BE FINANCIALLY INDEPENDENT

CMP 569, Market cap ~3150cr

ROCE ~32%, ROE ~24%, D/E ~0.07 PE ~29 (based on screener)

🟢EMS Limited is a multi-disciplinary EPC company, headquartered in Delhi that specializes in providing turnkey services in water and wastewater collection, treatment and disposal. EMS provides complete, single-source services from engineering and design to construction and installation of water, wastewater and domestic waste treatment facilities

🟢The company provides Sewage solutions, Water Supply Systems, Water and Waste Treatment Plants, Electrical Transmission and Distribution, Road and Allied works, operation and maintenance of Wastewater Scheme Projects (WWSPs) and Water Supply Scheme Projects (WSSPs) for government authorities/bodies.

🟢Healthy Order book of ~2100cr provides strong visibility of revenues over next few years. Company has repeat orders from various Government departments.

🟢EMS promoters have more than a decade of experience in executing water supply and sewage treatment projects

🟢Since incorporation, it has completed 67 projects in Bihar, Uttarakhand, Madhya Pradesh, Rajasthan, and Haryana. It has executed many projects awarded by government bodies such as Uttar Pradesh Jal Nigam (UPJN), Construction and Design Services (C&DS), Military Engineering Services (MES), and Indian Railway Construction Limited (IRCON). It has completed 4 O&M projects in last 4 years.

🟢Key clientele includes government bodies like Municipal corporation of Rajasthan (under AMRUT Scheme), Uttarakhand Urban Sector Development Agency and Bihar Urban Infrastructure Development Corporation (under National Mission for Clean Ganga ) and CPWD, Maharashtra

🟢EMS Limited has its own civil construction team and employs 57+ engineers, supported by third-party consultants and industry experts.

🟢Projects are mostly funded by World bank

🟢Development of Tier 2 Tier 3 towns, capital expenditure by Government gives good visibility for few years

🟢Promoter has sufficient skin in game with approx. 70% holdings, Sales are increasing and NPM is good

Risks

🔴Company works in a field of high capital intensive business and receivables will remain high

🔴Project execution risks within a budget are the ones which constantly hurts companies in these kind of businesses

🔴The company has not executed any HAM projects in the past but is executing one HAM project for the UP Jal Nigam. It has entered a joint venture with Ercole Marelli Impianti Tecnologici S.R.L. Italy.

🔴Revenue concentration from few clients/states poses a risk

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.

CMP 417, Market cap ~1450cr

ROCE ~15%, ROE ~10%, D/E ~0.19 PE ~41 (based on screener)

🟢Kabra Extrusion Technik Limited : It is India’s largest manufacturer of plastic extrusion machinery for more than 4 decades and recently ventured into manufacturing of Lithium-ion Battery Packs. The company is a part of the well-known Kolsite Group.

🟢In Extrusion Machinery Business it is India’s premier manufacturer & exporter of extrusion plants with presence in 100+ countries with +15,000 installations. also commands close to 40% market share in FY23

🟢Industry application in different sectors like -Packaging Industry, Infrastructure & Construction, Telecom and Plasticulture

🟢It has different products : Blown Film Lines, Pipe Extrusion Lines, Sheet Extrusion Lines, Compounding Lines and Auto Feeding Systems

🟢In new segment of Battrixx –Its an emerging leader and commands approx, 15% market share where

🟢Battrixx business is a battery related solutions for electric mobility and energy storage, Battery & related components constitutes ~35-45% of cost in an Electric Vehicle

🟢Products in Battrixx segment are Battery Packs across multiple chemistries, Battery Management Systems (BMS) and IoT Solutions

It is One of the few players with

🟢Company is continuously investing in RnD and want to enter E-trucks, E-buses and ESS(energy storage systems)

🟢Company is first EV battery-pack manufacturer to be accredited with ARAI certification under AIS 156 Amendment III Phase 2 for its batteries, conceptualized and designed in-house strategically with Hero Electric’s R&D team

🟢Company had earlier won 3L battery packs and chargers order from Hero Electric Mobility for FY24

Key focus areas of our R&D

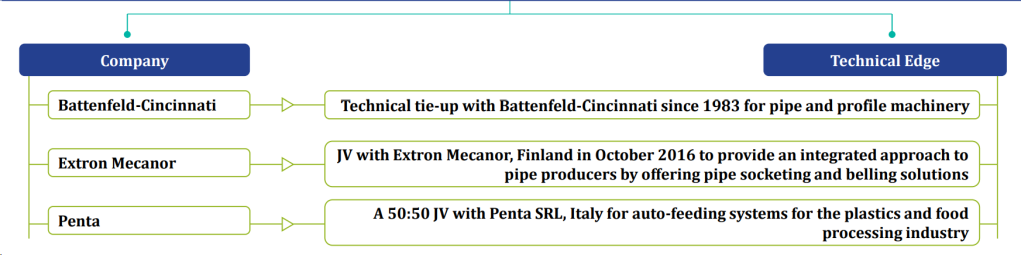

Company has technical tie up with Battenfeld-Cincinnati, Extron Mecanor and Penta for different domains

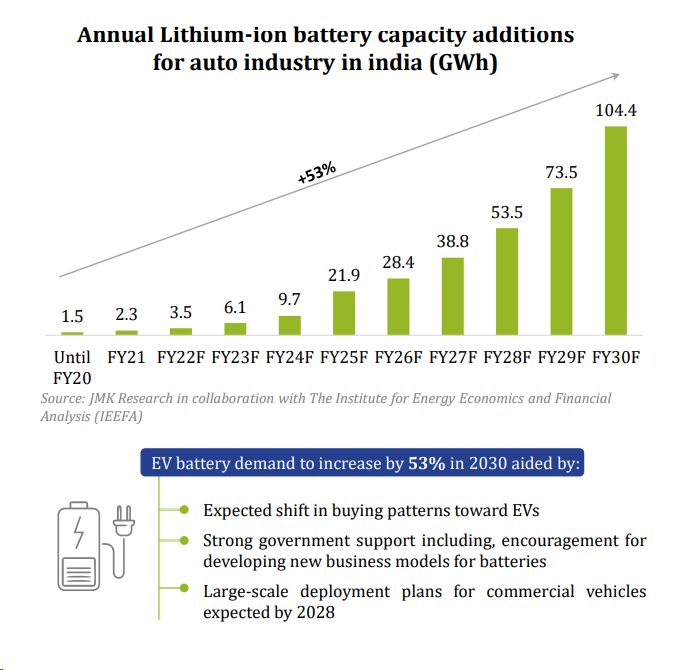

🟢Company has right tailwinds in longer run

🟢Company business is profitable though facing short term headwinds

🟢Promoter has sufficient skin in game with 60% holdings, FII holdings increasing in FY24

🟢Company credit rating has been upgraded last year CRISIL A+/Stable (Upgraded from ‘CRISIL A/Positive’)

Risks

🔴Company was able to successfully established new business but EV Battery sector run into headwinds with new rules. Company was first to be accredited with certification for new rules but still headwinds not went away fully. Company might take more time based on customers business

🔴Crude oil has indirect dependency as customers order go down for new machinery with increasing crude oil price. Hopefully now Crude is stable and Pipe volumes may come up seeing the real estate boom

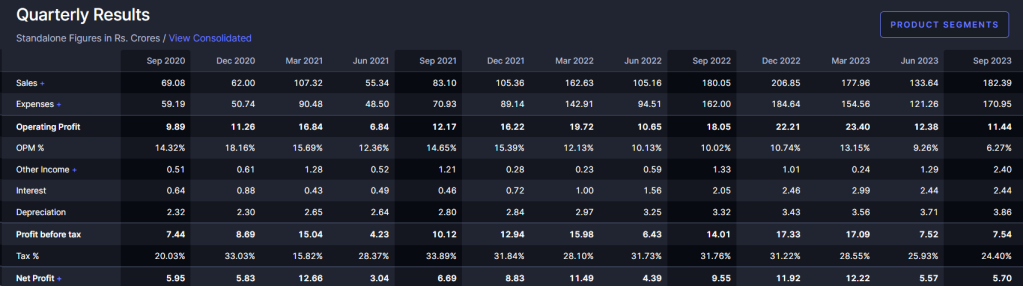

🔴Low OPM, NPM margins as of now –may improve with both domains of business picking up

🔴Technically weak structure for stock price

Company OPM have gone down recently and may take time to stabilize and come up. We need to carefully watch this space. Expected OPM is around 12% in longer run so enough space for company to showcase good results in coming years

Technical chart

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.