Avantel AGM 2024

Copied key contents which I liked from AGM transcript.

Disclosure : I am holding it from very low levels, Not added/not sold recently

we have consolidated our existing business in satellite communication for defence applications, we are also diversifying into two different areas and the results we expect to see in two years from now in a big way.

So, and we are very confident that both these initiatives will put the company in a different orbit.

From 2026 -27 onwards, we expect to see the results. And from 2027 onwards, the three years from now, there will be a quantum jump. we expect the company to establish itself as the top five companies in the country in the space of defence

First diversification that we are doing is the software defined radios. It’s a big, huge market globally. But if you come to very specific to India alone itself, it’s around $11 billion market globally. But coming to India in the Indian Defence market alone, it’s, it’s around, it’s around $300 million leaving the civilian commercial market only Indian defence market per annum. That is $300 million is per annum

we would be number two, I mean, if I’m not wrong, in that space of SDR’s with SCI compliance and that covers various spectrum like HF, VHF, UHF, L band, Satcom, SDR. There are various frequency bands and various versions of them for like portable versions, handheld versions with vehicle borne aircrafts, helicopters, shipborne submarines

C4ISR is the basic backbone of any, you know, any defence service, which includes command, control, communication, computing, intelligence, surveillance and reconnaissance

We are planning to complete a range of products by this year, financially and itself, but we expect to see a good revenue and all from 26, 27 onwards. By 2027, we should have, we consolidated as a serious player in that segment in India. And these products will also have possibility to expand in the global market.

second diversification is in the space sector where there the government of India has started opening up the sector very seriously and they want to see that private sector enters BLO, build, launch and operate kind of services. So in all the both upstream as downstream and midstream services in satellite space will be open to the private sector either through partnership with public sector or, government. Public private partnership or private sector alone government of India is looking at something like $50 billion in the next eight to nine years

we are well positioned to expand our presence in the space sector by getting into two areas.

One is ground station as a service like it includes satellite operation Centre, mission control Centre and also receiving the data and images from the satellites. Their station is supposed to receive the signals from satellites and then distribute that to the customers.

And the second part is the assembly, integration and testing of the satellites themselves. There up to satellite weight of say 1000 kgs max. We should be able to do it in house. So we are establishing a facility in ECT electronic city in Hyderabad. It is near airport. It’s about four acres of land. The construction is going on and we should be able to complete that facility in all respects by this year end. So there two things

Orders

we have around 287 crores worth of orders on hand right now. there are a lot of other things in pipeline railways now, we are well established. We are expecting another 60 crores order, approximately, and maybe in a month or two and followed up by another tender coming up. They are coming up for I think maybe 12,000 terminals. So that will be a public tender. NSIL, we are doing, I mean, we have an order for around 27,600 or so

Five-kilowatt HF system we have already delivered and that has only been delivered to Indian Navy, government

of India through bath electronics, installed and commissioned. So, there’s a good requirement in that space. And right now, A, we have the product in hand and we are ready for that. So, whenever the RFP comes, we are. That will be a big opportunity. Maybe few hundred crores.

we want to work on satellite payloads also which is again state of the art kind of development work. Subsystems for satellites. These are highly manpower intensive kind of work. So, the manpower expenses in R and D will grow a lot significantly in the next three to four years because we are investing heavily in R and D in those software, different radios and satellite subsystems right now.

We have five projects sanctioned by Minister of defence government of India and five is the maximum they can give to any company. So, and we got five out of this. Two contracts are signed. One is in the final stage of contract signing. Maybe this month, June they will sign another one, maybe in June end or July. So enough. There are two major projects we have signed wherein once we complete the development, we’ll be the only vendor for those requirements. And those projects are having high potential because we’ll be the single vendor and those projects are having huge requirement from Indian army

Government of India is giving a grant for those projects, investing in that. And they are investing in their time and effort to do the trials, conduct the field trials for these projects. So earlier we have to understand the requirements, develop the product without anything, no cost, no commitment basis, go after them to conduct trials and accept that. Now it has come from them. They are given the specs, they have given the requirements, they are giving the grant and they are saying once it is completed, they will buy from us. So, it is like a phenomenal change in the outlook from the government of India. And in terms of making India and self-reliant, I think they mean business

Receivables

Receivables we have, because we did 38 crores in the last quarter. I mean there is some, it appears to be more, but we have already received close to 39 crores from those 68 crores. And in that again around eleven crores is towards installation commissioning which will come over a period of time as we complete the installation of the equipment and all crores, another remaining eleven crores we should be receiving in June or July. So, there is absolutely no, as you could see, there are no bad debts at all for the company and they are, if they are there also, they are minuscule, 0.001% something like that. Because all receivables are from government of India or government of India undertakings.

IMax opportunity

we may do some two and a half crores or so next year. Then following year maybe, we may even go up to ten crores, then 15 crores. But we are confident that we will reach 100 crores by 2030. So that’s not a very ambitious target because of the market here is around $11 billion and we are importing about $7 billion every year in medical equipment. That sector, which is about $7 billion, is the import itself around 60,000 crores or more they are importing. There is a huge potential there that is also expected to go to $50 billion by 2030. we are very well positioned in that because our expertise in electronics and engineering and mechanical, everything is very helpful in making world class equipment. We are not compromising on quality or anything. We are trying to build artificial intelligence into that. We want to make this equipment IOT enabled and benchmarked against the best in the world. So, there is no doubt that we will do well in image. It’s only a matter of time. So, But the break-even may happen. Maybe if not this year, next year definitely it will break even and get into cash profit. We’ll make profits in 25, 26 for sure. And after that the growth will be exponential. So, the I max would be a very, very significant

we are positioned in a place called AP MedTech zone where the world class facilities are created for complete testing and certification. It’s world class, it is recognized by WHO also. So, our facility is coming up in that 300 acre or something kind of a thing, where there is incubation centre, the test labs, certification labs, and many companies also have already started operations about four or five years back, and they’re doing extremely well. So, in that we have chosen space where two, three areas we have identified.

One is the respiratory area, like. Like ventilators and C Pap, BiPap and things like that. Then we are selected. Endoscopy is one of the areas And of course, to start with a low, low-end side, we have taken surgical staplers where it is certified. And then we, as I briefed you earlier, we got a contract for supply, 25,000 numbers per month from another OEM company. So, we’re on the right track. And then the final, we also want to, as I rightly, as I told you earlier, we want to develop something called hospital at home kind of equipment, which will be very useful for in times like Covid or for elders or for communities. So where in a budget of, say, ten lakhs, you can have everything that a hospital can provide. In an ICU, which is a small, it’s an equipment which will be carried on a cart or something like that, which will monitor all vitals. It will supply oxygen, it will have ventilator, it will have infusion pump to infuse injections and all. It will monitor all the vitals. They will be communicated to the doctor. Essential medicines will be made available there. Simple. Some small blood tests also can be done. So basically, it is like everything that you can ask for in an ICU, kind of things will be made available. Any nurse can handle that. And as the vitals are monitored remotely and doctor can be. Will receive alerts and then he can give guidance and then nurse can attend to that

are we able to develop any new products now which will help us be ahead of the competition for the next three, four years and enjoy similar margins?

Dr Abburi Vidyasagar- Actually we are continuing that initiative in developing intellectual property. The fundamental focus of the company is on innovation. Always it’s an innovation driven company, though we give very lot of importance to customer service and operational excellence, which are also required to make our company profitable. But the core is innovation only even today.

we have already started working on software, different radios with SCA compliance for Indian as well as global market in defence communication. That is going to be. I mean, there will not be many companies in that anyway. Okay, I don’t say zero competition. There will be competition, but there will be limited competition. Similarly, the ground terminals I am talking about in KU band, cultivating Gaga band, which is again, very few companies will be there. I mean, the satellite terminals I am talking about, which are portable, mobile, you know, airborne, those versions which can be mounted in aircraft or a helicopter, those satellite terminals, again, very few companies will be there

Avantel AGM 2025

we have taken

up five projects, 5 projects from the Ministry of Defence under the scheme of iDEX Indian

Defence Challenges. So, the projects are mostly related to satellite communication. In fact,

all the five projects are related to satellite communication. And the first one is sat phone

based on geostationary satellite. The second one was again Convoy Management based on

satellite. Both are for Indian Army. The third one is the receiver for receiving video through

satellite, again for Indian Army. Port and 5th projects are for the requirements of Indian

Navy, which is mostly based on Satcom on the move, the communication on the move for

both land-based platforms as well as for the airborne applications. So, all five out of the

five project, the 5th project contract was signed recently, but the fourth projects were

signed quite some time back about six months back and the development work is going on

very well

we have come for rights issue which is that

near Vijayawada about an hour from the airport of Vijayawada, it’s on the highway. So that

we would like to use for you know, making antennas which like HF antennas which are

very huge and in terms of occupy a lot of space, 5 kilowatt HF antennas, one kilowatt HF

antennas and then other types of antennas use it in military applications as well as sat com

ground station antennas for say 7.3 meters, 9.3 meters, even 11 meters satellite (Not

Clear) antennas can be manufactured there.

we are meeting all the

requirements in terms of production as well as design, development of various products for

MSS, particularly MSS mobile satellite services and UHF, SATCOM and UHF LOS

radios, HFSDRs and HF one kilowatt systems and the real time training information

systems, fishing transponders for boats from the Department of Fisheries through NSL.

The

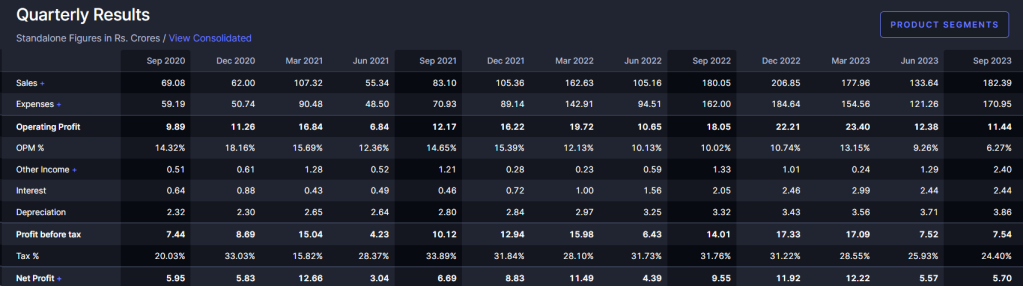

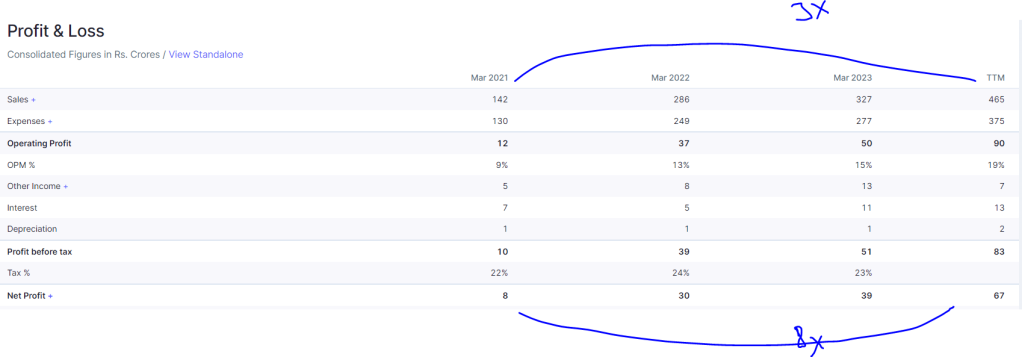

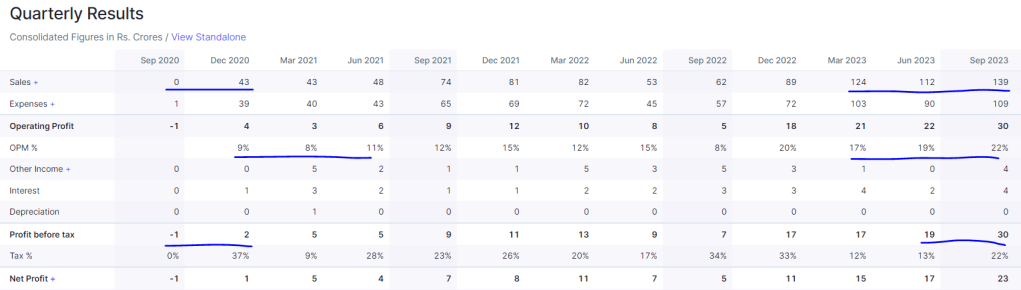

growth again using CAGR growth. So for example, in 2021, the sales was 77 crores and

now 24-25 it is 248 crores either kind of almost it’s more than it’s about 3 times 300%. If

you look at the profit, it was 15 crores in 2021 and now it is 24-25 which has come to about

close to 60 crores, 59.56 crores see this is about almost four times Ok, the 400% something

like. So this kind of increase you, I would like to caution you will not be there for next

couple of years in 25-26 and 26-27, which it will be more stable and from 27-28 again, you

can expect a steep growth. If a couple of opportunities from say 4 to 5 opportunities, 5

opportunities are there, which are likely to take us to the next level of growth to say sound

50 crores turnover supposed to be aimed to reach by 2030 to reach that kind of from say

sound 50 again, 300% again over a period of four years. So that is possible from if we can

convert two out of five to six opportunities that we are working on, which will get us good

numbers in terms of both sales as well as the profit

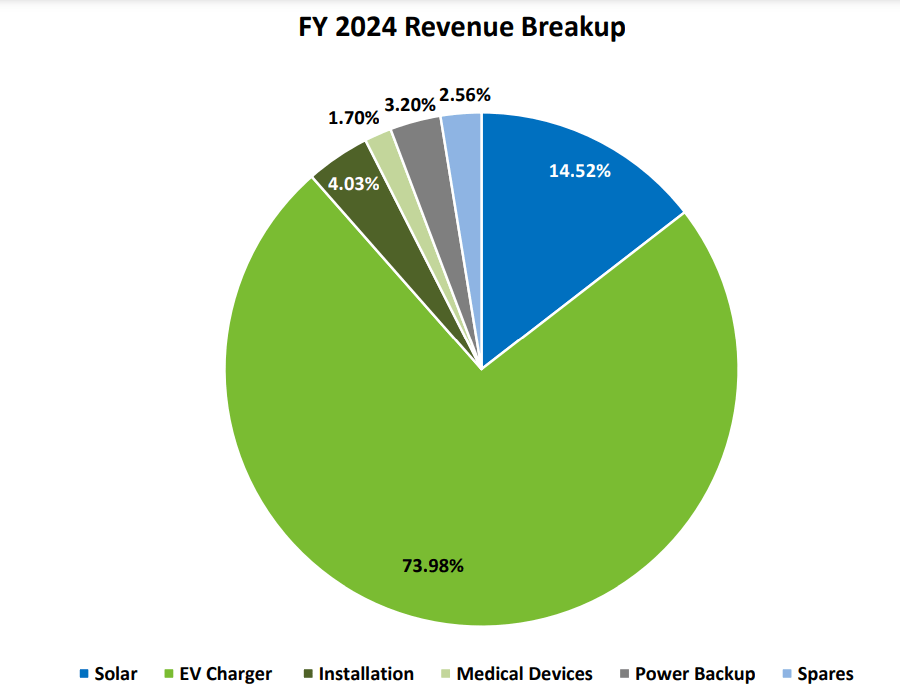

l. Coming to IMAX, so as I told you in the last meeting, this medical

equipment requires certification, Ok. The certification process will quite elaborate and go

through and has to go through many levels of testing particularly things like those

noninvasive ventilators and then you know CPAP patient monitoring systems. Those things

have to go through a lot of processes that for certification. But the total money, if you to

put them in the right perspective the startups with one single product also I have to remain

investing at least 5 to $10 million. And all the money that we have invested here is close

to $4 million, not even 4 million rather than 4 million. And if we have around 5 products

in place and the certification process will be completed for all these products by September

for sure. I mean some of them we got already and some of them by June this month end,

some of them July end one more and August one more and September. So in the next three

months we are getting all the certifications. Plus we have to build a facility with a clean

room and other things. The kind of world class facility built and out of 30 crores close to 22

crores has gone for fixed assets. There’s nothing that and you can assume that eight crores

have gone for product development. So basically we laid the strong foundation for IMAX

to go forward and if any of the shareholders are very, very, I mean worried about this, then

the promotes can take over if required. So, but thing is the medical industry, the projections

are from $12 billion in 23-24, they are expected to reach $50 billion by 2030. That is the

kind of growth they are expecting in IMAX

. I’ll come to the first point

that and he also was asked about unsecured loans and all that CDB. There are two reasons

for which the shares have been sold. One is to subscribe to the rights issue number 1.

number 2 is Laxmi Foundation. I have donated quite some time back the 45,00,000 shares

and obviously that donated means I want to sell the shares and invest in the trust for

building the hospital, which we already have a hospital in leisure premises and we want to

go for our own building for the hospital, much bigger hospital, maybe around 200 bed

hospital, multi-specialty hospital. So we have to, I mean, I’m going to not stop here. I’m

going to maybe donate more, another 45,00,000 shares or maybe another 45,00,000 shares,

maybe another 90,00,000 shares for every next 3-4 years. So that’s and I think that’s my

privilege to donate. And then once we donate, they have to be sold to be able to invest in

the foundation activities. So I think that’s obvious and I hope shareholders understand that

point. Regarding these loans unsecured loans because the company because suddenly the

lot of projects were implemented and obviously the receivables have to come from

government PSUs and where there were delays, there were delays in receivables. So instead

of rushing to the bank. So whatever money I wanted to got to invest in rights, I have

invested as unsecured loans here because it is the easiest route for me to fund immediately.

e SDR market is around 3000 crores every year for the last,

so many last 7-8 years is buying from different services is about SDR business for military

segment alone is that much so and obviously it’s not something that you can do overnight,

then everybody could have done it, you know, So for Avantel also, it takes time to do as

per software communication architecture, SCA 4.1 specifications and kind of stringent

requirements that army and the navy are asking for, including Air Force that shows that the

kind of intellectual property that is involved in development of SDRs and Avantel’s

capability number one is we are already supplying HFSDRs 1 kilowatt HFSDRs is being

supplied to Indian Navy and the shipyards. So our competency and capability is already

proven. We have delivered. We are already demonstrated and trials have completed for

UHF SDR and UHF sat com SDR to Indian Navy in trials on ships. So there also it’s not

on the board drawing board. It’s proven. And 3rd, as you can see, we are selected by Deal

Dehradun as against competition from Bell L&T and other major players. So we are short,

we became L1 and we are technically qualified. So and those radios are meant for Indian

Air Force, Ok, so airborne SDRS for which we have been we got the received the contract

also they gave us two years, but I am sure we will develop much before that. Ok. That’s a

four channel radio now. Right now they are being imported. This is an import. Two

companies were there and we are L1 and some company L2 both of us shared the order,

other one is Coral yeah. So that that’s about the SDR capability and development and the

big numbers. Defence Services in the next maybe one year. So we are participated in the RFI and if

definitely qualification criteria we have to see how much turnover and all that individually

or through conversion we will bid for that. That’s big number. So in that the product that is

required for that is in am advanced stage and definitely we will meet the requirements. We

have given the complaints for all the requirements and it’s that development is going on

now, right now at ECT facility in Hyderabad, Ok, when that is 12,000, you can, I don’t

know it will be 3000 crores or by 10,000 crores. It depends upon the kind of estimate they

have for this product. But definitely I’m sure it will be around maybe 3000 crores or even

more, Ok. So that’s the kind of segment we are positioning ourselves and there are entry

barriers. There is not something that everybody can by investing money they can develop

the product unless the import and obviously imported the equipment are at least 100% more

expensive than what is developed by Bharat Electronics. Not even a lender in Bharat

Electronics is giving it a competitive price when compared to imports. Dr. Ajit may correct

me if I’m wrong. So this is about the SDR part about win profile radar. Yes, we have the

technology. We already delivered sharp and two more tenders are coming. One tender is

expected this year. One tender is already come. We have already participated in the bid and

it may be opened anytime, maybe in the next couple of months. And the next one, the RFP

for us may come in the next 2-3 months and we are very confident that we will be there,

one for Indian Air Force, One for ISTRAC

Somebody’s talking about 100 crores less or something kind

of order. This 100 plus crores of orders will come this year itself and other things like

ground stations and all that. One good news is we have a good collaboration with Safran

France, the one of the best companies in France, in aerospace, not only in France, in the

Europe itself and maybe in the world. So they are, we are collaborating with them for all

the ground station 360° coverage, full motion antennas for satellite data reception,

we have already tied up with one company in Med Tech

industry for Health Kiosk and we will be doing the contract manufacturing for them. And

also we can also sell directly also. It is a very good product. It’s called help pod. It’s like an

ATM for healthcare. There are many, many parameters automatically measured. Maybe

it’ll take 15 minutes maximum, Max that is otherwise all together, actual measurement time

is 5 minutes. So that health part like an ATM Kiosk and we have some requirements. It can

be proliferated both. In fact, there’s a potential in military also for that along with our home

care product which can be moved into ambulances, army vehicles, trucks and health centers

everywhere. It can be fixed along with the H pod. H pod and our health home care unit

together. It will be like a mini hospital during diagnostics and service. So both are very

good products and the home care product when it comes, it integrates multiple technology.

It will have x-ray, ultrasound scan, patient monitor, ventilator. It will have everything that

you can ask for to like in whatever is there for the best possible treatment in hospital. So that’s

our product and HPOD is the product from Satyendra Goyal who is from Chicago, USA.

They have developed it and they want us to partner. We have signed an MOU also and that

is another great opportunity. And in Imax when, when we when we start producing, after

the certificate get, start get going, the growth rates will not be 10-15%, but they could be

40-50% year on year or even more 100% or something like that. So once it starts with some

4-5 crores this year, afterwards it could be 30 crores, then it could be 60 to 75 and then

hundred. That’s the kind of potential that is there in that area in highlights