Kabra Extrusion Tecknik

CMP 417, Market cap ~1450cr

ROCE ~15%, ROE ~10%, D/E ~0.19 PE ~41 (based on screener)

Also Read Pick1, Pick2, Pick3, Pick4, Pick5

🟢Kabra Extrusion Technik Limited : It is India’s largest manufacturer of plastic extrusion machinery for more than 4 decades and recently ventured into manufacturing of Lithium-ion Battery Packs. The company is a part of the well-known Kolsite Group.

🟢In Extrusion Machinery Business it is India’s premier manufacturer & exporter of extrusion plants with presence in 100+ countries with +15,000 installations. also commands close to 40% market share in FY23

🟢Industry application in different sectors like -Packaging Industry, Infrastructure & Construction, Telecom and Plasticulture

🟢It has different products : Blown Film Lines, Pipe Extrusion Lines, Sheet Extrusion Lines, Compounding Lines and Auto Feeding Systems

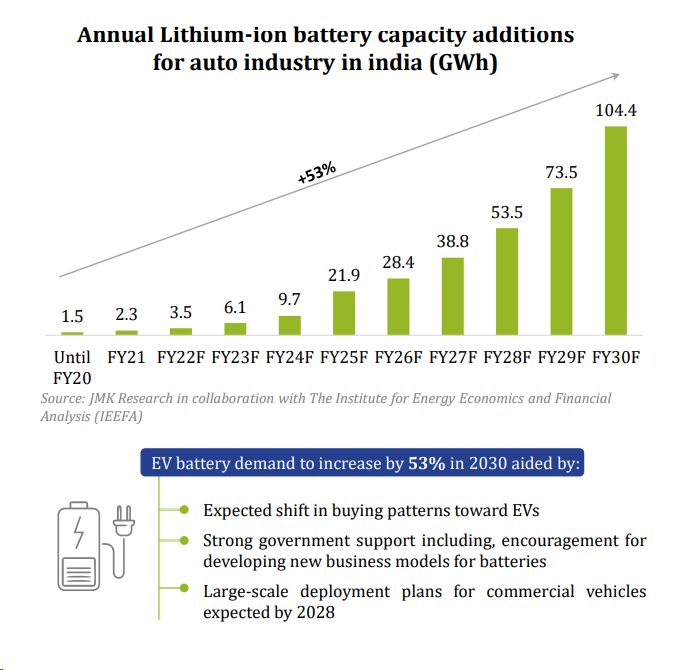

🟢In new segment of Battrixx –Its an emerging leader and commands approx, 15% market share where

🟢Battrixx business is a battery related solutions for electric mobility and energy storage, Battery & related components constitutes ~35-45% of cost in an Electric Vehicle

🟢Products in Battrixx segment are Battery Packs across multiple chemistries, Battery Management Systems (BMS) and IoT Solutions

It is One of the few players with

- The ability to handle multiple chemistries & types of cells

- Chemistries – LFP, NMC, NCA, etc.

- Types of Cells – Prismatic & Cylindrical

- Expertise across Electrical & Electronics

- Smart BMS

- IoT & Telematics

- Data Analytics Solutions

🟢Company is continuously investing in RnD and want to enter E-trucks, E-buses and ESS(energy storage systems)

🟢Company is first EV battery-pack manufacturer to be accredited with ARAI certification under AIS 156 Amendment III Phase 2 for its batteries, conceptualized and designed in-house strategically with Hero Electric’s R&D team

🟢Company had earlier won 3L battery packs and chargers order from Hero Electric Mobility for FY24

Key focus areas of our R&D

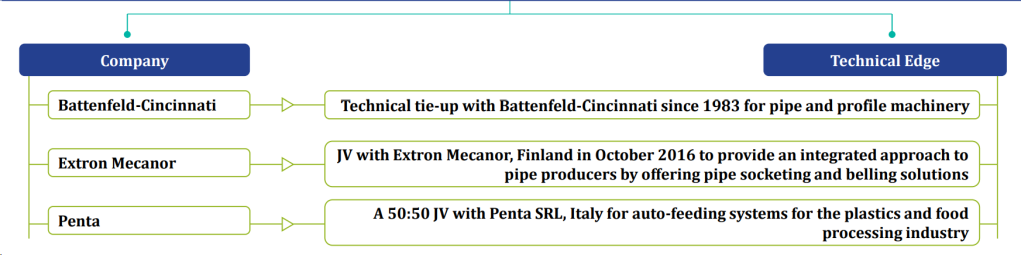

Company has technical tie up with Battenfeld-Cincinnati, Extron Mecanor and Penta for different domains

🟢Company has right tailwinds in longer run

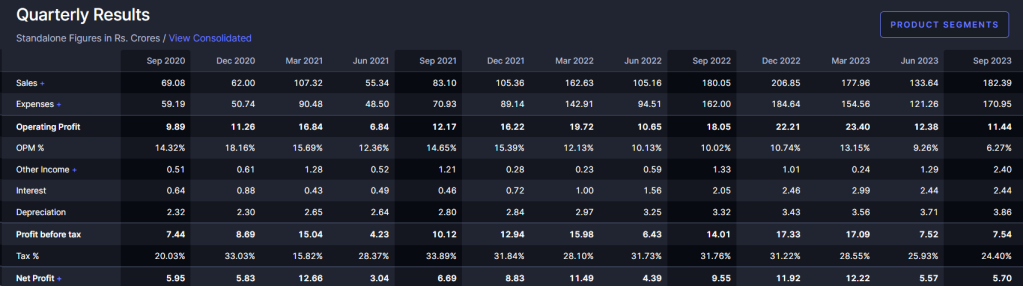

🟢Company business is profitable though facing short term headwinds

🟢Promoter has sufficient skin in game with 60% holdings, FII holdings increasing in FY24

🟢Company credit rating has been upgraded last year CRISIL A+/Stable (Upgraded from ‘CRISIL A/Positive’)

Risks

🔴Company was able to successfully established new business but EV Battery sector run into headwinds with new rules. Company was first to be accredited with certification for new rules but still headwinds not went away fully. Company might take more time based on customers business

🔴Crude oil has indirect dependency as customers order go down for new machinery with increasing crude oil price. Hopefully now Crude is stable and Pipe volumes may come up seeing the real estate boom

🔴Low OPM, NPM margins as of now –may improve with both domains of business picking up

🔴Technically weak structure for stock price

Financials

Company OPM have gone down recently and may take time to stabilize and come up. We need to carefully watch this space. Expected OPM is around 12% in longer run so enough space for company to showcase good results in coming years

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

Discover more from ALPHA AFFAIRS

Subscribe to get the latest posts sent to your email.

25 thoughts on “SS-6”