BE FINANCIALLY INDEPENDENT

Read more for these IPO before listing on their business, strength, risks Bector Food , Happiest minds, Route mobile, Rossari biotech, Burger king

Read more here on Route Mobile

Read more here on Burger King

Read more here on boAT

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Chemcon– is a manufacturer of specialized chemicals, such as HMDS (Hexamethyl Disilazane) and CMIC (Chloromethyl Isopropyl Carbonate) and is market leader in both products. This are predominantly used in the pharmaceuticals industry, and inorganic bromides, namely Calcium Bromide, Zinc Bromide and Sodium Bromide, which are used as completion fluids in the oilfields industry

Offer purpose — 318cr Complete offer for sale by promoters

Key Service domains – Pharmaceuticals and oilfields industry

Clients -Hetero Labs Limited, Laurus Labs Limited, Aurobindo Pharma Limited, Sanjay Chemicals (India) Private Limited, and the key customers of Oilwell Completion Chemicals include Shree Radha Overseas, Water Systems Specialty Chemical DMCC, Universal Drilling Fluids and CC Gran Limited Liability Company.

Revenues from Key Clients— 67%

Revenues from Key regions–32% exports

Risks —

Limited product range

Significant portion from few customers

Promoters past is the biggest risk. There are cases of non-compliance and criminal proceedings

Future

Company has grown revenues and profits and partially supported by ban of chemicals in China to support environmental policies

Due to specialty chemicals and market leader, company stands at good point to gain

Valuations

Reasonable considering peers in India in specialty chemicals. Fundamentals seems promising as of now

Should we apply?

Less chances of allotment due to small size. People who understand chemical business well can take the risk of applying

Less risk taking people can avoid

Listing day may see see moderate gains . Recommended to book profits if any on listing day

Keep an eye on promoter walk the talk scenario if holding for long

Also Read

Happiest Minds IPO crisp summary –Listing with substantial gains

Route Mobile IPO crisp Summary — Listing with substantial gains

Rossari biotech IPO detailed summary –Listed with substantial gains

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

CAMS– almost two decades of experience –is a technology-driven financial infrastructure and services provider to mutual funds and other financial institutions. Aggregate market share of approximately 70% based on mutual fund average assets under management (“AAUM”) managed by their clients and serviced by us

Offer purpose — 2258cr Complete offer for sale by promoters

Key Service domains – Mutual funds, AIF business, KYC registration, Insurance services business

Clients -SBI Mutual Fund, HDFC Mutual Fund, ICICI Prudential Mutual Fund, and Aditya Birla Sun Life Mutual Fund are serviced by CAMS

Revenues from Key Business— 85% ( mutual funds)

Risks —

Huge dependency on Mutual fund business with major revenue from it (more than 85%)

Significant disruptions in information technology systems can cause it a loss

Slow revenue growth in past few years

Risk of Regulators.

Pricing power can be a hurdle to grow earnings

Future

Long term growth seems reasonable and demand seems to increase in coming years with Indian Mutual fund industry set to grow

Almost all Major mutual funds are clients

Valuations

Expensive but considering almost duopoly, it can undergo time correction

Should we apply?

High chances of allotment. Less Risk taking people can avoid

Listing day can see (-8%) to 20% . Recommended to book profits if any on listing day

3+ year holding can give good returns even from this price if things workout well

Also Read

Happiest Minds IPO crisp summary –Listing with substantial gains

Route Mobile IPO crisp Summary — Listing with substantial gains

Rossari biotech IPO detailed summary –Listed with substantial gains

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

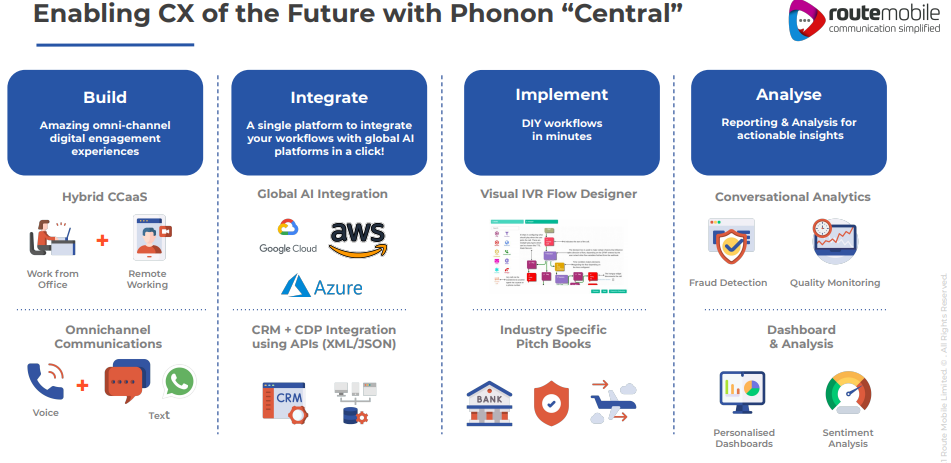

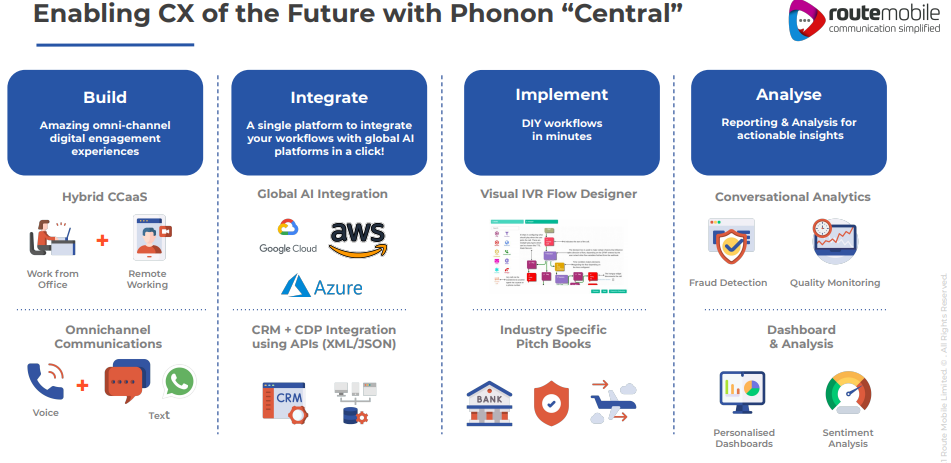

Route Mobile– almost 16 yr old company –technology service provider specializing in communication services to enterprises. Acts as communication platform as a service

Offer purpose — 360cr as offer for sale by promoters and 240 cr as fresh issue. so 40% will flow to company to reduce loans, acquire companies etc

Key Service domains – Messaging services and Call center services

Clients -ICICI Bank, State Bank of India, Skype, Emirates Airlines, Bank of Maharashtra, WeChat, OSN and Viber.

Revenues from Key regions — 82% from exports, 12% from India,

Revenues from clients— Largest client 15% , 64% from top 10 clients

Risks —

Greater dependency on 3rd parties mobile network operations,Rely on 3rd party technology systems and infrastructure

Major revenues from limited client. So high concentration risk, although total clients 2500+.

Risk of potential claims resulting from the client’s misuse of its platform to send unauthorized text messages in violation of TRAI regulations.

Future

May gain from clients consistent need to serve more customers with limited resources

Billable transaction increasing at good rate and most companies pay it in advance

Long term growth seems reasonable and demand seems to increase in coming years

Valuations

Similar to peers in India and less than globally listed peers

Should we apply

High chances of over subscription and less allotment

Possible gains on Listing day can be seen but caution is advised to book profits if any

2+ year holding can give substantial gains if things workout well

Also Read

Happiest Minds IPO crisp summary –heavily subscribed

Rossari biotech IPO detailed summary –It came out with flying colors

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.