India has been going through a transformative change through Aatmnirbharta

Lot of sectors have big tailwinds including

- Railways (New Trains, New Tracks, New Wagons, Metro rail expansion to new cities etc.)

- Defense (Reducing imports, Replacing old ammunition, New Fighter planes, Ships )

- Automobiles (Building India as exports hub, increasing population with rising income profile)

- Space ( Chandrayaan, Aditya L1 launches, Starlink agreements with ISRO, small satellites launches increase etc)

- Marine and Shipping Industry (Building submarines, Ships, Ports infra, Sagarmala projects etc)

- Industrial Expansion in many industries with capex being announced every week here and there

- Oil and Gas industries And Heavy Earth moving Equipment’s

- Power transmission and distribution

Considering all above, ALPHA AFFAIRS see

FORGING as MEGA TREND

And from that Mega trend, we focused earlier on RK forge, covered here and here

Today we are focusing on one emerging player in same industry but has bigger vision in new sunrise industries as well. We have also covered with small details on Baluforge earlier

Balu Forge

CMP 285, Market cap ~2900cr

ROCE ~27%, ROE ~22%, D/E ~0.16 PE ~44 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4

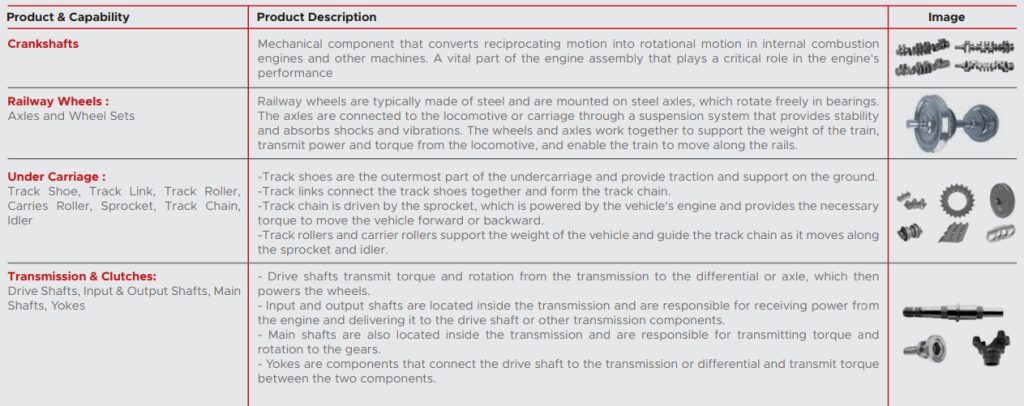

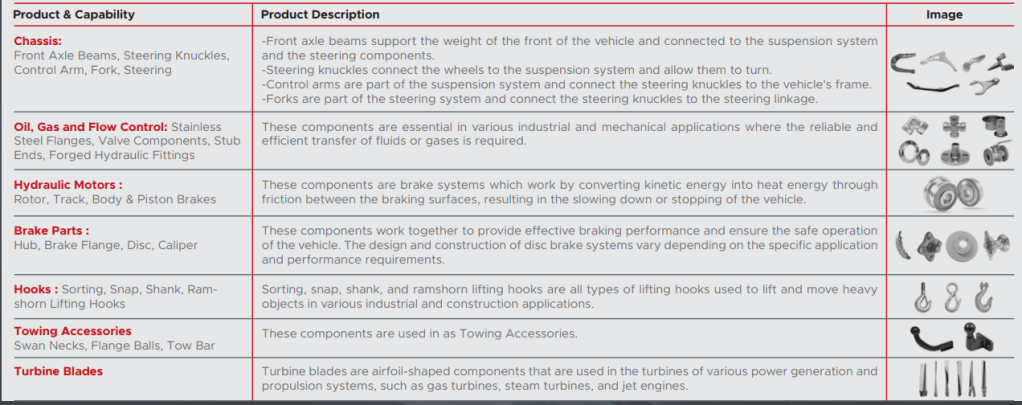

🟢It is engaged in the manufacturing of finished and semi-finished crankshafts and forged components and has a strong clientele comprising of 25+ OEM’s. Company has Fully Integrated Forging & Machining Unit with a large product portfolio offering to customers ranging from 1 Kg to 500 Kgs. The Forging Unit comprises Both Closed Die Forging Hammers & Presses

🟢Balu Forge has a distribution network in over 80+ countries and operates in domestic and export markets

🟢Balu Forge is already an approved vendor to a majority of the 41 Ordnance Factories part of the Ordnance Factory Board in India.

🟢Acquired Mercedes Benz Truck, Mannheim, Precision Machining Plant in 2021.

🟢Company has 3 subsidiaries. 2 in UAE and One in India.

Kelmarsh Technologies FZ LLC in 2021 (100%). Headquartered in the UAE with operations spread across 3 countries in Africa. Focused on manufacturing and innovation of agricultural equipment predominately tractors and tractor ancillary components

Safa Otomotiv FZ LLC (100%). Focusing on the machining and assembly of products in order to increase localization in the MENA region as well as meeting the product requirements for Agriculture and Oil & Gas industry

Balu Advanced Technologies & Systems Private Limited

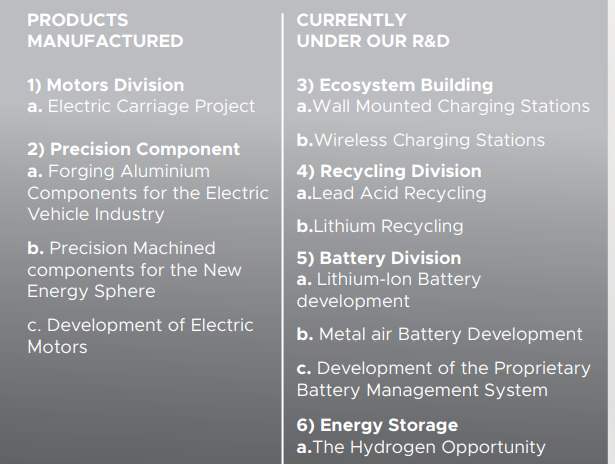

Naya Energy Works Pvt Ltd (100%). Naya Energy is engaged in manufacturing of products for New Energy Sector

Company claims to work on Hydrogen Fuelling Stations & pilot project is presently underway to establish the first Hydrogen Fuelling Stations for fuel cell vehicles

Also company is in the process of patenting our domestically developed Refining Technology, NayaRefine. Currently One Module deployed can roughly produce 3-3.5 Tons of pure lead every day.

Company is working on a range of Charging Stations Conforming to Bharat EV AC Charger (BEVC-AC001) & Bharat EV DC Charger (BEVC-DC001) norms

Company also claims to work on ESS (energy storage solutions in form of hydrogen)

🟢Entered into leave and lease agreement with Hilton Metal Forging Ltd enabling Balu to backward integrate from precision machining player to Forging and Machining player

🟢Existing capacity to produce 18,000 tonnes Forged Components per annum which will be expanded to ~32,000 tonnes in the coming quarters. Annual capacity to manufacture 3,60,000 crankshafts. Wheel Production capacity of 6,000 wheels per year with a diverse application suitable for railway wagons, passenger coaches & locomotives in various gauges. Company want to Expand the wheel production capacity to 48,000 wheels per year

🟢On the capex front, Company plan for enhancing machining capacity by ~14,000 tonnes at newly acquired 13 acre land in Belgaum, Karnataka is progressing well. The operations from this facility are expected to commence from Q4 FY24, that will enable us to produce heavier and more complex crankshafts having better realizations and margins. After expansion, company will be operating on 22cr (previously 9 acres)

🟢The new facility will not only act as a Manufacturing Centre but will also be setup as a Technology & Innovation Campus with a strong focus on Integrated Defence Research & Production, Cylindrical Cell Production for Electric Vehicles, Components Suitable for New Energy Vehicle Drivetrains & Powertrains, Spent Battery Recycling to name a few but not limited to the same. There will be a dedicated R&D center spread over 4000 m² with a strong focus on the following key areas:

- Advanced Materials & Composites (Development of New Materials)

- Fuel Cell Development

- Cylindrical Cell & Module Development (LFP & NMC)

- Metal Air Battery Development (Zinc Air)

- New Energy Powertrain & Drivetrain solutions (New Vehicle Components)

- Advanced & Additive Manufacturing

- Energy Storage Solutions

- Alternate Bio fuels

- Spent Battery Recycling

- Advance Defence systems & solutions

Key focus areas of our R&D

Exploring the use of new materials, such as lightweight alloys or advanced composites, to enhance the product offering.

Investigating cutting-edge manufacturing methods, such as additive manufacturing (3D printing) or advanced Machining, to achieve higher precision and tighter tolerances.

Analyzing and optimizing product designs using computer simulations and finite element analysis to maximize performance and minimize stress concentrations.

Building a robust platform for the product expansion into the Railway & Defence Industry by way rapid prototyping & increase the speed of New product development

Successful Prototyping of some key components for the New Energy Mobility sphere to ensure the long-term vision of building strong capabilities in Fuel Agnostic solutions.

Investigating new heat treatment methods to enhance the strength and fatigue resistance of our products.

🟢Diverse array of products including Crankshafts, Railway Wheel, Under carriage, Transmission and clutches, Hydraulic motors etc

🟢Company is witnessing a lot of green-shoots in the defense and railway industry. This presents a significant growth opportunity for BFIL, as we continue to expand our footprints in these sectors

🟢Company is spending 2-4% in R&D and have 45 employees in that division, Overall employee strength is more than 700. Company is also Backed by certifications like IATF 16949 accredited by Tuv Nord Cert GMBH

🟢Revenue is expected to conservatively grow by ~25.0% in FY24 over FY23, led by growth opportunities in the various industries like defence, railways, and others

🟢EBITDA margins are expected to be in the corridor of 22.0%-23.0% in the upcoming quarter on the back of increasing scale of operations and efficiencies

🟢Promoter has skin in game with roughly 54% allocation. FII Have entered. Some DII money is also getting poured in this one. Management has good 3 decades of experience in the industry and now 3rd generation also into same business leveraging the domain strength acquired over years

🟢Fund raising and Preferential allotment Promoter infused 26cr at 115 Rs/share in 2023 and then 92cr (almost double of fixed assets 48cr) at 183 Rs/Share. Ashish Kacholia & Sage one also participated in Pref. at Rs.115. On 48crs of Fixed assets , Company has raised~300crs for expansion. Recently new fund also entered at 183 Rs/Share. All the selling hangover by a fund over last 2 years has been absorbed and stock is back to new highs

🟢Order wins in last 12 months. Significant order win from a tractor manufacturer based out of the Middle East of supplying 10,000 sets of sub-assemblies & there is scope to increase the same to over 50,000 annually

Risks

🔴 Volatility in the price of major raw material- steel and aluminum is a major risk, the operating margin remain susceptible to these volatilities

🔴Large working capital days cycle. The company provides a credit period of 150-180 days to its customers due to business requirements and maintains an inventory of 60-80 days due to diversified product portfolio

🔴Most of the talks under Naya energy division or Balu Advanced systems is just been talk. We need to see when and what product comes out of these new divisions. Many other companies progressing fast on Recycling, Defense and EV/Hydrogen space. We have not seen much on this part regarding their advances in these domains which significantly upgrade their Revenue or profit from these divisions. These may become sunk cost if management is not focused

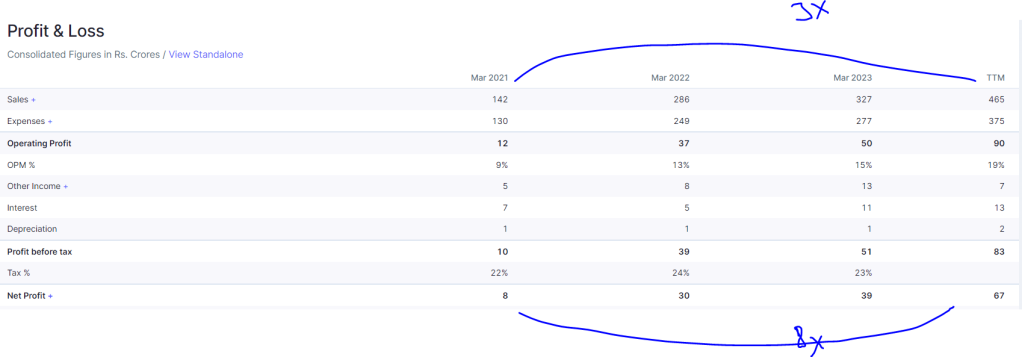

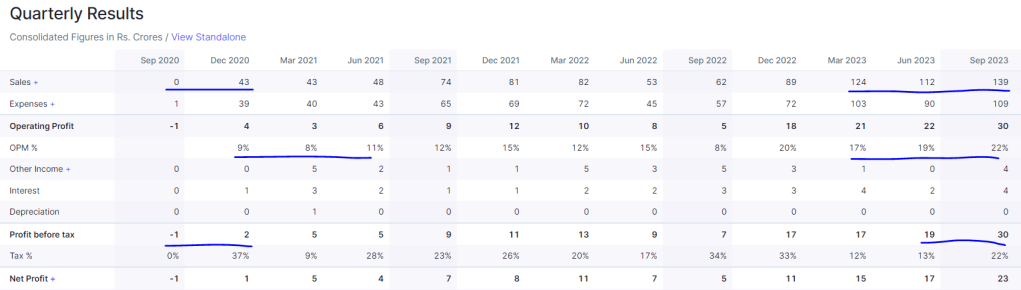

Financials

Sales have grown 3x and Profits 8x in last 3 years approximately, OPM margins have improved, over 3 years company financials have improved

Technical chart

Good Daily and Weekly Breakout with volumes in 1st Week of Jan24

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Discover more from ALPHA AFFAIRS

Subscribe to get the latest posts sent to your email.

27 thoughts on “SS-5”