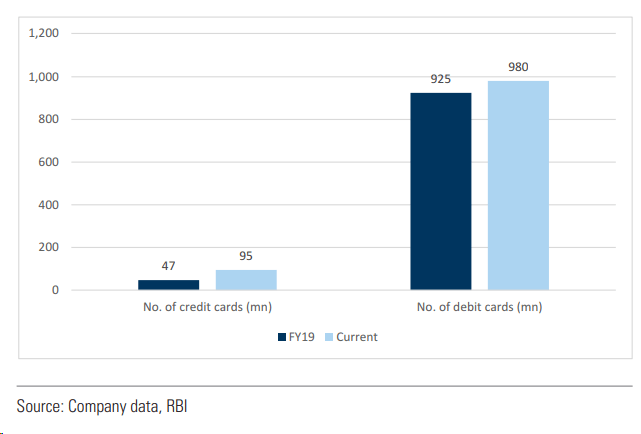

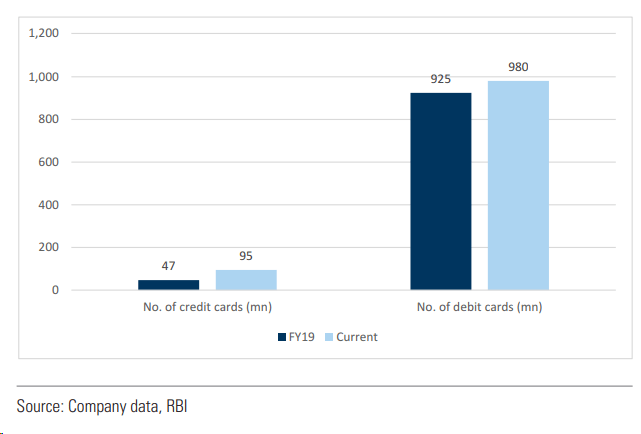

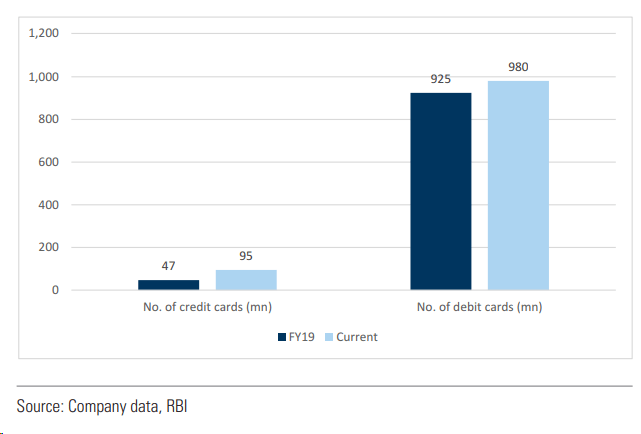

Credit cards rising faster : Long term Trend

BE FINANCIALLY INDEPENDENT

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

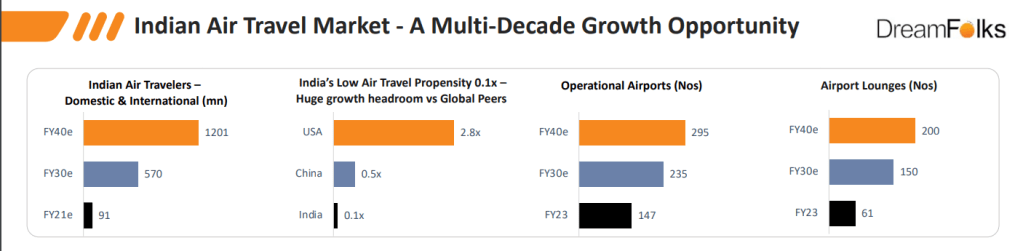

Dreamfolks in India’s Largest Airport Service Aggregator Platform. Company provides clients the option of providing their end consumers different mechanisms to access certain airport-related services like lounges and all the other services

DreamFolks platform is proprietary and has been developed in-house. The platform and the technology is cloud-based and it allows lounges and other operators to check the benefits of the consumers based on the cards, memberships, or vouchers, and also allows access to the different facilities based on the benefits or integration as per our clients, such as banks or networks, processes, and their systems

Company’s platform actually comprises of quite a few components. There is benefit configuration, there is benefit calculation, there’s an entire management engine, there are data exchange, APIs with different banks and networks, and integration options to embed into different mechanisms, including with company partners. Platform also facilitates the use of hybrid access modes depending on the client’s preference, so they can use whichever mechanism that is most beneficial for them. It also facilitates lounge access processes so that consumers benefit such things in real time across various access modes. And that drives accurate accounting and is designed to prevent abuse and denial of services to consumers

Major expenses are linked to employee compensation and in-house R&D expenses. And being an extremely asset-light company with a very lean organizational structure and size, Company don’t have any major capex needs or other outlays and Company seems confident of financing any future scale-up or expansion through internal accruals

Current mix of the lounge versus other services 95% versus 5%, Similar margins

40% to 45% in the first half and rest in the second half of the year, due to the simple reason that the festivals and the holiday season kicks in only starting from August, September.

100% coverage across all 60 Airport lounges operational in India

Market share of ~95% of all India issued card based access to domestic lounges in India (FY22)

68% share of the overall lounge access volume in India (FY22)*

Present currently in 10 railway lounges across the country and witnessed a steep growth rate with our modernization of railway stations happening at great next speed

Golf Games, Lessons and Railway lounges are new categories

This association will give customer access to golf games and lessons at 40+ golf clubs throughout India and 250+ golf clubs and resorts in the Asia Pacific region.

Price Realization on the blended basis is INR 940 approximately. Domestic is close to INR 840-INR 845. And internationally, that would be between INR 1,200 to 1,400.

Client 52 —Employees 60 –Nov 22 update, 64 employees Feb23

Touchpoints 1450 in Nov 22, 1486 in Feb23, might cross 1500 by Apr23

Touchpoints refer to a service fulfilment point at Airports across India and overseas owned by service providers with whom Dreamfolks has a contractual arrangement

Next phase of growth is centered upon three levers;

Cross-selling and up-selling to existing clients,

Acquiring new clients in existing and new sectors and

Via geographic expansion from a purely domestic focus currently to an international focus in pre-determined geographies.

With the existing clients, we aim to increase wallet share and expand our association beyond airport lounge services to include F&B, spa, meet and assist.

As regards new clients, we aim to expand into new sectors to create customer engagement and provide loyalty management solutions. Another focus area is to focus on customer engagement and loyalty solutions for corporate clients and build specific solutions for loyalty companies, ecommerce companies, new age digital companies, hospitality sector companies, and neo banks amongst others

Replication of similar successful operating model by leveraging deep knowledge of industry, technology innovation, process expertise and business model across new high growth markets which include Central and Eastern Europe, Middle East, Africa and Southeast Asia.

Recent developments

ASPIRE Lounges Australia – Delighted to tie up with ASPIRE Lounges Australia. With this partnership, air travelers can now experience exclusive luxury lounge access in Sydney, Melbourne, Perth and Brisbane as part of 66 Aspire Branded Lounges globally.

Dhanlaxmi Bank – Tie-up for access to Indian Lounges for their customers

FCM Travel – Corporate tie-up to provide their customers with domestic lounge access, Meet & assist and Airport Transfer Services

Onboarded 5 New Clients Including Akasa Air, one of the newest LCCs in India

Lounge area and capacity expansion at T3 Indira Gandhi International Airport, Delhi from 2,500 sq ft to 10,000 sq ft.

Added Lounge at Bengaluru’s KempeGowda International Airport, T2

Strategic tie-up with the leading Golf Service provider for access to golf games and lessons at 40+ golf clubs throughout India and 250+ golf clubs & resorts in the Asia Pacific region.

Company is is getting into exclusive contracts with the lounges.

In terms of the technology company is deeply integrating with banking partners. So that is one of the strong points because the step of integrating with these clients itself is a very long process, And there are a lot of compliance as well.

Value added services:- airport meet, assist in transfer, golf, railway lounges not easy to start and pickup by competition

Amazing aspect is almost Nil CAC

RBI may reduce the MDR rates on credit card companies so going forward, what credit card companies also have indicated that if this were to happen, and they will reduce rewards and services they offer to protect their margins – that will negatively impact company business in short term

International lounge vs domestic lounge traffic can change margin profile on either side

Any situation like Covid can again lead to bad times for company

UPI payments can pose a small risk

Competition like Priority Pass etc –this risk is somewhat mitigated as competition have been in this market and they

have been the global player across for more than 30 years now. So, in their presence, Company have actually taken away the India share from them

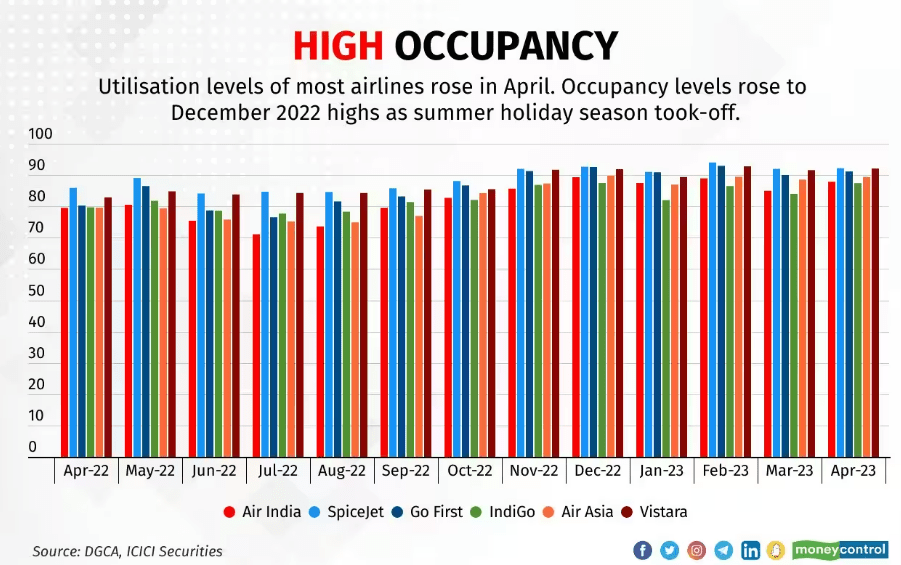

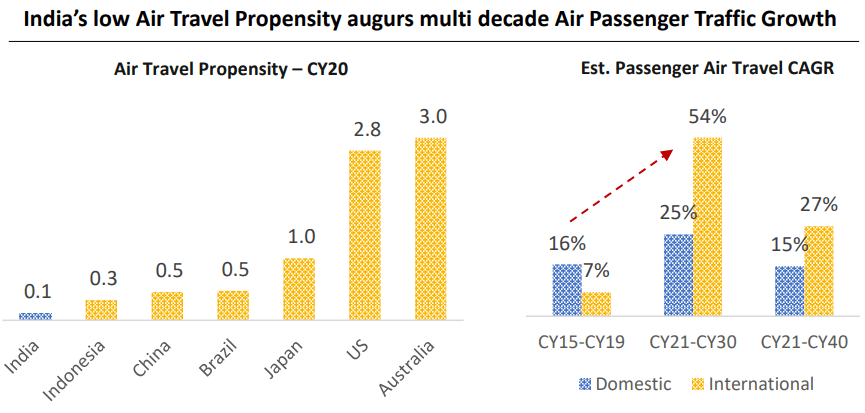

IMAGES FROM INDIAN AIRPORTS over last 10 months showing lounges are high in demand, runway are back to back lined up with airplanes signifying air travel increasing and travellers interest in lounges also increasing–so Increase in travelers and increase in interest of traveler for lounges can be huge tailwind in coming decade 2023-2033

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.