Buyer to builder

BE FINANCIALLY INDEPENDENT

Also Read : INOX INDIA

Its about iDEX and IDDM

Disclaimer – Below Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Business —

Data Patterns is a leading player in India’s Defence and Aerospace industry. The Company is respected for its proprietary capabilities: design to manufacture, testing to validation and support for products throughout the life cycle. Data Patterns is the only Indian company in the Defence and Aerospace sectors to offer complete systems.

Data Patterns’ core competence covers the entire spectrum of electronics including Processors, Power, RF and Microwave, Embedded Software & Firmware. This unique capability allows Company to offer complete solutions, an area addressed only by international OEMs.

Data Patterns has succeeded in building products in high technology domains such as Radars, Electronic Warfare (EW), Communications, Satellite Systems, Video, Control Systems and Navigation, besides others. It is one of the few Indian companies offering indigenously developed products catering to the entire spectrum of Defence platforms – space, air, land, and sea. The Company established its quality management system in line with the demanding standards of AS9100 Rev. D by TUV-SUD, an internationally acclaimed certification

Product offerings and Clients

Can they do 3x in next 6yrs for revenue? Chances are bright with emerging tailwinds

Moats —

Biggest moat is long term relationship with Indian Defense companies built over years. A new company will take years to develop, manufacture, provide and test the integrated systems and then won new orders

Data Patterns is the only Indian company in the Defence and Aerospace sectors to offer complete systems.

Data Patterns’ core competence covers the entire spectrum of electronics including Processors, Power, RF and Microwave, Embedded Software & Firmware. This unique capability allows Company to offer complete solutions, an area addressed only by international OEMs

Strengths

Capabilities and Opportunity

Some triggers and updates ( Market size, order wins etc)

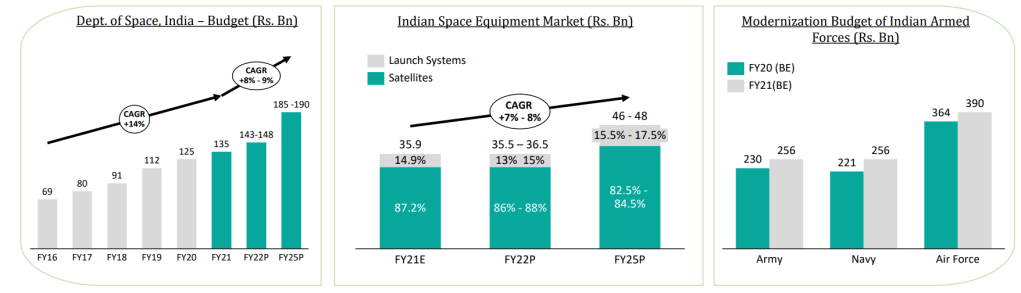

Opportunity Size

TAM (total addressable market) of USD 4.65 bn by 2030 growing at CAGR – 9% from 2020*

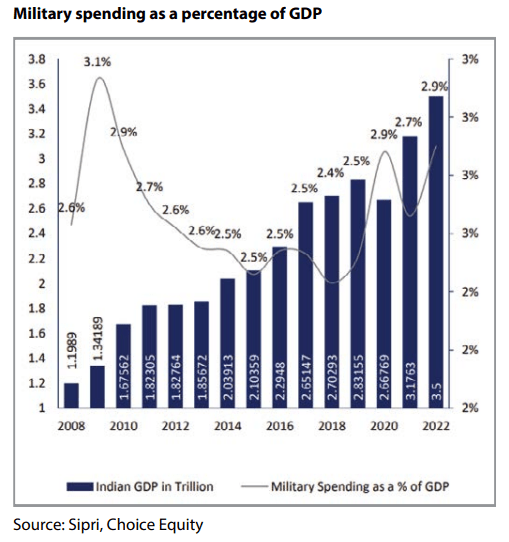

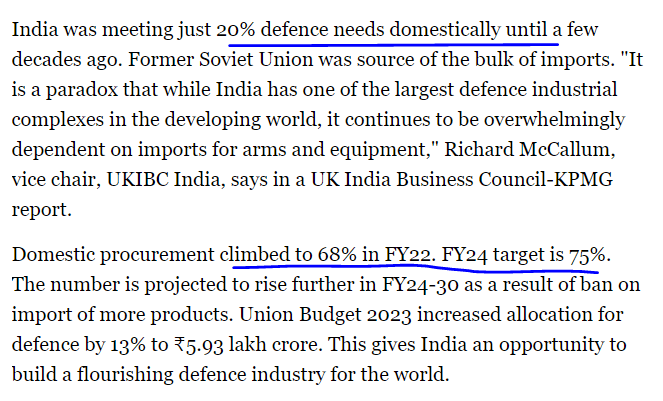

Make in India, Indigenous manufacturing defense Theme

Beneficiary of shifting procurement trends in Defence – Aatma Nirbhar Bharat , Make in India, new defence acquisition policies among

others

Increasing indigenization, Domestic defence procurement, Higher share of electronics in warfare

Defense modernization program

Expansion of facilities

Data Patterns is in the process of upgrading and expanding the current facility, with a proposed doubling of available floor area and manufacturing capacity, as well as addition of capability of handling large and heavy equipment, integration of large radars and mobile electronic warfare systems, satellite integration facility. The new infrastructure is slated to be ready by September 2022.

Data Patterns is also in the process of acquiring an additional 2.81 acres of adjacent land for further expansion

Promoter holding

Promoters have sufficient skin in game, along with FII and DII holdings and big players leading to only 21% approx for retail investors

Fast rampup in orders is key along with execution. Will fast orders and execution can lead to profitability, we need to see in coming quarters and years

The business has long gestation period and inherited execution delays, consequently causes volatility in revenue recognition

Company face challenges to meet the requisite financial criteria of tender based business, for which it needs to rely on bigger entities

Cash conversion cycle and working capital cycle has been really a big risk. Need to be watchful on these two parameters consistently. Major trigger is inventory levels, which should come down with normalized operations and betterment of chip availability

Seasonality Improving but Q4 still Significant

Valuations for such company is difficult to judge as growth can happen exponentially and company one good year can turn the tables on valuations and vice -versa. As per experience start with specific risk reward and then performance observed over a period of time and as and when orders emerge.

Looking at past, such companies look overvalued, Looking at future opportunities, Company seem undervalued

We entered around 700 even when valuations look high and markets took it to 1540+ –so Premium companies might be rerated faster than one can imagine –hence our focus is to ride as long as growth happens in company but 1-2 quarters should not deter us to stop holding long enough and give chance to company to perform

Only thing here is if valuation blow up faster than business –we need to book some partial profits

Your strategy can be different than mine. Your selection of company might be different than mine. So let’s not be a BLIND FOLLOWER

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It is for educational purpose and it can be used for educational purposes further. There could be lot of things which might have been missed in my analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.