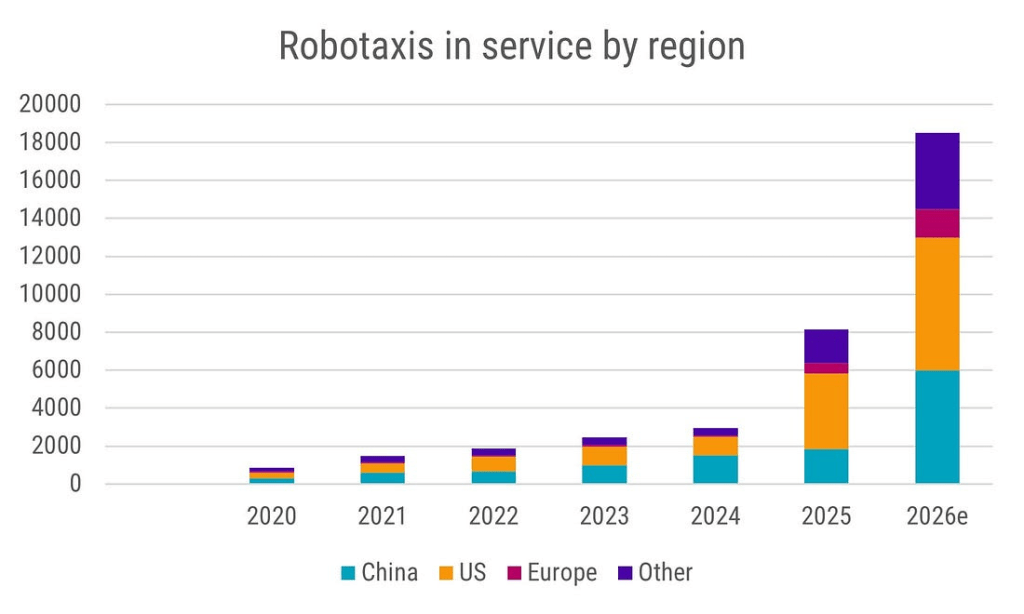

Robotaxis : Future is here

BE FINANCIALLY INDEPENDENT

Leading the way for Hydrogen and CNG storage and mobility

About company –See the focus on R&D and Product innovation

Products under development

Upcoming Projects changing trajectory in coming time

New Products & Projects

Inorganic Growth

Lets start with Financial highlights

49% box build revenue catches my eye

Greenfield and brownfield expansion

Partnership with global equipment manufacturer company for complex subsystem manufacturing

Partnering with CDAC for high performance computing

Partnership with Zepco in motors, drives, controllers.

Secured projects in global auto components, home electrification, rail, industrial, infrastructure, clean energy, and communications

OUR DUAL SHORE MANUFACTURING

In FY2025, we enhanced this model with the commissioning of a new export-focussed facility in Chennai. Construction has also begun on two additional facilities – one to serve growing domestic demand and the other focussed on exports. Our U.S. operations continue to serve marquee customers in highly regulated sectors, while our Indian facilities leverage scale and cost benefits

One stop shop and Diverse capabilities

Solutions

All major certifications

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Sansera Engineering IPO-Incorporated in 1981, Sansera manufactures complex and critical precision engineered components and caters across automotive and non-automotive sectors

Business — The company manufactures precision components such as connecting rods, rocker arms, crankshaft assembly and gear shift forks for the automotive industry

Region of operation –Company caters to India 65% revenue and have 35% exports revenue. 12% revenue comes from non automotive segment.

Offer purpose —

The IPO is entirely an offer for sale by the promoters and other strategic investors

Risks —

High concentration of revenues from few clients. Bajaj auto being highest , contributing close to 20% of automotive revenue

Export oriented risks

Faster shift to EV can cause some turbulence

Strength

Strong Operating profit Margin

Pass through arrangements with domestic customers for cost escalations help margins

Long term relationship with most customers

Reducing dependence on ICE vehicles

Experienced management team.

Future

The client profiles and relationship, move towards EV and contracts available presents good future prospects

Valuations

Valuations are matching with peers but look pricey

Should we apply?

People with high risk apetite can subscribe for long term only

Add more if it dips below issue price keeping long term horizon mindset

Others can avoid

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Car Trade IPO-Cartrade Tech Limited (“Cartrade”) was incorporated on April 28, 2000. Cartrade is a multi-channel auto platform with coverage and presenceacross vehicle types and value-added services.

Business –Cartrade Tech Limited (“Cartrade”) is a multi-channel auto platform with coverage and presence across vehicle types and value-added services. Their platforms operate under several brands: CarWale, CarTrade, Shriram Automall, BikeWale, CarTrade Exchange, Adroit Auto and AutoBiz. Through these platforms, they enable new and used automobile customers, vehicle dealerships, vehicle OEMs and other businesses to buy and sell their vehicles in a simple and efficient manner.

Revenue streams — Commissions and fees, advertising, lead generation for OEM, inspection related charges

Risks —

High and intense competition in industry

High valuations

Industry still in nascent stage so continuous threat of new entrants will be there

Strength

Leading marketplace for automotive sales with an effective ecosystem

Technology platform oriented business

Network effects can make it a commanding marketplace

Profitable and scalable business model

Future

The company is well positioned to benefit from used vehicle industry growth as well as digital ecosystem. With Network effects coming into place with time, and selective acquisitions it can grow big

Valuations

Valuations are high

Should we apply?

We can avoid subscribing or apply for listing gains and exit

Wait for correction to enter for long term

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Sona BLW Precision forgings IPO– one of leading automotive technology companies in India and among top 10 globally for differential level gear segment.

Business — Designing, manufacturing and supplying differential assembly, gears, conventional and micro hybrid starter motors

~75% business comes from exporting

Offer purpose — Offer of 5550 cr for debt prepayment and exit of one of PE investors

Risks —

High valuations

Most of EV related business form one customer and client concentration risk for ~60% revenue from top 5 customers

Strength

Company has diversified business revenue mix in terms of geography, vehicle segment, powertrain and products

With about 40 per cent of its revenues from hybrids (mostly micro hybrids) and EVs, the company is a play on the growing market for cleaner vehicles across the globe

Future

Electric drive motors and inverters to Sona BLW’s existing product line of differential gears and assemblies for electric vehicles (EVs) has been added after the acquisition of comstar few years back

The expected change in product mix is value adding for the company as revenue realisations (and hence, profitability) for differential assemblies generally move up as the powertrain shifts from combustion to full hybrids and EVs.

Valuations

Very expensive looking at last results

As consolidation and revenue mix changes, may become available at decent valuations

Should we apply?

People can ideally avoid and if one subscribe, then do for possible listing gains only. If no listing gains then may need to hold longer

Recommended to sell if getting 10-20% gains on listing day

One can wait to enter at low prices for investment purposes after listing

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Weekend HookUp: 18th December, 2020

Parenting; Startups; Electric Vehicles; Learning Kindle

Parenting: Raising Intelligent kids with resilient brains (CNBC)

Startups: Agritech Startups (Forbes)

Kindle: How it is like it is (TechCrunch)

Electric Vehicles: Solid state battery (Nikkie Asia)

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

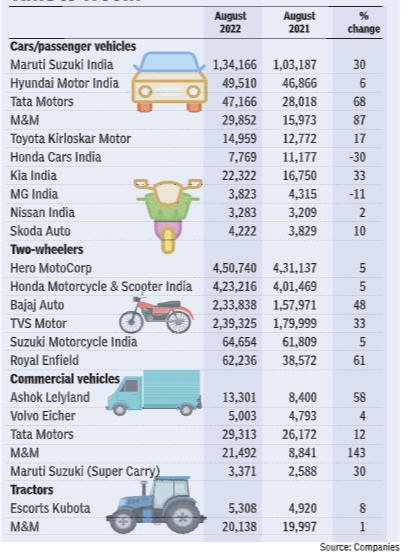

Among Top 5 car makers, Kia Motors and Tata motors gain market share and other have lost. After quite some time, Maruti’s Market share dropped below 50% mark

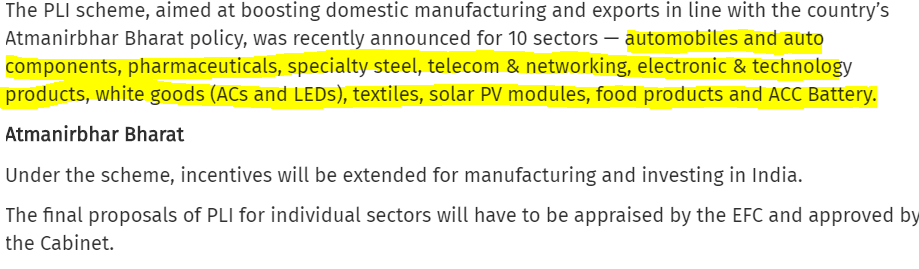

Implementation of production-linked incentive (PLI) schemes worth up to ₹1.45 lakh crore for 10 key sectors announced recently by the government is likely soon.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Two indicators showing more recovery in economy

Actual test lies in Dec 2020 collections