Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Ramkrishna Forgings

Business

Ramkrishna Forgings Ltd is primarily engaged in manufacturing and sale of forged components of automobiles, railway wagons & coaches and engineering parts. Company mission and vision is to be the most preferred supplier of forged, rolled, machined, fabricated and cast products for all end use industries like Railways, Automotive, Earth Moving, Mining, Farm Equipment, Oil & Gas and General Engineering globally by supplying products meeting highest quality standards at highly competitive costs

Manufacturing facilities

RKFL’s facilities in eastern India are located in close proximity to automobile manufacturing hubs and key suppliers of of raw material

- Less chance of supply interruptions

- Lower logistics cost

- Reduced working capital requirements

Customers and Regions of Revenue and Product verticals

Products

Company focus is on de-risking business from few customers or few segments or few geographical areas

They have succeeded quite well in last 4 years

When a company has to grow to large company, many such things will give stability to company to perform well

Experienced promoters and established track record of the company

Promoters have 40 years of experience in forging industry

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

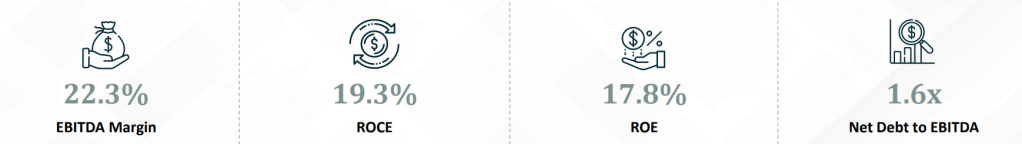

PAT , ROE, ROCE, PAT margin showing improved profile

8x sales growth and 35x profit growth in 10 years

Stock price is also 20x in 10 years and its quite possible to become 2-3x in next 3 years with CAGR of 24-30% approximately

Debt to equity has come down considerably and now close to 1 while Debt to EBITDA also is planned to reduce to 1 by FY25

Cash conversion cycle has improved to 100 days and Working capital days has also improved

Topline and bottom-line has improved significantly in last 3 years and trajectory is expected to continue in similar fashion

Shareholding pattern

Good promoter holding, skin in game, FII are increasing stake, Public domain have few strong holdings as well

FY23 Fundamentals ratios

ALSO READ : Company at Y2K moment

ALSO READ : Dream come true

Strengths

Manufacturer and supplier of a variety of auto and non-auto components

Global presence with footprints in North America and Europe

2nd largest forging player in India with over 40 years of experience Promoter possessing multi-decade forgings industry experience

Continued focus on diversification with foray into EV components

Longstanding relationship with marquee customers

Outstanding Credit ratings –perfect recipe for large cap progerssion in coming years

Triggers

Opportunity size in exports and domestically

There is a huge requirement in India and in various overseas countries. Compant exports are grwoung well

Capacity Enhancement and future growth from internal accruals

Commissioned 7,000T Press Line in 2021 and also commissioned a Warm Forging Line and a Fabrication Facility in 2021

The company has commissioned 23,800T of capacity as on 18th July 2023 and the remaining 32,500T will be commissioned by September and overall Increasing to 2,10,900T (current installed capacity 187000T)

In addition, the company has planned to setup cold forging capacity of 25,000T. The Company has sufficient capacity for the next phase of healthy & robust growth. Capacity ramp-up along with operating leverage will result in faster improvement in profitability

Cold Forging Press line to be commissioned by Q1FY25

Entire 100% capacity has been booked by an OEM, the contract of the same is valid for 7 years

Management guidance in Q1FY24 Call

Subsidiaries and Strategic Acquisitions

Company has done a JV with Titagarh rail company for manufacturing and supplying of forged wheels for Indian railways

Ramkrishna Forgings announces strategic acquisition of Multitech Auto Private Limited and its wholly owned subsidiary Mal Metalliks Private Limited along with Mal Auto Products Private Limited. This can lead to 20% of current revenue addition

Also company has done some acquisitions in ACIL , JMT auto and Tsuyo. This push will help company to foray into tractor, PV segments, Heat treatment, gears, BLDC EV segments

Industry growth rate

Various forecast showing industry will grow between 6-10% for next few years. Important to understand here is the industries the company caters to

All these segments have Government focus and will grow heavily in next 5-7 years. So I believe company is present in right segment and right regions (fastest and biggest regions)

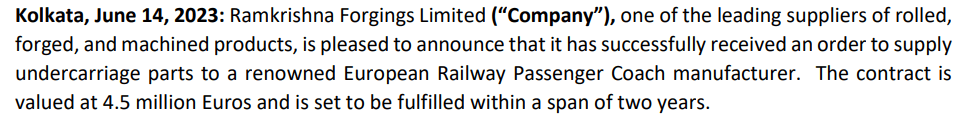

Recent Order wins

Just listing few wins in last one year

Risks

Susceptibility to raw material cost could affect Company profitability.

US landing into recession may also trigger less future orders in short term. Stock may consolidate before moving up

Stiff competition from peers like Bharat forge but this risk is bit mitigated with many order wins recently and consistently

Higher revenue concentration from Auto segment and CV domain in that is a risk–though company is taking utmost steps to remove this risk as highlighted above

High capital working requirements remain a risk

JV falling off with Titagarh rails for reasons is a small risk

Railways not going ahead with orders and new tenders in coming time is another risk which we need to consistently monitor

Technicals on 22 July 23

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip market offers else Ignore the stock

Stock might be up in short term and then give a chance to buy around 400-450 range for long term investment purpose

I am holding it from lower levels and I reserve the right to add more or exit as per company performance without a followup /update here

Also Read : ICEMAKE Refrigeration : Time to Chill

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.