Gold Medal

BE FINANCIALLY INDEPENDENT

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9, Pick10, Pick11, Pick12

Savita Oil Technologies Limited, established in 1961, is a specialty petroleum products company engaged in manufacturing Transformer Oils, White Oils etc.

The Co manufactures products like Transformer Oils, Liquid Paraffins, White Oils, Automotive and Industrial Lubricants, Coolants and Greases, among others. These products are essentially obtained through refining base oil, and topped with additives to derive the required characteristics. A wide range of lubricants, greases, and coolants of the Co are sold to retail customers under the brand SAVSOL

The Co has a market share of ~35% in the domestic transformer oil and white oil segments.

The Co’s manufacturing facilities are situated in the state of Maharashtra and at Silvassa in the UT of Dadra and Nagar Haveli and Daman and Diu with total refining capacities of 450,000 kilolitres per annum. Its windmills are located at 18 sites in the states of Maharashtra, Tamil Nadu, and Karnataka and have an installed capacity to produce 54.15 MW of wind-powered electricity

Company has 80 % domestic sales vs 20% exports

Revenue distribution 75% from petroleum and 25% from lubricating oils

Unit I – Navi Mumbai, Maharashtra

Unit II – Mahad, Maharashtra

Unit III – Kharadpada, Silvassa

Unit IV – Silli, Silvassa

Products, Segments and Strengths

Two major segments : Petroleum Oils and Lubricating Oils

Petroleum oils : Transformer oils, White and Mineral oil, Speciality oil : ~75% sales as portion of total sales over last 2 years

3.Formulated & Specialty Products

Lubricating oils : Automotive and Industrial oils

Automotive oils

Industrial oils

Strengths

Multi-decade relationships with many of our OEM and B2B customers across all product lines

In-house technology and R&D is the backbone of our company and has manifested many high quality products across the product portfolio.

Focus on innovation

Focus on sustainable products development

Management has almost 3 decades of experience.

Company has ISO and other necessary certifications in its field of operations

Clients

Consistent record of Dividends since listing in 1994

Healthy cash generation over the years

Debt free balance sheet

Consistent track of profitability despite market volatility

Longstanding relationships with customers and vendors

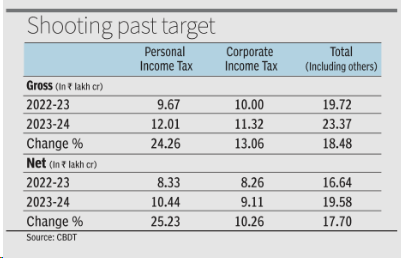

Consistent Tax records

Cash conversion cycle and working capital cycle is good.

Cash flows seems good

ROCE is reasonably above 20%

Promoter has skin in game. SBI energy fund has entered recently

Key triggers

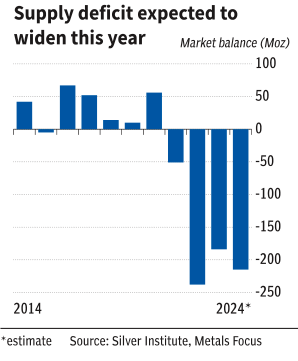

Transformer oils : Rising Investments over the next decade in transmission segment to support higher generation capacity and rural electrification

Rising demand for modernization of aging grid infrastructure coupled with large scale capacity addition will boost the market

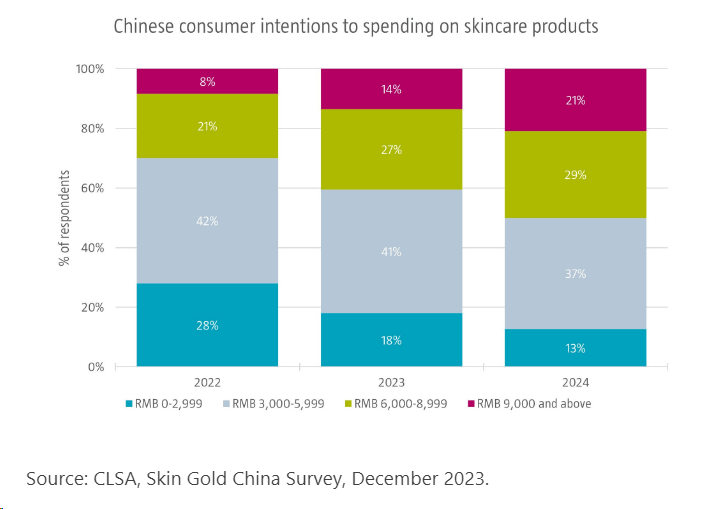

White oils : The Indian personal care industry is witnessing a boom due to changing perceptions, growing awareness, and the rise of direct-to-consumer (D2C) companies making waves in the online retail space

Growing demand of cosmetic and pharma products from urban & rural India

Product Innovation

Company is focused on building an independent distribution network for our industrial lubricants and with this now in place , they want to rapidly scale up industrial lubricant volumes

Company has created a subsidiary and moving towards plastic recycling

Savita Greentec Limited (a subsidiary of Savita Oil Technologies Limited) is expected to commence construction of Greenfield Projects in plastic recycling in theQ4Fy24

SAVSOL Bio Boost, one of India’s most biodegradable engine oils is launched

Oct23 – successfully commissioned new Synthetic Ester manufacturing plant

Commissioned new Synthetic Ester manufacturing plant at Mahad, Maharashtra with a designed capacity of 5,000 metric tons of which current operational capacity would be ~3,000 metric tonnes per annum

The new synthetic ester manufacturing plant will provide a strategic advantage to Savita by making it the first company in the world to manufacture and market all three classes of Transformer Fluids vis. Mineral Oil Based, Natural Ester Based as well as Synthetic Ester Based Transformer Fluids. The applications of these Esters are very versatile, and we will be able to leverage our existing client base to cross-sell these products while tapping new clientele. With these plant-based esters, we will have a more sustainable and environment friendly product range in the premium and synthetic categories. We plan to launch a new range of EV Coolants and immersion Cooling Fluids based on Esters from this plant. One of our products has already been approved by a reputed OEM as an EV coolant. We are also undertaking trials with another potential customer for immersion cooling.

Environment friendly products

Company have evaluated the introduction of versatile ester-based compounds (esters) in product range to enhance our diversified offerings of environmentally friendly products.

Group V Base Oils comprising Polyol, Phosphate and other Esters are the most superior performing fluids that exceed the performance of synthetic base oils on parameters of lubrication, thermal stability, oxidative stability, compatibility with most metals and sealants and biodegradable with low toxicity

Modernisation of Existing Transformers: Majority of India’s transformers and power infrastructure components are ageing and need replacement or modernisation. This drives the demand for newer, more efficient, and technologically advanced transformers.

Implementation of Smart Grid: The development of smart grids requires intelligent transformers that can handle bidirectional power flow, manage voltage fluctuations, and support grid automation. This opens avenues for technologically advanced transformers. Moreover, the demand for energy-efficient transformers that reduce transmission losses and improve overall grid efficiency is steadily expanding in India.

The transformer fluids market in India holds promising opportunities as the country strives to meet its increasing

power demands while addressing environmental concerns and adopting technological advancements.

Company is seeing a substantial increase in customer order books within the Power and Distribution Transformer sector, with their production capacity reserved for the coming 12-16 months. This heightened demand extends beyond India; the export segment to North America and other regions is also demonstrating promising growth potential. This is attributed to India’s competitive manufacturing ecosystem for transformers, well-suited to meet global requirements.

Alternative Fluids

Bio-Based – Your Company also produces bioTransol, a natural ester-based insulating fluid designed for transformers. This groundbreaking product was originally launched by Savita Polymers Limited (earlier a wholly-owned subsidiary of your Company which is in the process of being merged into your Company), in 2015. Remarkably, it marked the first instance of an Indian company introducing such a product to the market.

With an extensive reach, bioTransol has been applied to over 300 projects, solidifying its impact. This product promotes environmental consciousness with a high proportion of biodegradability. Moreover, its safety and efficiency surpass conventional options across various equipment applications.

Your Company is actively engaged in collaborating with major national and state utility boards, as well as Original

Equipment Manufacturers (OEM) clients, to showcase the product’s merits. Not only does bioTransol offer a more

effective solution within its grade, but it also embodies environmental sustainability. In an environment where global OEMs are compelled to reduce their carbon footprint, the appeal of such products is further enhanced.

Company is confident that the adoption of Natural Ester-Based Transformer Fluids will witness substantial growth, becoming an integral component of OEM consumption.

Synthetic Based – Your Company is poised to introduce Transol Synth100, a cutting-edge synthetic ester-based

insulation fluid. This fluid represents a significant advancement in transformer fluid technology, surpassing

existing solutions across a range of parameters.

Transol Synth100 stands as the most robust transformer fluid to date. As this product comes at a higher cost compared to mineral or natural esters, Transol Synth100 finds application in highly sensitive applications such as Locomotives (Metro and Rail), Mining, and Floating Solar projects. The overall lifecycle cost of this fluid effectively offsets its initial investment which will serve as a key driving force in the gradual transition from mineral to ester fluids within the ecosystem. With the launch of Transol Synth100 in the coming financial year, your Company will achieve a remarkable milestone, emerging as the sole manufacturer of the entire spectrum of transformer fluids – Mineral, Natural, and Synthetic.

Capex

Capacity Expansion Increasing capacity through continued investments for efficient leveraging of comprehensive and balanced product portfolio

Valuations

Reasonable valuations with PE <20. If the company shows growth in coming years as per their talk and opportunity size, this price looks undervalued

During the quarter under review, two critical components – Base Oils and the Exchange Rate have witnessed major volatility and both of these impacted us adversely. Base Oils Prices have fallen about 25% since June 2022 and the Indian rupee also depreciated significantly in the Quarter ending December, 2022. This resulted in

inventory and foreign exchange losses which have impacted our margins

Any policy changes can impact the company hard

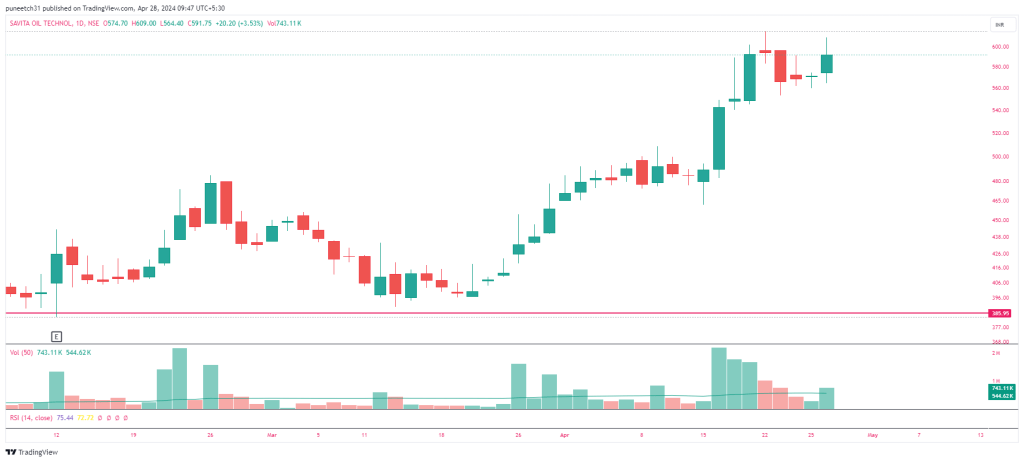

Technicals on 28Apr24

Stock has given a breakout and volumes are supporting upmove as well

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip, market offers, else Ignore the stock

Stock might be volatile in short term and give a chance to buy around 500-650 range for long term investment purpose

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Inox India is World’s leading provider of customized cryogenic equipment with Over 30 years of experience in design , manufacturing and installation of cryogenic equipment

Global customer base across 100+ countries

Large-scale serial manufacturing facilities at four locations in India and part manufacturing and service distribution from one location at Brazil with service distribution extending to Brazil and the Netherlands

Products, Segments and Strengths :

Income in different segments and Export : Domestic Contribution

Orders in different segments and Export : Domestic Contribution

Serving Industrial Gas, LNG and Cryo Scientific Division

Working continuously towards Clean Energy initiatives in – LNG, Liquid Hydrogen & Fusion Energy

Company has done good over years , some of the things mentioned below

Company has

Clients and Certifications

Professional Management team

ROCE and ROE are at reasonably good levels

Debt to Equity is almost Nil

Promoter has skin in game.

Sales, OPM, Net profit has been on rising trend continuously, OPM stable above 20%

Cash conversion cycle needs to be monitored.

Working capital days are good

Orders received for thermal shield repair, LCNG stations, Export orders as well in Q3FY24

Order Inflow was at ₹.295 Cr, up by 7% YoY

Company recorded highest revenue in Industrial Gas division of ₹. 214 Cr

As on 9MFY24, the Order Backlog was at ₹.1,043 Cr with 50% orders from Industrial Gas, 23% orders from LNG and balance 27% orders from Cryo Scientific Division and export order comprised of 47% of the Order Backlog

Capex

Company has incurred greenfield capex at Savli plant of ₹.100 Cr, entirely funded through internal accruals

Focus on LNG and Hydrogen

Agreements

ATGL and INOXCVA enter into a mutual support agreement to strengthen LNG ecosystem in the country

Both companies will accord a preferred partner status for delivery of LNG equipment and services

Memorandum of Understanding towards collaboration for the development of technology for the design and manufacture of SuperConducting Magnet based System for clinical, industrial, defense and research applications.

Patents

Company has received Patent Rights from Patents Office, Government of India titled: “A METHOD FOR SUSPENDING INNER VESSELS OF DEW AR TYPE CONTAINER TO STORE CRYOGENIC FLUID” bearing

Patent No. 530403

Company jointly with Institute for Plasma Research has received Patent Rights from Patents Office, Government of India titled “DISPLACEMENT DECOUPLING ARRANGEMENT FOR PIPING SYSTEMS” bearing Patent No. 502670

Company has received Patent Rights from Patents Office, Government of India titled:

Valuations

Company is richly valued and at price of 1356 could be Fairly overvalued as well. Due to certain moat in business it is doing, it is commanding rich valuations while Earnings Growth is only around 25%.

High Cash conversion cycle due to inherent nature of business. It needs to be monitored closely

Rich valuations. One bad quarter can lead to correction in stock prices

Exports having a significant contribution in sales. Any disruption due to escalation of ongoing conflicts like China Taiwan or Israel Palestine, Iran can cause temporary issues

Exposure to intense competition in international markets:

The company operates in the capital goods sector, which is cyclical in nature and susceptible to international policies governing end-user industries, such as oil and gas and industrial gases.

Survived well in last one month market correction and Recently made new highs. ANy correction towards 1250 zone, I would be tempted to add to my Position

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip, market offers, else Ignore the stock

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

With great pleasure and best wishes from all of you, we are delighted to launch new batch of

ALPHA Mentorship Art and Science of Investing (basics to advanced)

to make you Independent in stock markets

A PROGRAM TO MAKE YOU LEARN AND EARN

This is a unique live program for 2.5years approx. with live classes for approx. 5-6 months (on weekends) and 2 years of handholding further

Where one can learn necessary

Fundamental Qualitative concepts to understand the things which create wealth in long run–like how to evaluate management, how to evaluate certain corporate actions, how to understand direction of company

Fundamental Quantitative concepts to substantiate what we have seen qualitatively, understanding ratios and numbers like margins and numbers like EBITDA, PAT, OPM, Financial Ratio, Valuation ratios PE, PB, PS, EVEBITDA, ROE, ROCE, Debt, equity and many other deep ratios to understand whether stock at right price or not

Learn about cost of capital, working capital cycle, inventory turnover, asset turnover, interest coverage, pledging(good or bad)

Why Dividend is good or bad

How long we can hold a stock or when to leave the stock

Capex, Opex and how it impacts and when it impacts

Why certain high pe stocks keep on running and low pe stocks remain down

Red flags and green flags

Necessary Technical aspect to make our entry and exit better in stocks ,oscillators and unique indicators including SMA, DMA, RSI, MACD, EMA, Trends, SL, , different time frames and some UNIQUE TECHNICAL INDICATORS NOT TAUGHT by ANYONE

Technical aspect and understanding of Price Volume action, candlestick patterns ( bullish, bearish, single, double, triple patterns)

Technical understanding of Targets from different patterns, How to look for patterns and when to look for which pattern

Resources to analyze faster to analyze more companies faster

Understand Contrarian, Cyclical, Value and Growth investing

Bucket and GRADE Framework

Business Moats understanding–how to categorize moats, what is real moat, what is fake moat

Exit Strategies in stocks

Reading Balances sheet in simple way to analyze results and issues to make quick exits or to do pyramiding after results

Reading Cash flows in simple way to understand where money is being moved in company

Reading Quarterly, half yearly, yearly results and interpreting them better

Tricks and Checklist for faster analysis of Annual Reports to help us all understand whether to deep dive or not

Conf-call understanding, Transcripts Concepts and Tricks to understand faster

Big money moves aspect to understand where money is moving

Concepts and tricks on various intricacies in stock market

Understanding about primary, secondary market

Also get a KNOWHOW on

Checklist for stocks to identify red flags faster

Checklist for deep dive into selected stocks

How to build Portfolio for Short term

How to build Portfolio for Long term

How to find Multi bagger stocks

How to avoid pitfalls in market

When to exit stocks

Join like minded people to interact with on CHARTS, Domain KNOWLEDGE, Sector Expertise etc

This is a program YOU CAN NOT AFFORD TO MISS

Other Details

Time period 2.5 Years

Starting time Jan24

Live classes on Sunday afternoon mostly

Time duration of each lecture –approx 1.5 to 2 Hrs

Time period of live classes 6 months

Each session recorded and shared with participants

Next 2 years handholding to close the GAPS in knowledge with Handholding, Quizzes, Exercises, Bonus sessions, Charts, Fundamentals and Business analysis from time to time

Have a Resolute NEW YEAR 2024

Let 2024 be the start of your journey towards INDEPENDENCE IN STOCK MARKETS

ACT NOW for your Independence

FEEDBACK By ALPHA LEARNERS

ACT NOW for your Independence

CONTACT us

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Market took away updated SL and we did not lose anything on the positions. Following process saved us

No positions as of now. From January to March we have gradually reduced from 8 to 6 to 4 to 3 positions and did not add new ones. It really helped in this fall from Positional portfolio perspective