BE FINANCIALLY INDEPENDENT

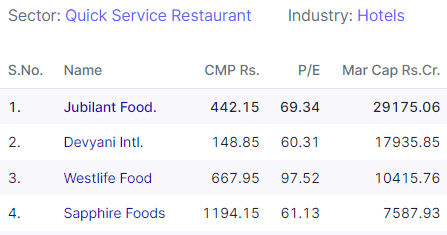

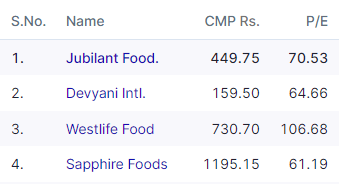

Looks better to stay away from QSR companies like Sapphire, Devyani, Zomato, Jubilant food

Dated 25-feb-23

Dated 25Apr-23 –Decision paid off well –even in the recent rally , these stocks did not run

Time is coming to accumulate slowly after one correction

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Devyani Internationals Limited IPO-“DIL” is the largest franchisee of Yum Brands in India and is amongst the largest operators of chain quick service restaurants in India and are among the largest operators of chain quick service restaurants (“QSR”) in India on a non-exclusive basis. DIL is also a franchisee of the Costa Coffee brand in India, which is owned by Costa,

Business — DIL’s business is broadly classified into three verticals that includes stores of KFC, Pizza Hut and Costa Coffee operated in India (KFC, Pizza Hut and Costa Coffee referred to as “Core Brands”, stores operated outside India primarily comprising KFC and Pizza Hut stores operated in Nepal and Nigeria (“International Business”); and certain other operations in the F&B industry, including stores of our own brands such as Vaango and Food Street

Region of operation — Major cities in India and in Nepal, Nigeria

Offer purpose — The IPO is issuance of shares worth ₹1838 crore for debt clearance and general corporate purposes.

Risks —

Termination of or inability to renew long term contracts with brands

Loss making company

High and intense competition in QSR space

Outstanding litigation proceedings against the Company, Subsidiaries, Directors, and Promoters

Strength

Presence across key consumption markets

Highly recognized global brands catering to a range of customer preferences

Multi-dimensional comprehensive QSR player

Future

The quick-service restaurant channel has been rapidly growing in popularity in India, owing to factors such as rise in literacy, exposure to media, increase in disposable incomes, and easier and greater availability. Affordability has also been a key factor.

Valuations

Valuations are high and bit lesser than peers

Should we apply?

People can subscribe only for listing gains. Sell on listing day

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Zomato IPO is little different because company is showing losses and when they will break-even is not sure. So read further and analyse all points with a pinch of salt. Many investors dream of being a venture capitalist one day and to all those guys, Zomato is giving you a chance.

Put your HAT of venture capitalist and drop the hat of investor to view this IPO. If it works good — ENJOY!!, If it does not–Don’t lose sleep.

Zomato IPO– Incorporated in the year 2008 as a restaurant-discovery website – Zomato, is now one of India’s largest food delivery company.

Business — Zomato has four business segments – two core B2C offerings including food delivery and dining-out. There is B2B ingredients procurement platform ‘Hyperpure’ and the customer loyalty program, ‘Zomato Pro’ as well

Region of operation — Company has operations in 23 foreign countries – UAE, Australia, New Zealand, Philippines, Indonesia, Malaysia, USA, Lebanon, Turkey, Czech, Slovakia, and Poland. However, the company generates 90% of its revenue from India.

Offer purpose — 9,000 crore will be a fresh issue, while the remaining an offer for sale from the oldest investor – Info Edge (India) Ltd. Company will be possibly using this money for organic and inorganic growth

Risks —

Company unit economics of profitability is not sustainable as of now

Highly competitive industry and many players have shut down in past few years. Any new player with deep pockets can come and start competing. Amazon has already started with aggressive pricing

High dependence on order size and repeat orders for making money

Strength

Adjusted for cash and cash equivalents, Zomato has an asset-light balance sheet and it will help company to sustain for few more years with almost 16000cr cash and cash equivalents

Covid-19 has given push to delivery based eating model and it will possibly help the company to cut operational costs with lower discounts and higher delivery charges

Only two major players in fray and other players are only focused on one part of business while Zomato is well leading ahead in other domains as of now

Able management

International presence

Future

Company has been growing and survived last few years onslaught when many players have shut shop(including uber, ola, foodpandaetc). The way Indian population is moving to nuclear families, demand for food delivery will increase and so will be competition.

Hence ability to charge high prices may remain limited.

Diversification into other areas like stake in grofers, kitchens, increase in memberships may help the company to survive against competition a bit longer.

How fast they can expand in tier 2 and tier 3 towns and how much they are able to extract from people is the key in next few years for breaking even.

Its the only player in 4 different segments as compared to peers is an advantage for them as of now

Valuations

Valuations are extremely stretched out. Nothing much to talk sensible here

Should we apply?

People falling into high risk taking category can bid in IPO and and add more after listing to play out this theme over few years.

People who can take risk of capital erosion can subscribe with one lot and book out on listing gains if any.

Please note that company is not profitable and entire capital put in company shares can go down the drain if things do not turn in anticipated way

Whatever you want to do with this IPO , don’t become a long term investor if you applied for listing gains or vice versa. Be sure of why you are applying and stick to that

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.