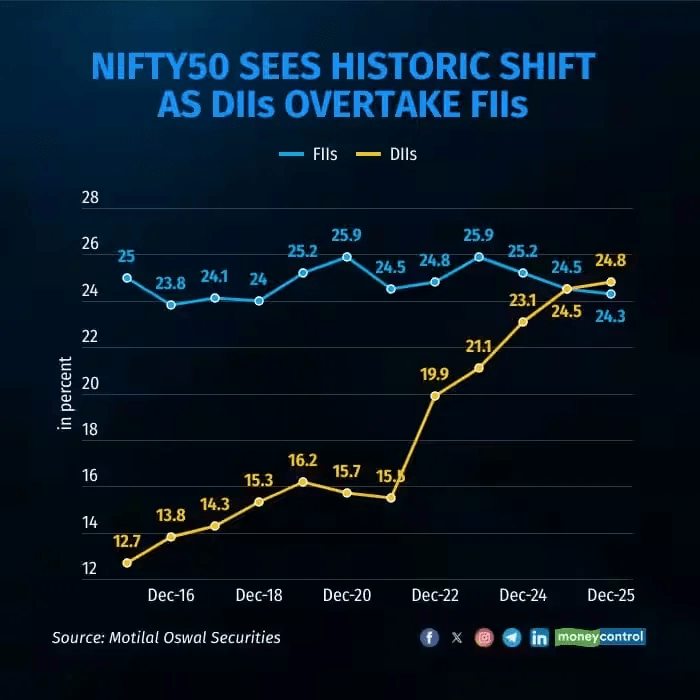

DII vs FII

BE FINANCIALLY INDEPENDENT

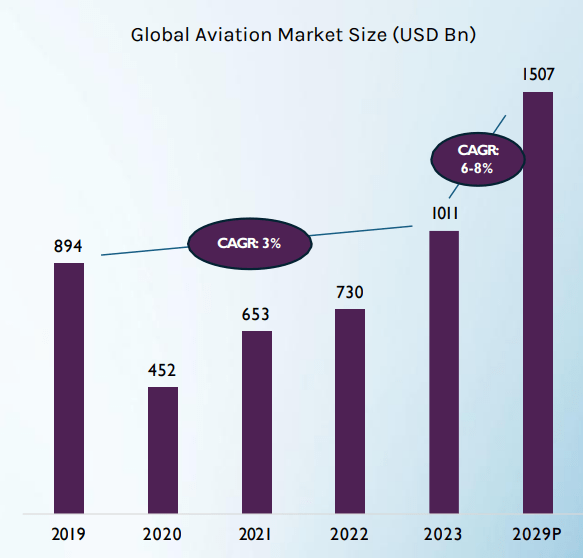

India Aviation mkt

Anything changes on 1st Jan?

Yes, we all add some resolutions!!

What’s mine then for 2026

Focus Focus Focus

But Where?

Focused Execution

2026 is the year where the base of next 4-5 years is being formed

We cant go wrong in base formation

What I am doing?

Concentrating my bets

How?

By removing the small allocation bets

and Increasing the high allocation bets

What if they dont work this way as all along I have been a Diversified player!!

I am not looking for an excuse without trying that approach

One of the images that stuck with me is this one!!

I stay doubtful but persistent enough to be successful

Source : Vintage coffee ppt

The Halting International Relocation of Employment (HIRE) Act seeks to discourage outsourcing and promote job creation within the United States. It proposes a 25 per cent outsourcing tax on payments made to foreign workers for services used within the US.

The bill also removes the ability of companies to claim these outsourcing payments as tax-deductible expenses. The collected revenue will be channelled into a Domestic Workforce Fund designed to finance training and apprenticeship programs for American workers.

read more at

Unified by Purpose : Accelerated by AI

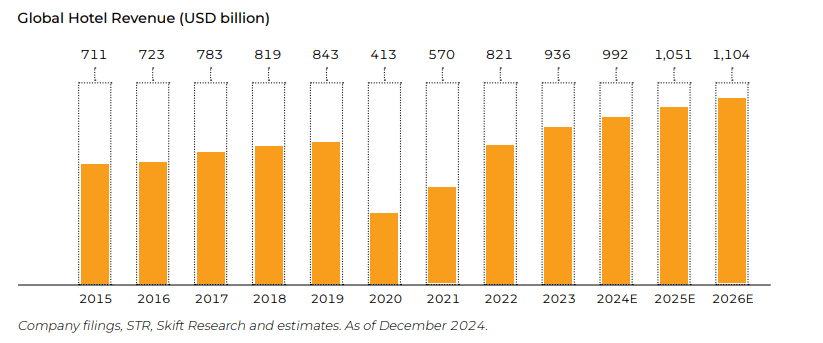

Steady growth

RATEGAIN Platform

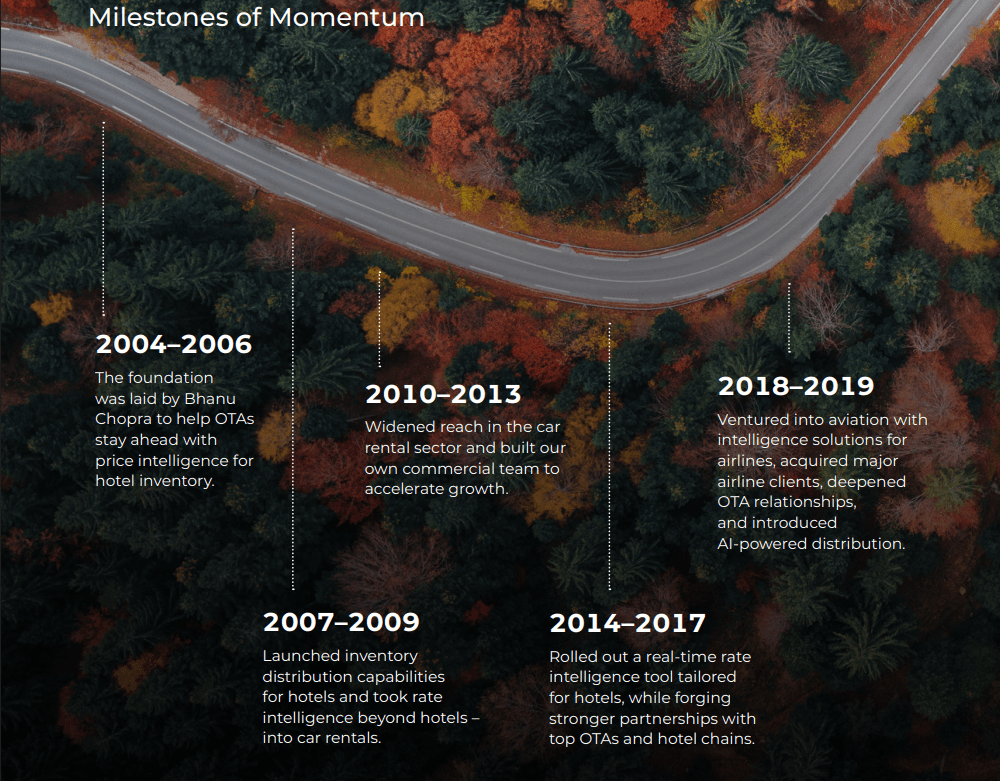

Milestone of momentum

World is changing : AI first approach

5 Megatrends transforming the global travel technology

Navigating NEXT

RateGain plans to drive growth by:

About company –See the cutting edge cloud GPU’s

Services

TIR GEN AI PLatform

AI LABS as a service

FY25 Highlights

Monthly Run rate

Strategic Leap with L&T

Leading the way for Hydrogen and CNG storage and mobility

About company –See the focus on R&D and Product innovation

Products under development

Upcoming Projects changing trajectory in coming time

New Products & Projects

Inorganic Growth

Lets start with Financial highlights

49% box build revenue catches my eye

Greenfield and brownfield expansion

Partnership with global equipment manufacturer company for complex subsystem manufacturing

Partnering with CDAC for high performance computing

Partnership with Zepco in motors, drives, controllers.

Secured projects in global auto components, home electrification, rail, industrial, infrastructure, clean energy, and communications

OUR DUAL SHORE MANUFACTURING

In FY2025, we enhanced this model with the commissioning of a new export-focussed facility in Chennai. Construction has also begun on two additional facilities – one to serve growing domestic demand and the other focussed on exports. Our U.S. operations continue to serve marquee customers in highly regulated sectors, while our Indian facilities leverage scale and cost benefits

One stop shop and Diverse capabilities

Solutions

All major certifications

The Centre is significantly scaling up its proposed Maritime Development Fund (MDF) to ₹70,000 crore, 2.8 times the allocation announced in the February Budget, to boost shipbuilding, ship repair, ancillary industries, expansion of shipping tonnage, and port-linked infrastructure, according to a report by The Economic Times.

The revised corpus has reportedly already secured clearance from the expenditure finance committee (EFC), chaired by the finance ministry’s expenditure secretary, with Cabinet approval expected shortly.

The MDF will operate on a blended finance model: 49 per cent concessional capital from the government, including contributions from state-owned major ports, and 51 per cent commercial capital from multilateral and bilateral lenders as well as sovereign funds.

Government estimates peg India’s maritime sector investment requirement between $885 billion and $940 billion by 2047, The Economic Times report said. This includes:

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

We have covered this company earlier at

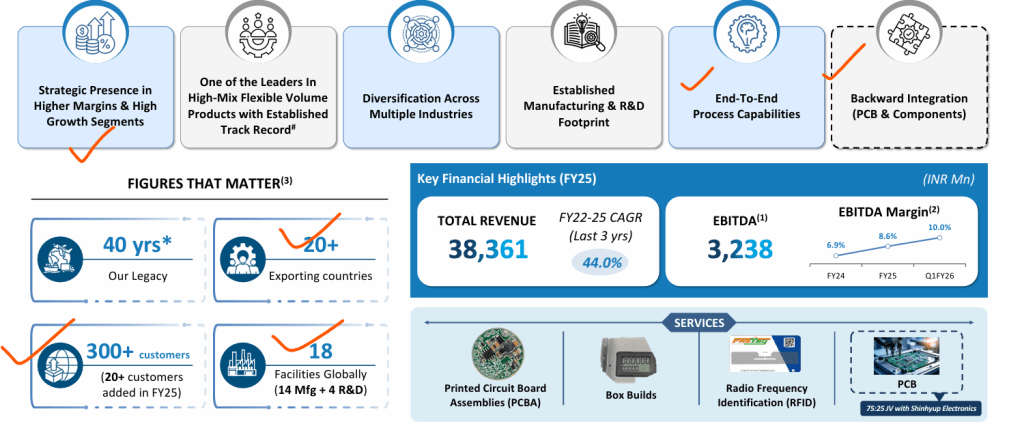

SYRMA SGS

Manufactures various electronic sub-assemblies, assemblies and box builds, disk drives, memory modules, power supplies/adapters, fiber optic assemblies, magnetic induction coils and RFID products, and other electronic products. The company is a part of Tandon Group with Sandeep Tandon as chairman of the company. Its manufacturing facilities are spread across Northern India (Bawal, Haryana, Manesar, Haryana, Baddi, Himachal Pradesh) and southern India – Chennai (Tamil Nadu), Bengaluru (Karnataka).

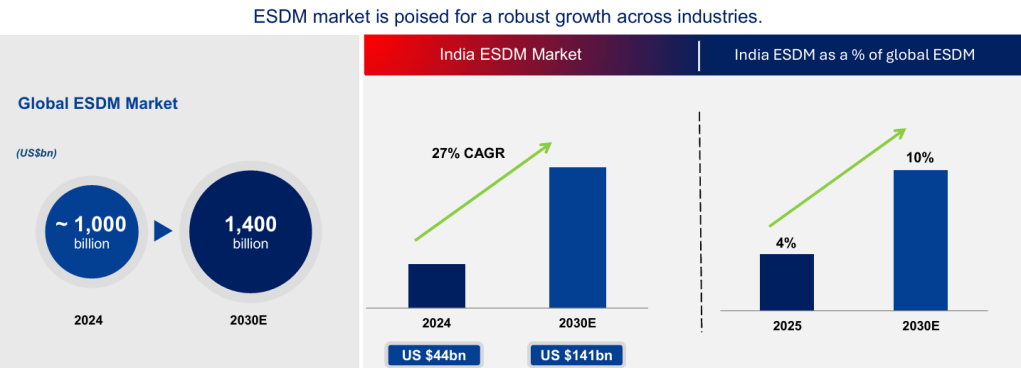

One of India’s Largest ESDM Company in the Non-Consumer Segment

300+ customers, 18 Facilities, 20+ exporting countries

with end to end capabilities and backward integration of PCB and components inhouse

Business verticals serving high growth industries

Four Dedicated R&D Facilities

1 in Germany & 3 in India

190 employees in RnD, 537 overall engineers

1800+ suppliers

Global certifications in place

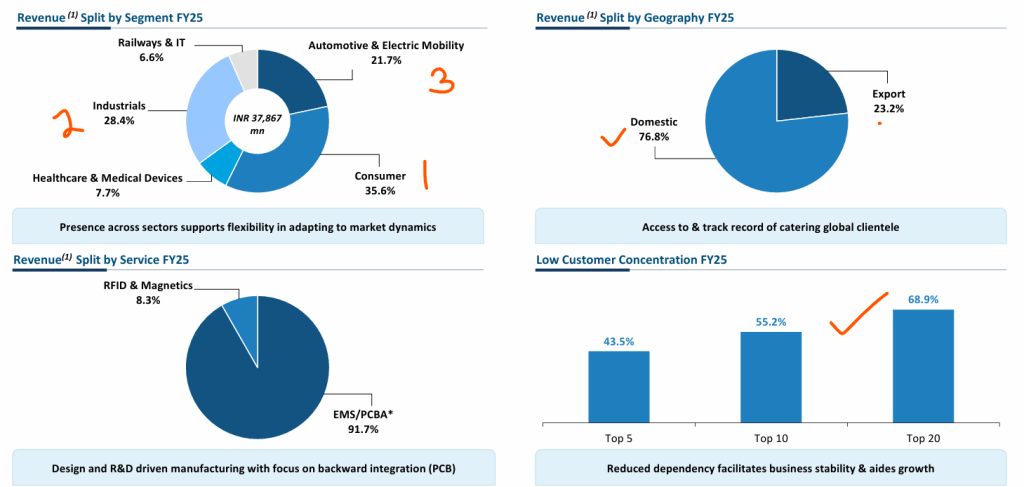

Revenue splits

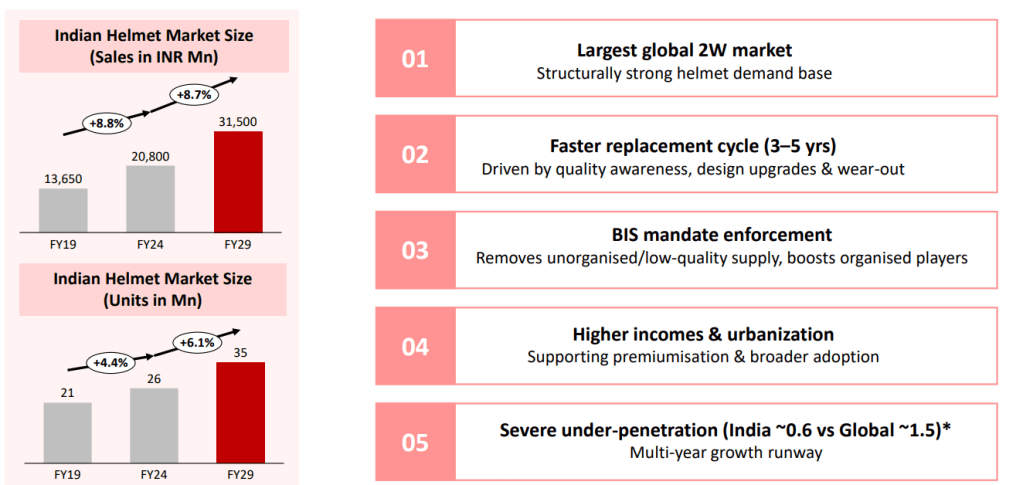

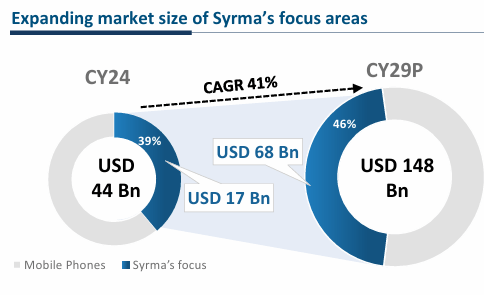

Opportunities and Growth Drivers

Government Initiatives

Capitalizing on government incentives such as PLI, MSIPS, ECMS, PM E-drive and EMC Tax incentives, infrastructure support

Growth of IoT & Smart Devices

IoT in industrial, automotive, consumer segments to drive customized solutions

Automotive IoT growth driven by connectivity, ADAS, personal UI, etc

Export Opportunities

Rising trend of supply chain diversification

India being favored as the global alternative as part of China + 1 strategy

Increasing outsourcing by OEMs

OEMs increasing reliance on ESDM players for cost efficiency, scalability, supply chain flexibility

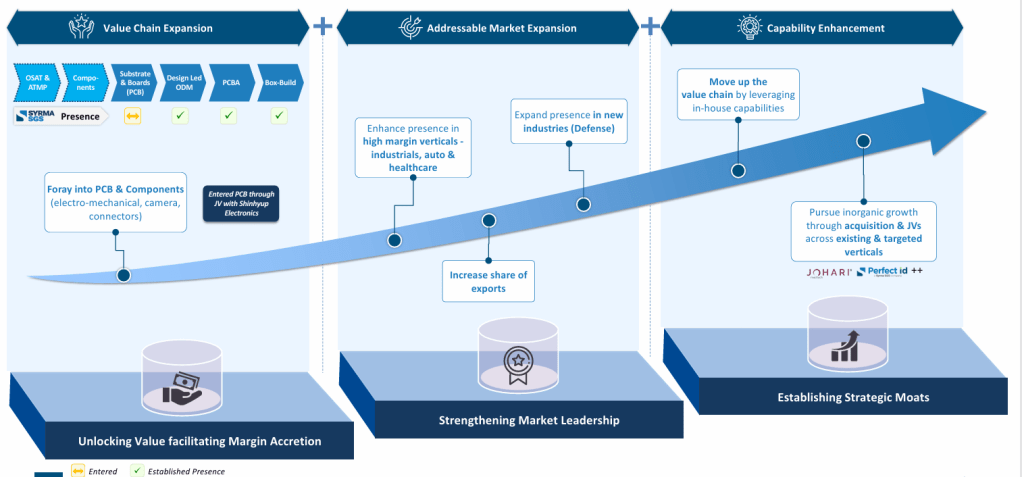

Increasing focus area

Very very interesting chart on what SYRMA wants to do in coming time

RISKS

The company imports 60% of its material requirements, which exposes it to foreign exchange fluctuation risk. While part of the forex exposure is naturally hedged from exports (about 25% of the total revenue), the company takes three months forwards to cover part of the open exposure and is able to pass on the impact of foreign exchange fluctuation to customers to some extent, any major forex fluctuation can impact the margins.

Time to time changes in technology may impact business in short term

Intensive working capital nature of business may need consistent cash flows

Technicals

One of the companies that can benefit from this trend as per our understanding is JG chemicals. Listen about company at 2hr 35min onwards in below link

1. India’s Chemical Industry at a Glance

* Current Size (2023): $220 billion

* 2030 Aspirations: $400450 billion

* 2040 Potential: $8501,000 billion

* GDP Contribution: ~7%

* Global Consumption Share (2023): 33.5%

* Target by 2030: 56%

2. Challenges Hindering Growth

* Heavy reliance on imports, $31B trade deficit

* High concentration on bulk chemicals (e.g., 95% propylene -> PP)

* Feedstock limitations and logistics inefficiencies

* Complex regulatory processes

* Skill shortage and limited R&D

3. Feedstock Conversion Comparison (India vs Global)

* Propylene to PP: India 95%, Global 70%

* Ethylene to PE: India 75%, Global 63%

* Benzene to BZ derivatives: India 87%, Global 25%

* Butadiene to PBR/SBR: India 84%, Global 54%

4. Government Interventions Proposed

* Establish chemical hubs with shared infrastructure

* Develop port infrastructure and logistics clusters

* Introduce opex subsidies for critical chemicals

* Foster R&D and global tech partnerships

* Streamline environmental clearances

* Secure FTAs with chemical-specific provisions

* Expand ITIs and vocational chemical training

5. Projected Impacts by 2030

* 700K1M jobs created

* $3540B additional exports

* Net-zero trade deficit

* 56% global production share

6. Lessons from Chinas Chemicals Growth

* 6% -> 33% global share (20002022)

* State-driven overinvestment, tech imports, JV with MNCs

* Supportive R&D, cluster development, free trade zones

* Capex: $370B by 2023

7. Indias Roadmap: 4 Strategic Pillars

1. Tap into Export Markets (e.g., paints, polyester fiber)

2. Grow Sunrise Segments (e.g., battery & electronic chemicals)

3. Solve for Production Competitiveness (e.g., EVA, phenol)

4. Unlock Technology Access (e.g., MDI/TDI, acetic acid)

Source

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The report highlights the market size, revealing that the online video sector generated an estimated $4.2 billion in 2024. Of this revenue, 75 percent came from advertising, while 25 percent was derived from subscriptions.

According to the report, piracy could cost India’s digital video sector $2.4 billion and lead to a loss of 158 million users by 2029.