Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

Jash Engineering

Key Investment thesis –> Increasing Demand of Water Intake Systems, Water and Waste Water Pumping Stations and Treatment Plants, Storm Water Pumping Stations, Water Transmission Lines, Consistent Business and Order book

Read Pick1, Pick2, Pick3, Pick4, Pick5, Pick6, Pick7, Pick8, Pick9, Pick10, Pick11, Pick12, Pick13, Pick14, Pick15, Pick16, Pick17, Pick18, Pick19, Pick20, Pick21, Pick22, Pick23

Business

Jash engineering is dedicated to offering varied products for use in Water and Wastewater Pumping Stations and Treatment Plants, Storm Water Pumping Stations, Water Transmission Lines, Desalination, Power, Steel, Cement, Paper & Pulp, Petrochemicals, Chemicals, Fertilizers and other process plants.

Headquartered in Indore – India, Jash has six well-integrated state-of-art manufacturing facilities, four in India and one each in the USA & UK. Global presence with bases in India / USA / Austria / Hong Kong / UK

Employees > 1075, Countries served 45+, Manufacturing units 6, Capacity utilization 70% approx

Company has many accolades, and technical collaborations

Joint Venture with Invent , Germany to manufacture their range of aeration and mixing equipment.

Technical & Financial collaboration with Schuette, Germany for Bulk solids valves

Technical Collaboration with Invent, Germany for Disc Filter

Technical collaboration with Rehart, Germany for Archimedes screw pumps & hydro power generation.

Technical collaboration with Weco Armaturen, Germany to offer its range of Valves in Asian market

Business Segments and Revenue Contribution and Products

Domestic 40%, Exports 60%

Water control gates –60% (FY24) 49%(Q1Fy25)

Valves -15% FY24, 13% Q1FY25

Screening equipment 15% FY24, 31% Q1FY25

Hydropower and pumping solutions 10% FY24, 7% Q1FY25

Clientele

Strengths :

- Long standing relationships with domestic marquee customers.

- Efficient business model

- Strong project execution capabilities

- Diversified geographical presence in India and world

- Strong Technical Qualification to bid for new projects

- Highly experienced Management Team

Fundamental Ratios, Cash, EBITDA, PAT

ROCE>25% and ROE> 22%, DE ~0.23 , Free cash flow is good , Pledge is Nil

Net Profit went 67X+ in 10 Years, Consistent Dividend Payout

Consistent Profit growth, sales growth, ROE over 3 years, 5 years, 10 Years

Triggers

Expanding presence and Acquisitions

Acquired Waterfront Fluid Controls Ltd, UK in 2023.

WATERFRONT UK PLANT & OFFICE INAUGURATION

After successful acquisition of Waterfront Fluid Controls Ltd, UK, the company has taken manufacturing plant on lease which is adjoining shed to the present Waterfront’s shed. This plant was commissioned on 31st May 2024.

A new plant for manufacturing process equipment is under construction in Chennai. This plant will be commissioned in December 2024/Feb25. This facility is being built at an approximate cost of Rs. 20 crores and this will start contributing to improvement in revenue from April 2025 onwards. This facility at its peak production capacity will contribute up-to Rs. 100 Cr to company revenue.

A new land has been acquired for expansion of Unit 4 (Fabricated Products Plant), SEZ Unit. This new plant of ~ 55000 sq. ft. will be commissioned in FY 2025-26. Manufacture Stainless steel products for the growing export market. The construction of this plant will start in October 2024 and the plant will be commissioned by year end 2025. This plant will be constructed at a tentative cost of Rs 22-23 crores inclusive of land and at its peak production capacity will contribute up-to Rs. 100 Cr to company revenue.

Good execution and order book and Consistent new orders

946 cr order book on 1st sep24, 74cr orders in pipeline, negotiation

FY25 guidance ~675cr

New Product developments

First Vortex Grit Mechanism with Grit Classifier For 26 MLD STP Jhansi, UP Jal Nigam

Combined Screening & Grit Removal System-1MLD (PTU) for Enviro-Infra, Bareilly, UP

First set of Bladder Vessel 9 m3 x 3, 1 m3 x 3 supplied to Varanasi WSP Project

3 Wheel Sealed Version Disc Filter for 6 MLD capacity for Delhi Jal Board

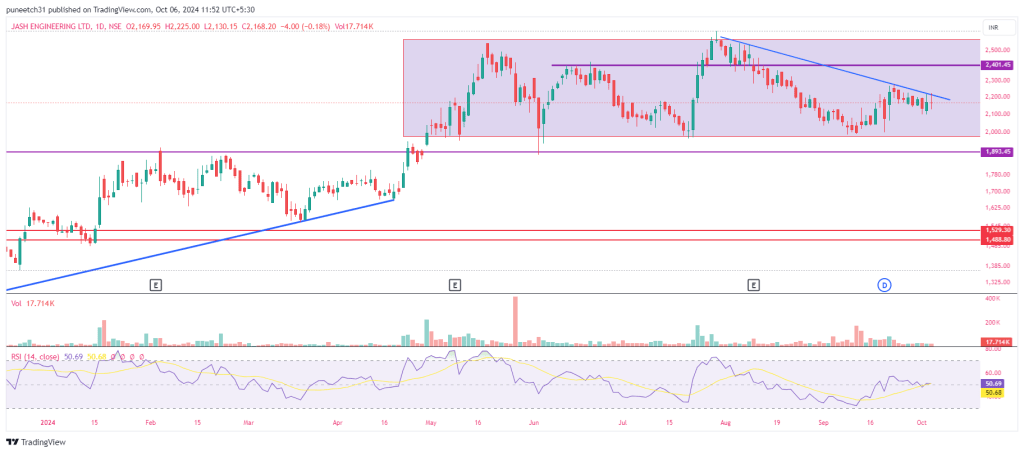

Technical chart on 6 Oct 24

Risks

| Large working capital requirement, cash conversion cycle is bit high Trade receivables and Inventory on higher side Rising raw material and commodity costs Increase in competitive bids for procuring the projects |

Disclaimer – Analysis is NOT a BUY/SELL/HOLD Recommendation. It can be used for educational purposes. There can be lot of things which have been missed in analysis either due to lack of information or oversight etc.. Do your own diligence & contact your expert financial adviser before making any investment decision.

In case you have any questions/ queries, please feel free to reach me through Contact Form

Do spread the word among your peers, family members or anyone who can benefit from this blog and asked them to subscribe. But be selfish and take care of yourself first by subscribing before they do.

Enjoy the day and your life. Don’t forget, we are alone in this grand universe and may not get a chance to live again.