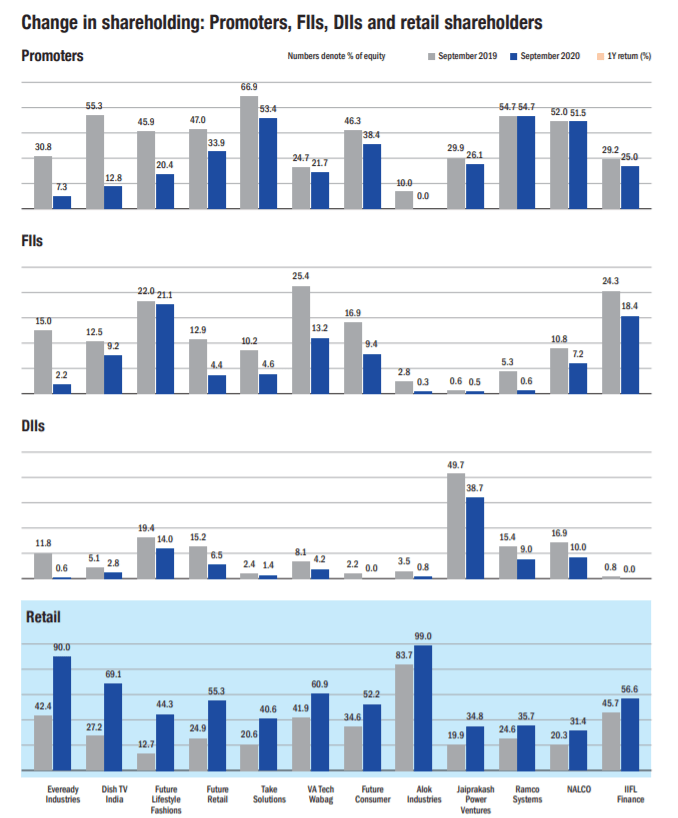

Retail investors often take their investment decisions based on the share price instead of the fundamentals. They tend to buy what looks ‘cheap’ and get influenced by the news around a company. They often see a large fall in share price as an opportunity. However, such investments often end up becoming value traps. A huge price decline may not always be due to a temporary issue but also due to a permanent dent in the company’s prospects. Also, a sudden surge in the stock price attracts retail investors. They then invest in such a company, without paying much attention to its fundamentals. Curiously, the lower the ticket size of the share, the more interested retail investors become. All these are wrong reasons to buy a stock. A stock should be bought because the fundamentals of the underlying company are robust. Tracking the activity of promoters, FIIs and DIIs can be a useful input in determining this.

-source Valueresearchonline