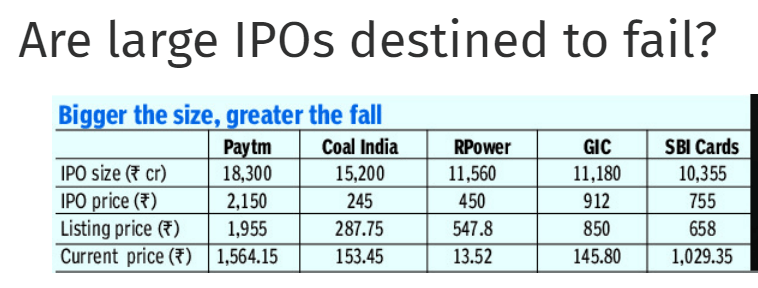

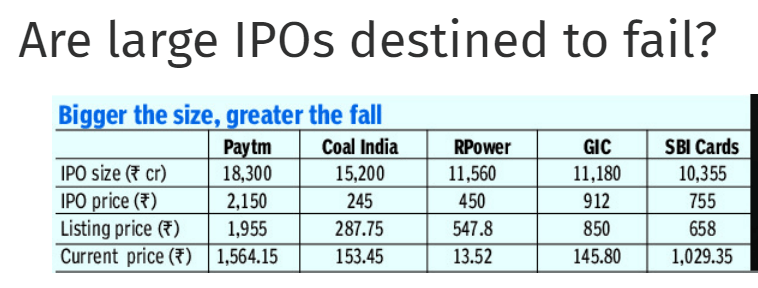

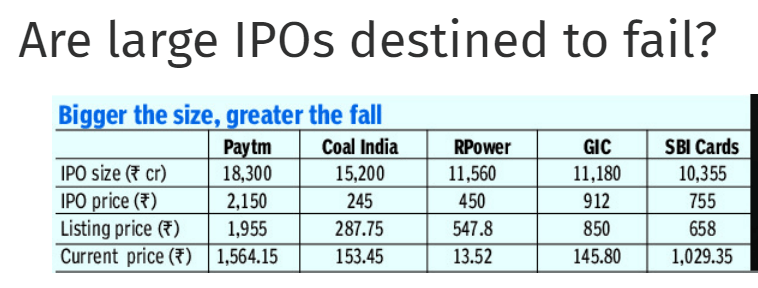

Large IPO and Failures : Deadly combo

BE FINANCIALLY INDEPENDENT

Q2 FY21 results fo SBI cards are out and does not look great on few fronts although long term story seems intact as of now

Few snaps from SBI recent investor presentation where we can see the lagging part from company as compared to previous year FY20

SBI Cards : Declining portfolio growth, SBI Cards : Increasing NPA , SBI Cards : Declining PAT

Looks better to wait for right entry price : NOT a RECOMMENDATION

Looking at HDFC Bank Q4 confcall transcript analyses. One key point was discretionary spending on cards is effecting total spending. This do not bode well for companies like SBI cards where not only spending goes down but it will hit the profit as well due to late payment and increase of NPA in certain cases.

Also Read : SWOT analysis : SBI Cards

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

This is in series of posts where you can find the SWOT of a listed company along with factors to watch out for in coming quarters.

SWOT means

S – Strength of a company

W- Weakness of a company

O- Opportunities available for a company

T – Threats for a company

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Also Read – SWOT- Parag Milk Foods

Also Read – New to Stock Market : Part 1 : As Investor or Trader?

Also Read – Invest in stock markets only if

Also Read – SWOT- Dhanuka

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Read on SBI cards Business Strengths, Oppurtunities, Weakness, Threats in the post SBI CARDS IPO. We will discuss in this post on what could be an investor strategy once its listed on 16th Mar20.

Since Market scenario has turned bad as compared to IPO subscribe days, its better to be prudent in investing. Just pulling back line from old article on subscription strategy, the longer term strategy will remain as such

One can subscribe to SBI cards IPO if one can hold the shares for 3 to 5 years and looking for long term gains

Note taken from earlier post on subscribe or not : SBI CARDS IPO.

This could very well turn out to be a blessing in disguise as you have money available to put in stock market. Whereas others are finding it challenging to arrange money to buy stocks available at cheap valuations after a drastic fall, you are spoilt of choices.

Action 1–> Keep some money ready for SBI cards and allocate rest amount to buy other quality stocks in market

Action 2–> If Listing happens at premium of +15-25% IPO price, you need not to do anything. Wait for correction in stock price before initiating your position

Action 3–> If Listing happens at +/- 5% of IPO price, you need not to do anything. Wait for correction in stock price before initiating your position

Action 4–> If Listing happens at -20% of IPO price or share price moves down 20% from IPO price ( approx 600 Rs), you can initiate buying and can put 33% of your money kept aside for SBI Cards. In more likelihood, you will get chance to put more at down levels.

Action 1–> Sell all allotted shares of SBI cards if listed at 20-25% premium to IPO price and wait for re-entry

Action 2–> If Listing happens at +/- 5% of IPO price, you need not to do anything and wait for further correction before averaging down your price

Action 3–> If Listing happens at -20% of IPO price or share price moves down 20% from IPO price ( approx 600 Rs), you can initiate buying and can put 25% of your money kept aside for SBI Cards. In more likelihood, you will get chance to put more at down levels.

Action 4–> Buy 50% or more of money kept aside if share price moves down 40% from IPO price ( approx 450 Rs).

Action 1–> Sell all allotted shares of SBI cards if listed at 15-20% premium to IPO price and wait for re-entry.

Action 2–> If Listing happens at +/- 5% of IPO price, you need not to do anything and wait for further correction before averaging down your price.

Action 3–> If Listing happens at -25% of IPO price or share price moves down 25% from IPO price ( approx 530 Rs), you can initiate your further buying and can put 20% of your money kept aside for SBI Cards. In more likelihood, you will get chance to put more at down levels.

Action 4–> Buy 50% or more of money kept aside if share price moves down 50% from IPO price ( approx 375 Rs).

Slowing economy may led to lot of defaults. NPA % is sure thing to watch out for

Rich Valuations at IPO time may take longer time to deliver mutlibagger returns and if any quarter results are not as good as expected, these rich valuations may play havoc

Emergence of new player to snatch market share. Keep watch out for AXIS Bank and ICICI Bank market share vs SBI Cards market share

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Few things on SBI CARDS IPO to help you decide whether to go ahead with subscribing for IPO or not.

Healthy Balance sheet

Strong parentage backup (subsidiary of SBI)

Second largest credit card issuer in India with 18%

Low credit card penetration in India ( @ 3% only) . Developed markets have this ratio @300%

Largest co-brand credit card issuer, having partnerships with several major players.

Will become the only listed company in India in this space.

Fast usage of UPI interfaces may led to increased competition

Fast usage of mobile wallets may led to decline of credit card users or slow penetration into new user base

Unsecured credit may lead to high NPA

High Valuations

One can subscribe to SBI cards IPO if one can hold the shares for 3 to 5 years and looking for long term gains

Slowing economy may led to lot of defaults. NPA % is sure thing to watch out for

Rich Valuations at IPO time may take longer time to deliver mutlibagger returns and if any quarter results are not as good as expected, these rich valuations may play havoc

Emergence of new player to snatch market share. Keep watch out for AXIS Bank and ICICI Bank market share vs SBI Cards market share

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.