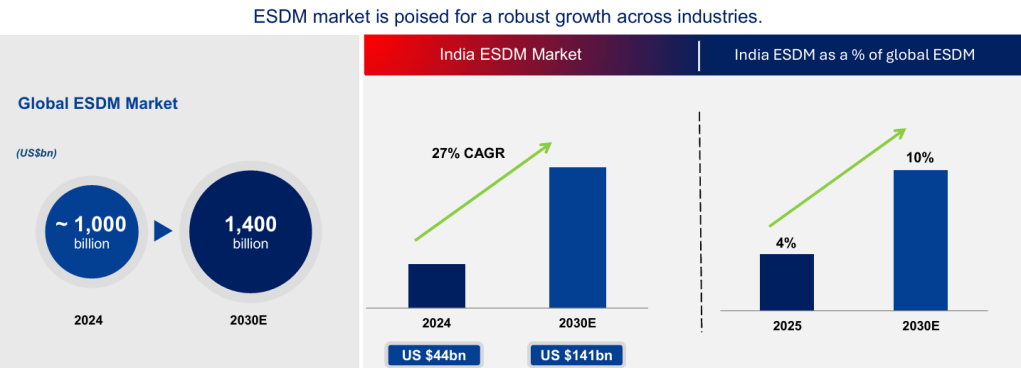

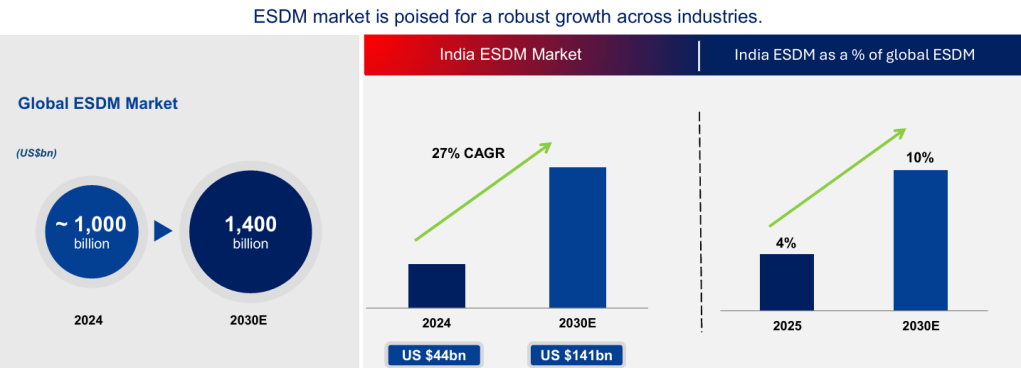

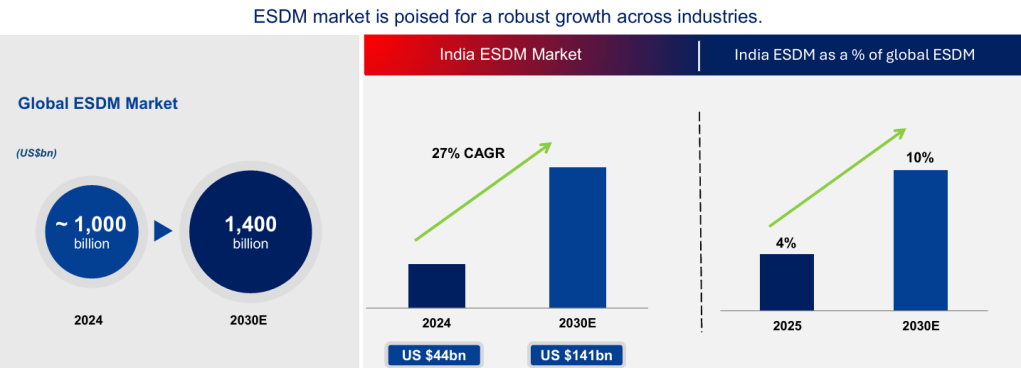

ESDM market and India’s % share

BE FINANCIALLY INDEPENDENT

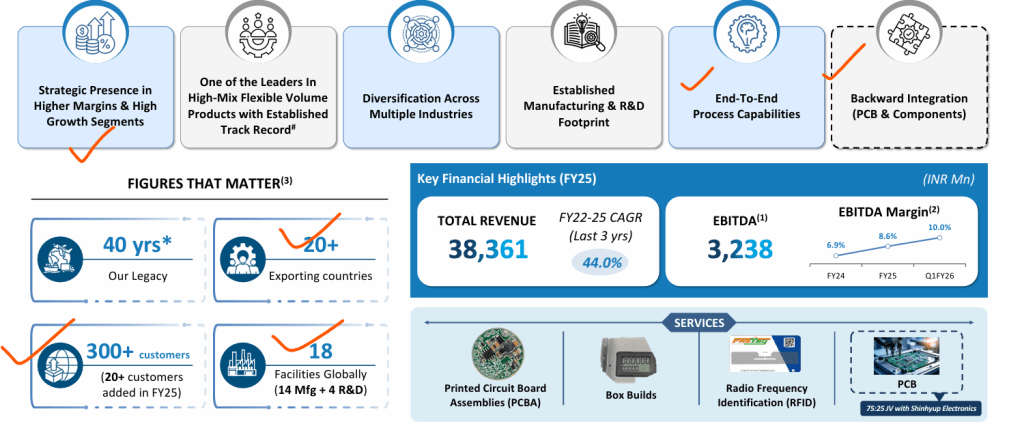

Lets start with Financial highlights

49% box build revenue catches my eye

Greenfield and brownfield expansion

Partnership with global equipment manufacturer company for complex subsystem manufacturing

Partnering with CDAC for high performance computing

Partnership with Zepco in motors, drives, controllers.

Secured projects in global auto components, home electrification, rail, industrial, infrastructure, clean energy, and communications

OUR DUAL SHORE MANUFACTURING

In FY2025, we enhanced this model with the commissioning of a new export-focussed facility in Chennai. Construction has also begun on two additional facilities – one to serve growing domestic demand and the other focussed on exports. Our U.S. operations continue to serve marquee customers in highly regulated sectors, while our Indian facilities leverage scale and cost benefits

One stop shop and Diverse capabilities

Solutions

All major certifications

We have covered this company earlier at

SYRMA SGS

Manufactures various electronic sub-assemblies, assemblies and box builds, disk drives, memory modules, power supplies/adapters, fiber optic assemblies, magnetic induction coils and RFID products, and other electronic products. The company is a part of Tandon Group with Sandeep Tandon as chairman of the company. Its manufacturing facilities are spread across Northern India (Bawal, Haryana, Manesar, Haryana, Baddi, Himachal Pradesh) and southern India – Chennai (Tamil Nadu), Bengaluru (Karnataka).

One of India’s Largest ESDM Company in the Non-Consumer Segment

300+ customers, 18 Facilities, 20+ exporting countries

with end to end capabilities and backward integration of PCB and components inhouse

Business verticals serving high growth industries

Four Dedicated R&D Facilities

1 in Germany & 3 in India

190 employees in RnD, 537 overall engineers

1800+ suppliers

Global certifications in place

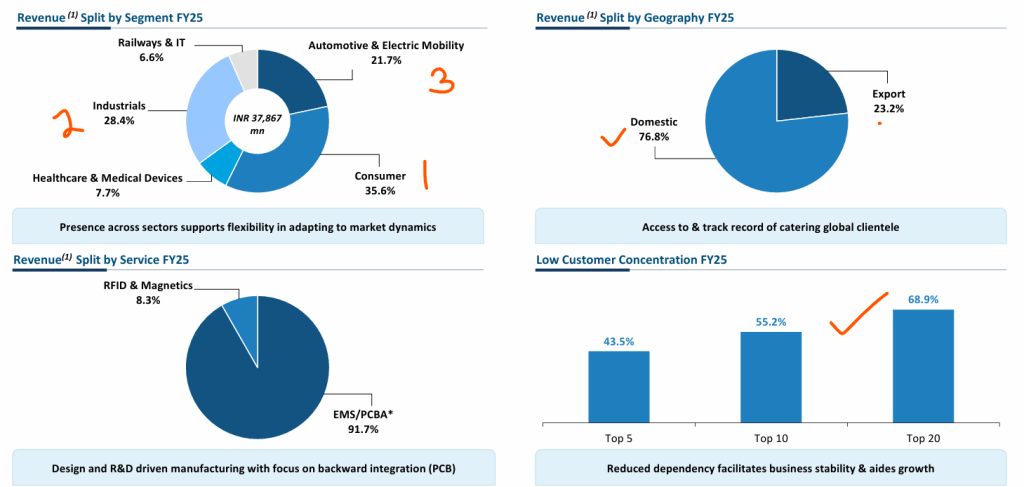

Revenue splits

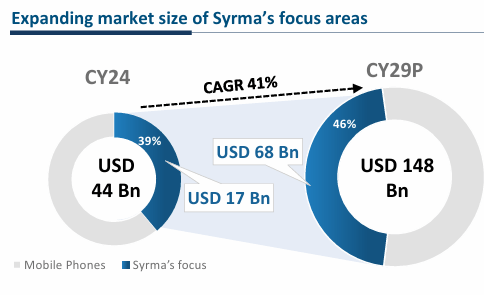

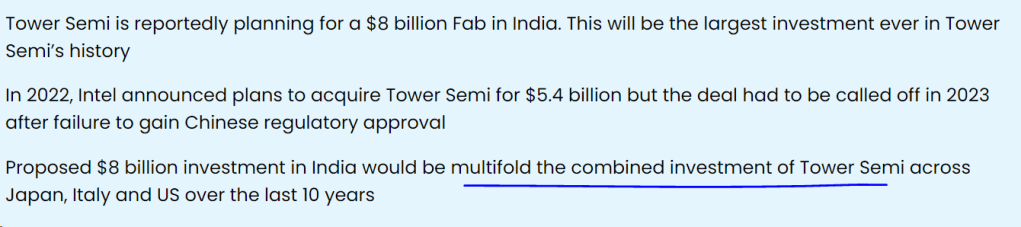

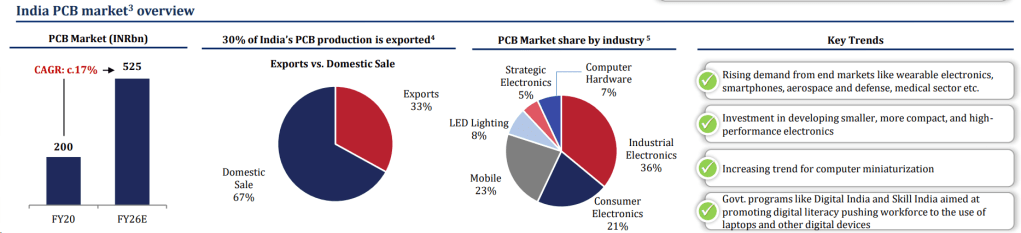

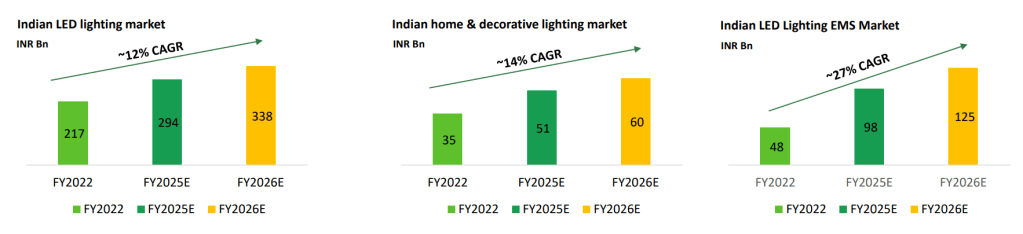

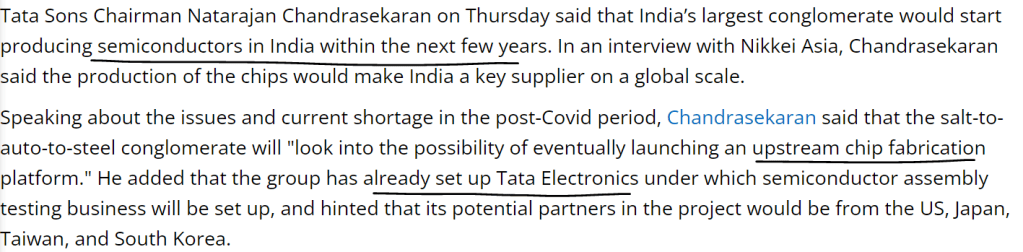

Opportunities and Growth Drivers

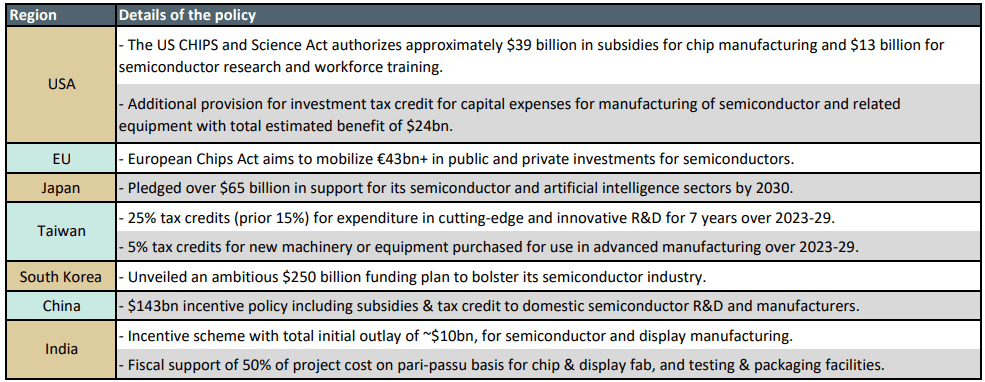

Government Initiatives

Capitalizing on government incentives such as PLI, MSIPS, ECMS, PM E-drive and EMC Tax incentives, infrastructure support

Growth of IoT & Smart Devices

IoT in industrial, automotive, consumer segments to drive customized solutions

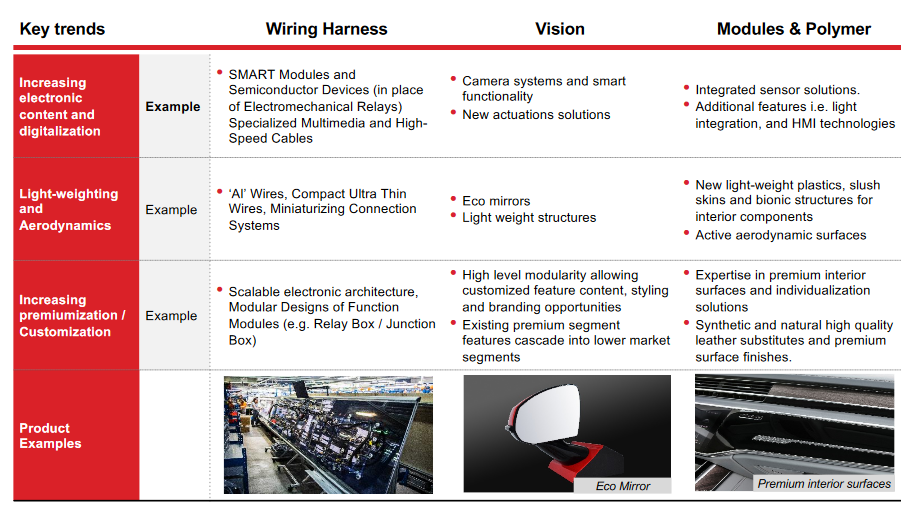

Automotive IoT growth driven by connectivity, ADAS, personal UI, etc

Export Opportunities

Rising trend of supply chain diversification

India being favored as the global alternative as part of China + 1 strategy

Increasing outsourcing by OEMs

OEMs increasing reliance on ESDM players for cost efficiency, scalability, supply chain flexibility

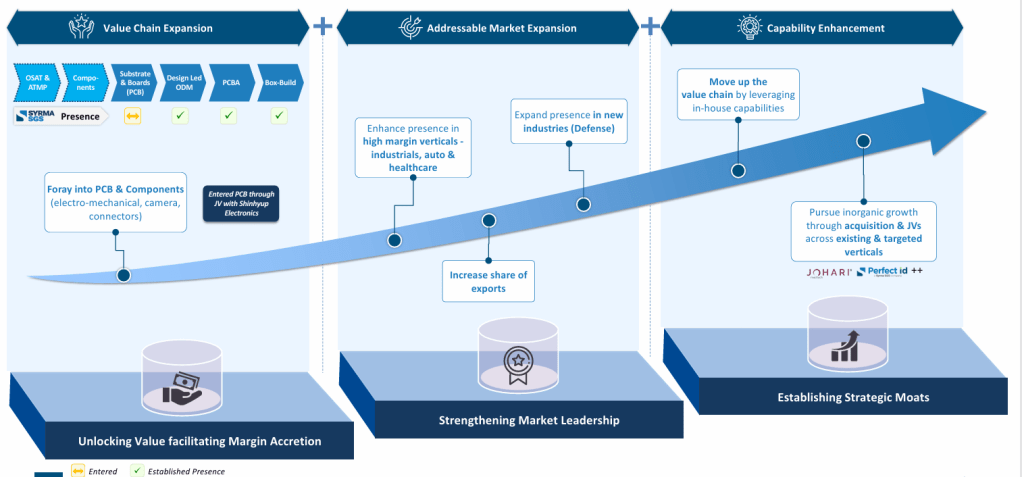

Increasing focus area

Very very interesting chart on what SYRMA wants to do in coming time

RISKS

The company imports 60% of its material requirements, which exposes it to foreign exchange fluctuation risk. While part of the forex exposure is naturally hedged from exports (about 25% of the total revenue), the company takes three months forwards to cover part of the open exposure and is able to pass on the impact of foreign exchange fluctuation to customers to some extent, any major forex fluctuation can impact the margins.

Time to time changes in technology may impact business in short term

Intensive working capital nature of business may need consistent cash flows

Technicals

Implementation of production-linked incentive (PLI) schemes worth up to ₹1.45 lakh crore for 10 key sectors announced recently by the government is likely soon.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Source : Motherson Sumi Investor presentation

Also read : https://alpha-affairs.com/2020/07/05/growth-motherson-sumi/

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.