Likhitha Infra (approx 33 yr old company) is an Oil Gas Pipeline Infrastructure provider in India. Operations include Cross Country pipelines and associated facilities, City Gas Distribution including CNG stations, and Operation & Maintenance of CNG/PNG services.

Strong presence in more than 16 states and 2 Union Territories in India.

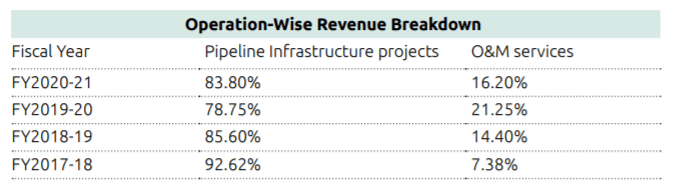

Two major domains, if we divide the operations , are Pipeline Infrastructure Projects and O&M services (Operation and Maintenance)

Revenue breakdown for the domains are highlighted below (for last 4 Financial years)

Strengths

Long standing relationships with domestic marquee customers.

Efficient business model

Strong project execution capabilities

Diversified geographical presence in India

Strong Technical Qualification to bid for new projects

Strong promoter holding showing skin in game

Good ROCE, stable and improving PAT margins and EBITDA

Highly experienced Management Team

Triggers for company in coming quarters

CGD is increasing in India and company is at right place for its business to grow with Strong client base and on top of that company has Strong Technical Qualification to bid for new projects which is visible in orders won recently

Company has received orders worth Rs. 250 Crores (approx.) excluding GST from various City Gas Distribution Companies during the

quarter from October 2021 to December 2021.

Till Aug. 2021 company has an outstanding order book of 1020 cr giving good revenue visibility. In Oct-Dec 2021 , company received 250cr of additional orders

As per the recent Government policies, PNGRB has increased the number of Geographical Areas (GAs) to 228 comprising of 402 districts spread over 27 States and Union Territories, covering 70% of Indian population and 53% of its area. These recent Government initiatives have provided lucrative opportunities for Oil & Gas infrastructure service providers

Recent policy moves, including a wide-scale rollout of CNG and the expansion of gas infrastructure including LNG terminals, long-distance transmission pipelines and city gas distribution networks, will help drive 30bnm³ of gas demand growth over the next decade through fuel switching away from coal and oil. A recent switch to CNG from coal in India’s brick industry is encouraging greater gas use.

Exit Triggers

Order chain drying up in coming quarters

Unforeseeable change in Government policies

Declining margins and increasing debtors or working capital cycle days

Risks

Any change in CGD policy

Much faster penetration of EV in coming 2-3 years

Rising raw material and commodity costs

The Company is deriving significant portion of orders from major Oil & Gas distribution companies inducing a client concentration risk