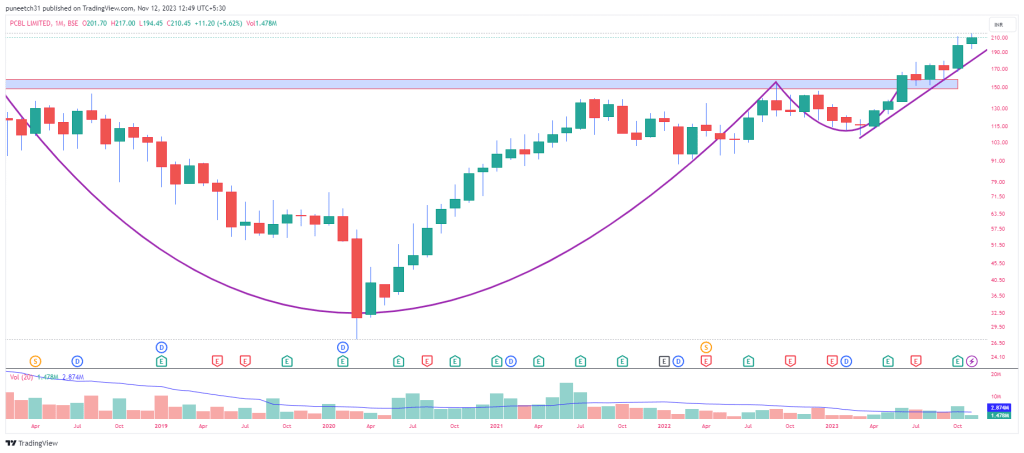

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

SS-6

Kabra Extrusion Tecknik

CMP 417, Market cap ~1450cr

ROCE ~15%, ROE ~10%, D/E ~0.19 PE ~41 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5

🟢Kabra Extrusion Technik Limited : It is India’s largest manufacturer of plastic extrusion machinery for more than 4 decades and recently ventured into manufacturing of Lithium-ion Battery Packs. The company is a part of the well-known Kolsite Group.

🟢In Extrusion Machinery Business it is India’s premier manufacturer & exporter of extrusion plants with presence in 100+ countries with +15,000 installations. also commands close to 40% market share in FY23

🟢Industry application in different sectors like -Packaging Industry, Infrastructure & Construction, Telecom and Plasticulture

🟢It has different products : Blown Film Lines, Pipe Extrusion Lines, Sheet Extrusion Lines, Compounding Lines and Auto Feeding Systems

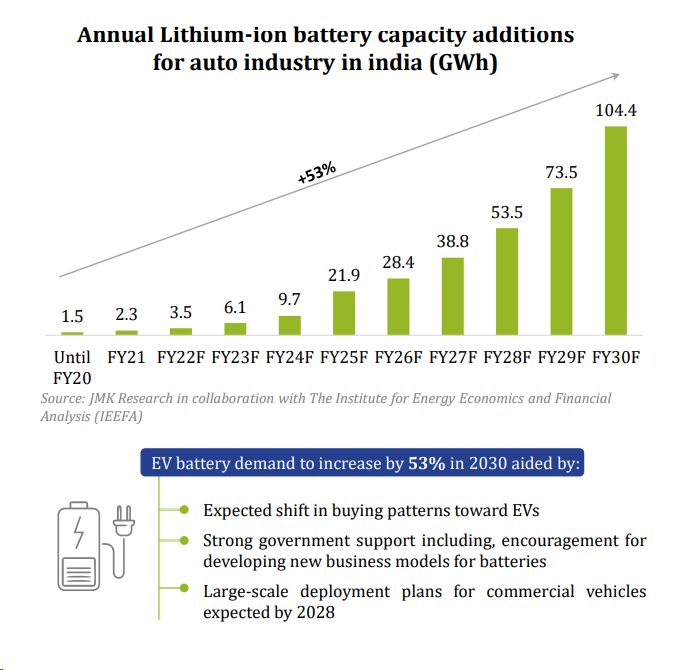

🟢In new segment of Battrixx –Its an emerging leader and commands approx, 15% market share where

🟢Battrixx business is a battery related solutions for electric mobility and energy storage, Battery & related components constitutes ~35-45% of cost in an Electric Vehicle

🟢Products in Battrixx segment are Battery Packs across multiple chemistries, Battery Management Systems (BMS) and IoT Solutions

It is One of the few players with

- The ability to handle multiple chemistries & types of cells

- Chemistries – LFP, NMC, NCA, etc.

- Types of Cells – Prismatic & Cylindrical

- Expertise across Electrical & Electronics

- Smart BMS

- IoT & Telematics

- Data Analytics Solutions

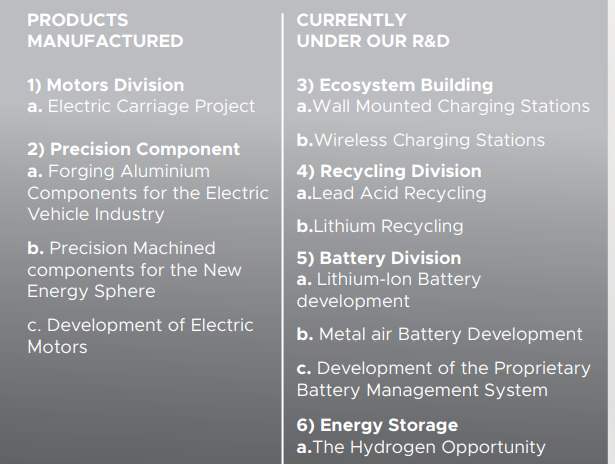

🟢Company is continuously investing in RnD and want to enter E-trucks, E-buses and ESS(energy storage systems)

🟢Company is first EV battery-pack manufacturer to be accredited with ARAI certification under AIS 156 Amendment III Phase 2 for its batteries, conceptualized and designed in-house strategically with Hero Electric’s R&D team

🟢Company had earlier won 3L battery packs and chargers order from Hero Electric Mobility for FY24

Key focus areas of our R&D

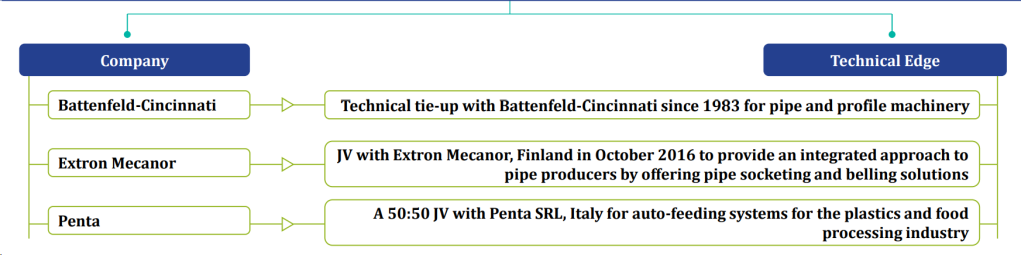

Company has technical tie up with Battenfeld-Cincinnati, Extron Mecanor and Penta for different domains

🟢Company has right tailwinds in longer run

🟢Company business is profitable though facing short term headwinds

🟢Promoter has sufficient skin in game with 60% holdings, FII holdings increasing in FY24

🟢Company credit rating has been upgraded last year CRISIL A+/Stable (Upgraded from ‘CRISIL A/Positive’)

Risks

🔴Company was able to successfully established new business but EV Battery sector run into headwinds with new rules. Company was first to be accredited with certification for new rules but still headwinds not went away fully. Company might take more time based on customers business

🔴Crude oil has indirect dependency as customers order go down for new machinery with increasing crude oil price. Hopefully now Crude is stable and Pipe volumes may come up seeing the real estate boom

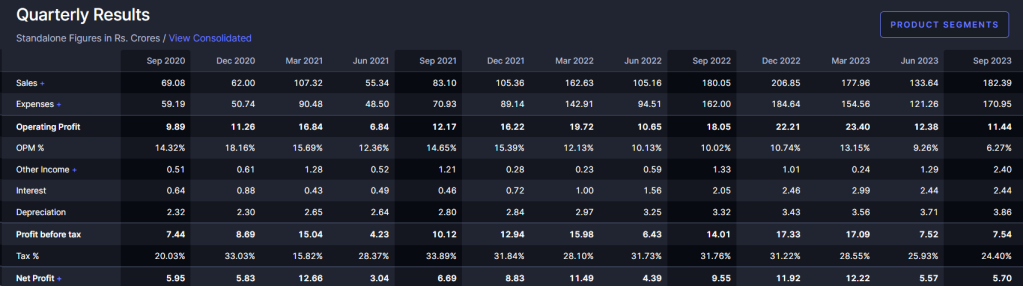

🔴Low OPM, NPM margins as of now –may improve with both domains of business picking up

🔴Technically weak structure for stock price

Financials

Company OPM have gone down recently and may take time to stabilize and come up. We need to carefully watch this space. Expected OPM is around 12% in longer run so enough space for company to showcase good results in coming years

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

SS-5

India has been going through a transformative change through Aatmnirbharta

Lot of sectors have big tailwinds including

- Railways (New Trains, New Tracks, New Wagons, Metro rail expansion to new cities etc.)

- Defense (Reducing imports, Replacing old ammunition, New Fighter planes, Ships )

- Automobiles (Building India as exports hub, increasing population with rising income profile)

- Space ( Chandrayaan, Aditya L1 launches, Starlink agreements with ISRO, small satellites launches increase etc)

- Marine and Shipping Industry (Building submarines, Ships, Ports infra, Sagarmala projects etc)

- Industrial Expansion in many industries with capex being announced every week here and there

- Oil and Gas industries And Heavy Earth moving Equipment’s

- Power transmission and distribution

Considering all above, ALPHA AFFAIRS see

FORGING as MEGA TREND

And from that Mega trend, we focused earlier on RK forge, covered here and here

Today we are focusing on one emerging player in same industry but has bigger vision in new sunrise industries as well. We have also covered with small details on Baluforge earlier

Balu Forge

CMP 285, Market cap ~2900cr

ROCE ~27%, ROE ~22%, D/E ~0.16 PE ~44 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4

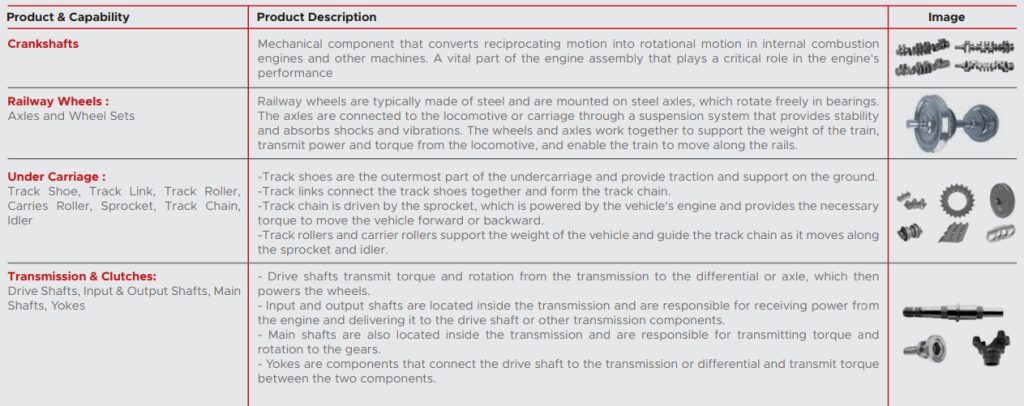

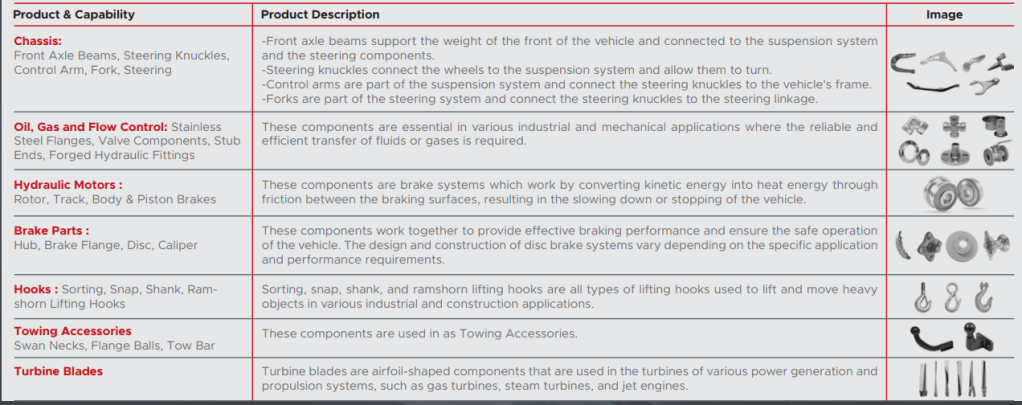

🟢It is engaged in the manufacturing of finished and semi-finished crankshafts and forged components and has a strong clientele comprising of 25+ OEM’s. Company has Fully Integrated Forging & Machining Unit with a large product portfolio offering to customers ranging from 1 Kg to 500 Kgs. The Forging Unit comprises Both Closed Die Forging Hammers & Presses

🟢Balu Forge has a distribution network in over 80+ countries and operates in domestic and export markets

🟢Balu Forge is already an approved vendor to a majority of the 41 Ordnance Factories part of the Ordnance Factory Board in India.

🟢Acquired Mercedes Benz Truck, Mannheim, Precision Machining Plant in 2021.

🟢Company has 3 subsidiaries. 2 in UAE and One in India.

Kelmarsh Technologies FZ LLC in 2021 (100%). Headquartered in the UAE with operations spread across 3 countries in Africa. Focused on manufacturing and innovation of agricultural equipment predominately tractors and tractor ancillary components

Safa Otomotiv FZ LLC (100%). Focusing on the machining and assembly of products in order to increase localization in the MENA region as well as meeting the product requirements for Agriculture and Oil & Gas industry

Balu Advanced Technologies & Systems Private Limited

Naya Energy Works Pvt Ltd (100%). Naya Energy is engaged in manufacturing of products for New Energy Sector

Company claims to work on Hydrogen Fuelling Stations & pilot project is presently underway to establish the first Hydrogen Fuelling Stations for fuel cell vehicles

Also company is in the process of patenting our domestically developed Refining Technology, NayaRefine. Currently One Module deployed can roughly produce 3-3.5 Tons of pure lead every day.

Company is working on a range of Charging Stations Conforming to Bharat EV AC Charger (BEVC-AC001) & Bharat EV DC Charger (BEVC-DC001) norms

Company also claims to work on ESS (energy storage solutions in form of hydrogen)

🟢Entered into leave and lease agreement with Hilton Metal Forging Ltd enabling Balu to backward integrate from precision machining player to Forging and Machining player

🟢Existing capacity to produce 18,000 tonnes Forged Components per annum which will be expanded to ~32,000 tonnes in the coming quarters. Annual capacity to manufacture 3,60,000 crankshafts. Wheel Production capacity of 6,000 wheels per year with a diverse application suitable for railway wagons, passenger coaches & locomotives in various gauges. Company want to Expand the wheel production capacity to 48,000 wheels per year

🟢On the capex front, Company plan for enhancing machining capacity by ~14,000 tonnes at newly acquired 13 acre land in Belgaum, Karnataka is progressing well. The operations from this facility are expected to commence from Q4 FY24, that will enable us to produce heavier and more complex crankshafts having better realizations and margins. After expansion, company will be operating on 22cr (previously 9 acres)

🟢The new facility will not only act as a Manufacturing Centre but will also be setup as a Technology & Innovation Campus with a strong focus on Integrated Defence Research & Production, Cylindrical Cell Production for Electric Vehicles, Components Suitable for New Energy Vehicle Drivetrains & Powertrains, Spent Battery Recycling to name a few but not limited to the same. There will be a dedicated R&D center spread over 4000 m² with a strong focus on the following key areas:

- Advanced Materials & Composites (Development of New Materials)

- Fuel Cell Development

- Cylindrical Cell & Module Development (LFP & NMC)

- Metal Air Battery Development (Zinc Air)

- New Energy Powertrain & Drivetrain solutions (New Vehicle Components)

- Advanced & Additive Manufacturing

- Energy Storage Solutions

- Alternate Bio fuels

- Spent Battery Recycling

- Advance Defence systems & solutions

Key focus areas of our R&D

Exploring the use of new materials, such as lightweight alloys or advanced composites, to enhance the product offering.

Investigating cutting-edge manufacturing methods, such as additive manufacturing (3D printing) or advanced Machining, to achieve higher precision and tighter tolerances.

Analyzing and optimizing product designs using computer simulations and finite element analysis to maximize performance and minimize stress concentrations.

Building a robust platform for the product expansion into the Railway & Defence Industry by way rapid prototyping & increase the speed of New product development

Successful Prototyping of some key components for the New Energy Mobility sphere to ensure the long-term vision of building strong capabilities in Fuel Agnostic solutions.

Investigating new heat treatment methods to enhance the strength and fatigue resistance of our products.

🟢Diverse array of products including Crankshafts, Railway Wheel, Under carriage, Transmission and clutches, Hydraulic motors etc

🟢Company is witnessing a lot of green-shoots in the defense and railway industry. This presents a significant growth opportunity for BFIL, as we continue to expand our footprints in these sectors

🟢Company is spending 2-4% in R&D and have 45 employees in that division, Overall employee strength is more than 700. Company is also Backed by certifications like IATF 16949 accredited by Tuv Nord Cert GMBH

🟢Revenue is expected to conservatively grow by ~25.0% in FY24 over FY23, led by growth opportunities in the various industries like defence, railways, and others

🟢EBITDA margins are expected to be in the corridor of 22.0%-23.0% in the upcoming quarter on the back of increasing scale of operations and efficiencies

🟢Promoter has skin in game with roughly 54% allocation. FII Have entered. Some DII money is also getting poured in this one. Management has good 3 decades of experience in the industry and now 3rd generation also into same business leveraging the domain strength acquired over years

🟢Fund raising and Preferential allotment Promoter infused 26cr at 115 Rs/share in 2023 and then 92cr (almost double of fixed assets 48cr) at 183 Rs/Share. Ashish Kacholia & Sage one also participated in Pref. at Rs.115. On 48crs of Fixed assets , Company has raised~300crs for expansion. Recently new fund also entered at 183 Rs/Share. All the selling hangover by a fund over last 2 years has been absorbed and stock is back to new highs

🟢Order wins in last 12 months. Significant order win from a tractor manufacturer based out of the Middle East of supplying 10,000 sets of sub-assemblies & there is scope to increase the same to over 50,000 annually

Risks

🔴 Volatility in the price of major raw material- steel and aluminum is a major risk, the operating margin remain susceptible to these volatilities

🔴Large working capital days cycle. The company provides a credit period of 150-180 days to its customers due to business requirements and maintains an inventory of 60-80 days due to diversified product portfolio

🔴Most of the talks under Naya energy division or Balu Advanced systems is just been talk. We need to see when and what product comes out of these new divisions. Many other companies progressing fast on Recycling, Defense and EV/Hydrogen space. We have not seen much on this part regarding their advances in these domains which significantly upgrade their Revenue or profit from these divisions. These may become sunk cost if management is not focused

Financials

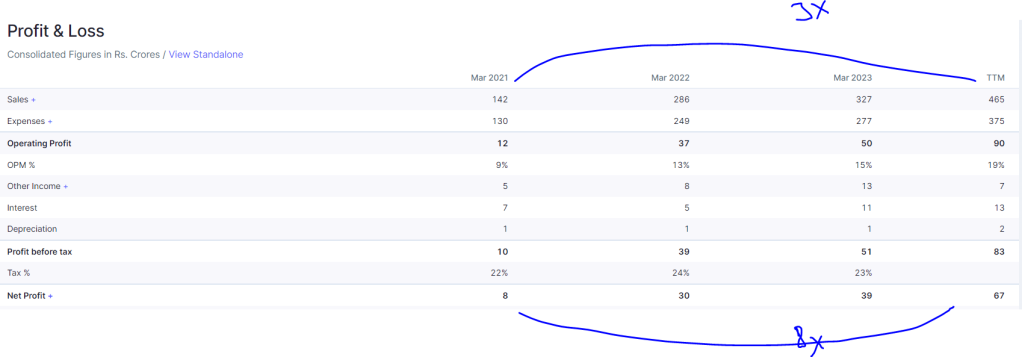

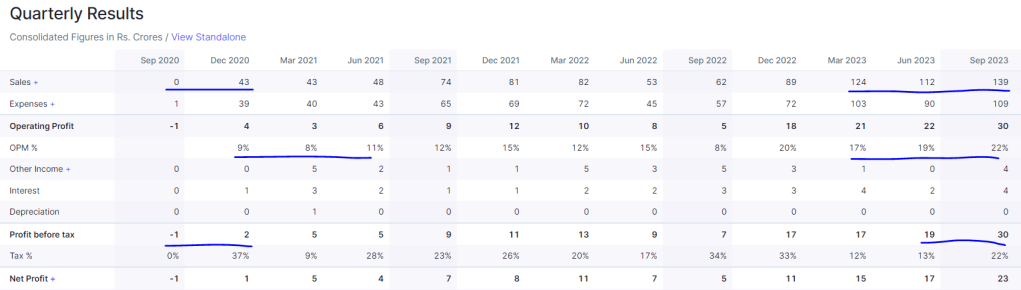

Sales have grown 3x and Profits 8x in last 3 years approximately, OPM margins have improved, over 3 years company financials have improved

Technical chart

Good Daily and Weekly Breakout with volumes in 1st Week of Jan24

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Diwali to Diwali -4

MSTC

CMP 568, Market cap ~4000cr

ROCE ~37%, ROE ~33%, ROE 3Yr 30 %, D/E ~0.16 PE ~17.4 (based on screener)

Company is paying Dividends but not consistent, Changing Business Profile

Also Read Pick1, Pick2, Pick3

🟢Company conducts electronic auctions (“e-auctions”) primarily on behalf of the government of India and related parties like government-owned companies. MSTC is a Mini Ratna Category-I PSU of GoI, based in Kolkata.

🟢MSTC has 50:50 joint venture with the Mahindra group called Mahindra MSTC Recycling Private Limited (MMRPL). This company is an authorised RVSF (“Registered Vehicle Scrapping Facility”) for vehicles reaching end of their life. These old vehicles are purchased for de-polluting, dismantling and converting the metallic parts in an environmental friendly manner. In December 2022, the Government of India issued a directive regarding its Scrappage Policy, a government-funded initiative which seeks to phase out old passenger and commercial vehicles, thereby reducing urban air pollution, increasing passenger and road safety, and stimulating vehicle sales. This means that all government owned vehicles will be auctioned off on MSTC’s e-commerce platform when they reach end of life. This opportunity is close to 15Lakh vehicles

🟢MSTC is casting more focus on the untapped e-commerce business from the private sector and in this stride MSTC has signed big ticket agreement with Reliance Industries, Indus Tower, Tata Power, L&T, Jindal Group, Vedanta

🟢Company has negative cash conversion cycle and that helps company to grow without any need of capital

🟢Diversity in auctions management is a kind of moat. Company have done auction of properties, Gold, Metal scrap, Steel, coal mines, Aircarft, UDAN scheme etc etc etc

🟢Promoter has skin in game with roughly 64% allocation. FII started entering. Some DII money is also getting poured in this one

🟢Sale of natural resources such as iron ore mines, coal, minerals, sand blocks, and resources extracted by government-owned companies like iron ore and natural gas. This principle also extends to the ongoing sale of scrap, surplus stores, old plant and machinery, e-waste, and obsolete items belonging to different branches of both the state and central government across India.

🟢Recently Govt has announced that multiple block of minerals mines will be auctioned. Bidding of these auctions will be around 50K crore. MSTC will be getting % of these auctions (mostly less than 1%). Most of these auctions if done through MSTC, then most of the revenue will also flow to bottom line

Risks

🔴Company business is dependent on many government entities auction like coal, metal etc. So business can be lumpy to certain extent

🔴Launch of any new portal or shifting of auction business to individual companies of Govt or reduction of margins can potentially derail thesis

🔴Significant increase risk of investing in PSU as Govt can interfere on many things

🔴Any breakdown of portal or any bug in portal can lead to revenue loss and further loss of business

🔴Company has litigations earlier and need to be closely tracked on this front as well

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Diwali to Diwali -3

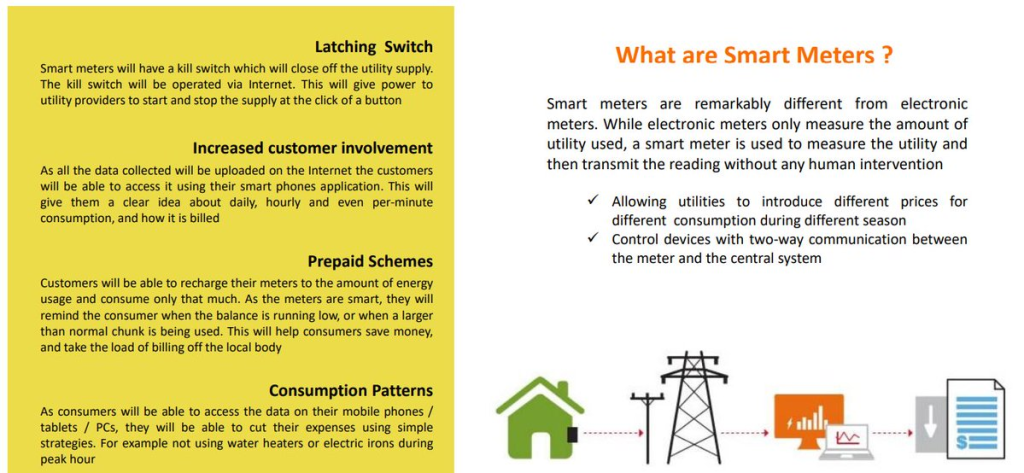

▪ At present, India loses around 30% of its power generated due to transmission, distribution, billing generation and collection inefficiencies

▪ Theft is the one of the main causes of the high losses. Theft occurs in several ways, viz: by tapping power lines and tempering / by-passing meter etc

▪ Meters play a vital role in reduction of AT&C Losses – Replacement of defective meters by tamper proof electronic meters / smart meters – AMI / Smart metering to the consumer for reduction of commercial losses and billing and collection ease

▪ Smart meter has the following capabilities: – Smart Meters and AMI Meters have communication capability – It can register real time or near real time consumption of electricity or export both. – Read the meter both locally or remotely – Remote connection or disconnection of electricity – Remote communication facilities through GSM / GPRS / RF etc

Here comes the company which tackles the problem head on and manufacture smart meters

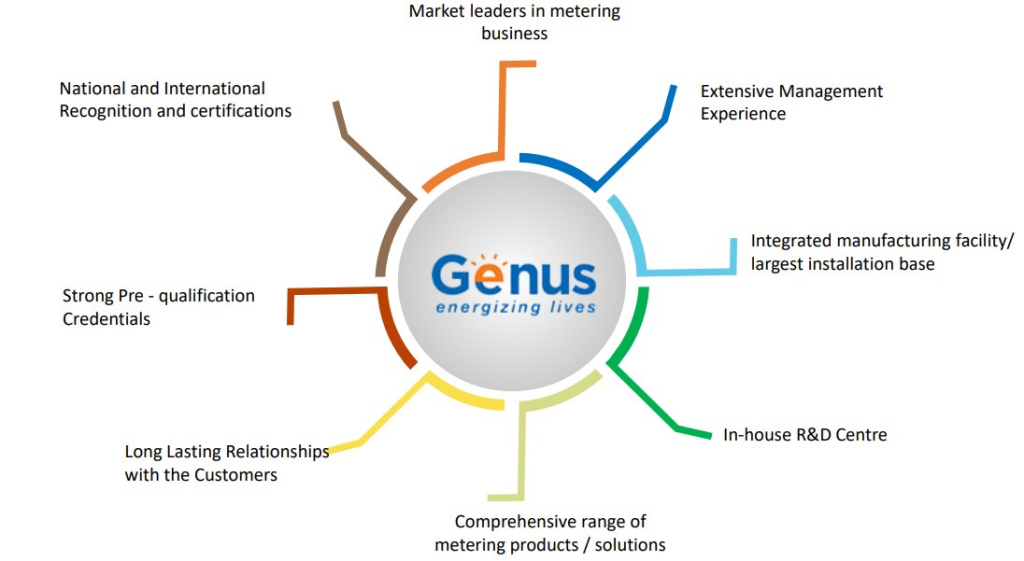

Genus Power

CMP 223

Stock PE 71, ROCE, ROE <10%, Debt to equity < 0.3 (based on screener)

Also Read Pick1, Pick2

➡️It is engaged in manufacturing and providing Metering and Metering Solutions and undertaking ‘Engineering, Construction, and Contracts’ on a turnkey basis

➡️In 1996 it pioneered unique tamper-proof single & three-phase electronic energy meters in India.

➡️1st company in India to obtain various certifications like DLMS certification for Energy Meters, BIS certification for Smart Meters, etc.

➡️Current Order book is massive 19K crore –many order they have won recently

➡️Many State Electricity Boards (SEBs) have initiated the process of inviting bids for the deployment of smart meters under RDSS scheme

➡️In May 2023, the company has signed a commitment letter with United States International Development Finance Corporation (“DFC”) to obtain a Loan up to USD 49.5 million to scale up the deployment of electric smart meters.

➡️Company expects a substantial recovery in revenue from Q3FY24 onwards on back of our robust orderbook and consistent order inflow, further bolstered by the normalisation of the supply chain

➡️GIC Affiliate and Genus Power Infrastructures Limited to set up a Platform to fund Smart Metering projects

o Company signed definitive agreements with Gem View Investment Pte Ltd, an affiliate of GIC, Singapore (“GIC”) for setting up of a Platform for undertaking Advanced Metering Infrastructure Service Provider (“AMISP”) concessions

o Genus Power would be the exclusive supplier to the Platform for smart meters and associated services

➡️Largest player in India’s electricity meter industry ~27% market share in Meter Industry

~70% market share in Smart Meters

➡️Annual Production capacity of 10 mn+ meters

➡️Empanelled with 40+ different utilities across the country

➡️Only Indian company to receive BIS certification for Smart Gas Meters

➡️CMMI level 3 Company Accredited with – ISI, KEMA, SGS, STS, ZIGBEE, UL, DLMS etc., which is amongst the highest in Indian Metering Solutions Industry

➡️Big and reputed clientele

➡️In-House NABL Accredited Electronic Energy Meter Testing Laboratories

GOVERNMENT INVESTMENT

The government is planning to invest up to $21 billion till 2025 in smart grid technologies

The smart cities initiative is targeting 100+ cities in India, out of which 20 have been declared

More than 14 smart grid pilots have been launched in cities across India, to push smart solutions in Power Generation & Distribution Industry

Risks

➡️Fairly valued to bit overvalued until Earnings kick in

➡️Increase in employee cost and other expenses, as expanding workforce and enhancing systems in preparation for the execution of the substantial orderbook

➡️Significant increase in financing costs as a result of the company’s obligation to provide new bank guarantees to secure the massive order inflow

➡️Delay in execution of existing orders received by a quarter or two

➡️New order tenders getting delayed

➡️Change in policies

➡️Increase in RM costs

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

ALPHA LEARNERS – Mentorship program Jan-24

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

EARLY BIRD DISCOUNTS if one Enrols before 25th DEC 2023

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Free lifetime learning through a Whatsapp Community (apart from Program content) & Bonus Sessions

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

EARLY BIRD DISCOUNTS if one Enrols before 25th DEC 2023

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

DIWALI To DIWALI PICKS – 2

FCL –Fineotex Chemicals

CMP 358, Market cap ~4000cr

ROCE ~36%, ROE ~28%, ROE 3Yr 25.5 %, D/E ~0

Consistent Dividend Payout, Consistent increase in revenues, Profits over a decade

Also Read : PICK1

Business, Revenues and SHP

➡️FINEOTEX group is one of the leading manufacturers of chemicals for textiles, construction, water treatment, fertilizer, leather, and paint industry. Fineotex manufactures and provides products for Pretreatment processes, Dyeing processes, Printing processes, and Finishing processes for textile processing to customers across the globe

➡️Company focus is on two categories –Textile chemicals and Clean & Hygiene chemicals

➡️Revenue 77% domestic, 23% International

➡️Bluesign, ZDHC, Star Export House Accreditations + several ISO certifications

➡️Fineotex Chemical Limited has earned the prestigious ECO PASSPORT by OEKO-TEX® certification, the highest rating in the globally renowned audit that measures standards of sustainability

➡️Received Dun and Bradstreet ESG Badge, it showcases the impact of ESG listing and ranking on organizations, and recognize their contribution towards sustainability

➡️Presence in more than 70 countries with 100 + dealers with 470+ product categories

➡️Consistent promoter holding, Good DII participation, Big Shark Ashish Kacholia holding 2.83% stake ( built his stake in last one year)

➡️Company has strong experienced leadership team and has reputed clientele

Strengths and Triggers

🟢Capex, expansion Done in last few years–Total capacity 104000MT, Ambernath plant is fungible and has the capabilities to manufacture products for both textile chemical and cleaning and hygiene segment.

🟢The facility is equipped with modern infrastructure and amenities, enabling sustainable chemical production with advanced automation, storage, and logistics handling

🟢Emerging/Expected Favorable tailwinds with UK FTA deal under discussion, Can open doors for Indian Textile segment and the company is proxy to textile sector

🟢Working capital days, Inventory days have come down significantly

🟢Malaysia plant has Easy access to high quality raw materials in the region. Malaysian plant provides raw materials to the Indian facilities. Cost benefits due to Free Trade Agreements (FTAs) with important regional markets like Vietnam, China and India

🟢Recent collaborations to expand product profile and geographical reach —

Eurodye-CTC, Belgium, to commercialize specialty chemicals for the Indian market

HealthGuard, Australia to become the exclusive global marketing and sales channel partner with joint operations from Malaysia

Setting up a state of art Research & Development center in collaboration with Sasmira Institute, one of India’s premier textile institutes

🟢Developed technical expertise to enter attractive new markets –like -Cleaning and Hygiene Chemicals Drilling Speciality Chemicals Other Speciality Chemicals

🟢Non-textile segments will drive volume and value growth going forward

🟢Team of 34 professionals for providing technical solutions to customers

🟢Technical barriers to entry and high levels of development and product customisation

🟢ICRA rating upgraded -Long Term Rating: A+ -Short Term Rating: A1+

🟢Successful acquisition and realisation of synergies with Biotex

RISKS

🔴Further Delay or non progress in UK FTA deal

🔴Textile exports remaining down or Reemergence with force by Bangladesh Textile companies

🔴Threat of imports of chemicals/dumping by China

Disclaimer — Not a buy/sell recommendation.

Purely for studying the stock idea with risks and strengths

Your Profit, Your Loss based on your conviction

Disclaimer

We have 96 MASTERS

DIWALI PICKS – 1

PCBL –Philips carbon black

CMP 210, Market cap ~7900cr

Mcap/Sales < 1.5, ROCE ~17%, PE ~18.5

Business, Revenues and SHP

➡️India’s largest & world’s 7th largest Carbon Black Company with strong presence in specialty chemical

➡️Existing 4 plants combined Annual capacity of 623 KTPA & green power generation plant of 98 MW

➡️Focus on RnD in Speciality chemicals -50+ scientists & technical professionals in R&D and process technology

➡️70% revenue from domestic, 30% international

➡️65% revenue from Tyre segment –Major Tyre companies are doing capex–INR 35000 crs of investment by tyre industry in last 3 years in capacity creation & debottlenecking

➡️Presence in more than 50 countries with 100 grades of Carbon black, 65+ grades of speciality chemicals, 1100+ employees

➡️Consistent promoter holding, Good FII and DII participation

➡️Company has strong experienced leadership team + Company belongs to Renowned RPG group

Strengths and Triggers

🟢Capex, expansion ongoing -Green field project at Tamil Nadu with Annual capacity of 147 KTPA & green power generation plant of 24 MW, Specialty capacity in Mundra of 20 KTPA. Brownfield Expansion at Mundra plant, Gujarat. Total Specialty Chemical capacity after all expansions – 112 KT.

🟢Favorable tailwinds as vehicle scrappage policy, Growing demand for EV tyres, SUV tyres, Acceleration in freight movement

🟢Tyre exports witnessed healthy growth of 9% in FY23 driven by growth in passenger car , agri & construction sectors and increased acceptance for Indian tyres globally. Domestic Tyre demand is estimated to grow by 8-9 % in FY24 with growth recovery in OEM and replacement segments

🟢Tyre imports are reducing

🟢Easy access to raw materials and international customers with proximity to ports

🟢Lower logistics cost on account of well spread manufacturing facilities and proximity to customers

🟢Lower risk of business interruption with multiple manufacturing location spread across India

🟢Increasing Contribution from High Margin Specialty & Performance Chemicals Portfolio

🟢Company is also focusing on digitalization in its operations like INDUSTRY 4.0: Smart factory Solutions —

a) Smart Automation in new manufacturing unit in Chennai, Tamil Nadu to generate key analytics and dashboards, eliminate human error and improve safety.

b) Adoption and deployment of best-in-class Data Security softwares and Advanced threat protection for all end users.

c) Creating Digital Infrastructure by set up of disaster recovery data centre for critical data protection, Automated tool-based backup is scheduled and monitored for all critical Cloud Servers.

RISKS

🔴Key Raw material CBFS is imported and dependent on crude oil price

🔴Major portion of PCBL’s revenue is from sale of CB to tyre manufacturers which is cyclical business

🔴Threat of imports of carbon black or Dumping by China

Disclaimer — Not a buy/sell recommendation.

Purely for studying the stock idea with risks and strengths

Your Profit, Your Loss based on your conviction

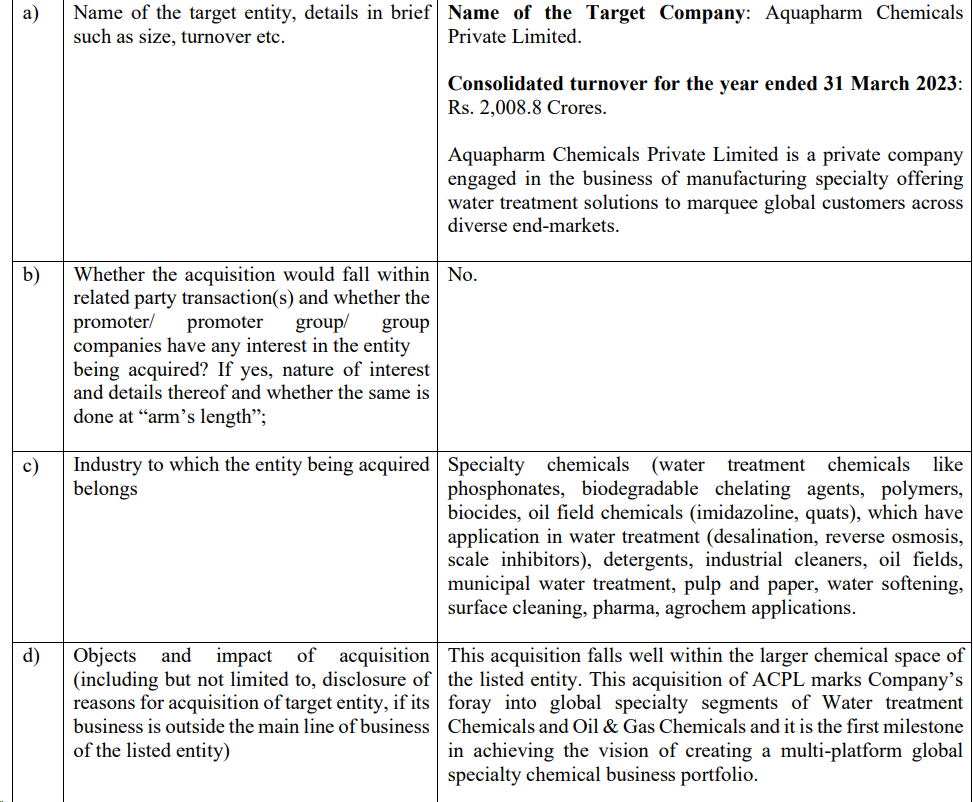

Update in 28-Nov-23, 29-nov-23

Acquisition of ACPL at 3800cr, EBITDA of ACPL is 417Cr in FY23

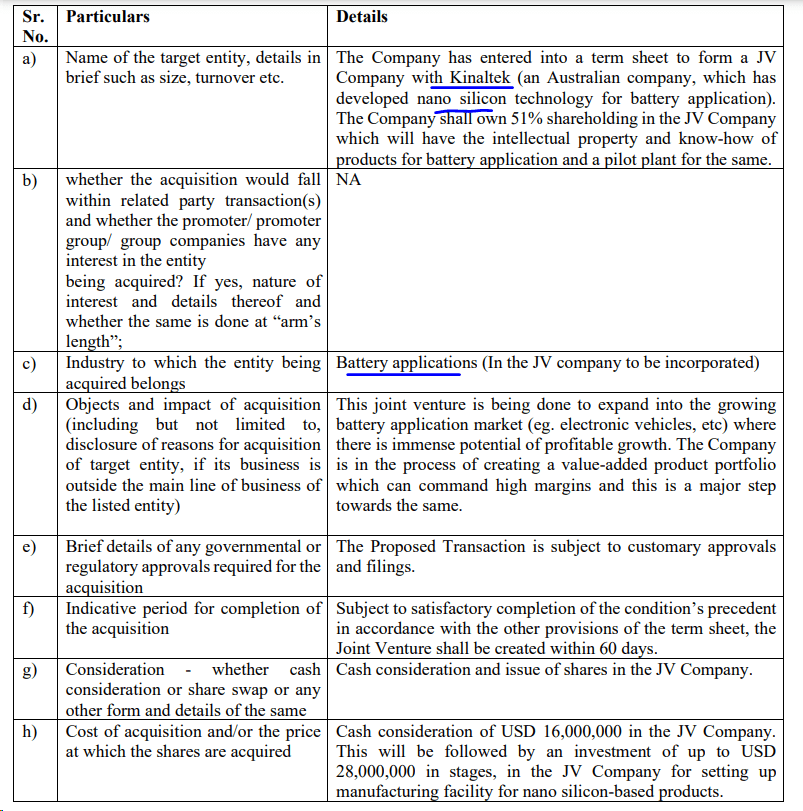

JV with Kinaltek for battery applications

Best-Inventions-2023

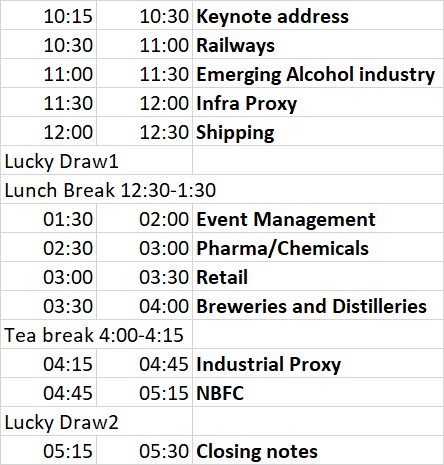

Alpha Learners Day 28th Oct23 : Join Immediately

We will be having ALPHA LEARNERS DAY this 28th oct Saturday

Its an event designed to increase domain knowledge from different sectors and hence companies are chosen from different sectors segments

Timing is from 10:15 to 5:30pm with relevant lunch and tea breaks in between

Format–Online Zoom Meeting

Around 10 companies with thesis will be presented–We are planning to record as well

How these meets/events can be useful —One may get a lead to deep dive more into the stock presented or relevant sector

One of my latest entry SKYGOLD which is the fastest doubler came out of one such meet

Remember

Any stock shared or discussed is NOT A BUY/SELL recommendation, Treat it as a lead to increase domain knowledge

Any losses /gains arising out of that –nobody is responsible from presenter/organizer side —we are clear that we are not recommending any stock

Its just a collective effort to learn new things from people who have taken a next step–No they are not Well known names–but they have chosen the “ROAD LESS TRAVELLED* and this initiative is to support them in their journey

Schedule looks something like this–Last minute changes may be possible

Event is free for Learners in Alpha Mentorship program (who have shown interest earlier) + Any person who wants to present a stock that day with thesis

This is a unique event where people amongst us have been able to conquer their fears and took the jump towards company analysis–not an easy task –more difficult is to present —no guarantee that it can be glitch free event–

but its a start and we will definitely reach good heights in coming time

Anyone from this group or their friends/colleagues/Relatives –if they want to join — can pay a nominal fees of 750 Rs for full day to attend

Further this fees + participation makes you eligible to participate in next event as well

Drop me a mail at alphaaffairsf2f@gmail.com if interested to join the event

You will come out richer in knowledge

There are two lucky draw for audience from the presentations (Where if you answer correctly, you are eligible to win a prize)

One lucky draw each in morning session and evening session

There is a Best presentation award for participants based on audience polling

MNC not able to tame Indian Markets

Right first time? Unlikely

Only 2 questions

ALPHA LEARNERS – Mentorship program Oct-23

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 2 years of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Free lifetime learning through a Whatsapp Community (apart from Program content)

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS MONTH of 2023 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Long term (part-time) Investor!!

Always something you can do today

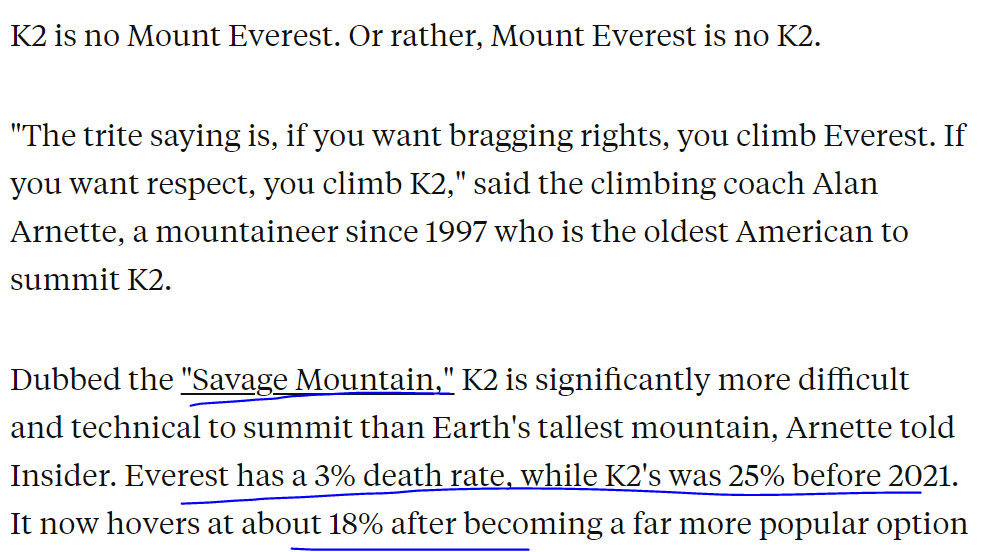

K2 : Savage Mountain

Growth feels risky : You need a method, coach

ALPHA LEARNERS – Mentorship program July-23

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 30th June23

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Free lifetime learning through a Whatsapp Community (apart from Program content)

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS MONTH of 2023 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

AVAIL EARLY BIRD OFFER (save 3000 bucks) till 30th June 2023

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Your thoughts are not your own!!

Protected: Improve the ODDS : POST only FOR ALPHA LEARNERS

Protected: Red Flags : POST Only for ALPHA LEARNERS

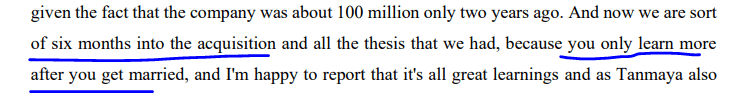

You learn more after marriage!!

So simple yet so deep message!!

Deals, Mergers, acquisitions look lucrative but actuality comes when its done. Similarly as an investor you learn more about a company after buying a good quantity of shares. You have skin in the game once you do that.

I believe in this concept from Day1 , only advantage we have is we can divorce a stock

Pomodoro Technique

The Pomodoro Technique is very popular. The steps are easy:

- Select one task on which you will focus.

- Set a timer for about 25 minutes.

- Get to work on your project.

- When the timer goes off, take a quick break.

- Repeat this cycle.

- After a few repetitions, take a more extended break.

Alpha Mentorship Batch Jan2023

ALPHA LEARNERS – Mentorship program Jan-23

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 31stDec 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Bonus sessions on (apart from Program content)

Financial planning &

IPO

Free lifetime learning through a Community (apart from Program content)

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

4-5 months of teaching and mentoring

Can be extended based on queries, case studies

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS Last MONTH of 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 31st Dec 2022

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Won’t Matter

ALPHA LEARNERS – Mentorship program Aug-22

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 15th Aug 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL, Heiken Ashi candles, different time frames

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Bonus sessions on (apart from Program content)

Financial planning &

IPO

Free lifetime learning through a Community (apart from Program content)

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

4-5 months of teaching and mentoring

Can be extended based on queries, case studies6-7 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap –this will be an approximate six month effort by all participants

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS INDEPENDENCE MONTH of 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 15th Aug 2022

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

Number of batches and batch size is very very limited considering live classes

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Up and down cycling

Pilot needs to be good at maths

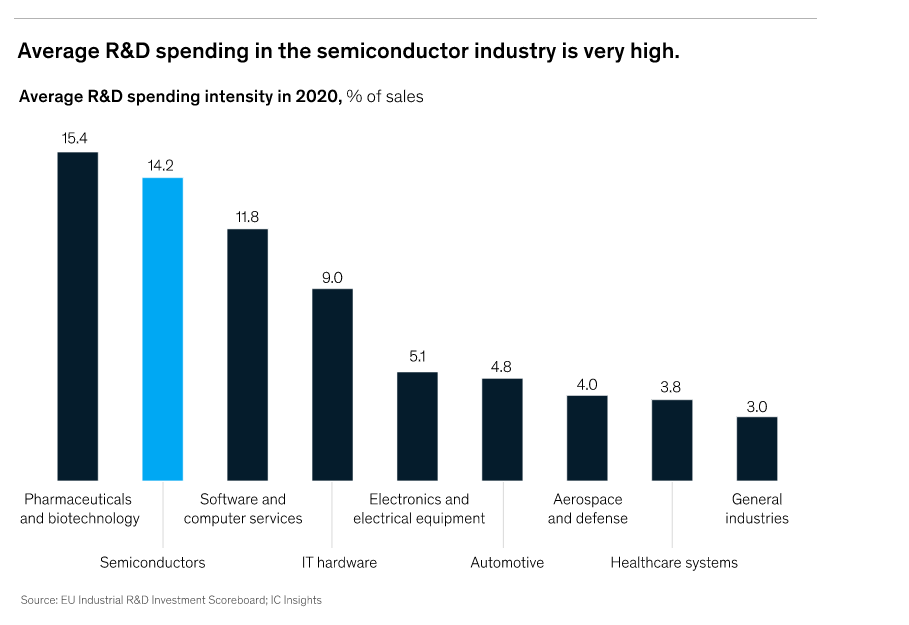

High R&D expense

ALPHA LEARNERS – Mentorship program Apr-22

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 25th April 2022

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions (apart from Program content)

Mutual Funds

Financial planning

IPO and

Big money moves

3-4 months of teaching and mentoring

Can be extended based on queries, case studies1-2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap –this will be an approximate six month effort by all participants

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS NEW YEAR 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 15th April 2022

FEEDBACK By Ongoing ALPHA LEARNERS

ACT NOW for your Independence

FEEDBACK By Ongoing ALPHA LEARNERS

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Alpha Learners B42

Do you have time to make mistakes!! Learn from others learnings

Protected: Alpha Learners MF

Protected: Alpha Learners 18

ALPHA LEARNERS – Mentorship program Jan22

With great pleasure and best wishes from all of you, we are delighted to launch

ALPHA Mentorship program

ALPHA LEARNERS

Art and Science of Investing

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and indicators including RSI, MACD, STOC RSI, EMA, TEMA, DEMA, Trends, SL

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Concept of Futures and options

4 Bonus sessions from experts (apart from Program content)

Mutual Funds

Financial planning

IPO and

Accumulation Distribution session

3-4 months of teaching and mentoring

Can be extended based on queries, case studies1-2 months of handholding

To clear doubts, correction of mistakes, independent walking in markets

10+ Assignments

Based on actual events happening in markets during the course

Case studies

Based on future growth understanding and pitfalls to avoid

Quizzes

To help you assess yourself whether you are progressing or not during the programPresenting Stock idea by Learners to bridge the learning gap

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS NEW YEAR 2022 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

CONTACT us

AVAIL EARLY BIRD OFFER till 1st Jan 2022

ACT NOW for your Independence

FEEDBACK By Ongoing ALPHA LEARNERS

CONTACT us

Number of batches and batch size is very very limited considering live classes

Major part of this initiative will go towards orphan children education and food

Do make use of this opportunity and be part of bigger initiative

Connect with us to help genuine needy children

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Alpha Learners class

Crypto Super App : Cryptowire

Protected: Session11

Alpha Bravo Charlie

Biggest Marketing Bargain : Customer Service

Protected: ALPHA Learners OCT

Essential Cash Flow Tips for Small Business Owners

Guest Blogger : Michael

For more valuable financial resources, check out the Alpha Affairs website!

Cash flow issues sink small businesses every single day. If you’re not on top of your cash flow, future financial problems are inevitable. Learning about common cash flow issues and good financial management practices will ensure you don’t fall victim to the mistakes made by many other small business owners. Below, we share some great tips to help you establish good cash flow practices from day one!

Protect Your Personal Assets