What the donors have subscribed to is essentially a zero-coupon, zero-principal security.

It is neither a bond nor a share.

The securities cannot be traded and will carry a tenure equal to the duration of a given NGO’s project.

BE FINANCIALLY INDEPENDENT

What the donors have subscribed to is essentially a zero-coupon, zero-principal security.

It is neither a bond nor a share.

The securities cannot be traded and will carry a tenure equal to the duration of a given NGO’s project.

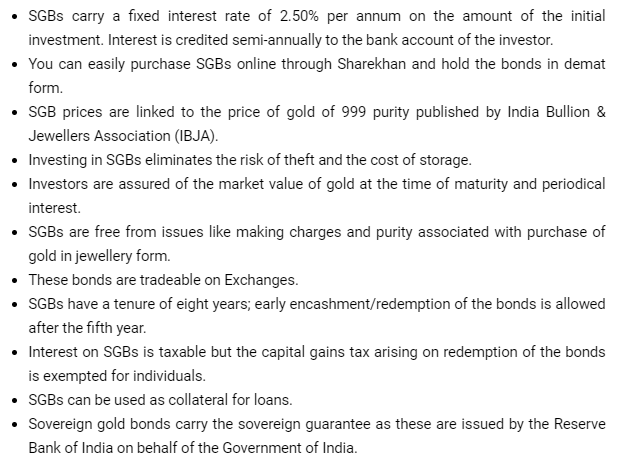

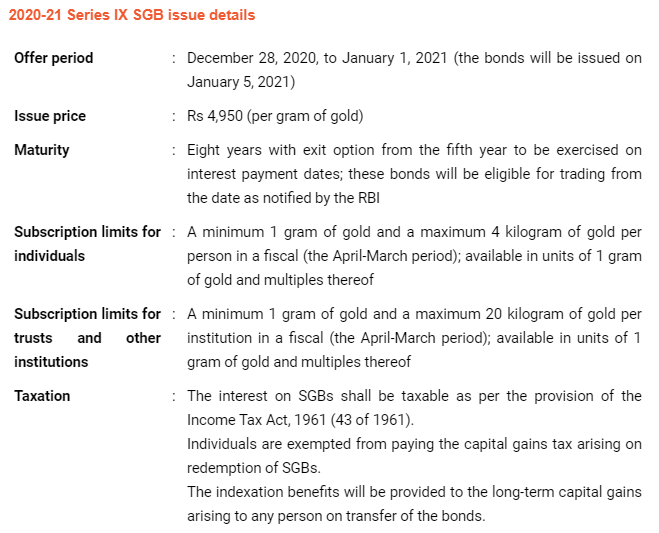

SGBs are government securities denominated in grams of gold.

These are substitutes for holding physical gold.

SGBs are issued by the central bank on behalf of the Government of India.

Investors have to pay the issue price in cash and the bonds are redeemed in cash on maturity.

There are many reasons for buying gold.

The yellow metal acts as a hedge against inflation.

It is a relatively stable investment compared to equities.

It is a good diversification strategy.

It can be purchased easily

In recent years, there is strong inclination see in investors for investing in US stocks. Of course there is a reasoning behind it. Let’s try to figure out WHY and HOW part of it

To understand this let’s understand the returns by DOW and BSE in last 10 years

US market consistently outperformed Indian market in last 10 years. Although there is no guarantee that it will happen in next 10 yrs again

So outperformance of US markets along with Indian currency depreciation widens this performance gap further and this makes a strong case for investments in foreign stocks

Buying foreign stocks allows investors to

As a thumb rule for starters, a 5% to 10% exposure to foreign stocks for conservative investors, and up to 10-25% for aggressive investors seems ok

Individual investors can invest up to $250,000 every year overseas under the RBI’s Liberalised Remittance Scheme. After opening an overseas brokerage account, investors will be needed to fund it by remitting money from his/her bank account

Now let us understand the 2nd part of it

Open a low-cost international broking account and invest in low-cost international exchange-tradedfunds

Let’s also understand the precaution or risks to be taken care of

When you invest in the US stock market, , please be aware of taxation part

Dividends will be taxed in the US at a flat rate of 25%. Due to Double Taxation Avoidance Agreement (DTAA), taxpayers can offset income tax already paid in the US (Foreign Tax Credit)

Disclaimer : The article is written to provide information and make investors aware of potential avenues of investment. Please don’t treat this as an investment advice. There could be change in tax laws from time to time and one should track it before investing. Past performance of any index returns can not and should not be taken as reference for future performance. Percentage allocation for each investor can vary and its best to consult to one ‘s own financial advisor before making investment decisions. We don’t have any mutual agreement with the sources or apps shared for investment and we dont gain/loss from your action in this regard

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

I recommend you to read Full article to understand bigger picture

link – https://www.morningstar.in/posts/58599/4-pillars-investing.aspx

As lot of people keep asking me regarding the specific financial advice when entering a stock market, this quick-read article gives you some pointers before you jump into stock markets

Read in detail : Emergency funds

Also Read : You should invest in Stock Market if

Also Read : You should not invest in Stock Market if

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.