Buyer to builder

BE FINANCIALLY INDEPENDENT

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Key Investment thesis –> Company focus on Aerospace, Defense, Semiconductor, Electronic system verticals and gearing up for FY26, FY27

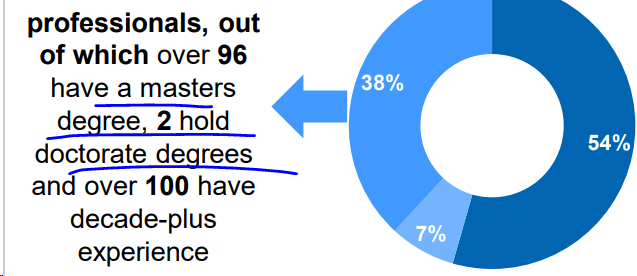

AXISCADES is a leading, end to end technology and engineering solutions provider aiding creation of innovative, sustainable and safer products worldwide. AXISCADES is headquartered in Bangalore with subsidiaries in USA, UK, Canada, Germany, India and China; and offices in Germany, France, Denmark, USA and Canada.

AXISCADES has a diverse team of over 3,100 professionals working across 20 locations across North America, Europe, UK and Asia-Pacific, striving to reduce the program risk and time to market.

The company offers Product Engineering Solutions across Embedded Software and Hardware, Digitization and Automation, Mechanical Engineering, System Integration, Test Solutions, Manufacturing Engineering, Technical Publications, and Aftermarket Solutions.

The solutions comprehensive portfolio covers the complete product development lifecycle from concept evaluation to manufacturing support and certification for Fortune 500 Companies in the Aerospace, Defense, Heavy Engineering, Automotive, Energy and Semiconductor industries.

Company Portfolio

Current serving Major Industries

Awards

Received 3rd consecutive Diamond supplier award from Bombardier for 2022. This recognition is a testament to our unwavering commitment to excellence, innovation, and delivering with the highest standards of quality.

Opportunities :

Revenue Breakup

FY24 revenue breakup

Q1Fy25 revenues breakup

Q2Fy25 revenues breakup

Stable OPM, Stable tax, Quarterly YOY growth in sales and PAT, Borrowing reducing

DE ~0.4 , Free cash flow is good , Pledge is Nil, ROCE < 15 and ROE<10%

Promoter has sufficient skin in game, Cash flows are good, Cash conversion cycle is elongated

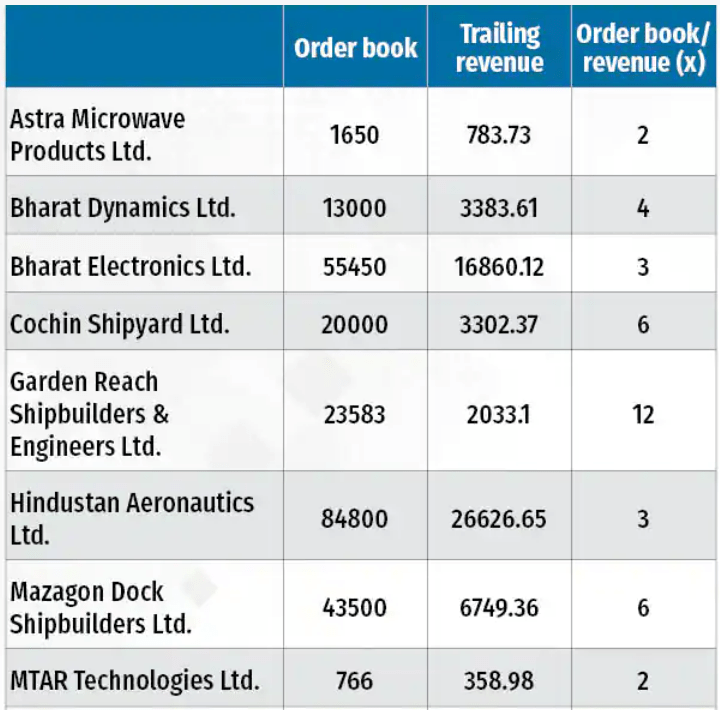

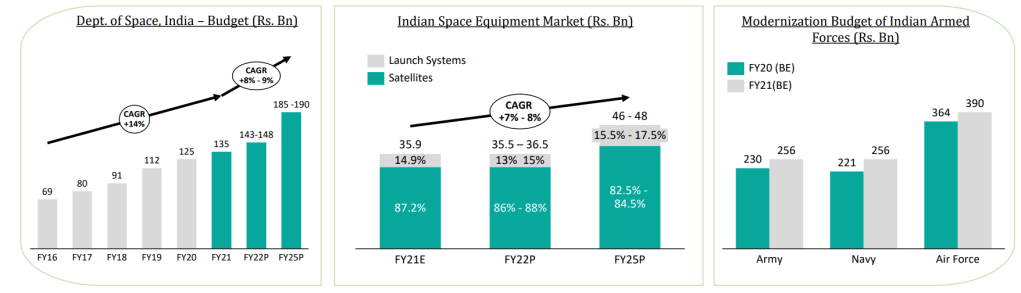

Macro Trends :

Recent Triggers in last 1 year or so

Appointment of Chairman Mr. Abidali

Appointed Mr. Abidali Neemuchwala as Chairman of the Board and Non-Executive Director at AXISCADES. With a distinguished career spanning over three decades in the technology industry, he has earned enviable reputation for his expertise in aligning organizations, driving business results, and consistently leading transformational initiatives.

Strategic partnerships and Opening Engineering design center

Signed a strategic partnership with with Cantier, a Singapore-based powerhouse in Manufacturing Execution Systems (MES), with a specialization in Industry 4.0 integration to create a synergy that promises to elevate precision, efficiency, and innovation in the manufacturing sector.

Inaugurated Engineering Design Centre in Saltney, UK to serve the long-term requirements of the Aerospace Industry and various promising opportunities in the region.

Signed a strategic partnership with KANZEN Institute Asia-Pacific Pvt Ltd (KIAP), for new age Industry IIoT, Digital Automation and MES 4.0 implementation for delivering enhanced value to our Global customers.

Mergers and Acquisitions and QIP

Completed the acquisition of add solution GmbH which will strengthen our service offerings and bring opportunities to deliver enhanced value to our combined global client base. . This will provide us with a strategic foothold in the automotive space, with significant offshoring opportunities and access to marquee global automotive OEMs.

The board has also approved the acquisition of EPCOGEN., a niche service provider in Energy space, specializing in engineering design and solutions. This proposed acquisition will strengthen our presence in energy vertical, provide access to Middle East and North American Energy markets

QIP in Jan2024 at 657Rs/share — The Company successfully concluded the Equity Raise of INR 220 Crores in January 2024, with marquee Institutional Investors subscribing to the issue. This will strengthen the balance sheet and improve profitability, Reduction in Net Borrowings by 60% from INR 214 crores to INR 85 crores, which will significantly reduce Finance Cost

Deal Wins

Q4FY24 updates

Order book at 30th Ap24 — 749Cr

Q1FY25 updates

Expenses hit in past Q3/Q4 Fy24

Increase in finance cost due to debt funding for Mistral acquisition . In Q2 FY24, the material cost has increased due to increase in production orders in Mistral and increase in employee expenses on account of annual increments and investments in building competencies in Embedded and Digital for future growth

Q2FY25 Update

Defence revenues grew by a healthy 73% QoQ, with Defence production revenues surging by 84% QoQ, bolstered by a significant order backlog set for execution in fiscal years 2025 & 2026. With a healthy pipeline and focused approach, over the next 12-18 months, we aim the defence revenue to reach around 60% of the overall company’s revenue

Management commentary With latest focus areas

Capturing some discussions from Dec24 confcall

C2P strategy, that is, chip to product. That is Mistral’s non-defense activity, or our group’s non-defense activity., we are shifting the center of gravity of C2P to US. Basically it will be driven out of US. We’ll have a small team there and driving the offshore team here. That’s the strategy

We are a very, very good RF in RF. We consider we are among the best in India for RF. RF and RF activities. Second is probably we are one of the best in handling mixed signals. We can handle analog, digital, RF, everything together. That is one of our forte.

Third is sensor fusion. We can handle multiple sensor. Sensor fusion comes very, very handy when you deal with multiple sensor in a new AI environment, in new robotics or auto-driven and those kinds of things. We are extremely good in both. Then we are very good in ruggedization. We are especially because we are very defense focused. We can ruggedize any product and do that.

And finally that we are very good in the chip, chip level, post-silicon, whatever it is, validation, verification, and take the chip to the product and then product to the customers

Continuous Hiring of Talent

Orders winning, Expansion in Middle east and Outlook for different segments by Management

Added this latest development on 17Jun25

INDRA SIGNS AGREEMENT WITH AXISCADES TO BOOST PRODUCTION OF CUTTING-EDGE SYSTEMS IN INDIA

Technical chart on 15-dec24

Technical chart on 29-dec24

Highly competitive industry

Acquisitions dont play out as anticipated

Customer concentration risk – On a consolidated basis, ~26% of ACTL’s revenues in FY23 were from its top two clients (35% in FY22).

Slowdown in Europe impacting automotive revenues

Heavy Engineering vertical remains a drag for few more qtrs although optimization work going on

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Also Read : INOX INDIA

Its about iDEX and IDDM

Disclaimer – Below Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Business —

Data Patterns is a leading player in India’s Defence and Aerospace industry. The Company is respected for its proprietary capabilities: design to manufacture, testing to validation and support for products throughout the life cycle. Data Patterns is the only Indian company in the Defence and Aerospace sectors to offer complete systems.

Data Patterns’ core competence covers the entire spectrum of electronics including Processors, Power, RF and Microwave, Embedded Software & Firmware. This unique capability allows Company to offer complete solutions, an area addressed only by international OEMs.

Data Patterns has succeeded in building products in high technology domains such as Radars, Electronic Warfare (EW), Communications, Satellite Systems, Video, Control Systems and Navigation, besides others. It is one of the few Indian companies offering indigenously developed products catering to the entire spectrum of Defence platforms – space, air, land, and sea. The Company established its quality management system in line with the demanding standards of AS9100 Rev. D by TUV-SUD, an internationally acclaimed certification

Product offerings and Clients

Can they do 3x in next 6yrs for revenue? Chances are bright with emerging tailwinds

Moats —

Biggest moat is long term relationship with Indian Defense companies built over years. A new company will take years to develop, manufacture, provide and test the integrated systems and then won new orders

Data Patterns is the only Indian company in the Defence and Aerospace sectors to offer complete systems.

Data Patterns’ core competence covers the entire spectrum of electronics including Processors, Power, RF and Microwave, Embedded Software & Firmware. This unique capability allows Company to offer complete solutions, an area addressed only by international OEMs

Strengths

Capabilities and Opportunity

Some triggers and updates ( Market size, order wins etc)

Opportunity Size

TAM (total addressable market) of USD 4.65 bn by 2030 growing at CAGR – 9% from 2020*

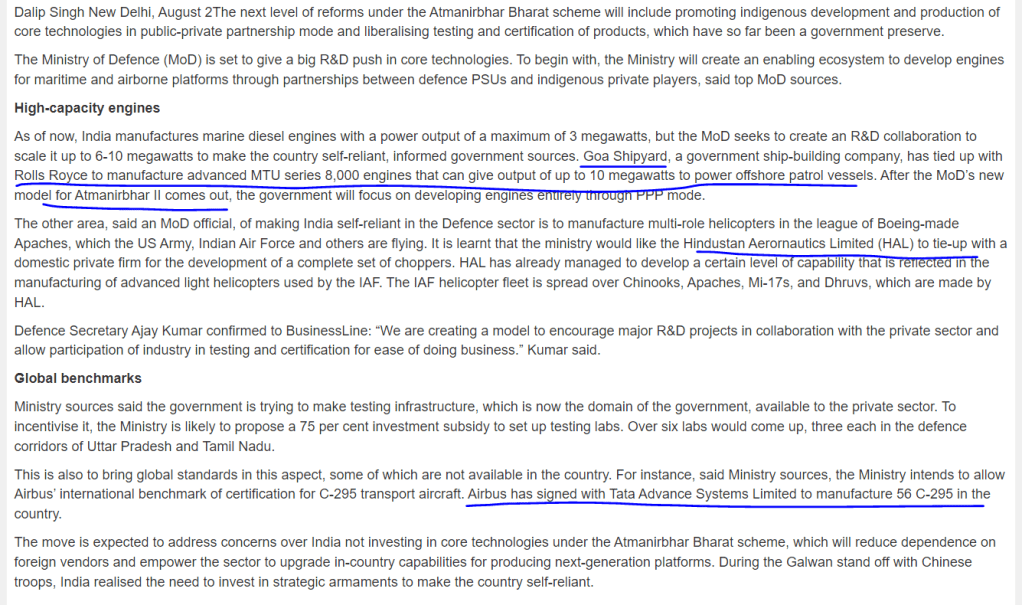

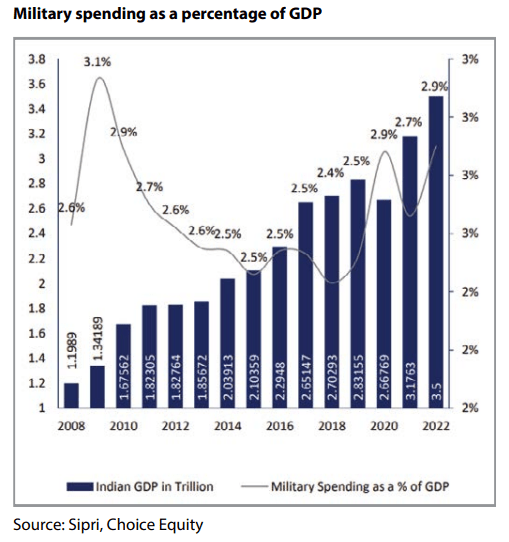

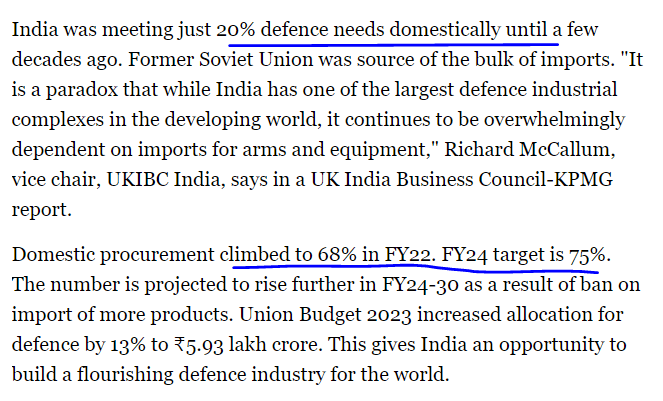

Make in India, Indigenous manufacturing defense Theme

Beneficiary of shifting procurement trends in Defence – Aatma Nirbhar Bharat , Make in India, new defence acquisition policies among

others

Increasing indigenization, Domestic defence procurement, Higher share of electronics in warfare

Defense modernization program

Expansion of facilities

Data Patterns is in the process of upgrading and expanding the current facility, with a proposed doubling of available floor area and manufacturing capacity, as well as addition of capability of handling large and heavy equipment, integration of large radars and mobile electronic warfare systems, satellite integration facility. The new infrastructure is slated to be ready by September 2022.

Data Patterns is also in the process of acquiring an additional 2.81 acres of adjacent land for further expansion

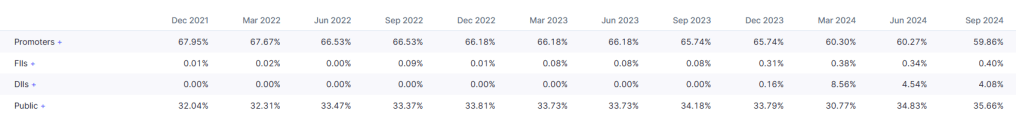

Promoter holding

Promoters have sufficient skin in game, along with FII and DII holdings and big players leading to only 21% approx for retail investors

Fast rampup in orders is key along with execution. Will fast orders and execution can lead to profitability, we need to see in coming quarters and years

The business has long gestation period and inherited execution delays, consequently causes volatility in revenue recognition

Company face challenges to meet the requisite financial criteria of tender based business, for which it needs to rely on bigger entities

Cash conversion cycle and working capital cycle has been really a big risk. Need to be watchful on these two parameters consistently. Major trigger is inventory levels, which should come down with normalized operations and betterment of chip availability

Seasonality Improving but Q4 still Significant

Valuations for such company is difficult to judge as growth can happen exponentially and company one good year can turn the tables on valuations and vice -versa. As per experience start with specific risk reward and then performance observed over a period of time and as and when orders emerge.

Looking at past, such companies look overvalued, Looking at future opportunities, Company seem undervalued

We entered around 700 even when valuations look high and markets took it to 1540+ –so Premium companies might be rerated faster than one can imagine –hence our focus is to ride as long as growth happens in company but 1-2 quarters should not deter us to stop holding long enough and give chance to company to perform

Only thing here is if valuation blow up faster than business –we need to book some partial profits

Your strategy can be different than mine. Your selection of company might be different than mine. So let’s not be a BLIND FOLLOWER

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.