Category: Wealth destruction

ZERO

Missing and Not found yet!!

And what happens next!! Are you ready

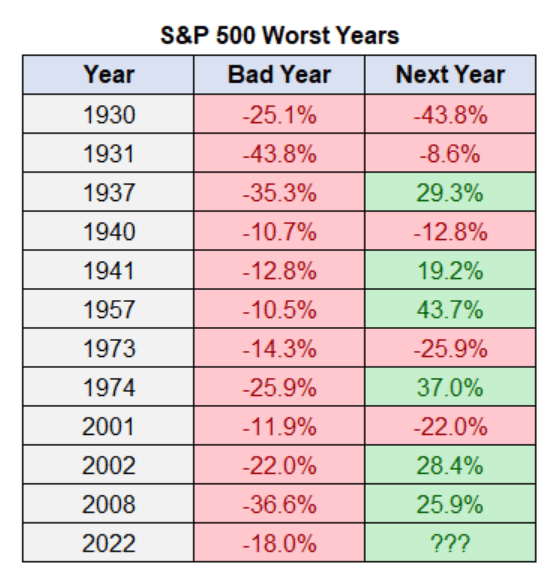

The thing about big losses in the stock market is sometimes they are followed by big losses…but sometimes they’re followed by big gains.

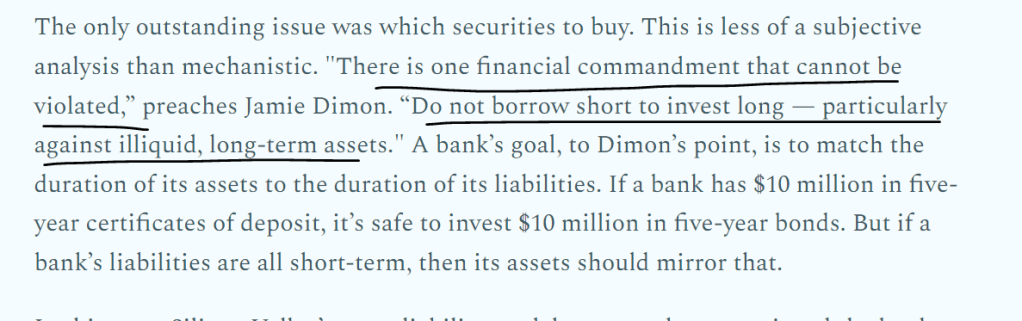

Sin of SVB

Your thoughts are not your own!!

Neo Phoebus LED cartel

But Relevant question as a investor is –> WHO MAKES THE DRIVER!!!

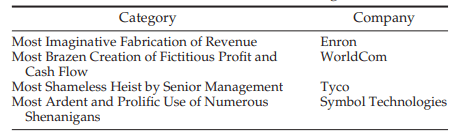

As BAD as it gets

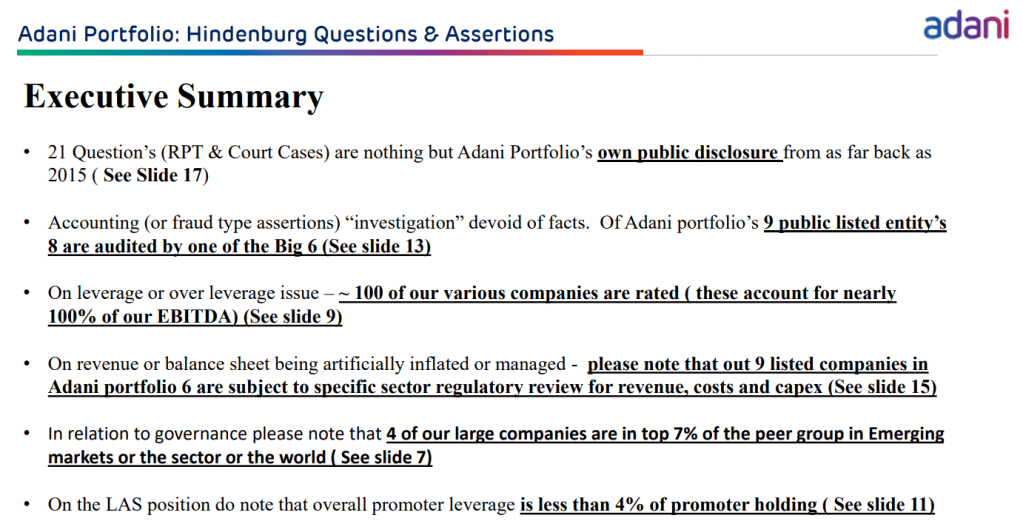

Response to response to response : Adani vs Hindenburg : Undying Saga

Step1

Step 2

Step 3

413 page response by Adani

Gist of response here

Step 4

Hindenburg response to Adani group here

Answers to Qs of Adani

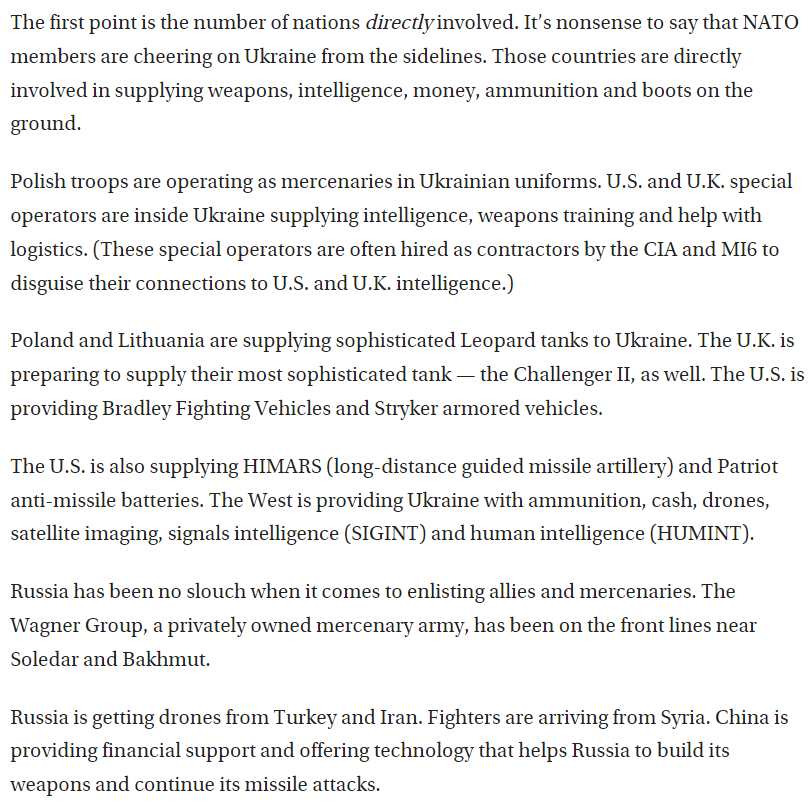

1937 stage : World war III

RBI on crypto

IPO 2022

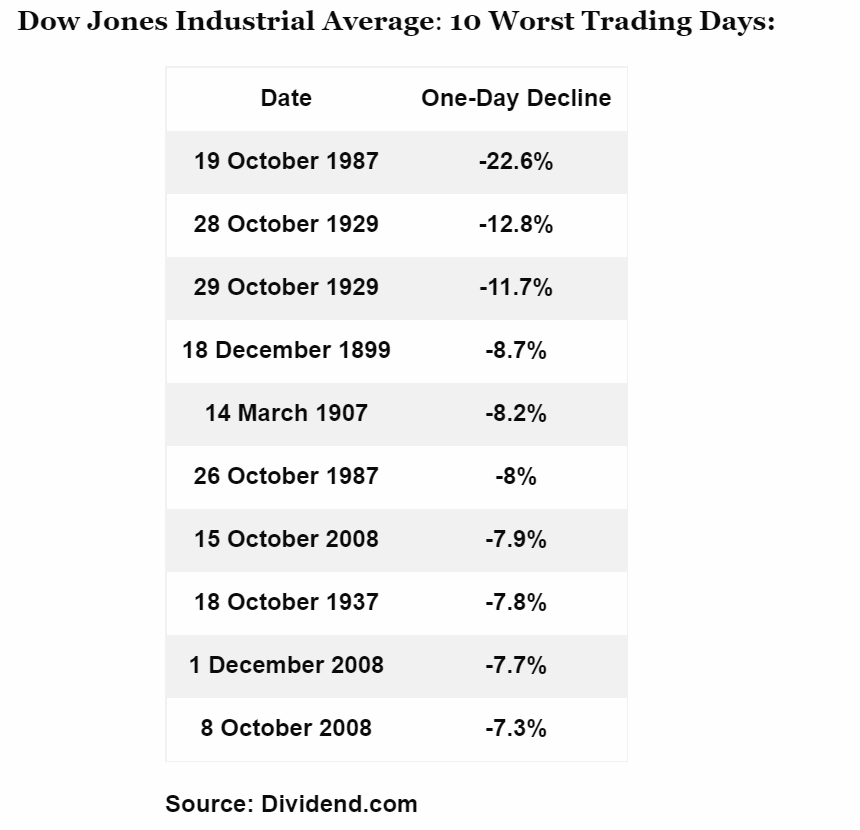

Haunted October

Frenziness…

Another Wisconsin!!

Side effects of Crypto : Luxury Watches

Behaviour in bear markets

Indian IPO : Bogus applications!!

90 is half of 80!!

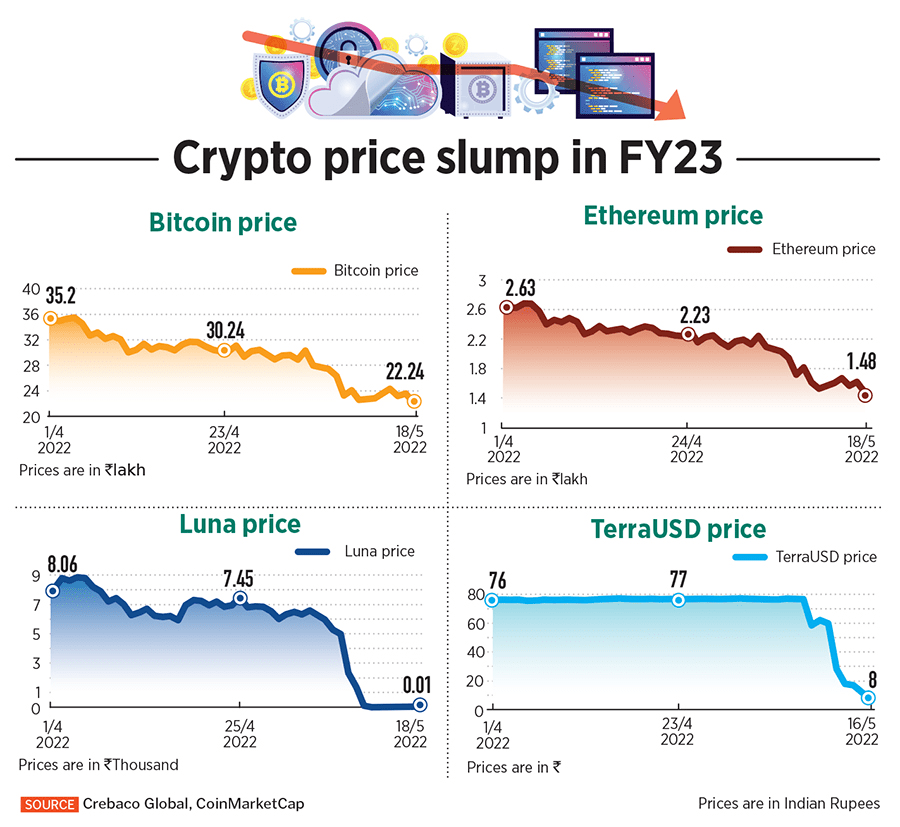

Crypto Price Slump -40 to 90% down

ICEX out

TDS in Crypto ecosystem

Hot Potatoes : Free fall in many recently listed IPO

Vikas of NPA underway!!

Digital Gold : BEWARE or BE AWARE

MSEI: Wicket ready to fall down?

8 months : 8 brokers : Penny wise Pound foolish

How the Mighty Fall!

Zomato IPO : Subscribe or NOT?

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Zomato IPO is little different because company is showing losses and when they will break-even is not sure. So read further and analyse all points with a pinch of salt. Many investors dream of being a venture capitalist one day and to all those guys, Zomato is giving you a chance.

Put your HAT of venture capitalist and drop the hat of investor to view this IPO. If it works good — ENJOY!!, If it does not–Don’t lose sleep.

Zomato IPO– Incorporated in the year 2008 as a restaurant-discovery website – Zomato, is now one of India’s largest food delivery company.

Business — Zomato has four business segments – two core B2C offerings including food delivery and dining-out. There is B2B ingredients procurement platform ‘Hyperpure’ and the customer loyalty program, ‘Zomato Pro’ as well

Region of operation — Company has operations in 23 foreign countries – UAE, Australia, New Zealand, Philippines, Indonesia, Malaysia, USA, Lebanon, Turkey, Czech, Slovakia, and Poland. However, the company generates 90% of its revenue from India.

Offer purpose — 9,000 crore will be a fresh issue, while the remaining an offer for sale from the oldest investor – Info Edge (India) Ltd. Company will be possibly using this money for organic and inorganic growth

Risks —

Company unit economics of profitability is not sustainable as of now

Highly competitive industry and many players have shut down in past few years. Any new player with deep pockets can come and start competing. Amazon has already started with aggressive pricing

High dependence on order size and repeat orders for making money

Strength

Adjusted for cash and cash equivalents, Zomato has an asset-light balance sheet and it will help company to sustain for few more years with almost 16000cr cash and cash equivalents

Covid-19 has given push to delivery based eating model and it will possibly help the company to cut operational costs with lower discounts and higher delivery charges

Only two major players in fray and other players are only focused on one part of business while Zomato is well leading ahead in other domains as of now

Able management

International presence

Future

Company has been growing and survived last few years onslaught when many players have shut shop(including uber, ola, foodpandaetc). The way Indian population is moving to nuclear families, demand for food delivery will increase and so will be competition.

Hence ability to charge high prices may remain limited.

Diversification into other areas like stake in grofers, kitchens, increase in memberships may help the company to survive against competition a bit longer.

How fast they can expand in tier 2 and tier 3 towns and how much they are able to extract from people is the key in next few years for breaking even.

Its the only player in 4 different segments as compared to peers is an advantage for them as of now

Valuations

Valuations are extremely stretched out. Nothing much to talk sensible here

Should we apply?

People falling into high risk taking category can bid in IPO and and add more after listing to play out this theme over few years.

People who can take risk of capital erosion can subscribe with one lot and book out on listing gains if any.

Please note that company is not profitable and entire capital put in company shares can go down the drain if things do not turn in anticipated way

Whatever you want to do with this IPO , don’t become a long term investor if you applied for listing gains or vice versa. Be sure of why you are applying and stick to that

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Defaulting Brokers : List getting longer

Cozo Pets !! Is it a fraud

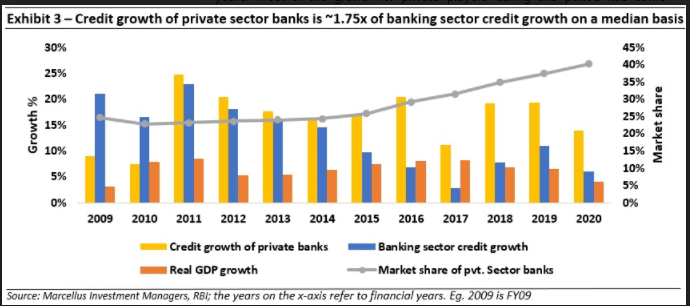

Private banks vs Banking sector

$Titan –> $64 to $0

Checkmate : WazirX

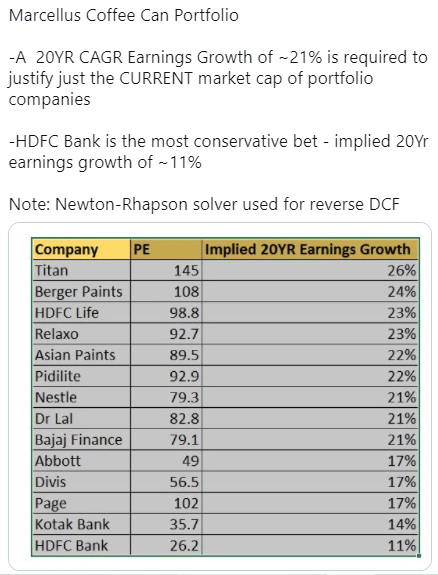

Coffee Can and 21% CAGR for 20 years!!

Minority shareholders : JSPL

Bitcoin crash a win for cryptos!!

InvIT : Why to avoid

Yield : No assurance

Capital : Risk of capital losses

Fees : Multiple layer of fees with no regulatory cap as of now

Taxation : Complex : Interest Income, Dividend Income, Capital gains might fall into different tax slabs

Returns : Not guaranteed, can be lumpy

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Mutual Fund mistakes to avoid

Software in 2k : Oxygen in 2021

Why NFO Investing is a Bad Idea

Another Multibagger in making : Bad loans

DHFL : Zero Valuation in offering

Investments in 2020 : Are you on track?

Cox and Kings : Self destruction

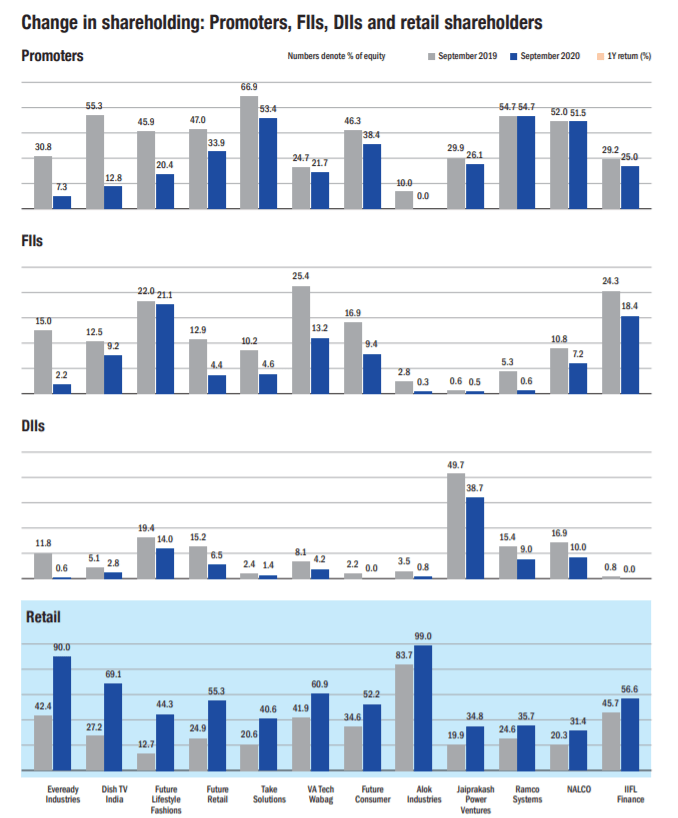

Value buying or value trap for retailers !!

Retail investors often take their investment decisions based on the share price instead of the fundamentals. They tend to buy what looks ‘cheap’ and get influenced by the news around a company. They often see a large fall in share price as an opportunity. However, such investments often end up becoming value traps. A huge price decline may not always be due to a temporary issue but also due to a permanent dent in the company’s prospects. Also, a sudden surge in the stock price attracts retail investors. They then invest in such a company, without paying much attention to its fundamentals. Curiously, the lower the ticket size of the share, the more interested retail investors become. All these are wrong reasons to buy a stock. A stock should be bought because the fundamentals of the underlying company are robust. Tracking the activity of promoters, FIIs and DIIs can be a useful input in determining this.

-source Valueresearchonline

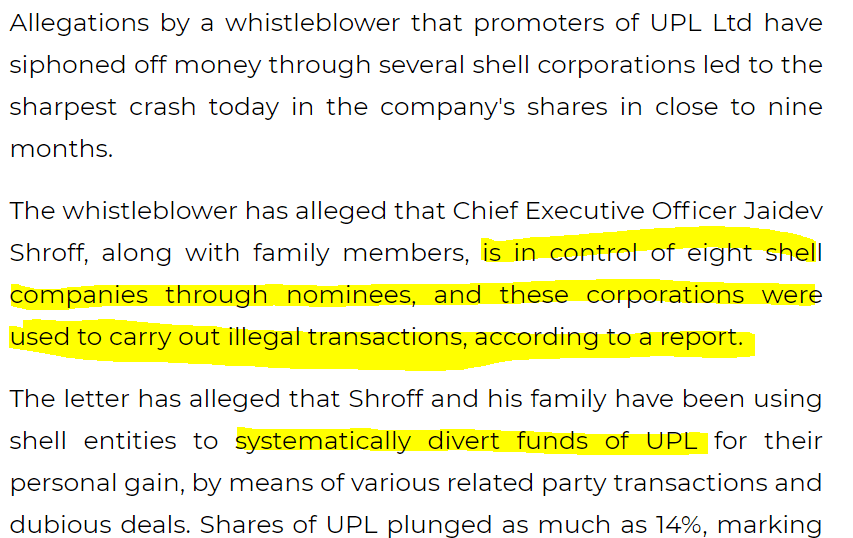

UPL Money Siphoning case : Be Aware or BEWARE

Top Dividend players to Govt

Investor Dilemma : Nash Equilibrium

Nobel prize winning economist John Nash created the pay off matric for prisoner’s dilemma.

Focusing on Nash equilibrium is important for best desirable outcomes

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Chasing oversubscribed IPO on listing day!! See this

Borrowing against Investments : Beware or Be Aware

In times of trouble, lot of avenues available to monetize your investments and borrow against them.

You need to be aware of what is available and at what rate? Kind of repayment flexibility available. Read more

Addition to Ponzi Scheme

It’s SPICEJET turn now

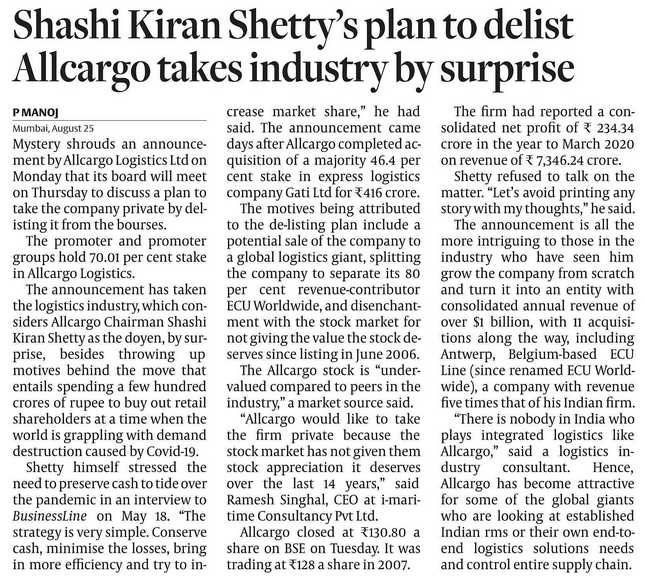

De-listing Season

There are few companies who have announced plan to delist from Indian bourses. Most of these companies are either planning to sell their holding to global players or promoters want to take private control citing the markets not giving right valuations to their company stock prices.

Prominent names inlcude

Vedanta

Adani Power

Hexaware

and latest in the list is

All cargo logistics

This is different from delisting due to other reasons like Sancia Global Infraprojects Limited and Delma Infrastructure Limited where no trading happened for six months and these companies were planned to be removed from BSE exchange some time back

Will PSB Recap ever end?

Future of Future !!

YES BANK : Path to recovery

Times are changing : HDFC bank ?

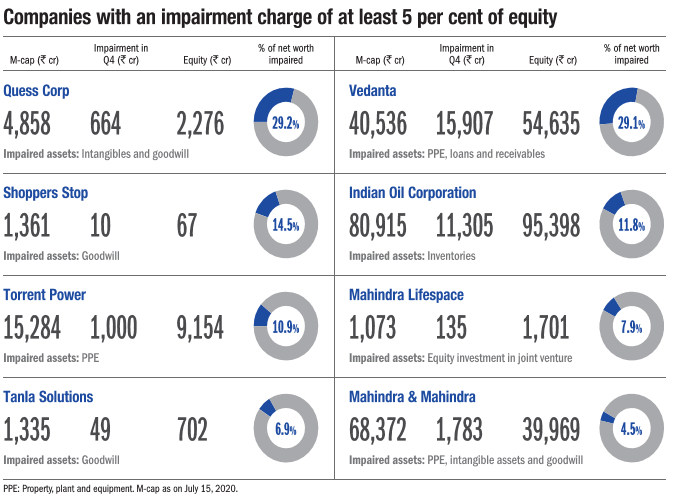

Impairment Charge : BEWARE or BE Aware