Category: Stocks

Protected: Positional Stocks 10-Feb-24

SS-7

EMS limited

CMP 569, Market cap ~3150cr

ROCE ~32%, ROE ~24%, D/E ~0.07 PE ~29 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6

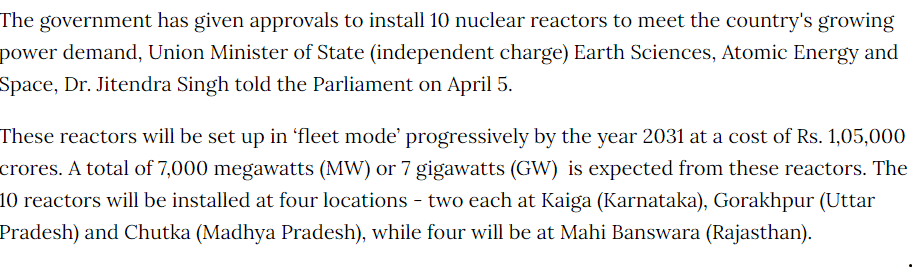

🟢EMS Limited is a multi-disciplinary EPC company, headquartered in Delhi that specializes in providing turnkey services in water and wastewater collection, treatment and disposal. EMS provides complete, single-source services from engineering and design to construction and installation of water, wastewater and domestic waste treatment facilities

🟢The company provides Sewage solutions, Water Supply Systems, Water and Waste Treatment Plants, Electrical Transmission and Distribution, Road and Allied works, operation and maintenance of Wastewater Scheme Projects (WWSPs) and Water Supply Scheme Projects (WSSPs) for government authorities/bodies.

🟢Healthy Order book of ~2100cr provides strong visibility of revenues over next few years. Company has repeat orders from various Government departments.

🟢EMS promoters have more than a decade of experience in executing water supply and sewage treatment projects

🟢Since incorporation, it has completed 67 projects in Bihar, Uttarakhand, Madhya Pradesh, Rajasthan, and Haryana. It has executed many projects awarded by government bodies such as Uttar Pradesh Jal Nigam (UPJN), Construction and Design Services (C&DS), Military Engineering Services (MES), and Indian Railway Construction Limited (IRCON). It has completed 4 O&M projects in last 4 years.

🟢Key clientele includes government bodies like Municipal corporation of Rajasthan (under AMRUT Scheme), Uttarakhand Urban Sector Development Agency and Bihar Urban Infrastructure Development Corporation (under National Mission for Clean Ganga ) and CPWD, Maharashtra

🟢EMS Limited has its own civil construction team and employs 57+ engineers, supported by third-party consultants and industry experts.

🟢Projects are mostly funded by World bank

🟢Development of Tier 2 Tier 3 towns, capital expenditure by Government gives good visibility for few years

🟢Promoter has sufficient skin in game with approx. 70% holdings, Sales are increasing and NPM is good

Risks

🔴Company works in a field of high capital intensive business and receivables will remain high

🔴Project execution risks within a budget are the ones which constantly hurts companies in these kind of businesses

🔴The company has not executed any HAM projects in the past but is executing one HAM project for the UP Jal Nigam. It has entered a joint venture with Ercole Marelli Impianti Tecnologici S.R.L. Italy.

🔴Revenue concentration from few clients/states poses a risk

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks 4-Feb-24

Protected: ALD 26-27Jan Presentations

Protected: Positional Stocks 27-Jan-24

SS-6

Kabra Extrusion Tecknik

CMP 417, Market cap ~1450cr

ROCE ~15%, ROE ~10%, D/E ~0.19 PE ~41 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5

🟢Kabra Extrusion Technik Limited : It is India’s largest manufacturer of plastic extrusion machinery for more than 4 decades and recently ventured into manufacturing of Lithium-ion Battery Packs. The company is a part of the well-known Kolsite Group.

🟢In Extrusion Machinery Business it is India’s premier manufacturer & exporter of extrusion plants with presence in 100+ countries with +15,000 installations. also commands close to 40% market share in FY23

🟢Industry application in different sectors like -Packaging Industry, Infrastructure & Construction, Telecom and Plasticulture

🟢It has different products : Blown Film Lines, Pipe Extrusion Lines, Sheet Extrusion Lines, Compounding Lines and Auto Feeding Systems

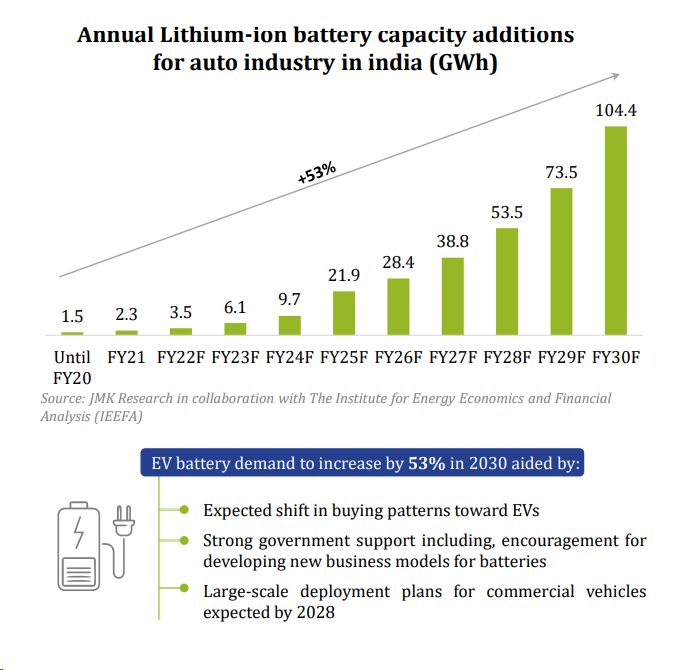

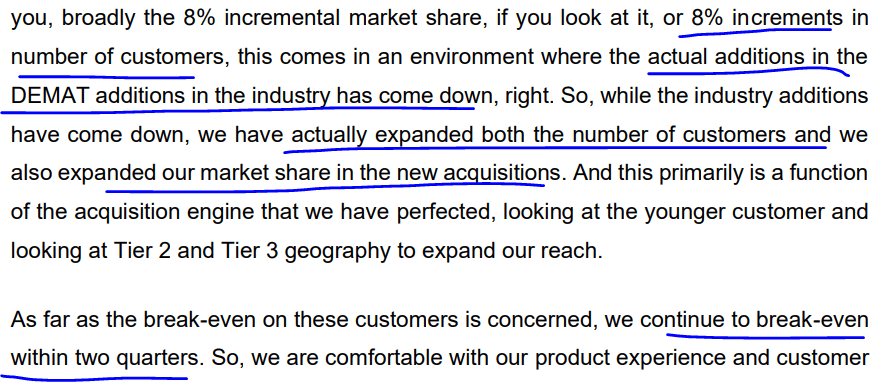

🟢In new segment of Battrixx –Its an emerging leader and commands approx, 15% market share where

🟢Battrixx business is a battery related solutions for electric mobility and energy storage, Battery & related components constitutes ~35-45% of cost in an Electric Vehicle

🟢Products in Battrixx segment are Battery Packs across multiple chemistries, Battery Management Systems (BMS) and IoT Solutions

It is One of the few players with

- The ability to handle multiple chemistries & types of cells

- Chemistries – LFP, NMC, NCA, etc.

- Types of Cells – Prismatic & Cylindrical

- Expertise across Electrical & Electronics

- Smart BMS

- IoT & Telematics

- Data Analytics Solutions

🟢Company is continuously investing in RnD and want to enter E-trucks, E-buses and ESS(energy storage systems)

🟢Company is first EV battery-pack manufacturer to be accredited with ARAI certification under AIS 156 Amendment III Phase 2 for its batteries, conceptualized and designed in-house strategically with Hero Electric’s R&D team

🟢Company had earlier won 3L battery packs and chargers order from Hero Electric Mobility for FY24

Key focus areas of our R&D

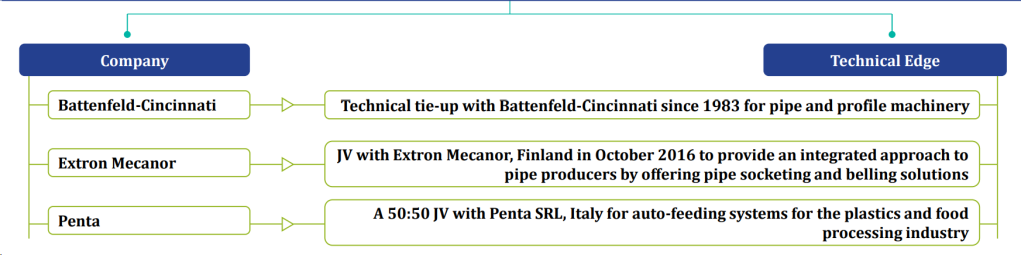

Company has technical tie up with Battenfeld-Cincinnati, Extron Mecanor and Penta for different domains

🟢Company has right tailwinds in longer run

🟢Company business is profitable though facing short term headwinds

🟢Promoter has sufficient skin in game with 60% holdings, FII holdings increasing in FY24

🟢Company credit rating has been upgraded last year CRISIL A+/Stable (Upgraded from ‘CRISIL A/Positive’)

Risks

🔴Company was able to successfully established new business but EV Battery sector run into headwinds with new rules. Company was first to be accredited with certification for new rules but still headwinds not went away fully. Company might take more time based on customers business

🔴Crude oil has indirect dependency as customers order go down for new machinery with increasing crude oil price. Hopefully now Crude is stable and Pipe volumes may come up seeing the real estate boom

🔴Low OPM, NPM margins as of now –may improve with both domains of business picking up

🔴Technically weak structure for stock price

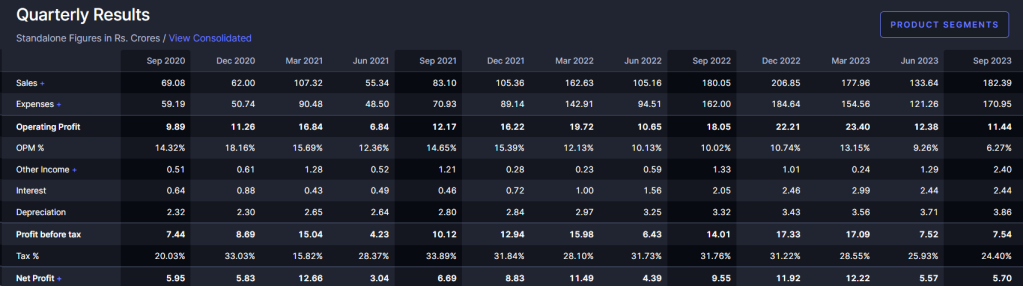

Financials

Company OPM have gone down recently and may take time to stabilize and come up. We need to carefully watch this space. Expected OPM is around 12% in longer run so enough space for company to showcase good results in coming years

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks 20-Jan-24

Protected: Premium Stocks : 13-Jan-24

Protected: Positional Stocks 13-Jan-24

Chemical and Pharma Player : AMI organics

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Ami Organics

SS9

CMP 1116, Market cap ~4100cr

ROCE ~20%, ROE ~15%, D/E ~0.16 PE ~57 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8

Business

AMI Organics (AMI) is a research and development driven manufacturer of specialty chemicals with varied end usage and is focused on the development and manufacturing of advanced pharmaceutical intermediates for regulated and generic active pharmaceutical ingredients (“APIs”) and New Chemical Entities (“NCE”) and key starting material for agrochemical and fine chemicals. AOL has three manufacturing facilities (excluding the recent acquisition of Baba Fine Chemicals [BFC] during H1FY24). Company manufactures intermediates from the ‘N minus 8’ to the ‘N minus 1’ level (where N is the final active pharmaceutical ingredient [API])

Products, Segments and Strengths

Company operates in two segments

Advance Pharma intermediates — 185+ Products, Intermediates across 17 therapeutic areas, Chronic Therapy focus: ~90%, Majorly backward integrated to Basic Chemical level, 50-90% global market share key molecules

Fermion had been among the biggest clients for Ami Organics in this domain. Ami Organics had been supplying intermediates for APIs like Darolutamide (prostate cancer), Entacapone (Parkinson) and Trazodone (Antidepressant). Company would be supplying an advanced intermediate for the Darolutamide API, starting from Q4FY24. At present, the company is the exclusive supplier for the same.

Speciality chemicals –This is where we are interested in coming future

Niche KSM for Agrochem and Finechem companies, Parabens & paraben formulations, Salicylic Acid and other specialty chemicals that

find end-use in cosmetics, dyes, polymers and agrochemical industries, animal foods, and personal care industries

New segment – Electrolyte used in manufacturing cells for energy storage devices. This also has huge potential in solar industry, automobiles industry

Clients

Advance intermediates : Speciality chemicals sales ratio –Approximate is 82:18 which is expected to go towards 75:25 in coming time. FY23 Ratio was 84:16

Export Sales: Domestic Sales ratio is approx. 58:42 in FY23, Q2FY24 ratio was 54:46 due to China oversupply and price erosion factors

➢ Well established and long-term relations with domestic and MNCs across large and fastgrowing markets globally

➢ Diversified customer base, 58% of revenue from Top 10 customers in FY23, 13 customers associated since last 10 years, 50 customers associated since last 5 years

➢ Long term supply contract with key customers

➢ Prolonged adherence to stringent client requirements leads to new business from existing customer base as well as from new client. ➢High entry barriers due to long gestation period to be enlisted as a supplier, Involvement of complex chemistries, Regulatory requirements. First to Market in most of the products

Strong focus on R&D

120 R&D members with 16 PhD, 14 process patents, Average approx expense on R&D is 1.7% of Revenue over last 4 years. In absolute terms its almost 7-8Cr per year

The Patent Office, Government of India, has granted Pracess Patents to Company for its inventions titled:

- A PROCESS FOR THE PREPARATION OF 2- (PIPERIDIN-4-YL)-1H-BENZO[D]IMIDAZOLE

- APROCESS FOR THE DIRECT SYNTHESIS OF FEDRATINIB INTERMEDIATE

for the term of 20 years in accordance with the provisions of the Patents Act, 1970. The above mentioned patented processes have been indigenously developed at the R&D Centre of Ami Organics Limited. With this the total number of Patents granted to Company for its innovative processes and technology stands at 9.(march2024)

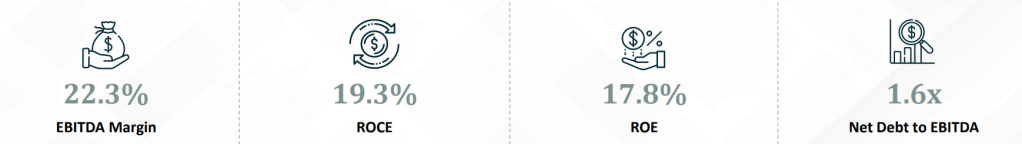

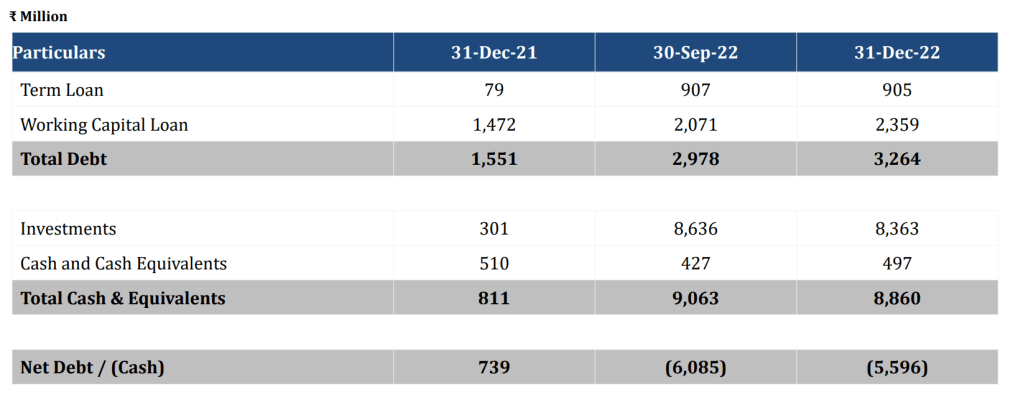

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

Sales and Profits have been growing decently(>25-30%) over past few years while for current FY24, it has slowed down, FY25 and FY26 seems to be the major booster for company going forward

Similarly ROCE and ROE has come down in last 2 years but still at reasonable levels

Debt to equity is at comfortable levels and can afford more debt for future expansions

Cash conversion cycle is on uptrend (not a good sign) and Working capital days are also increasing . Need to be monitored closely

Shareholding pattern

Increasing promoter holding, FII, DII are increasing stake, Public domain have few strong holdings as well

ALSO READ : Company at Y2K moment

Recent Developments

Advance Pharmaceutical Intermediates

➢ Fermion contract: – Signed a new contract for additional advanced intermediate taking total product under CDMO contract to 3 products. On track to start the production from Q4FY24 onwards from Ankleshwar Unit

15-sep-23 Ami Organics Limited has signed another definitive multi-year, multi-tonne agreement with Fermion. As part of the agreement, Ami Organics will supply an additional advanced pharmaceutical intermediate to Fermion. Based on the supply projection shared by Fermion, the total minimum contract value is expected to be multi-million Dollar, spread across multi-year horizon. The product is expected to start contributing meaningfully to the revenue from FY25. Ami Organics had signed its first agreement with Fermion in November 2022 for supply of an advanced pharmaceutical intermediate. This agreement is in addition to previous agreement and further increases the total value of the CDMO contract with Fermion.

14-Dec-23 Ami Organics and Fermion ink another agreement for two additional Advanced Pharmaceutical Intermediate with Fermion. The products are slated to be manufactured at the Ankleshwar Facility and is expected to start contributing meaningfully to the revenue from FY25

Specialty Chemicals

- Received orders for a UV Observer product used in Paint Industry. Expect commercial production to start from Q3 FY24

- Electrolyte additives update- Advanced stages of negotiation of contract with couple of customers.

- Process upgradation for existing products – methyl salicylate and parabens

- it is working on two additives, not been manufactured so far by any other company in India. In this space, the company has received approval from nine customers and expects a large commercial order

Ami Organics Limited has signed a non-binding MOU with a global manufacturer of Electrolytes for manufacturing of electrolytes for battery cells and allied materials in Gujarat, India. In furtherance to this, the company will also sign an MOU with Government of Gujarat for

investment amounting up to Rs 300 crores for set up of dedicated manufacturing facility for electrolytes business in the state of Gujarat, in the upcoming Vibrant Gujarat Summit 2024.

Capex ongoing

Pharma intermediates capacity to expand to 4x

Related to the Fermion contract is the capacity expansion plan in Ankleshwar at a capital outlay of Rs 190 crore. Here, one block is dedicated for Fermion. This would carry on supplies related to the recent contract. Machinery installation in progress in block-1 at Ankleshwar unit, Started the recruitment process for the new facility. On track to commence the production activity in Q4 FY24 .The Ankleshwar facility is envisaged to have 436 KL — nearly 3x bigger than the existing facility

Acquisitions

Baba Fine Chemicals Acquisition – Completed acquisition of majority partnership stake in Baba Fine Chemicals during Q2FY24. The acquisition of Baba Fine Chemicals (55 percent stake) is interesting as it deals with high entry-barrier products (photo-resistant chemicals), having applications in the semiconductor industry.

To reduce operational cost , the board has approved investment in a 16 MW solar power plant which along with already work in progress 5 MW solar power plant that will nullify our electricity expense once fully operational.

Company decided to fully impair the existing investment of Company, in the joint venture Ami Oncotheranostics LLC, as it is presumed that revenue generation from Ami Oncotheranostics will take significant time considering the inherent nature of its research activity in terms of

longer gestation period and uncertain success rate

Transformation of acquired entities like Gujarat Organics

Recently they acquired two manufacturing facilities Gujarat Organics (which was making loss makings as they did green field expansion in 2018) as Guj Org was making losses, it was bought by AMI Organics and turned EBITA margin moved from meagre 2% to 10% as of now (expected to touch 18% by next 2 year – also highlighted in their conf call as they are moving from batch processing to continuous flow chemistry). This acquisition enhances its specialty and fine chemical portfolio to enter Agrochemical, Cosmetics & Polymer Industry.

Due to this acquisition, one of client of Guj Organics referred them to make this electrolyte addictive. And hence, they have ventured into electrolyte addictive (belonging to carboxylic group) which is made by AMI in the whole Asia (except for few Chinese companies)

Details about Baba Fine chemicals

Valuations

Expected Cumulative sales projections for FY25 and FY26 is 2800-3500cr (considering existing business will also grow at 18-20%) and with PAT margin of 14% , we get PAT of 390-525 cr cumulatively. So stock price may move towards 2000-4200 Range by 31Mar26. There could be short term downside in stock which can be used for accumulation in case we are convinced about projections and sales

Risks

Susceptibility to raw material cost could affect Company profitability.

Inherent regulatory risk (USFDA compliance)

Competitive nature of industry driving pricing pressures. Oversupply from China does impact company growth in targeted markets

Combination of low margin and high margin products causes volatile OPM –This risk is expected to reduce with integration and business of other acquisitions done in recent years

High Capex ongoing and timely completion and start of production along with capacity utilization is a risk which needs to be monitored

High capital working requirements remain a risk. This is due to its wide portfolio, AOL needs to maintain sufficient inventory of the raw material as well as finished products.

Fermion contract getting cancelled midway

No major breakthrough in BFC business or electrolyte business

Technicals on 13Jan24

Stock has been consolidating between 900-1300 mostly in last 2+ years

Technicals on 3-Mar-24

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip market offers else Ignore the stock

Stock might be volatile in short term and give a chance to buy around 1000-1200 range for long term investment purpose

Also Read : ICEMAKE Refrigeration : Time to Chill

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Affluent India : Companies that can benefit

Fortnightly Thesis

Protected: Positional Stocks 6-Jan-24

CBG : New trend

Protected: Positional Stocks 31-Dec-23

Protected: Positional Stocks 24-Dec-23

Protected: Positional Stocks 16-Dec-23

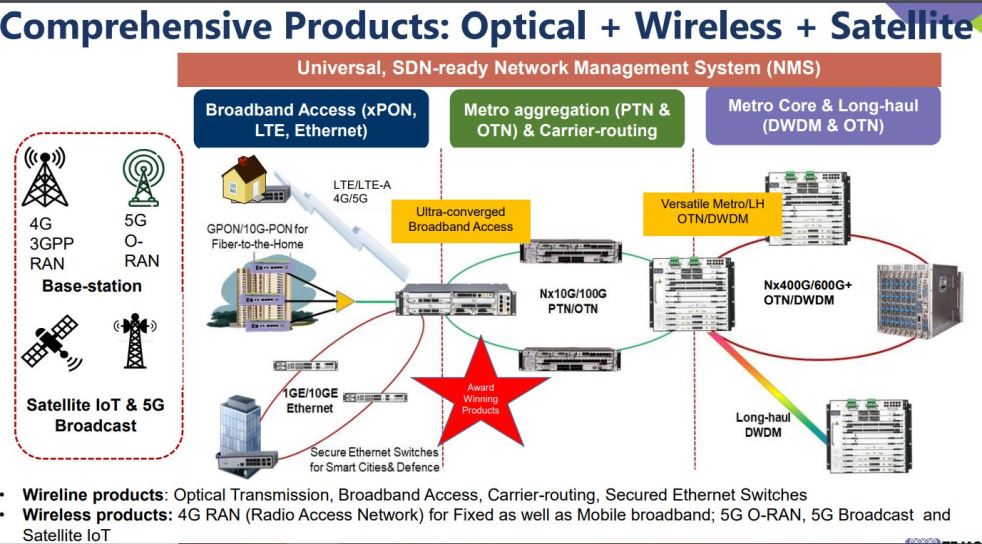

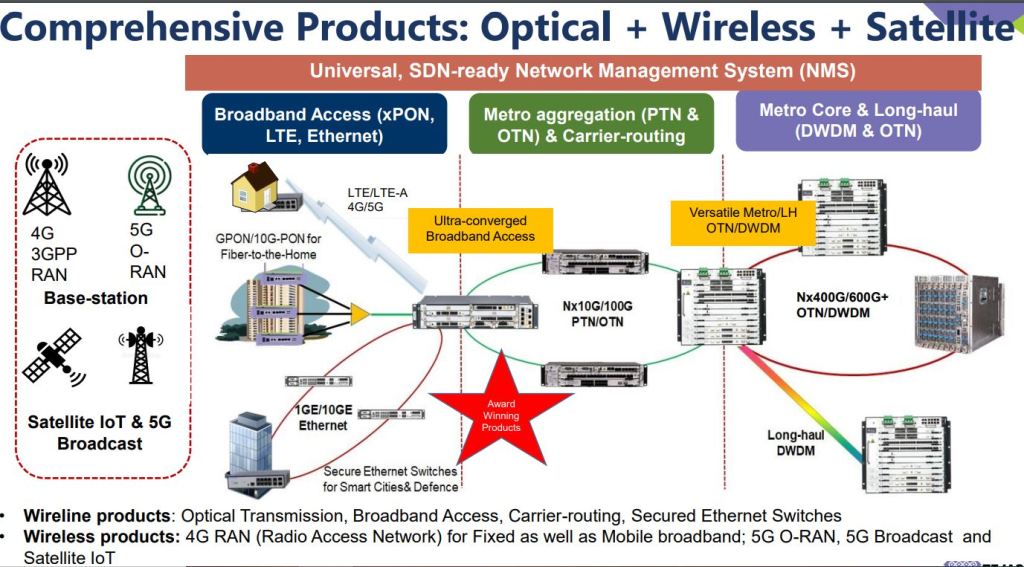

Aatmnirbhar version : 5G RAN

Saurshakti

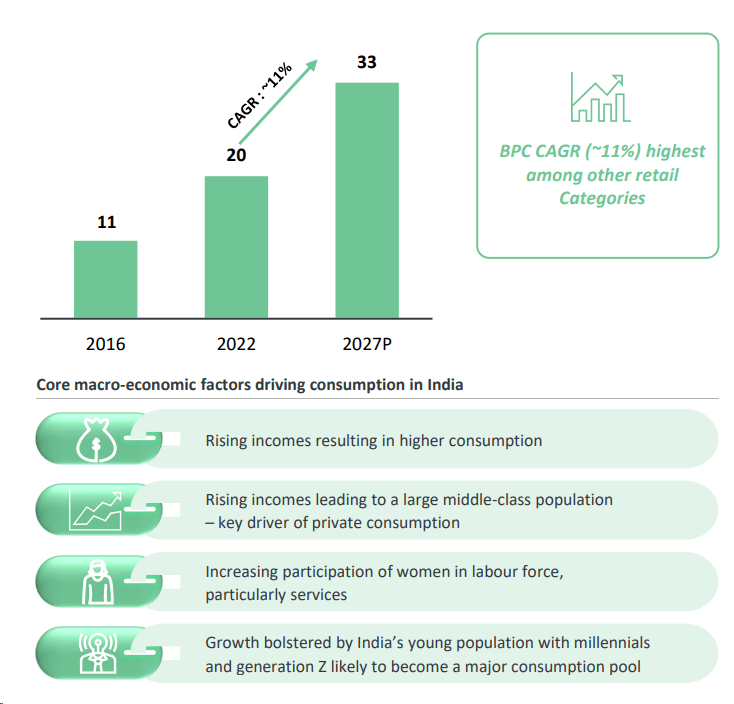

ALPHA LEARNERS – Mentorship program Jan-24

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

EARLY BIRD DISCOUNTS if one Enrols before 25th DEC 2023

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Free lifetime learning through a Whatsapp Community (apart from Program content) & Bonus Sessions

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

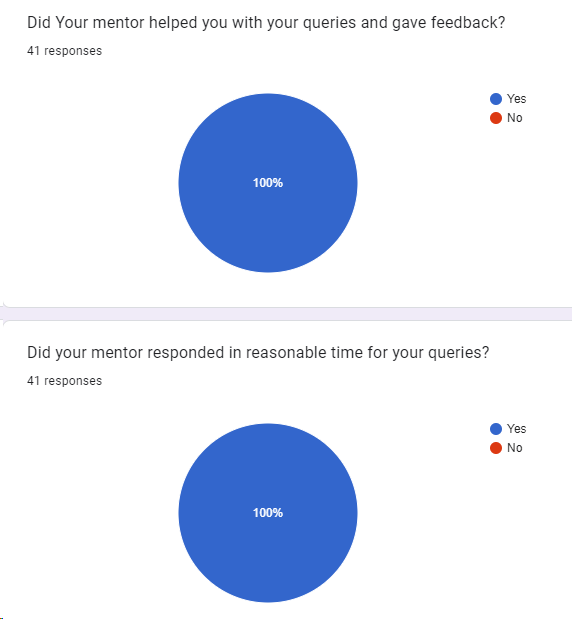

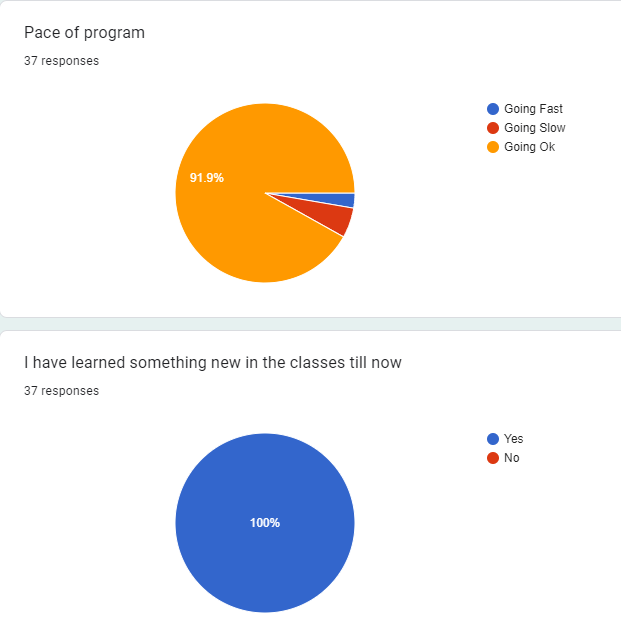

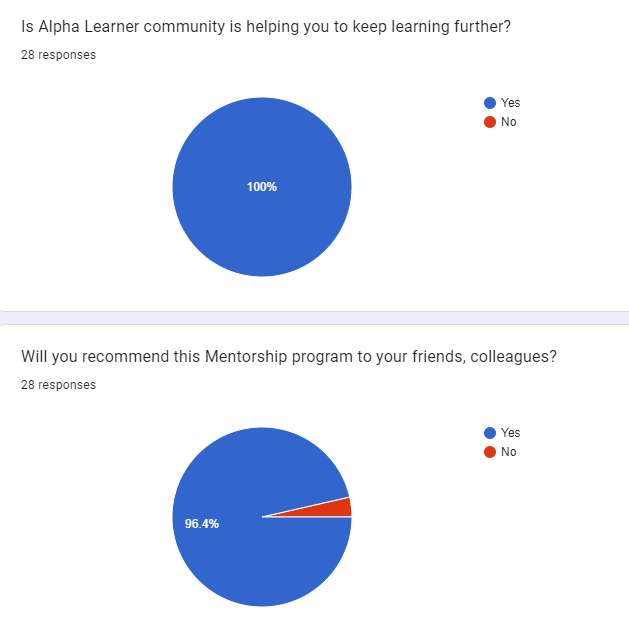

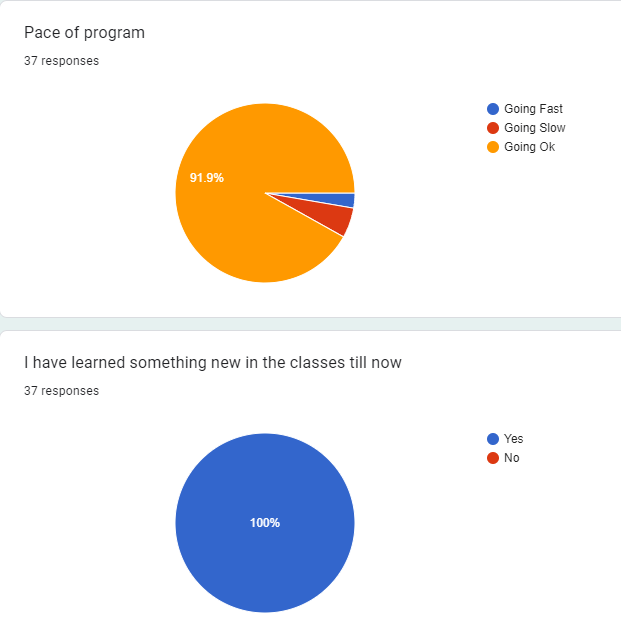

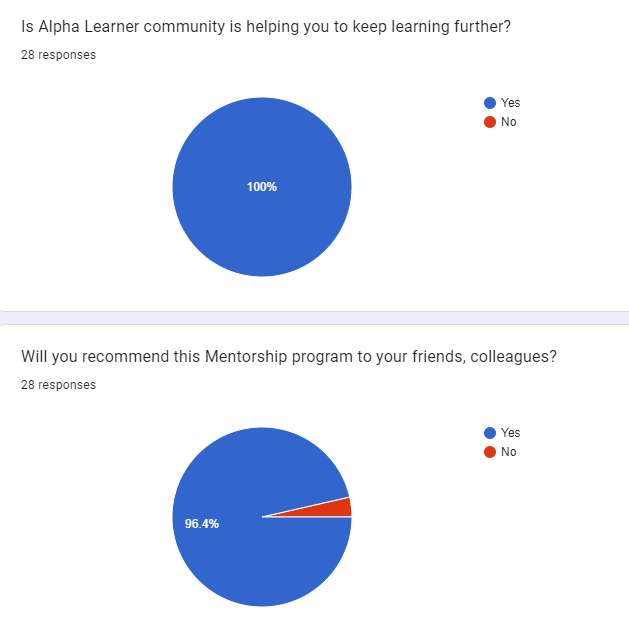

FEEDBACK By ALPHA LEARNERS

EARLY BIRD DISCOUNTS if one Enrols before 25th DEC 2023

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Insourcing : Short term trend

Protected: Positional Stocks 9-Dec-23

Most Profitable

Protected: Positional Stocks 2-Dec-23

Writing Instruments : Medium term trend

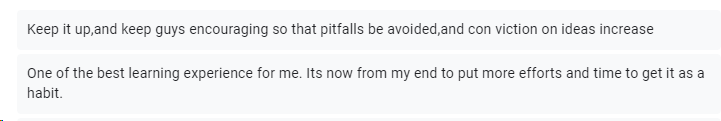

Medical Imaging AI : New trend

DIWALI To DIWALI PICKS – 2

FCL –Fineotex Chemicals

CMP 358, Market cap ~4000cr

ROCE ~36%, ROE ~28%, ROE 3Yr 25.5 %, D/E ~0

Consistent Dividend Payout, Consistent increase in revenues, Profits over a decade

Also Read : PICK1

Business, Revenues and SHP

➡️FINEOTEX group is one of the leading manufacturers of chemicals for textiles, construction, water treatment, fertilizer, leather, and paint industry. Fineotex manufactures and provides products for Pretreatment processes, Dyeing processes, Printing processes, and Finishing processes for textile processing to customers across the globe

➡️Company focus is on two categories –Textile chemicals and Clean & Hygiene chemicals

➡️Revenue 77% domestic, 23% International

➡️Bluesign, ZDHC, Star Export House Accreditations + several ISO certifications

➡️Fineotex Chemical Limited has earned the prestigious ECO PASSPORT by OEKO-TEX® certification, the highest rating in the globally renowned audit that measures standards of sustainability

➡️Received Dun and Bradstreet ESG Badge, it showcases the impact of ESG listing and ranking on organizations, and recognize their contribution towards sustainability

➡️Presence in more than 70 countries with 100 + dealers with 470+ product categories

➡️Consistent promoter holding, Good DII participation, Big Shark Ashish Kacholia holding 2.83% stake ( built his stake in last one year)

➡️Company has strong experienced leadership team and has reputed clientele

Strengths and Triggers

🟢Capex, expansion Done in last few years–Total capacity 104000MT, Ambernath plant is fungible and has the capabilities to manufacture products for both textile chemical and cleaning and hygiene segment.

🟢The facility is equipped with modern infrastructure and amenities, enabling sustainable chemical production with advanced automation, storage, and logistics handling

🟢Emerging/Expected Favorable tailwinds with UK FTA deal under discussion, Can open doors for Indian Textile segment and the company is proxy to textile sector

🟢Working capital days, Inventory days have come down significantly

🟢Malaysia plant has Easy access to high quality raw materials in the region. Malaysian plant provides raw materials to the Indian facilities. Cost benefits due to Free Trade Agreements (FTAs) with important regional markets like Vietnam, China and India

🟢Recent collaborations to expand product profile and geographical reach —

Eurodye-CTC, Belgium, to commercialize specialty chemicals for the Indian market

HealthGuard, Australia to become the exclusive global marketing and sales channel partner with joint operations from Malaysia

Setting up a state of art Research & Development center in collaboration with Sasmira Institute, one of India’s premier textile institutes

🟢Developed technical expertise to enter attractive new markets –like -Cleaning and Hygiene Chemicals Drilling Speciality Chemicals Other Speciality Chemicals

🟢Non-textile segments will drive volume and value growth going forward

🟢Team of 34 professionals for providing technical solutions to customers

🟢Technical barriers to entry and high levels of development and product customisation

🟢ICRA rating upgraded -Long Term Rating: A+ -Short Term Rating: A1+

🟢Successful acquisition and realisation of synergies with Biotex

RISKS

🔴Further Delay or non progress in UK FTA deal

🔴Textile exports remaining down or Reemergence with force by Bangladesh Textile companies

🔴Threat of imports of chemicals/dumping by China

Disclaimer — Not a buy/sell recommendation.

Purely for studying the stock idea with risks and strengths

Your Profit, Your Loss based on your conviction

Disclaimer

Protected: Premium Stocks : 26-Nov-23

Protected: Positional Stocks -26-Nov-23

Biofuel gensets

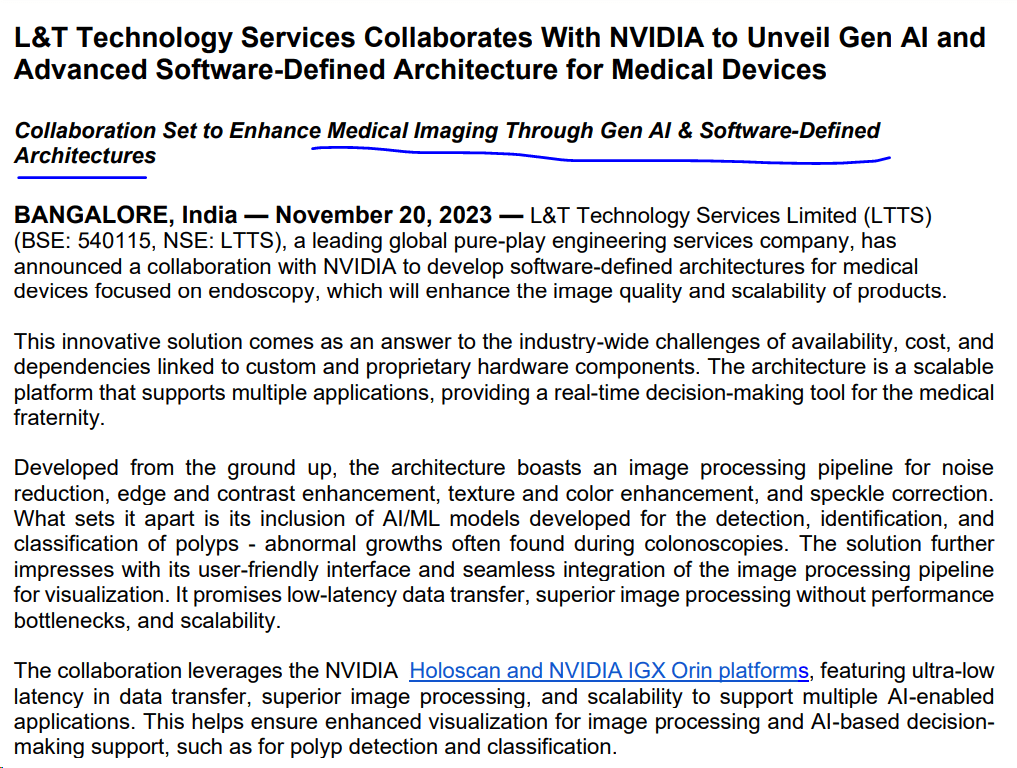

BPC market : Medium term trend

Winner or runner up

Protected: Positional Stocks -19-Nov-23

DIWALI PICKS – 1

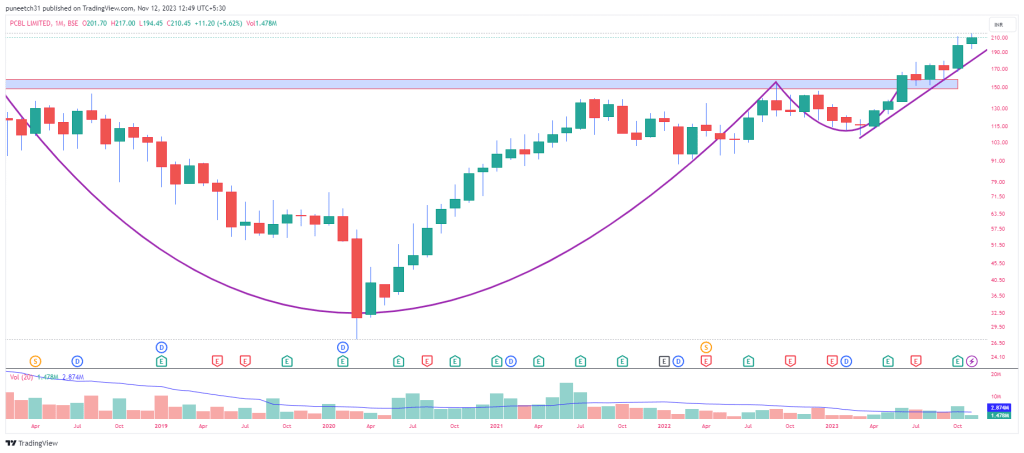

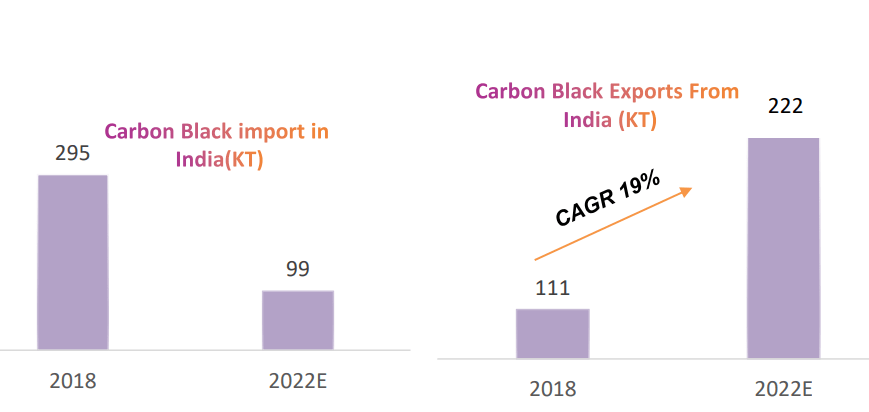

PCBL –Philips carbon black

CMP 210, Market cap ~7900cr

Mcap/Sales < 1.5, ROCE ~17%, PE ~18.5

Business, Revenues and SHP

➡️India’s largest & world’s 7th largest Carbon Black Company with strong presence in specialty chemical

➡️Existing 4 plants combined Annual capacity of 623 KTPA & green power generation plant of 98 MW

➡️Focus on RnD in Speciality chemicals -50+ scientists & technical professionals in R&D and process technology

➡️70% revenue from domestic, 30% international

➡️65% revenue from Tyre segment –Major Tyre companies are doing capex–INR 35000 crs of investment by tyre industry in last 3 years in capacity creation & debottlenecking

➡️Presence in more than 50 countries with 100 grades of Carbon black, 65+ grades of speciality chemicals, 1100+ employees

➡️Consistent promoter holding, Good FII and DII participation

➡️Company has strong experienced leadership team + Company belongs to Renowned RPG group

Strengths and Triggers

🟢Capex, expansion ongoing -Green field project at Tamil Nadu with Annual capacity of 147 KTPA & green power generation plant of 24 MW, Specialty capacity in Mundra of 20 KTPA. Brownfield Expansion at Mundra plant, Gujarat. Total Specialty Chemical capacity after all expansions – 112 KT.

🟢Favorable tailwinds as vehicle scrappage policy, Growing demand for EV tyres, SUV tyres, Acceleration in freight movement

🟢Tyre exports witnessed healthy growth of 9% in FY23 driven by growth in passenger car , agri & construction sectors and increased acceptance for Indian tyres globally. Domestic Tyre demand is estimated to grow by 8-9 % in FY24 with growth recovery in OEM and replacement segments

🟢Tyre imports are reducing

🟢Easy access to raw materials and international customers with proximity to ports

🟢Lower logistics cost on account of well spread manufacturing facilities and proximity to customers

🟢Lower risk of business interruption with multiple manufacturing location spread across India

🟢Increasing Contribution from High Margin Specialty & Performance Chemicals Portfolio

🟢Company is also focusing on digitalization in its operations like INDUSTRY 4.0: Smart factory Solutions —

a) Smart Automation in new manufacturing unit in Chennai, Tamil Nadu to generate key analytics and dashboards, eliminate human error and improve safety.

b) Adoption and deployment of best-in-class Data Security softwares and Advanced threat protection for all end users.

c) Creating Digital Infrastructure by set up of disaster recovery data centre for critical data protection, Automated tool-based backup is scheduled and monitored for all critical Cloud Servers.

RISKS

🔴Key Raw material CBFS is imported and dependent on crude oil price

🔴Major portion of PCBL’s revenue is from sale of CB to tyre manufacturers which is cyclical business

🔴Threat of imports of carbon black or Dumping by China

Disclaimer — Not a buy/sell recommendation.

Purely for studying the stock idea with risks and strengths

Your Profit, Your Loss based on your conviction

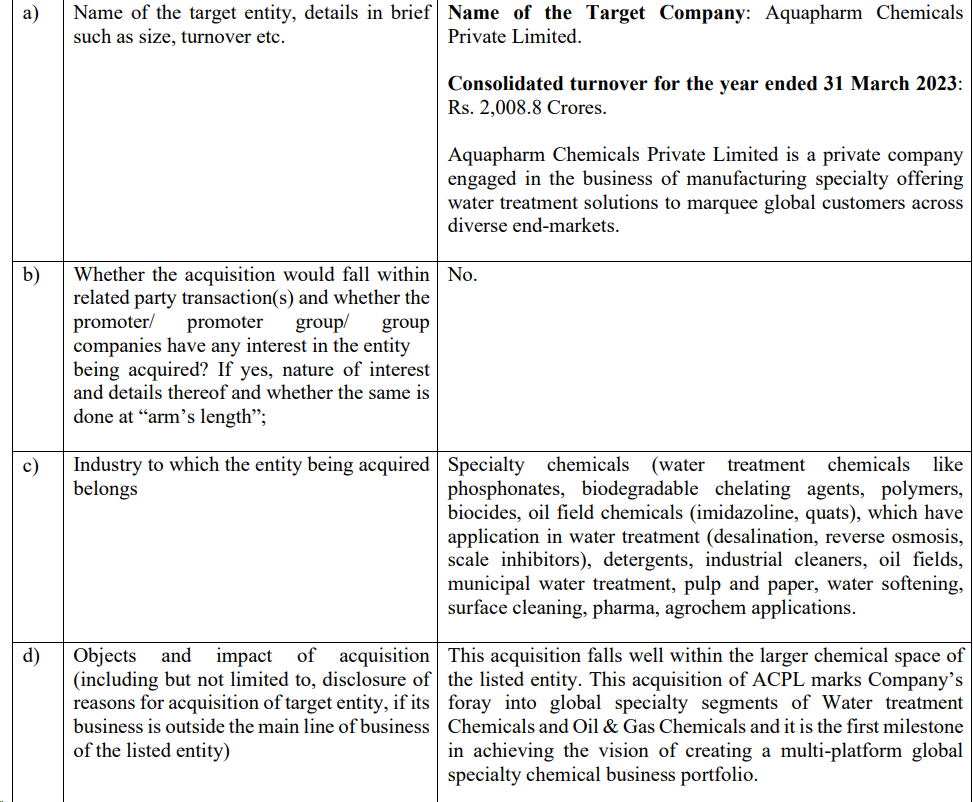

Update in 28-Nov-23, 29-nov-23

Acquisition of ACPL at 3800cr, EBITDA of ACPL is 417Cr in FY23

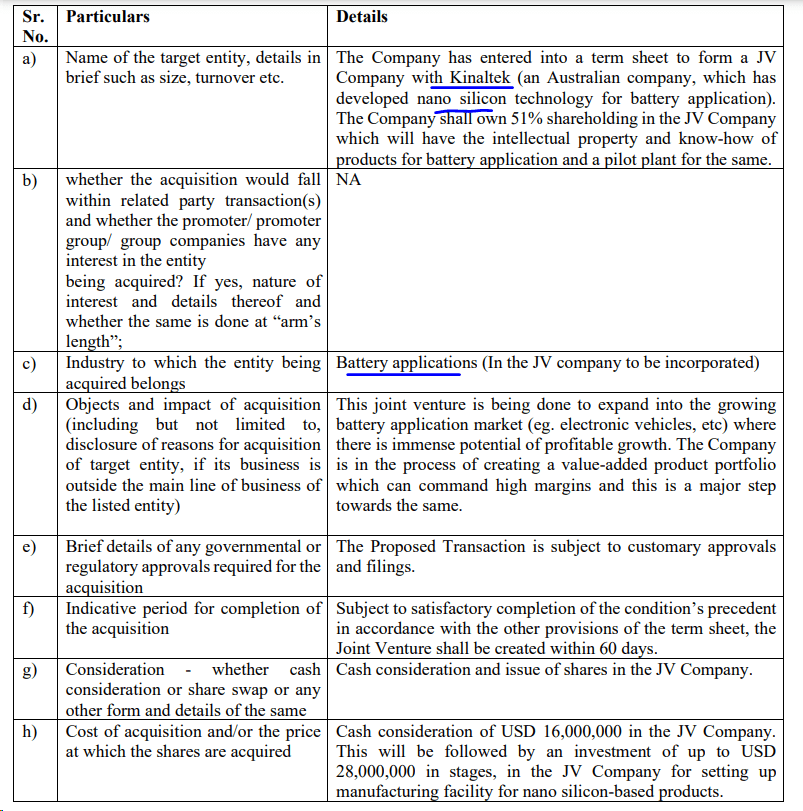

JV with Kinaltek for battery applications

Happy Diwali greetings to all of you

Starting 12th Nov23

1 stock with future potential coming every alternate week (total 25 stocks till next Diwali) only on http://alpha-affairs.com

Though stocks have been chosen with certain basic criteria, but there is no guarantee of success in markets.

All 25 can fail, all 25 can become multibaggers—it depends upon Entry point, conviction to hold, timeframe, business potential, macro factors that impact business

I am just sharing what I found useful for myself

One can safely assume that I have a vested interest in stocks I share on my timeline

Hence, no queries will be entertained on buy, hold or sell, You need to Develop your own conviction

I will not be responsible for your losses or your profits None of the posts related to stocks picks should be construed as buying recommendation from my side

EPIC value chain

Protected: Positional Stocks -22-Oct-23

Protected: Premium Stocks : 20-Oct-23

High Price segment in power trading

Protected: Positional Stocks – 14-Oct-23

India’s Space race

ALPHA SUNRISE Portfolio precisely captures this theme along with Recycling, Defense, EMS

If you want to be part of my journey of portfolio creation in emerging sunrise sectors then just drop a mail to alphaaffairsf2f@gmail.com and at a nominal yearly amount get to know ALPHA SUNRISE Entry and exits

Protected: Positional Stocks – 7-Oct-23

ALPHA LEARNERS – Mentorship program Oct-23

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 2 years of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Free lifetime learning through a Whatsapp Community (apart from Program content)

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS MONTH of 2023 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 2-Oct-23

Hydrogen Fuel cell Powered Buses

Protected: Positional Stocks – 17-Sep-23

Kaala sha kaala (Black is black)

Astra Microwave

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Astra Microwave

Business

Astra Microwave Products Limited (Astra) was incorporated in 1991 by a team of distinguished scientists with experience in RF/Microwave/Digital Electronics and management of projects with high technology content. Astra Microwave Products Limited, engaged in the business of design, development and manufacture of RF and Microwave Components, sub-systems and systems used in defense, space, meteorology and telecommunication

With over 30 years of experience in microwave radio frequency (RF) applications, AMPL has moved up the value chain from sub-systems to high value-added systems

Astra has 3 Automatic assembly lines for PCBA assembly, 5 class 10K cleanrooms, functional test infrastructure that extends from 30MHz up to 40GHz, in-house Environment test facilities including EMI/EMC facility and a first for any Indian Private Industry – Near Field Antenna test and measurement range.

Total workforce (as on March 31st, 2023) – 1,290

Subsidiaries

In fiscal 2014, AMPL floated the 100% owned BEPL as a captive supplier of raw material for overseas orders. In fiscal 2015, AMPL floated the 100% owned ASPL in Singapore, as a supplier of MMIC products for semi-conductors. In fiscal 2019, AMPL set up a joint venture, Astra Rafael Comsys Pvt Ltd, with Rafael Advanced Defence Systems for production of communication systems and sub-systems for defence.

Product Portfolio

The company’s product portfolio spans across Defense, Space, Meteorology, Homeland Security and Systems Vertical

Has a diverse range of microwave products like filters, transmitters, receivers, antennas etc.

Manufacturing facilities

5 facilities in Hyderabad, Continuous investment in World Class Infrastructure for Assembly, Functional and Environment testing. Astra’s facilities are approved by several foreign companies for production

R&D Capabilities

Track record of new product development; now graduated to a SYSTEM integrator in Radar. Dedicated R&D facility at Bengaluru to manufacture radars

Strong in-house capability in the microwave radio frequency (RF) applications domain.

Executes orders through BTS (Build To Specifications) and BTP (Build To Print) route

Customers and Regions of Revenue

- Clientele includes Indian Government Laboratories, Indian Defense

- Public Sector Undertakings, Indian Space Research Organization

and many foreign OEM’s

Revenue mix

Geographical spread of total revenue stands as follows: India – 60% and Exports – 40%

Applications

Defense

- Radars

- Electronic Warfare

- Missile Electronics

- Telemetry

- Counter-Drones

Space

- Flight Model Application

- Ground based

Application - INSAT MSS Terminals

Hydro/Meteorology

- Water Level Measurement (Bubbler/

Radar Sensor) - Automatic Weather Stations (AWS)

- Agromet Met Stations (AMS)

- Automatic Rain Gauge (ARG) X

Band Doppler Weather Radar

Other areas of work

- Antennas

- MMIC

- Contract Manufacturing

- Homeland Security

Awards and Certifications

The company has various certificates such as AS9100D & BS EN ISO 9001:2015, ISO27001:2013, ISO9001:2015, ISO14001:2015, ISO45001:2018, ISO/IEC17025:2017.

Awards

LAToT Ceremony for Coastal Surveillance Radar

Excellence in Innovation, Design Technology, R&D 2021

Counter-Drone System LAToT Handing over Ceremony

Award for Excellence in Aerospace lndigenisation-2021

ELCINA EFY Award for Business Excellence

Fundamental Ratios, Cash, Loans, EBITDA,PAT etc

Debt to equity is under control < 1

ROCE> 17

Pledge 0%

Short and long term liquidity under control

Recent Q1FY24 have been weaker than expected

Opportunity Size

Various tailwinds in the defence sector are creating a wide range of opportunities for Indian firms. Company expected to hit 6000-8000cr cumulative revenue in next 5 years if TAM is correctly addressed

Triggers

Defence spend in India has received a mega boost

Opportunities to develop and supply products which are published as negative import list by GOI

Government of India’s Atma Nirbhar Bharat initiatives

Favorable policy initiatives like Buy (IDDM – Indigenously Designed, Developed and Manufactured),MAKE-II, MAKE-Ill

Expansions and Acquisitions for future growth

QIP has been done at 270 rs for Reducing working capital and corporate purposes

Operating margins can improve further

Focusing on domestic defense order can lead to 20% OPM in coming years.

We aim to achieve 70% Domestic 30% Export Revenue distribution over next 2-3 years. Domestic business on an average carries 40 to 45% of gross margin as against 8 to 10% gross margin in exports.

Order inflows

Orders are worth an aggregate amount Rs. 158 crores for supply of Software Defined Radio (SDR) by Astra Rafael Comsys Private Limited (Joint Venture) Company has received an order from India Meteorological Department (IMD) for Supply of C-Band Dual Polarized SSPA based Doppler Weather Radars for a total value of Rs.32.97 crores. Order is to be executed within a period of 18 months.

Orderbook as of March 2023 is Rs. 1,544 crores. This order book consists of only 24% of export orders rest 76% are domestic orders. The BTP segment is a major contributor of our export orders, which are executable in the next 24 months. The sales mix is anticipated to be skewed towards domestic, high margin business.

Orders are worth an aggregate amount order(s)/contract(s) awarded in brief; of Rs.16.8 crores for supply of Satellite sub-systems and weather data processing system from ISRO

Company has bagged orders worth Rs.158 crores for supply of Satellite sub-systems, Airborne Radar and sub-systems of Radar and EW projects, from DRDO, ISRO and DPSU’s

Targeting JV and exploring fields like

Through JV or strategic alliances, offer improved technology and products.

Target the offset requirement in large defence procurement programmes of Gol.

In discussion with our JV partners to develop EO (electro-optics) product line. Bidding for the whole system – the complete radar system – for both DRDO and for future MoD requirements

Risks

Lumpy nature of domestic defence/space programs –Orders come in bulk and so are the payments.

Large working capital requirement: Gross current assets (GCAs) improved to 346 days as on March 31, 2022, from 398 days a year before, led by reduction in debtor days. GCAs are expected at around 400 days over the near to medium term with increased execution of domestic orders. The group primarily caters to domestic defence research and space establishments that usually have a long production cycle and longer working capital cycle compared with overseas orders. Though export revenue may be realised faster, it will be offset by stretch in receivables from domestic orders as domestic order execution is expected to increase in the future and thus working capital intensity would be a key monitorable. Furthermore, the group must maintain sizeable inventory to cater to all segments, as products are customised, and thus, requirements vary across segments.

Susceptibility to risks inherent in a tender-based business, and long gestation period for projects: The business depends on success in bidding for tenders invited by defence public sector undertakings and research establishments. Establishments such as the DRDO invite tenders from qualified vendors for their R&D requirement and commence bulk production on successful completion of product development. Long-term revenue visibility is primarily driven by the success of R&D projects at DRDO and the subsequent mass production of products.

Margins Volatility is high. Export vs domestic order execution changes margin profile and needs to be seen closely in coming quarters

Technicals on 25th Aug23

Disclosure –Invested. Do your own diligence before buying/selling

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 10-Sep-23

HBL : Powering ahead

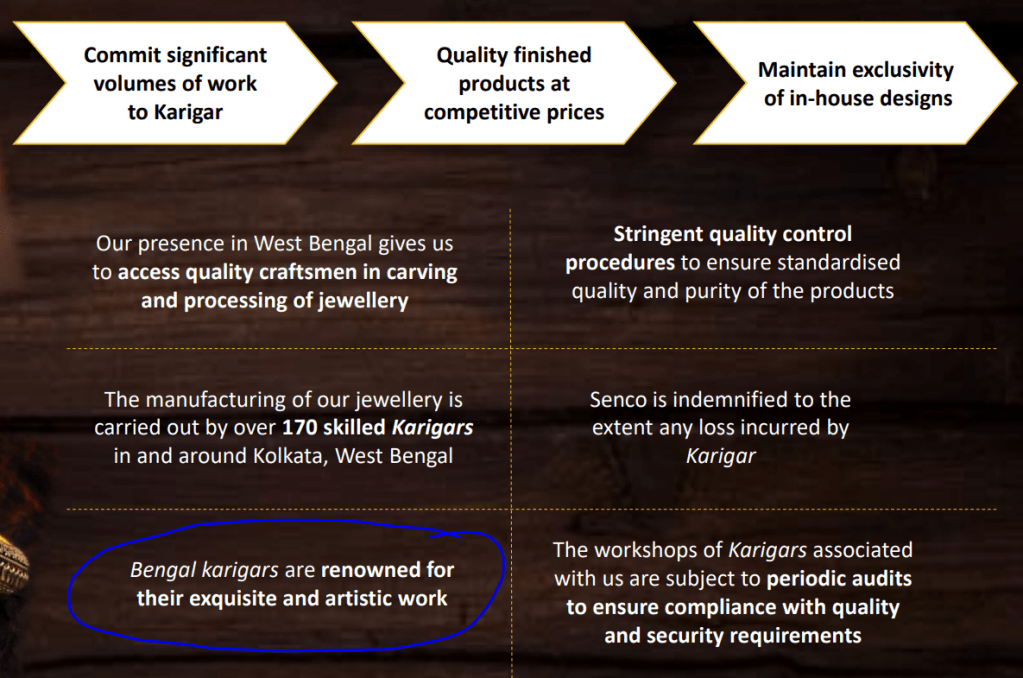

Renowned Bengal Karigars

Protected: Positional Stocks – 3-Sep-23

Only Indian Retailer

Protected: Premium Stocks : 28-Aug-23

Protected: Positional Stocks – 27-Aug-23

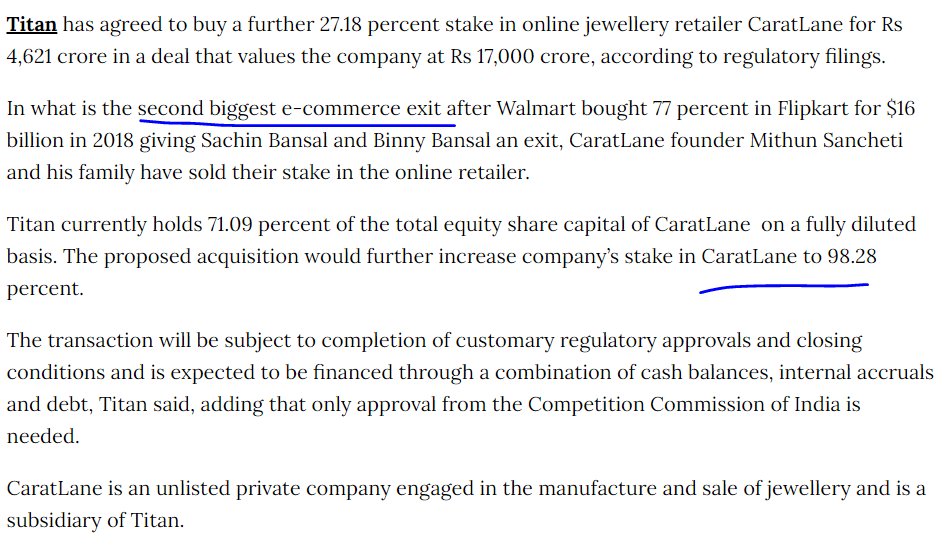

Second biggest E-commerce EXIT

Protected: Positional Stocks – 20-Aug-23

Protected: Positional Stocks – 13-Aug-23

Protected: Positional Stocks – 6-Aug-23

Greener way of SDA

2023 : 2032 : NTPC

Fertilisers : Drone friendship

Protected: Time for sunrise

Protected: Proxy to Sunrise Industries

Protected: Positional Stocks – 30-July-23

Protected: Positional Stocks – 23-July-23

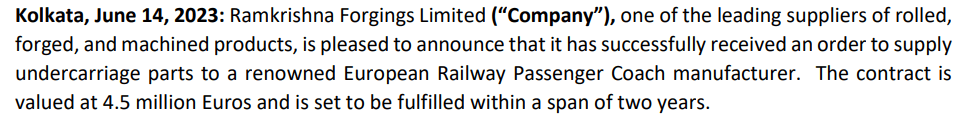

Time to Forge bonds : Ramkrishna Forgings

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Ramkrishna Forgings

Business

Ramkrishna Forgings Ltd is primarily engaged in manufacturing and sale of forged components of automobiles, railway wagons & coaches and engineering parts. Company mission and vision is to be the most preferred supplier of forged, rolled, machined, fabricated and cast products for all end use industries like Railways, Automotive, Earth Moving, Mining, Farm Equipment, Oil & Gas and General Engineering globally by supplying products meeting highest quality standards at highly competitive costs

Manufacturing facilities

RKFL’s facilities in eastern India are located in close proximity to automobile manufacturing hubs and key suppliers of of raw material

- Less chance of supply interruptions

- Lower logistics cost

- Reduced working capital requirements

Customers and Regions of Revenue and Product verticals

Products

Company focus is on de-risking business from few customers or few segments or few geographical areas

They have succeeded quite well in last 4 years

When a company has to grow to large company, many such things will give stability to company to perform well

Experienced promoters and established track record of the company

Promoters have 40 years of experience in forging industry

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

PAT , ROE, ROCE, PAT margin showing improved profile

8x sales growth and 35x profit growth in 10 years

Stock price is also 20x in 10 years and its quite possible to become 2-3x in next 3 years with CAGR of 24-30% approximately

Debt to equity has come down considerably and now close to 1 while Debt to EBITDA also is planned to reduce to 1 by FY25

Cash conversion cycle has improved to 100 days and Working capital days has also improved

Topline and bottom-line has improved significantly in last 3 years and trajectory is expected to continue in similar fashion

Shareholding pattern

Good promoter holding, skin in game, FII are increasing stake, Public domain have few strong holdings as well

FY23 Fundamentals ratios

ALSO READ : Company at Y2K moment

ALSO READ : Dream come true

Strengths

Manufacturer and supplier of a variety of auto and non-auto components

Global presence with footprints in North America and Europe

2nd largest forging player in India with over 40 years of experience Promoter possessing multi-decade forgings industry experience

Continued focus on diversification with foray into EV components

Longstanding relationship with marquee customers

Outstanding Credit ratings –perfect recipe for large cap progerssion in coming years

Triggers

Opportunity size in exports and domestically

There is a huge requirement in India and in various overseas countries. Compant exports are grwoung well

Capacity Enhancement and future growth from internal accruals

Commissioned 7,000T Press Line in 2021 and also commissioned a Warm Forging Line and a Fabrication Facility in 2021

The company has commissioned 23,800T of capacity as on 18th July 2023 and the remaining 32,500T will be commissioned by September and overall Increasing to 2,10,900T (current installed capacity 187000T)

In addition, the company has planned to setup cold forging capacity of 25,000T. The Company has sufficient capacity for the next phase of healthy & robust growth. Capacity ramp-up along with operating leverage will result in faster improvement in profitability

Cold Forging Press line to be commissioned by Q1FY25

Entire 100% capacity has been booked by an OEM, the contract of the same is valid for 7 years

Management guidance in Q1FY24 Call

Subsidiaries and Strategic Acquisitions

Company has done a JV with Titagarh rail company for manufacturing and supplying of forged wheels for Indian railways

Ramkrishna Forgings announces strategic acquisition of Multitech Auto Private Limited and its wholly owned subsidiary Mal Metalliks Private Limited along with Mal Auto Products Private Limited. This can lead to 20% of current revenue addition

Also company has done some acquisitions in ACIL , JMT auto and Tsuyo. This push will help company to foray into tractor, PV segments, Heat treatment, gears, BLDC EV segments

Industry growth rate

Various forecast showing industry will grow between 6-10% for next few years. Important to understand here is the industries the company caters to

All these segments have Government focus and will grow heavily in next 5-7 years. So I believe company is present in right segment and right regions (fastest and biggest regions)

Recent Order wins

Just listing few wins in last one year

Risks

Susceptibility to raw material cost could affect Company profitability.

US landing into recession may also trigger less future orders in short term. Stock may consolidate before moving up

Stiff competition from peers like Bharat forge but this risk is bit mitigated with many order wins recently and consistently

Higher revenue concentration from Auto segment and CV domain in that is a risk–though company is taking utmost steps to remove this risk as highlighted above

High capital working requirements remain a risk

JV falling off with Titagarh rails for reasons is a small risk

Railways not going ahead with orders and new tenders in coming time is another risk which we need to consistently monitor

Technicals on 22 July 23

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip market offers else Ignore the stock

Stock might be up in short term and then give a chance to buy around 400-450 range for long term investment purpose

I am holding it from lower levels and I reserve the right to add more or exit as per company performance without a followup /update here

Also Read : ICEMAKE Refrigeration : Time to Chill

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 15-July-23

Time to Chill : ICEMAKE Refrigeration

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

ICEMAKE Refrigeration

Business

Ice Make Refrigeration Limited is a leading producer of Cold Rooms, Freezer, Refrigeration System and Chilling Plant, etc. having a plant at Dantali, Ahmedabad. Company is leading supplier of innovative cooling solutions and manufacturer of over 50 plus refrigeration equipment in India. The company has started its business with a mere of Rs. 3 lakh & has crossed the market cap of Rs. 500 crores recently

Manufacturing facilities

Company has two manufacturing units in Gujarat and Tamil Nadu and also they have setup one more unit of manufacturing in West Bengal that is expected to be operational in the next one month

R&D Capabilities, Employee strength

Employee strength 625+, increased from 560+ in last 2 years

Company keeps on introducing new products in market. Ice Make’s innovative equipment product range also includes ice cream mix

preparation for small and medium scale, specially designed mix plant units. Its chiller product range includes Air Cooled Chiller, Water Cooled Chiller, liquid Chiller, Brine Chiller, and Screw Chillers.

Customers and Regions of Revenue and Product verticals

The Company operates under key business verticals including Cold Room, Commercial Refrigeration, Industrial Refrigeration, Transport Refrigeration & Ammonia Refrigeration and caters to wide range of Industries in India and also exports its products to overseas clients in 24 countries

The diversification in IMRL’s client profile also remained healthy with top clients contributing only around 25-40% of its total revenue over the last three years ended FY22. Around 70% of IMRL’s revenue is generated from direct sales whereas the balance is through its dealers and distributors spread across the country

Awards and Certifications

The company over the years have received several awards and accolades including Indian Leadership Award for Industrial Development, Best Medium Enterprise Canara Bank and SKOCH Award for manufacturing, India SME 100 Award and Gold Award for Excellence within its Core Industry category

Experienced promoters and established track record of the company

Promoters have 30 years of experience in cold chain industry

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

PAT , ROE PAT margin showing improved profile

Debt to equity has come down considerably

Cash conversion cycle has improved to 64 days and Working capital days has also improved

Topline and bottom-line has improved significantly in last 2 years

Shareholding pattern

Strong promoter holding, skin in game

Triggers

.New product launches in last few years as industry is evolving

Opportunity size

There is a huge requirement in India and in various overseas countries for innovative cooling and cold chain storage solutions and ICE Make is well positioned to take advantage of these opportunities. Continuous Penal business is expected to grow at a 14 % CAGR YOY & Cold Chain and storage business is expected to grow at a CAGR of 15% to 17% between years 2022 to 2027”

Need of cold chain infrastructure for Dairy, food and pharma

Capacity Enhancement

Company has acquired approximately 44,538 Sq. Mtr land situated at Mouje : Dhanwada, Taluka : Bavla, District : Ahmedabad, for “Continuous Panel” business. Project shall be fully functional by April 2024. Continuous penal business is a part of our refrigeration business which shall be used in big cold storage projects as well as in infrastructure projects

Company also setup one more unit of manufacturing in West Bengal that is expected to be operational in the next one month

Ice Make’s new project for Continuous PUF Panels has a revenue potential of over Rs. 200 crores in a single shift.

Subsidiaries and Acquisitions

Ice Make Refrigeration Limited has incorporated a Subsidiary of the Company in the name of ‘IceBest Private Limited’. As per the certificate of incorporation dated 28th December, 2022. runrate of 10cr expected, which will increase market share from east India

Industry growth rate

Various forecast showing industry will grow between 14-16% for next few years

Venturing into new markets

Expansion in east for manufacturing will help with voluminous products. Expansion in south, once the current lease gets over for subsidiary may happen. So company has that vision of expanding pan India

Recent Order win

lcemake has bagged Dairy Project for Design, Supply, Installation, and Commissioning of Civil, Mechanical & Electrical work for 1.0 LLPD (Exp. 1.5 LLPD) on Turnkey Basis at Haringhata, Dist. : Nadia, State : West Bengal, from West Bengal Livestock Development Corporation Limited (A Govt. of West Bengal Undertaking) for which the Company has received Award of Contract, amounting to Rs. 65.48 Crore including GST and all other charges / taxes. Entire Job including Handing over shall be completed within 540 days.

Scuttlebutt shared by one of fellows Yogesh whose family is in Icecream business–adding details with his permission

Risks

Susceptibility of IMRL’s profitability to volatile raw material prices. The main raw material used by IMRL in manufacturing comprise of polyurethane (PU) chemical and galvanized steel sheets along with components made from copper and aluminium. Prices of these products are volatile in nature (as PU is a crude oil derivative, while prices of metals are inherently volatile), it exposes IMRL’s profitability to adverse movement in these prices. Considering raw material cost constitutes ~75% of Cost of Sales, any variability in the same could affect IMRL’s profitability.

Further the nature of contracts are fixed, price can not be changed for existing contracts easily.

Stiff competition from organized big logistics players

Subdued performance of its wholly owned subsidiary viz. Bharat Refrigerations Private Limited (BRPL).

Technicals on 11 July 23

ALSO READ : Company at Y2K moment

ALSO READ : Dream come true

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Replacement

Protected: Positional Stocks – 8-July-23

All you need is certainty

Protected: Positional Stocks – 2-July-23

MSSP : OT Converged SOC

Protected: Sunrise Thesis

Protected: Turnaround Time

Protected: Premium Stocks : 1-Jul-23

Which one!!

Protected: Positional Stocks – 25-June-23

Right travelers at right time

Protected: Positional Stocks – 18-June-23

ALPHA LEARNERS – Mentorship program July-23

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship program

Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

AVAIL EARLY BIRD OFFER till 30th June23

Make your journey faster in Stock market (by 3 to 4yrs) with ALPHA LEARNERS Mentorship program

Number of batches and batch size is very very limited considering live classes

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for approx. 5 months (on weekends) and 7 months of handholding further, Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Free lifetime learning through a Whatsapp Community (apart from Program content)

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

LET THIS MONTH of 2023 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

AVAIL EARLY BIRD OFFER (save 3000 bucks) till 30th June 2023

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 11-June-23

Protected: Industrial Capex Business

Protected: Positional Stocks – 3-June-23

Protected: Sunrise 4

Protected: Sunrise 1

Protected: Positional Stocks – 28-May-23

Protected: Premium Stocks : 27-May-23

Pricol : Emerging Auto Ancillary

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Business

Pricol Limited is an auto component supplier headquartered in Coimbatore, Tamil Nadu that manufactures various products such as driver information systems, oil/water pumps, chain tensioners, cab tilts, fuel sensors, temperature/pressure sensors, speed limiting devices, and wiping systems. Company is the world’s second largest DIS manufacturer for 2 wheeler.

The promoters, and related family members/family-owned entities hold a 36.53% stake in Pricol.

Manufacturing facilities

9 Manufacturing Locations, 8 Manufacturing Plants in India , 1 Subsidiary Plant in Indonesia. 3 International Office in Tokyo, Singapore & Dubai

Two direct subsidiaries in Indonesia (produces and markets instrument clusters, oil pumps and fuel sensors), and Singapore (procurement arm).

R&D Capabilities

2 Technology Centers at Coimbatore, ~ 4.5% spend on total revenue for R&D, As of march 2022, co. has made 13 inventions for which 18 patents have been filed. Out of which 12 are granted and remaining are under review.

Employee strength 850+, Engineers 300+

Customers and Regions of Revenue

Two-wheelers accounted for 61% of revenues and domestic sales constituted over 90% of its revenues in FY2022. Exports as a % of total revenues have dropped from ~30% to ~10% from FY20 to FY22. primarily due to divestment of various loss-making foreign subsidiaries.

In FY21 , DIS and pumps & mechanical products accounted for 50% and 33% of consolidated revenues respectively. Target is to take it to 70:30 ratio

Awards and Certications

Leading Industry Certifications IATF 16949:2016, ISO 14001:2015, ISO 45001:2018

Pricol has been recognized with the “Business Innovation” Award by the Confederation of Indian Industries (CII) Tamil Nadu for the various innovations done on Driver Information and Connected vehicle solutions

Award received from Honda Motorcycle and Scooters India “Best Delivery Management”

Award From TATA Motors (TML) on 07-Sept-2022

Award received under the category “Technology Excellence Award 2022” for the Best Interactive Product in Automotive.Award From Quantic India on 14-OCT-2022

Award From Hero MotoCorp on 07-NOV-2022. Award received under the category “Best In Innovation & Technology” at the Hero – NEXT 22

TOP 50 INNOVATIVE COMPANIES

Confederation of Indian Industries (CII) awarded Pricol as one of the “TOP 50 INNOVATIVE COMPANIES” as a part of Industrial Innovation award 2022

Product verticals

Driver information and Connected Vehicle solutions

This vertical is having products which are becoming need of every vehicle, 2W, 4W, CV, PV, LCV. Next stage could be CV, 3W and EV penetration

Moreover with EV domain coming up, this vertical has more legs

Customers

All Major customers are their clients

Experienced promoters and established track record of the company

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

PAT transformation is sustained and growing, OPM got stable at 12%, we can expect OPM in range of 10-15% in coming years. Chances are it might get stable at 13-14% in next 2-3 years. EBITDA margins target of 15% from company side

ROE is improving over last decade and stands at 18%, ROCE at20%

Stable Cash conversion cycle and Working capital days are just under 25

Shareholding pattern

Low retail presence

IN house excellence

MANUFACTURING EXCELLENCE

PCB Assembly with SMT Lines

Robotic Lines with EOL Testing

State of the art Tool Room

Plastic Injection Molding

Pressure Die Casting

Machine Building

Sintering

Subject Matter Experts in Electronics

(Hardware & Software), Mechanical and

Electro-Mechanical domains

ASPICE level 2 practices

TESTING EXCELLENCE

EMI – EMC

Hil Lab

Environment

Endurance

Product Reliability

Triggers

Key partnerships of company with SIBROS, BMS, Technology provider, PSG institutions and Candera CGI studio can propel the company technically and come up with advanced products and solutions

Below snippet is from Q1FY23 Confcall Aug22 —talking about 12-36 months for different engines to fire

So 9 months has passed from that time.

New product launches in Q4FY23

In FY22, co. has launched certain new products, including some marking products especially for TVS on their iQube, the electric vehicle, a seven inch TFT the first of its kind, a hybrid TFT plus LCD instrument cluster, among others

Increase in exports to 20% of revenue

Exports as a % of total revenues have dropped from ~30% to ~10% from FY20 to FY22. Currently Plan of company is to take to 20% by 2025. Big deal with Caterpillar done and things will roll out in coming years

Capacity Enhancement and new machines

Production capacity enhancement in Tool room, Plastic Component Manufacturing Shop and SMT (Surface Mount Technology) for PCB assembly line by adding new machines.

Acquisition of shares by Minda

Minda holds 15.7% and wants to increase till 24.5%, That can trigger an open offer and push share price might move up. As of now Pricol is opposing the deal

Diversified product profile comprising of driver information systems, pumps and mechanical products mitigates product-specific risks to a large extent

Established relationships with OEMs with healthy share of business – Pricol is a reputed player in the Indian auto component industry with presence for over five decades and supplies to original equipment manufacturers (OEMs) like Hero MotoCorp Limited, TVS Motor Company, Bajaj Auto Limited, Ashok Leyland Limited and Tata Motors Limited.

Company has the target to reach 4000cr revenue by FY26. The company has an order pipeline for the next 3 years

Past Disposal of loss-making businesses–No overhang there

In order to reduce debt, co. has disposed off certain loss-making businesses and divested subsidiaries, for example, co. disposed off its Wholly Owned Subsidiaries – PWS India and Pricol and Pricol Espana in 2019 and 2020 respectively.

It has written off ~400 crores in the process of selling its loss-making foreign businesses

Venturing into new markets

Co. has plans of Venturing into motors and actuators, such as new sensors and newer technologies in driver information systems, like areas in EV vehicles and they have identified certain areas.

In FY22, co. has won many new businesses across various segments including products like Connected Vehicle Solution and around 10 % of the revenue of FY 22 was contributed by new business

PLI scheme approval and CAPEX plans

Pricol is approved for PLI (Production Linked Incentives) Scheme The PLI scheme (outlay of $ 3.5 bn(or)Rs 25,938 crore) for the automobile sector proposes financial incentives of up to 18% to boost domestic manufacturing of Advanced Automotive Technology (AAT) products and attract investments in the automotive manufacturing value chain…PRICOL LIMITED is approved by the Ministry of Heavy Industries(MHI) for the Component champion Incentive scheme

From Aug22 confcall

Targeting Exports and EV segment India’s growth story will be muted in the next 3 years for 2W auto segments; the company’s target is export. Company has a LOI for next 30 months and on the basis of that company projected the target of 4000cr. The company is working on premium products so even at low volume growth the target will be achieved. 8. Company is EV ready and in touch with all EV players in India. Currently 8% revenue is from EV in the DIS segment. Working with 22 EV players in the country. Margins are same from EV as well; also share of EV will go up as EV adoption increases in India

Demerger possibilities to unlock value To unlock value for shareholders, if there is a need to align with some other company to get technology from MNC players, then Pricol may demerge into 2 different companies for DIS and other businesses

Risks

Muted growth in Indian 2W Market

Company has shared at multiple times that next 2-3 years they expect muted growth in Indian 2W market, though with supply of premium products and margin, company may grow better than industry

Exposure to volatility of raw materials and forex rate fluctuations due to high reliance on imports

Semiconductors and electronic components account of ~20% of Pricol’s raw material requirements. Supplies have eased out in last few months. But any recurrence can again lead to volatile times

Heavy Dependency on few customers

High segment concentration with 2W contributing to over 70% revenues– Pricol continues to derive 70% of its revenues from the 2W segment, and 57% of its revenues from its top three customers. Further, over 90% of the revenues are from the domestic market

Heavy dependency on top 5 customers and top 12 customers for business –>12 strategic customers contributing to about (+) 85% for sale and we continue to

grow with all of these 12 customers and our primary sales are driven by these 12 customers comprising of two wheelers primarily followed by commercial vehicles and then passenger cars.

Hostile takeover bid by Minda

This creates an Overhang and use Management Bandwidth in wrong direction. Can lead to company stock price going nowhere

Technicals on 21st May

ALSO READ : Company at Y2K moment

ALSO READ : Dream come true

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Protected: Positional Stocks – 21-May-23

Protected: Positional Stocks – 14-May-23

Protected: Positional Stocks – 8-May-23

Company at Y2K moment

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Business

Incorporated in 2004, Syrma SGS Technology Limited is a Chennai-based engineering and design company engaged in electronics manufacturing services (EMS). The company provides integrated services and solutions to original equipment manufacturers (OEMs) from the initial product concept stage to volume production through concept co-creation and product realization