BE FINANCIALLY INDEPENDENT

A Decision which can have far reaching consequences for NSE, BSE, CDSL, NSDL

Out of these BSE and CDSL are listed on stock exchanges

More Details and discussion paper attached here ( from SEBI)

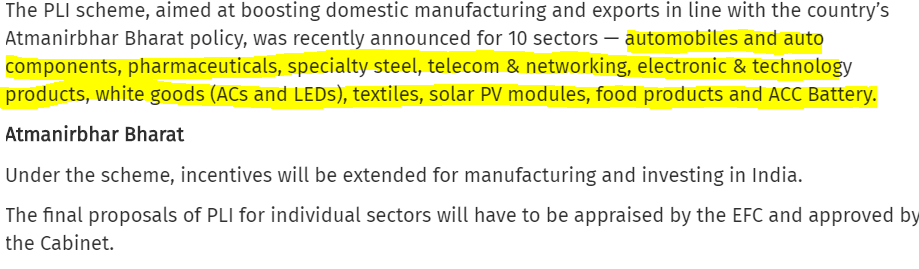

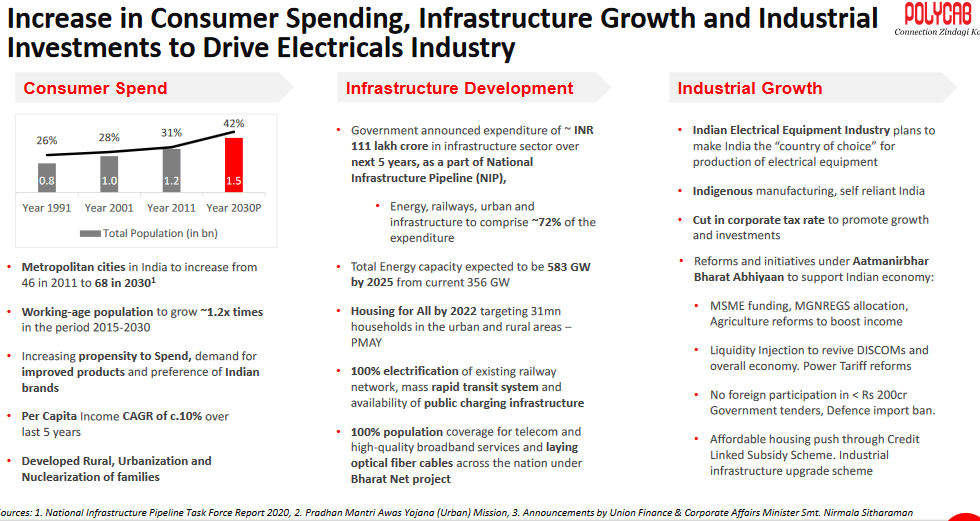

Implementation of production-linked incentive (PLI) schemes worth up to ₹1.45 lakh crore for 10 key sectors announced recently by the government is likely soon.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Multicap Funds — most diversified equity mutual funds that can put money in stocks across market capitalization.

Sebi new direction for multicap funds– Allocate minimum 25% each in large, mid and small cap by Feb 2021

Purpose : Recently these funds have been found to invested heavily towards large caps and Regulator’s move aimed at reducing risk of concentration in large-cap stocks and making market broad based. This way these funds can be truly labelled as Multi-cap

One quick estimate from a Quantum fund manager shows that 40% of entire MF industry equity investment is concentrated in top 6 large cap stocks thereby posing a huge concentration risk.

Why multicap loaded towards these large caps — to beat the benchmar index which has heavily loaded in these large caps

What all these changes can lead to

Multi cap fund managers to diversify and find opportunities in small and mid cap segment

Selling in Large cap stocks and some of mid cap stocks

Reshuffling of multicap funds portfolios multiple times for diversification and hence estimate is 25K cr will move into mid cap and small cap

Liquidity issues while investing in small caps –some of these small caps will become mid caps just by so much money coming into them and leading into ASM framework or mid caps becoming small caps because of selling pressure

Recategorisation of multicap funds into Large cap MF or Large and Mid cap mutual funds

Merging of few MF schemes into another in same fund house

Will small cap and mid cap stocks rally because of this? Should we buy more small cap and mid cap stocks?

Initial euphoria may drive this rally but retail people should understand the possibilities before putting their hard earned money

So any wrong move without due diligence can lead a retail investor into proud owner of junk stocks.

Best way is to own the business what you understand and have conviction. Other things will fall in place for you

Should we sell Multicap funds or buy them?

Stay invested in multi cap funds although one should not be having more than one or two of such category of funds.

Any such funds which will be recategorised as large cap funds will not change your returns much

Any such funds who will reshuffle their portfolio can go through short term pain but returns can be better in long run

Will this regulation stay? and is it good?

I see it as a good regulation because it helps in removing the concentration risk in few stocks from MF industry and as years progresses, this industry is bound to grow by leaps and bounds. This kind of framework helps in longer run although its a big pain in shorter run. It also helps few fund managers to showcase their skills for which we are spending 2-3% of expense ratio. Otherwise we are better off with Index ETF MF with lowest expense ratio if fund managers skills are absent and don’t make any difference to my returns

Happy investing!!

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

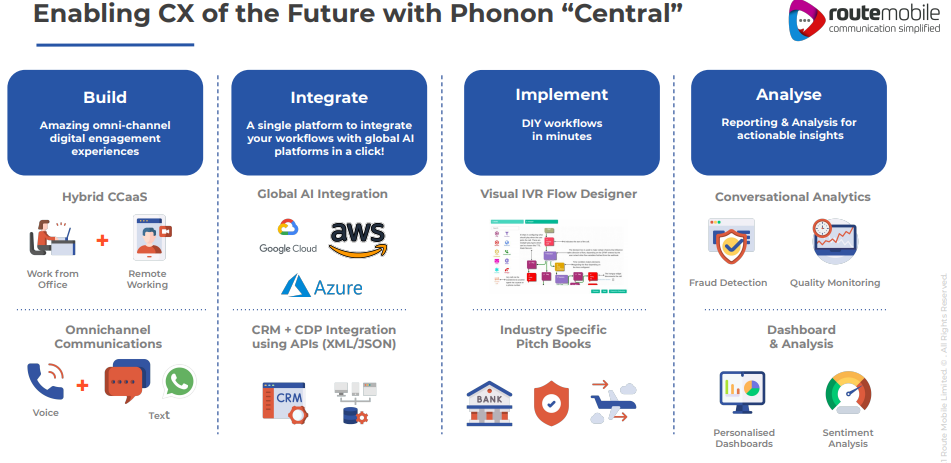

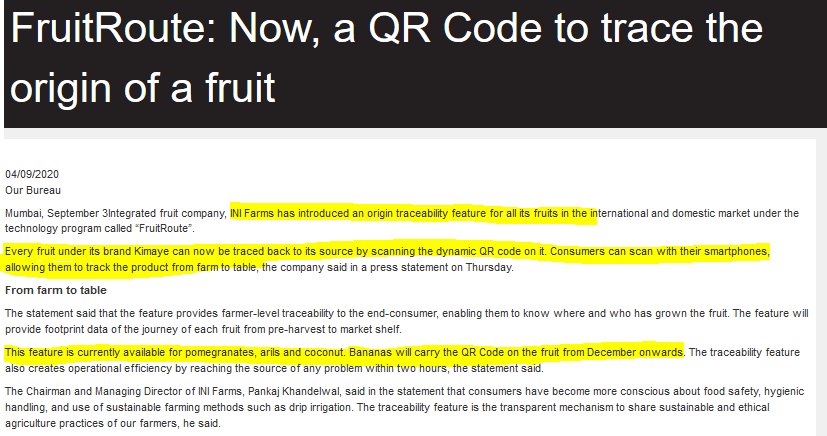

6 months back, this was shared by company as the way forward. How much they achieved might have been reflecting now in its stock price.

What will happen in next 6 months can be judged from last 6 months!!

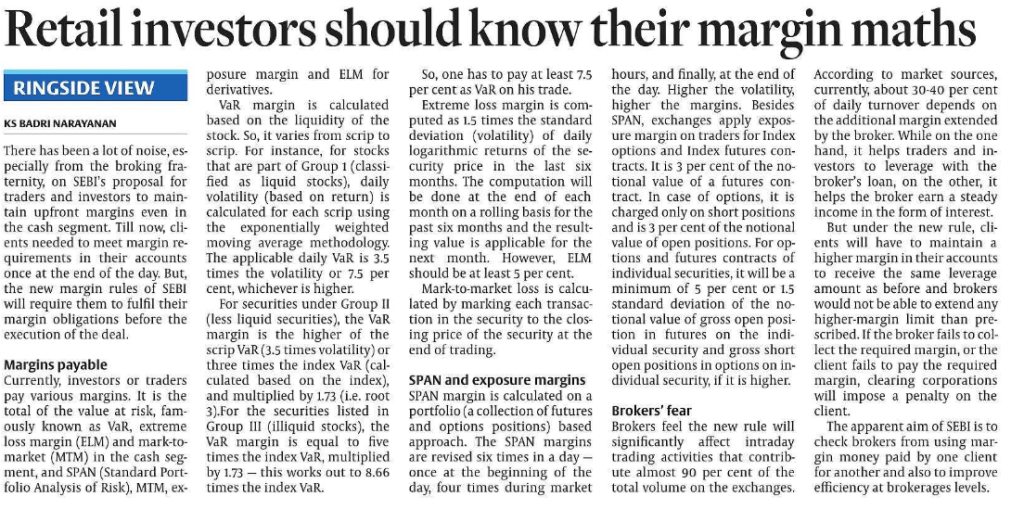

A move which seems bad for both retailer and broker in its first look!!! But devil lies in details. Its a move which will help everyone

SEBI aim is to check rampant usage of margin money paid by one client for another. The whole exercise looks to protect retail investors and in my view its a very good move for long term. This move i believe will limit the number of people leaving markets forever with losses as it may reduce the risk a retail investor can take with his money.

Brokers need to get this point that in long term their operations become efficient and their survival improves because investors will increase.

Retail investor has to understand that limiting margin will help them to take calculated risks and improve their chances of profit

BOGUS people will be filtered out. That’s the expected bonus

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

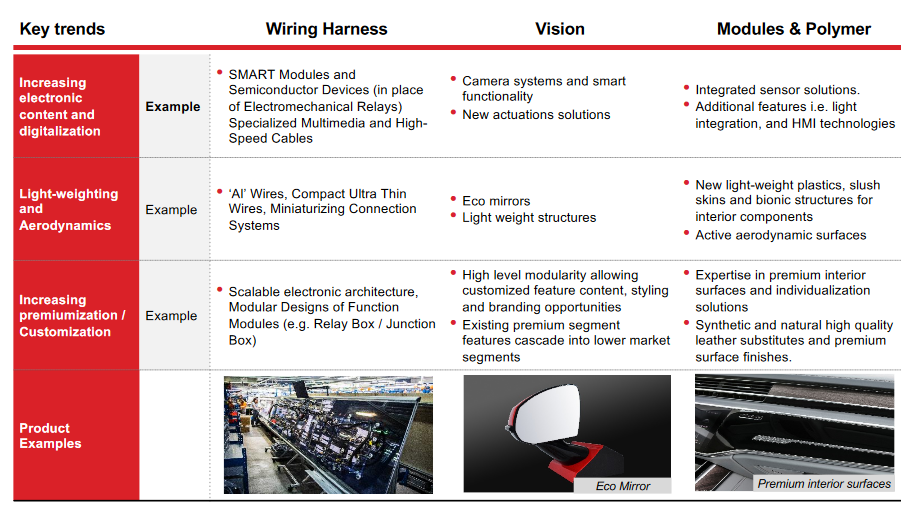

Source : Motherson Sumi Investor presentation

Also read : https://alpha-affairs.com/2020/07/05/growth-motherson-sumi/

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.