HPX

BE FINANCIALLY INDEPENDENT

After a meltdown in Q4 in markets, there was an anticipation of meltdown which never happened. Is current market correction on the way to meltdown? Which stocks to buy/ which to leave? Questions galore!! Lets revisit some of the stocks which have decent set of results in Q1 of FY21

Also go through decent set of results in Q4 FY20

Don’t treat this post as a basis of investment. There are lot more factors to decide where a company will go in coming quarters. Discuss with your financial advisors before taking any position in stocks

Disclaimer : I may be fully biased while treating a company result as decent or bad

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Interesting to see how many from solid and good results will move to Average and bad results category after Q1 FY21 results. Those who survive in good or solid category even after Q1’FY21 should be worth researching more to invest

Don’t treat this post as a basis of investment. There are lot more factors to decide where a company will go in coming quarters. Discuss with your mentors or financial advisors before taking any position in stocks

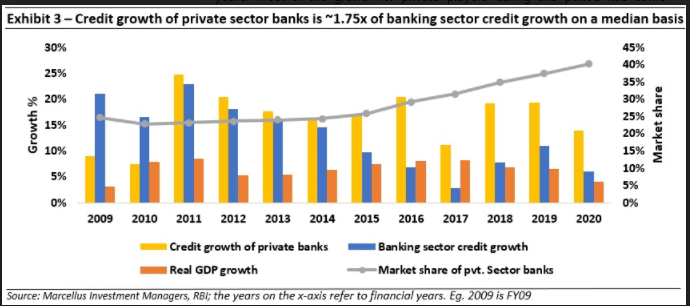

Banking and finance sector is the worst performer in recent months and there are high chances that it will continue to do so. There could be multiple reasons for same including defaults in payments and slow credit growth

Below is the list of Public and private sector banks with NIM, Net NPA %and Gross NPA% as of 17th April 2020. It may help you to make an investment decision more prudently. Don’t forget to consult your financial adviser before doing so.

Given a choice based on this data, the below banks seems better than other banks on certain criteria.

![]() Be aware that these NPA numbers has a high probability of increase in next two quarters.

Be aware that these NPA numbers has a high probability of increase in next two quarters.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.