Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Kilburn Engineering

Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9, Pick10

Business

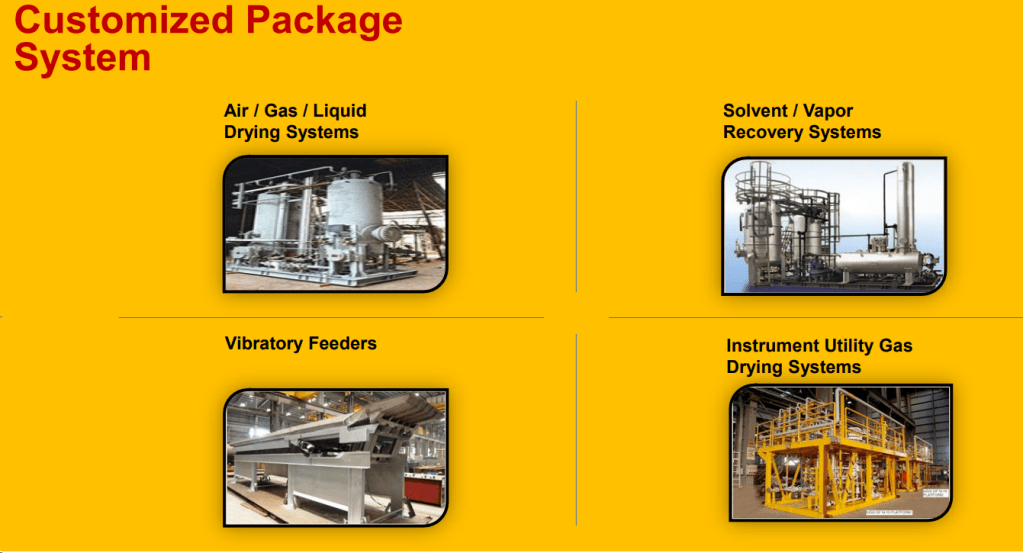

Kilburn Engineering Limited is primarily engaged in designing, manufacturing and commissioning customized equipment / systems for critical applications in several industrial sectors viz. Chemical including Soda Ash, Carbon Black, Steel, Nuclear Power, Petrochemical and Food Processing etc.

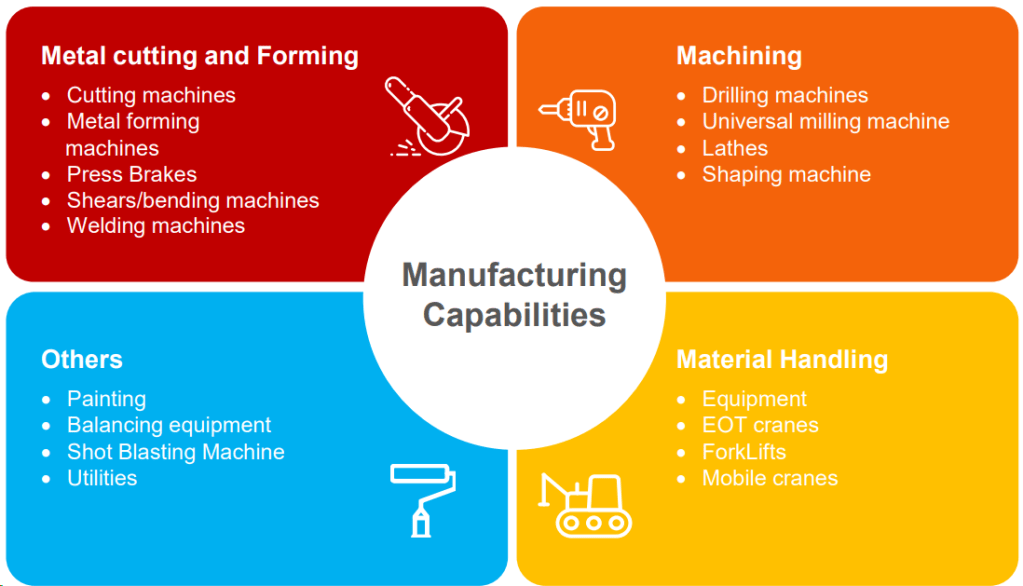

Company has cutting-edge manufacturing facility for fabrication, machining, and assembly of equipment located in Thane, Maharashtra (India). Manufacturing plant spans an area of 30,960 square meters and is equipped with state-of-the-art technology and machinery.

Products, Segments and Strengths

Company operates in two segments viz. Process Equipment and Tea Drying Equipment

Food Processing Equipment -During FY23 Company had bagged a total of 103 orders in the domestic market and 5 from overseas Market

for tea dryers

40+ Years of rich experience with 3,000+ Installations globally done

200+ Workforce and 15+ Sectors catered by products and solutions

Kind of Equipment’s & system’s orders got by company

- Silos for storage of PTA.

- Metal extraction plant for extraction of exotic material from refinery spent catalyst.

- Dryer, cooler, Granulator and Coater for fertilisers.

- Calciner package for API (Active Pharmaceutical Ingredients) industry.

- Hydrogen Fluoride Reactor package (Rotary Kiln)

- Rotary Dryers

- VFBD for wet clay

- Tea Dryers and others

In the wake of increasing concerns about environmental degradation, our Paddle dryers have emerged as a sustainable solution for drying sludge. These advanced dryers play a vital role in states where strict pollution norms have been enforced, making it imperative for industries to adopt ecofriendly practices. By efficiently removing moisture from sludge, these dryers significantly reduce the volume of waste generated, thereby minimizing the environmental footprint of industrial processes

Sewage treatment — The market size for water and wastewater management in India was 216.03 billion in 2022. By 2027, it is anticipated to grow to518.15 billion, with a projected CAGR of 15.95% during the period 2023-2027.

On similar note, many other industries catered by Kilburn are expected to grow at 5-14% CAGR till 2030 and further

Eextensive and sophisticated R&D facility that are equipped with a full range of pilot plant dryers,

including

- Paddle Dryers

- Vacuum Paddle Dryers

- Band Dryers

- Fluid Bed Dryers,

- Vibrating Fluid Bed Dryers

Company has good manufacturing capabilities and order book of 236cr in hand at 31st Dec23.

Order received in Q3FY24 94cr. Executed 73cr

Continuous order inflow in Q4FY24 as well

Order Enquiries –> Approx 100cr

Clients

Reputed clientele lik ACC, JSW , Reliance, Arvind, PCBL, Fnolex, Granules, Coromandel, SRF, LnT and many other renowned names

Professional Management team

Fundamental Ratios, Cash, Loans, EBITDA,PAT margin, Shareholding pattern

Similarly ROCE and ROE are at reasonably good levels

Debt to Equity is under control

Sales, OPM, Net profit has been on rising trend continuously

Cash conversion cycle needs to be monitored.

Working capital days are good and have been improving

Shareholding pattern

Promoter has skin in game. One of the old promoters has been selling and other has been buying. Now its settled and Public domain have few strong holdings as well.

ALSO READ : SS7 (Diwali to Diwali)

Recent Developments

Promoter buying from open market

Promoter has been buying from open market continuously. Good buying happened between 270-310 zone

Last buy around 320

Acquisition of ME energy

This acquisition will help the company to grow faster

Company has put an estimated target of 500cr revenue by FY25 as ME energy has a 118cr pending order book

Capex

Expecting small capex of 15-20 cr till Dec25

Valuations

Expected Cumulative sales projections for FY25 is ~500cr (considering orders and Acquisition) and with PAT margin of ~12% after merger, we get PAT of 60 cr. So stock price may move towards 500 by 31Mar25. There could be volatility in stock which can be used for accumulation

Risks

Chequered history of non-payment of loans and subsequent new promoters on board.

Due to the non-payment of its loan obligations to RBL Bank Limited (RBL) starting in March 2020, KEL underwent debt restructuring in FY21. The resolution plan (RP) sanctioned by RBL in accordance with the Reserve Bank of India’s criteria was accepted by the company board on March 4, 2021, and it was put into effect on March 31, 2021. As per the RP, the outstanding principal loan of Rs 95 crores and interest of Rs 9 crores due to RBL up to 31 March 2021 was to be restructured. As part of the debt restructuring, Rs 65 crores of sustainable debt was converted into long- term loans with a 12.5 year payback period at an annual interest rate of 9%, Rs 13.5 crores in equity shares were allocated to RBL, and Rs 25.5 crores in 0.01% cumulative redeemable preference shares (CRPS) were also allocated to RBL.

Chemical companies are facing challenge to make sales. Their capex plan may be delayed further leading to slow flow of order to companies like Kilburn

Economy impact because of possible US recession might delay things by a year or more

High capital working requirements remain a risk.

Delay in Acquisition of ME energy. This is major risk in short term

Technicals on 10Feb24

Stock has been consolidating between 260-290 for almost few months and given a breakout recently and then got good results as well

Technicals on 31-Mar-24

Survived well in last one month market correction

Conclusion

If you have understood the triggers and industries it cater to + RISKS which can materialize and have patience then think of buying this company in every dip, market offers, else Ignore the stock

Stock might be volatile in short term and give a chance to buy around 270-340 range for long term investment purpose

Also Read : ICEMAKE Refrigeration : Time to Chill

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Discover more from ALPHA AFFAIRS

Subscribe to get the latest posts sent to your email.

19 thoughts on “Capex is the key”