Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Axiscades Technologies Limited

Key Investment thesis –> Company focus on Aerospace, Defense, Semiconductor, Electronic system verticals and gearing up for FY26, FY27

Business

AXISCADES is a leading, end to end technology and engineering solutions provider aiding creation of innovative, sustainable and safer products worldwide. AXISCADES is headquartered in Bangalore with subsidiaries in USA, UK, Canada, Germany, India and China; and offices in Germany, France, Denmark, USA and Canada.

AXISCADES has a diverse team of over 3,100 professionals working across 20 locations across North America, Europe, UK and Asia-Pacific, striving to reduce the program risk and time to market.

The company offers Product Engineering Solutions across Embedded Software and Hardware, Digitization and Automation, Mechanical Engineering, System Integration, Test Solutions, Manufacturing Engineering, Technical Publications, and Aftermarket Solutions.

The solutions comprehensive portfolio covers the complete product development lifecycle from concept evaluation to manufacturing support and certification for Fortune 500 Companies in the Aerospace, Defense, Heavy Engineering, Automotive, Energy and Semiconductor industries.

Company Portfolio

Current serving Major Industries

- Aerospace

- Heavy Engineering

- Products engineering

- Products and Solutions for Defense

- AIP and Energy

- Semiconductors

Awards

Received 3rd consecutive Diamond supplier award from Bombardier for 2022. This recognition is a testament to our unwavering commitment to excellence, innovation, and delivering with the highest standards of quality.

Opportunities :

- Unique positioning with deep domain capabilities ranging across competencies, with respect to – Electronics Products, Engineering Services and Defence

- Growth driven by leveraging Digital ER&D and Defence

- ER&D Services – A large and underpenetrated market with a Global TAM of ~$1 Tn

- Strong Defence-Tech Play with leadership in Radar, Sonar and Electronic Warfare systems

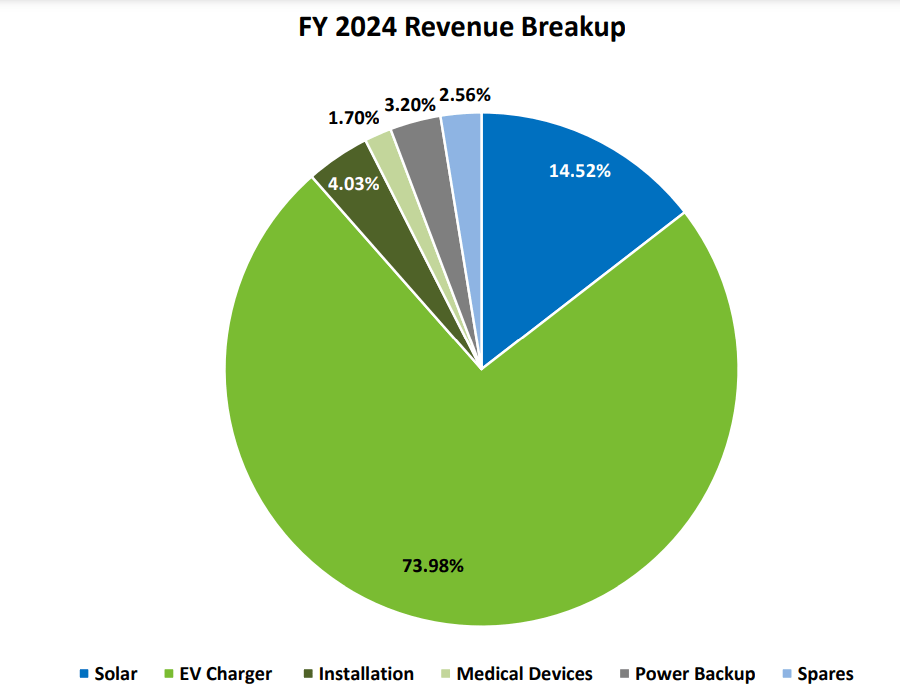

Revenue Breakup

FY24 revenue breakup

Q1Fy25 revenues breakup

Q2Fy25 revenues breakup

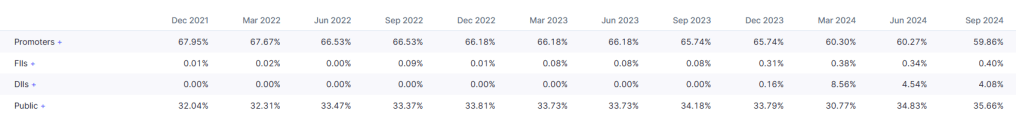

Fundamental Ratios, Cash, EBITDA, PAT, SHP

Stable OPM, Stable tax, Quarterly YOY growth in sales and PAT, Borrowing reducing

DE ~0.4 , Free cash flow is good , Pledge is Nil, ROCE < 15 and ROE<10%

Promoter has sufficient skin in game, Cash flows are good, Cash conversion cycle is elongated

Triggers

Macro Trends :

Recent Triggers in last 1 year or so

Appointment of Chairman Mr. Abidali

Appointed Mr. Abidali Neemuchwala as Chairman of the Board and Non-Executive Director at AXISCADES. With a distinguished career spanning over three decades in the technology industry, he has earned enviable reputation for his expertise in aligning organizations, driving business results, and consistently leading transformational initiatives.

Strategic partnerships and Opening Engineering design center

Signed a strategic partnership with with Cantier, a Singapore-based powerhouse in Manufacturing Execution Systems (MES), with a specialization in Industry 4.0 integration to create a synergy that promises to elevate precision, efficiency, and innovation in the manufacturing sector.

Inaugurated Engineering Design Centre in Saltney, UK to serve the long-term requirements of the Aerospace Industry and various promising opportunities in the region.

Signed a strategic partnership with KANZEN Institute Asia-Pacific Pvt Ltd (KIAP), for new age Industry IIoT, Digital Automation and MES 4.0 implementation for delivering enhanced value to our Global customers.

Mergers and Acquisitions and QIP

Completed the acquisition of add solution GmbH which will strengthen our service offerings and bring opportunities to deliver enhanced value to our combined global client base. . This will provide us with a strategic foothold in the automotive space, with significant offshoring opportunities and access to marquee global automotive OEMs.

The board has also approved the acquisition of EPCOGEN., a niche service provider in Energy space, specializing in engineering design and solutions. This proposed acquisition will strengthen our presence in energy vertical, provide access to Middle East and North American Energy markets

QIP in Jan2024 at 657Rs/share — The Company successfully concluded the Equity Raise of INR 220 Crores in January 2024, with marquee Institutional Investors subscribing to the issue. This will strengthen the balance sheet and improve profitability, Reduction in Net Borrowings by 60% from INR 214 crores to INR 85 crores, which will significantly reduce Finance Cost

Deal Wins

- Deal win with Aerospace OEM with TCV of $ 18 Mn in the areas of in-service repair and manufacturing support

- Design and prototype wins in several defense programs, such as HISAR, next generation ERP for combat aircrafts, Intel based SBC, DEAL satellite terminal design, DF for Naval program, adding to the production order pipeline

- Digital Team ramped to 75+ FTEs with deep competencies in automation, AI/ML and robotics, with complete digital project execution capabilities

- Acquisition of add-solutions GmbH and EPCOGEN, opens new vistas in Automotive and Energy Space, adding strategic logos and competencies

Q4FY24 updates

- Revenue from new customer logos grows to Rs.69 crores, a growth of 5 Times over the previous year

- Deal win with Aerospace OEM with TCV of $ 18 Mn in the areas of in-service repair and manufacturing support

- Defense Production Revenues in Mistral triples from Rs.39 crores to Rs.112 crores, with Rs.272 crores in executable production orders

- Commencement of delayed delivery of Man Portable Counter Drone System (MPCDS) to the Indian Army, with significant addressable

- market in Indian Defense and Global Markets

- Design and prototype wins in several defense programs, such as HISAR, next generation ERP for combat aircrafts, Intel based SBC, DEAL satellite

terminal design, DF for Naval program, adding to the production order pipeline - Digital Team ramped to 75+ FTEs with deep competencies in automation, AI/ML and robotics, with complete digital project execution capabilities

- Advanced level discussions with leading helicopter manufacturer for engineering and design support

- New opportunities in counter drone system over next 5 years are highly promising with addressable market more than INR 3,000 Cr. 40 Nos of one of a kind Man Portable Counter Drone System (MPCDS) cleared for dispatch to the Indian Army. Balance 60 Nos under production.

- Onboarded world’s largest phone and consumer electronic manufacturer as a customer with clear glide path on engagements into FY25

Order book at 30th Ap24 — 749Cr

Q1FY25 updates

- Mistral Solutions received order of ₹90 crores from BEL for supplying Radar Processing Systems

- Ramp up in aerospace with European OEM focused on production and plant migration efforts

- Ramp up in high end cybersecurity solutioning with UK automotive manufacturer.

- Onboarded an EPC major from Middle East as our customer with long term contract

- Completed second tranche of delivery of Man Portable Counter Drone System (MPCDS) to the Indian Army

Expenses hit in past Q3/Q4 Fy24

Increase in finance cost due to debt funding for Mistral acquisition . In Q2 FY24, the material cost has increased due to increase in production orders in Mistral and increase in employee expenses on account of annual increments and investments in building competencies in Embedded and Digital for future growth

Q2FY25 Update

Defence revenues grew by a healthy 73% QoQ, with Defence production revenues surging by 84% QoQ, bolstered by a significant order backlog set for execution in fiscal years 2025 & 2026. With a healthy pipeline and focused approach, over the next 12-18 months, we aim the defence revenue to reach around 60% of the overall company’s revenue

Management commentary With latest focus areas

- Unmanned combat, we are having anti-drone, drones, and drone controllers

- Foreign OEMs, we have a three-pronged, that is, weapon package, submarine, and avionics. preferred offset partner for the weapon system, weapon package

- new programs, all our missile programs, one is the largest missile program in India, another is an upgrade of the existing missile program, another is ground system for key programs

- Product focus : particular product direct RF. Then there is, of course, our product X-band radar, which is primarily used in the submarine and marine systems.

- Airbus, we have major programs running in India. C295, MRTT, Multi Role Transportation Tanker, which is going to be 330 based, And AVEX, of course, 319 based.

- Tying with AgniKul, having an MOU with them, and approaching the ISRO, ISRO and other space agencies for two major things, NGLV, New Generation Launch Vehicle, and Bharatiya Space Station. So we want to add value to them significantly, and there could be opportunities in 3D additive manufacturing, and designing of certain subsystem blocks, etcetera. Then there is also chances for electronics-based algorithms and advanced systems, and for the guidance and navigation, that product we’ll be able to make. The third one is AI-based anomaly detection in the launching

Capturing some discussions from Dec24 confcall

C2P strategy, that is, chip to product. That is Mistral’s non-defense activity, or our group’s non-defense activity., we are shifting the center of gravity of C2P to US. Basically it will be driven out of US. We’ll have a small team there and driving the offshore team here. That’s the strategy

We are a very, very good RF in RF. We consider we are among the best in India for RF. RF and RF activities. Second is probably we are one of the best in handling mixed signals. We can handle analog, digital, RF, everything together. That is one of our forte.

Third is sensor fusion. We can handle multiple sensor. Sensor fusion comes very, very handy when you deal with multiple sensor in a new AI environment, in new robotics or auto-driven and those kinds of things. We are extremely good in both. Then we are very good in ruggedization. We are especially because we are very defense focused. We can ruggedize any product and do that.

And finally that we are very good in the chip, chip level, post-silicon, whatever it is, validation, verification, and take the chip to the product and then product to the customers

Continuous Hiring of Talent

Orders winning, Expansion in Middle east and Outlook for different segments by Management

Added this latest development on 17Jun25

INDRA SIGNS AGREEMENT WITH AXISCADES TO BOOST PRODUCTION OF CUTTING-EDGE SYSTEMS IN INDIA

- Indra, a European-based global leader in defense, aerospace, and strategic systems, and

AXISCADES a prominent technology solutions provider in defense, aerospace and strategic

electronics, are proud to announce a strategic alliance. - Indra is keen to acquire defense-related products and services from AXISCADES, which will be

delivered through AXISCADES’ comprehensive design, development, production, and supply

chain center. - Both companies are actively exploring joint product development for the Indian and global

markets, potentially adapting existing Indra products or creating new ones specifically tailored to

meet customer needs.

Technical Chart

Technical chart on 15-dec24

Technical chart on 29-dec24

Risks

Highly competitive industry

Acquisitions dont play out as anticipated

Customer concentration risk – On a consolidated basis, ~26% of ACTL’s revenues in FY23 were from its top two clients (35% in FY22).

Slowdown in Europe impacting automotive revenues

Heavy Engineering vertical remains a drag for few more qtrs although optimization work going on

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.