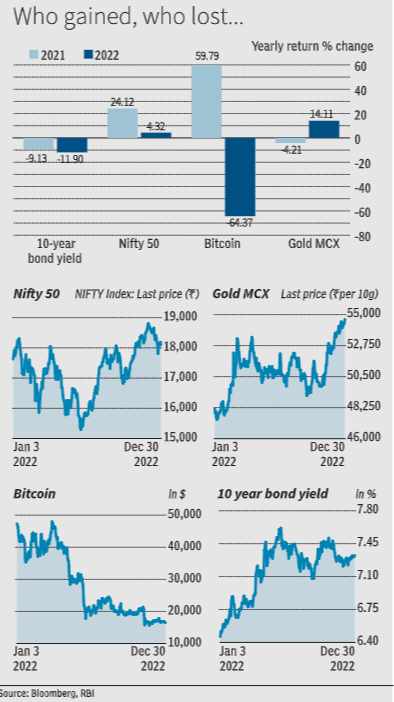

Bond Yields

BE FINANCIALLY INDEPENDENT

Please treat this as just a indicator as these are subject to change or could have been changed

Consult you financial advisor before making any investment decision

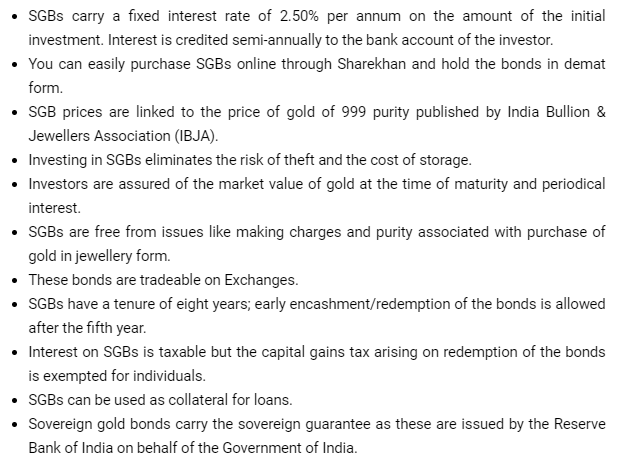

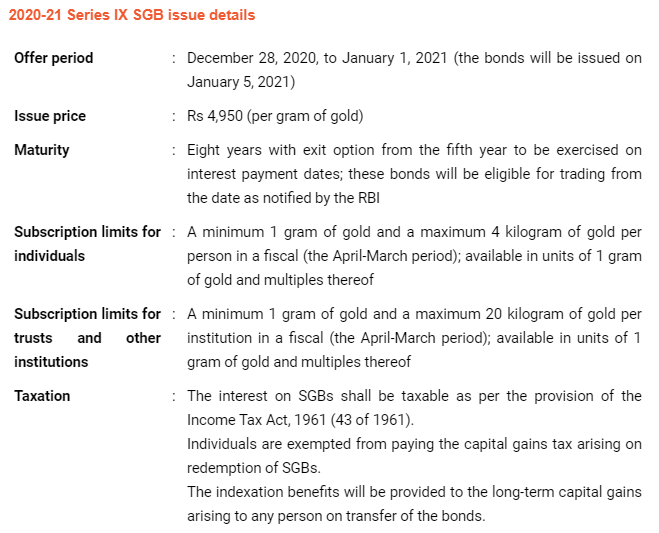

SGBs are government securities denominated in grams of gold.

These are substitutes for holding physical gold.

SGBs are issued by the central bank on behalf of the Government of India.

Investors have to pay the issue price in cash and the bonds are redeemed in cash on maturity.

There are many reasons for buying gold.

The yellow metal acts as a hedge against inflation.

It is a relatively stable investment compared to equities.

It is a good diversification strategy.

It can be purchased easily