Core industries growing

BE FINANCIALLY INDEPENDENT

Jubilant Ingrevia Ltd (JVL) houses the Specialty Chemicals, Nutrition & Health Solutions, and Life Science Chemicals businesses, which have been demerged from Jubilant Pharmova Ltd (erstwhile Jubilant Life Sciences Ltd)

It has a Strong presence in diverse sectors and its vertically integrated and due to this , it is Globally Lowest cost producers for most products.

Multi Location Manufacturing & Operation Excellence is achieved by company over the years

Leadership team has an average 30 years of industry experience

Company has expertise in 35 technological platforms at large commercial scale and

Company also has an expertise to handle multistep chemistry (up to 13 steps) at large scale.

Three major segments of Speciality chemicals, Nutrition and Health solutions and Life sciences chemicals

As shared from Company presentation 25% of Life sciences chemicals are consumed in house by specialty chemicals segment while for Nutrition and health solutions segment (vitamin B3, 100% in house sourcing done from Speciality chemicals)

Financial Highlights– RoE, RoCE stood at 15%+, EBITDA grew by 53% YoY while revenue from all segments growing well

Growth triggers

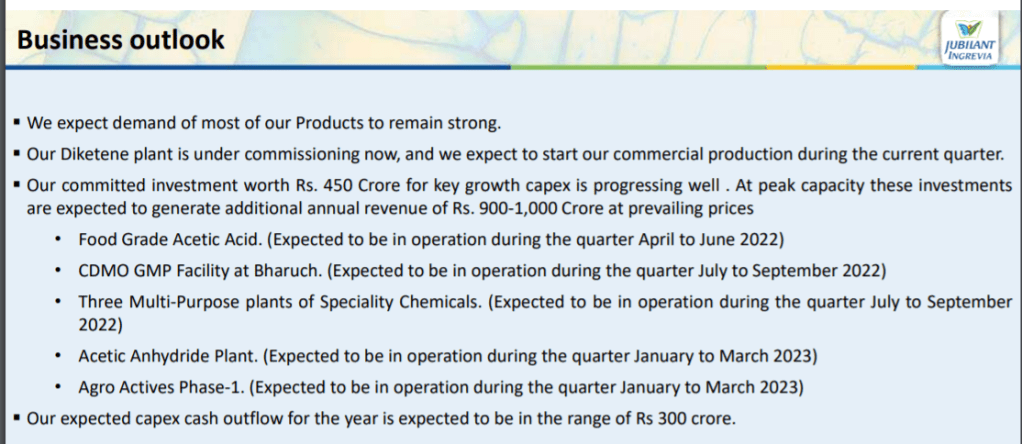

Company is planning to invest 900 cr (550 cr,100cr, 250 cr in different segments by FY24) and expecting 2x revenue in ~5 years

Multiple products in different segments are in pipeline to be launched in coming years

There is a strong demand for Acetic Anhydride and there is no new facility addition announcement globally in the recent past. Company’s customers are exploring to shift from high cost to low-cost countries. They are adding another Acetic Anhydride facility to increase capacity by ~35% by investing ₹250cr over next 3 years.

Co is planning to increase focus to leverage its long standing relationship with innovator pharma & agro-chemicals companies to expand its CDMO operation.

Company is also moving up the value chain in most of their product segments

In the process of launching its diketene (highly complex due to high temperature cracking and storage hazards) and its value added derivatives.

Risks

Raw Materials Prices: Key raw material for life sciences biz is acetic acid. Hence, dependent on the prices of Acetic Acid(Very volatile).

Large capex in next few years: he funding of this 900cr capex will largely from internal accruals. But if for some reason this capex is not completed on time or need more debt then it may affect profits in coming years

Exit Strategy

Acetic acid Raw material prices hurting company growth or

Any ban on application of its pyridine and similar substances by other countries can hurt the company growth

In such cases , its better to exit and have a relook on invested amount

Current Market price of 760 Rs, Company looks optically expensive for investment but looking at big picture if it sustains 10.5 eps for next 3 quarters giving 42 eps for FY22 , stock price looks to have decent upside available

Update on Q2FY22 by Company on business outlook

Update on Q3FY22 by Company on business outlook

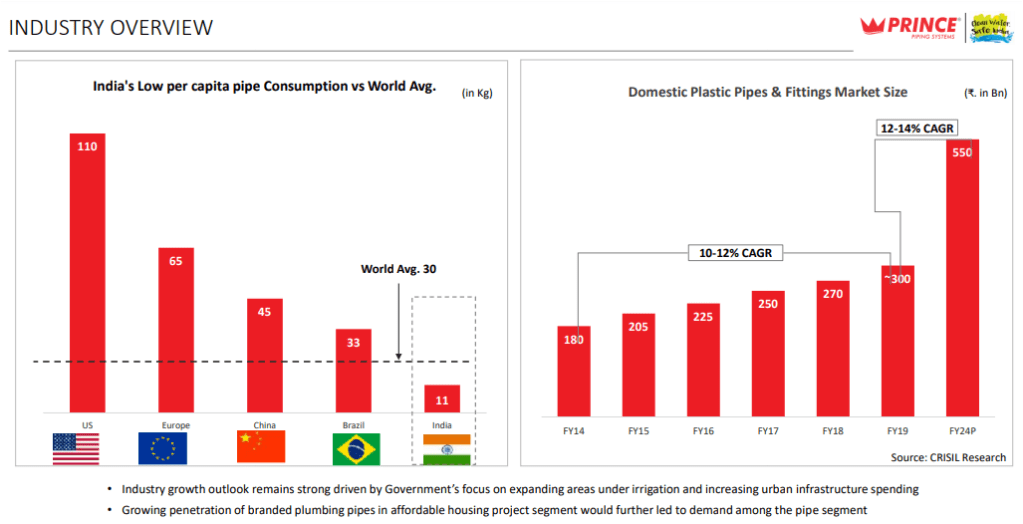

Prince Pipes and Fitting makes polymer pipes and fittings in India that are used in plumbing, irrigation and soil, waste and rainwater (SWR) management

It has 7,200 stock keeping units (SKUs) and 1,500+ channel partners.

Company has strong cash flow from operations and business share in Q4FY21 has been 69% from construction

Company current strategy is to expand in south india and increase distribution network while keeping the margins(EBITDA,OPM), ROCE in similar range

Company has been able to make use of 3 drivers of margin expansion in FY21 : inventory gains, product mix change, superior pricing power: past 8 Quarters company has been aggressive in passing on price .

Growth triggers

Total installed capacity of approximately 259,000 tonnes per annum (TPA). This will increase by a further 51,000TPA once its Telangana plant is fully commissioned- that means almost 20% increase in capacity

Various Government initiatives like AMRUT scheme, which is aimed at providing basic services, such as WSS, and ensuring that every household has access to assured tap water supply and a sewerage connection. Jal Jeevan mission (Urban) focuses on providing water supply to 4,378 urban local bodies with 260 million household tap connections. Nal se Jal scheme is planned to offer piped water to every rural household by 2024 –all these schemes is helping industry to grow by 35%(estimated) in next 2-3 years

There is a visible structural shift from unorganized to organised players and Prince pipes has shown both volume and sales growth wile other major players have shown de-growth in FY21

PPF is gradually increasing its emphasis on high-margin business of CPVC and double-wall corrugated pipes (DWC).

Recent tie up with Lubrizol will help the company in getting its supplies secure and as well as will attract more distributors towards company

Expansion into South India with Telangana Plant and focus on east india in coming years may keep the growth rate intact

Data-driven pull against conventional push is the new sales strategy of the company for the retail segment. Business-to-business (B2B) remains an area of improvement where PPF sees ocean of opportunities. It has moved into technology driven plumber data to move into B2B business as well as for normal business

Risks

Raw Materials Prices: Raw materials (resin) are derived from crude oil and any increase in crude oil price can hurt margins in short term.

COVID Lock-downs: Second wave of COVID, many states have had to announce lock-downs, although this time plants were not completely shut but still first quarter at least, could be dampner.

Corporate Governance Issues: There have been allegations of inadequate disclosure in the IPO prospectus of PPF PPF did not disclose all litigations, claims and criminal proceedings against the promoters (although re-filed DHRP corrected anamolies but still some differences are claimed)

No moats and No barriers to entry in this business

Fake / duplicate products can hurt company business

Exit Strategy

COVID-19 third wave creating more havoc than 2nd wave can impact the company balance sheet in big way for construction and this should be on radar

Break up with Lubrizol will definitely hurt the company and we need to relook if such thing happens in future

Any negative change in Govt policy for water schemes can hurt the growth prospects and may warrant an exit