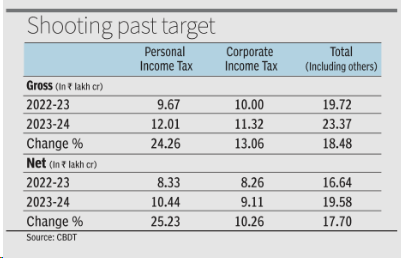

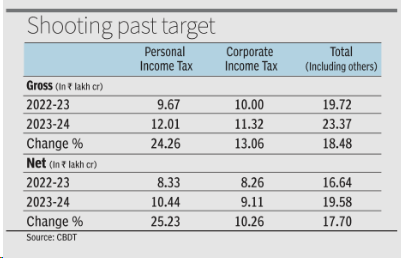

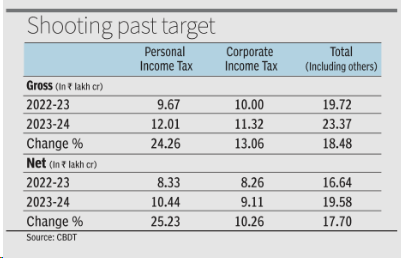

Direct tax collection

BE FINANCIALLY INDEPENDENT

Please treat this as just a indicator as these are subject to change or could have been changed

Consult you financial advisor before making any investment decision

New Tax regime proposed in Union Budget 2020 introduced few more tax slabs and one can choose to move to new tax regime for FY20-21 but one has to forego exemptions. This is where it gets tricky.

The process of tax filing has already been a cumbersome process for a common man and now with two different tax regimes at hand and different exemptions available for tax saving, it becomes a tedious task

Here’s is the first step for you to analyse before going further into details of new tax regime.

A sheet created by industry expert Deepak Shenoy of capital mind to help you analyse whether to move to new tax regime or stick to old one.

Also Read : Budget 2020 :Shockers and hits

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.