The data has been compiled from various sources and might have small difference but overall theme is to subscribe or not — we will focus on that

Devyani Internationals Limited IPO-“DIL” is the largest franchisee of Yum Brands in India and is amongst the largest operators of chain quick service restaurants in India and are among the largest operators of chain quick service restaurants (“QSR”) in India on a non-exclusive basis. DIL is also a franchisee of the Costa Coffee brand in India, which is owned by Costa,

Business — DIL’s business is broadly classified into three verticals that includes stores of KFC, Pizza Hut and Costa Coffee operated in India (KFC, Pizza Hut and Costa Coffee referred to as “Core Brands”, stores operated outside India primarily comprising KFC and Pizza Hut stores operated in Nepal and Nigeria (“International Business”); and certain other operations in the F&B industry, including stores of our own brands such as Vaango and Food Street

Region of operation — Major cities in India and in Nepal, Nigeria

Offer purpose — The IPO is issuance of shares worth ₹1838 crore for debt clearance and general corporate purposes.

Risks —

Termination of or inability to renew long term contracts with brands

Loss making company

High and intense competition in QSR space

Outstanding litigation proceedings against the Company, Subsidiaries, Directors, and Promoters

Strength

Presence across key consumption markets

Highly recognized global brands catering to a range of customer preferences

Multi-dimensional comprehensive QSR player

Future

The quick-service restaurant channel has been rapidly growing in popularity in India, owing to factors such as rise in literacy, exposure to media, increase in disposable incomes, and easier and greater availability. Affordability has also been a key factor.

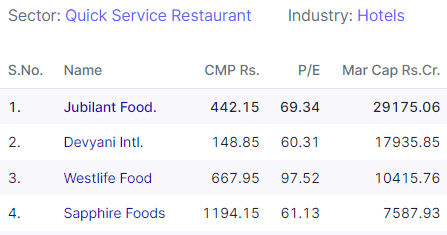

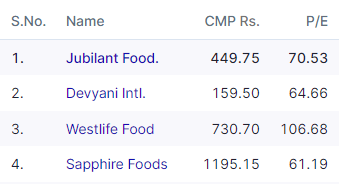

Valuations

Valuations are high and bit lesser than peers

Should we apply?

People can subscribe only for listing gains. Sell on listing day

Also Read

Burger King IPO crisp Summary — Listing with huge gains as shared

CAMS IPO crisp summary — Listed with 20% gains as shared

Happiest Minds IPO crisp summary –Listed with substantial gains as shared

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.