PAPA JOHNS : 2nd Avatar

BE FINANCIALLY INDEPENDENT

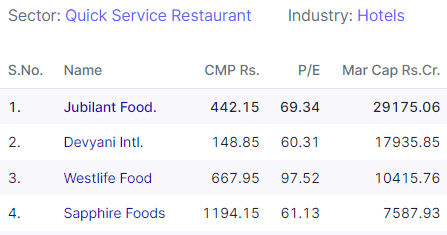

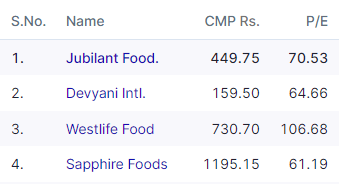

Looks better to stay away from QSR companies like Sapphire, Devyani, Zomato, Jubilant food

Dated 25-feb-23

Dated 25Apr-23 –Decision paid off well –even in the recent rally , these stocks did not run

Time is coming to accumulate slowly after one correction

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Bector Food Specialities IPO– Mrs. Bector’s Food is one of the leading companies in the premium and mid-premium biscuits segment and the premium bakery segment. Company is largest supplier of buns for QSR restaurants in India.

Business — Sells Biscuits, Bakery products, Frozen Products. And a contract Manufacturer for Oreo and Bournvita biscuits

Offer purpose — Offer for sale (540cr) including fresh issue of 40 cr. for expansion and general purposes

Key Service domains – Biscuits domestic 43% of total sales, 24% exports of total sales.

Key export regions are Africa and North America. Total 64 countries where export is done

Risks —

There are cases of non-compliance against certain legislations in the past by group company and some disciplinary actions as well

Highly competitive industry with company having only 1% market share. Margins can reman depressed for quite long time putting strain on cash flows

Low shelf life of certain products

Company do not have any long term supply agreements with any of their QSR customers is a strange thing and deals on day to day basis requirement for bns, bakery and frozen products

One of the lowest risk but having high business impact is focus on nutritional value of products which can hamper sales in future

Strength

A leader in biscuits and bakery segments in North India with well-diversified product portfolio.

Major food certifications i.e. BRC, USFDA, and FSSC.

Modern production process, Strong sales and distribution network.

Strategically located in proximity to target markets which minimizes freight and logistics related expense and time

Future

QSR is thriving industry and consumption food business will gain. QSR CAGR expected to grow >20% for next 4-5 yrs

Proxy play to QSR story, so should do well in coming years

Valuations

Profit making company but PAT going down from last three years

Focusing on growth in premium biscuits and bakery segment to improve margin having high competition

As compared to peers, valuations looks ok but needs consistent review

Should we apply?

People can subscribe looking at growth prospects

Listing day may see good gains. Recommended to sell if getting 10-30% gains on listing day

One can also hold long and review holdings with each quarter earnings

Also Read

Burger King IPO crisp Summary — Possible Listing with gain on cards

UTI AMC IPO crisp Summary — Listing with loss as shared

CAMS IPO crisp summary — Listing with 20% gains as shared

Angel Broking IPO crisp summary –Listing with loss as shared

Happiest Minds IPO crisp summary –Listing with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Burger King IPO– Company is 2nd largest burger chain in India, started operation in 2014 and fastest international brand to have 200 QSR outlets in Inda

Plan is to target 700 outlets in next 5-6 years.

Offer purpose — Offer for sale (360cr) plus fresh issue of 450 cr. To open new stores and pay some part of loan

Key Service domains – 2nd largest burger chain after McDonald

Risks —

Loss making company as of now. Loss of 119+ cr in six months of current FY21, loss of 76 cr in last year FY20

Offer on food tech apps may harm the business wrt competitors plus McDonald, Jubilant food will definitely try to defend the market share

Fast expansion may lead to more losses in coming years but its a double edged sword and can lead to gains as well

Strength

Post COVID –company will have lean structure and business should have good unit economics

Also because of urban developments and more money in hands to spend, culture of eating in QSR will support the company

Fast expansion can help the company in increasing mkt share

Future

QSR is thriving industry and consumption food business will gain. QSR CAGR expected to grow >20% for next 4-5 yrs

Sustainability looks good, McDonald, Dominos, Subway, KFC have already survived and adapted

Valuations

Loss making company and PE is negative

Last 3 Yr Revenue CAGR at 53.4%; Total Debt as of Sep 2020 at 195 Cr

As compared to peers , valuations are reasonable in terms of mcap/sales or mcap/ebitda

Should we apply?

People can subscribe looking at growth prospects

Listing day may see good gains. Recommended to hold long

If available on listing day around 50-70 Rs, one should add more from 3-5 yrs perspective for possibly good gains

Also Read

UTI AMC IPO crisp Summary — Listing with loss as shared

CAMS IPO crisp summary — Listing with 20% gains as shared

Angel Broking IPO crisp summary –Listing with loss as shared

Happiest Minds IPO crisp summary –Listing with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.